- AllllSevens

- Posts

- AllllSevens FREE Newsletter

AllllSevens FREE Newsletter

For The Week Beginning 6/26/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice. Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

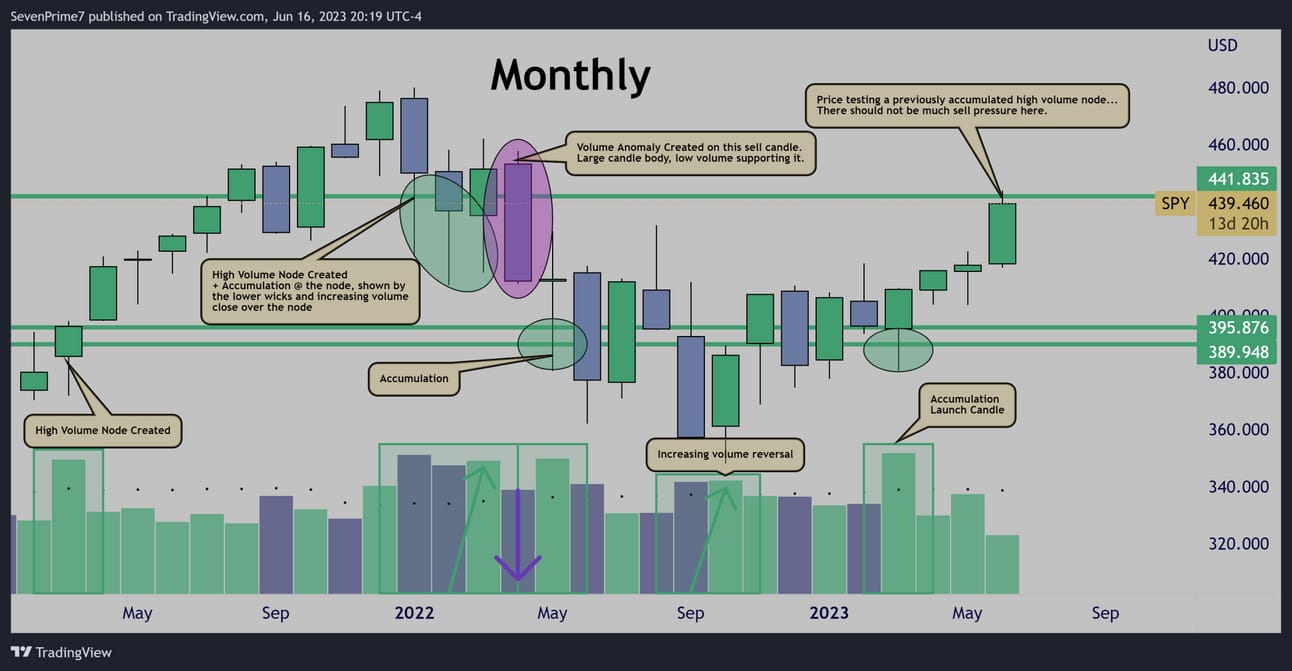

The monthly chart shows me that during all the retail panic over the last 1.5 years, institutions were buying.

$390-$395 and $442 are their main “points of control”

These are the largest Dark Pool levels in the last 2 years.

The monthly is bullish, but there is currently no actionable setup.

Let’s drop to the weekly and see what’s cooking there.

For more information on what a dark pool is, watch the video “What are dark pools and why are they useful?” on my twitter.

https://twitter.com/SevenParr/status/1673045899759570948?s=20

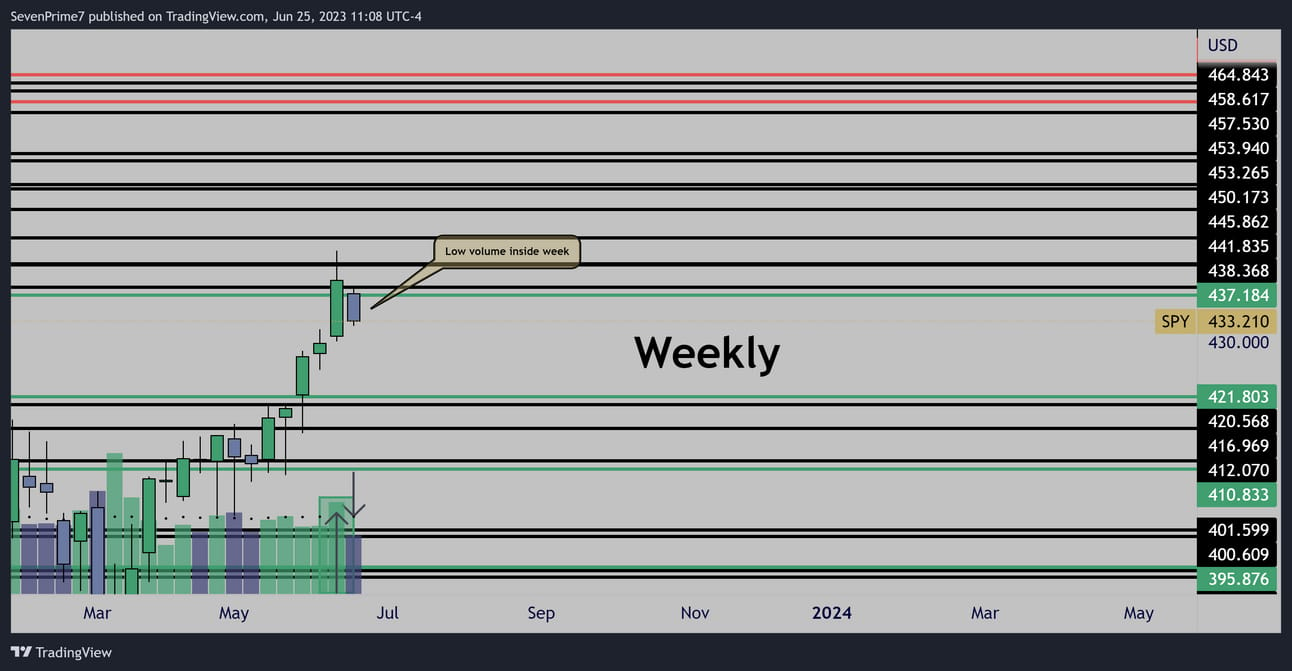

The weekly presents a bullish setup if price can reclaim $437.184

Last week provided a large bullish impulse (largest volume in 13 weeks)

Following this impulse, a low volume inside candle has formed.

This pattern typically favors continuation of the high volume candle.

However, as long as price is below $437.184, the only other level to buy at is all the way down at $421.803

I am not a buyer until the level above gets breached and confirms this pattern.

Until that happens- price is in in a potentially choppy and low probability consolidation period, with a chance of falling all the way to $421.803 if $437.184 cannot be reclaimed.

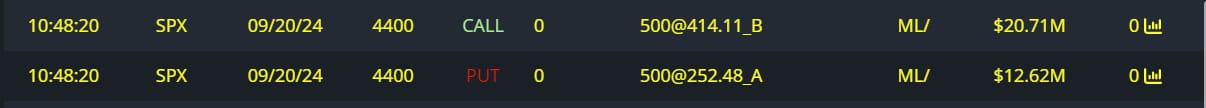

Unusual Options Flow

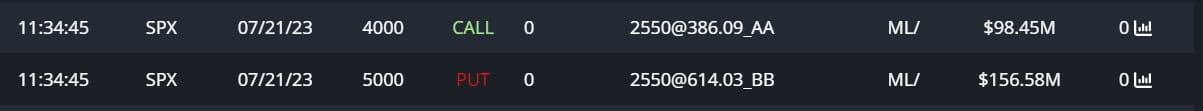

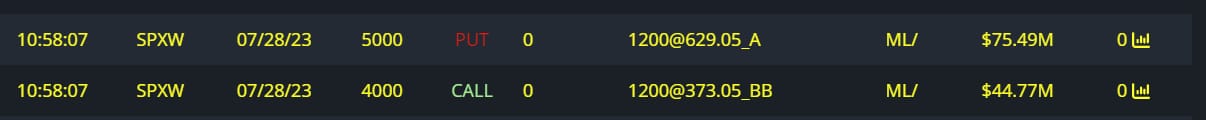

Pretty noisy options flow this week, confirming my analysis-

Stay away from this low probability consolidation period unless it touches a key level.

Upside continuation is the most probable scenario, but it is undeniable that price is below a key level, with no support for almost 1200PTS

$244M Bullish FULL RISK Reversal

$120M Bearish FULL RISK Reversal

$33M Bearish FULL RISK Reversal

Conclusion-

I am extremely bullish the S&P500

The monthly chart shows me that the entire sell-off for the last two years was purely retail panic, and institutional investors that own 2/3 of the market used it as a buying opportunity.

Price can only make SUSTAINED moves in the direction supported by this institutional money. There is proof of this in the recent rally, and price’s inability to make a sustained move below $390.

On a monthly basis, I would like to be a buyer over $442 or at $390 again.

The weekly chart looks enticing for a long setup, but it is not at a level where I am a buyer.

Price alerts will be set and I won’t be watching the screen until one is triggered. I’d love to play an upside break this week if it happens.

The options flow supports my “sit on hands” thesis for now, by providing strong sentiment in each direction…

If you want the rest of this weeks newsletter, sign up below for just $7.77!

https://allllsevensnewsletter.beehiiv.com/upgradeUpgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

Reply