- AllllSevens

- Posts

- AllllSevens FREE Newsletter

AllllSevens FREE Newsletter

For The Week Beginning 8/14/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

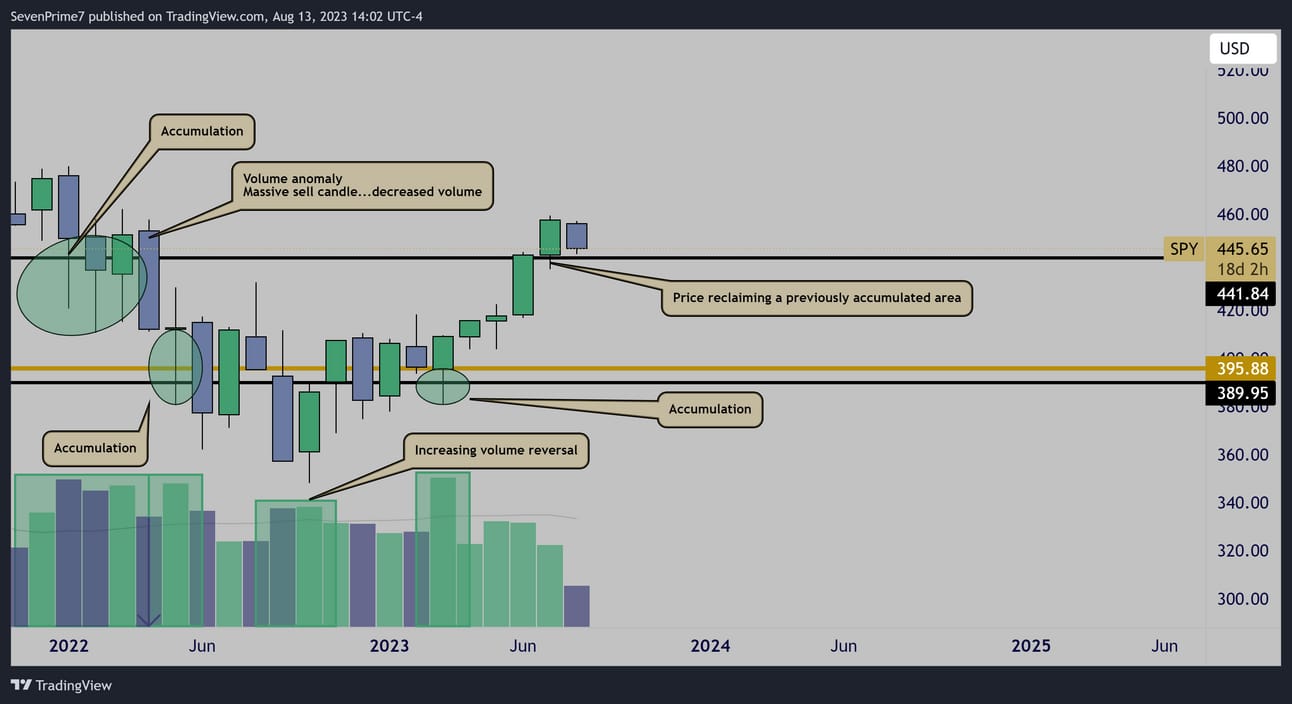

Monthly

This monthly chart is textbook volume-price-analysis.

Price is now reclaiming a previously accumulated area and I am anticipate the uptrend to continue-

However, the decreasing and below average volume is notable.

This tells me that some consolidation or a pullback could be needed, which is exactly what we’ve seen since the start of this month…

I am seeing signs that we want to reverse soon.

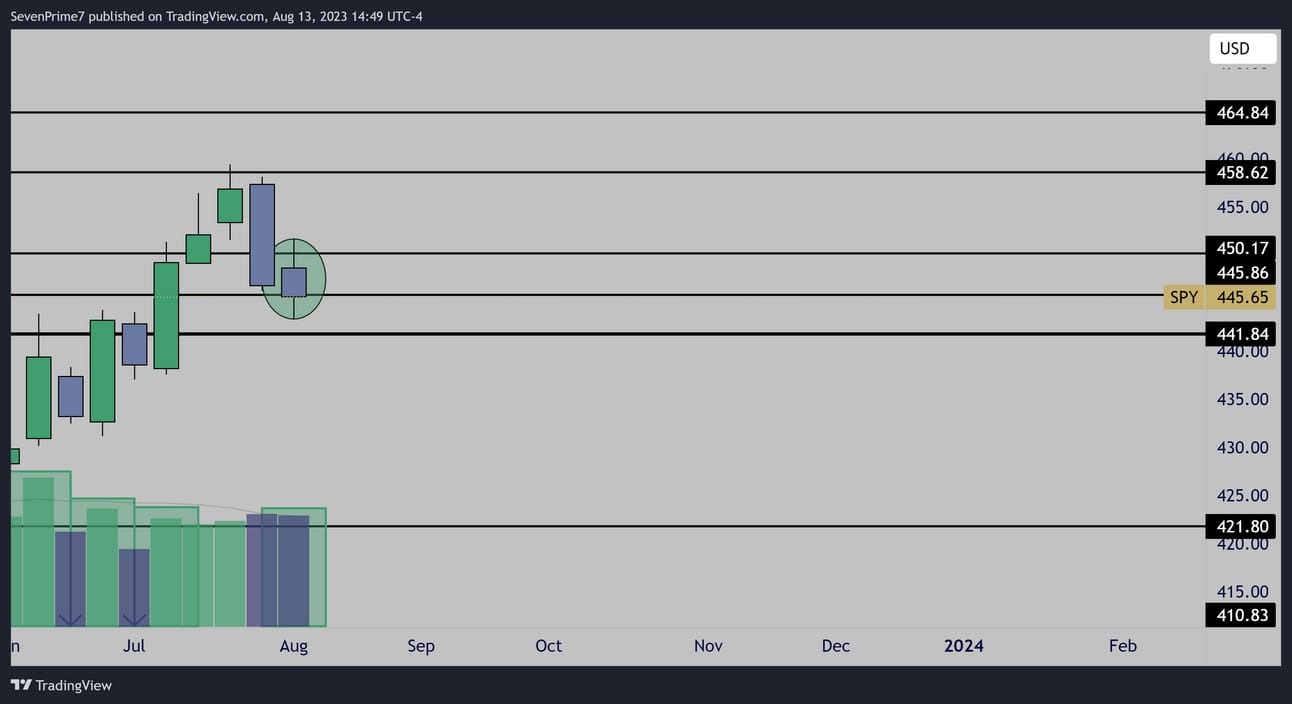

Weekly

On the weekly chart, I notice a slight volume anomaly.

Price formed an indecision candle on practically the same volume as the previous candle which has a much larger spread.

This signals potential stopping volume-

However, for this to truly be an A+ long setup, I would have liked to see increasing or even above average volume on this candle.

I think that price is getting close to resuming the uptrend, but still not a crystal clear signal. I think being conservative is the best move here.

When price does reverse, the move will last multiple weeks-

So I am not feeling particularly rushed to get long…

But, I do think there’s a decent chance the reversal comes sooner than later, let’s dive deeper…

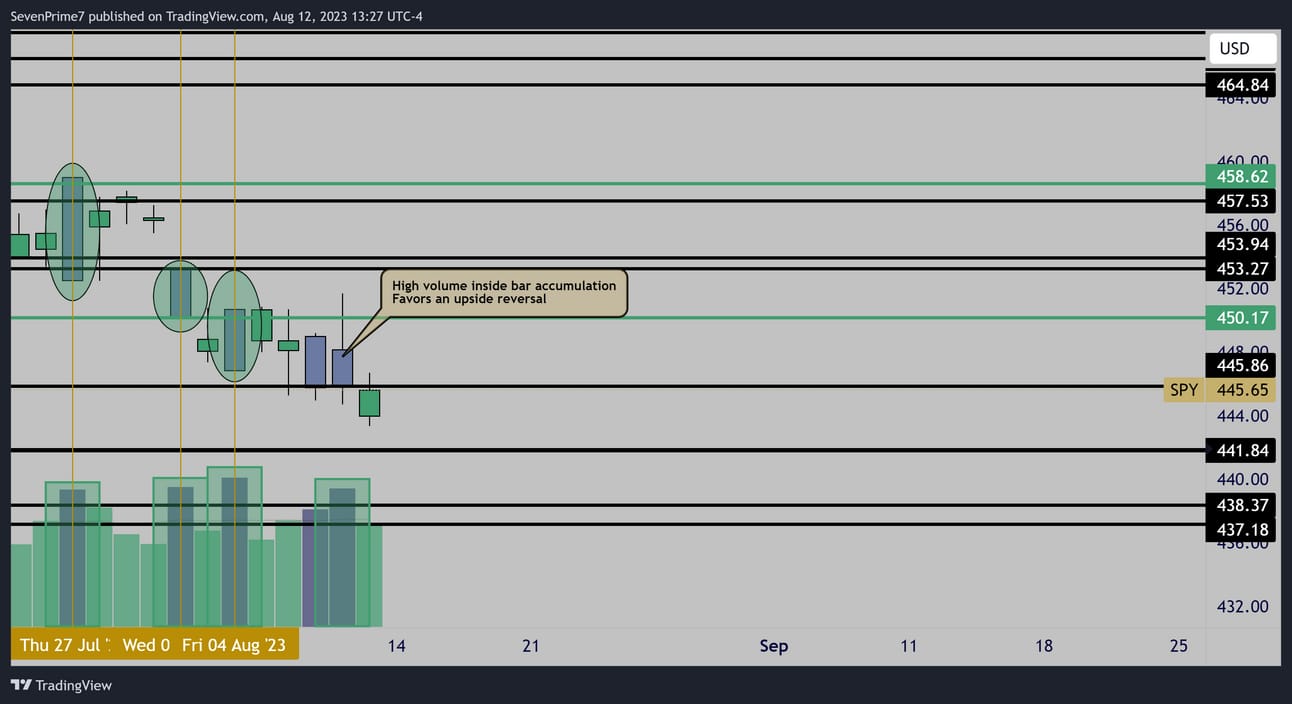

Daily

First off, Thursday’s candle was a very bullish signal-

And all the days prior, I have seen major intraday accumulation taking place inside what looks like clearly bearish candles…

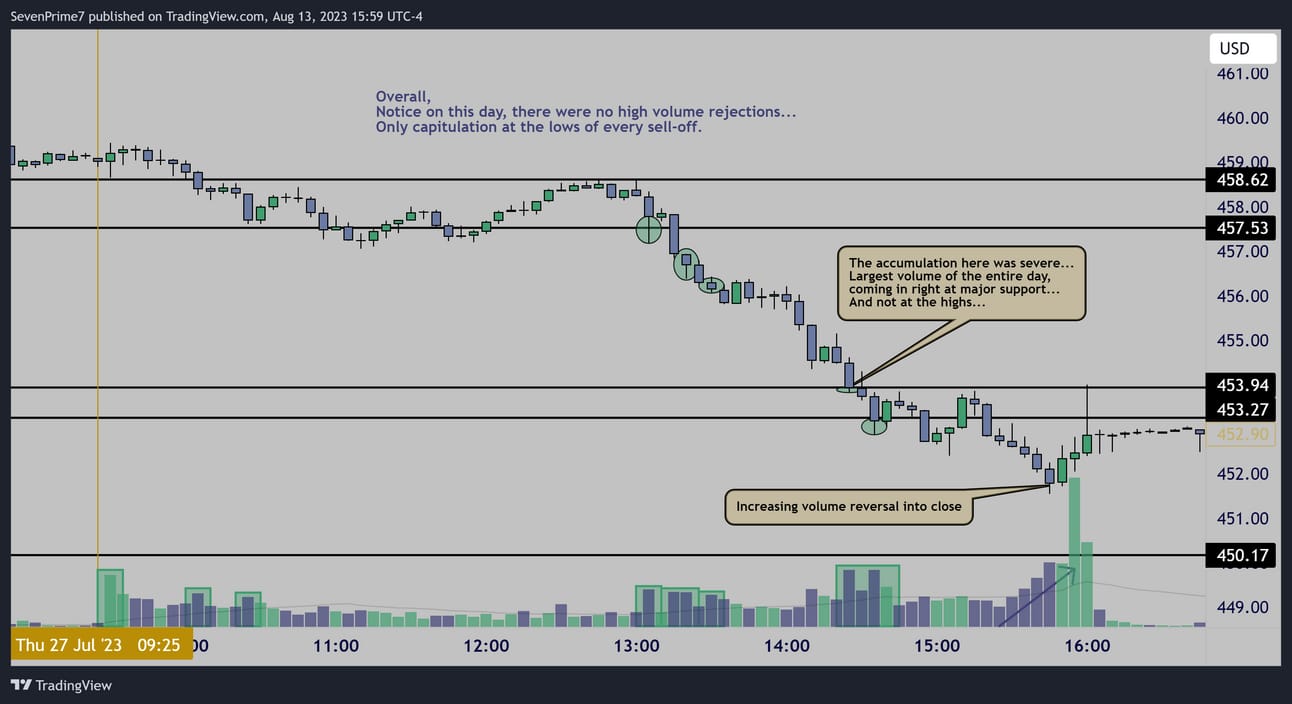

5m

7/27 accumulation

15m

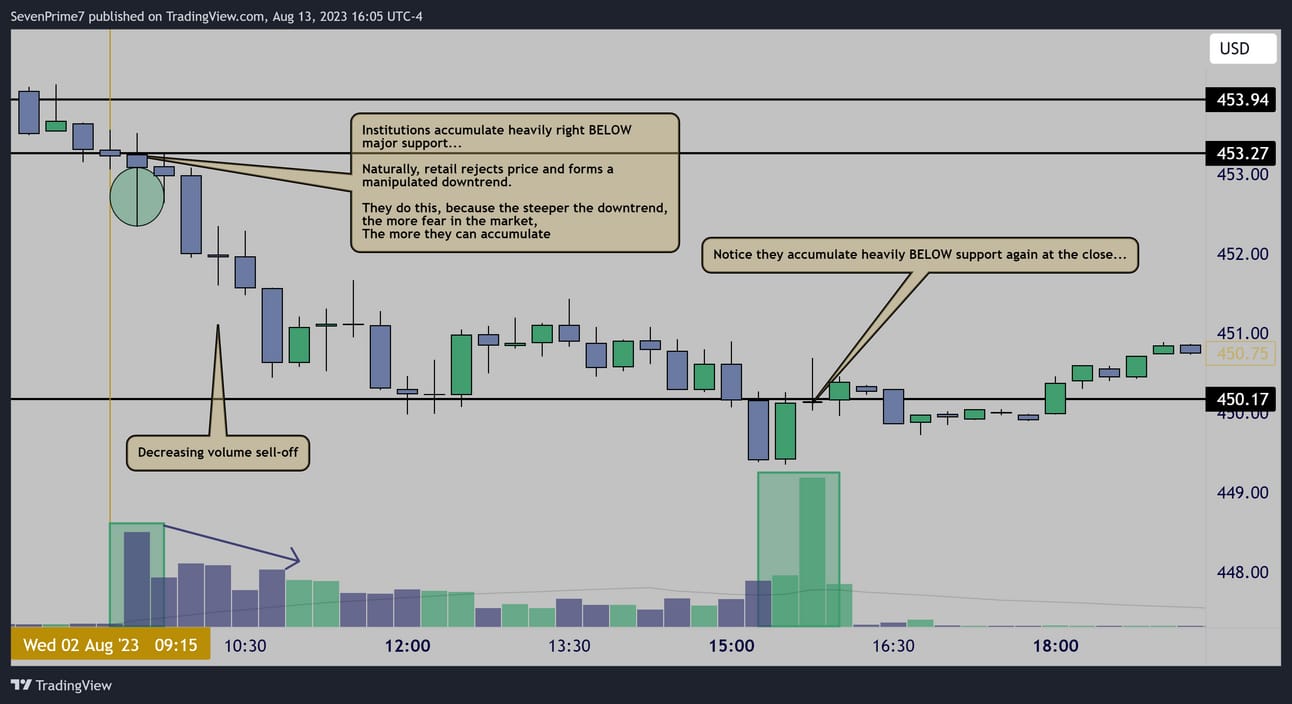

8/02 accumulation

Manipulated downtrend;

This is a common practice used by institutions to accumulate a large amount of shares…

The retail panic and abundance of sell orders is exactly what they need to be able to run massive buy programs.

They manipulated a downtrend off the open,

And again into the close, which resulted in further downside, and more accumulation over the following days.

15m

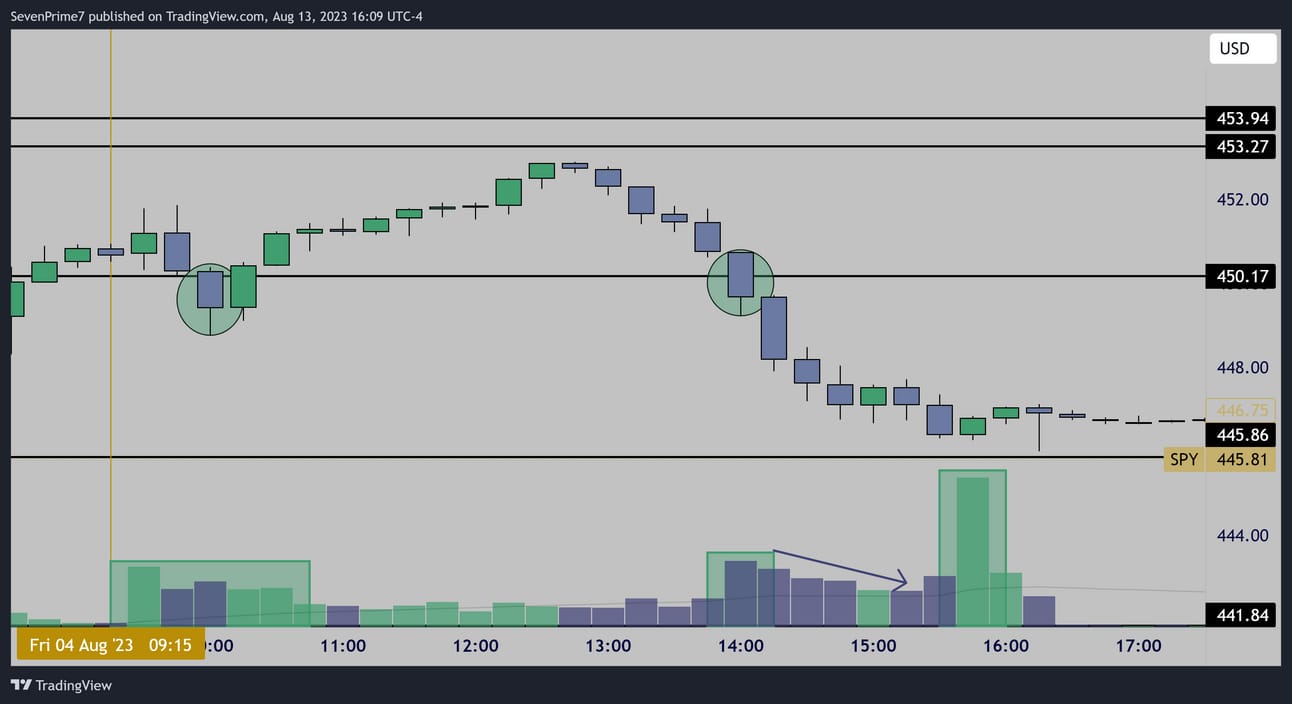

8/04 accumulation

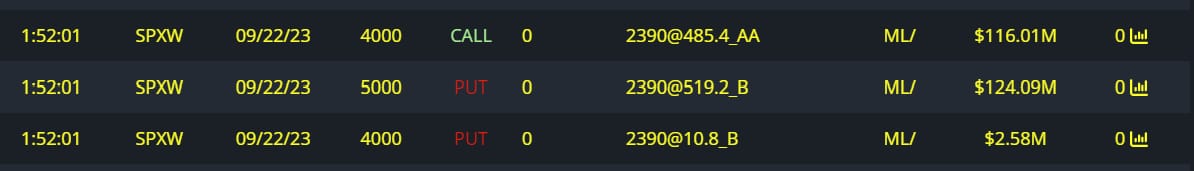

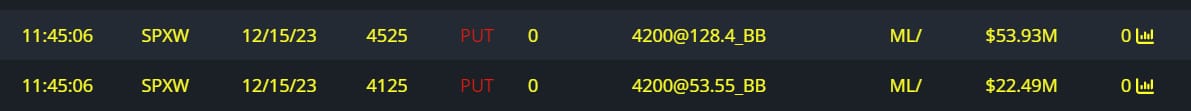

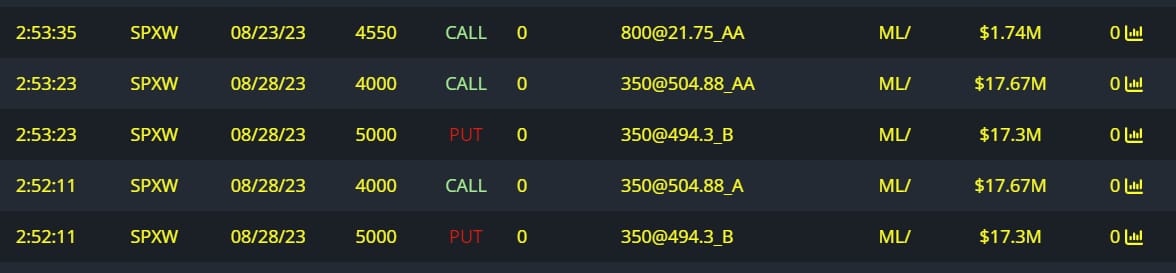

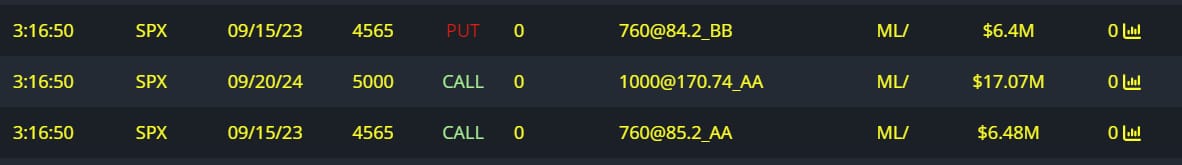

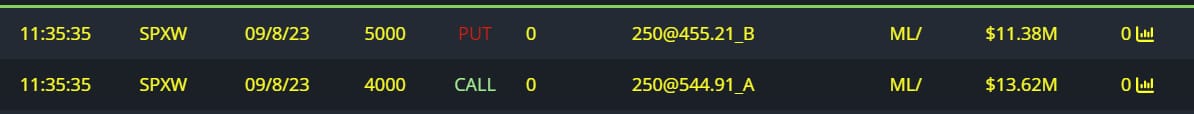

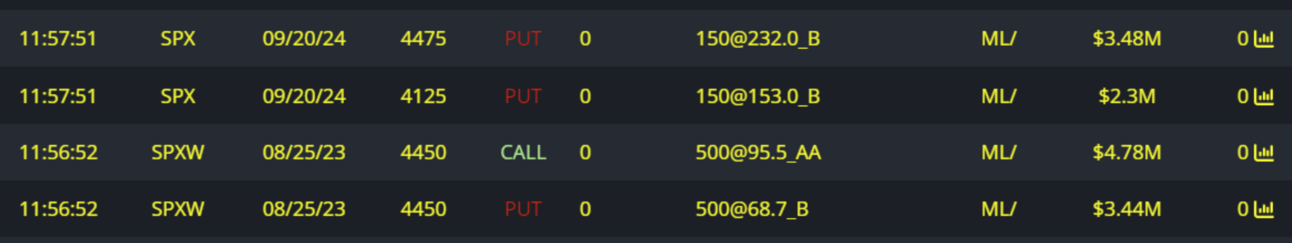

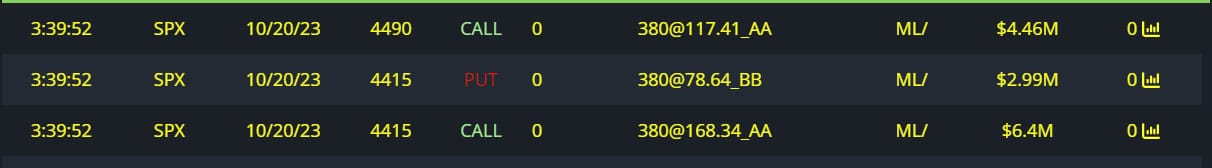

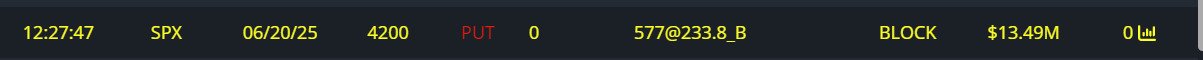

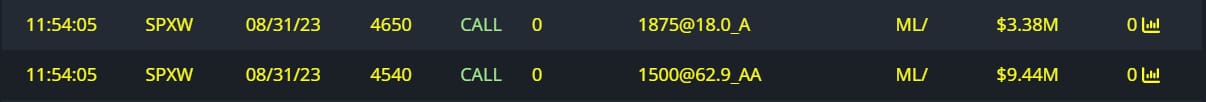

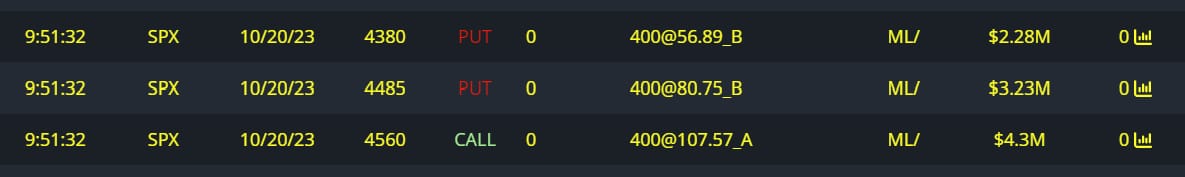

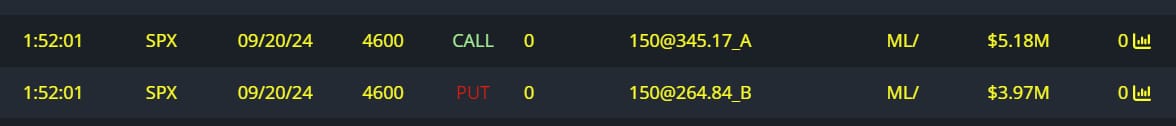

Unusual Options Flow

$240M full risk bullish order

$76M puts written

$70M full risk bullish order

$30M full risk bullish order

$25M full risk bullish order

$14M full risk bullish order

$13.8M full risk bullish order

$13.5M puts written

$12.8M calls bought

$9.8M full risk bullish order

$9M full risk bullish order

$5M full risk bullish order

Over $500M on some extremely unusual bullish options flow.

Most of the money is betting on an upside reversal into September and even into the end of this month.

Conclusion-

I’m very bullish long-term of course,

And I think more short-term upside is in store-

However, this weeks candle does not SCREAM long to me like I wish it did…

I can easily see some more downside, and more accumulation.

But,

If price opens over $445.90 this week, I think there is a good chance that the upside reversal begins.

Overall, I just want to keep in mind that when this does reverse to the upside again it will be a multiple week move…

So being conservative until the trend really forms is the best move.

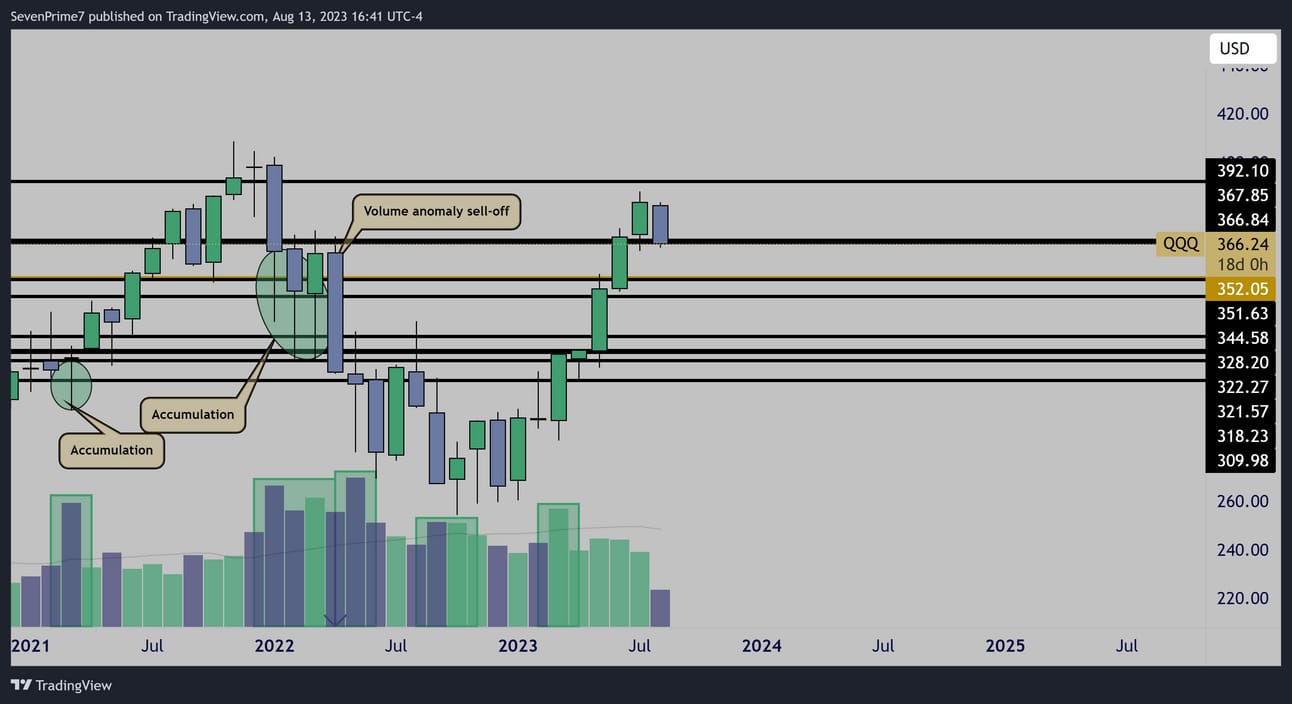

$QQQ

Monthly

The monthly chart here shows great accumulation patterns.

Price currently retesting support.

Weekly

I want to point out that the QQQ had it’s largest weekly volume since 2011, on a bullish impulse off the $350 support area back in 2022.

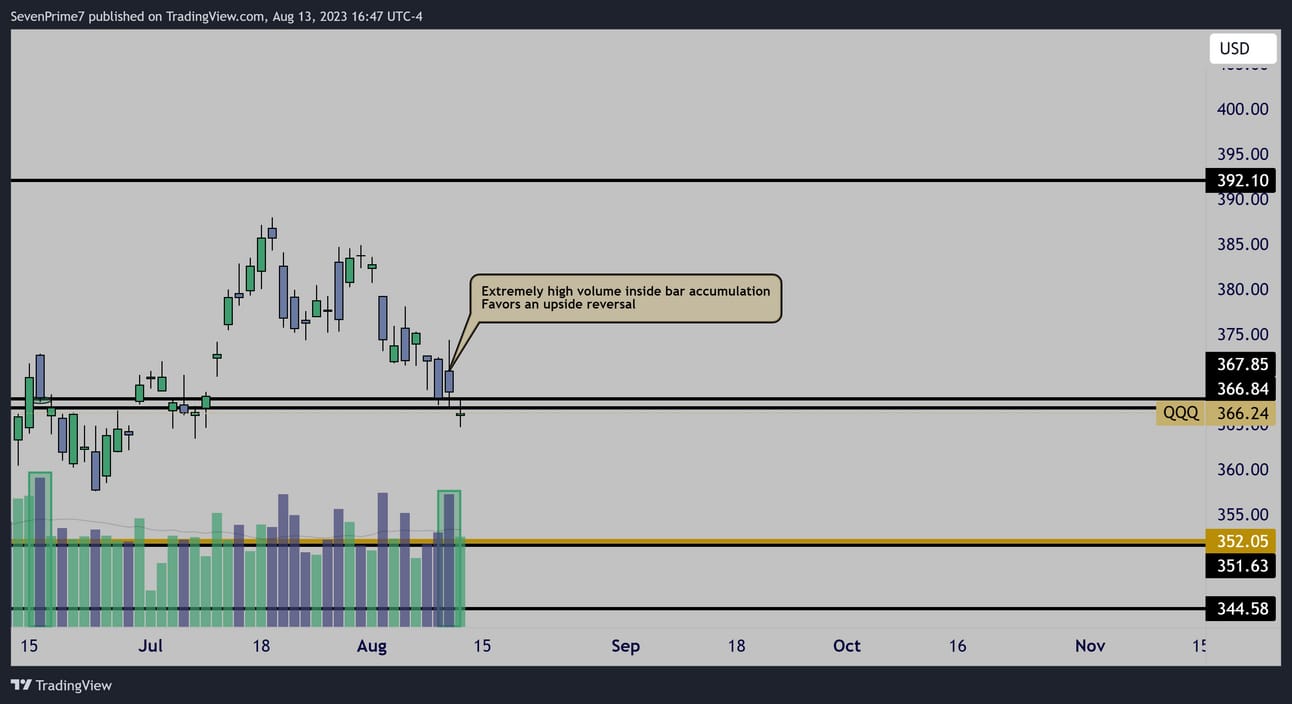

Daily

The daily chart here looks very interesting-

Clear buy pressure where I’d want to see it,

I think price needs to gap up over support next week though or we’re looking at chop and potential short-term downside.

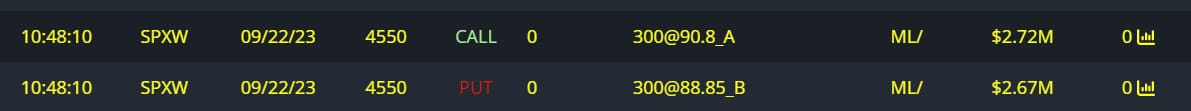

Unusual Options Flow

$120M calls bought

Conclusion-

I’m extremely bullish on this long-term of course,

But similar to the SPY, just not getting any crazy A+ upside signal quite yet…

Just like the SPY, I’m interested in QQQ longs only if there is a gap up over my levels on Monday,

Otherwise, I wait.

And even if I we get the gap up, I’m conservative until trend fully shifts with volume.

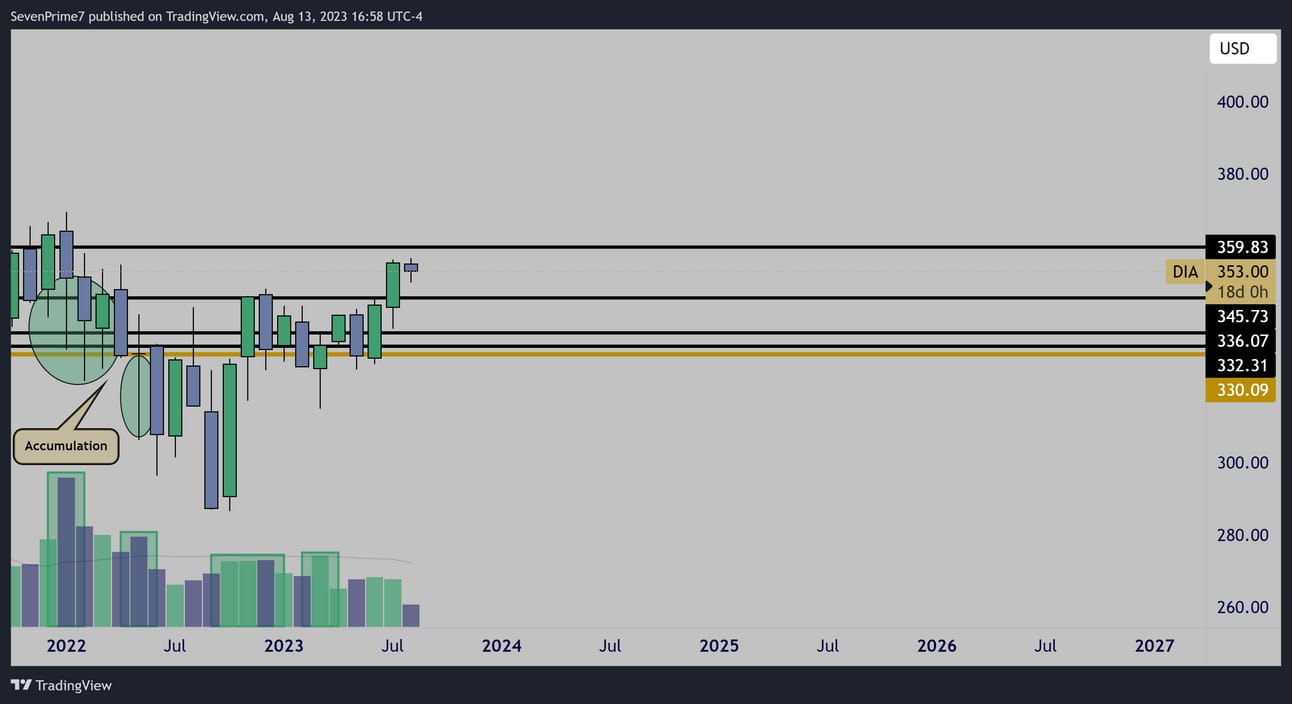

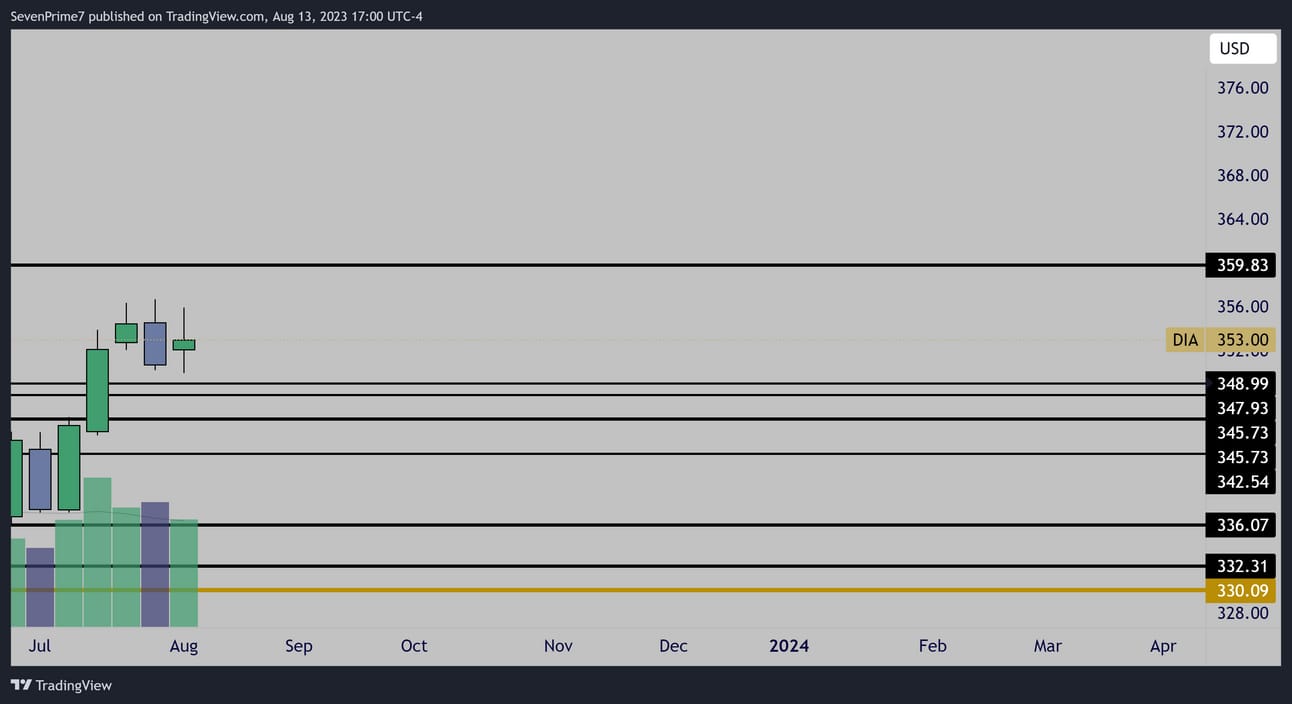

$DIA

Monthly

This monthly chart shows major accumulation in 2022

Price currently in no mans land.

Weekly

The weekly chart here doesn’t look very interesting to me at all.

Not much to work with.

Technically, it’s a bearish pattern,

A low volume inside bar following a bearish impulse favors continuation to the support below.

I just don’t think the risk-reward for that is valid,

I’m much more interested in waiting patiently for a long.

Conclusion-

I’m extremely bullish long-term,

But not seeing any active setup here.

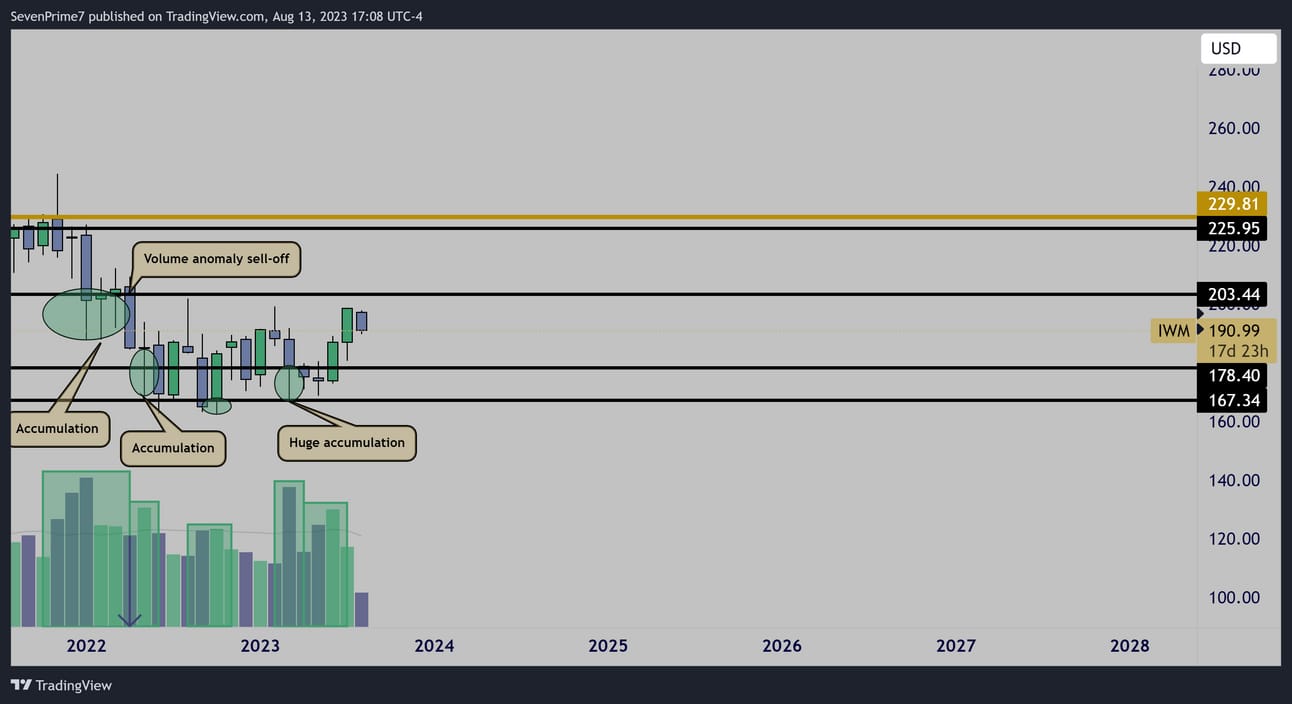

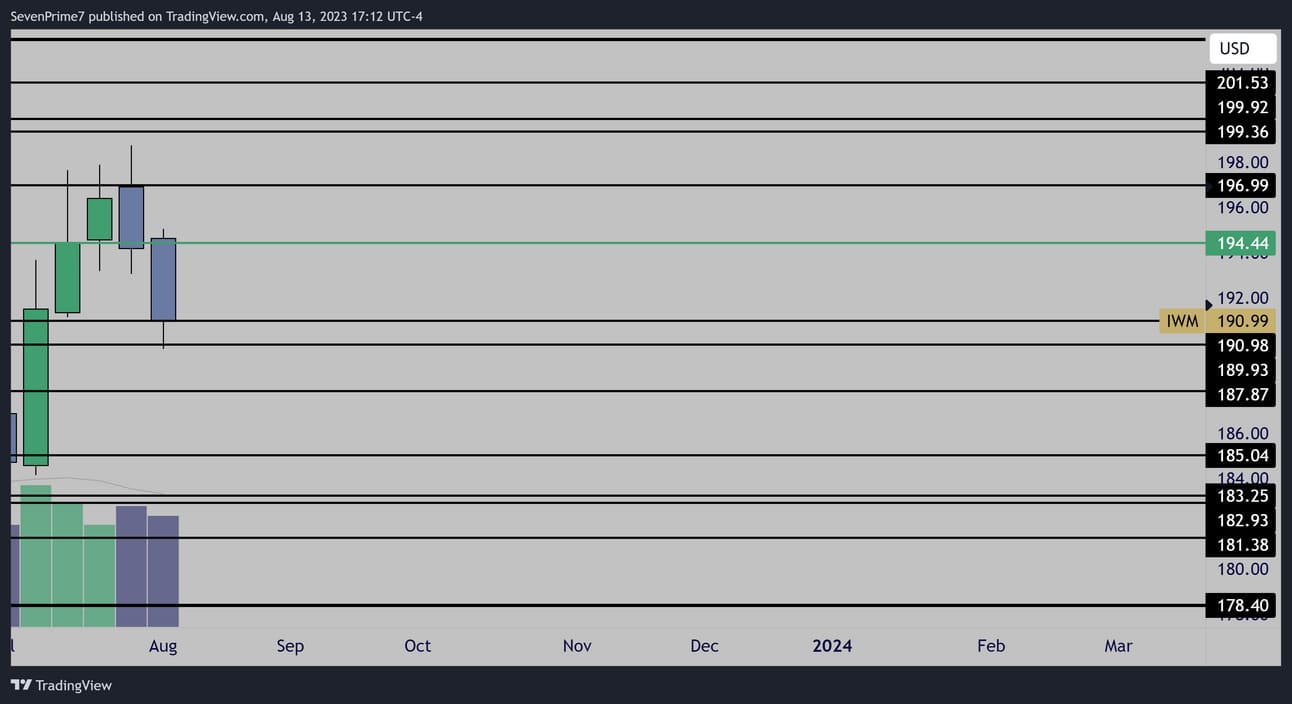

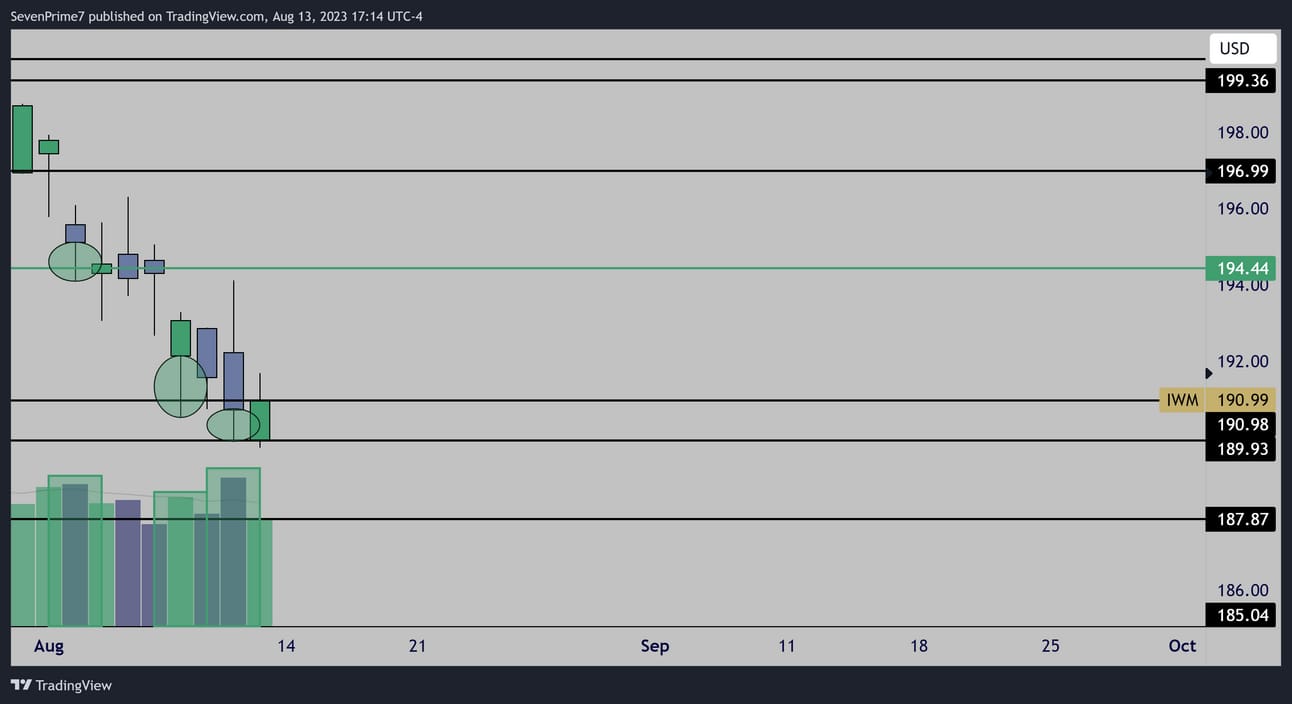

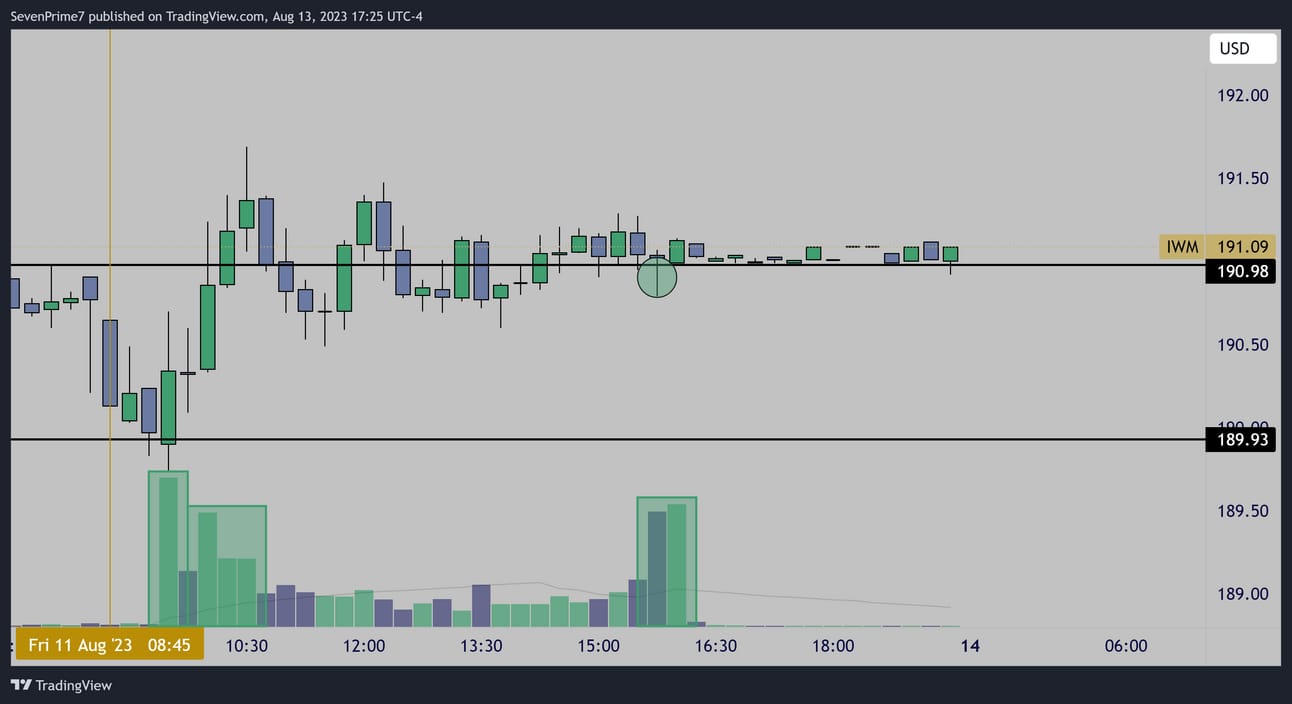

$IWM

Monthly

Some pretty great accumulation patterns on the IWM monthly chart.

Weekly

Nothing standing out on the weekly yet unfortunately…

Daily

I am seeing some accumulation taking place on the daily.

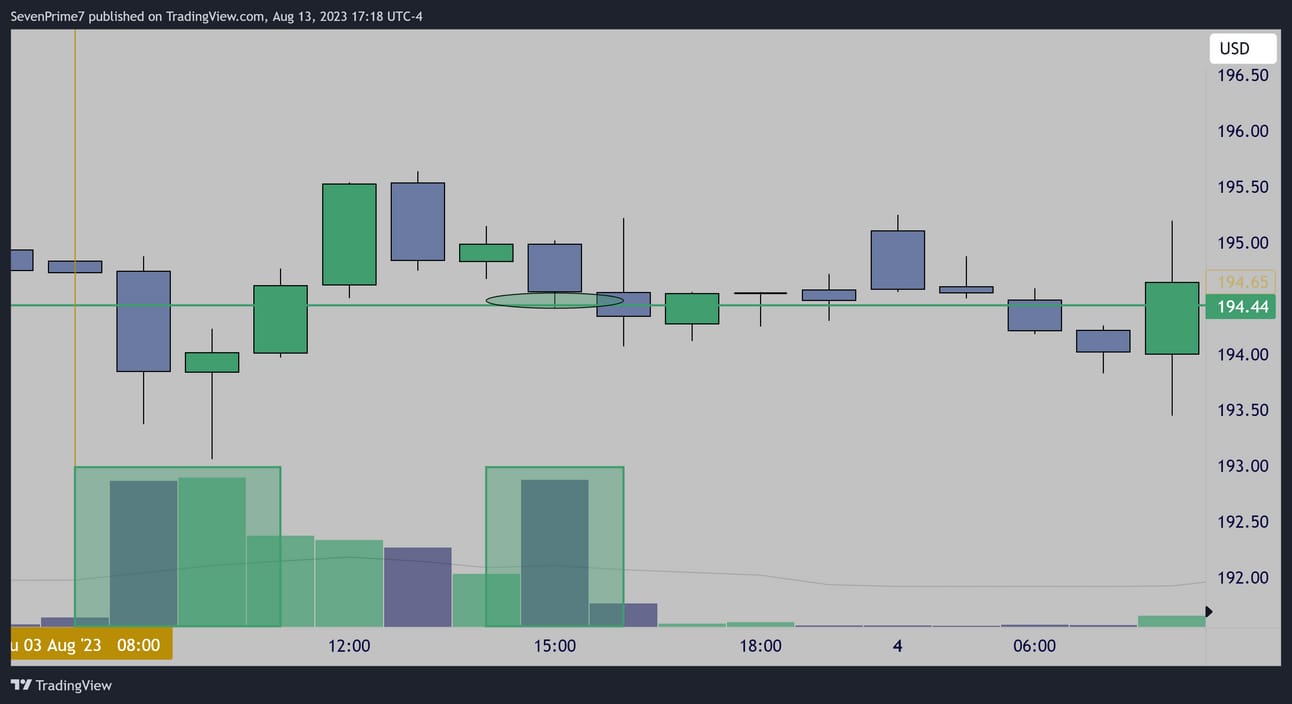

15m

8/01 accumulation

15m

8/02 accumulation

1hr

8/03 accumulation

15m

8/04 accumulation

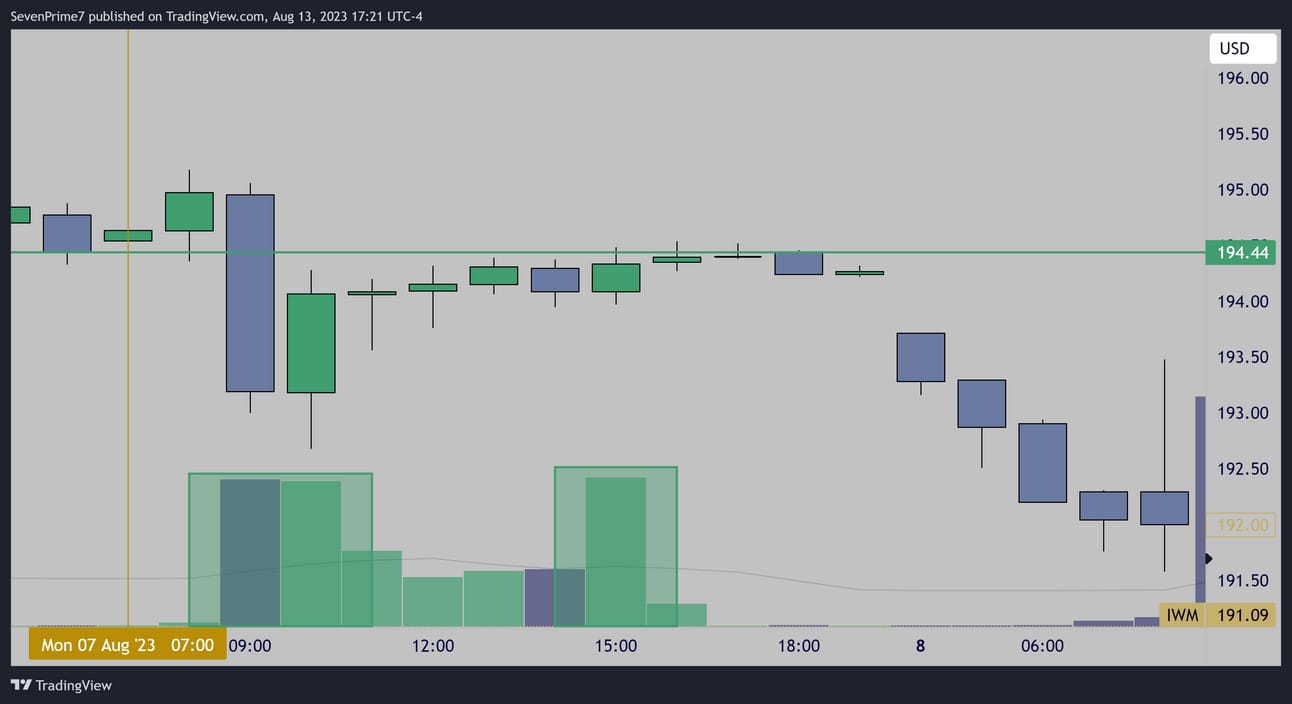

1hr

8/07 accumulation

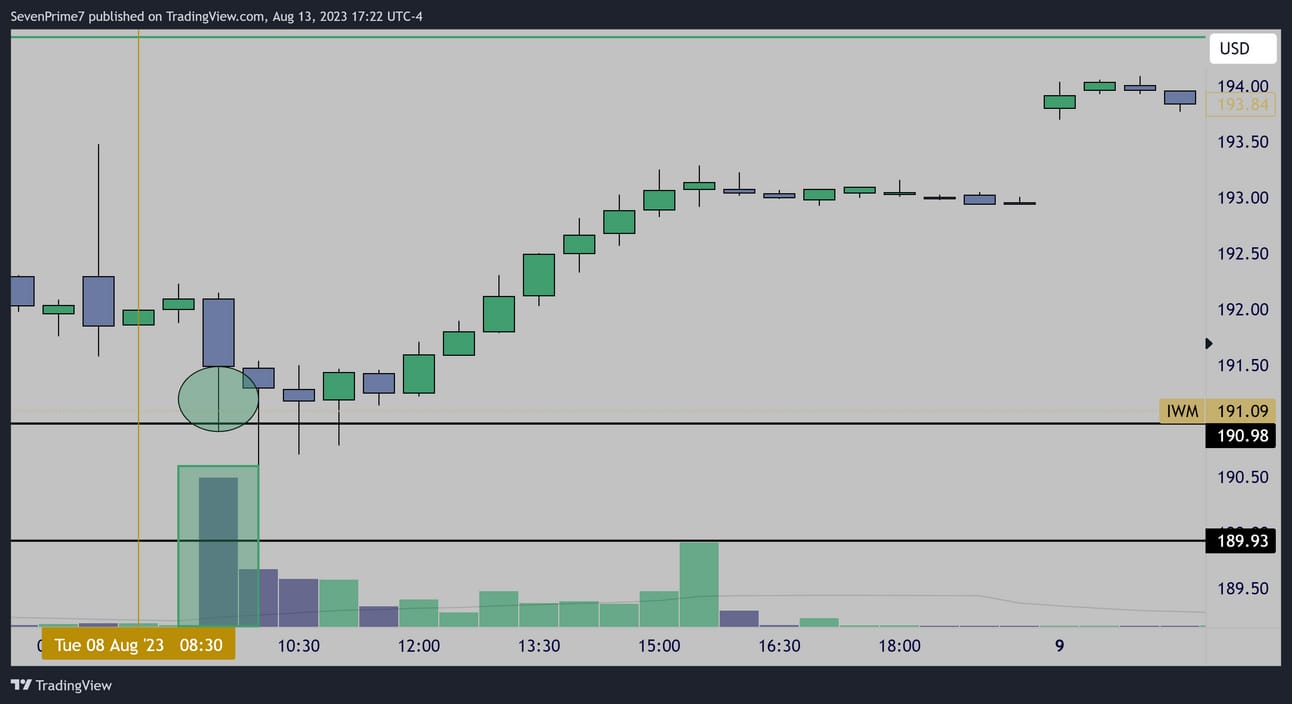

30m

8/08 accumulation

30m

8/09 accumulation

15m

8/10 accumulation

15m

8/11 accumulation

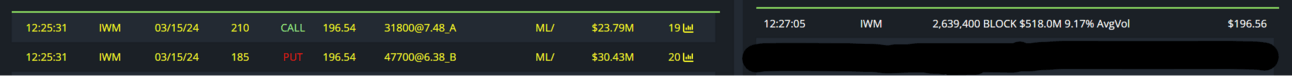

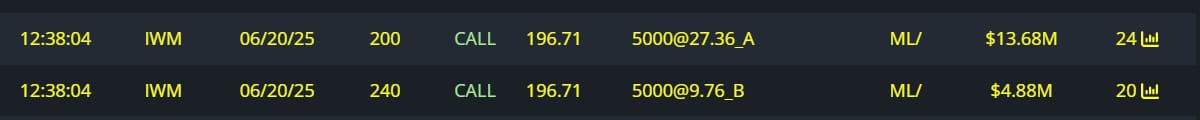

Unusual Options Flow

$54M full risk bullish order

+

$518M Dark Pool Transaction

$8.8M bullish call spread

Conclusion-

I am extremely bullish IWM long term,

And I think a big move is brewing here soon.

I am seeing some massive accumulation take place inside the recent downtrend, and this options flow that has came in is amazing.

It is only a matter of time before this confirms with a strong weekly candle.

There is so much time involved here, I’m not in a huge rush to get long, would love to see some weekly structure form on high volume.

That’s allll!

In conclusion, I am very bullish the overall market right now, but I do think there is good reason to be somewhat conservative until strong weekly bars form again!

If you want the rest of this weeks newsletter, sign up below for just $7.77!

I analyze individual stock picks, not just the indices!

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

Reply