- AllllSevens

- Posts

- 2/28/25 Market Scan

2/28/25 Market Scan

Notable Options Flow & Dark Pool Analysis ($IWM, $UNH, $XLV, $ZTS, $APP, $TQQQ, $SPXL, $FXI)

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of February 26, 2025. I am not liable for any losses incurred by others.

Past performance is not indicative of future results.

Preface:

Make sure to read my recent broad market update if you have not already:

Click here.

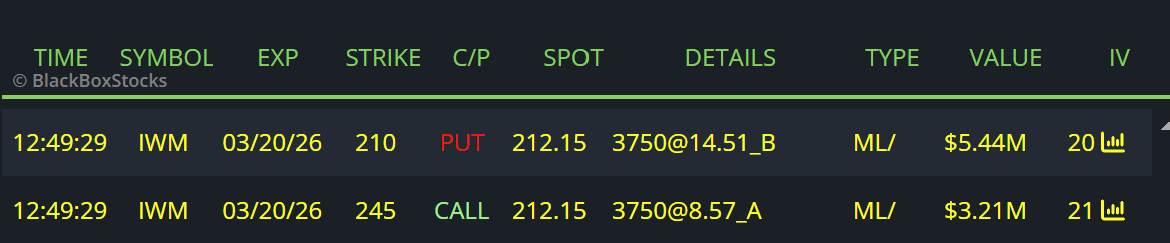

IWM / TNA

$5.44M Put Seller

$3.21 Call Buyer

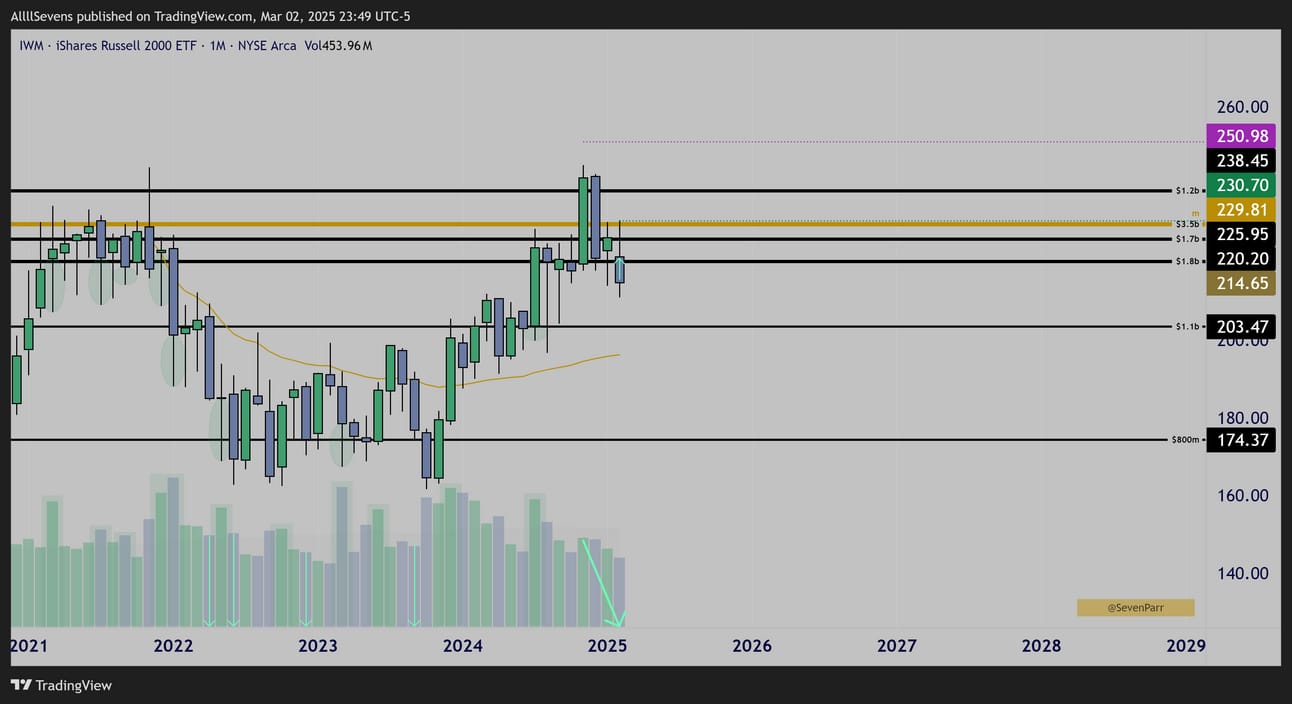

Monthly

IWM has experience amazing institutional accumulation over the last few years.

This last month, price has rejected a known area of accumulation - it’s largest Dark Pools on record… and formed a discount candle !!!!

An increased spread, decreased volume candle, confirming that institutions are NOT selling what they’ve been accumulating.

Weekly

Dark Pool accumulation remains active.

Discount in $240’s visible.

Phantom Print (price magnet) @ $250.98

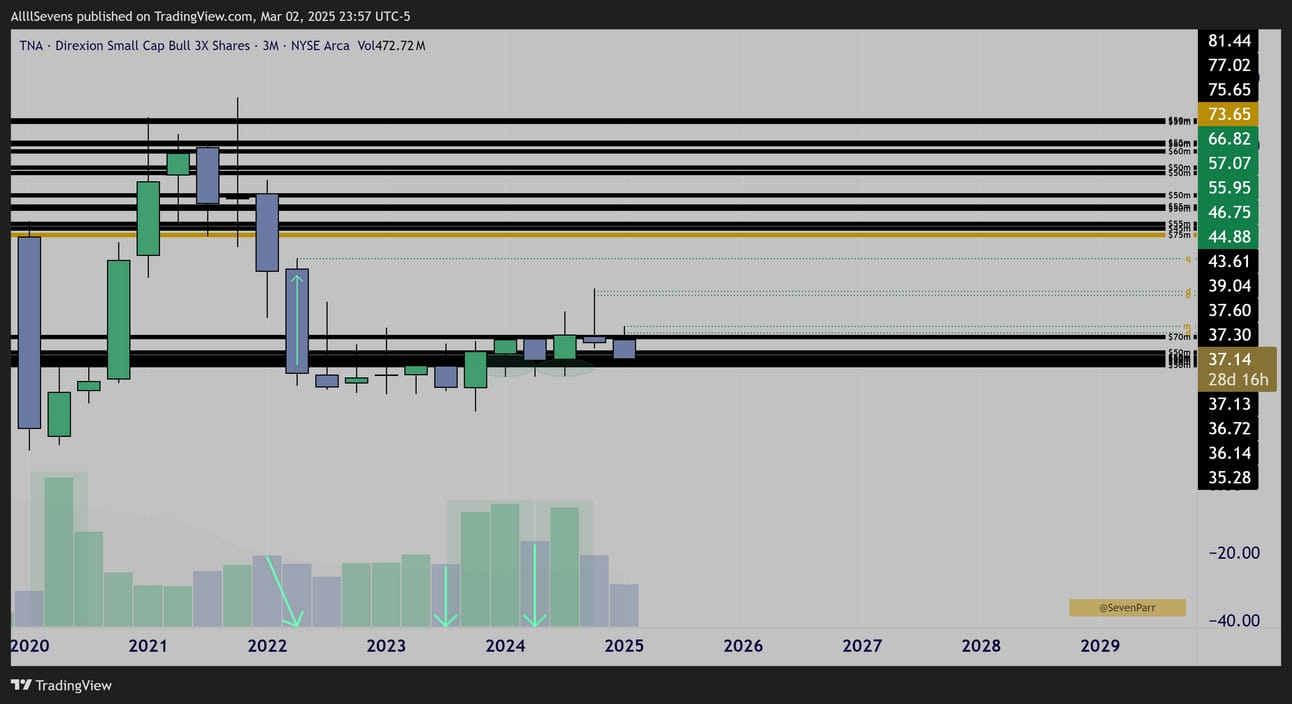

TNA Quarterly (3 Month)

Major accumulation patterns after a big discount sell in 2022

This is the same demand that launched price in after the 2022 “crash”…

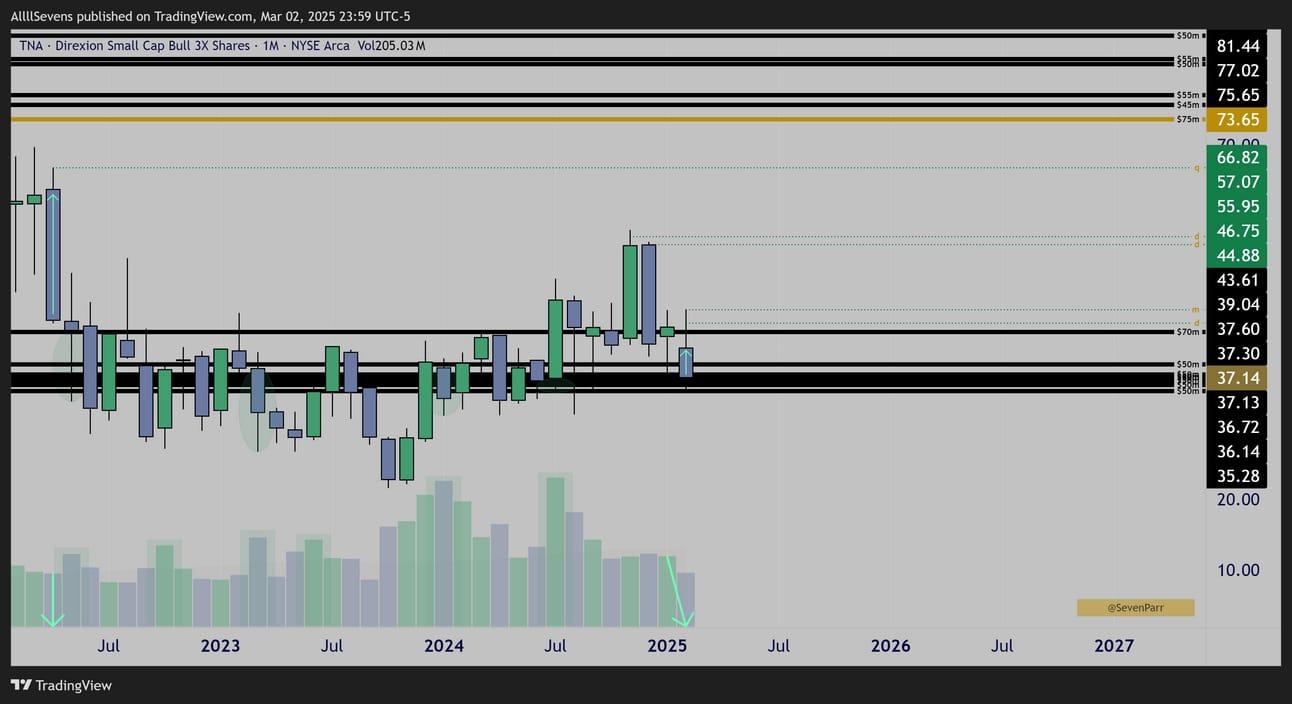

TNA Monthly

Same discount as IWM formed last month.

UNH

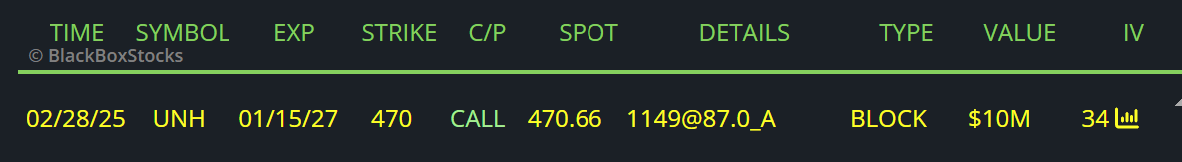

$10M At-The Money Call Buyer into 2027

$600K Bull Debit into May

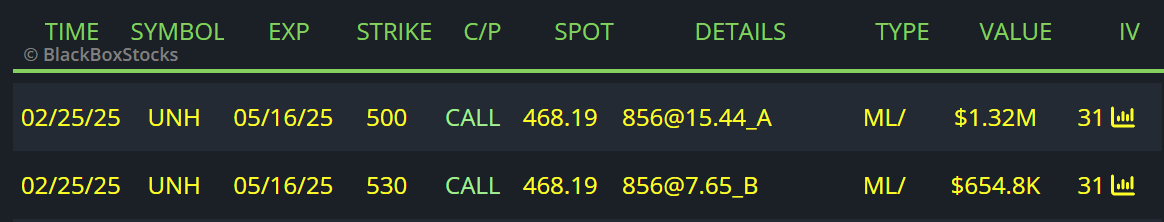

Monthly

I have been talking about the Dark Pool accumulation patterns on this stock for over a year now -

Halfway through 2024 price pushed ATH’s but failed to hold any kind of momentum resulting in a brutal 30% decline back into the the accumulation range. December was the highest monthly volume in nearly 5 years, forming a lower wick at largest DP on record. The weekly shows it best-

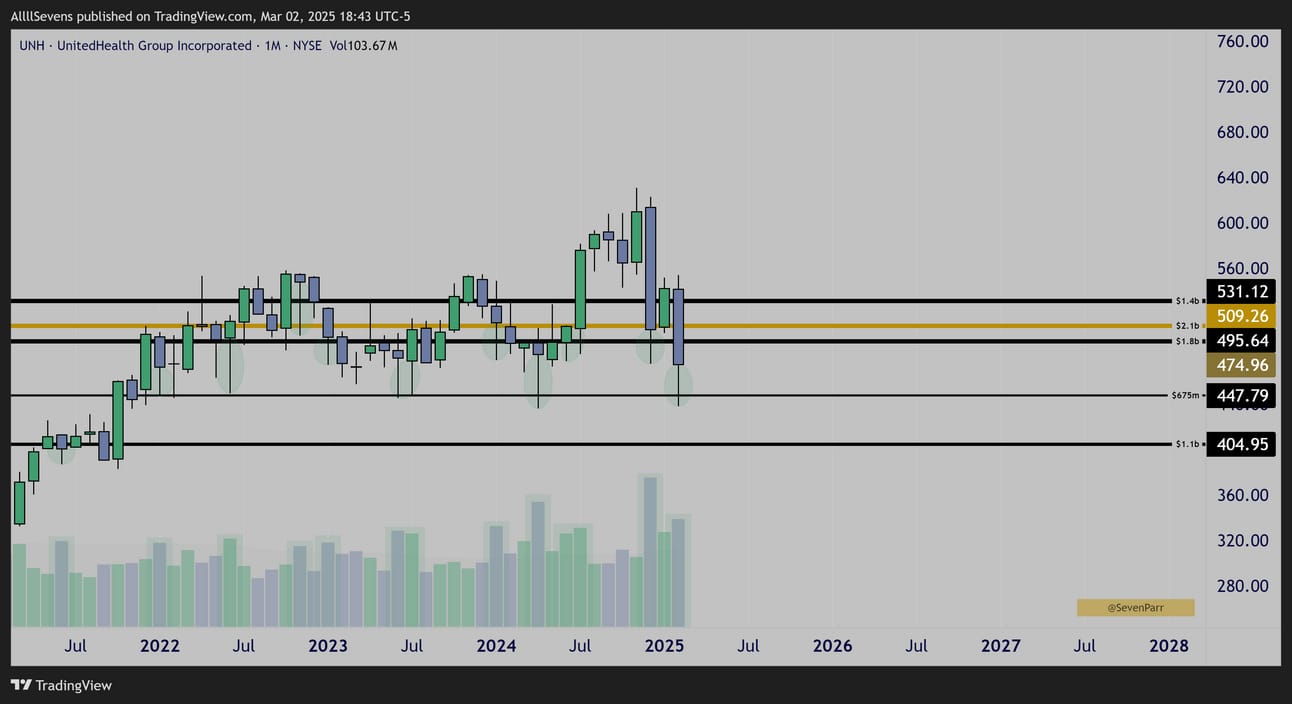

Weekly

Amazing Dark Pool accumulation patterns.

This time frame highlights how clear the buy accumulation into the end of December was. Again, highest volume in nearly 5 years.

Wicking right off the stocks largest DP on record within a multi-year accumulation phase around this level.

Falling 30% from highs and failing to hold largest Dark Pool on record last month despite the largest accumulation in 5 ears is not necessarily a sign of short-term strength…

I think the flow here needs and is expecting a very rapid recovery / false breakdown capitulation type move. Whether or not that happens, I don’t know.

I own the stock, but I’m not adding until / unless there is confirmation of a false breakdown and / or a nice sell-off into the lower $400’s creating a discount.

As of right now, there is not a single discount visible on this chart.

Since we’re on the topic:

XLV

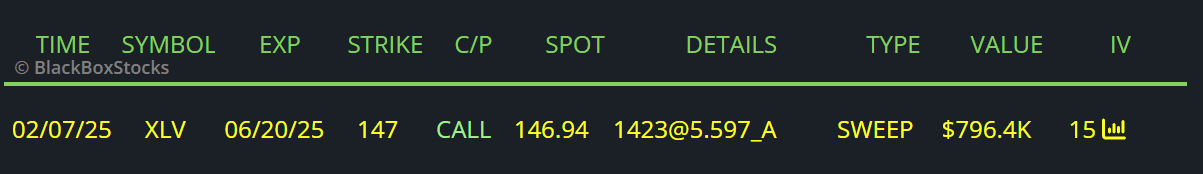

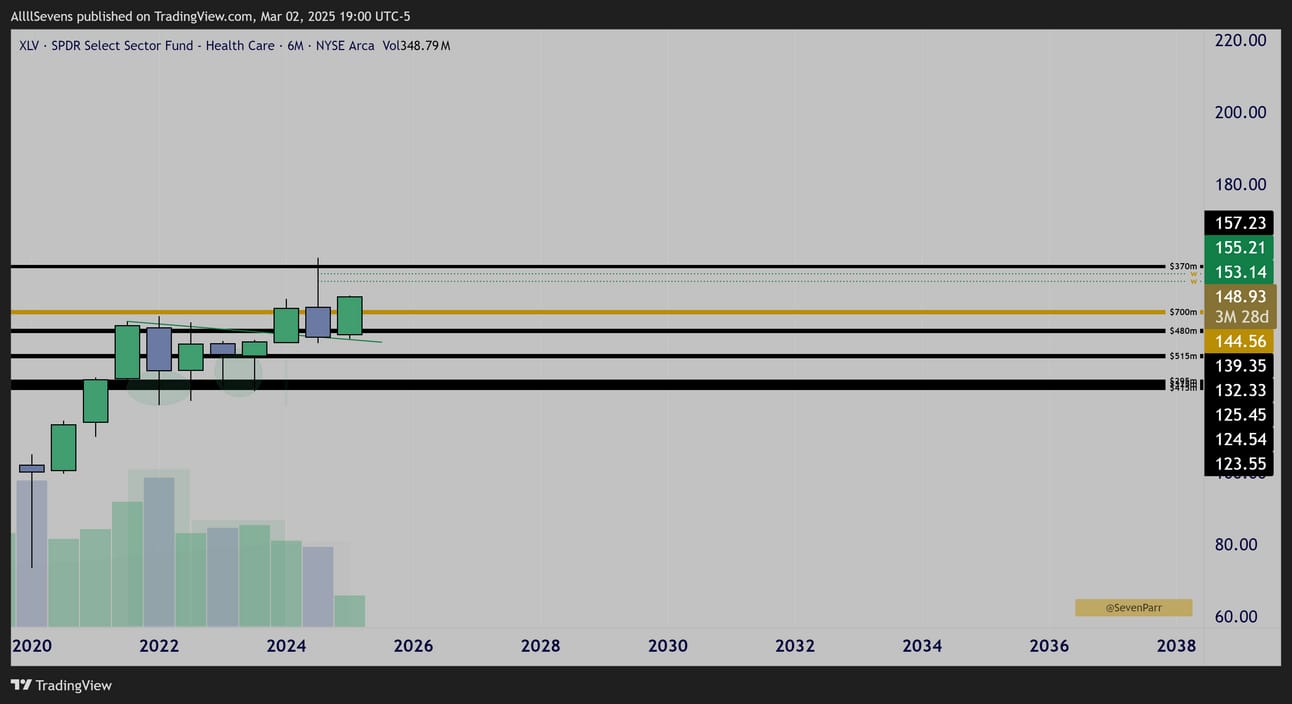

$800K Call Buyer into June

$3M Call Buyer Into September

Rolling Up & Out from February

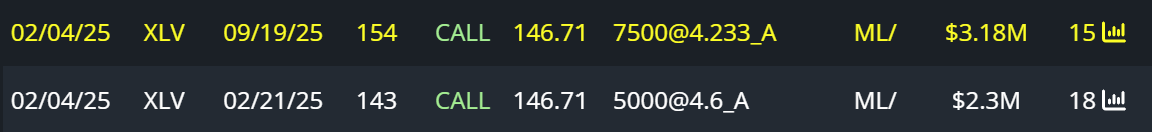

$750K Call Buyer into January

UNH is the second largest weight in XLV, making up 8% of the ETF

The Health Care Select Sector SPDR Fund (XLV) tracks the performance of the health care sector of the S&P 500 Index (SPY)

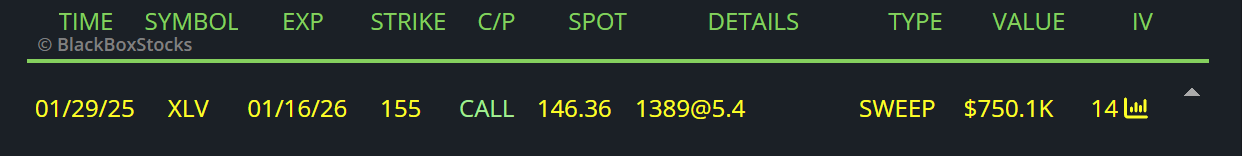

6 Month

XLV has been compressing and accumulating, fueling up for a large move to the upside, ever since the 2022 pullback.

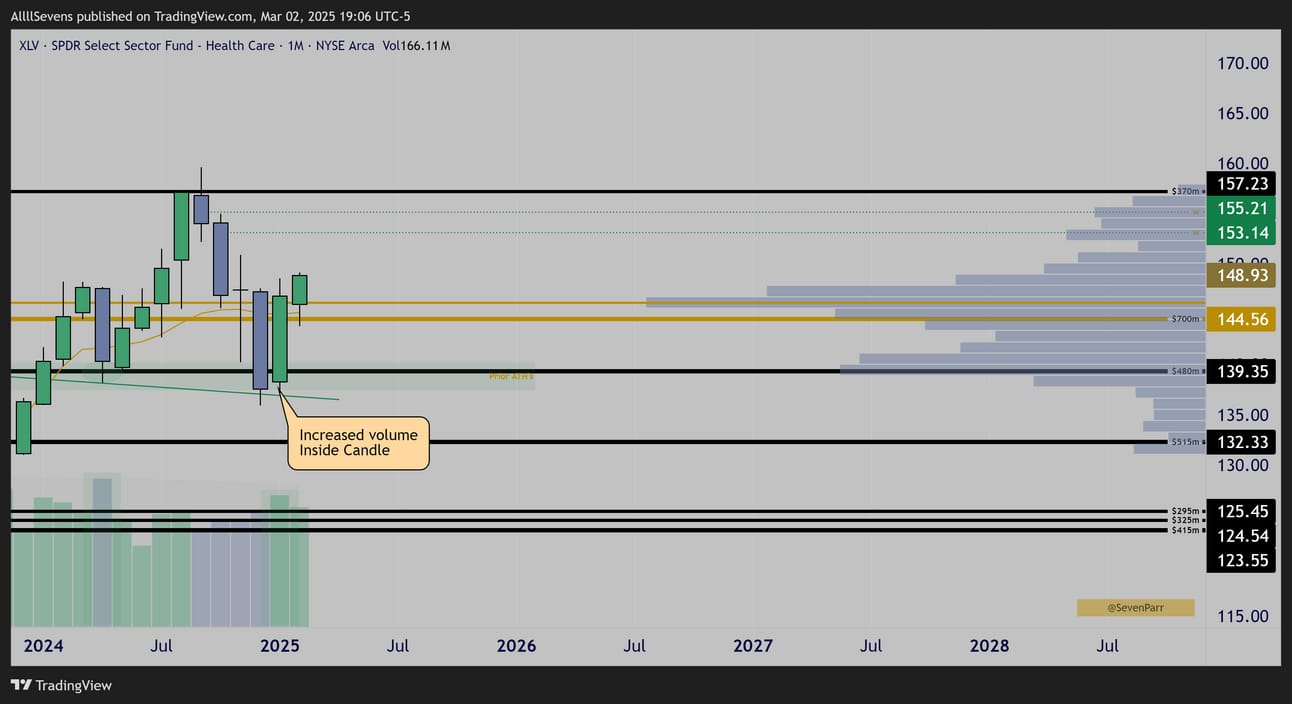

Monthly

Over the last quarter, XLV has greatly underperformed SPY, retesting prior ATH’s for the second time after quickly topping out late last year for whatever reason.

Lows of the first retest were broke, and price reversed sharply, forming an increased volume inside candle, reclaiming volume shelf support +bull trend.

Seems like a strong upside reversal pattern to me and this sector may be ready to outperform and truly breakout from this MULTI-YEAR compression / accumulation displayed on the 6-Month chart.

I want to re-iterate the time frame of this analysis. I think there is a very significant long-term move brewing here, and after shaking out short-term participants on the recent low, it could be time to truly enter an expansion phase.

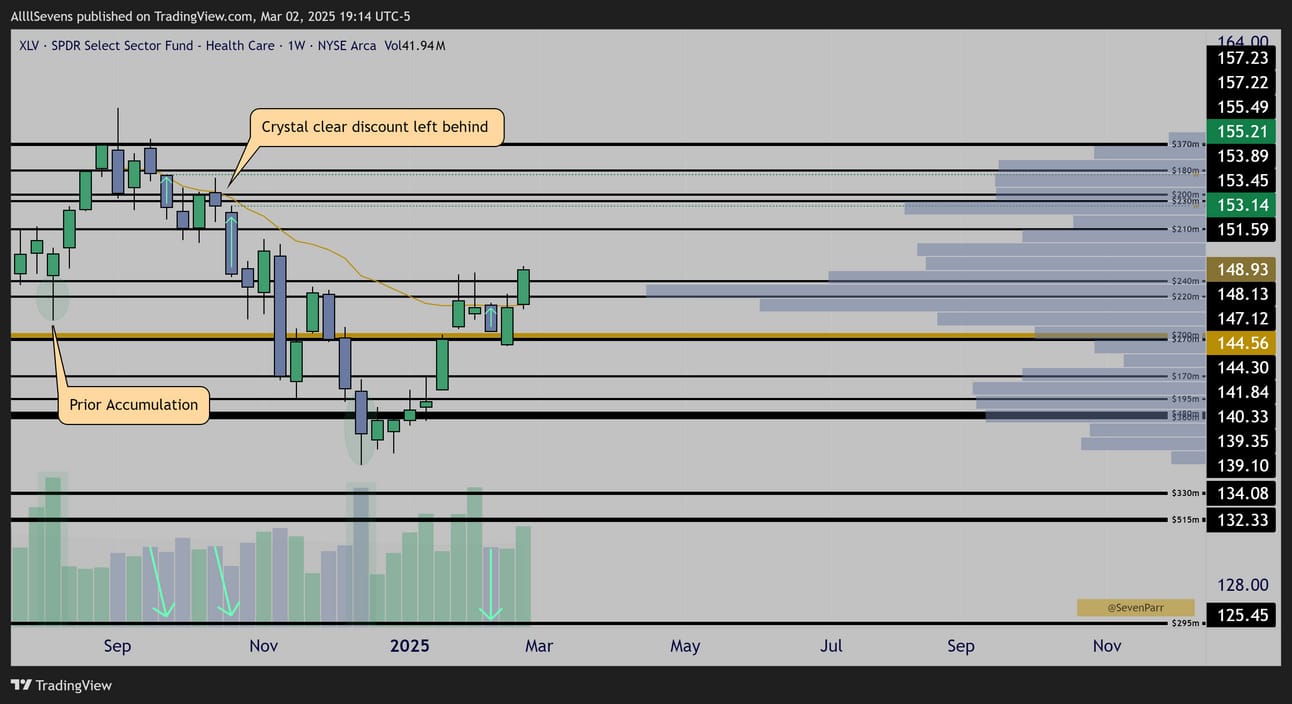

Weekly

The cherry on top for this is price currently reclaiming Dark Pools that saw AMAZING accumulation back in August

On top of this, we get confirmation that the sell-off from current ATH’s was false, and two discounts are active above- the second one being truly textbook.

A discount is an increased spread candle, with decreased volume behind it.

An anomaly, that tells us the institutional investors who bought in August, did not sell out during the September-October decline.

Reclaiming this area of prior accumulation + breaking bearish trend from ATH’s could be a statement for this sector.

And again, this a multi-year compression break into a double bottom retest of prior ATH’s. Looks truly explosive long-term if you ask me.

I have recently covered another healthcare, BMY, click here.

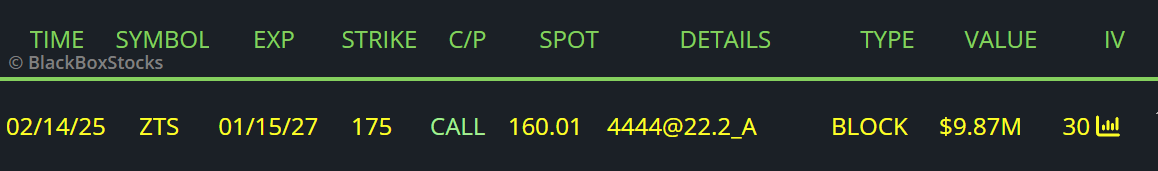

ZTS

Zoetis Inc., a global animal health company.

This is a very small stock-

You can see this by the size of the Dark Pools behind it relative to ones on UNH, XLV, or BMY. Keep this in mind at all times. Institutions place less money behind less established, more risky names. If successful, they up their position.

I want to make this clear because stocks like this can offer tremendously outsized returns if correct, which makes retail folk like us focus too heavily on them. The thing about this massive potential reward is it comes with massive risk and overall lower probability to succeed compared to something like XLV with the same patterns. Institutions spread themselves out, and go big on the less risky names. A a majority of these smaller stocks like ZTY will simply fail.

If a hand full of them become the next big thing though, they win.

Please keep this in mind for all of my analysis. I will not re-iterate this again in this newsletter. Pay attention to size of Dark Pools to understand how much risk institutional investors are taking.

$10M Call buyer into 2027

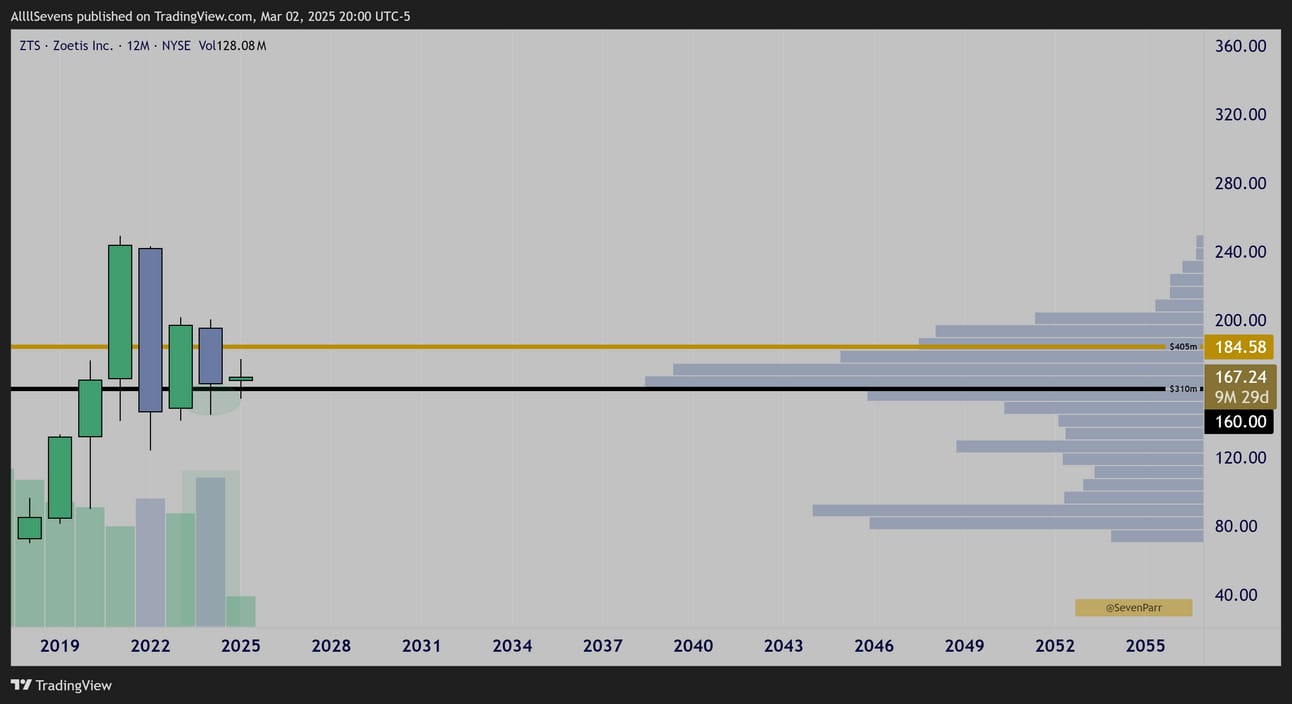

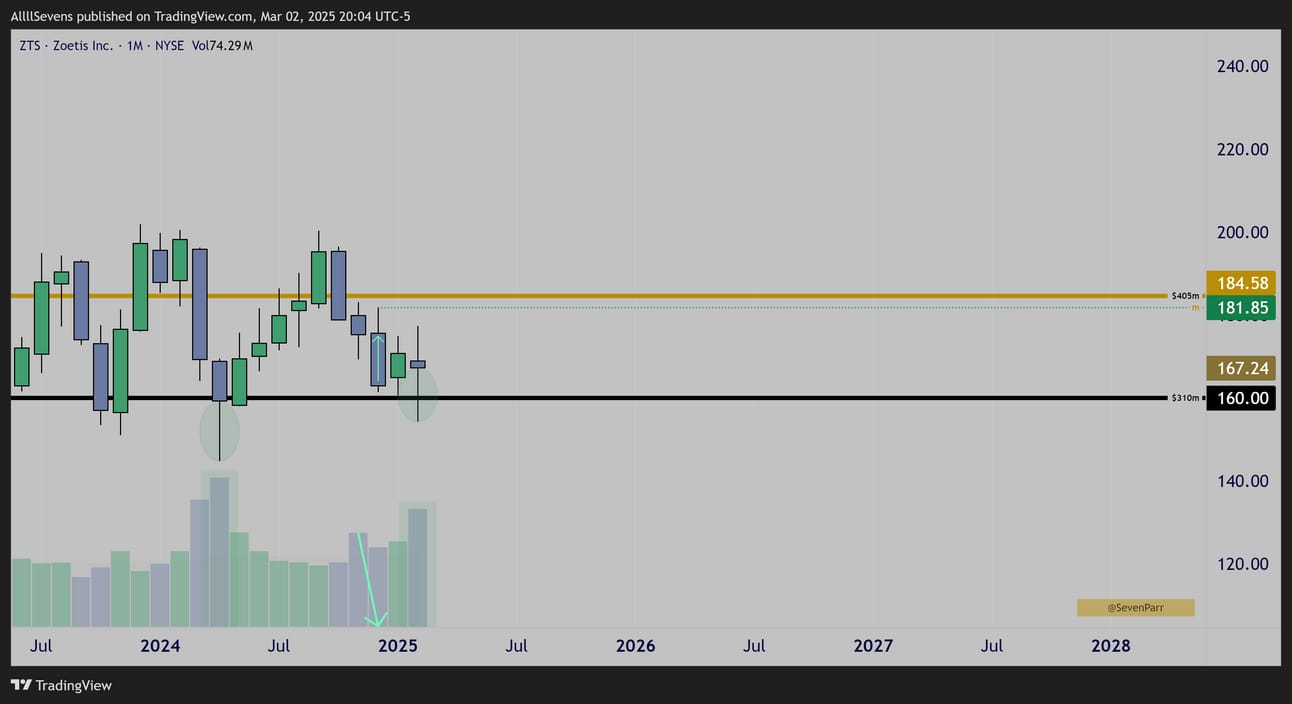

Yearly

2024’s candle formed a hammer / inside candle wicking off the second largest Dark Pool on record for this stock on it’s highest volume in seven years.

This is extremely notable and explains why there is such unusual flow active.

Compression + Accumulation can lead to high volatility expansions.

Monthly

Two hammers on volume at this Dark Pool

Last month formed a fractal of the yearly pattern, forming a double inside candle on increased volume!

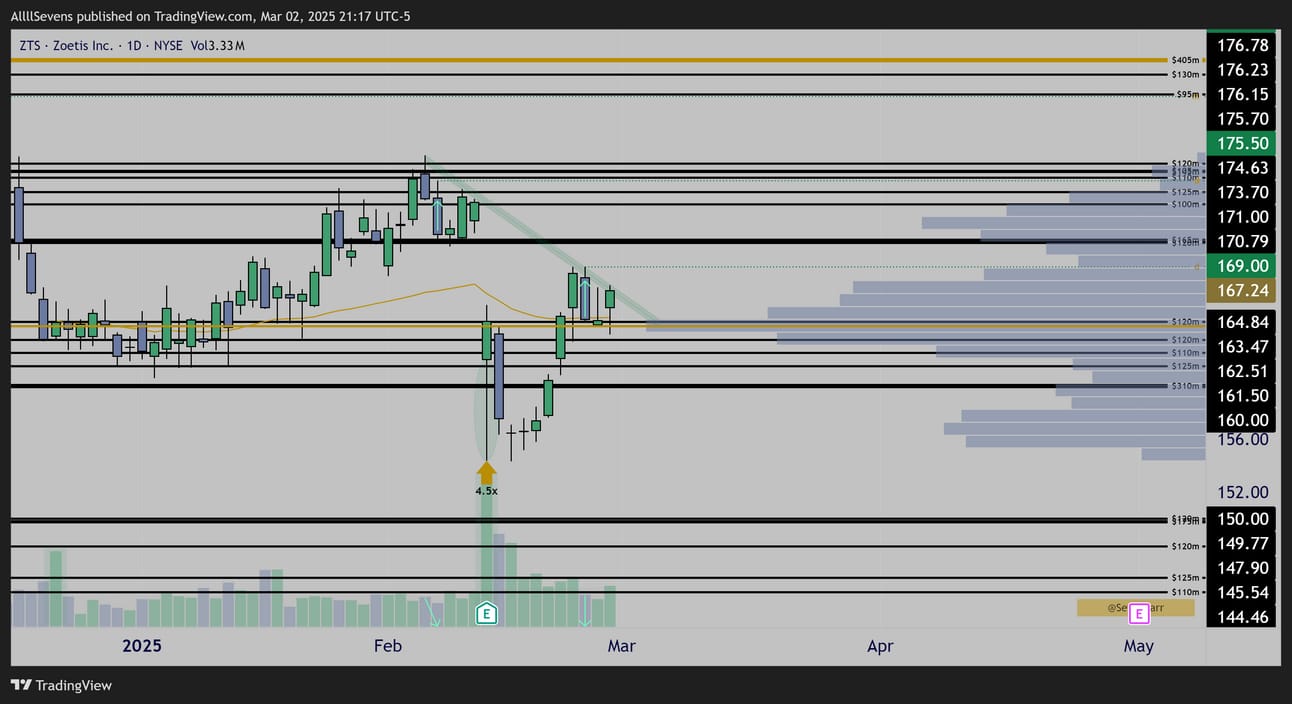

Daily

4.5x average volume buying the recent ER dip

Now setting up over volume shelf support, just needs to break downtrend resistance for a push to $170+

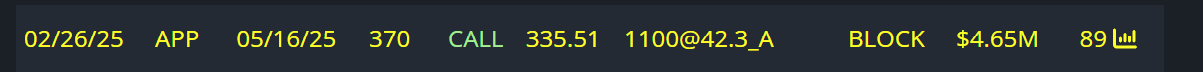

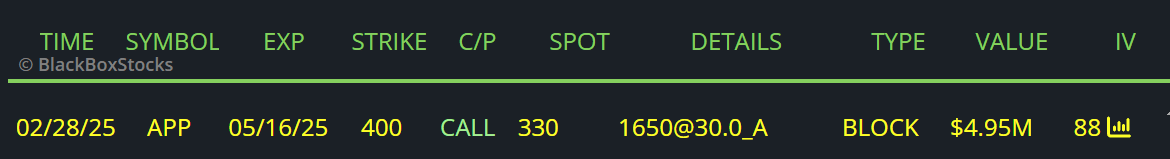

APP

$4.56M Call Buyer

$5M Call buyer

Daily

Highest volume EVER accumulating largest DP’s on record, worth $2B+

Discount sell on Thursday.

I’m not 100% convinced this is ready for short-term upside honestly, but the investment taking place is undeniable.

We’re seeing a theme here with many software names:

IGV Sector ETF Click Here - multi month accumulation FINALLY starting to go on discount

PLTR Click Here - very similar to APP, testing its largest DP on record right now.

Two “new” stocks with institutions matching the “hype”

SNOW Click Here - Insane yearly potential

NET Click Here - Very healthy pullback after PEG with CLEAR SKIES

TEAM Click Here - Massive flow active

There are many more, but these are the ones I have covered recently.

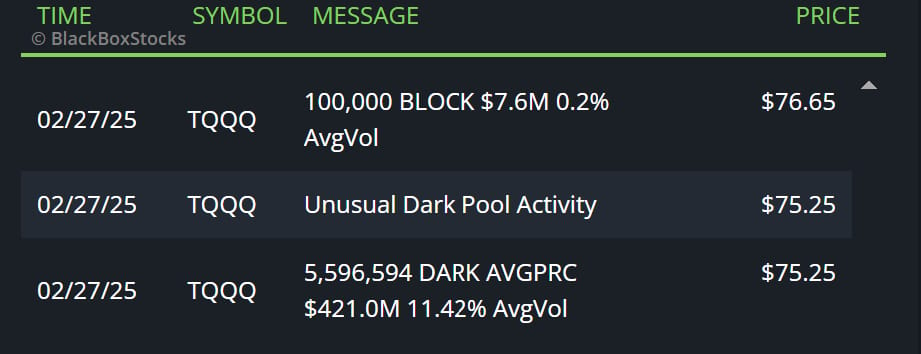

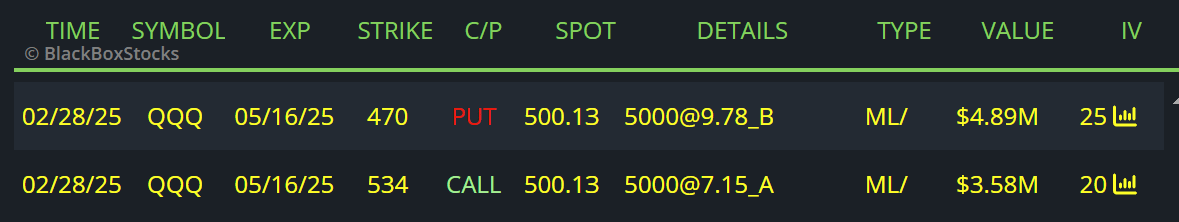

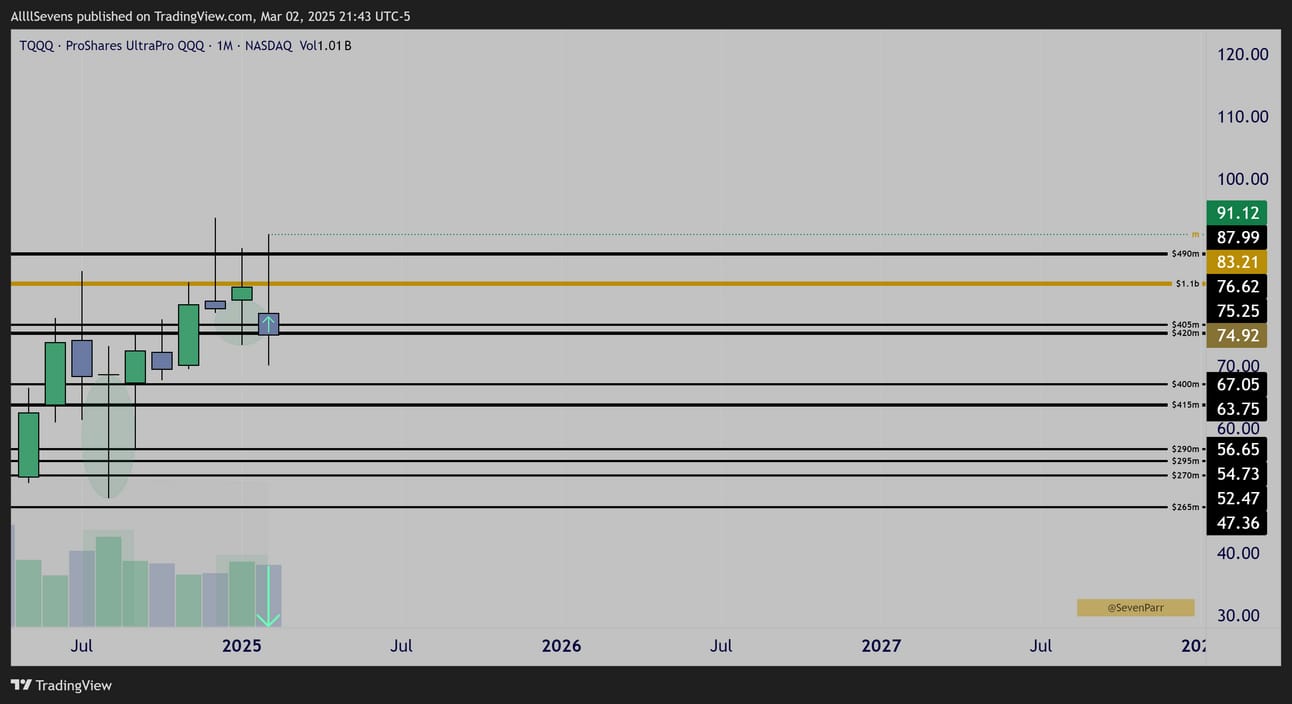

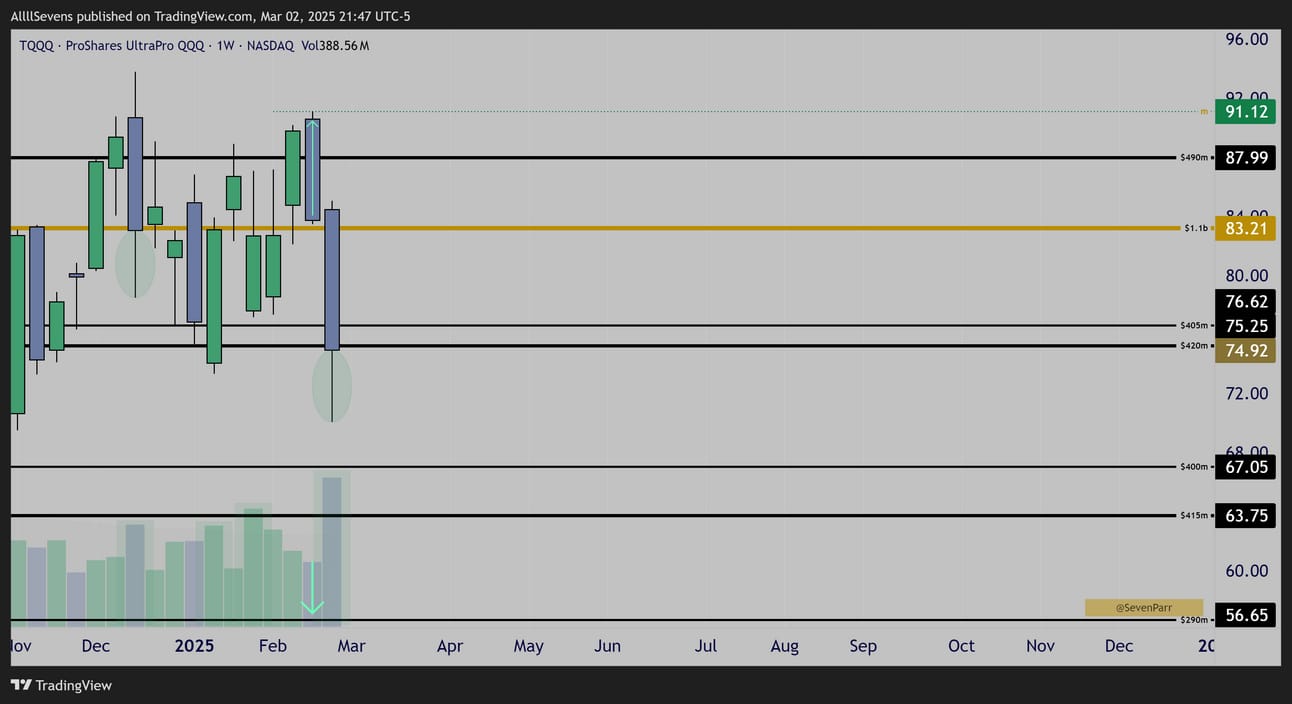

TQQQ

$421M Dark Pool @ $75.25

$4.89M Put Seller

$3.58M Call Buyer

Monthly

Clear Dark Pool accumulation sequence.

Discounted sell-off -during February.

Short-term participants sold this. Institutions held what they have been accumulating for multiple months now.

Weekly

Same discount that the SPXL & IVV left behind off recent highs.

Just further re-enforcing the monthly time frame here.

I do not know if these accumulations and discounts result in short-term gains.

The flow thinks so.

I just know major institutional investment / accumulation is underway here.

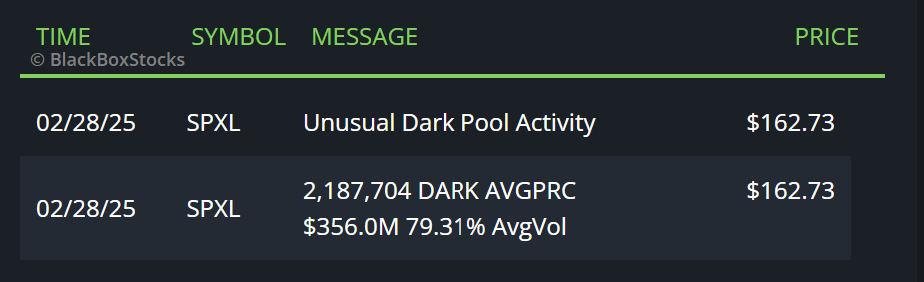

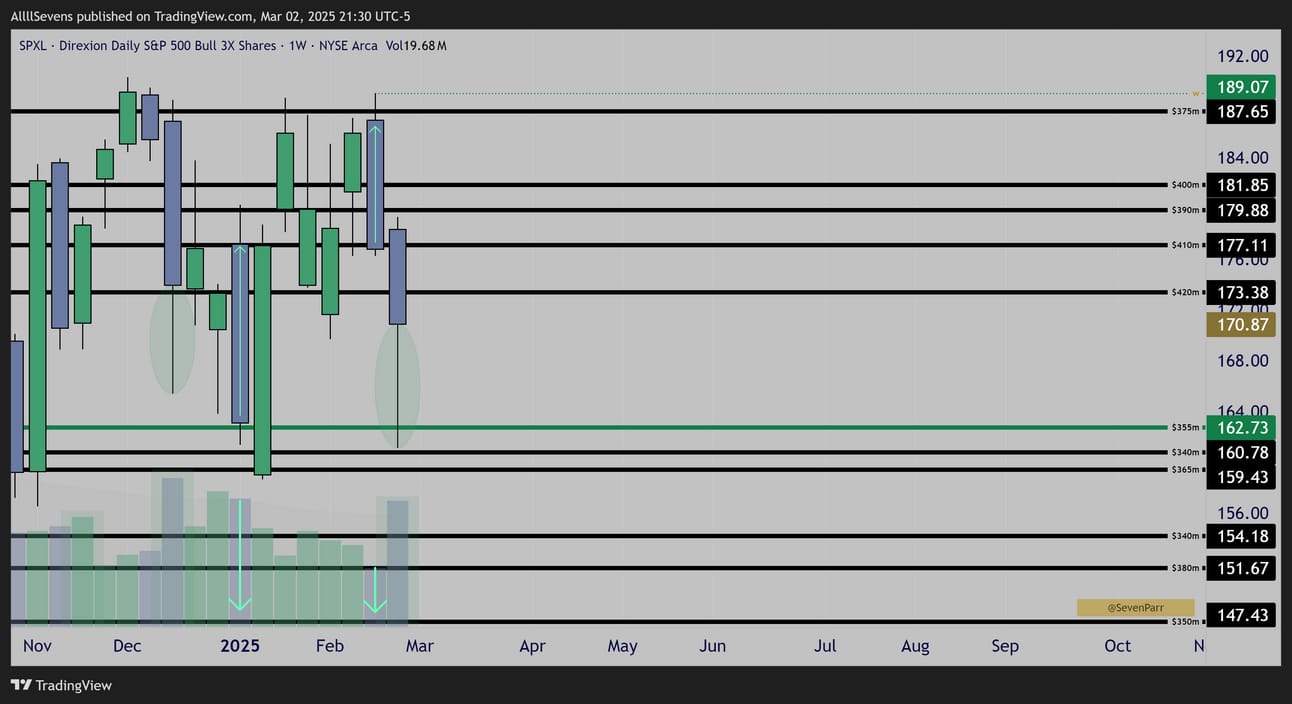

SPXL

$356M Dark Pool @ $162.73

Weekly

Dark Pool accumulation + Discount off recent swing high.

PLEASE read my broader market update. Click here.

IVV / SPY

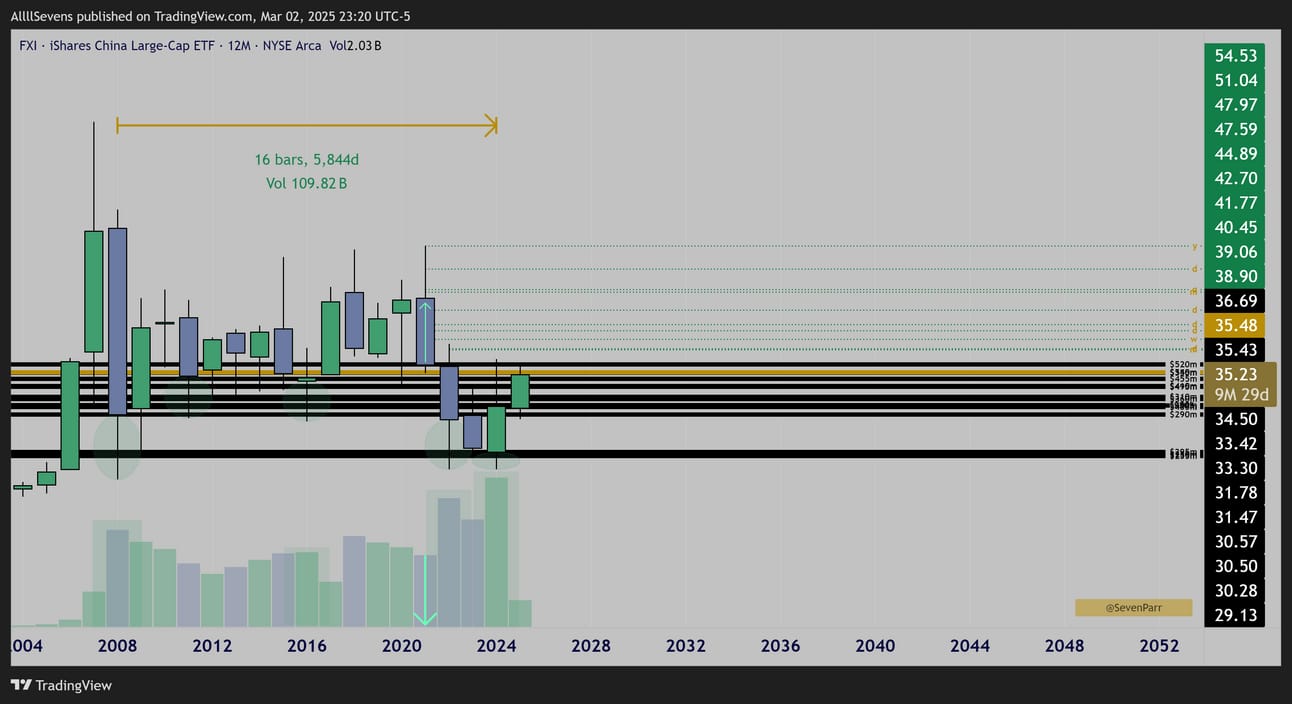

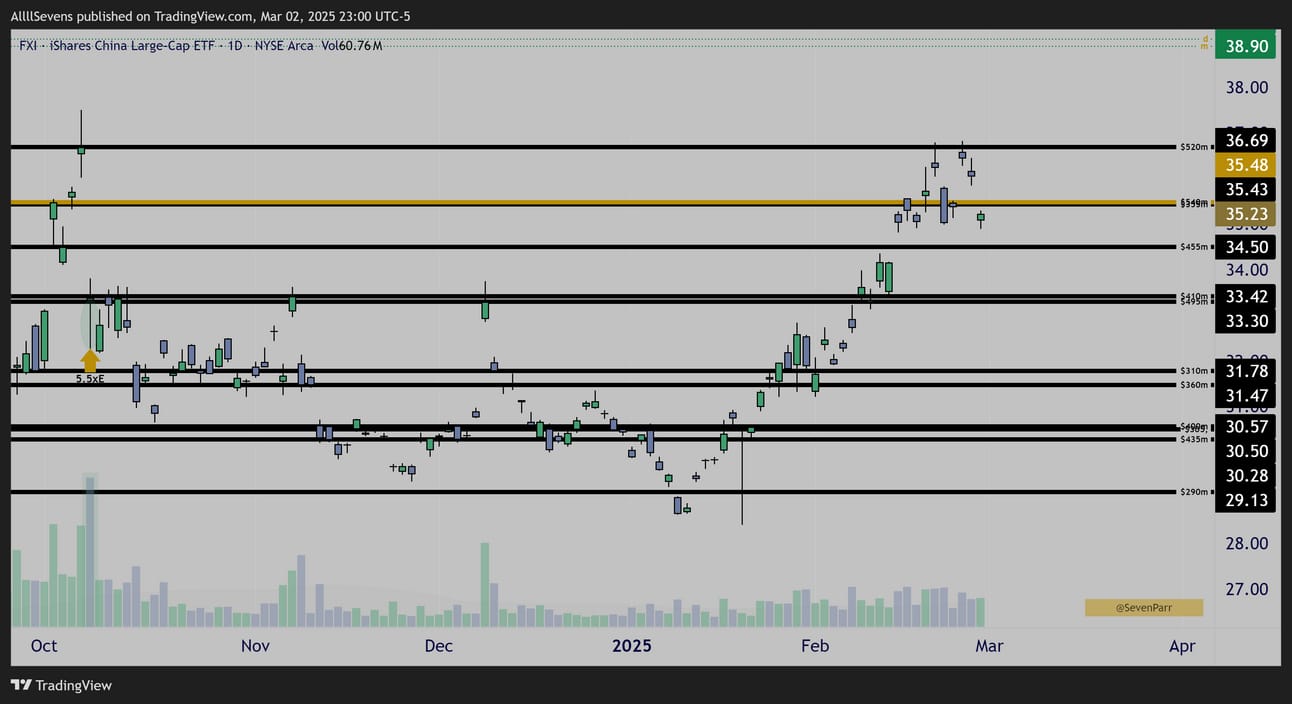

FXI / YINN

FXI Yearly

16-year base climaxing over the last four years on its highest volume EVER.

2021 formed a textbook discount candle making this ETF substantially undervalued below $54.53

2022 showed accumulation on the ETF’s highest volume ever, off the same Dark Pools that were previously accumulated on highest volume ever in 2008

2023 price compressed.

2024 a bullish engulfing candle, again, same Dark Pools, and another highest volume EVER. Such massive long-term accumulation has occurred here, starting in 2008, but especially over the last 5 years with an exploitable discount left behind in the $50’s. Truly remarkable.

Daily

October 8th, 2025 highest Daily volume ever accumulated the $33.30-$33.42 DP

YINN Daily

Just like FXI, this saw crystal clear accumulation @ DP on its highest volume ever back in October. In recent sessions price has reclaimed this support on increasing volume followed by decrease volume gaps down, showing that institutions are not participating om the sells - just the buys.

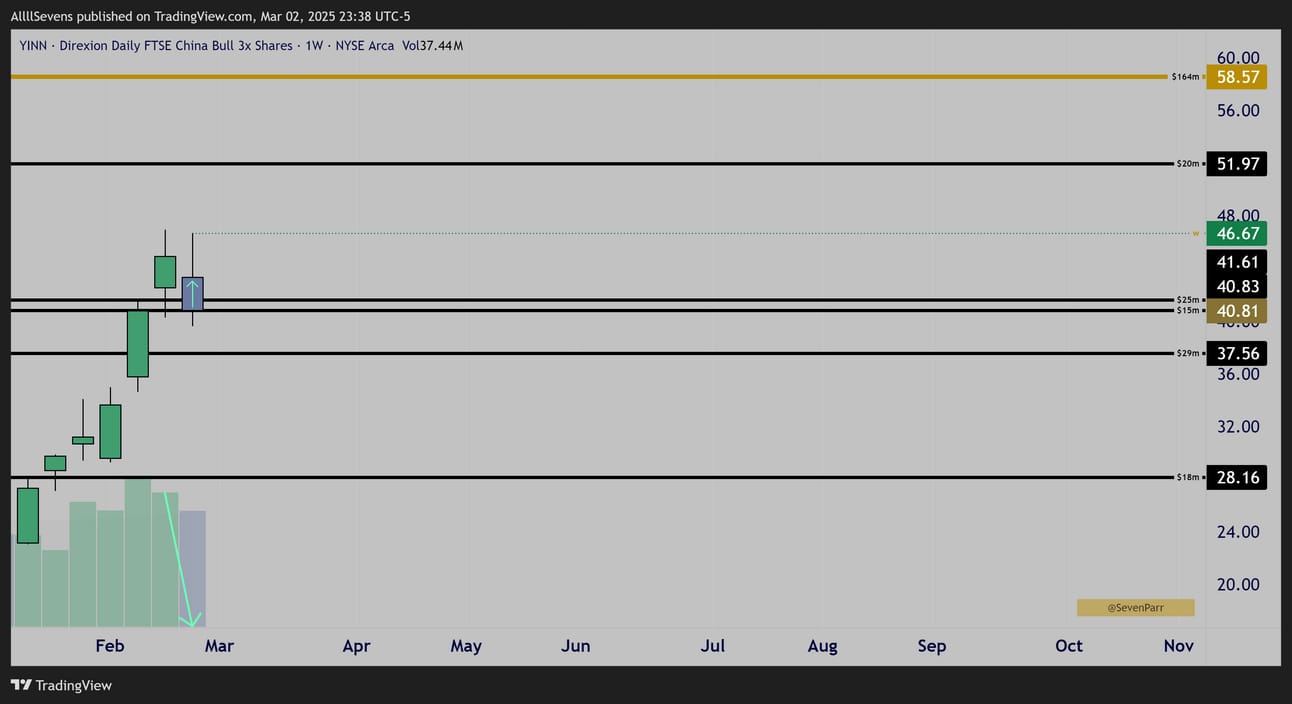

YINN Weekly

This time frame shows last weeks discounted selling best.

An increased spread candle with decreased pulling back into Dark Pools that have experienced historical accumulation.

$1.2M Call Buyer

$1.4M Likely Put Seller, but technically can’t be sure.

Thanks for reading, if you found value:

Upgrade your subscription to AllllSevens+ for $7.77 / month to show your support and get more of these newsletters.

Soon, I will not be sharing these for free.

-Discord Access

I collect and analyze all of this data in Discord before posting it to X or writing a newsletter. The Discord is an absolute gold mine. See for yourself.

Dark Pools & Options Flow on a Daily basis. Always open for discussion.

Building a community of like-minded folk.

We are witnessing stock market history right now.

Let’s work.

Click here to join AllllSevens+

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQo

I also have a referral link for TradingView, the charting software I use https://www.tradingview.com/pricing/?share_your_love=sevenparr

Reply