- AllllSevens

- Posts

- AllllSevens FREE Newsletter

AllllSevens FREE Newsletter

For The Week Beginning 8/28/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

The last few weeks I have shown you blatant accumulation taking place on the S&P500. Institutions are long and are actively adding new longs.

Unfortunately, this doesn’t always mean price is ready to go up NOW.

https://twitter.com/AllllSevens/status/1695861749700784415?s=20

In the short-term we must be very open minded, as institutions don’t move the market day-to-day or month-to-month.

Retail participants do.

This means price-momentum and current market sentiment is essential.

So, let’s approach this week with an open mind.

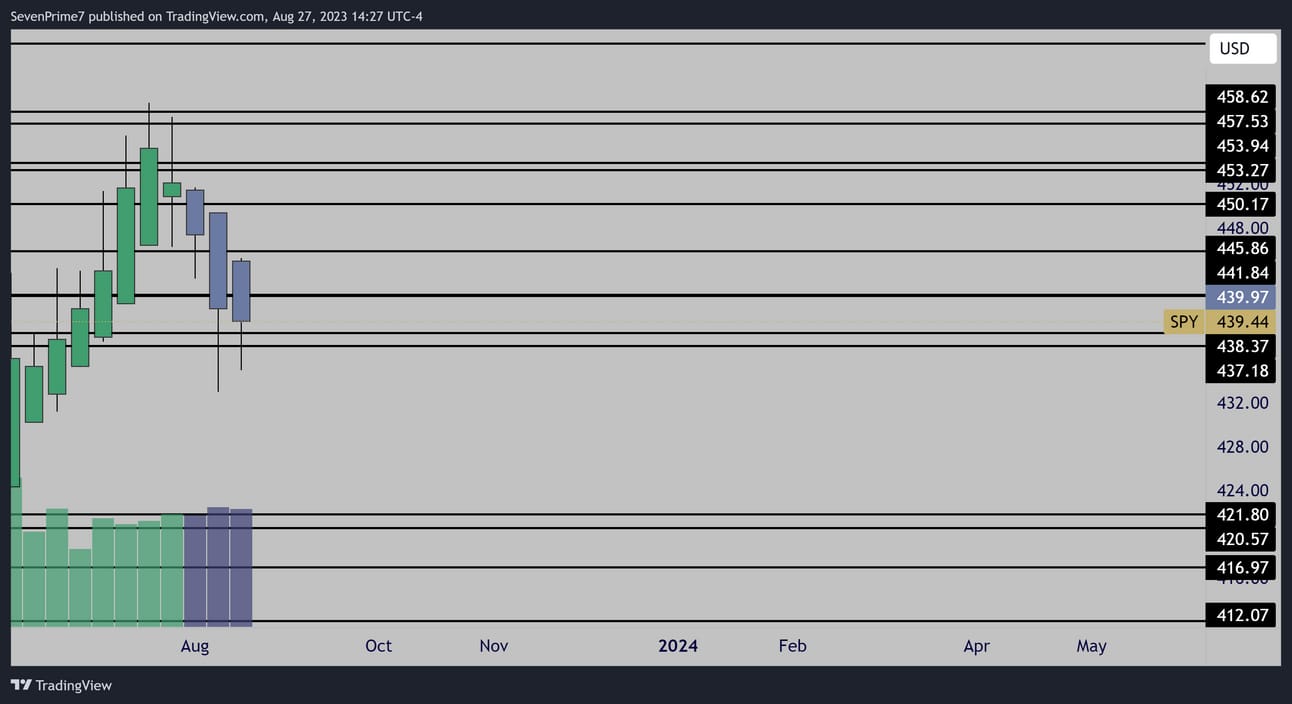

Weekly

I like to gauge price-momentum with Heikin Ashi candles.

Momentum is currently favoring downside as long as price opens below $441.84 this week.

If it opens above, then bulls could be taking control.

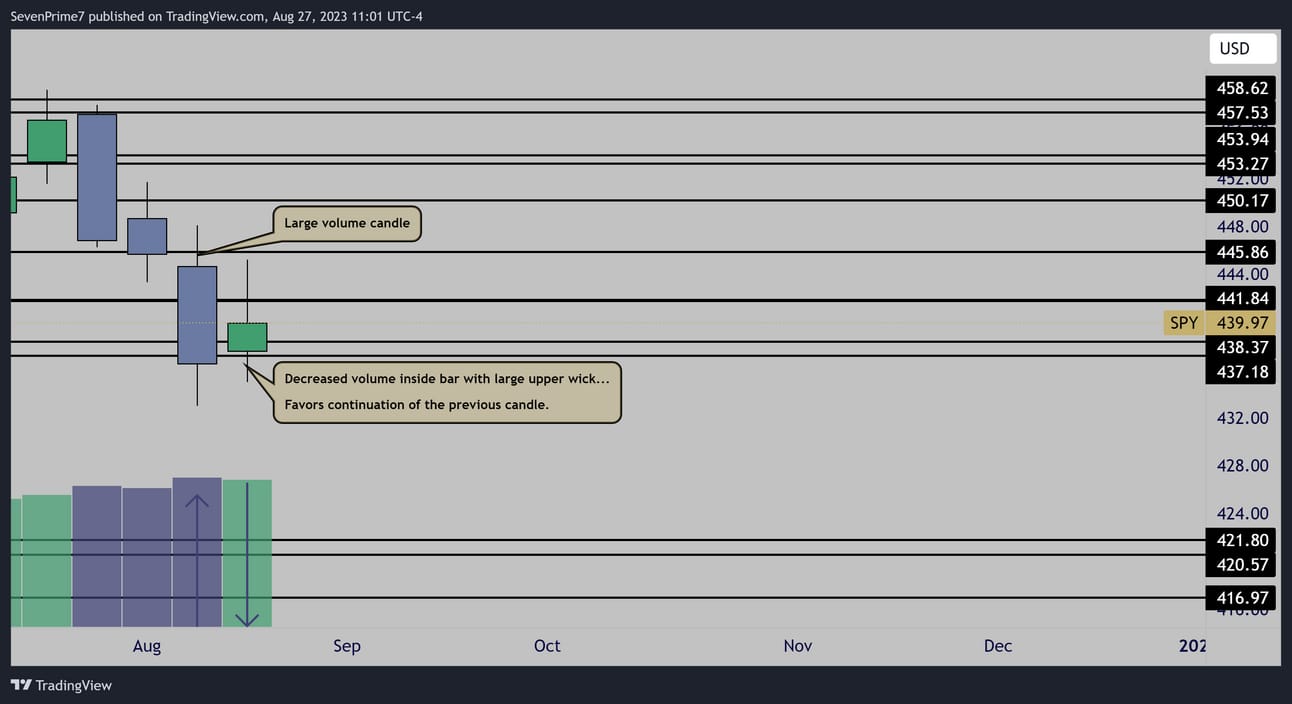

Weekly

Despite the two bullish volume anomalies the previous two weeks,

price is actually showing a bearish setup right now.

A decreased volume inside bar following a large volume candle statistically favors continuation of the large volume candle.

Also, a notable upper wick was left behind from the $441.84 level, which is keeping price-momentum in favor of bears.

As long as price stays below this level, I think downside is favorable.

While I think downside is favorable this week, I don’t think it’s absolutely A+

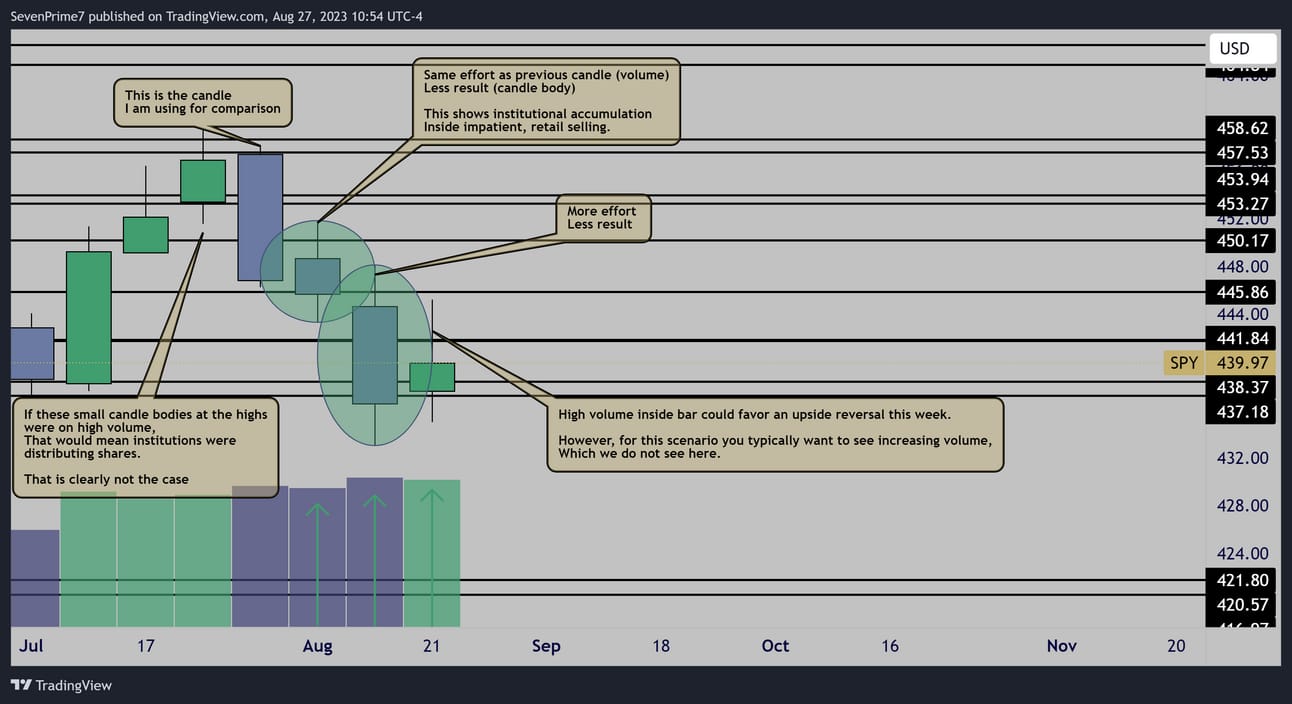

Weekly

Like I said, we have two bullish anomalies in recent weekly candles.

This week, while it is a decreased volume inside bar, favoring downside continuation, it is a relatively high volume candle…

Increased volume inside bars favor reversals of the previous candle.

This weeks candle is not increased volume, but it is above average.

So it is not an A+ long for me still.

But,

IF momentum shifts to the upside, and price begins to build structure over $441.84 then I think price will aggressively push higher.

Conclusion-

Monthly bias- Neutral

Weekly bias- Neutral/Bearish

My plan is simple this week.

I anticipate downside continuation below $441.80

If price builds structure over $441.80 I will anticipate upside.

My weekly bias is Neutral because while I think downside is the most probable scenario, it is not an A+ setup and I could easily see price reversing if it gets over resistance.

After this email is sent out, I send out my premium newsletter that includes analysis individual stocks!

Plus, get access to my Discord where I organize and update every idea I’ve ever posted. Keeping track of the newsletters can be a bit of a hassle. In discord it’s much easier to know my current thoughts on anything I’ve previously mentioned.

It’s $7.77 per month! Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

Reply