- AllllSevens

- Posts

- 3/4/25 Market Scan

3/4/25 Market Scan

Decision time.

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of February 26, 2025. I am not liable for any losses incurred by others.

Past performance is not indicative of future results.

Preface:

Make sure to read my recent broad market update if you have not already:

Click here.

A little recap:

IVV & VOO are now re-etesting their $50B+ Dark Pool supports, an area of KNOWN institutional accumulation. IVV specifically, is has shown HISTORIC accumulation off these levels, trading its highest volume ever a few weeks ago.

Yesterday, I outlined continued accumulation into SPXL. Click Here.

Plus, we FINALLY got a discount to form on SPY itself.

Monday’s sell-off is completely false.

Today, MASSIVE buyers stepped in, specifically on QQQ & TQQQ which is the focus of today’s update.

I think by the end of this week we will know whether or not the market is ready to push higher short-term, or if we’re going to see further discounts created and volatility to the downside begin to heat up. The next few days provide either a massive downside shakeout and finally the start of some short-term upside or the start of a true market correction creating extra-ordinary discounts relative to these historic institutional accumulations I have been highlighting.

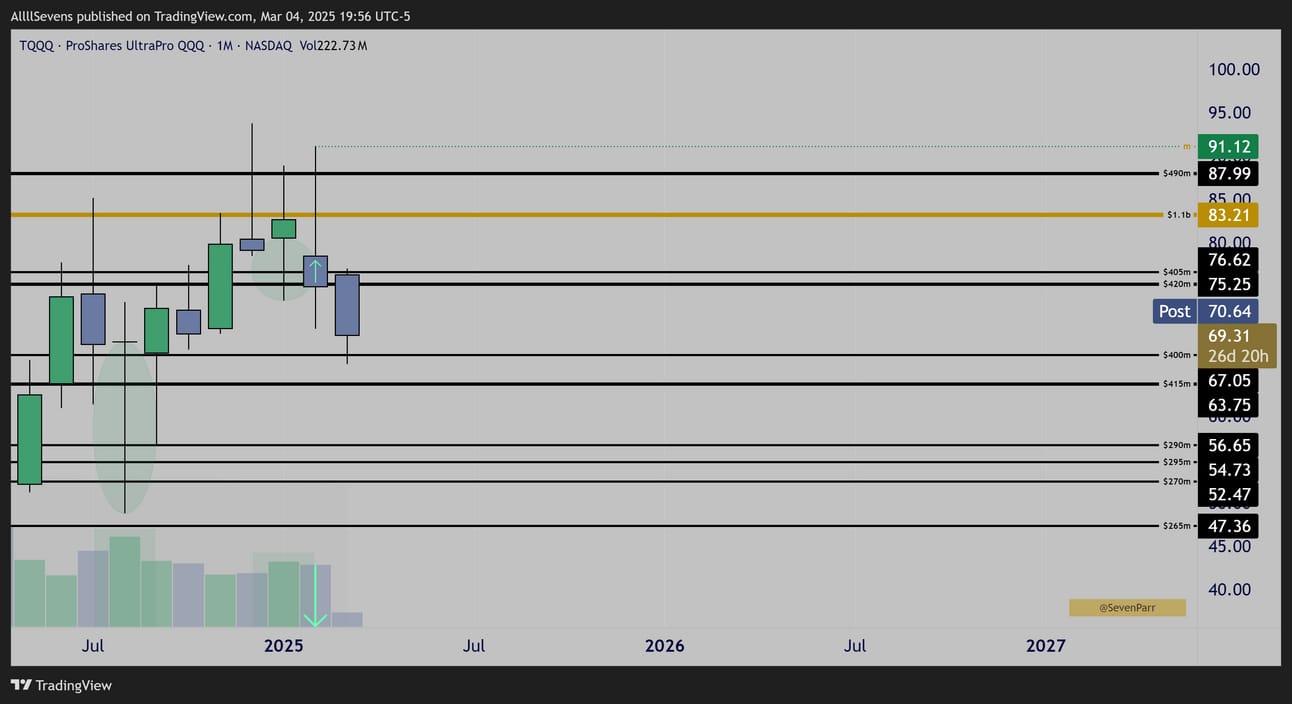

TQQQ

Monthly

Discount candle formed last month, confirming the Dark Pool accumulations highlighted in August of 2024 and January of this year.

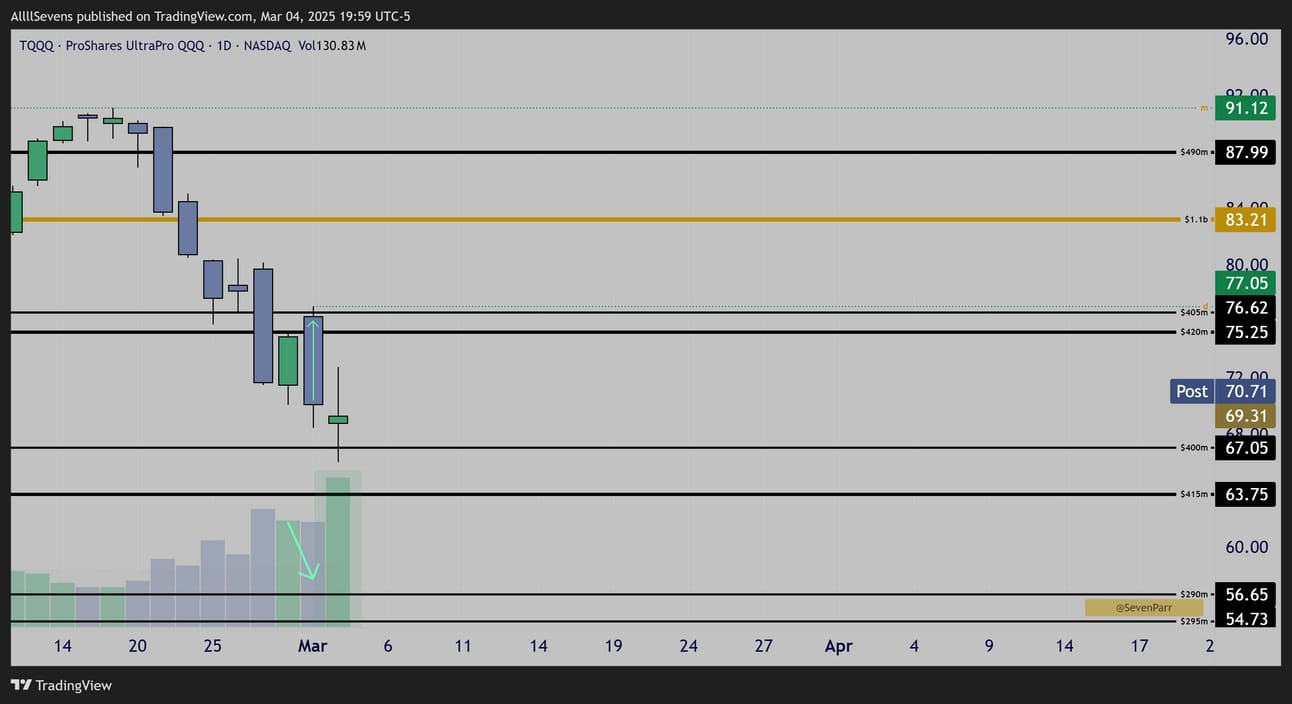

Daily

Highest Daily volume since the August 5th low which lead to a 70%+ rally…

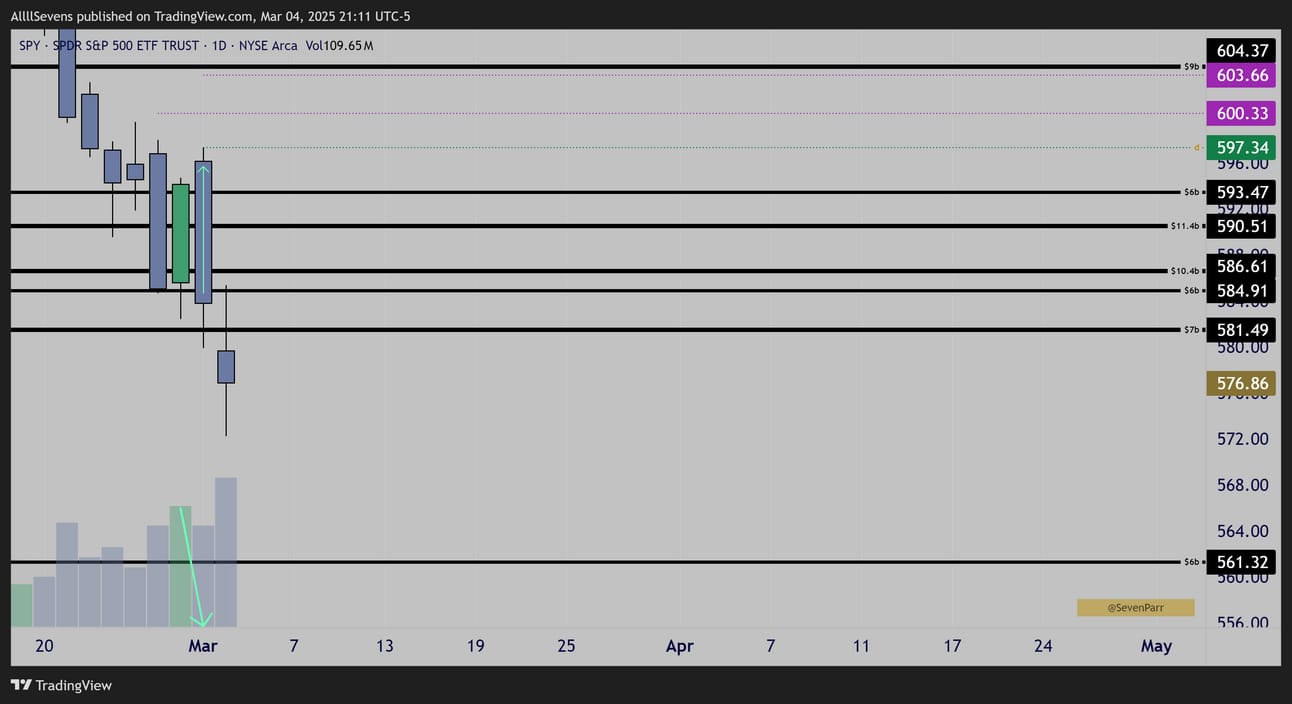

The S&P500

SPY Daily

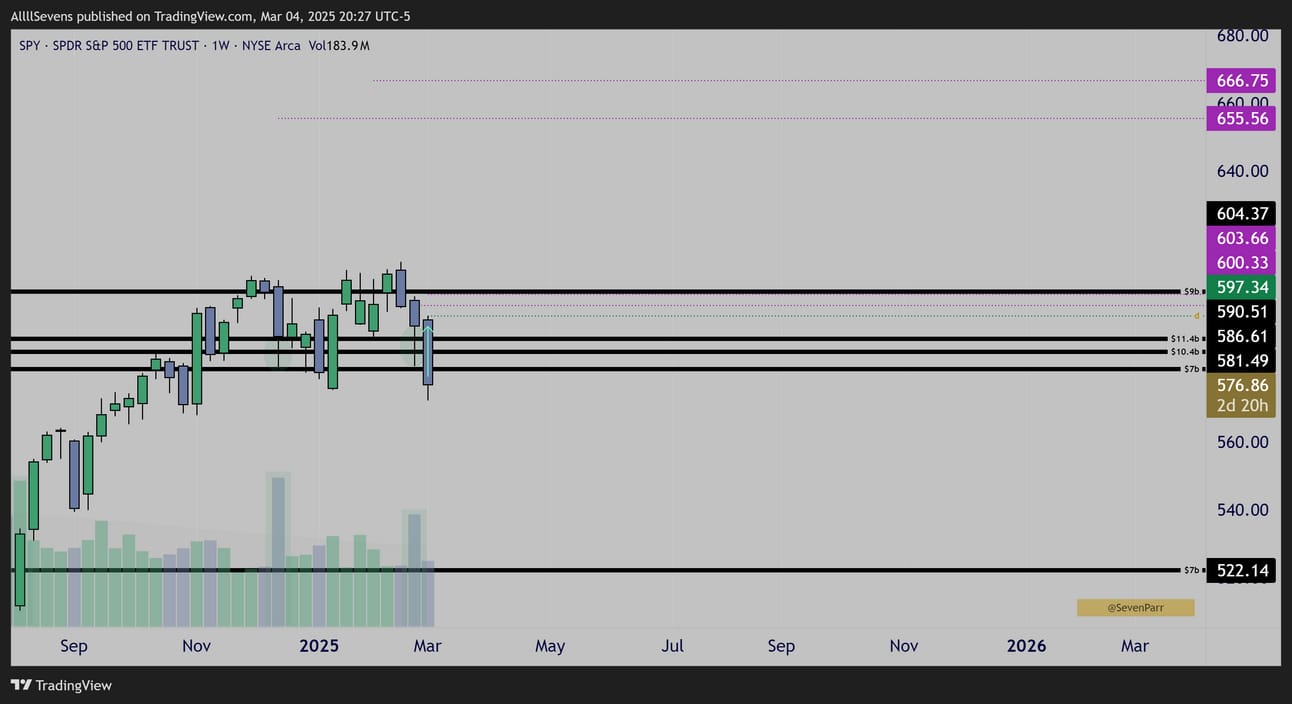

SPY Weekly

Currently losing support with yesterday’s discount and weekly accumulations still active. Remember the IVV & VOO Dark Pools?

VOO Weekly

IVV Weekly

This entire situation reeks of capitulation.

A sharp upside reversal over the coming sessions makes the most sense to me.

If the market can NOT reverse off these patterns…

It could be clear that a true short-term breakdown is occuring.

If that’s the case, it is so important to understand that the data I have been sharing remains valid. Institutions are making HISTORIC investment into the stock market. Short-term downside CAN occur and it does not invalidate anything, it simply delays gratification and transfers wealth from the short-term speculator to the long-term investor. I know what I am seeing right now.

There is NOTHING TO FEAR if the market fails over the next few sessions.

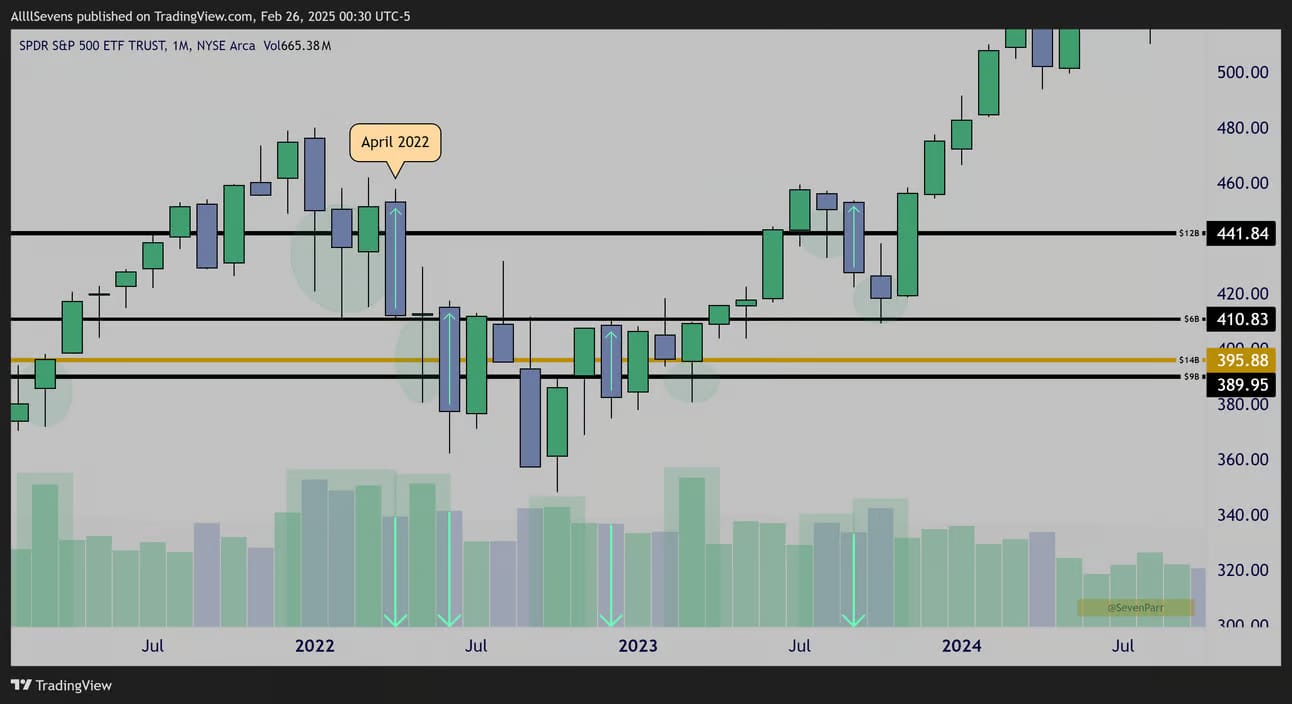

“Worst case scenario” would be similar to April of 2022, which would actually be best case scenario. Again, institutions are making HISTORIC long-term investment into the stock market right now. Further discount would offer a once in a lifetime wealth building opportunity.

SPY Monthly Discount Example

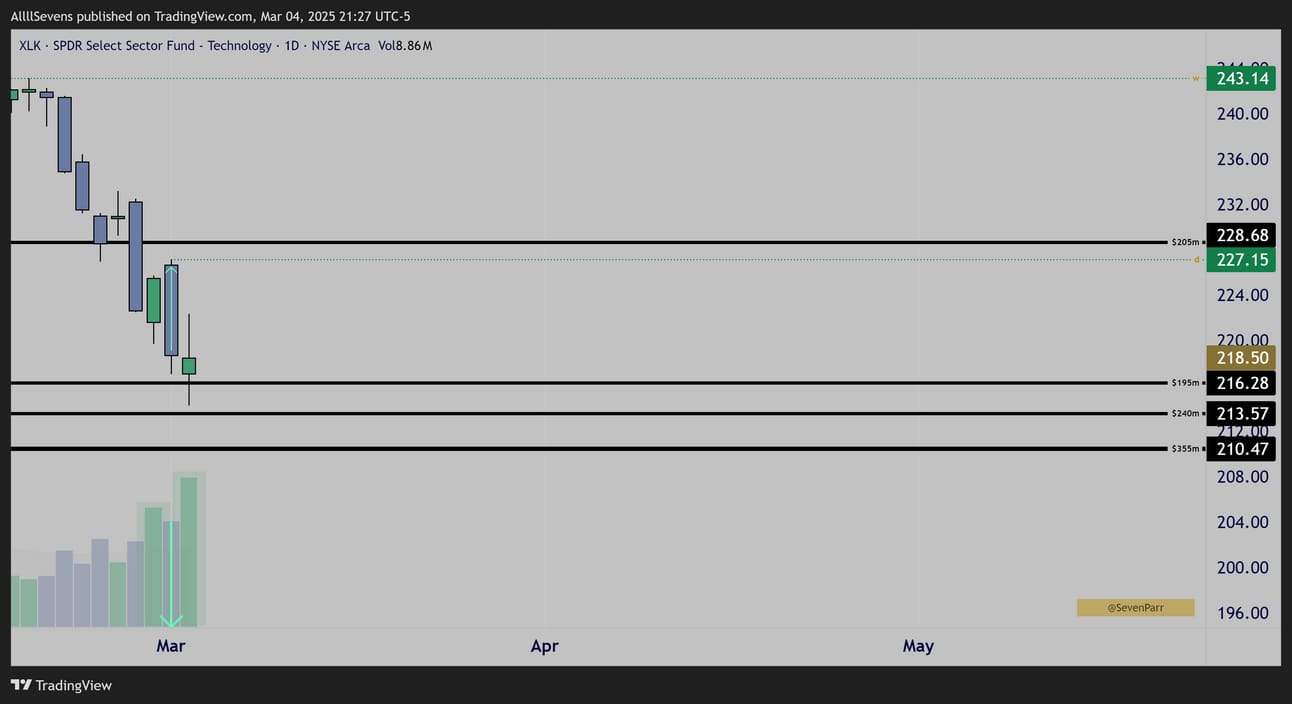

XLK

XLK Daily

TECL Weekly

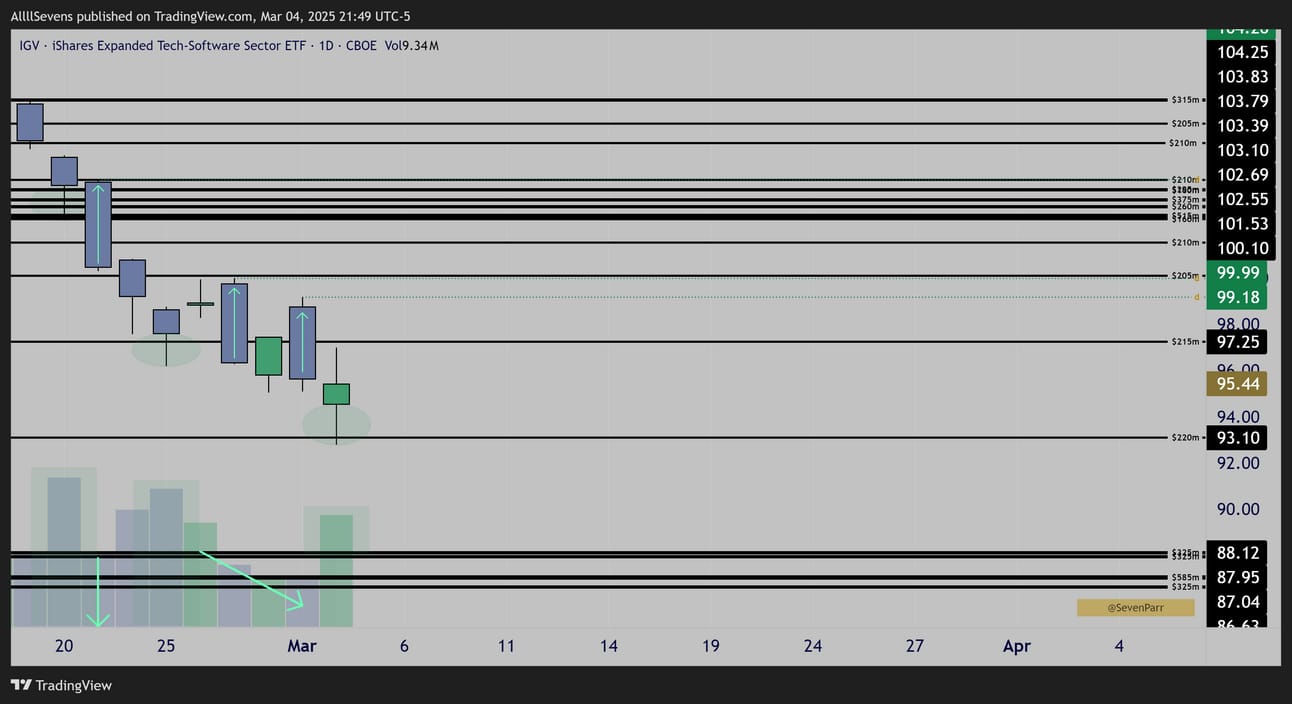

IGV

Daily

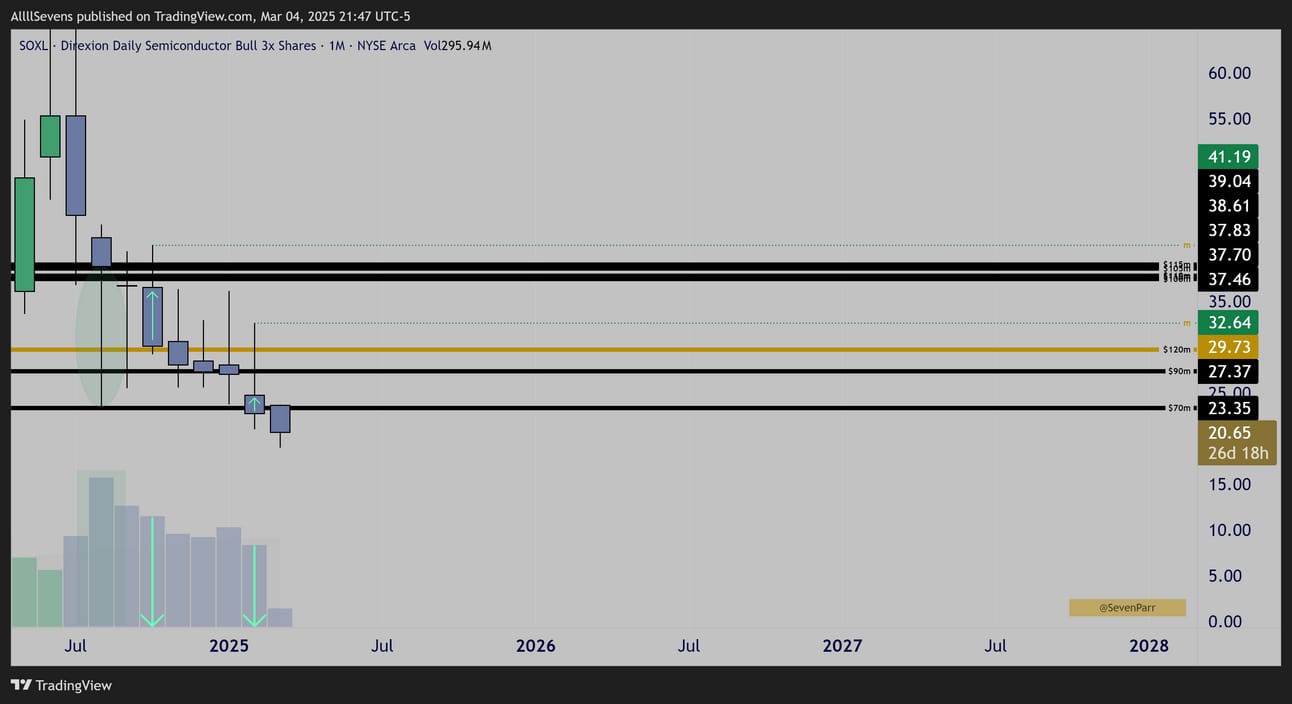

SOXL

Monthly

Thanks for reading, if you found value:

Upgrade your subscription to AllllSevens+ for $7.77 / month to show your support and get access to my Discord.

I collect and analyze all of this data in Discord before posting it to X or writing a newsletter. The Discord is an absolute gold mine. See for yourself.

Dark Pools & Options Flow on a Daily basis. Always open for discussion.

Building a community of like-minded folk.

We are witnessing stock market history right now.

Let’s work.

Click here to join AllllSevens+

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQo

I also have a referral link for TradingView, the charting software I use https://www.tradingview.com/pricing/?share_your_love=sevenparr

Reply