- AllllSevens

- Posts

- AllllSevens FREE Newsletter

AllllSevens FREE Newsletter

For The Week Beginning 8/21/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

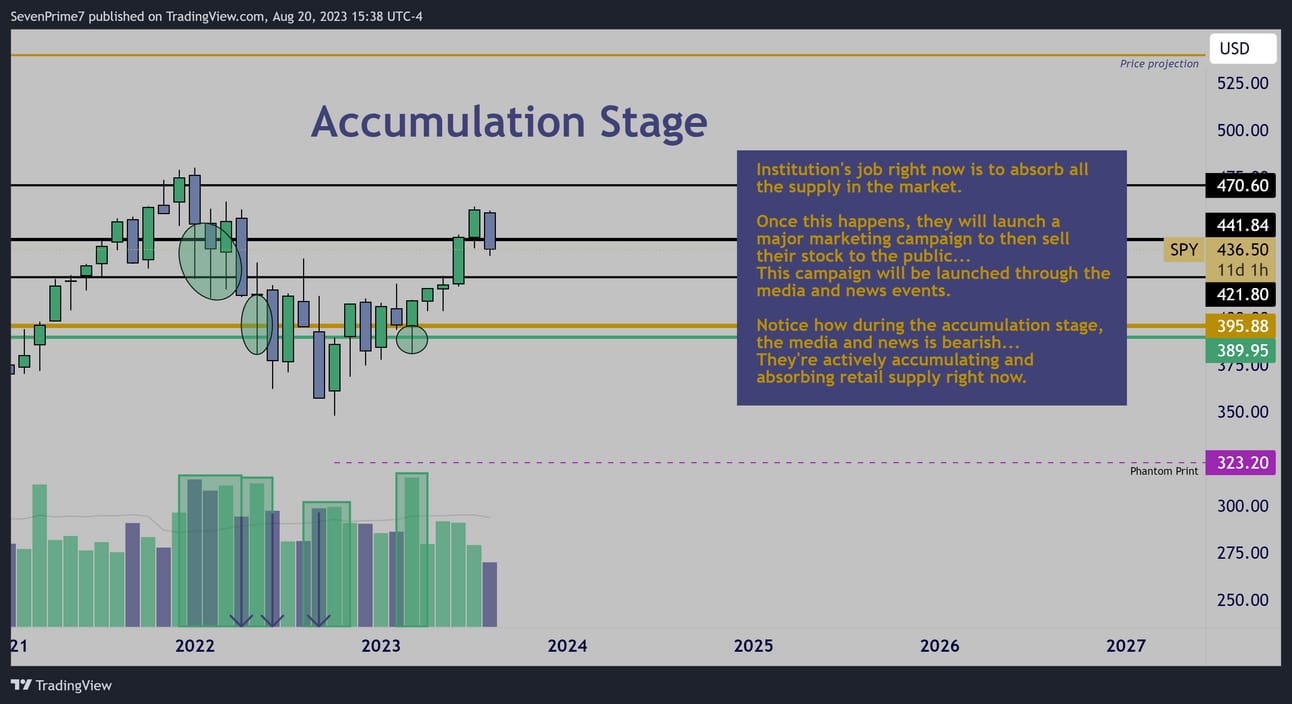

There are 4 cycles of price action-

-Accumulation (sideways)

-Public participation (uptrend)

-Distribution (sideways)

-Public participation (downtrend)

The $SPY is in an accumulation stage.

Monthly

Price can exit the accumulation stage once a majority of supply is absorbed.

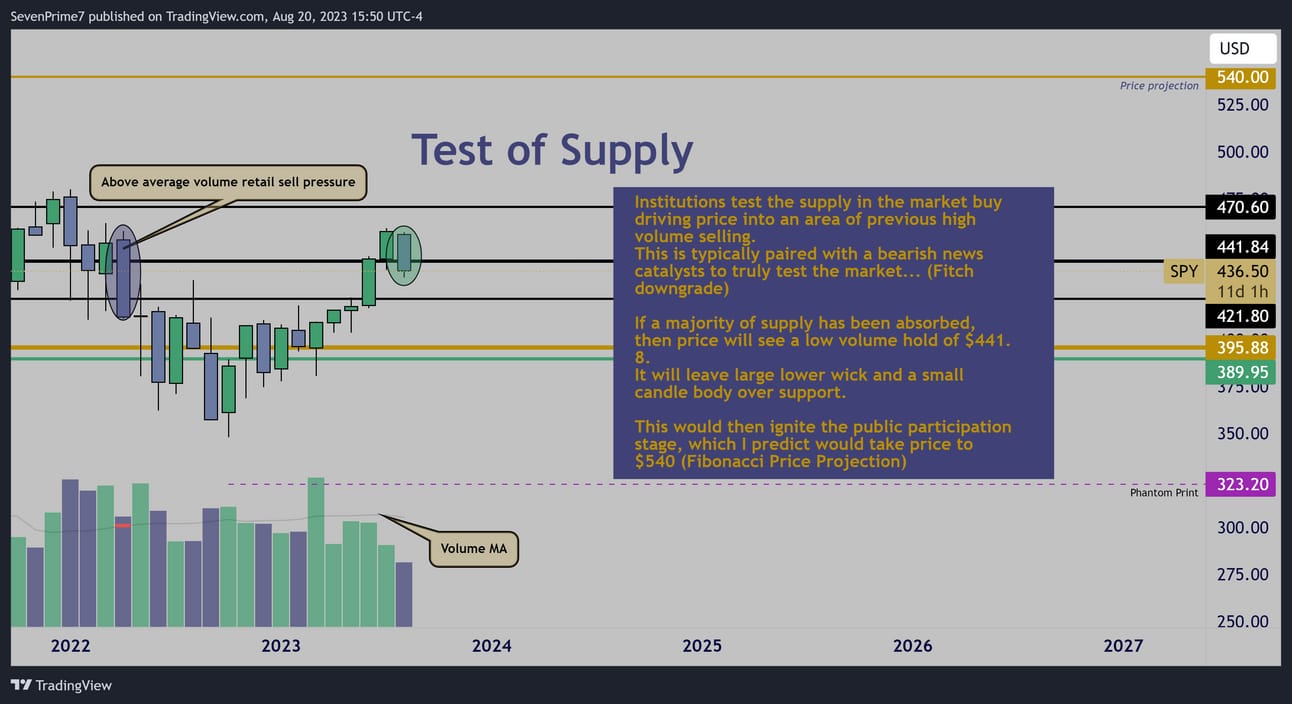

We will know when this happens because institutions will run a "Test of Supply"…

I believe this is what we're seeing right now.

If August candle closes properly, I believe $540 is coming.

Monthly

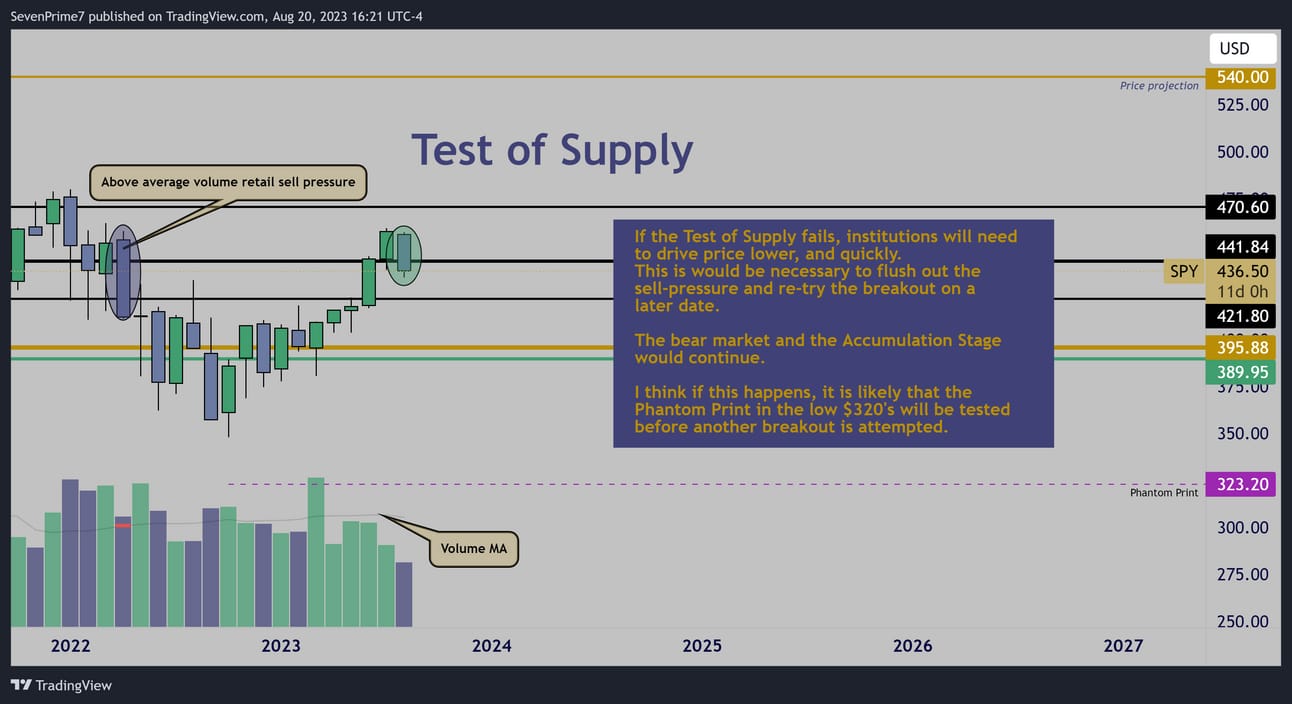

What if the market does not "pass" the Test of Supply?

If volume & price show signs of active sell pressure once again…

Then, the bear market will resume.

Institutions would need to flush out the remaining sellers and re-try the test again at a later date, likely months down the road.

I think price could see low $320’s if price fails this test and institutions begin another shake-out.

Monthly

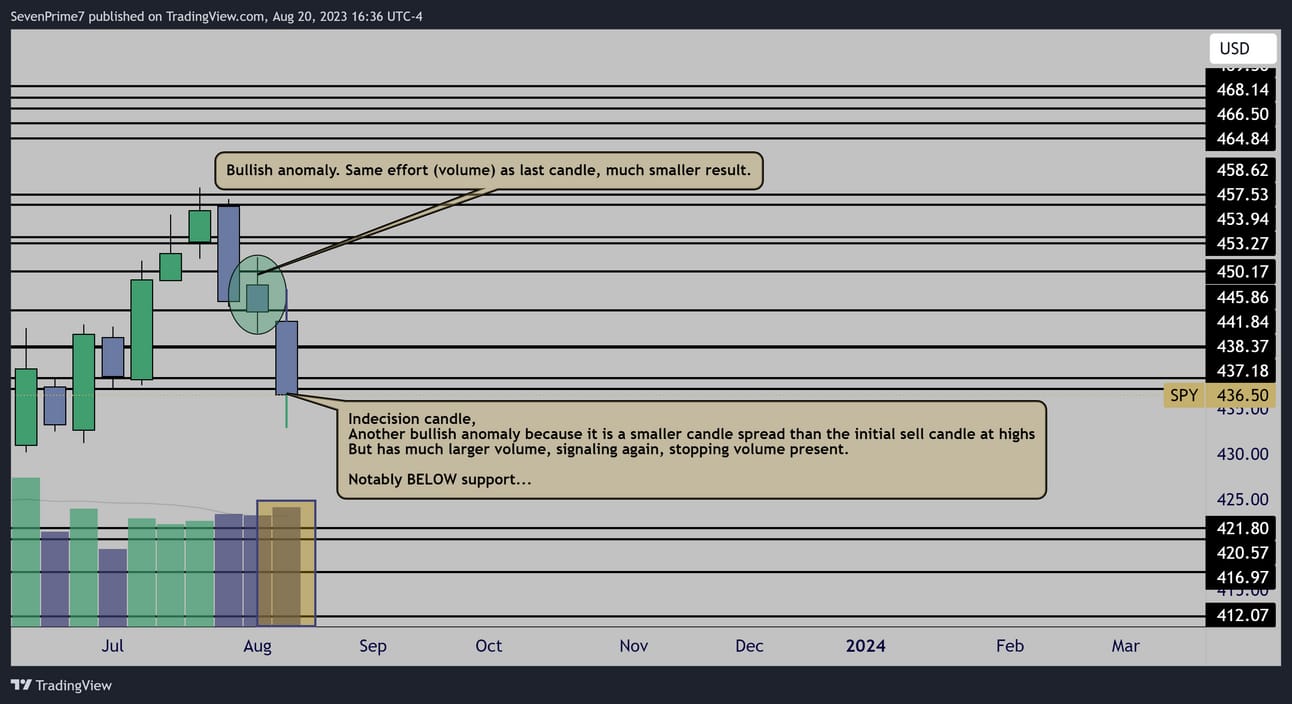

Let’s move onto the weekly chart and what to anticipate this week.

Weekly

The week before last was a bullish anomaly, but it closed below support…

This week is the same thing.

Smaller candle body than the initial sell candle, but much higher volume.

This signals a presence of buyers, and seller exhaustion.

However, just like the previous week, price was unable to hold support…

While volume is screaming that the market wants to move up, price is still giving me a “risk-off” signal below support.

Price could easily continue dropping if this level is not reclaimed, especially considering downside momentum now picking up.

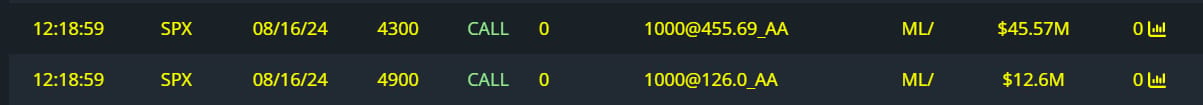

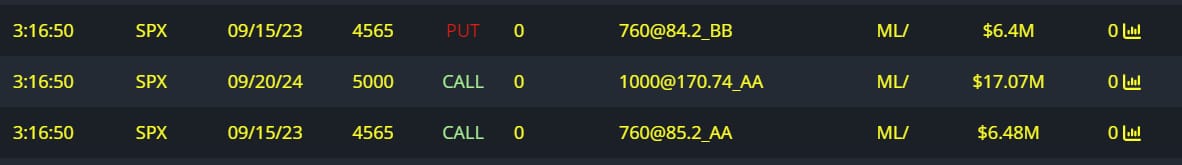

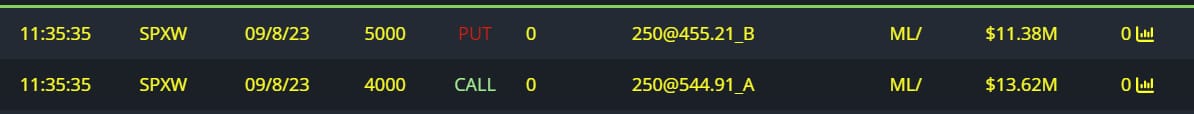

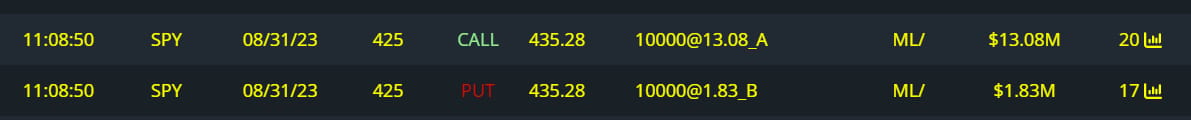

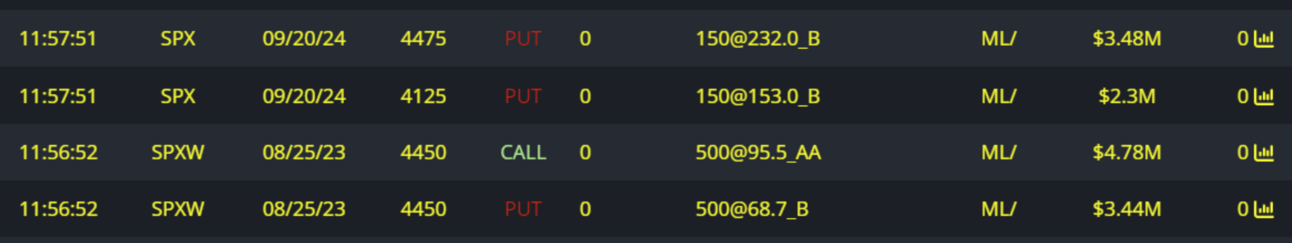

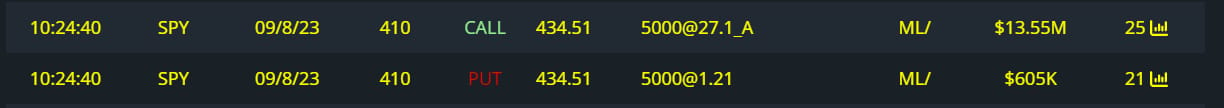

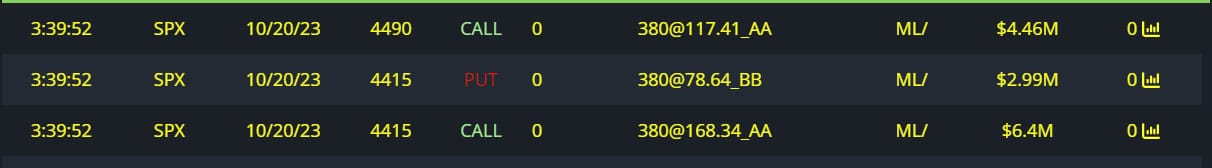

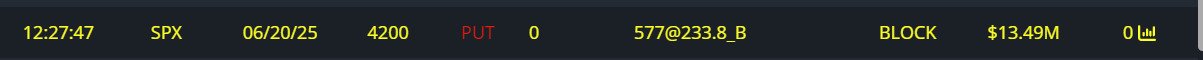

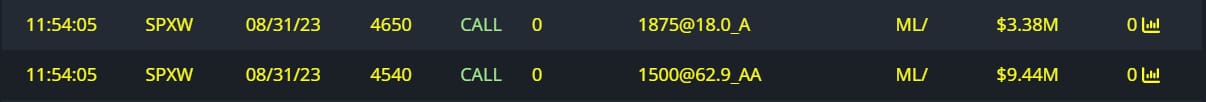

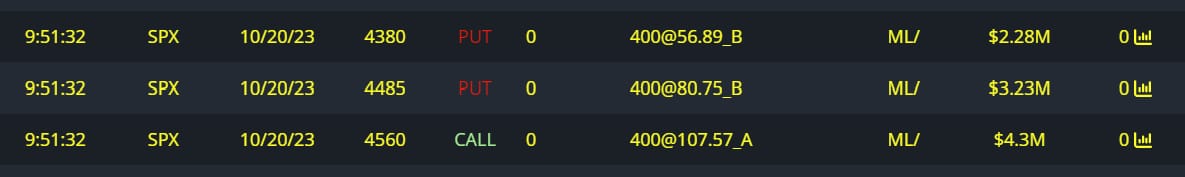

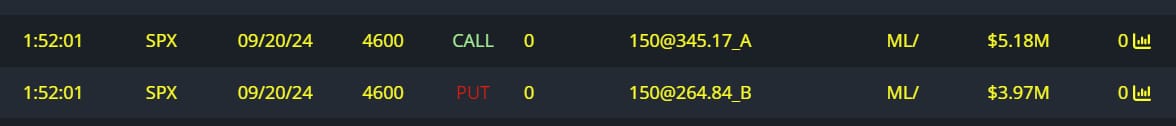

Unusual Options Flow

$675M Bullish Inflows

$267M Bearish Inflows

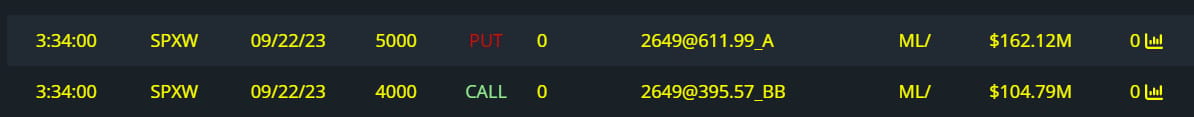

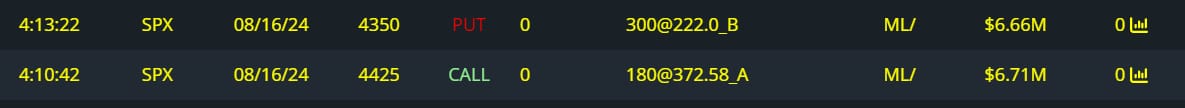

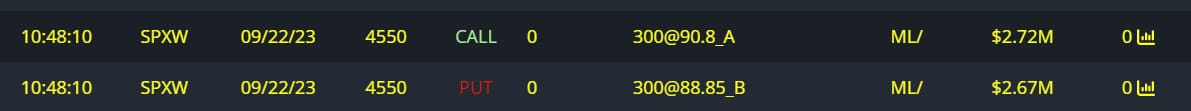

New notable bearish order came in before the close last Friday.

$267M full risk bearish order

$240M full risk bullish order

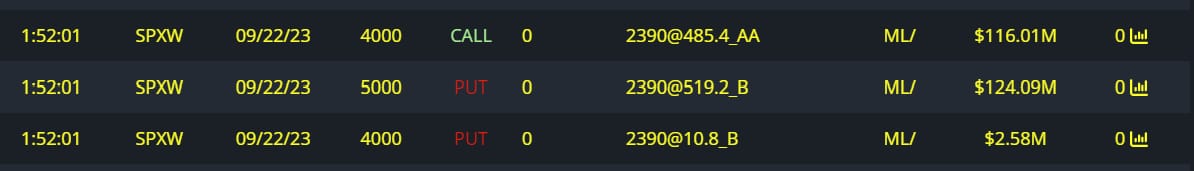

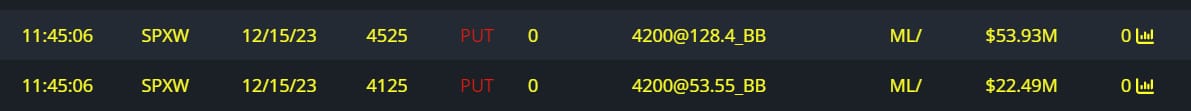

$76M puts written

$70M full risk bullish order

$55M calls bought

$49M full risk bullish order

$30M full risk bullish order

$25M full risk bullish order

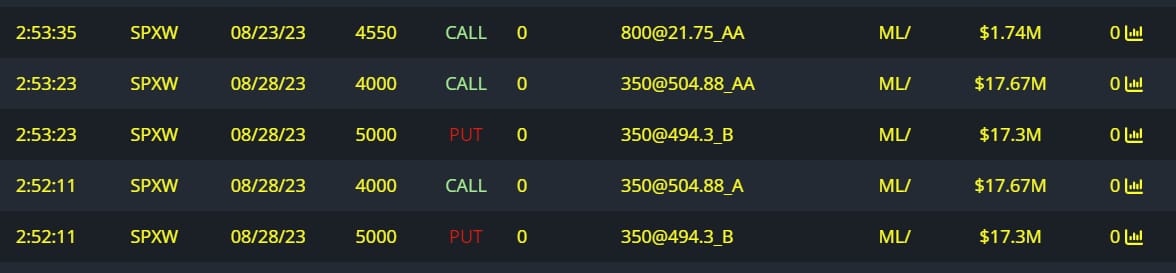

$15M full risk bullish order

$14M full risk bullish order

$14M full risk bullish order

$13.8M full risk bullish order

$13.5M puts written

$13M full risk bullish order

$12.8M calls bought

$10M full risk bullish order

$9.8M full risk bullish order

$9M full risk bullish order

$5M full risk bullish order

Conclusion-

This monthly candle is extremely important.

Until it closes, I’m pretty unbiased, seeing potential for either direction.

The weekly candle tells me to expect more downside next week if price cannot reclaim support.

But it also tells me that if price reclaims support, lose the bear bias fast.

Volume continues to scream bulls are coming, but until price can respect some levels and get over support, can’t force it.

After this email is sent out, I send out my premium newsletter that includes analysis not only on the indices, but individual stocks as well!

Really great stuff shares there using all the same tools.

Plus, get access to my Discord!

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

Reply