- AllllSevens

- Posts

- AllllSevens FREE Newsletter 9/11/23

AllllSevens FREE Newsletter 9/11/23

SPY & ARKK

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

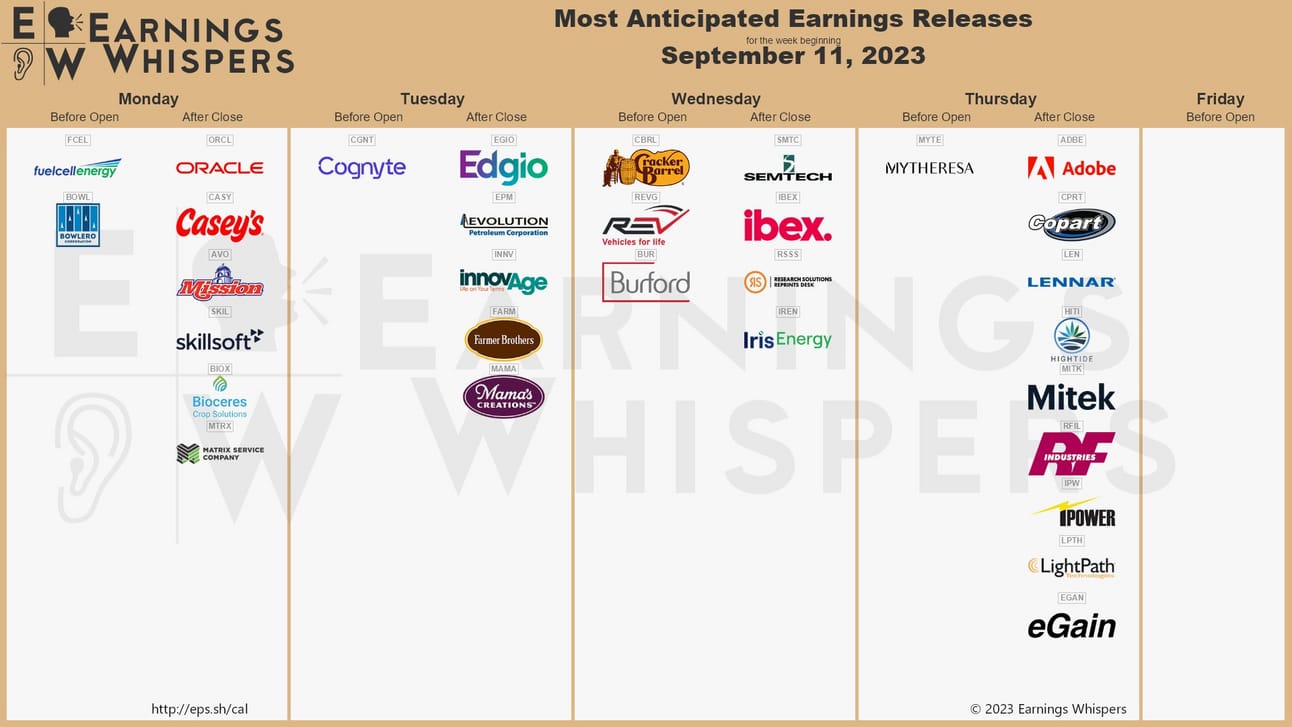

No high impact economic data this week.

A few earnings this week,

$ORCL & $ADBE are two big tech names that could provide some opportunity post-earnings.

$SPY

Be sure to read my MONTHLY update on SPY from last weeks newsletter.

To sum it up, bulls are strong and in control over $441.84

Below that level, momentum could be lost and I would be RISK-OFF.

Here is the link to that newsletter if you have not read it yet.

https://allllsevensnewsletter.beehiiv.com/p/allllsevens-free-newsletter-90523?utm_source=allllsevensnewsletter.beehiiv.com&utm_medium=newsletter&utm_campaign=allllsevens-free-newsletter-9-05-23

Twitter-

https://twitter.com/AllllSevens/status/1698825236030915008?s=20

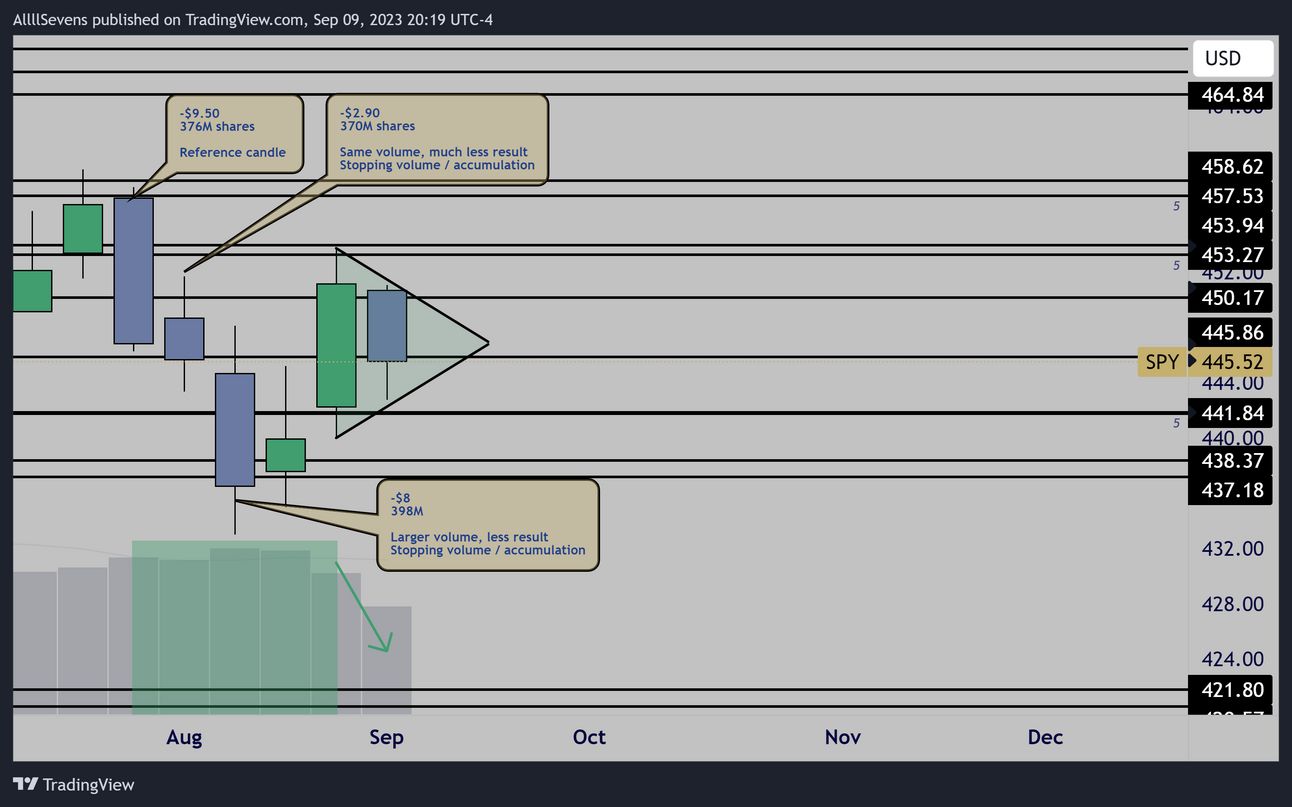

Weekly

Over the last month, we saw clear stopping volume / accumulation.

Finally, price reversed… but on low volume.

There is no A+ candle pattern here for a swing entry.

For a scalp though, I have an idea!

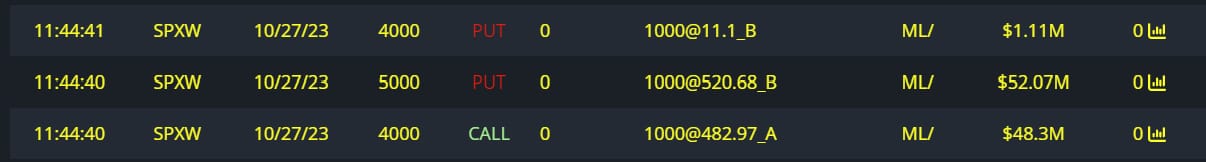

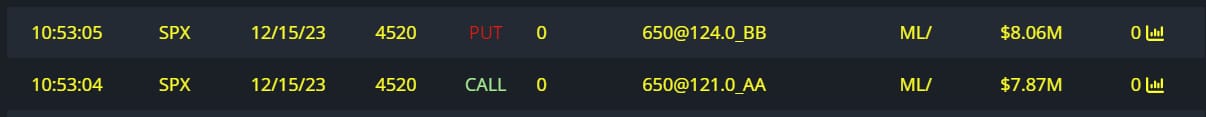

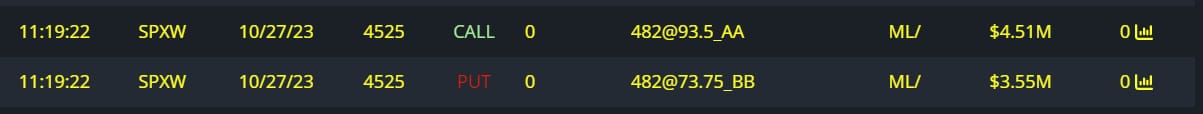

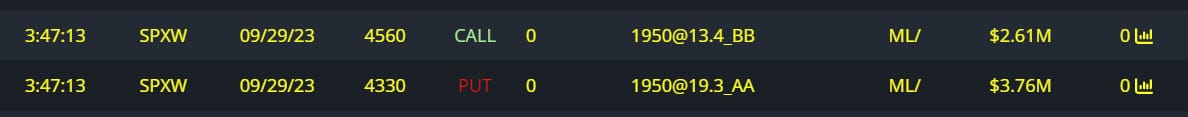

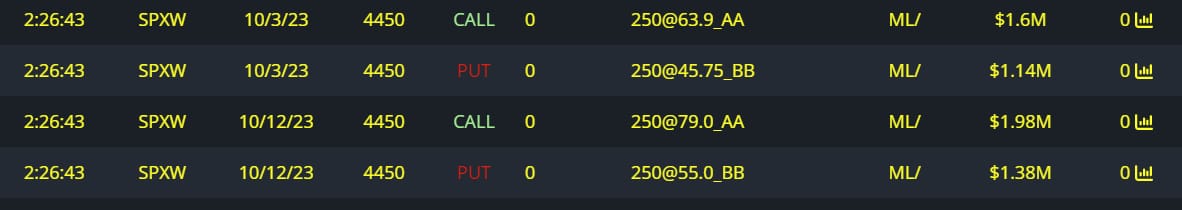

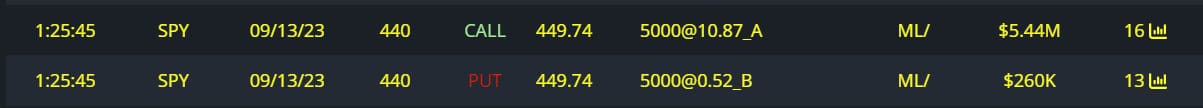

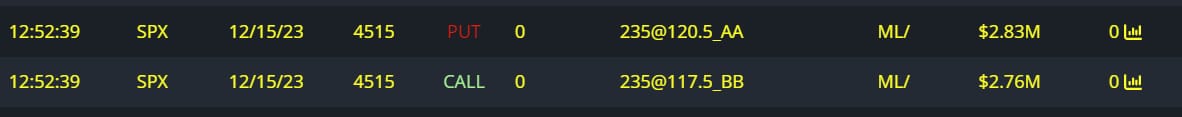

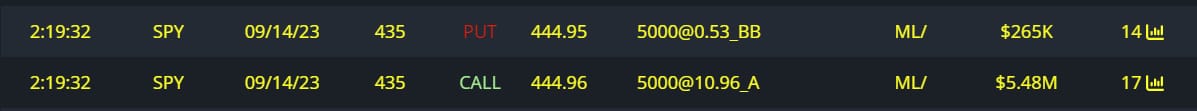

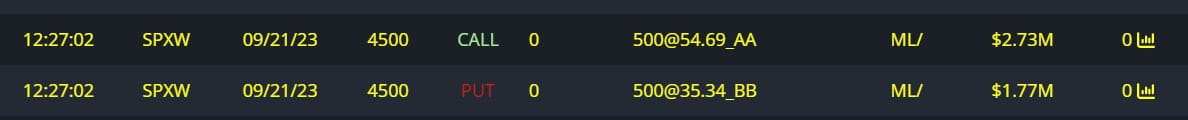

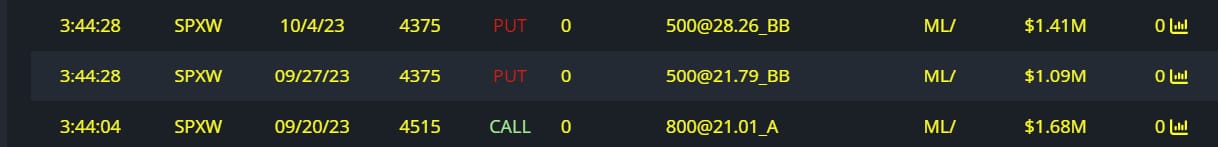

Unusual Options Flow

$149M Bullish

$12M Bearish

$100M Bullish

$15.9M Bullish

$8M Bullish

$6.3M Bearish

$6.1M Bullish

$5.7M Bullish

$5.6M Bearish

$4.7M Bullish

$4.5M Bullish

$4.2M Bullish

Conclusion-

I have no strong sentiment this week.

The low volume and the fact that FOMC is next week tells me this is a RISK-OFF environment for the time being.

After all, it is nearly impossible to make consistent money trading every single day and every single week. Sometimes, you just have to wait.

However, due to the weekly momentum and the options flow I do want to present to you a possible upside scalp scenario.

If price can open over $445.86 on Monday, bulls will have strong upside momentum. If that happens, I want to trade it.

Here are some key levels to watch for resistance or structure if this scenario plays out.

5m

If price fails to open and hold above $445.87, I am not very interested in trading this week. this would open the door to a potential loss of $441.84 which would put the market further into a risk-off environment.

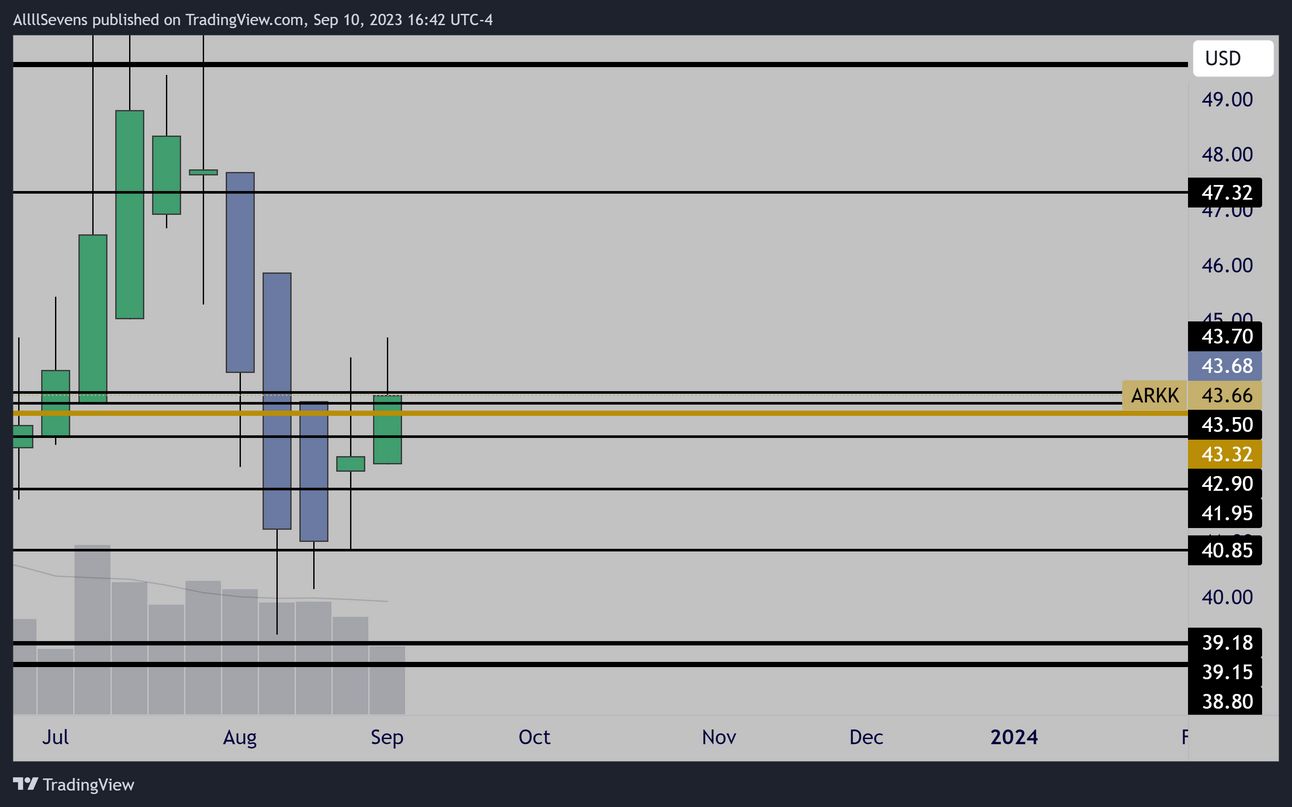

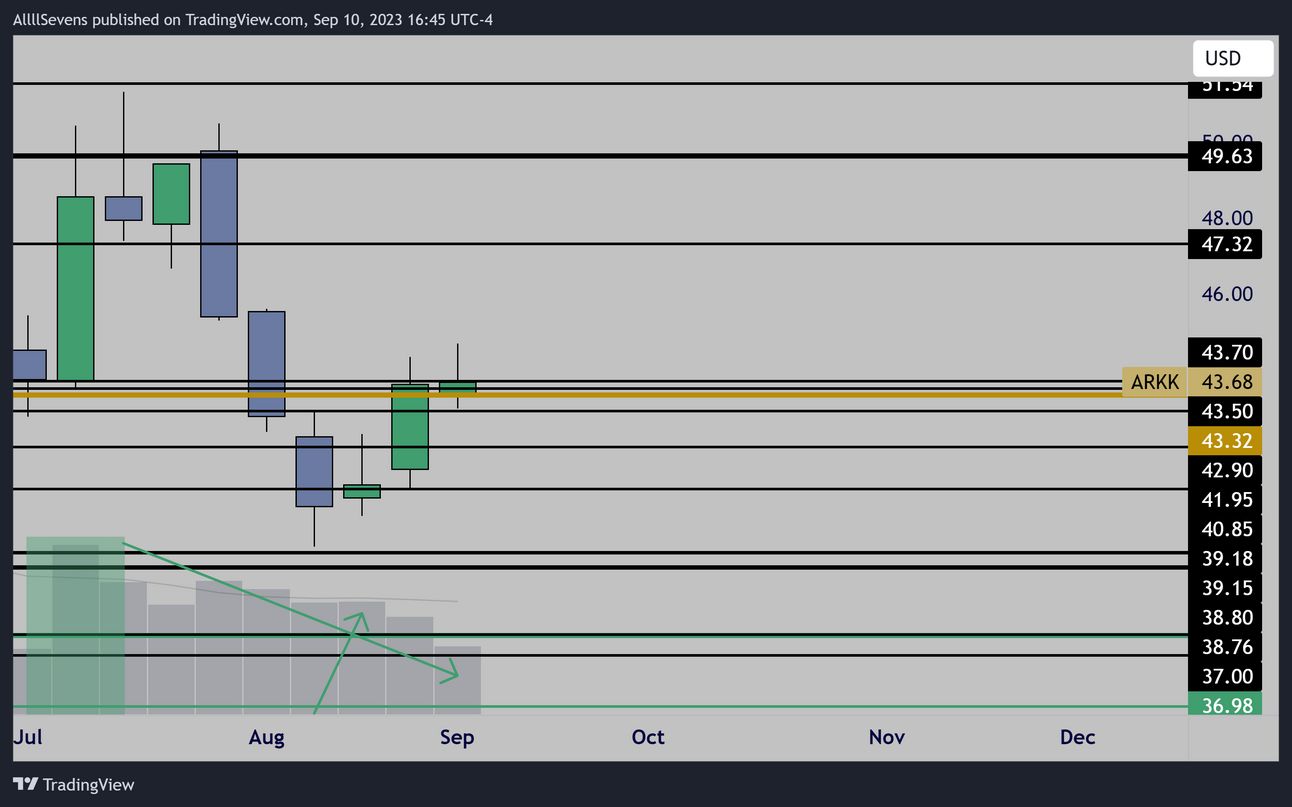

$ARKK

Weekly (Heikin Ashi)

Weekly momentum favors strong upside as long as this pivot is held…

Weekly

Strong bullish impulse off this level in July,

Price rejected and has pulling back on low volume.

Last week was very low volume, holding just above the monthly pivot, but also below the lesser level, $43.70

$43.70 break is what I want to watch this week.

Below there, it’s risk-off.

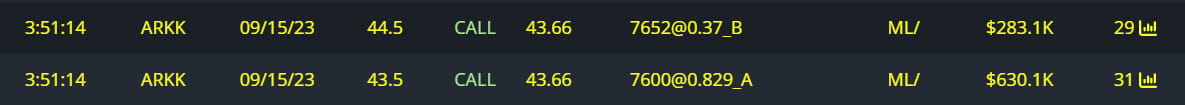

Unusual Options Flow

$347K Bullish Call Spread

Conclusion-

Outside of the $SPY gapping and holding $445.86 this is my #1 focus.

An upside break could send price as high as $47.30-

I’ll just be looking for a scalp though.

After this email is sent, I send a premium newsletter as well.

This newsletter is much of the same content, just more!

Plus, get access to my Discord where I organize and update every idea I’ve ever posted. Keeping track of the newsletters can be a bit of a hassle. In discord it’s much easier to know my current thoughts on anything I’ve previously mentioned.

It’s $7.77 per month! Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply