- AllllSevens

- Posts

- AllllSevens Newsletter

AllllSevens Newsletter

For The Week Beginning 6/20/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice. Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

First off, let me explain how I analyze price and volume.

2/3 of the market is owned by institutional investors holding for the long-term. They control price. In the long-run, price can only move in the direction that the “Smart Money” institutions are betting.

I predict the markets by logically analyzing the VOLUME trail smart money leaves behind.

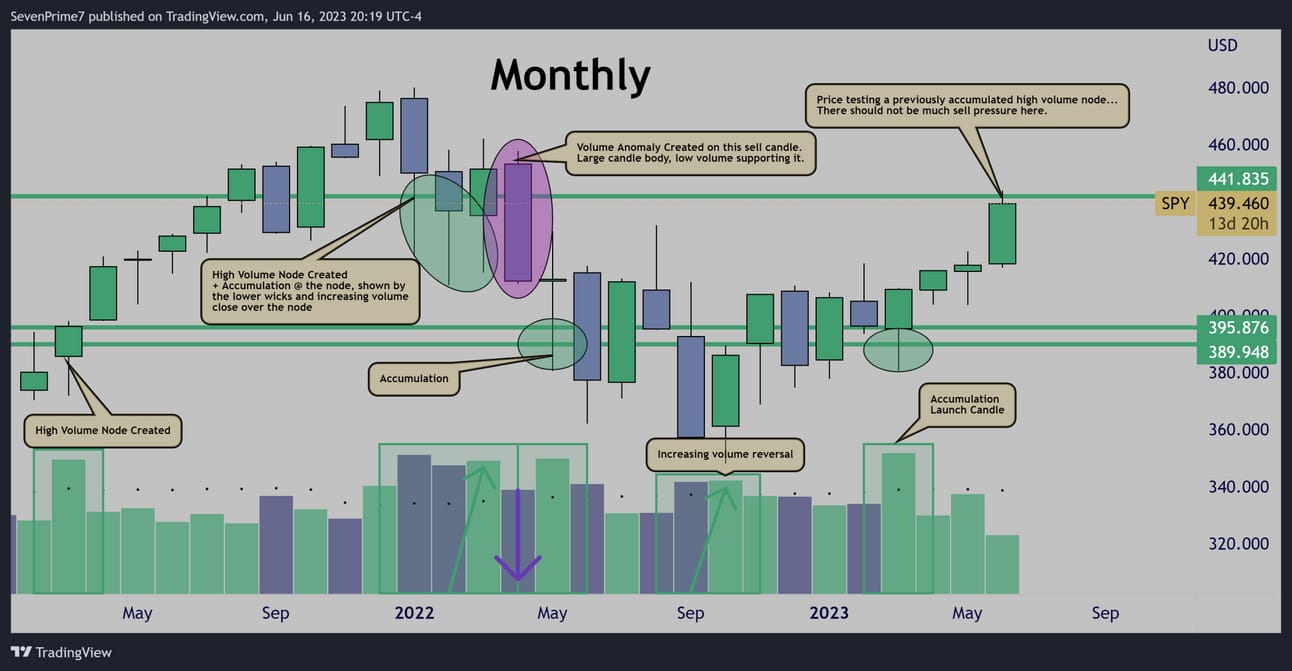

The Monthly chart is extremely bullish.

The “bear market” was fear mongering.

Smart money (institutions) were buying the entire time…

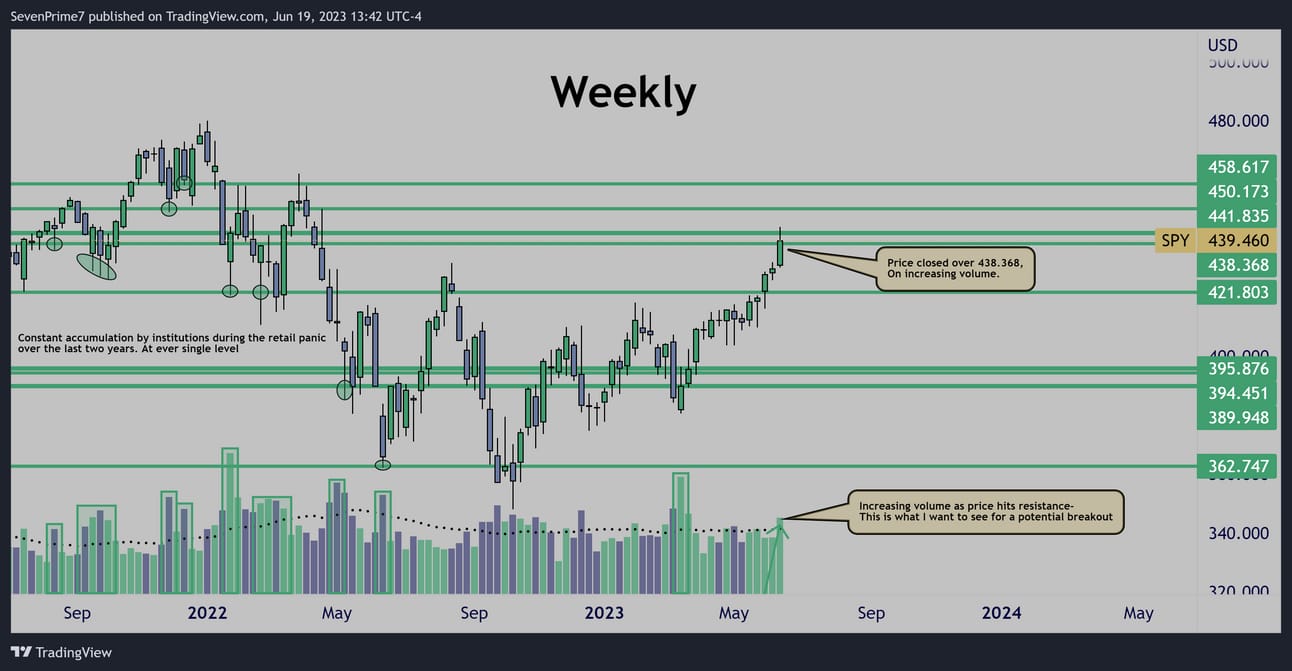

The weekly is very strong.

Increasing volume as it begins reclaiming key volume nodes that smart money has previously accumulated at, shows me that there is big money active at these levels once again.

Unusual Options Flow

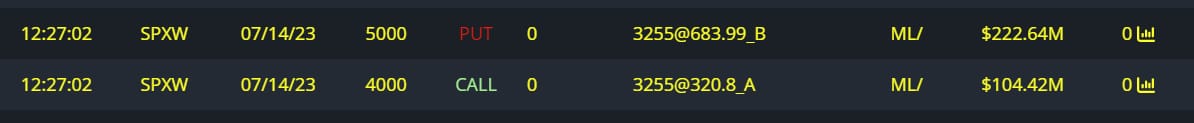

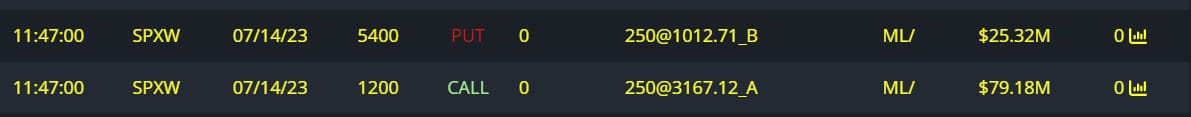

$430M on Bullish “Risk Reversal” bets came in this past week…

This further confirms my volume-price analysis.

An institution has bought $180M+ in call options expiring in just 4 weeks.

They also sold-to-open $245M in put options, expecting them to decrease in value, and buy them back at a lower price.

An extremely risky, and lucrative bullish bet on the $SPY put on by a presumably experienced trading/investment firm.

$327M Bullish Risk Reversal

$104M Bullish Risk Reversal

Conclusion-

I am extremely bullish the S&P500

The monthly chart shows me that the entire sell-off for the last two years was purely retail panic, and institutional investors that own 2/3 of the market used it as a buying opportunity.

There is increasing volume-price-momentum on the monthly chart right now, which tells me there is a low probability of a rejection at these levels, and it is more likely that price can break through.

The weekly chart shows the same increasing volume-price-momentum.

The options flow agrees with my current sentiment.

Top Pick

$CHPT

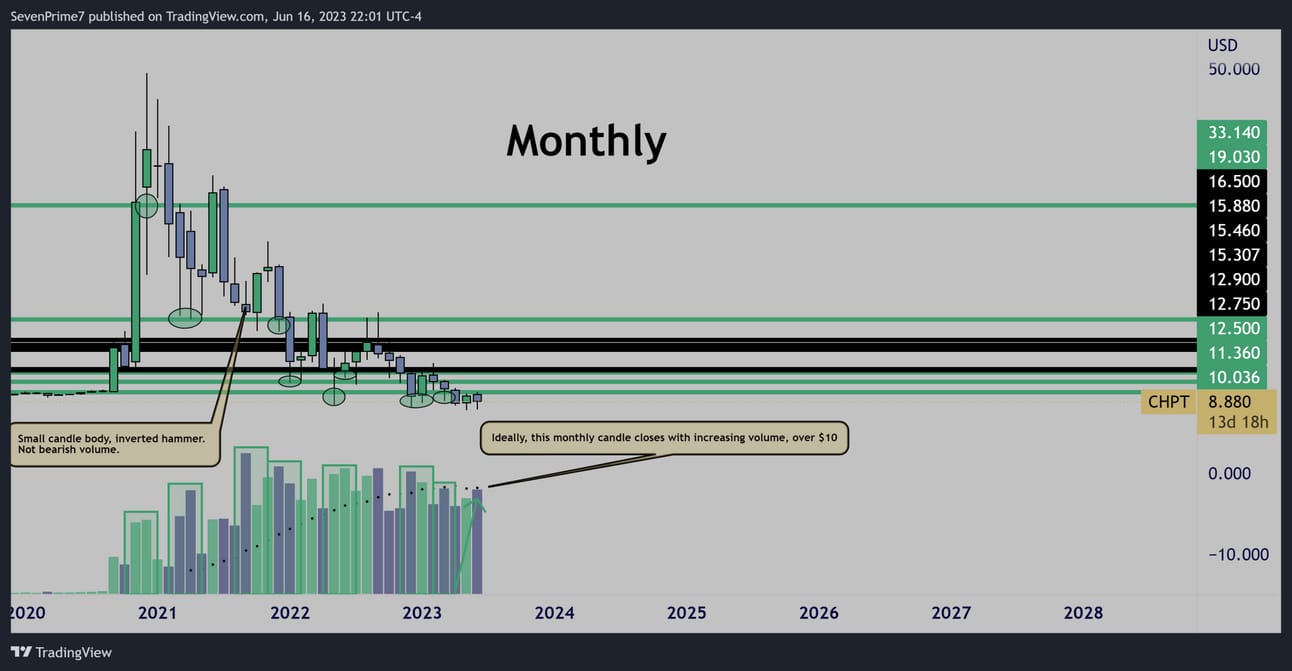

Non-stop accumulation patterns on the monthly chart.

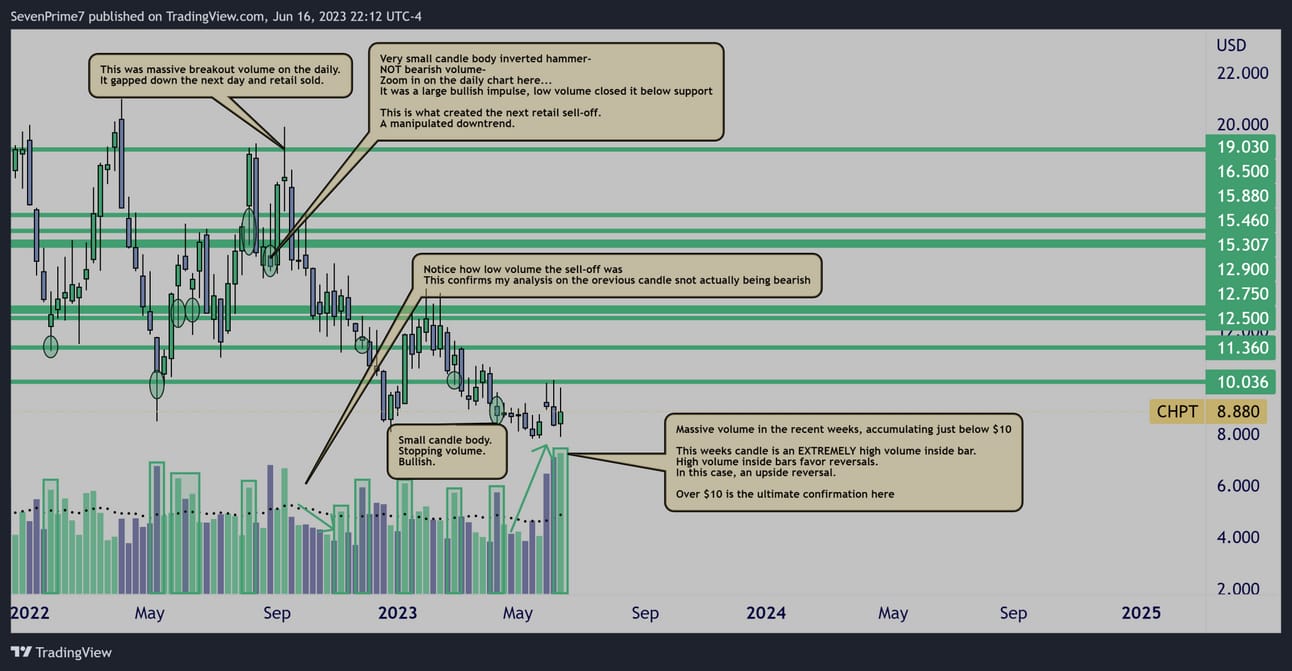

The weekly chart is where things get very interesting…

This is where I see that every single level has been accumulated.

Heading into this week, there is a high volume inside bar, typically leading to reversals, which means upside is very likely next week.

Over $10.036, this name can really pick up upside momentum.

Unusual Options Flow

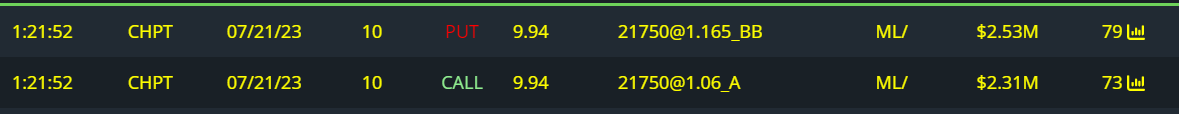

A very notable bullish risk reversal trade expiring in 5 weeks.

$5M Bullish Risk Reversal

Conclusion

This name has been beat down to a pulp the last three years, and smart money has been buying into all the weakness.

The monthly chart is already increasing in volume, with 9 sessions left.

If it can close green, and over $10.036, this can pick up a LOT of bullish volume-price-momentum.

I like it specifically this week because of the high volume inside bar.

There is lot’s of volume build up just below this $10 level.

Remember, this truly confirms when price clears that $10 level.

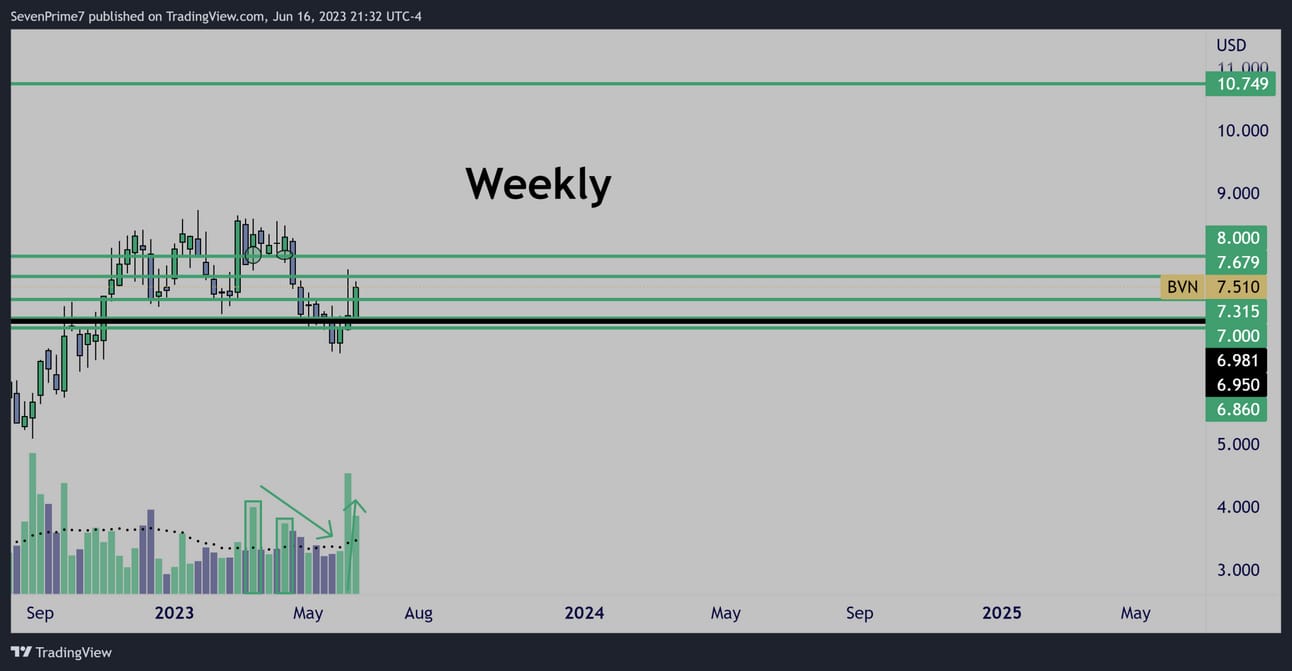

$BVN

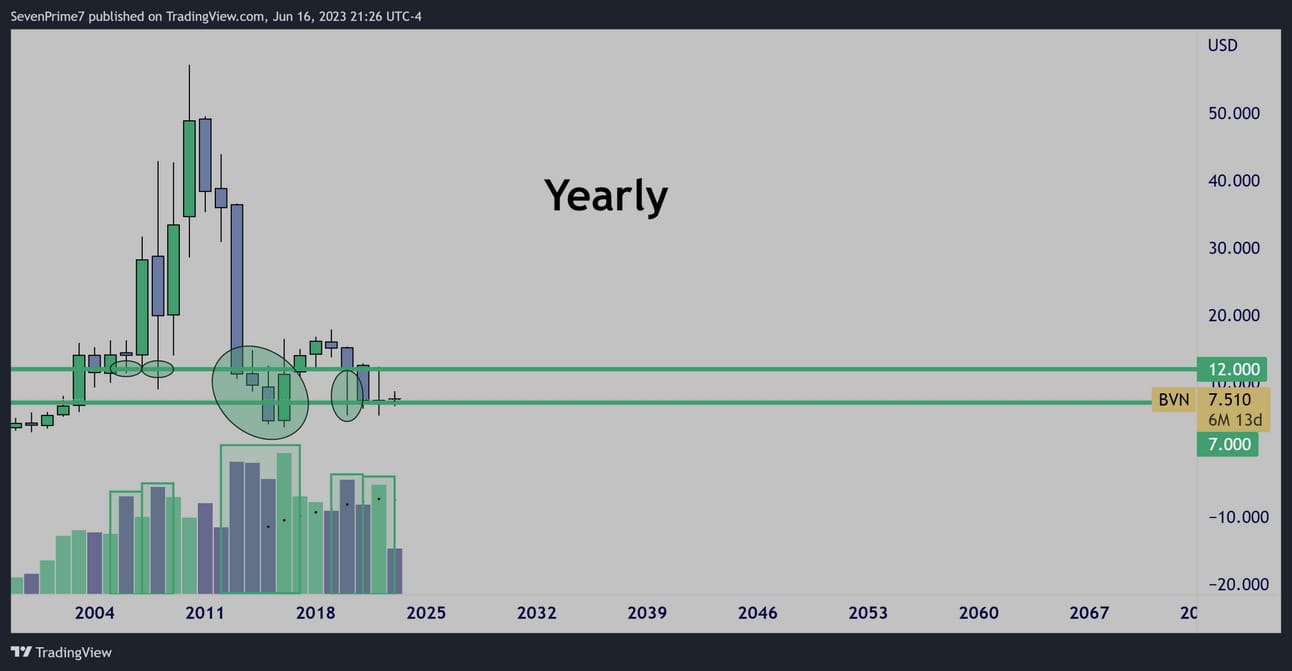

Accumulation on the yearly chart…

The monthly chart already shows increasing volume with 9 sessions left until the candle close…

That’s extreme volume-price-momentum building off of this $7.00 base.

The weekly is moving up rapidly on above average volume, and should build even more volume as these levels are cleared.

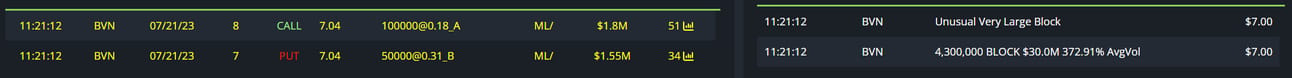

Unusual Options Flow

A very unusual piece of options flow here-

A bullish risk reversal tied to a significantly sized transaction of shares.

Someone is putting over $30M to work here, and the chart lines up.

$3.3M Bullish Risk Reversal

Tied to a 4.3M Share Dark Pool ($30M)

Conclusion

I think this has uncapped potential.

I see accuilation at both yearly levels, suggesting that this can break over $12 and move even higher. Where too? I’m not sure.

At one point, this was a $50 stock.

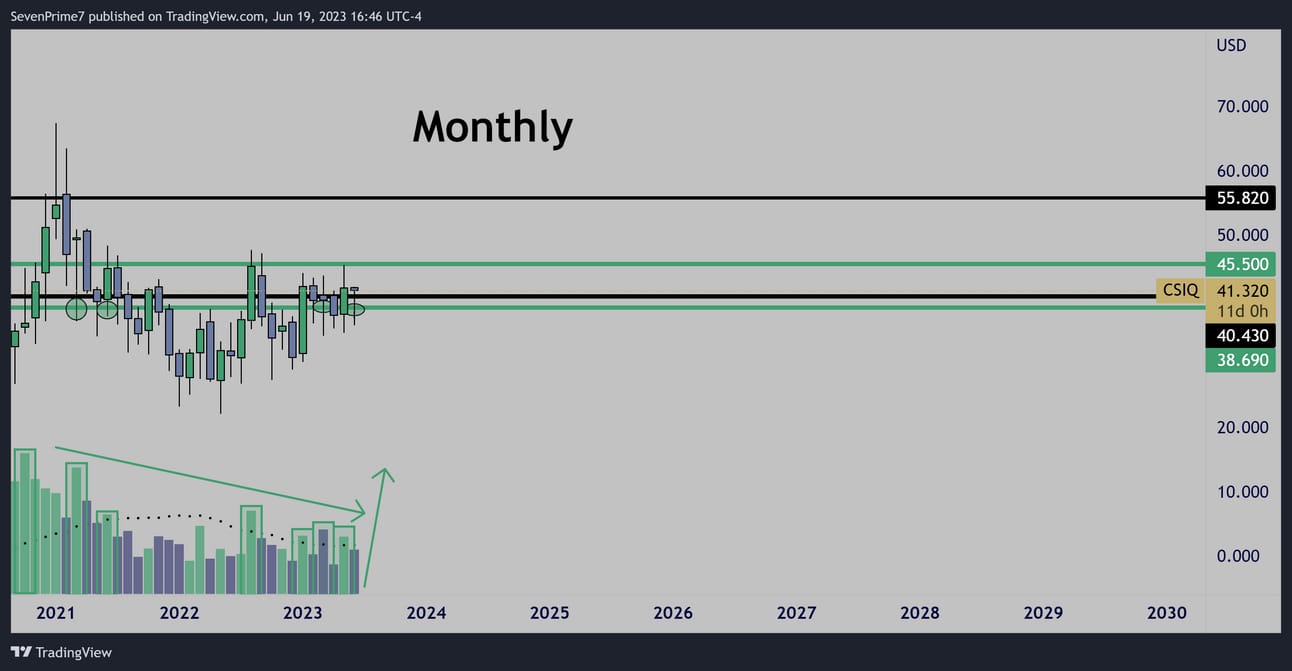

$CSIQ

Monthly accumulation.

Increasing volume heading into this month, and potential for increasing volume this month if the next 9 sessions remain strong.

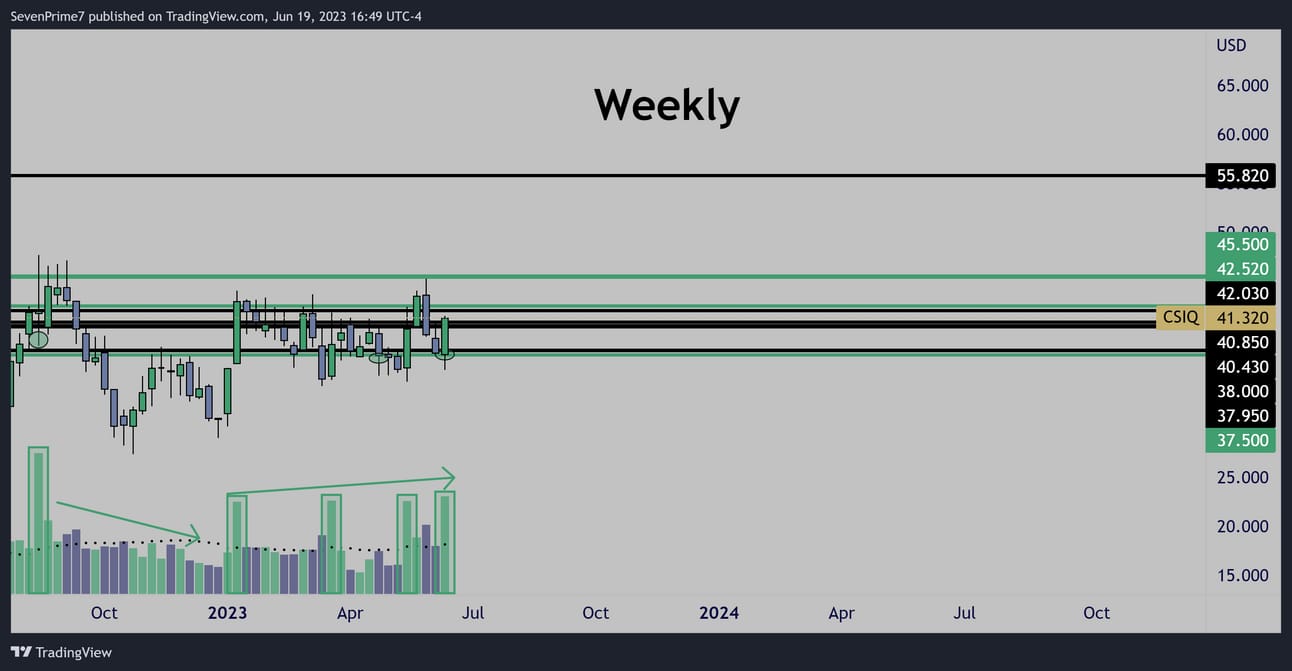

Steady accumulation on the weekly chart, getting larger and larger volume each time.

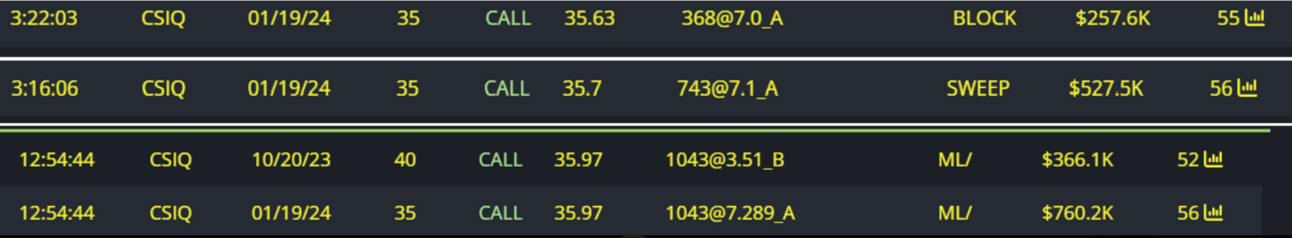

Unusual Options Flow

Nothing insane on the options flow here, but a few orders supporting the bullish accumulation.

Over $1M total being put to work on call options.

$780K Call Buys

$390K Bullish Call Spread

Conclusion

I love this setup because the increasing volume-price-momentum is already primed on the monthly and the weekly charts.

I think this can get to that upper $55 level rather quickly.

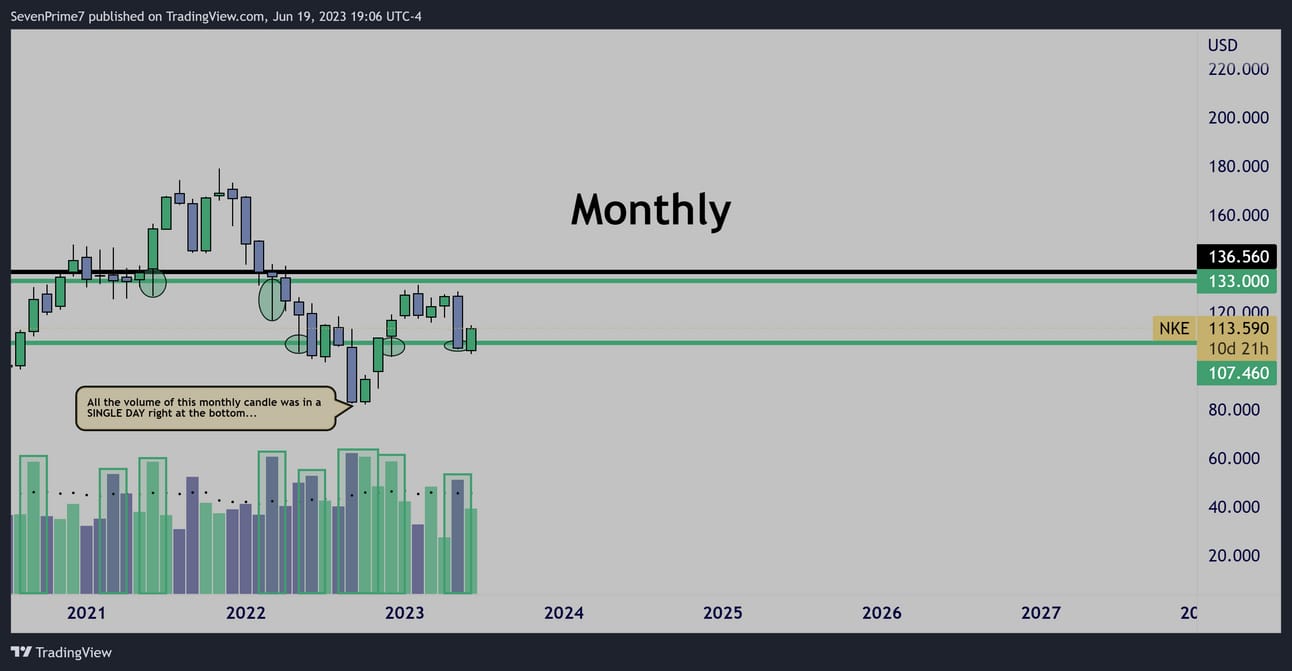

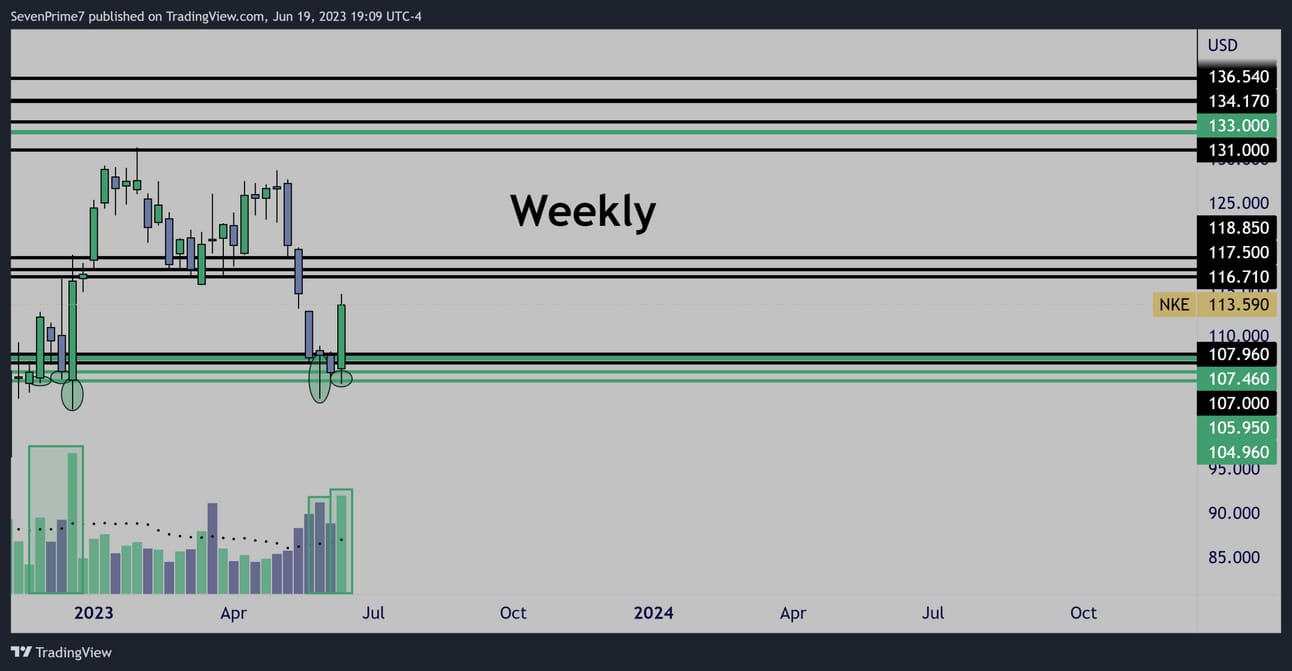

$NKE

Monthly accumulation.

Increasing volume heading into this month.

Potential for another increasing volume month.

Massive stopping volume on this $107 retest leading to an even larger volume reversal…

This level has been aggressively defended.

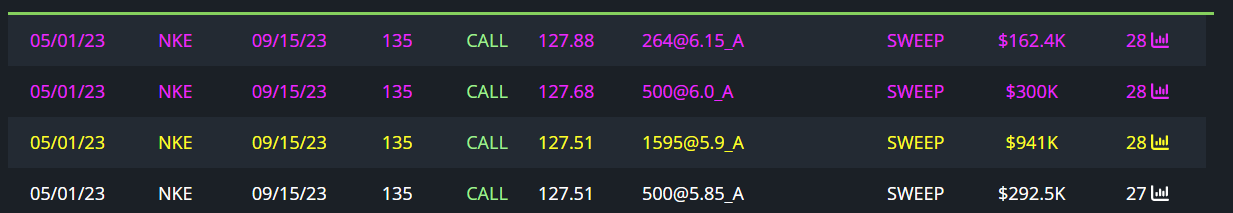

Unusual Options Flow

This flow came in right before the massive sell-off, and they have held the entire position since…

$1.7M Calls Bought

Conclusion

A+ Monthly and Weekly volume-price-momentum.

Some options flow that came in last month, is now on major discount.

The monthly chart shows me that these calls could reach their strike price by expiration.

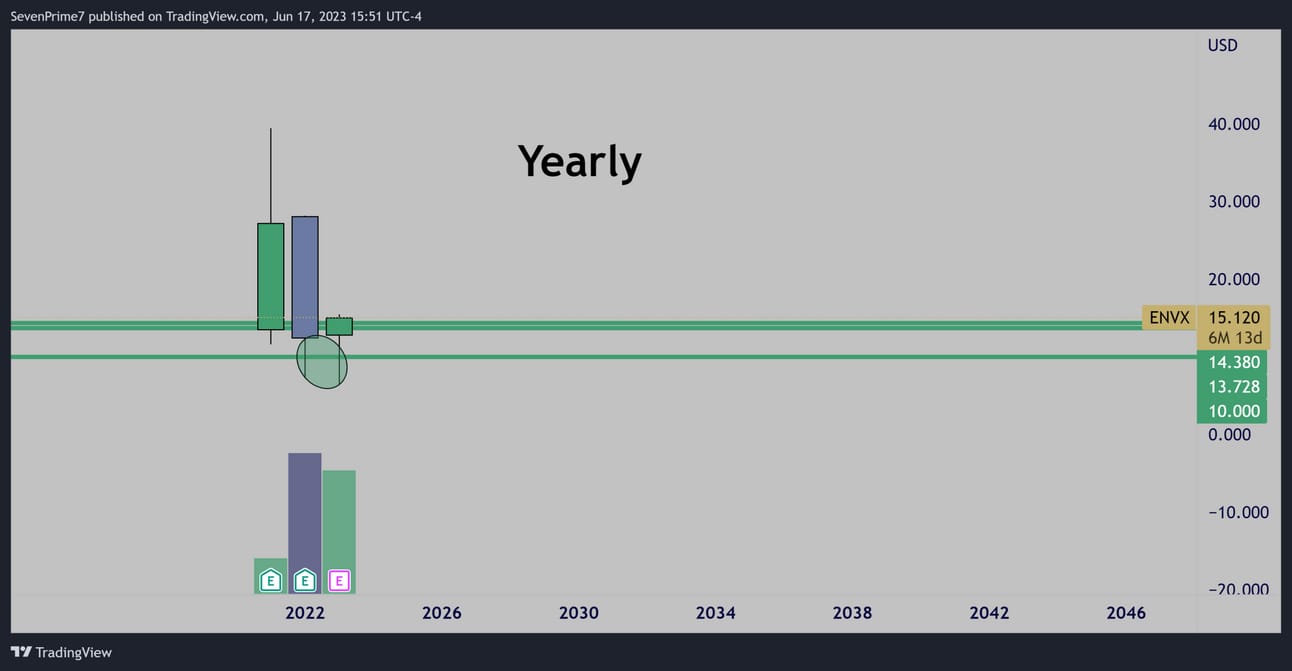

$ENVX

Yearly chart bouncing from demand on very large volume…

Still 6 months left until this candle closes and it’s already close to the same volume as the previous year’s candle.

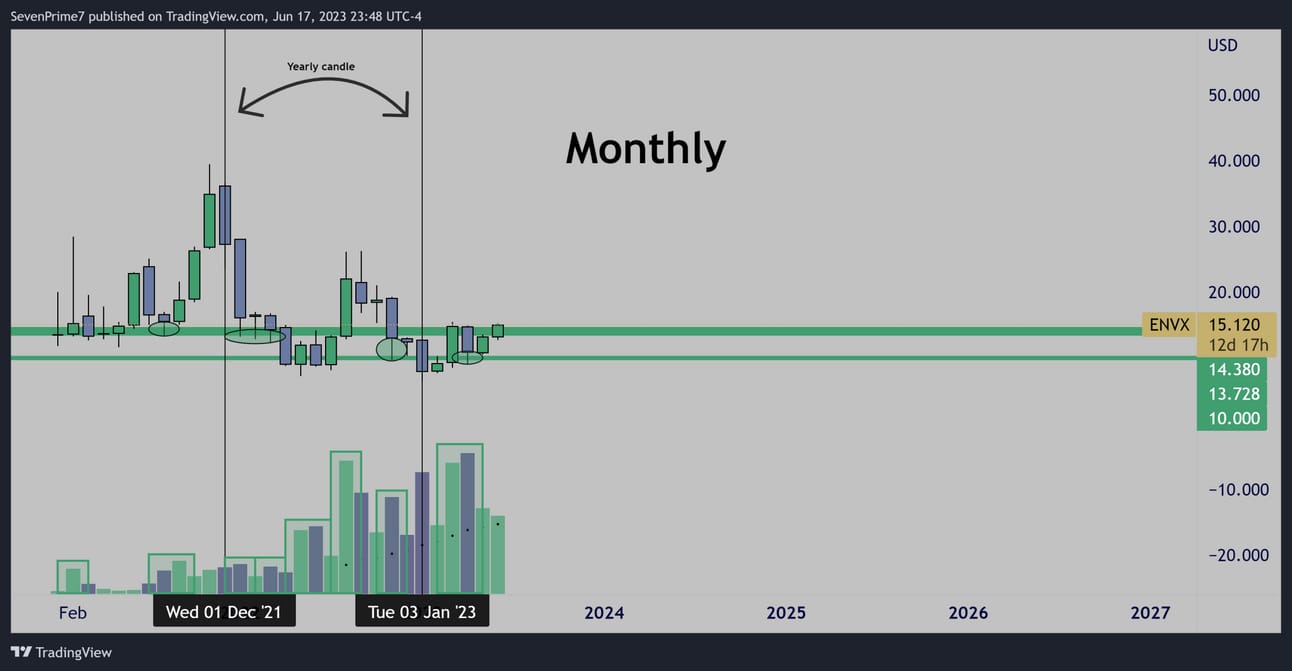

Monthly chart shows all the volume from the prev. year’s bearish candle was at the bottom, at this support, leaving that lower wick.

Heavy accumulation on this chart since it’s inception.

Safe to say this monthly candle is about to close with increasing volume.

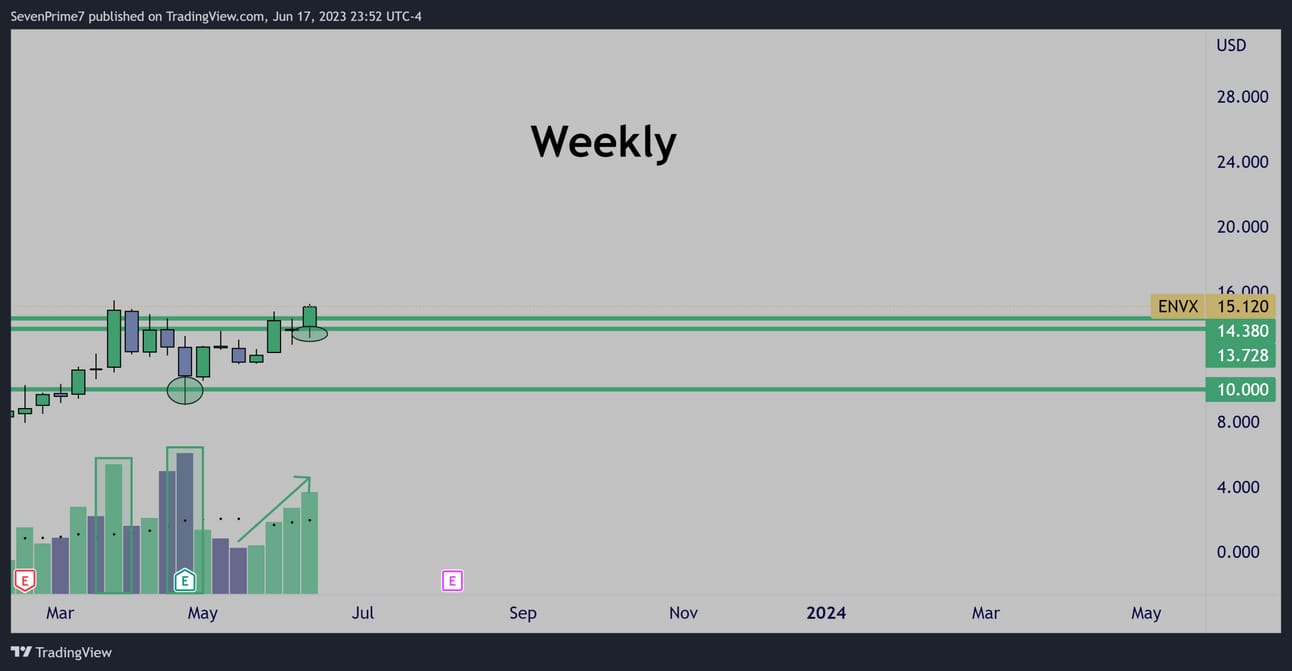

Weekly looks ready to explode now with very strong increasing volume-price-momentum.

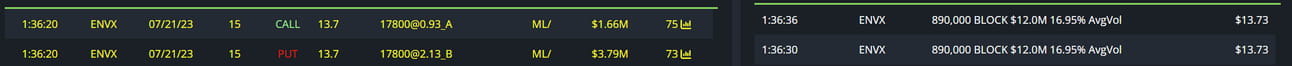

Unusual Options Flow

A very unusual piece of options flow here, tied to a large share transaction, similar to $BVN.

Over $30M being put to work here.

$5.5M Bullish Risk Reversal

Tied to a 1.78M Share Dark Pool ($24M)

Conclusion

Very similar setup to $BVN

I also do not know how high this can go, all I know is it has created a very nice base here for two years and appears to have sufficient volume-price-momentum to begin a breakout.

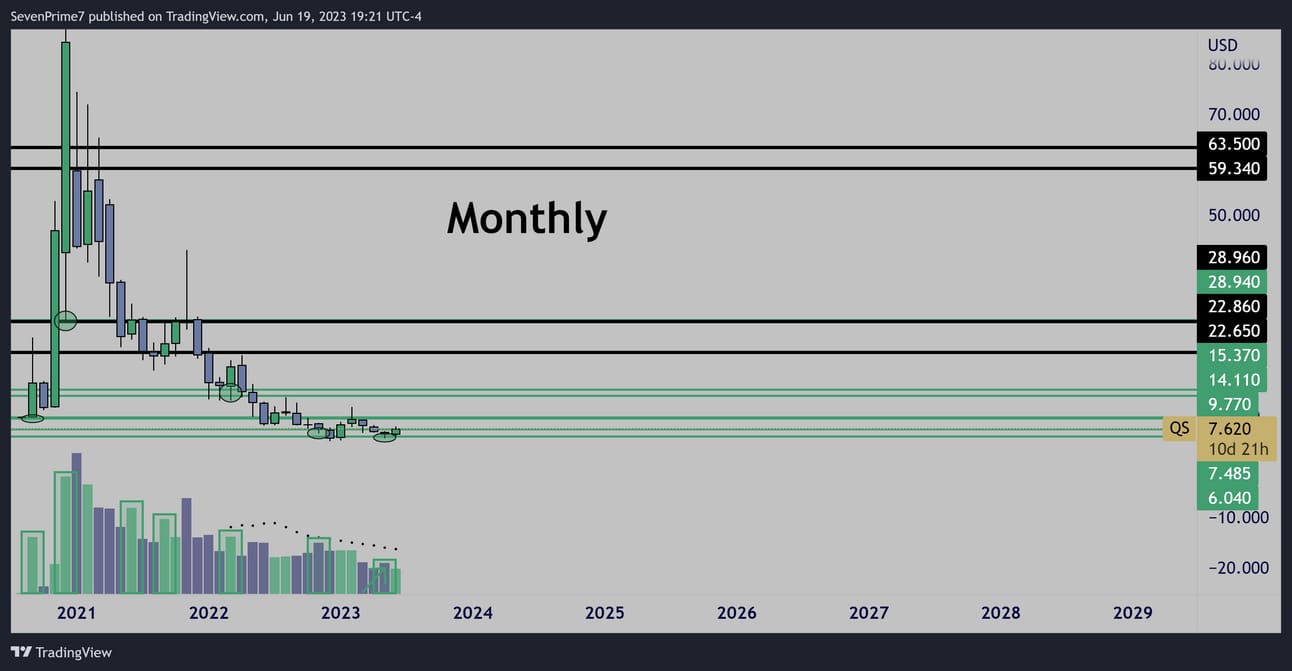

$QS

Monthly accumulation patterns.

Increasing volume heading into this month with a lower wick off of key support.

Potential for another increasing volume monthly close.

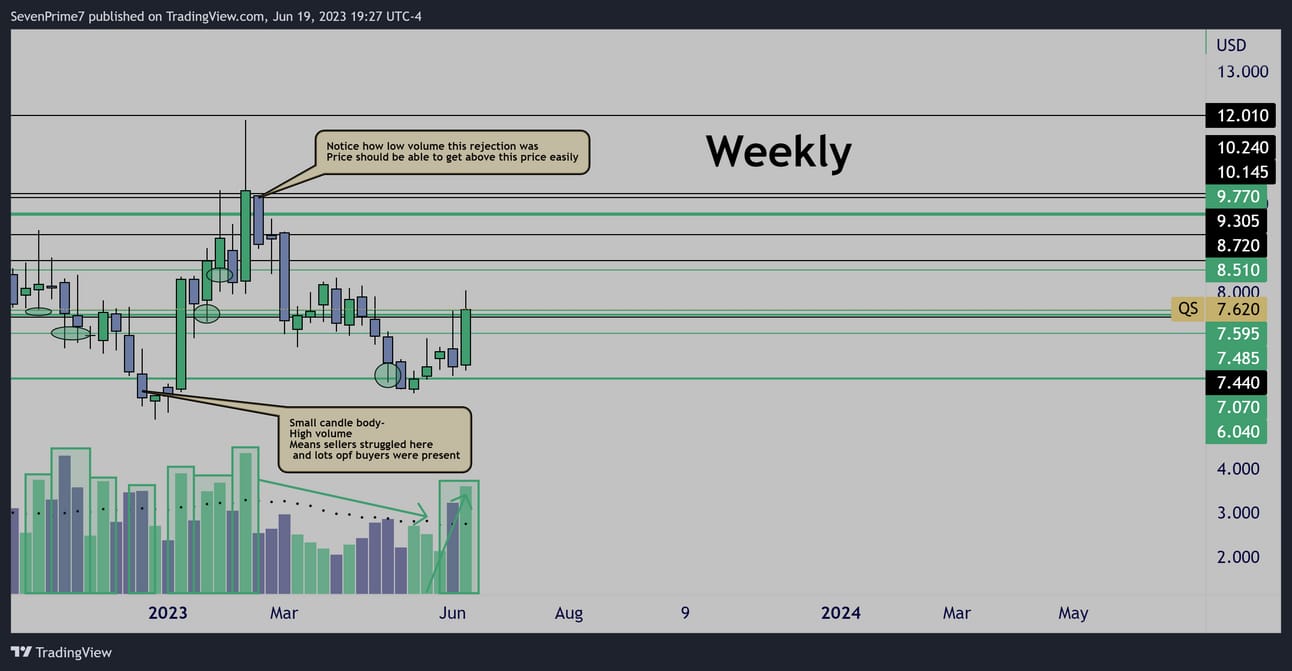

Weekly shows A+ accumulation, a weak rejection at $10.00, leading to a decreasing volume consolidation-

Now we see large volume pick back up, taking price over the $7.50 level where large buyers have accumulated at repeatedly…

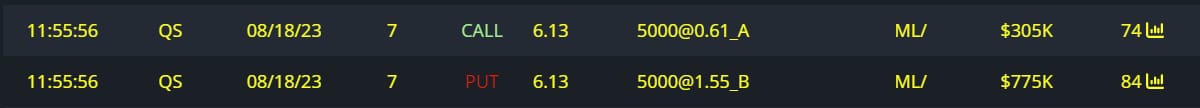

Unusual Options Flow

A decent size bullish risk reversal to confirm what the volume shows.

$1M Bullish Risk Reversal

Conclusion

This chart looks absolutely primed on the weekly to break $10 and get to $12 fast.

After that, it will be up to the monthly candle to reclaim the $14-$15 range and take this back into the $20’s

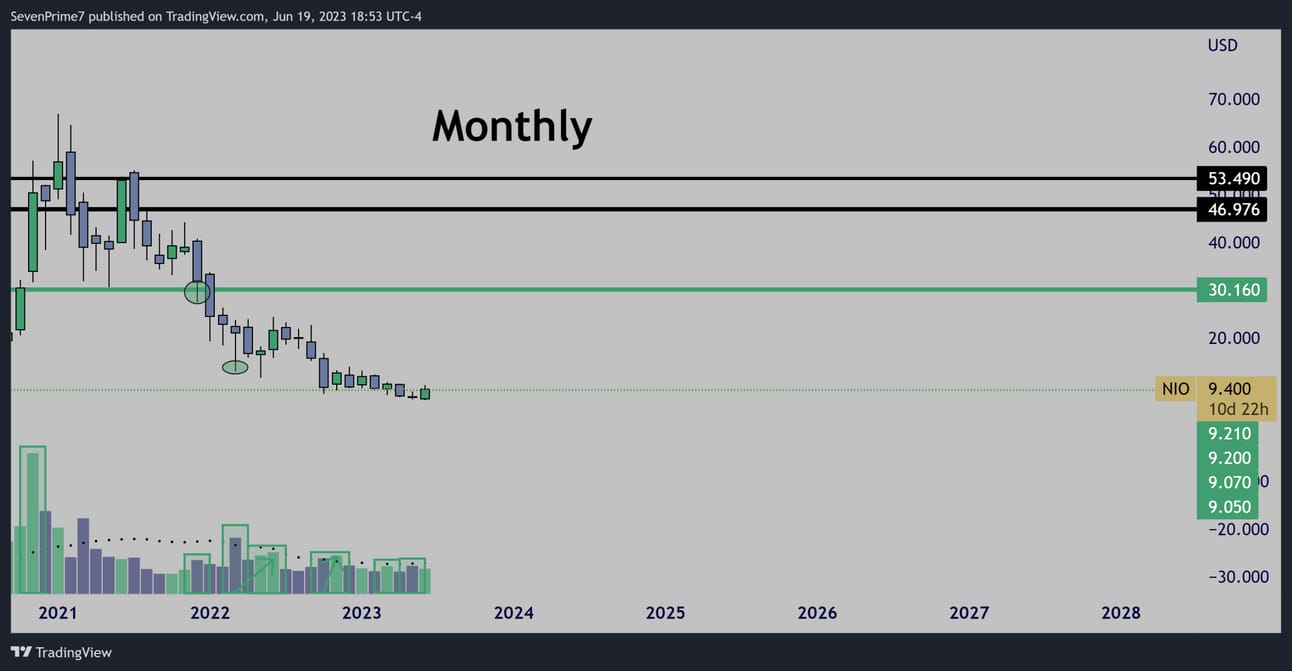

$NIO

Monthly accumulation patterns.

Very aggressive accumulation visible on the weekly-

Leading to a a very strong $9 breakout this week on increasing volume-price-momentum.

Unusual Options Flow

None

Conclusion

This weekly chart looks incredible with on $9 breakout -

The monthly chart has potential for an increasing volume break over $9 as well. I can see this reaching $22+ fast.

These are just 7 of the 40+ names I am currently watching…

I offer a premium tier of this newsletter for $7 per month.

In AllllSevens+ , you get the following;

-More stock picks just like the ones above

-Analysis on other ETF’s like the QQQ, IWM, FXI, ARKK, ARKF, etc. when I see something interesting. This week, I cover the QQQ, FXI, and ARKK

-S&P500 Sector Analysis (XLK, XLV, XLF, XLY, XLI, XLC, XLP, XLE, XLU, XLB, XLRE, XBI) every single week to identify relative strength and weakness.

-Discord access

-All previously covered ideas from the newsletter neatly organized AND updated with all previous and new data that comes in.

-Unusual Options Flow after market close

-Live trading sessions

-VPA education

-Community

-More features coming

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

Reply