- AllllSevens

- Posts

- AllllSevens Newsletter $ETSY & $BYND

AllllSevens Newsletter $ETSY & $BYND

Etsy, Inc. & Beyond Meat, Inc.

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this essay below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Don’t hesitate to reach out with any questions.

ETSY

Long-Term…

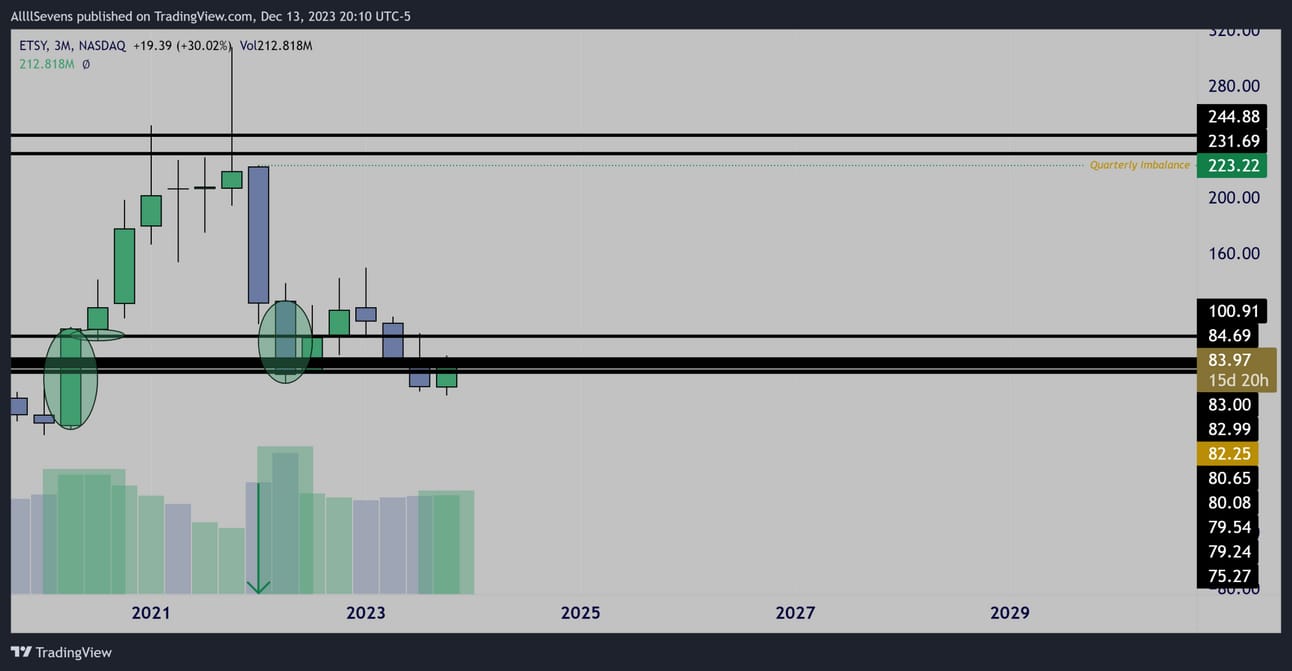

Quarterly

$82.25 largest Dark Pool on record.

Large buyers present at this level in 2020

Upon retesting in 2022, a decreased spread increased volume stopping candle formed, confirming institutional buyers are present once again.

Also notable is the candle that rejected $230’s and brought price down.

It was a larger spread candle than the 2020 buying… and less volume.

A clear anomaly creating an imbalance at $233.22

Daily

When I zoom in on the 2021-2022 correction I am seeing some extremely clean accumulation patterns.

Every dip is high volume buying. Every top is low volume.

There was zero distribution leading to this drop.

An imbalance was left behind at $279.23

I believe that is the long-term “fair value” of this stock.

I believe it will go even higher than that over more time.

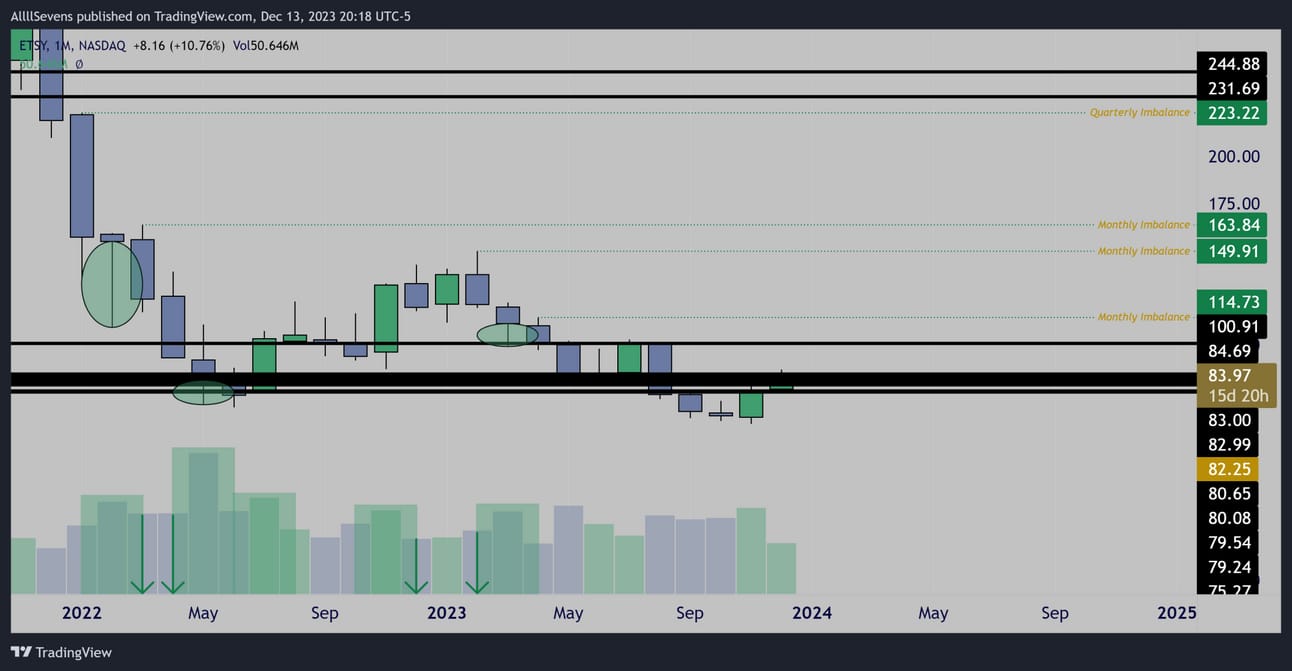

Monthly

Beautiful accumulation as price retest’s it’s largest Dark Pool on record.

It’s very very clear that shares of this stock have been transferred from the hands of impatient retail investors to the hands of patient institutional investors holding for the long-term.

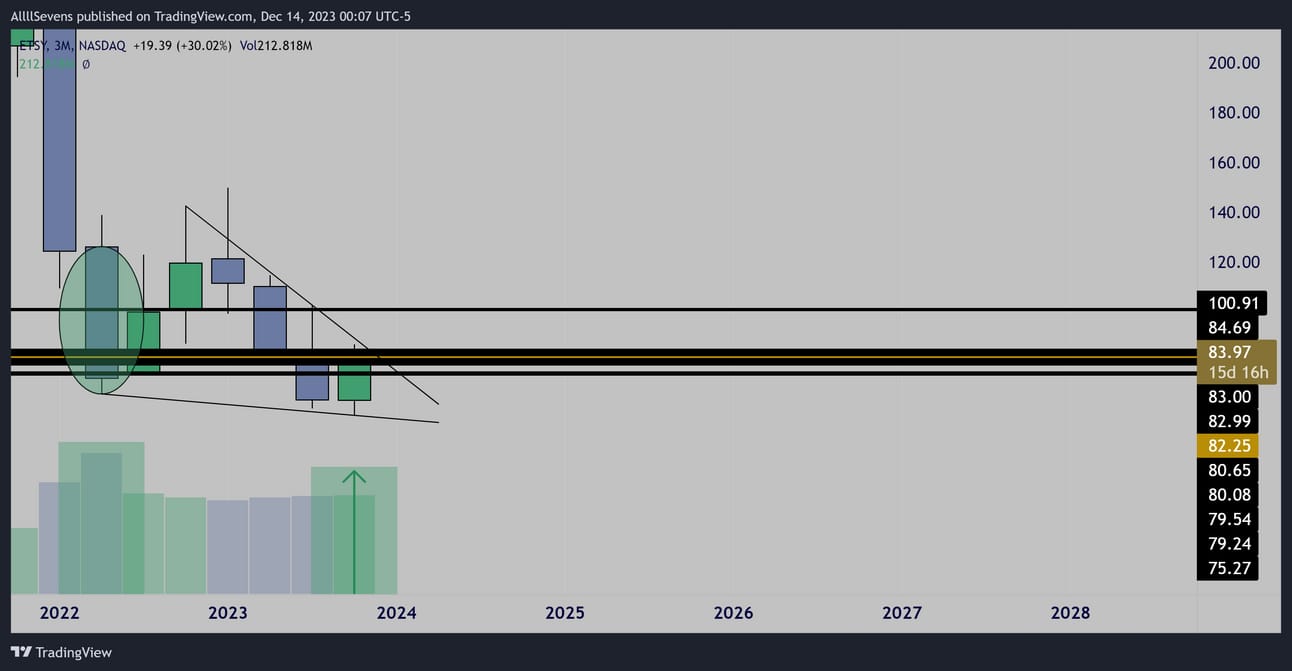

Short-Term…

For a short-term bullish reversal, we want to see this quarterly candle continue increasing in volume and remain strong,

Closing OVER $82.25

I’m also seeing a falling wedge reversal pattern here.

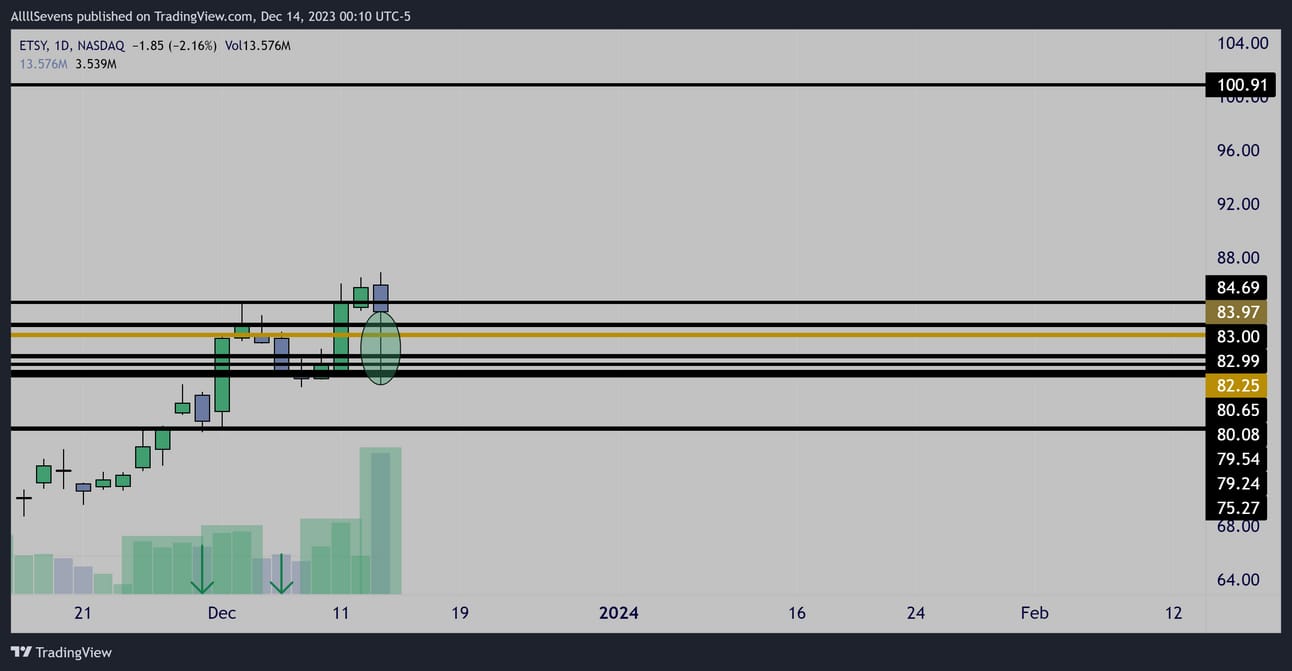

Daily

We see on today’s candle that institutions are actively accumulating the largest Dark Pool on record…

Making it a good chance that the quarterly candle holds strong.

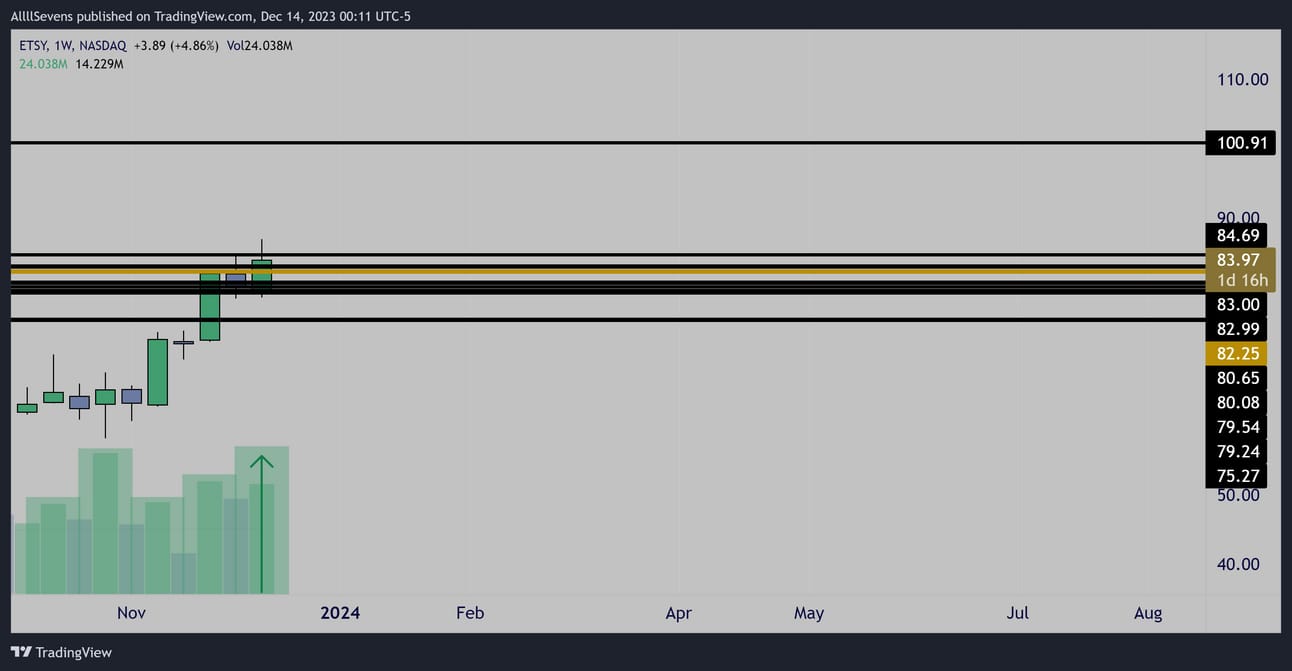

Weekly

A really solid weekly pattern as price is attempting to breakout over the largest Dark Pool on record…

Ideally, we get a bullish engulfing weekly close over $84.69,

Opening price into the range towards $100

Conclusion

As a short-term trade, we are looking for a strong breakout to end this week.

OR

Consolidation over $82.25 and a monthly close over this level for expansion to occur into the new year.

As a long-term investment, this looks solid.

The ratio of risk-to-reward is great.

Risk being shares go to zero.

Reward being shares to fair value or higher ($279.23) +230%

BYND

Long-Term…

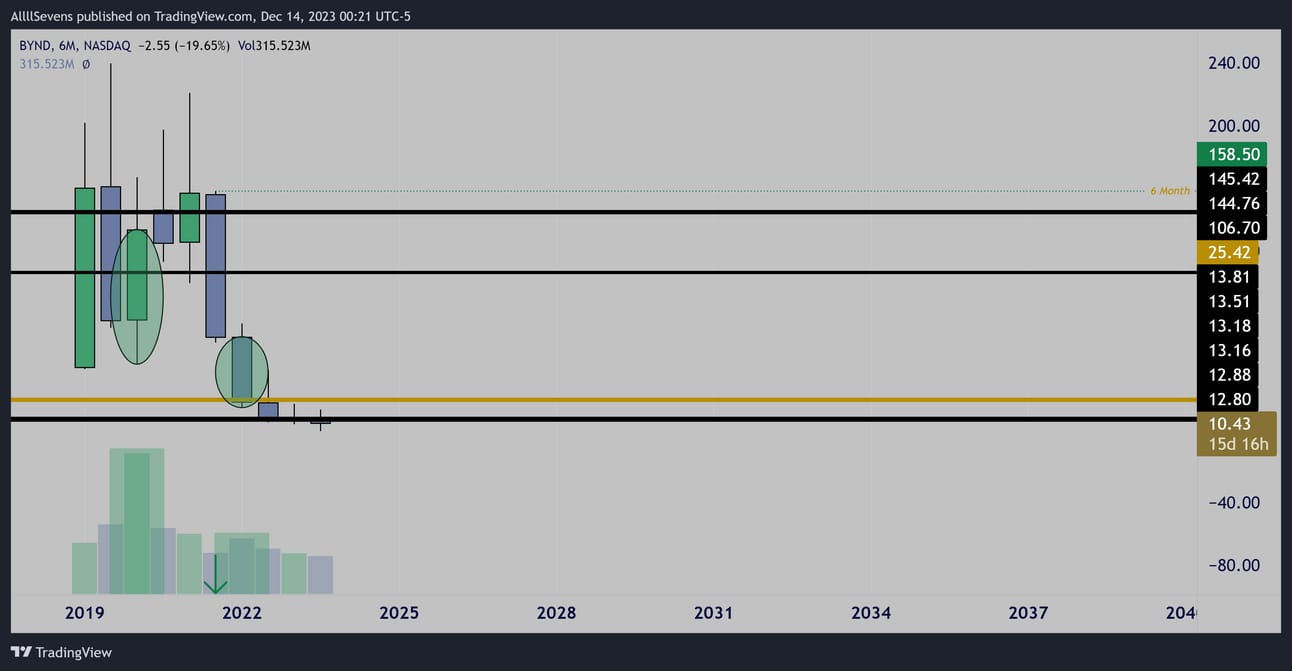

6 Month

Huge institutional buy pressure in 2020

In 2021, the lowest volume ever created a massive sell-off

A clear anomaly.

Creates an imbalance at $158.50

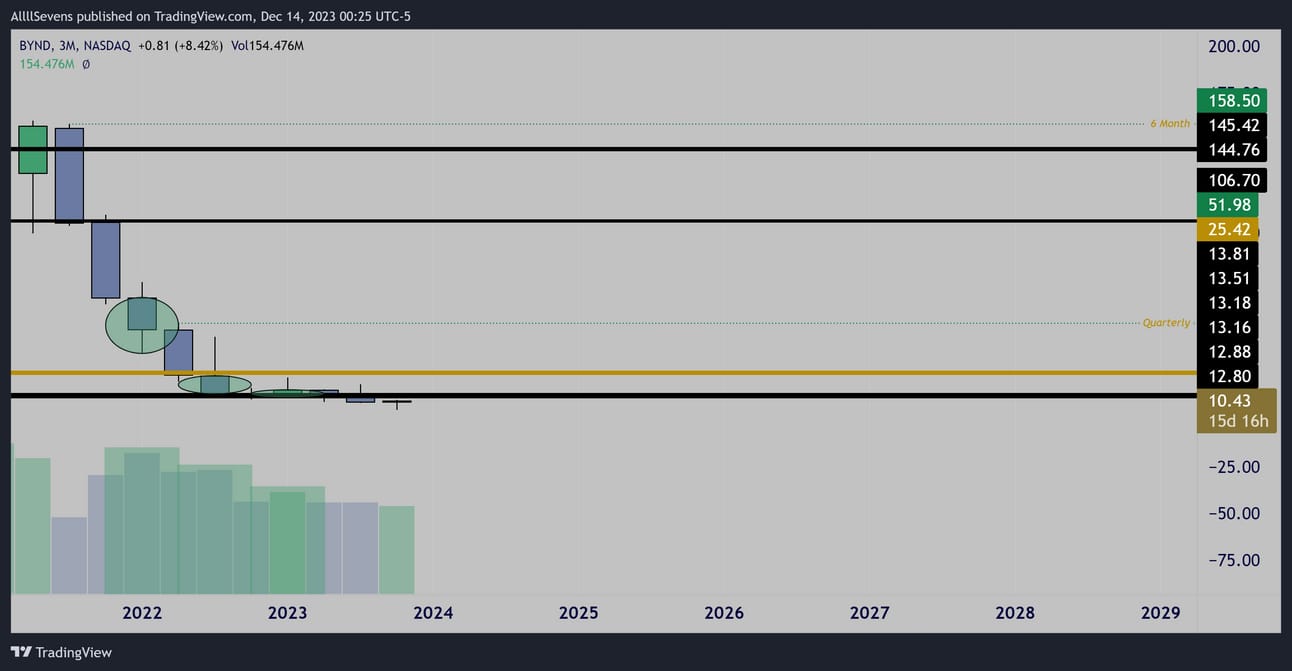

Quarterly

Clear accumulation.

Imbalance at $51.98

Monthly

This is where the accumulation is most obvious.

Institutions were really loading this in $100-$150

It’s pretty insane how much it has sold off since,

And continues to see accumulation.

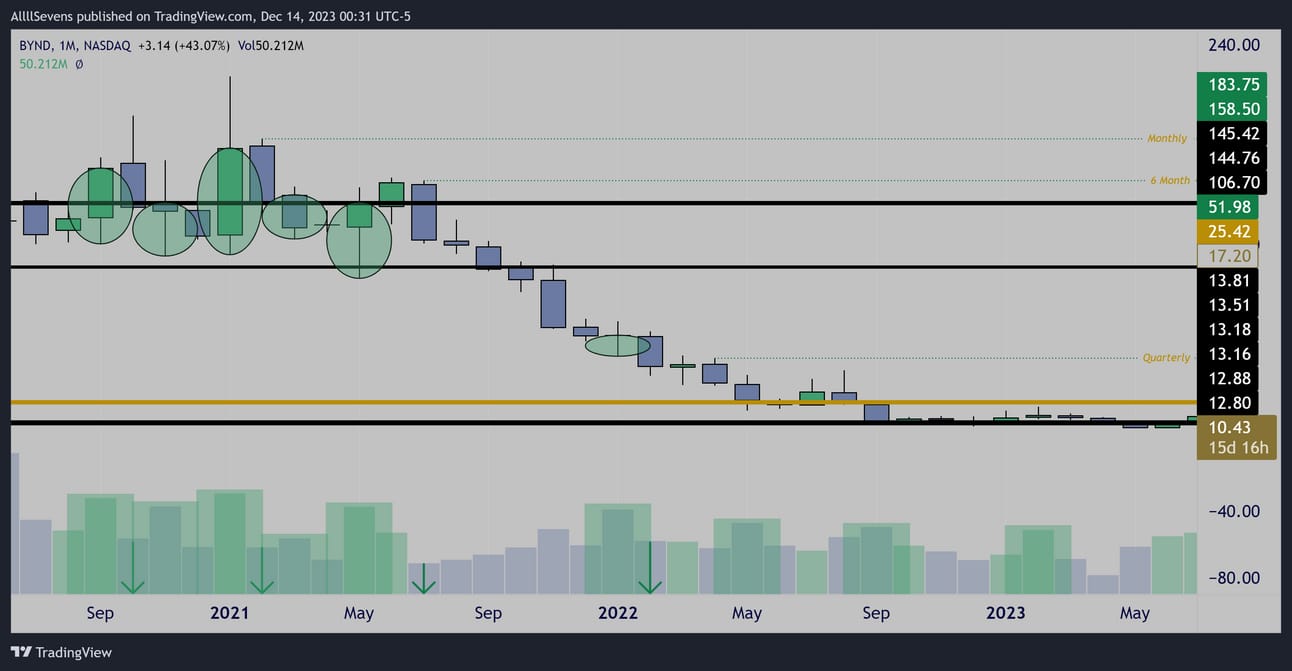

Weekly

This is where it gets crazy…

First look all the way to the left.

Blatant weekly accumulation off the largest Dark Pool on record…

And notice the incredibly low volume that rejected price from $40

It’s very clear that shares of this stock have been transferred from the hands of impatient retail investors to the hands of patient institutional investors holding for the long-term.

Short-Term…

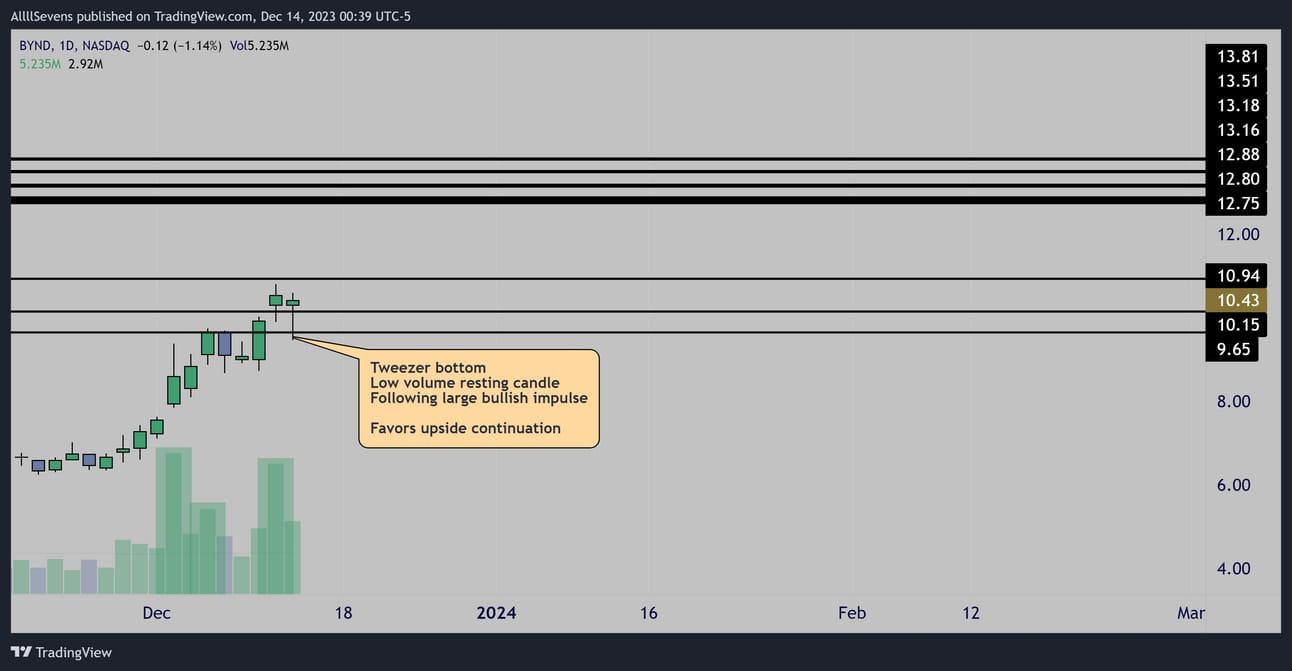

Daily

I LOVE the current daily setup.

Bulls clearly in control.

Today’s candle setting up perfect for upside tomorrow.

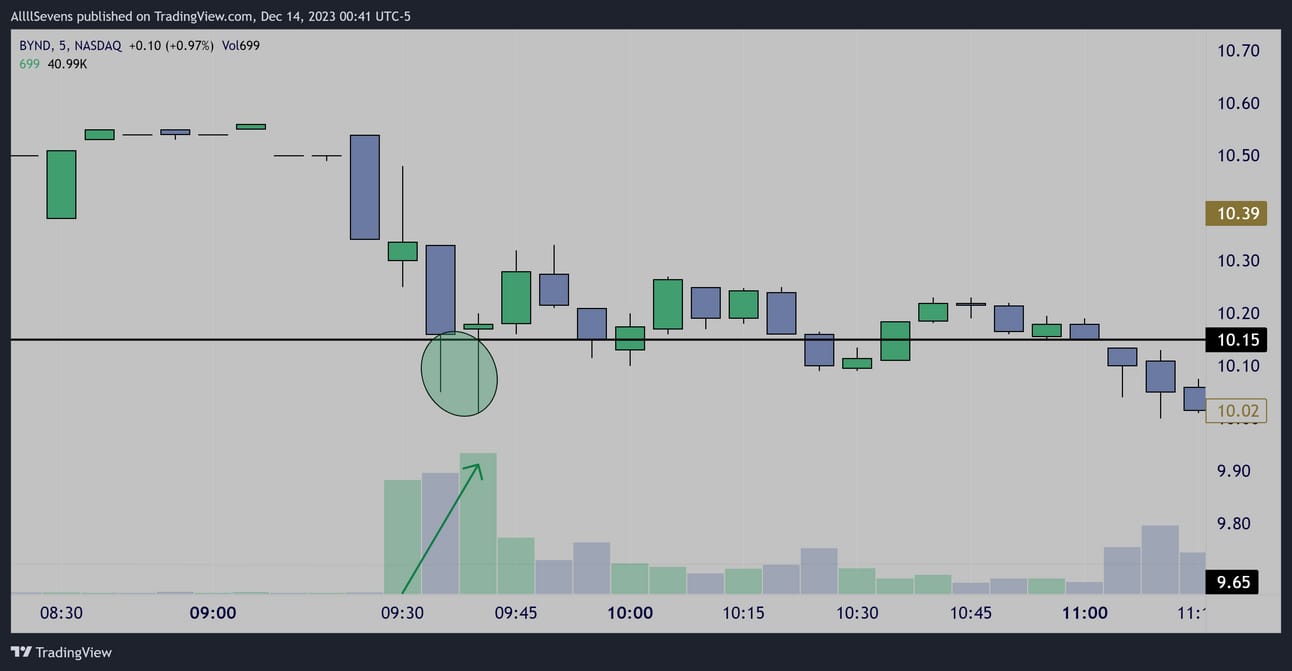

5m

Major intraday accumulation off $10.15 today

Really, I think this level should be defended well in the coming days or something is wrong.

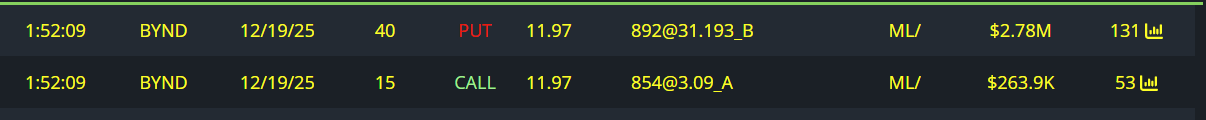

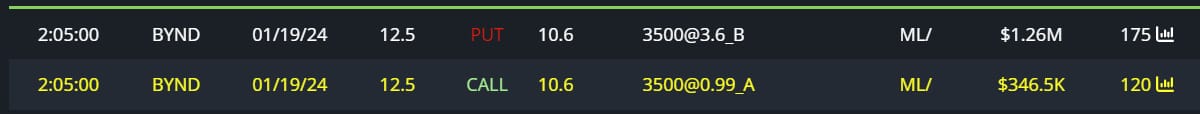

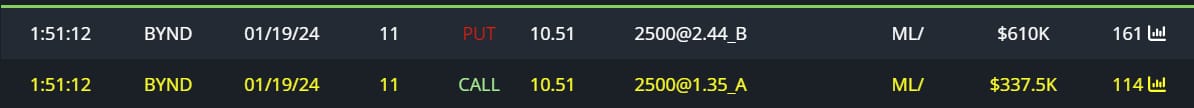

Unusual Options Flow

$3M Full Risk Bull

$1.6M Full Risk Bull

$1M Full Risk Bull

Conclusion

As a short-term trade, this looks pretty great.

The daily sequence is A+ for upside continuation.

I loved the intraday accumulation on the 5m directly at Dark Pool

Plus,

We have some large bullish flows executed in this area.

1/19/25 15c’s

1/19/24 11c’s & 12.5c’s

As a long-term investment…

I love it. Call me crazy, but the amount of Dark Pool activity on this stock when compared to to it’s market cap and other names in the market, this name has HEAVY institutional interest.

Most names like this, do NOT have this much Dark Pool interest.

The ratio of risk-to-reward is incredible.

Risk being shares go to zero.

Reward being shares to fair value or higher ($183.75) +1,650%

AllllSevens+

Upgrade to AllllSevens+ for just $7.77 per month.

You’ll get more newsletters just like this.

You’ll get access to my Discord where I have dedicated channels for EVERY ticker I have ever analyzed with LIVE updates displaying Unusual Options Flow that comes in and volume patterns @ dark pools.

I also notify trade ideas.

The information I share is extremely valuable and I am currently charging just $7.77 per month for this service even though it’s worth $777.77

Why? Because I wan to help as many people as possible!

Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtj0fe

Reply