- AllllSevens

- Posts

- AllllSevens Newsletter $HOOD & $M

AllllSevens Newsletter $HOOD & $M

Robinhood Markets Inc. & Macy's Inc.

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

My outlook on the market is determined using Volume Price Analysis specifically at the largest dark pools on record for the ticker in question.

Doing this allows me to present the market through the lens of an institutional trader/investor. Pure data. No personal bias.

I can determine whether or not “smart money” has bought, is buying, has sold, or is selling. This can be extremely valuable information.

HOOD

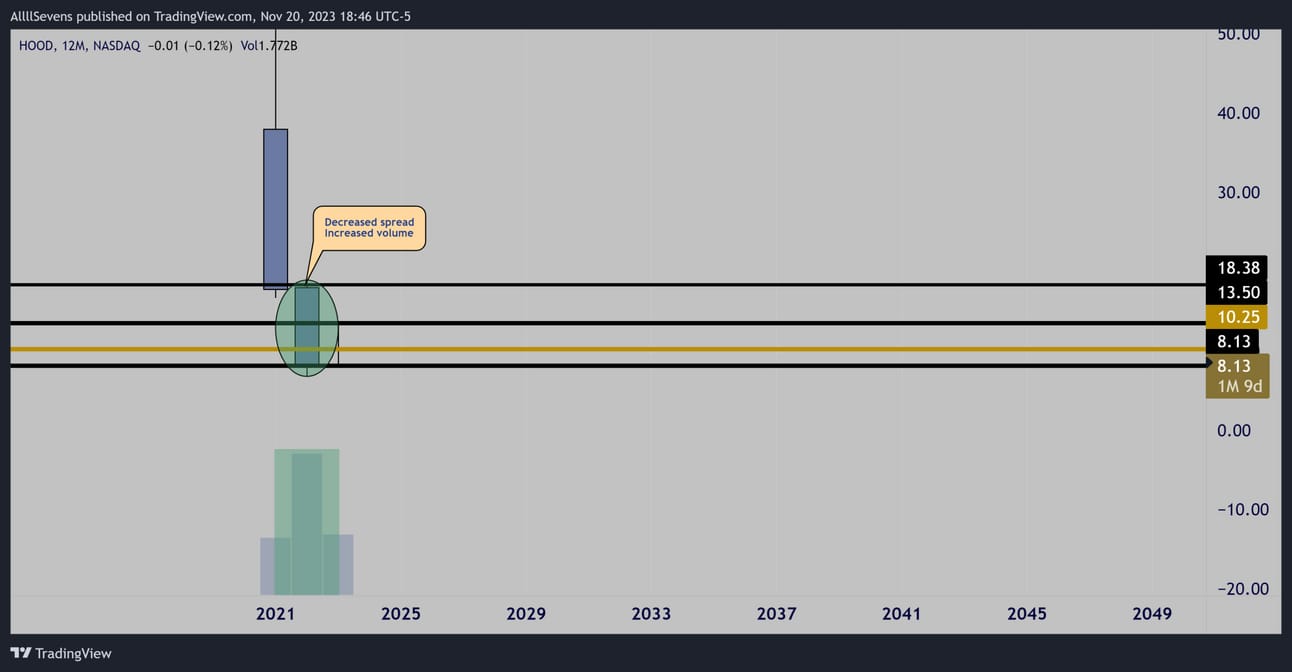

Yearly

Extremely high volume formed a decreased spread candle in 2022

signaling institutional stopping volume (accumulation).

Multiple large dark pools have came in creating a support for price.

$10.25 being the largest.

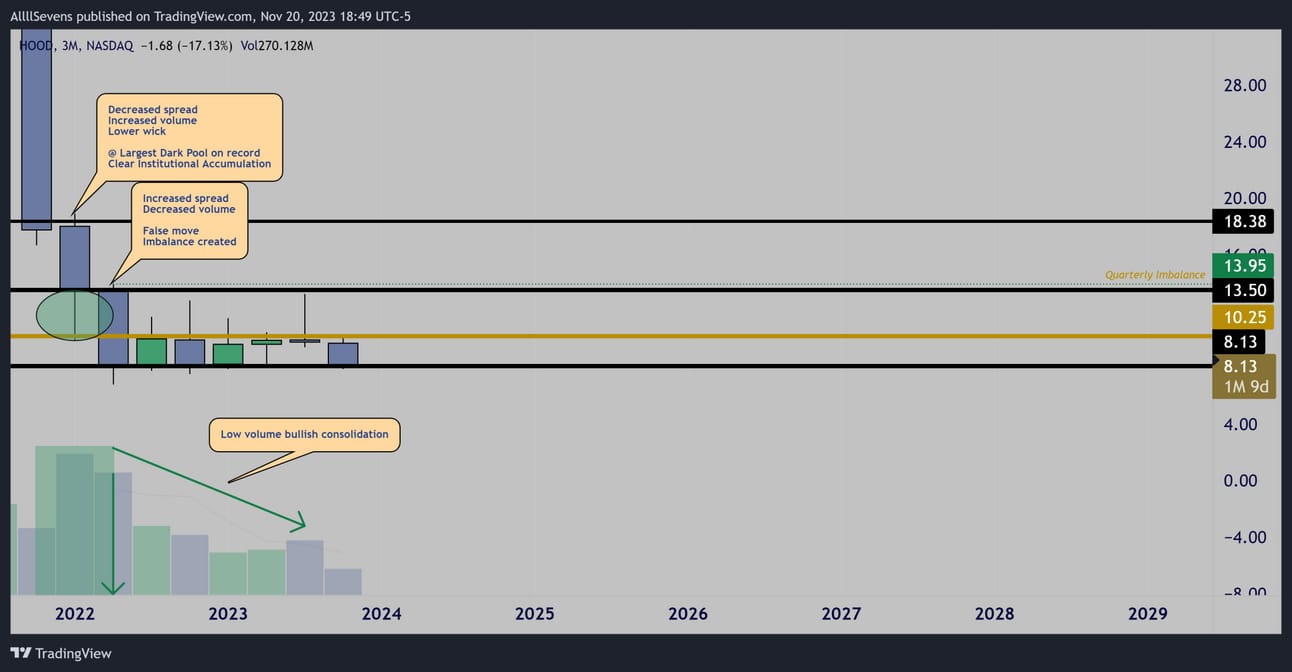

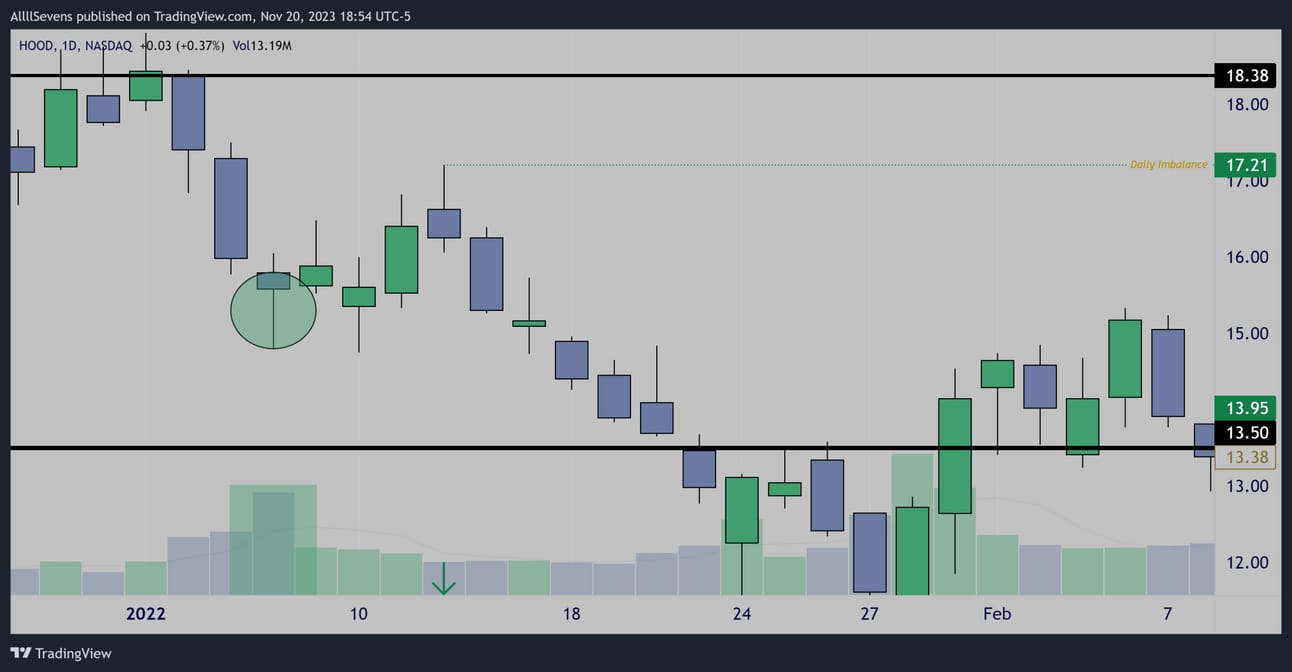

Quarterly

In January of 2022 there was large institutional accumulation visible through a decreased spread candlestick with a sharp increase in volume creating a lower wick at the largest Dark Pool on record, as well as the $13.50 dark pool.

Following this accumulation is an increased spread candlestick with decreased in volume, confirming that institutions did not continue to sell shares driving price lower, but rather public participants did so.

This creates an imbalance at this candle high.

$13.95 is a potential target for HOOD in the future.

That would be a 70% increase in price from current levels.

Since the accumulation, price has gone sideways over a year.

A new dark pool came in today:

Over this price level, it’s possible price can begin to break from the current downtrend and begin retracing to the quarterly imbalance.

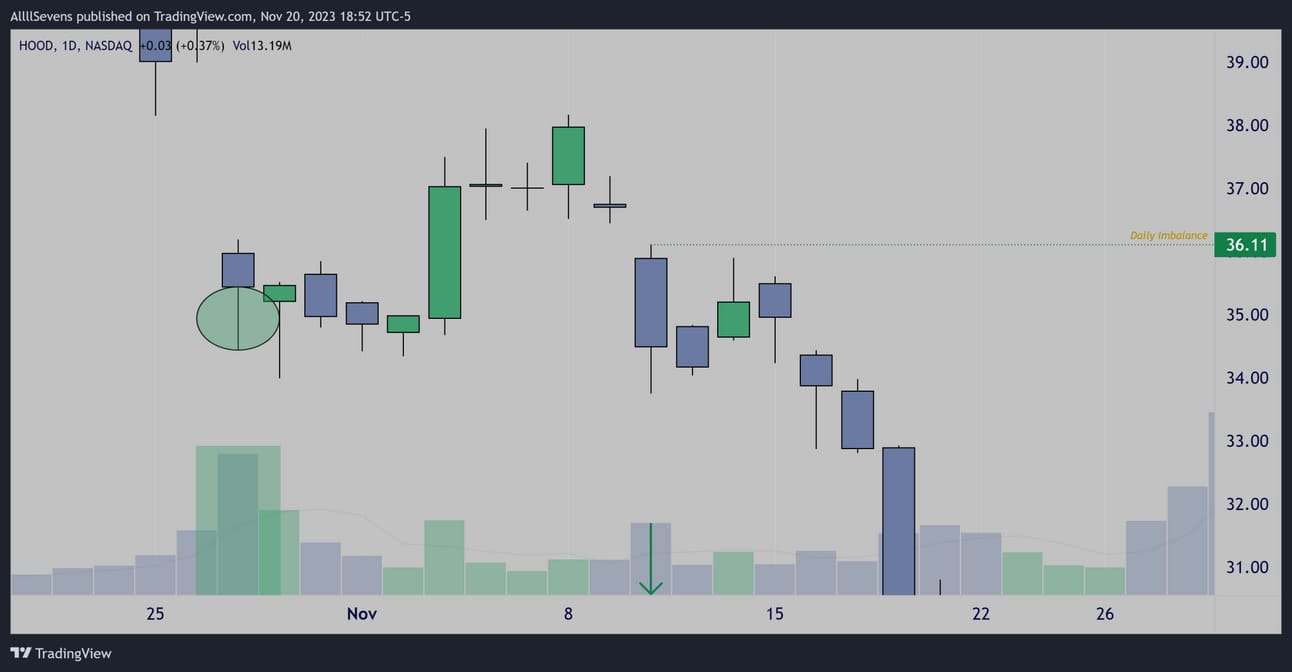

Daily

There is a daily imbalance at $36.11

This would be a 340% increase in price from current levels.

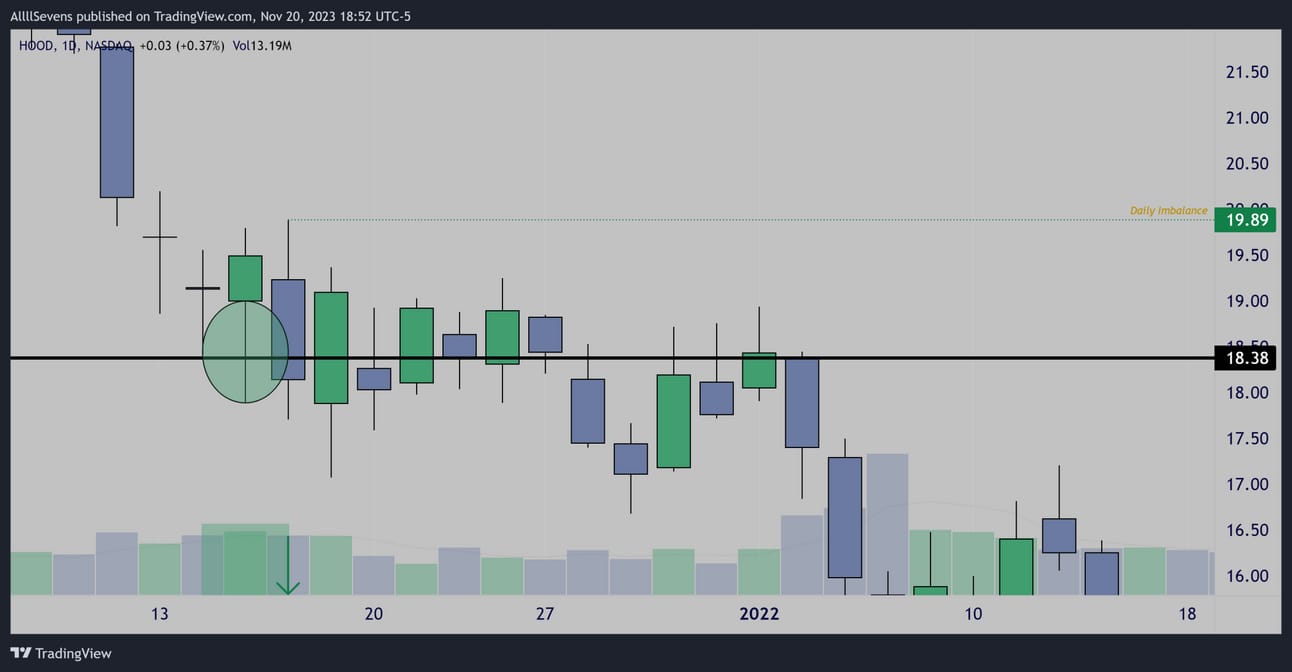

Daily

Another daily imbalance.

Daily

Another.

Daily

The closest imbalance.

This would be a 40% increase in price from current levels.

Why does has this not increased in price yet?

Why does HOOD continue to move sideways / lower for the last year despite the clear institutional accumulation?

Public participants move price in the short-term.

Institutions are placing long-term bets and they also have more money to continue accumulating shares at even lower prices if the public continues to sell this stock below the current $8.00 support.

Conclusion

Institutional money is accumulating $HOOD

There is no doubt about that.

But, for price to begin rising, retail participants also need to begin buying.

Right now, price is clearly in a base / downtrend and the probability for a rally to begin NOW is unknown.

The most risk-averse way to approach this stock would be to wait for a confirmed breakout from this base. Wait for price to reclaim the largest Dark Pool on record as well as the $13.50 Dark Pool for confirmation.

This was where the most accumulation has taken place and with price OVER those levels, the probabilities for an uptrend increase ten fold.

This would still offer a 160% potential return.

Without that confirmation, it is truly unknown WHEN this stock will begin trending up and not sideways/down and therefore the risk involved is greater. The potential to get “bagged” is increased dramatically.

At the same time, the potential reward is much greater…

On top of this, the market cap of $HOOD is extremely small and the relative amount of Dark Pool activity to other stocks in the market is extremely small as well.

While it’s clear some big money is accumulating this company, in the grand scheme of things they are not betting a whole lot on this stock.

With high reward comes high risk and they know this.

I believe we need to be aware of this as well.

A potential 340% return does not come at no cost.

M

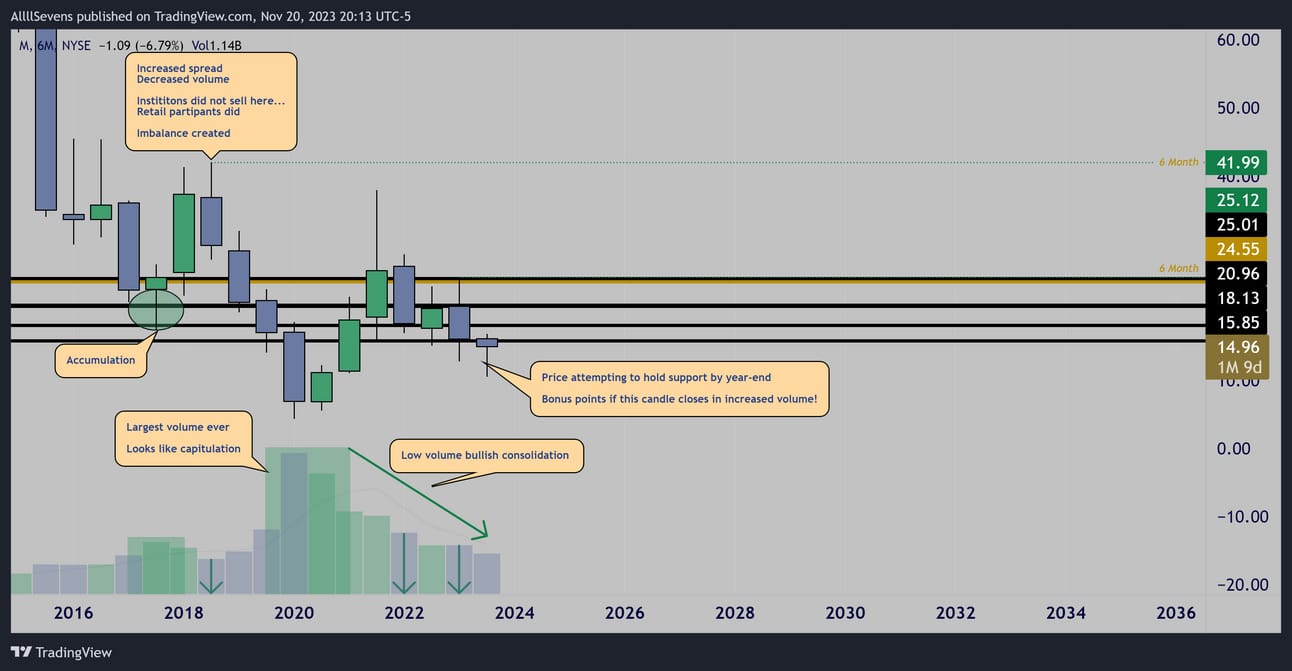

6 Month

The $15.85-$25 support was previously accumulated in 2017 visible through a decreased spread increased volume hammer candle.

Price later reversed in 2018 on an increased spread with decreased volume confirming institutions did not sell out of their position here, only retail participants did so and therefore an imbalance is created.

Price crashed hard following this (Covid) and we see a massive spike in volume (the largest ever) reversing price back up into support.

This looks like capitulation and a strong low was formed.

As price retests this support, another imbalances has been created.

Price has been falling once again on very low volume.

This 6 month candle is currently trying to form a hammer candle holding the final support level.

If it successfully does so, especially on increased volume, the probability for a strong uptrend to form is pretty good.

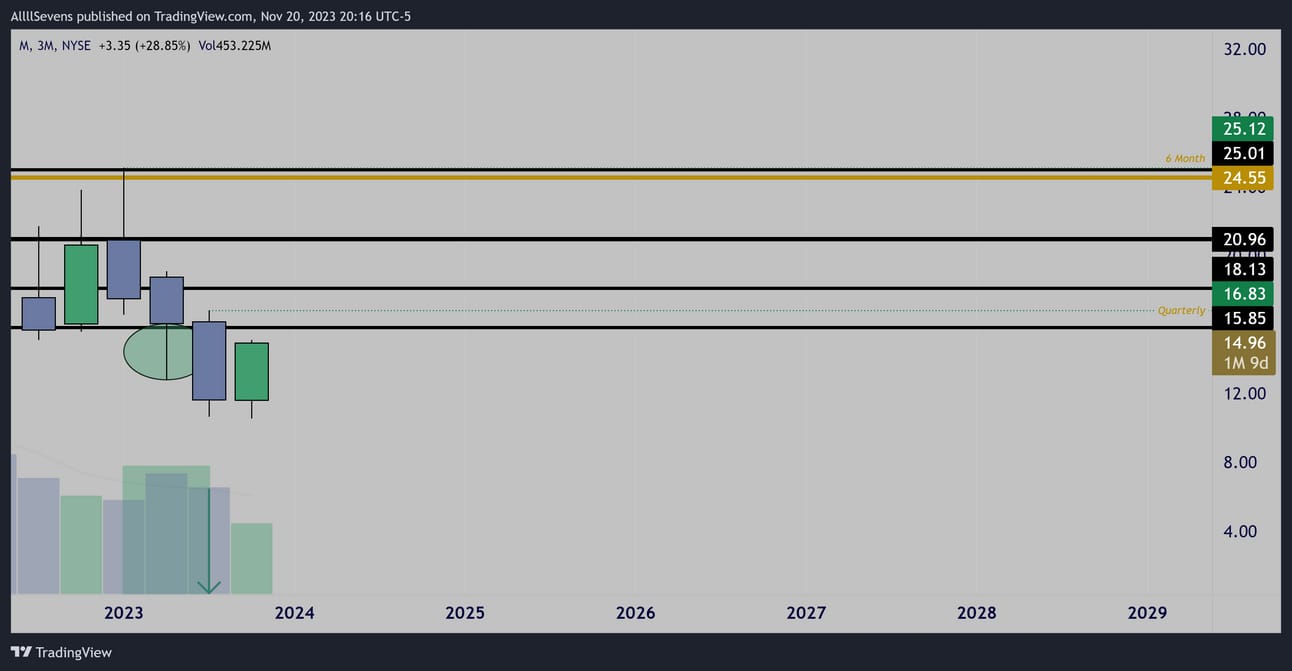

Quarterly

Clear institutional accumulation off the $15.85 support followed by a retail sell-off creating another imbalance at $16.83

If you have followed me for a while now, you have seen this this exact pattern many times. It is one of my favorites and one of the most reliable.

Weekly

One of THE greatest weekly accumulations I have ever see.

Extremally clean.

Tons of imbalances created.

This will go in a textbook when it’s all said and done.

Price is currently attempting a breakout from the recent downtrend, backed by some good sentiment from a positive earnings report-

Still below major dark pool levels so, really, no major rush to get in.

Conclusion

I like this setup 10x more than HOOD.

#1- well established company

#2 much more institutional interest on the Dark Pool despite a smaller market cap.

This name feels “safer”

Makes sense considering the potential upside here is about 180% rather than 340%

Overall, I like that price is breaking trend- next I want it to break over Dark Pool resistance and turn it to support for a true strong trend to form. The 6 month candle closing over support on increasing volume could be a MUST for this to see short-term upside and not continue chopping lower for multiple more months.

I hope you find this analysis valuable, I put a lot of time into it!

if you have any questions or comments, please feel free to reach out.

If you want MORE analysis: premium newsletters & LIVE updates on charts and Unusual Options flow: Discord access consider AllllSevens+

AllllSevens+

Upgrade to AllllSevens+ for just $7.77 per month.

You’ll get more newsletters like this. Ones even better.

You’ll get access to my Discord where I have dedicated channels for EVERY ticker I have ever analyzed with LIVE updates displaying Unusual Options Flow that comes in and volume patterns @ dark pools.

The information I share is extremely valuable and I am currently charging just $7.77 per month for this service even though it’s easily worth $77.77

Why? Because I wan to help as many people as possible!

Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

We-Bull Referral

https://a.webull.com/gzxp9cTCDSzfJtjQeA

Reply