- AllllSevens

- Posts

- AllllSevens Newsletter 10/2/23

AllllSevens Newsletter 10/2/23

SPY QQQ IWM XLK

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

My goal is to present the market through the lens of an institutional trader/investor with absolutely no personal bias.

Institutions own over 60% of the market so as far as I am concerned-

They control it. Whatever they are positioned for, I want to position for.

The levels you see on my charts are data points. Dark Pool transactions.

There is no bias or subjectivity involved. Why Dark Pools?

Millions of shares are transacted at these levels creating very concentrated institutional volume at specific prices.

Highly concentrated volume creates support & resistance.

Dark Pools are institutional support & resistance.

In conjunction with Dark Pool levels, I analyze the relationship between candle spreads and the volume backing them to determine how institutional money is positioned in the market.

Let’s get started…

SPY

I anticipate the S&P500 to be relatively range-bound for the foreseeable future.

Institutions are running a bullish campaign, preparing for a prolonged bull-run, but before the bull run begins, their goal is to accumulate as many shares as possible.

To do this, they create false up-trends, which trap dumb-money on the long side and creates liquidity to fulfill their accumulation in the future.

When the false up-trends break, institutions buy while everyone sells…

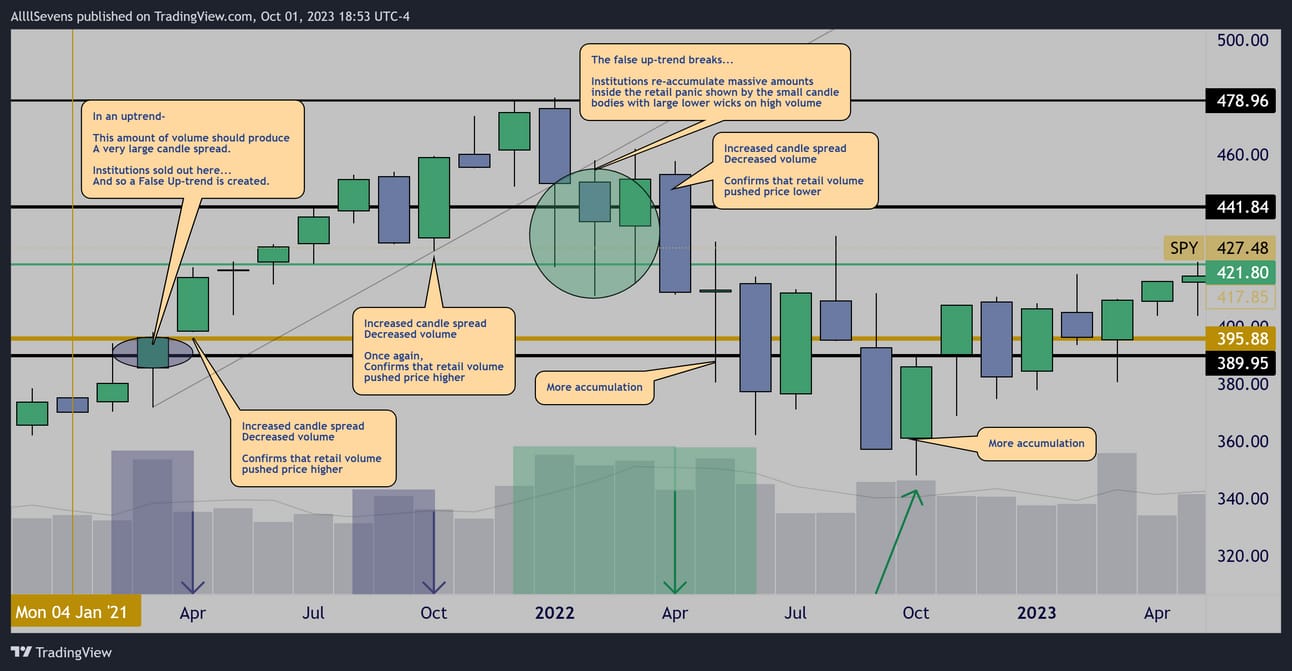

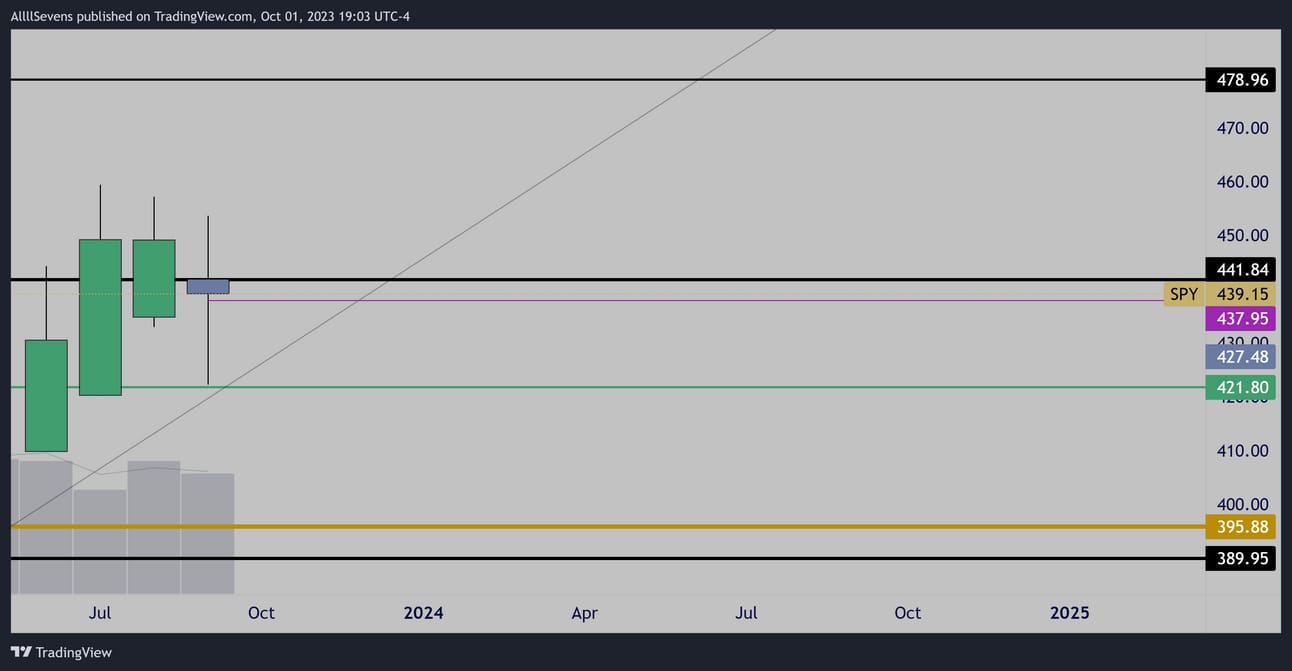

Monthly distribution & re-accumulation

In March of 2021, institutions began their campaign…

They distributed shares and created a false-uptrend.

Eventually, this trend broke and they were able to re-accumulate much more than they distributed since so much dumb-money was now selling.

Fast forward…

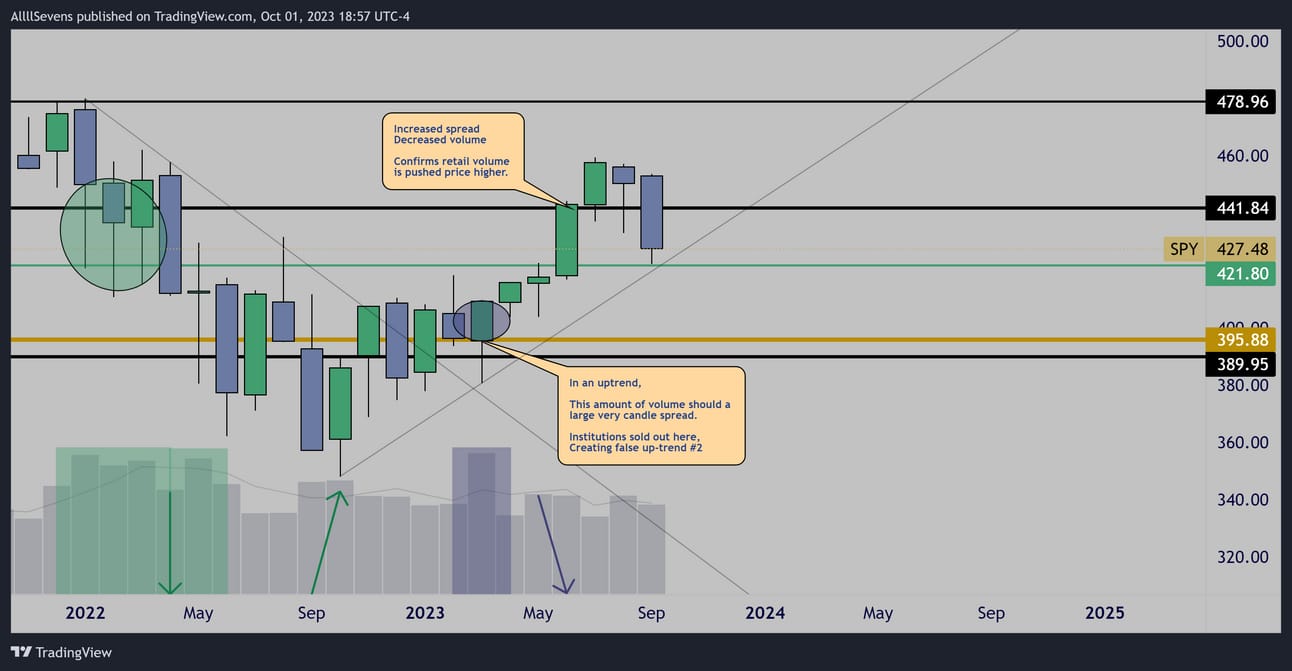

Monthly distribution & …

The market is actively trapping dumb-money again.

At some point in the future it is safe to assume this trend will be breached, and institutions will re-accumulate even more.

Therefore, my #1 priority right now is conserving cash for that opportunity. Until then, let’s see if we can make some extra bucks on short-term trades!

First off, it is notable the that September’s candle has an increased candle spread relative to August, yet less volume.

This tells me sellers are not particularly strong as we approach support despite the recent loss of upside momentum.

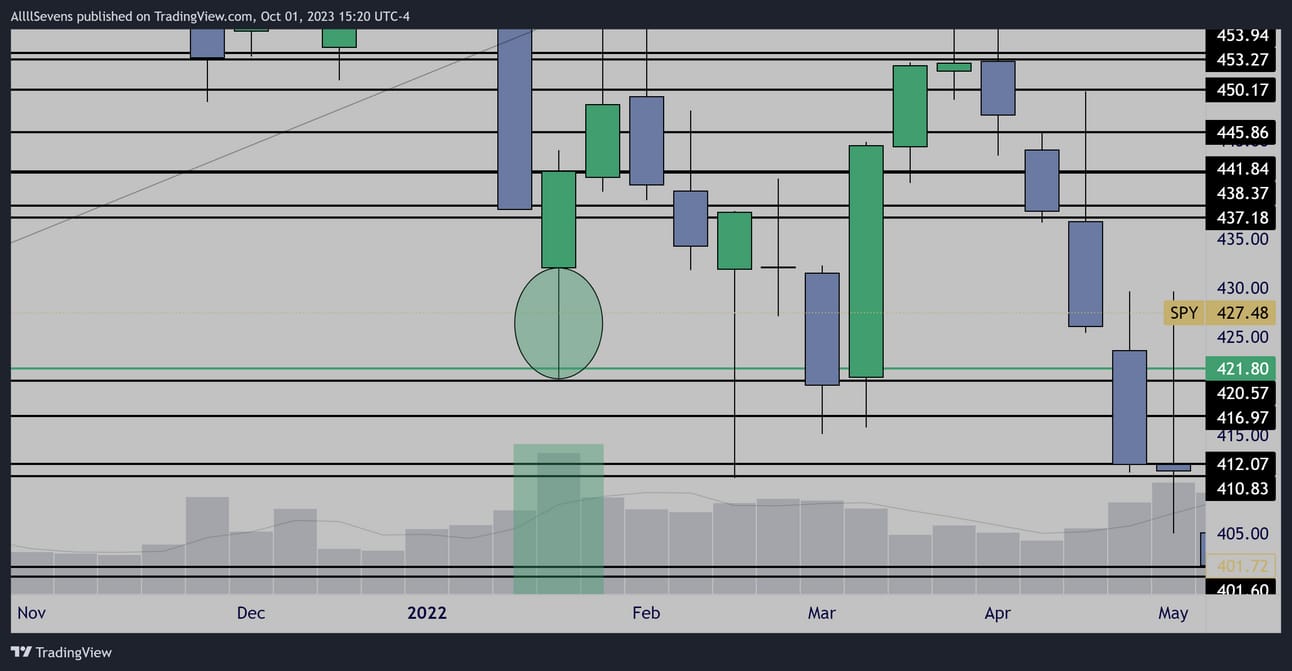

Weekly trend test

The weekly chart is testing a key trend support

+

A major weekly dark pool.

Weekly Dark Pool

$421.80 is extremely notable because during the first re-accumulation,

the largest volume in over 90 weeks occurred here, creating a very strong hammer candle off of this level. A retest could offer a strong short-term bounce-

And if it does not, it would be a major breakdown in the short-term.

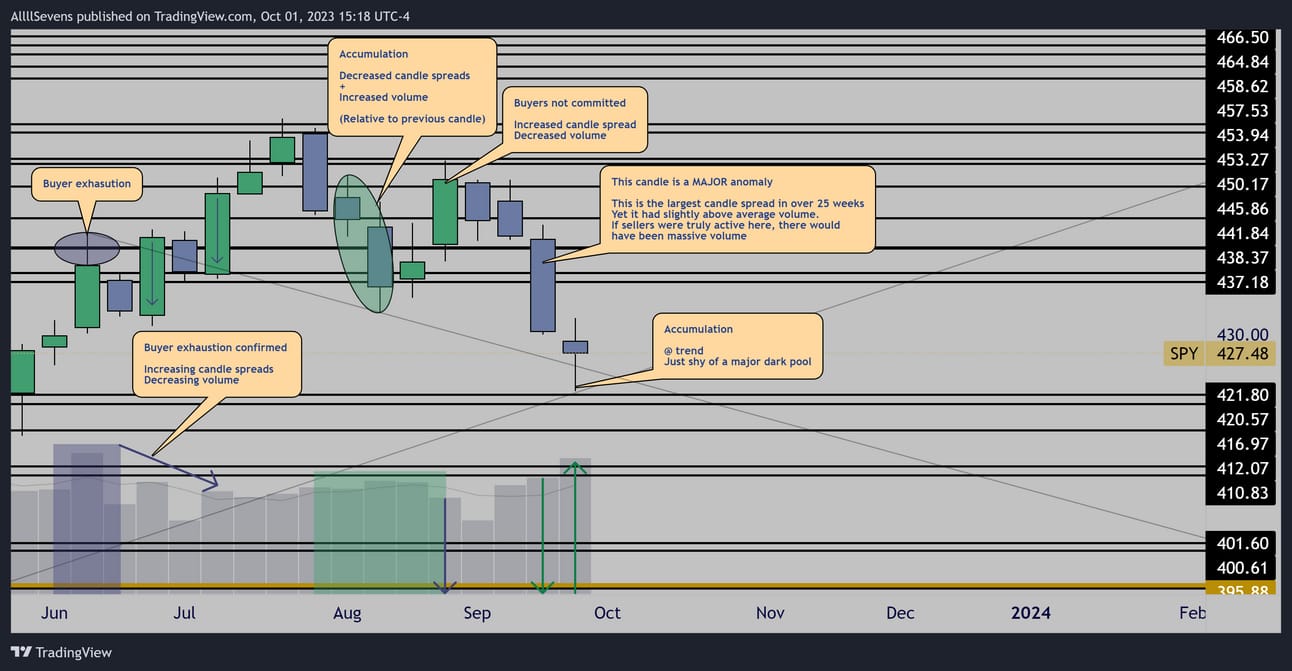

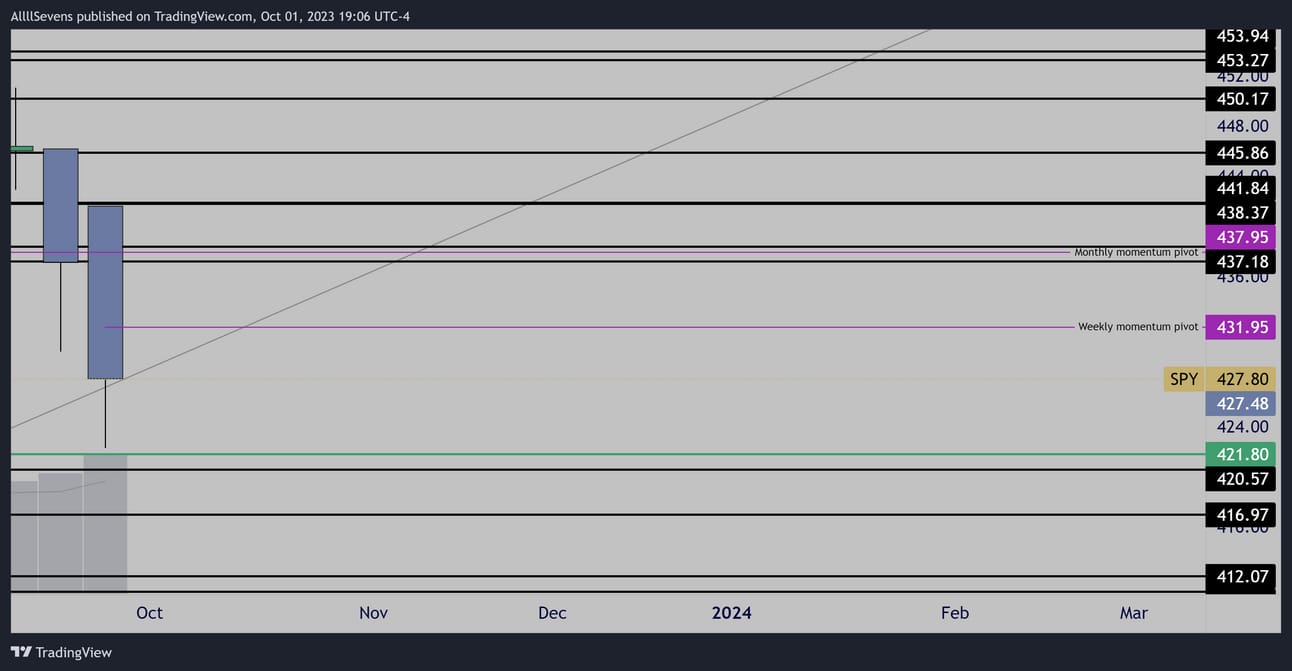

Weekly spread analysis

It is clear buyers were exhausted June-July,

That is why the recent sell-off has occurred.

It’s notable that there aren’t any real signs of further distribution here-Only weak buyers stepping in when price reverses, which keeps leading to pullbacks for more accumulation.

There are clear signs of accumulation on every dip- but not a lot of follow through.

The week before last was extremely notable-

It was the largest candle spread in over 25 weeks and did not have very large volume. Sellers aren’t strong.

Last week, institutional buyers clearly took advantage and re-accumulated some shares.

Momentum

I find Heikin-Ashi candles to be great for measuring momentum in the market on any time frame.

Monthly Heikin Ashi

Strong upside momentum has been lost and it is shifting downwards as trend support is being tested.

$437.95 is the pivot price-

Bullish momentum above, and bearish momentum below.

Weekly Heikin Ashi

Momentum is strong to the downside right now.

$431.95 is the pivot price-

Bullish momentum above, and bearish momentum below.

Conclusion

On a monthly time frame-

I clearly do not want to buy long-term yet.

I am hopeful for a further correction in the future.

Short-term price is approaching trend support on an increased spread, decreased volume anomaly, which tells me the chances of a short-term bounce here are higher than normal.

At the same time, monthly momentum is shifting to the downside…

For the time being, I do not want to be aggressively long here on the monthly time frame I need to see signals for a reversal on the weekly.

On a weekly time frame-

Volume says there is a high probability of a bounce from this inflection point: trend support + $421.80 dark pool support.

However, momentum strongly favors downside as of now…

You might notice that $421.80 has not been tested yet, I would love to see that happen before a reversal.

For me to look at longs this week, I need either $421.80 to get tested and held with strong volume, or I need to see the weekly momentum pivot broke to the upside.

Overall, on the weekly time frame, I don’t see any reason to expect a breakdown here.

The only thing that would stop a short-term bounce is momentum-

Momentum IS important so I am not overly bullish.

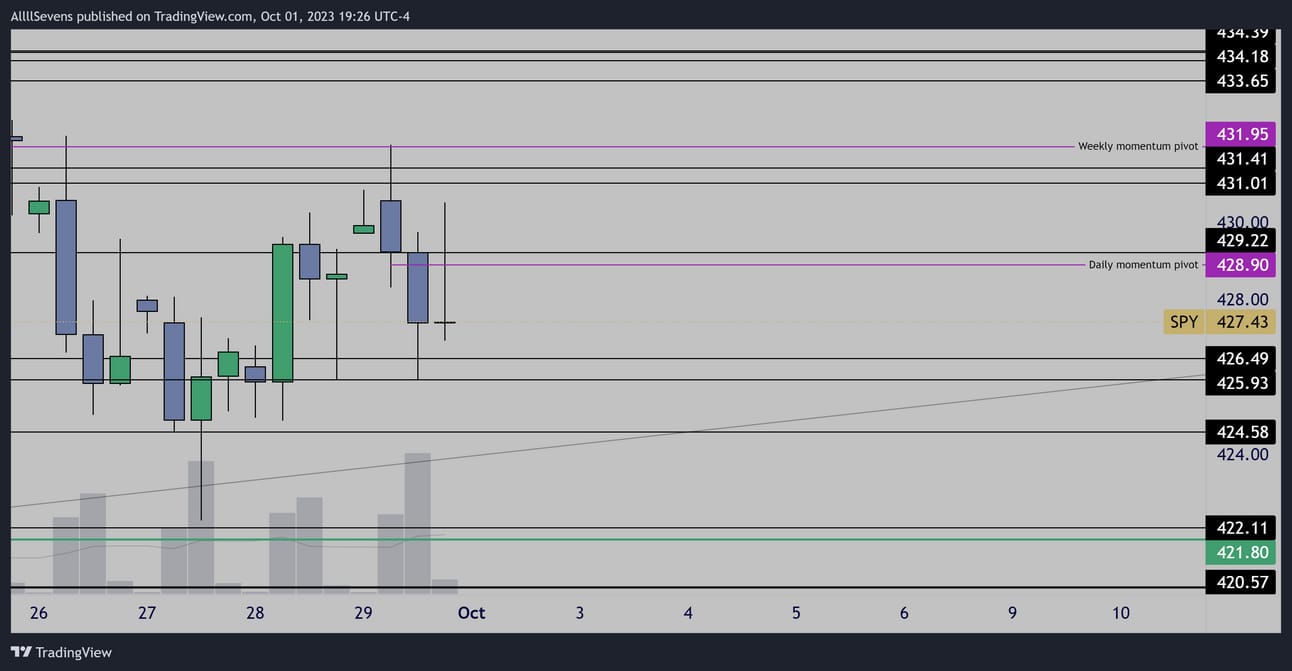

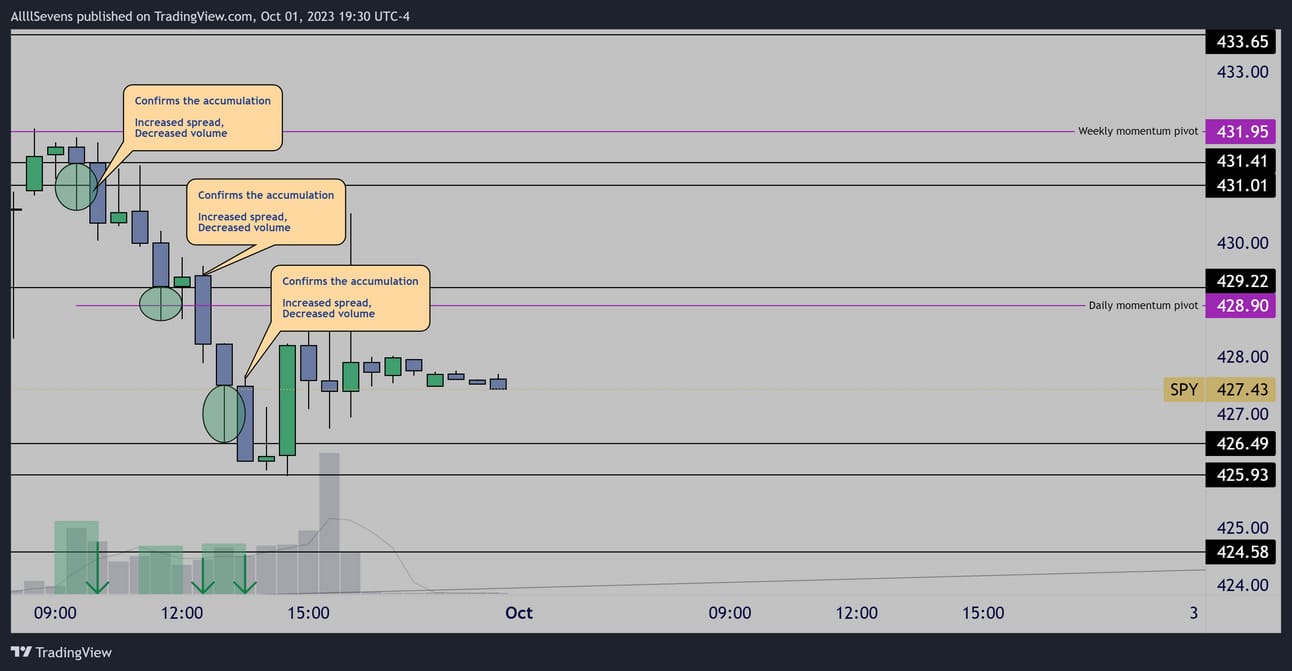

4HR levels

30m from Friday 9/29/23

Conclusion of the conclusion

I am definitely leaning towards the long side this week, but due to the downside momentum on both time frames, I am somewhat cautious.

Price needs to break over $431.01-$431.95

Or, needs a strong volume test and hold of $421.80

Otherwise, I am not going to aggressively fight the current short-term trend. I'll gladly be patient for volume and momentum to align if I must.

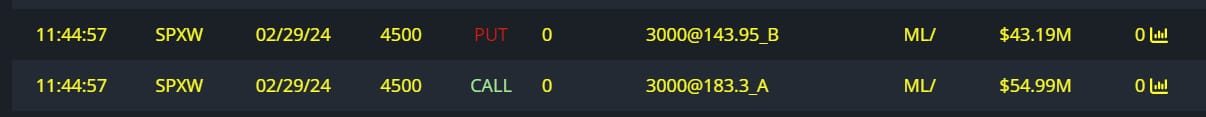

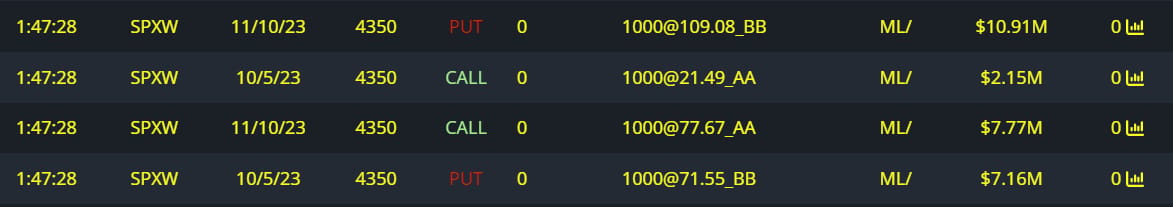

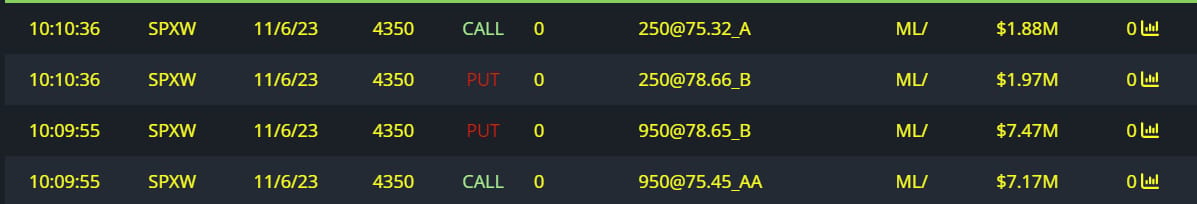

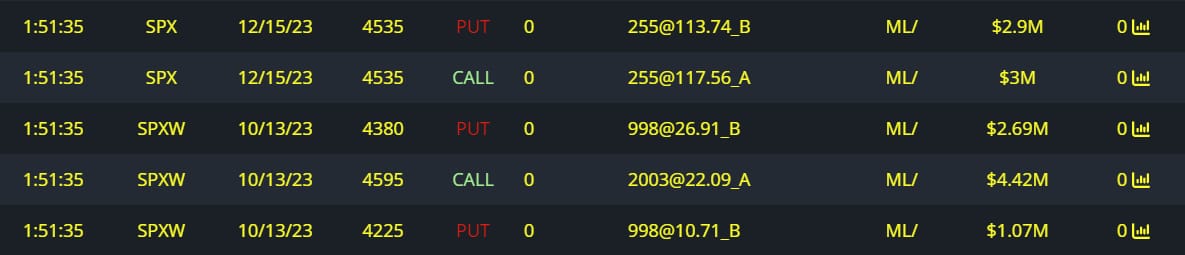

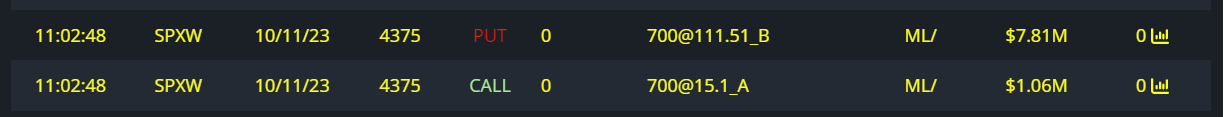

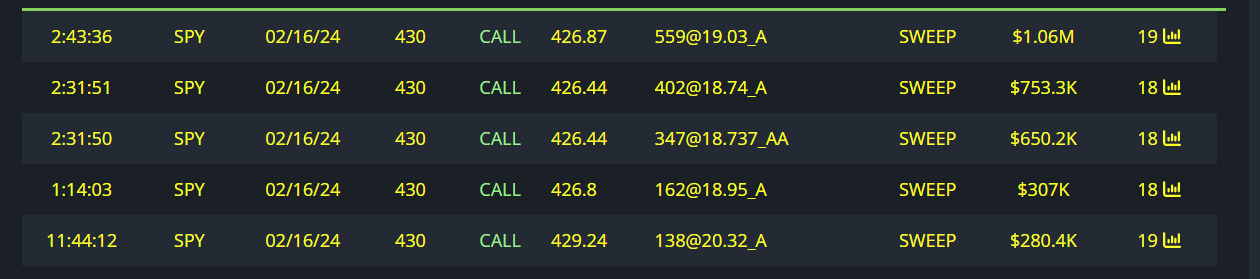

Unusual Options Flow

$98.18M Full Risk Bull

$27.99M Full Risk Bull

$18.49M Full Risk Bull

$14.08M Full Risk Bull

$8.87M Full Risk Bull

$6.1M Full Risk Bull

$3.37M Full Risk Bull

$2.58M Full Risk Bull

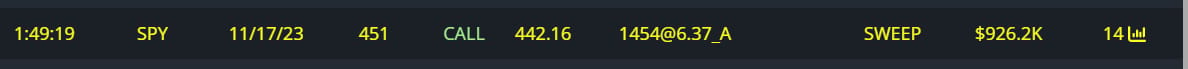

$1.99M Calls Bought

$1.7M Full Risk Bull

$926K Calls Bought

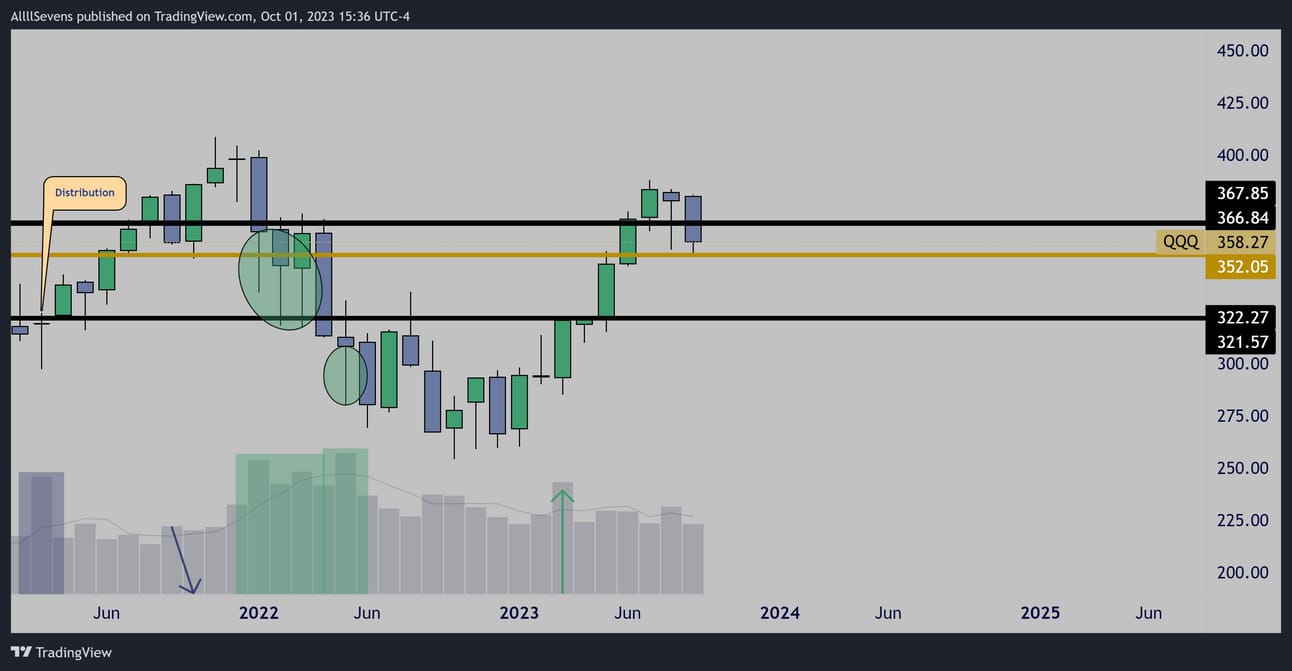

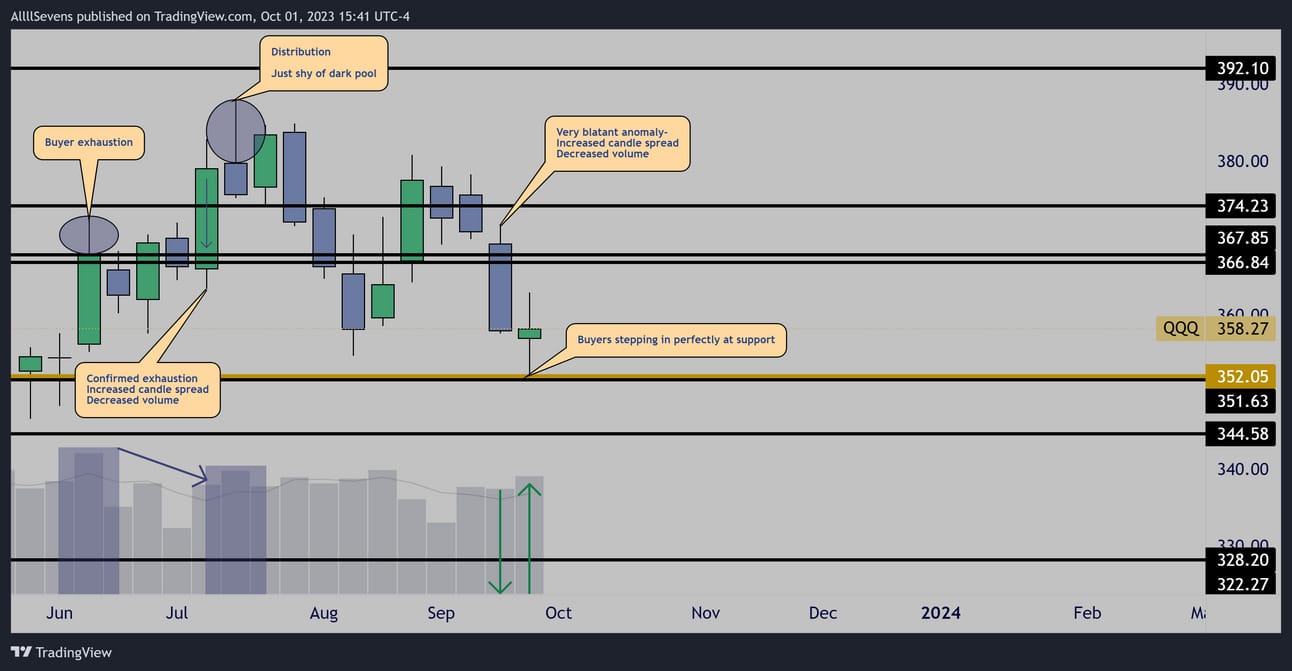

QQQ

The first thing I notice about the QQQ is while it is extremely similar to the SPY in structure, the current uptrend looks a lot more sustainable…

The March candle is not nearly as small, and there was not an increased candle spread, decreased volume anomaly in June.

If the markets bounce here short-term the QQQ could outperform.

Monthly

The QQQ is at a much more notable support here compared to the SPY

Weekly

The weekly chart looks primed for a push towards $366.84 in the coming weeks. This one touched support perfectly, and the previous weeks anomaly is even more clear than it is on SPY

Weekly

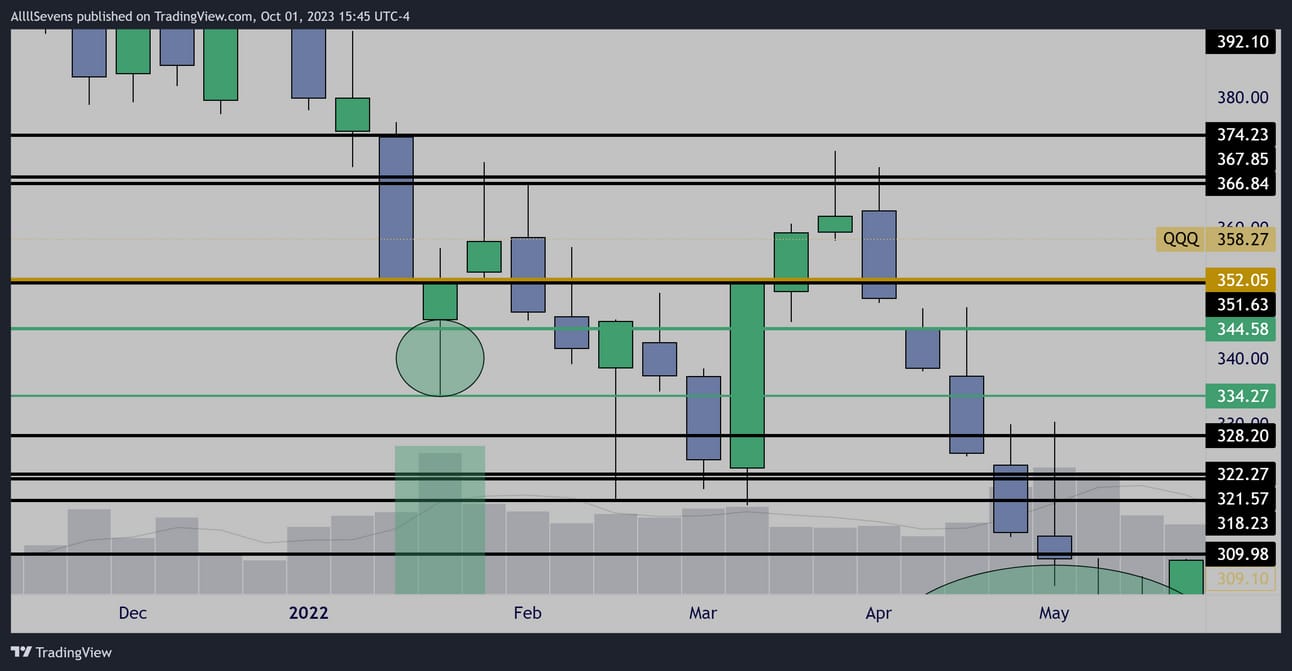

Just like the SPY, the support being tested here had extremely notable volume during the initial 2022 sell-off. On the QQQ, this was the largest volume in over 10 years. Clear accumulation.

The weekly is at an inflection point.

Two trends, and just shy of a very very key dark pool support…

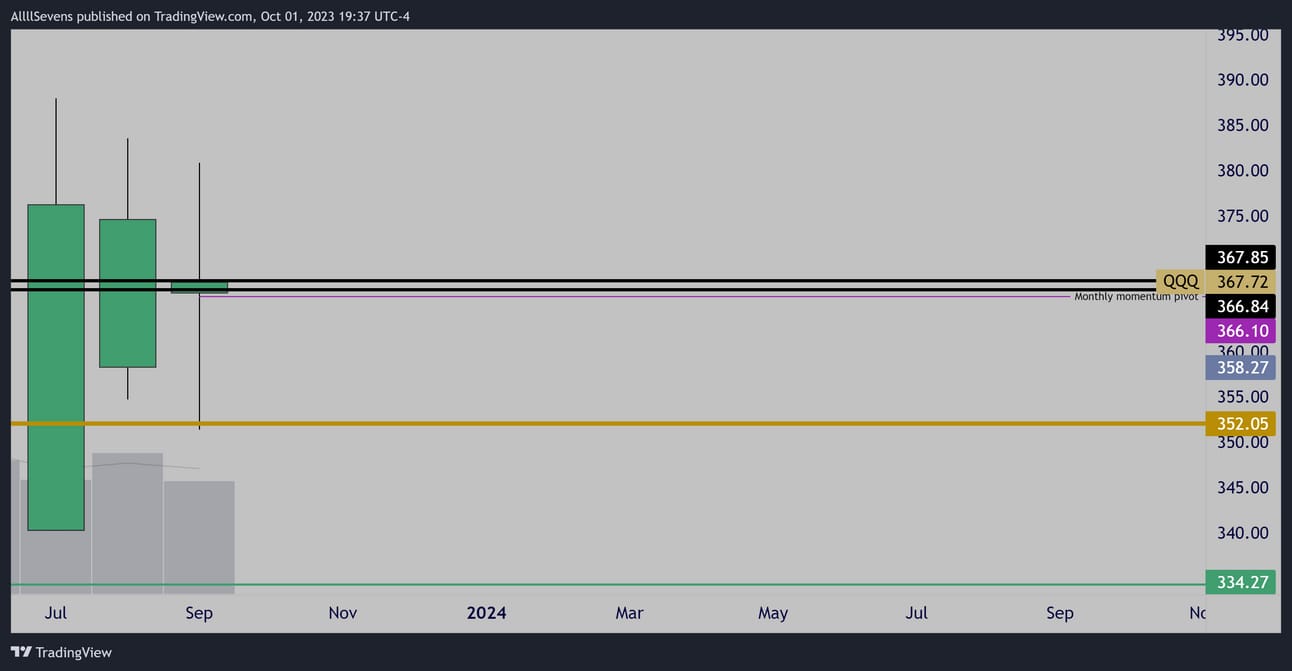

Momentum

Monthly Heikin Ashi

$366.10 monthly momentum pivot

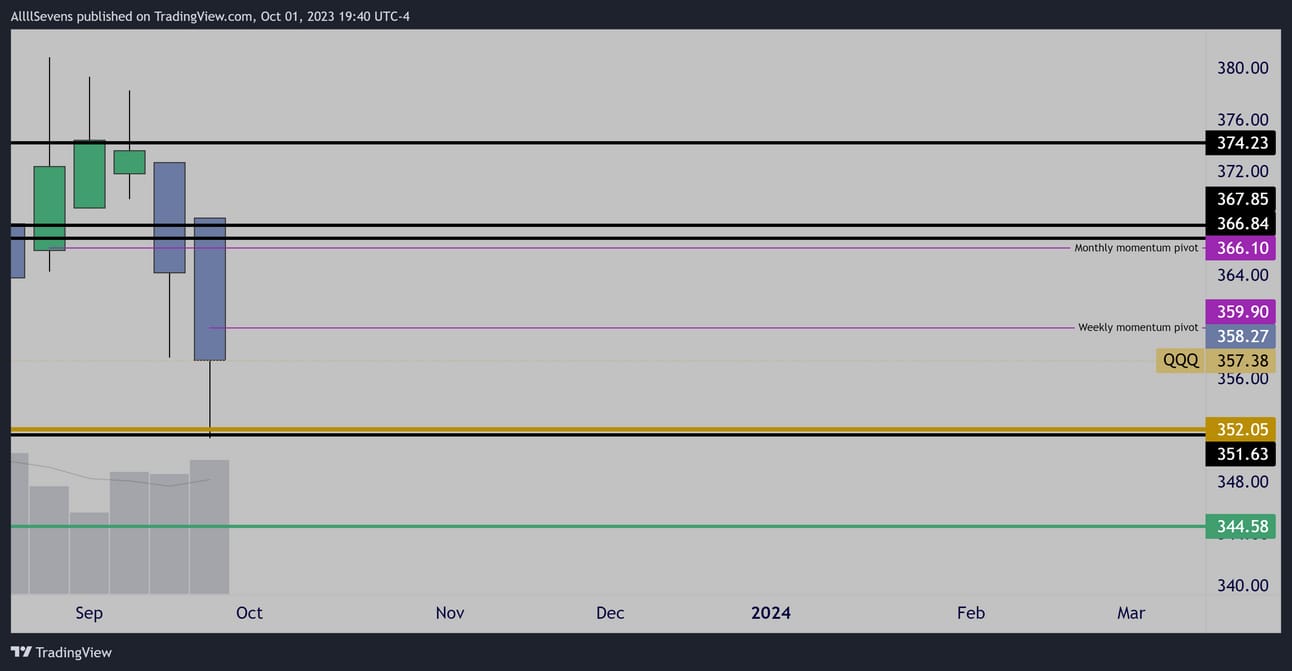

Weekly Heikin Ashi

$359.90 weekly momentum pivot

Conclusion

On a monthly time frame-

The QQQ looks much healthier than the SPY-

It does not show the same distribution pattern this March

Same increased spread, decreased volume anomaly showing a lack of aggressive sellers this past month.

Price is right at a major support level-

No trend support here for me, as the QQQ has been in a much steeper trend

Momentum currently favors a shift to the downside just like the SPY

On a weekly time frame-

This weekly chart looks primed for a short-term bounce if it can break the weekly momentum pivot. If the markets reverse, here short-term QQQ will surely lead the way.

Conclusion of the conclusion-

I’m going to go out on a limb here and say to start the week, if QQQ is holding over the current support zone @ $356.91-$357.60 I’ll be rather bullish. Below, I would expect a more choppy environment here, and I’d look to the SPY for smoother downside.

4HR

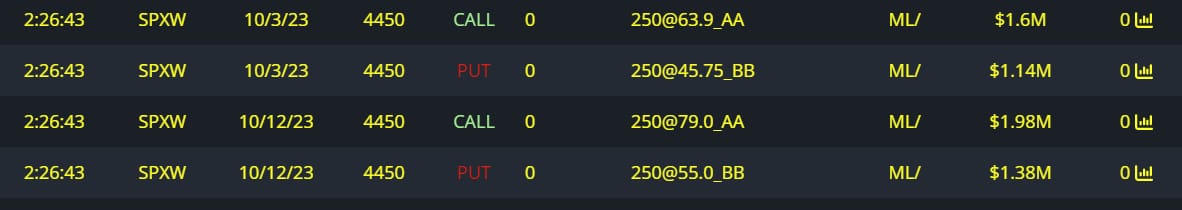

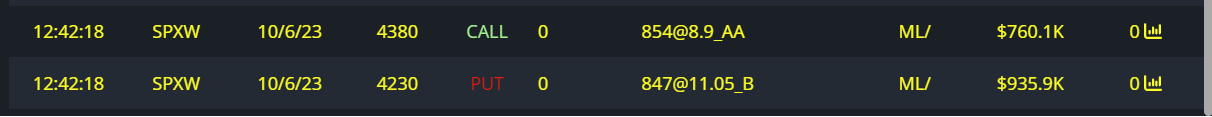

Unusual Options Flow

$14.49M Full Risk Bull

IWM

Monthly

Clear accumulation patterns-

A loss of support, and now strong downside momentum on the monthly is not the best look for a short-term reversal to take place here yet…

However, this loss of support is clearly false and if it is reclaimed quicky then a reversal could be rather aggressive.

Weekly

The weekly chart here is incredible.

Sellers have no merit and an eventual reversal is extremely probable.

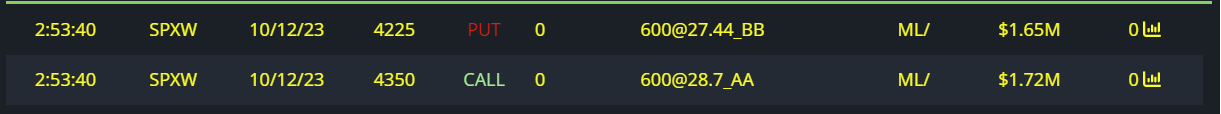

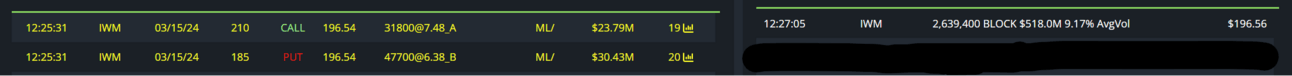

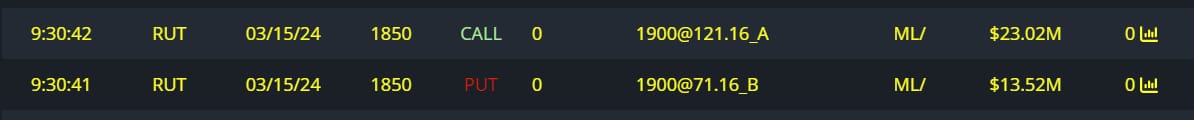

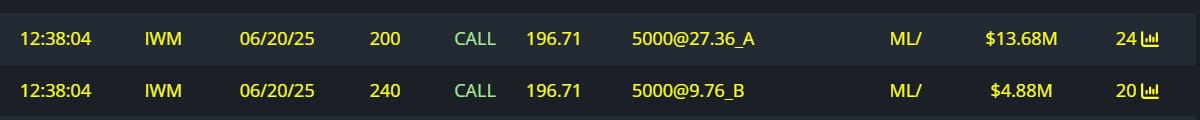

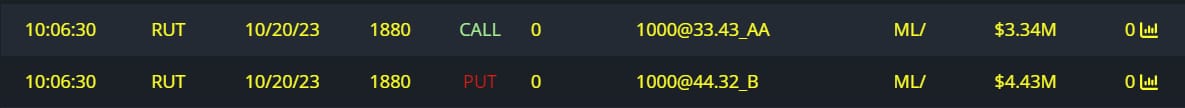

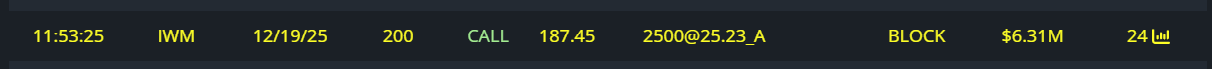

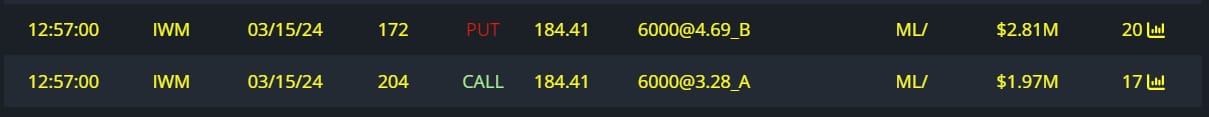

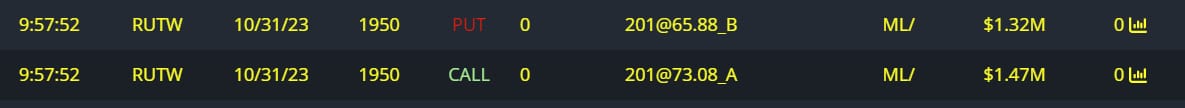

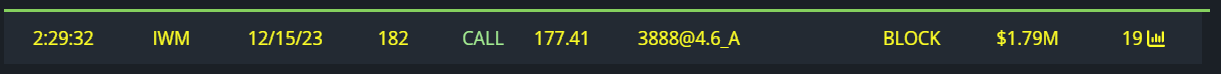

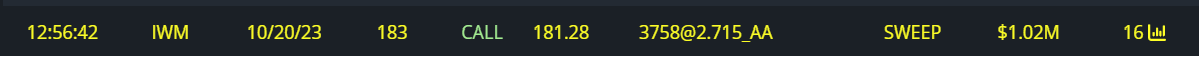

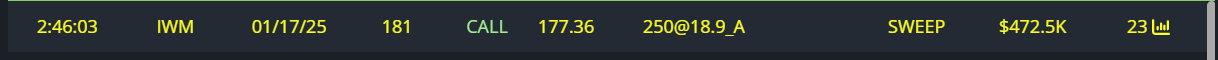

Unusual Options Flow

$54.22M Full Risk Bull

+

$518M Dark Pool

$36.53M Full Risk Bull

$8.8M Bullish Call Spread

$7.77M Full Risk Bull

$6.31M Calls Bought

$4.78M Full Risk Bull

$2.79M Full Risk Bull

$1.79M Calls Bought

$1.29M Puts Sold

$1.28M Calls Bought

$1.02M Calls Bought

$560.9K Calls Bought

$555.9K Calls Bought

$472.5K Calls Bought

$427.2K Calls Bought

Conclusion

The bull flow here is clearly insane-

Some of the most aggressive directional orders I have ever witnessed.

All of them are down bad. This has had an extremely tough time reversing…

Due to the time on most of these contracts, as well as the current monthly momentum, I am patient here.

I’m watching for the support above to get reclaimed on high volume on all time frames, and then this can see a huge rally. There’s really no rush.

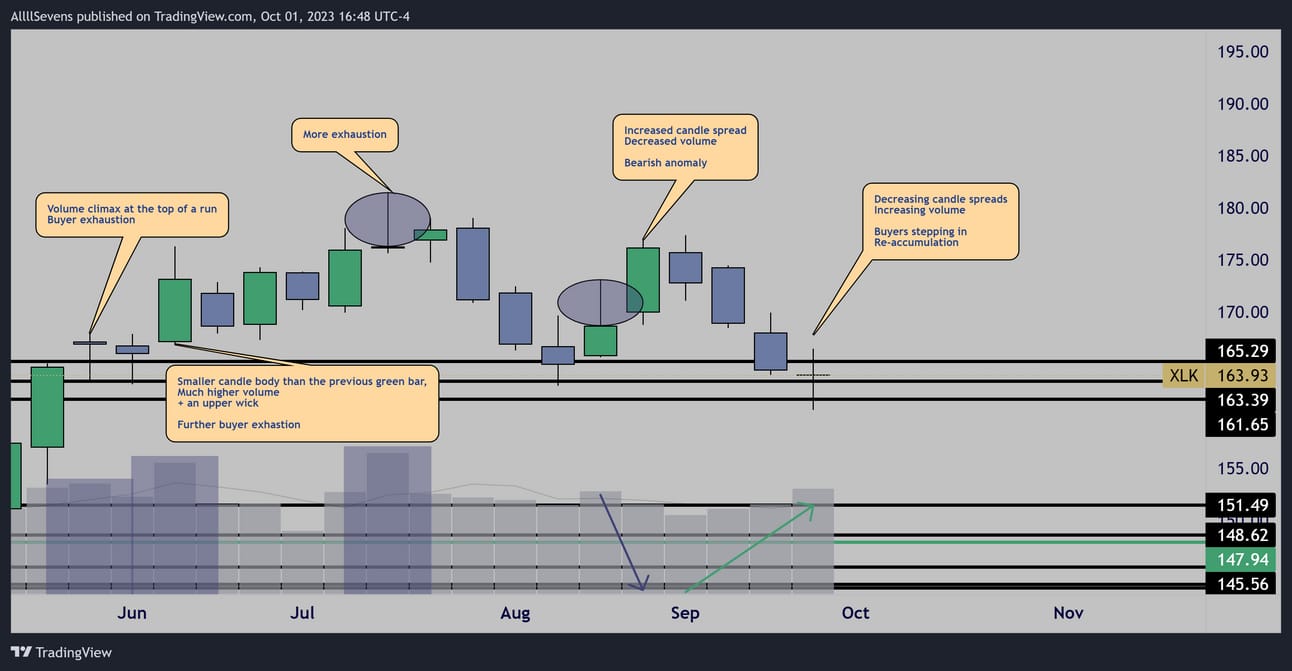

XLK

Weekly

Overall, very bearish patterns for the XLK the last few months.

However,

On this recent test of support, the sell pressure is clearly weakening and it looks like institutions are re-accumulating.

As long as price continues to hold $161.65 I’d anticipate a bounce.

This is the heaviest weighted sector in the SPY

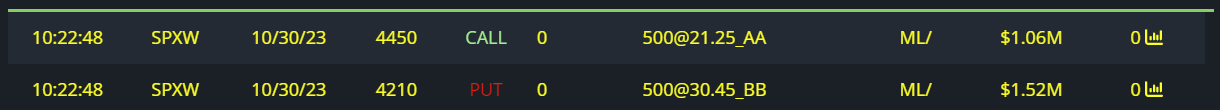

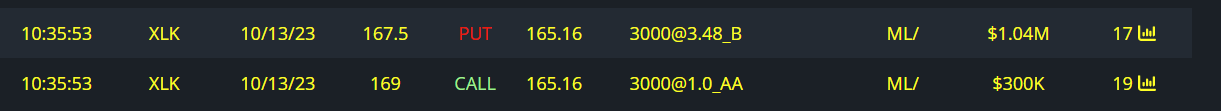

Unusual Options Flow

$1.3M Full Risk Bull Order

Thank you for your time.

I am very passionate about what I do and it is extremely rewarding to know that there is even one individual person opening this each week to consider my perspective. I hope you find value here.

Make sure to stick around for next weeks newsletter!

If you have any questions, concerns, or suggestions please email me or message me on twitter.

I would love to hear from you.

[email protected]

https://twitter.com/AllllSevens

If you like my style of analysis, consider upgrading your subscription…

I write a premium newsletter every week as well.

It will be sent out shortly after this.

It is only $7.77 per month!

You also get access to my Discord community!

I have channels/forums for every single stock I have ever analyzed that I update on a consistent basis with any volume anomalies or unusual options flow.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply