- AllllSevens

- Posts

- AllllSevens Newsletter

AllllSevens Newsletter

For The Week Beginning 6/12/23

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice. Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

$SPY

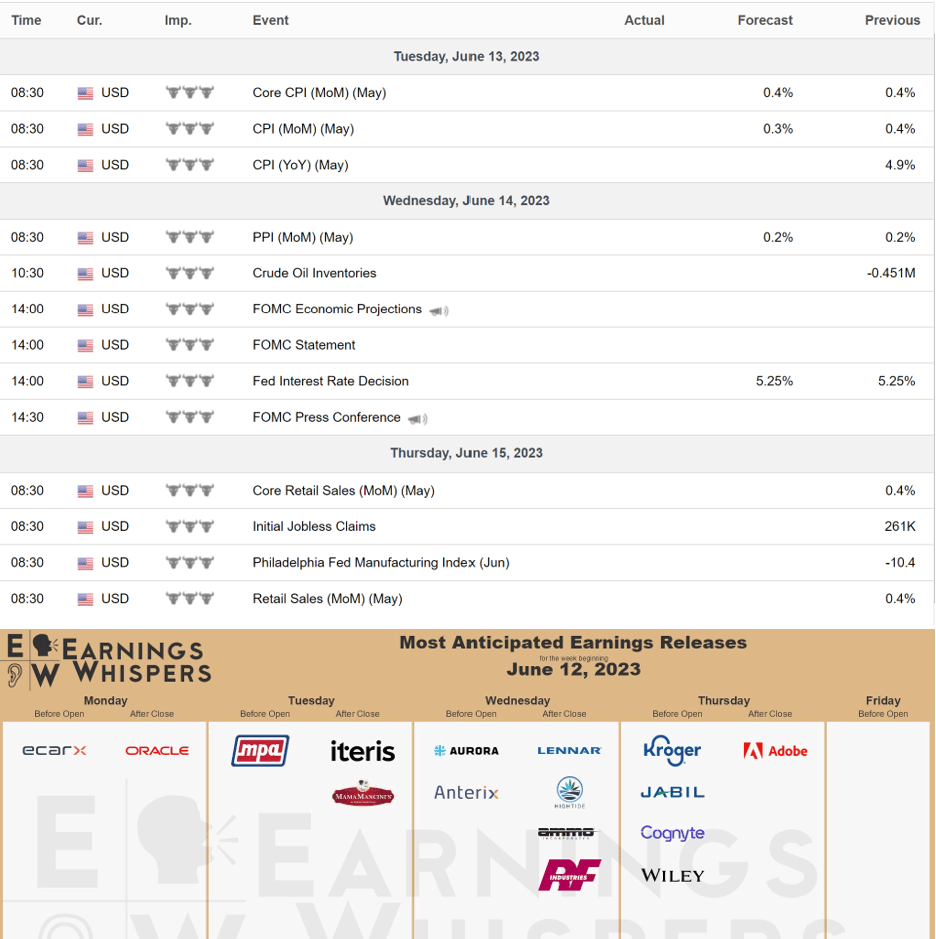

The Monthly chart is extremely bullish.

The “bear market” was a manipulated downtrend…

Big money bought the entire way down.

In early 2022, price lost a key support @ $440

Retail panic ensued. Big money LOADED longs, visible by the lower wicks and very large volume bringing it back into $440.

What you must understand, is big money can only buy when there are abundant sell orders. So, when price comes back to retest $440, they aren’t going to support it anymore. This is how a manipulated downtrend begins…

Naturally, price rejects the retest and creates a bullish volume anomaly-

A large sell candle with very little volume supporting it.

New lows were made, and once again, big money LOADS longs at the $390-$395 area.

This March, the largest volume since the Covid-Crash came in leaving a lower wick on the $390-$395 support that big money accumulated at.

This has sent price soaring the last 2 months…

I am extremely bullish.

I think $440 is on the way, and I think when price gets there, there is a good chance it can break out since there was massive buying at that level on the initial test in early 2022, followed by manipulated retail sell.

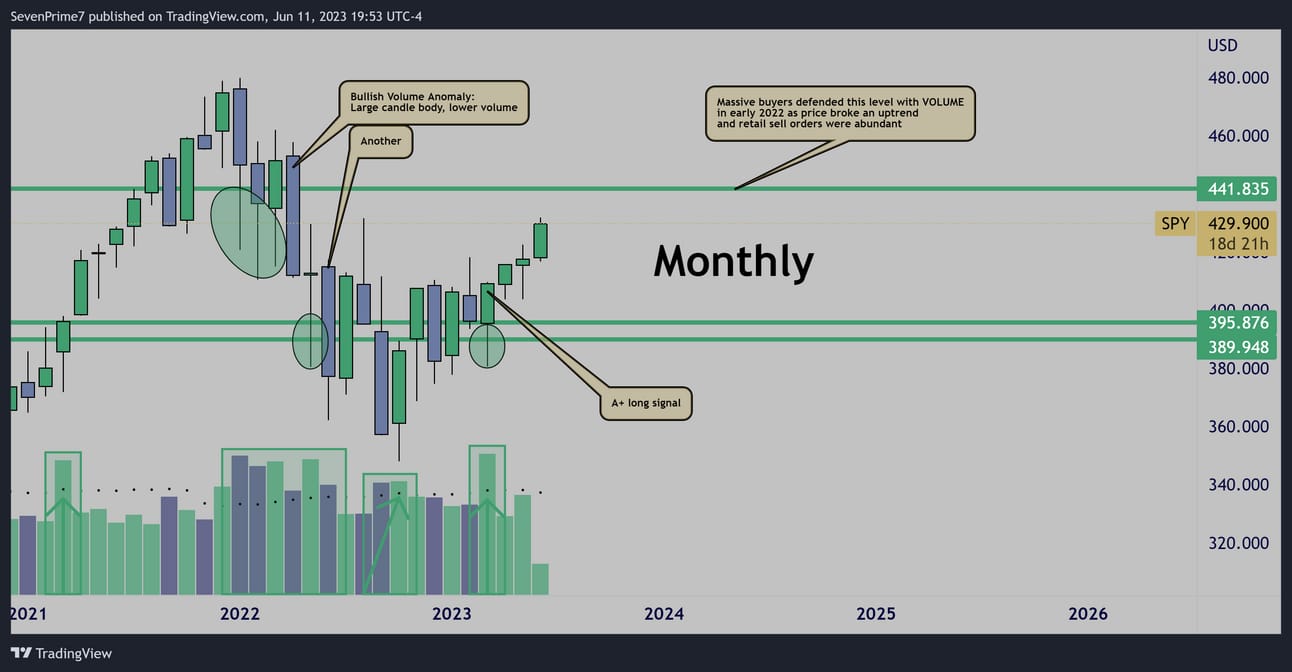

The weekly looks healthy, however, price is not near any levels, so the risk-reward of opening new swing positions here is poor to me.

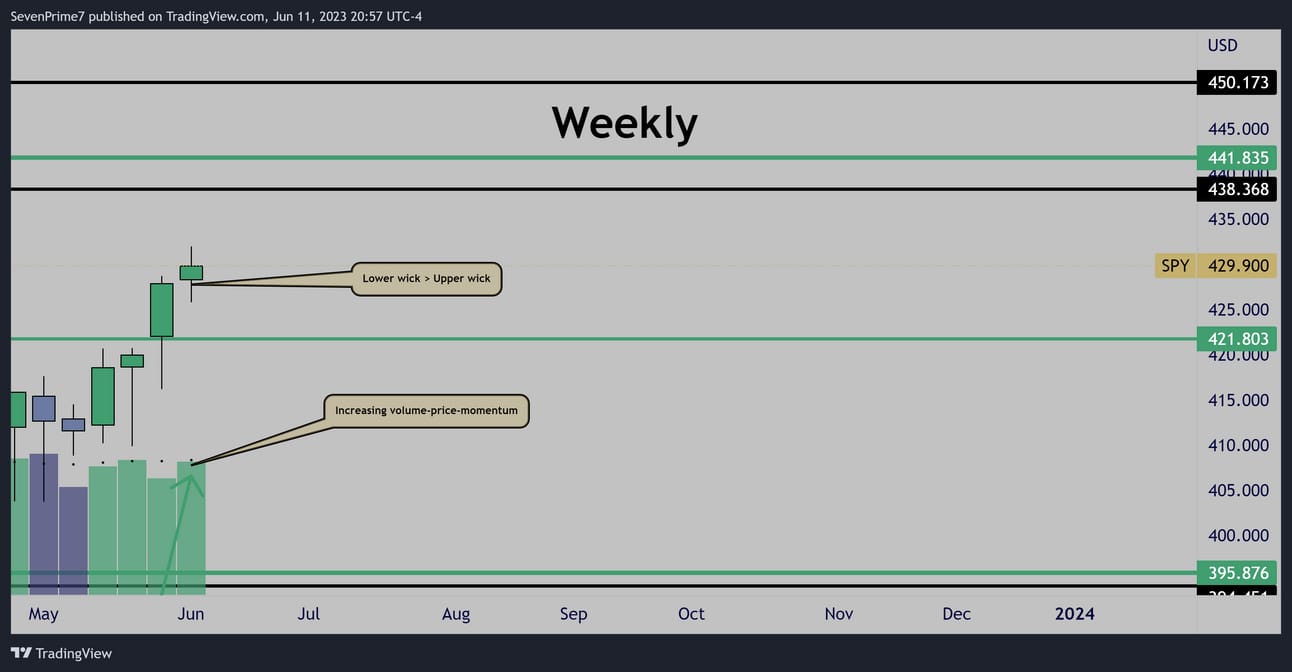

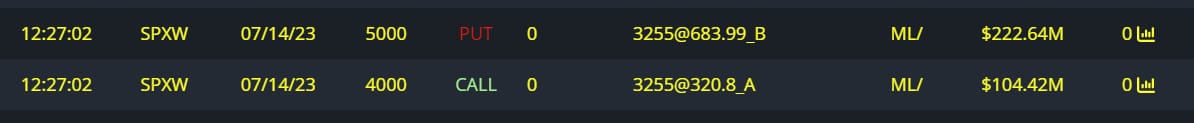

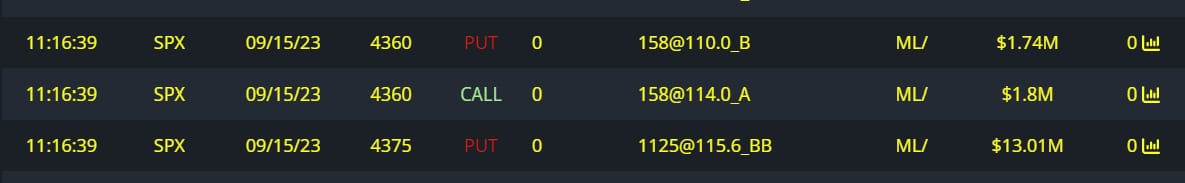

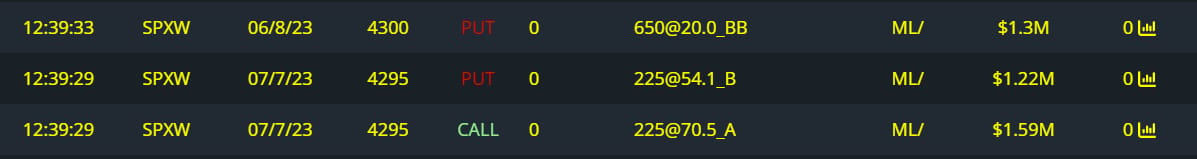

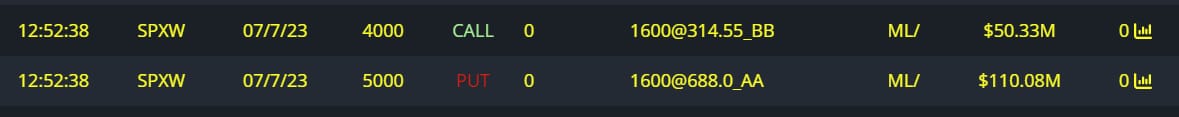

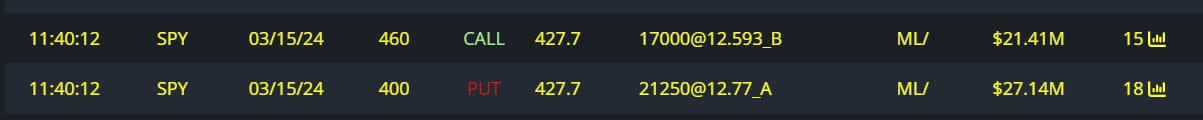

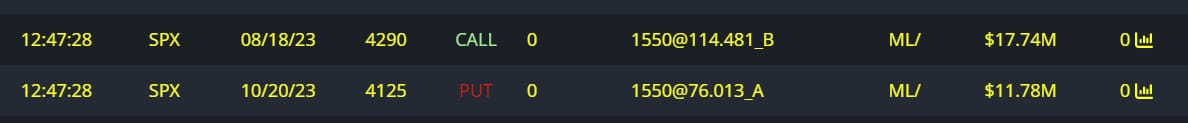

Unusual Options Flow

$745M Bullish Inflows

$245M Bearish Inflows

Bulls taking the lead by a lot after a very indecisive inflow last week.

$377M Put Writing

$327M Bullish Risk Reversal

$17M Calls Bought

$16.5M Bullish Risk Reversal

$5M Bullish Risk Reversal

$4M Bullish Risk Reversal

$160M Bearish Risk Reversal

$48.5M Bearish Risk Reversal

$29.5M Bearish Risk Reversal

$6.5M Bearish Risk Reversal

Conclusion-

I remain extremely bullish.

The chart last week told me up, but the flow said chop-

The result was a choppy green week.

Now, the chart tells me up, and the flow says up as well.

But, like I said,

The weekly time frame is not near a good R/R entry.

And there is some very notable bearish flow, even though it does not come close to topping the bull flow.

Specifically, I note the 7/07 expi bearish flow.

Perhaps the market sees a pullback by then, and the dip gets ate.

Either way, my only focus this week will be calls, and they will be scalps only, as I do not have the R/R I would like to open call swings, unless price re-tested $421.803, or breaks over $441.835.

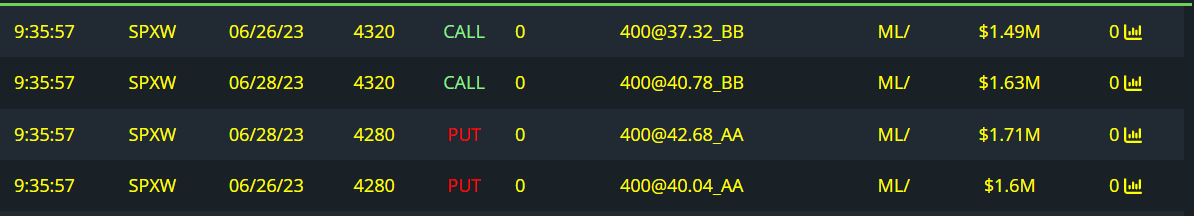

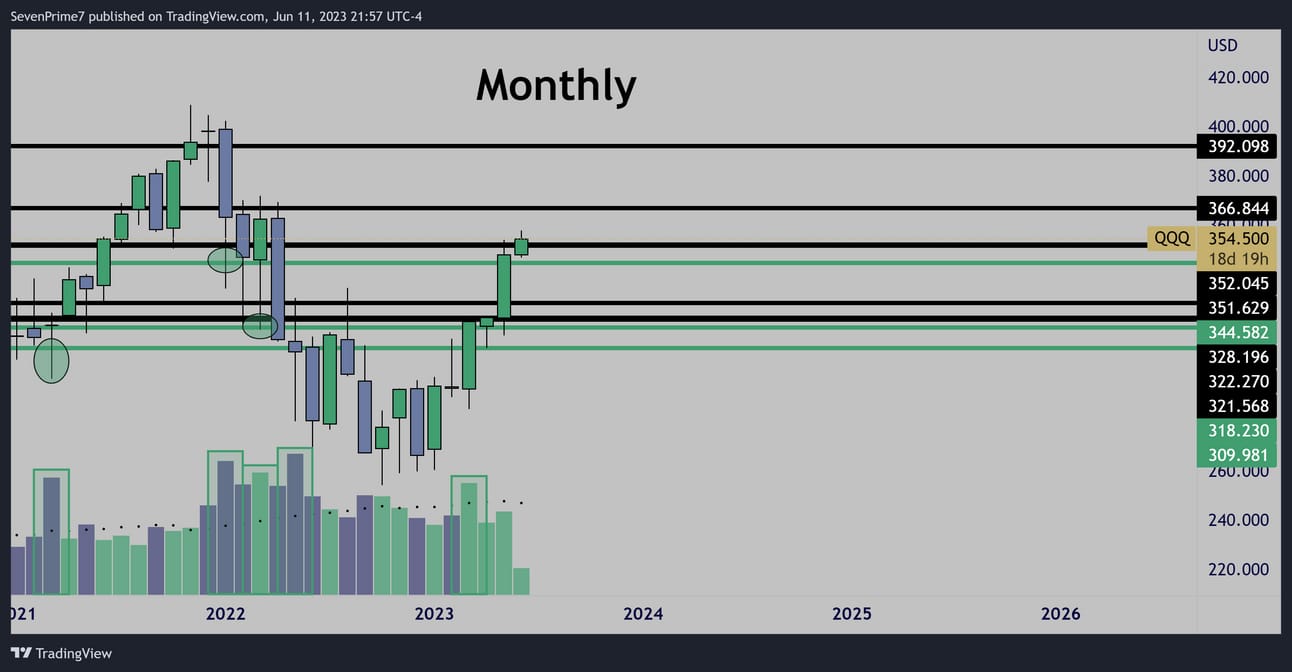

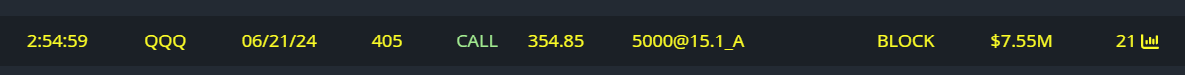

$QQQ

The $QQQ weekly chart has something crazy going on that apparently nobody else has noticed, because I haven’t seen anyone talk about this.

Price is reclaiming levels where there was the largest volume impulse the ETF has seen in 10 years… and it was bullish. Volume is slowly beginning to increase as price consolidates over this zone…

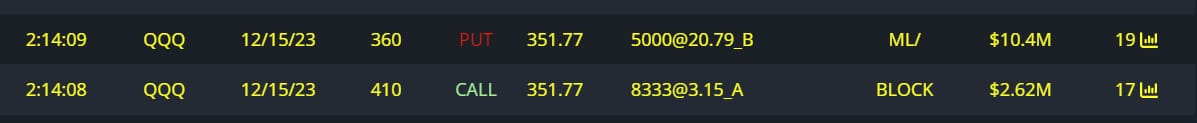

Unusual Options Flow

$20.5M Bullish Inflows

$2M Bearish Inflows

Not a ton of new positioning this week-

Last week it was neck and neck, just like $SPY

This week, bulls take control similar to the $SPY

$13M Bullish Risk Reversal

$7.5M Calls Bought

$2M Puts Bought

Conclusion

The weekly chart has explosive upside potential here.

Top Pick

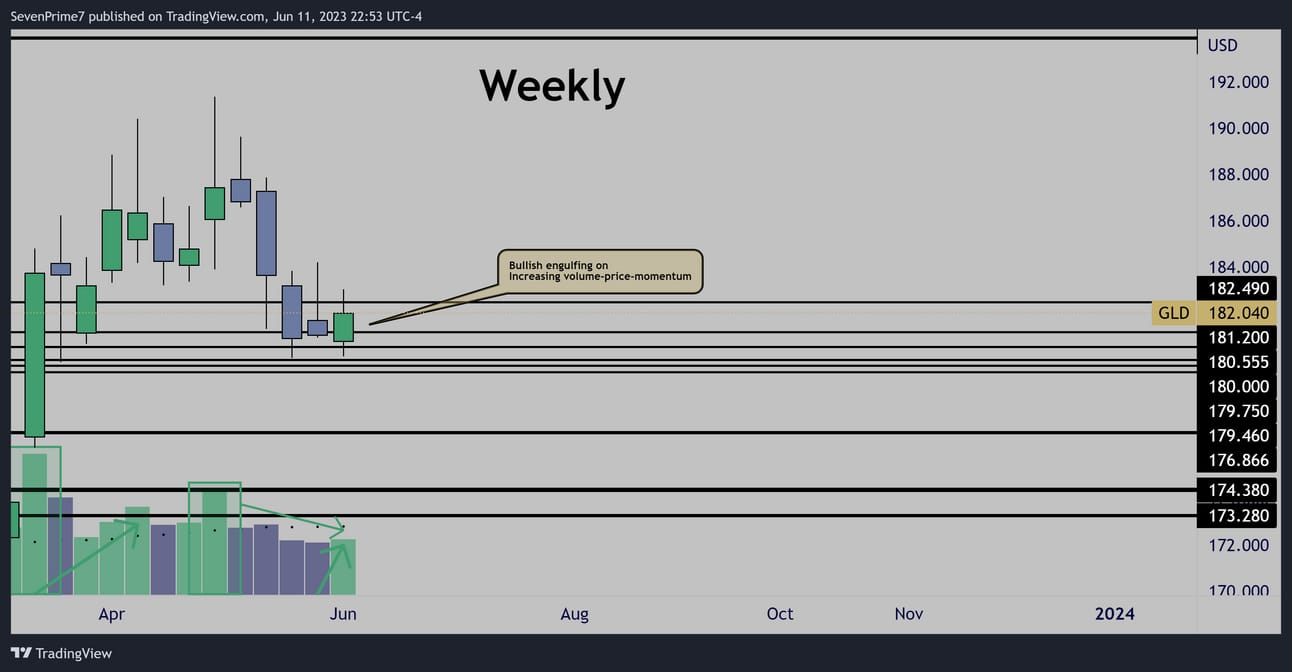

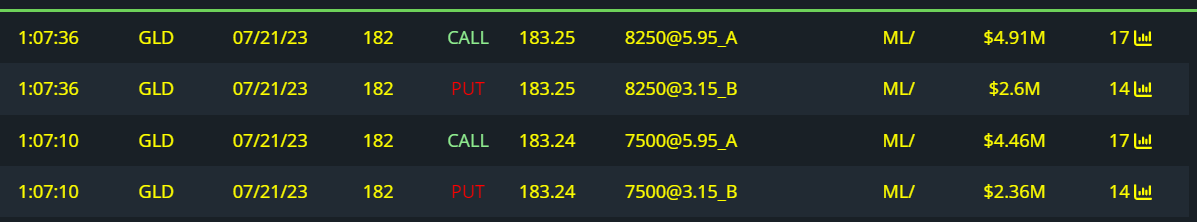

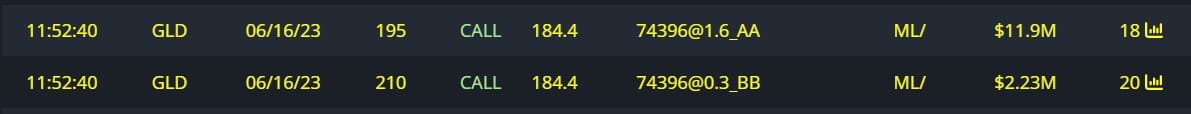

$GLD

Weekly accumulation patterns-

Price now in a decreasing volume bullish consolidation.

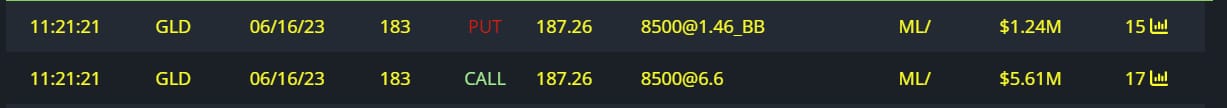

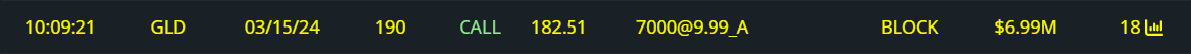

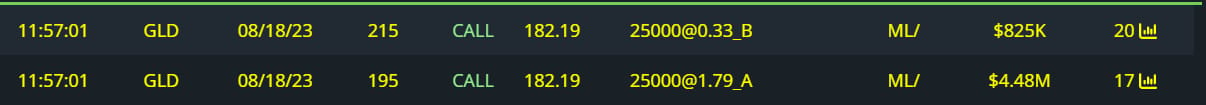

Unusual Options Flow

$14M Bullish Risk Reversal

$10M Bullish Call Spread

$7M Bullish Risk Reversal

$7M Calls Bought

$4M Bullish Call Spread

Conclusion

Increasing volume-price-momentum bullish engulfing candle heading into this week. This could be big. I want $193+ by August.

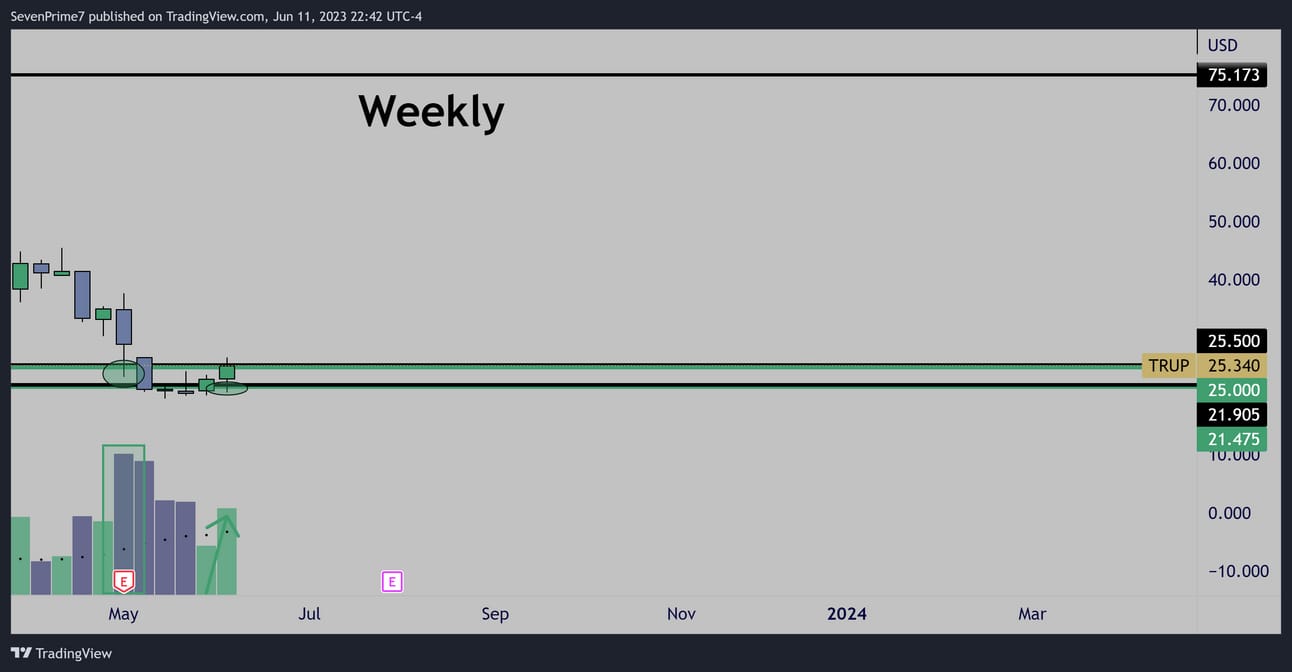

$TRUP

Largest monthly volume ever-

Got a good close above the POC

Weekly picking up great volume-price-momentum over $25.00

Unusual Options Flow

$6M Bullish Risk Reversal

Conclusion

This looks ready to go over $25

I think this chart has a lot more potential past just 6/16

Shares could triple over a few month time period…

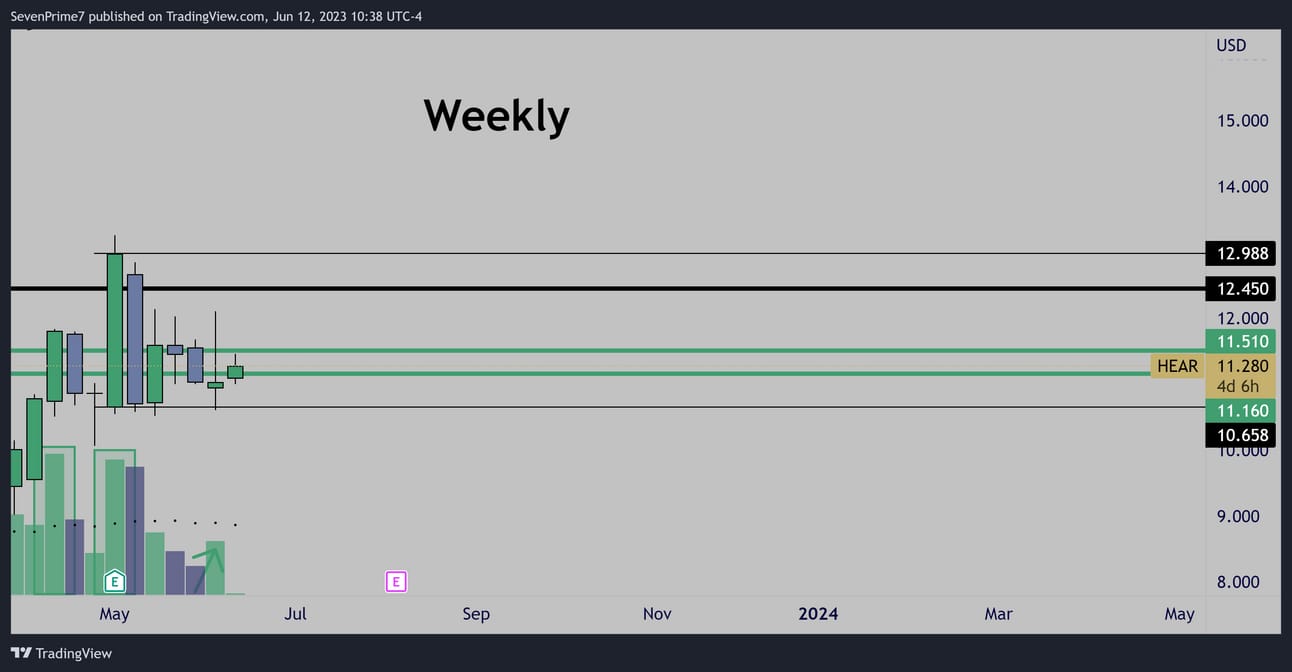

$HEAR

Five inside weeks following a large bullish impulse.

Inverted hammer on high volume signaling a potential upside reversal this week to break towards $12.45

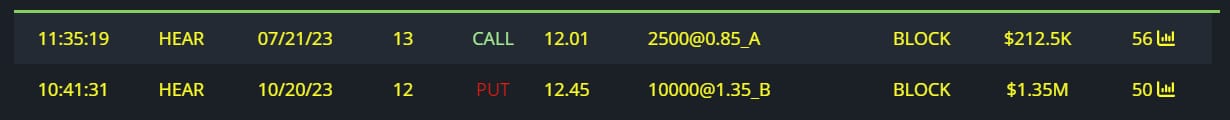

Unusual Options Flow

$1.5M Bullish Risk Reversal

Conclusion

Over $11.16 I like this a lot for longs.

Shares can run 10%+ maybe a LOT more over the next year, options do have wide spreads on this, but should jump nicely if price sees $12+ in the next 2 weeks.

That is all I have got for this week!

I am on vacation, not going to overwork myself-

I posted a TON of setups last week to prepare for this-

All of those setups are still valid, and many of them are looking A+ this week again.

Have a great week!

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

BlackBoxStocks offers a 20% discount to first time members!

Use this link —>http://staygreen.blackboxstocks.com/SHMs

This also helps support me, as I am a BBS affiliate program member!

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com/

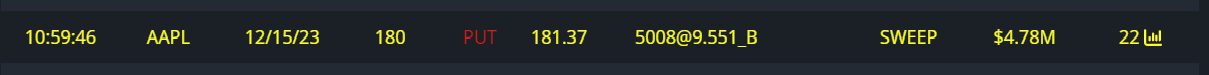

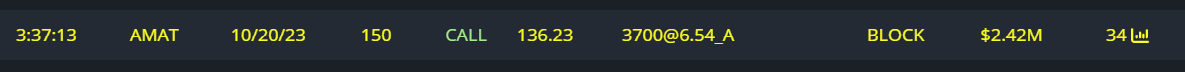

Unusual Options Flow

$AAPL $5M Put Writen

$AMAT $2M Calls Bought

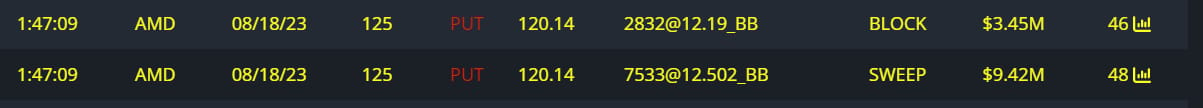

$AMD $14M Puts Written

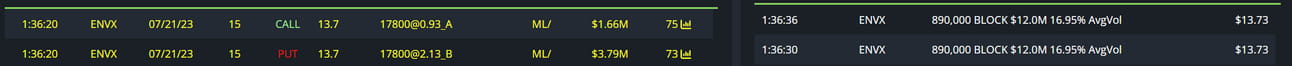

$ENVX $5.5M Bullish Risk Reversal tied to a $24M Dark Pool

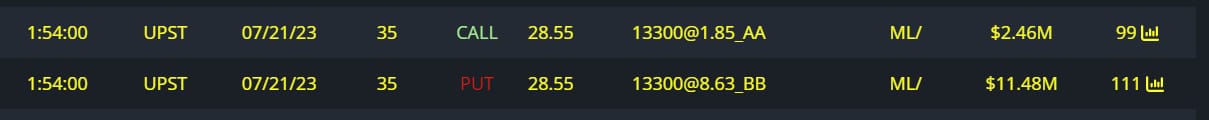

$UPST $14M Bullish Risk Reversal

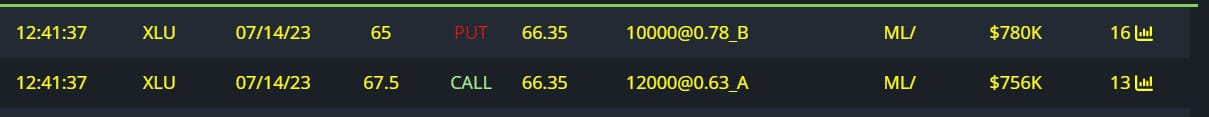

$XLU Bullish Risk Reversal

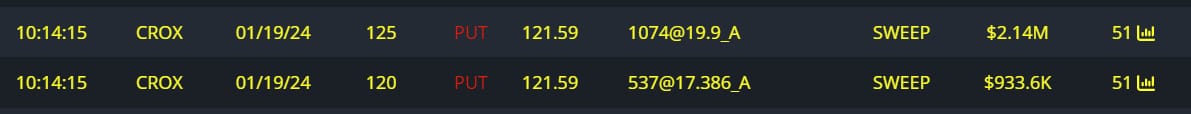

$CROX $3M Puts Bought

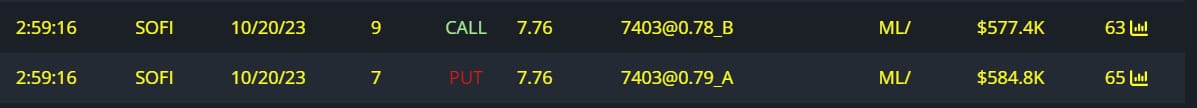

$SOFI $1M Bearish Risk Reversal

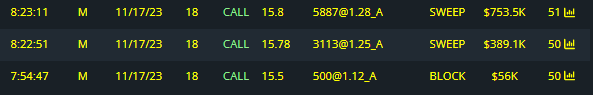

$M $1M Calls Bought

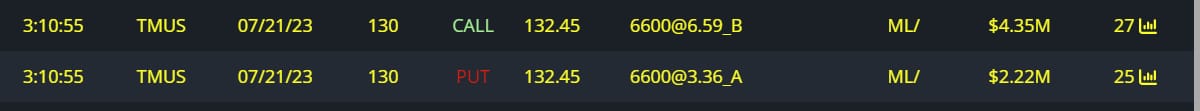

$TMUS $6.5M Bearish Risk Reversal

Reply