- AllllSevens

- Posts

- AllllSevens Newsletter $KRE

AllllSevens Newsletter $KRE

SPDR S&P Regional Banking ETF

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

Preface:

This newsletter is all about the SPDR S&P Regional Banking ETF

It has experienced a rather drastic sell-off over the last two years…

Yet it appears no institutional money sold out…

In fact, they were buying before the big crash.

They proceeded to buy a LOT more on the crash itself.

Price is now in the process of basing out, prepping for a recovery.

I believe this ETF is on a great long-term discount at these prices.

KRE

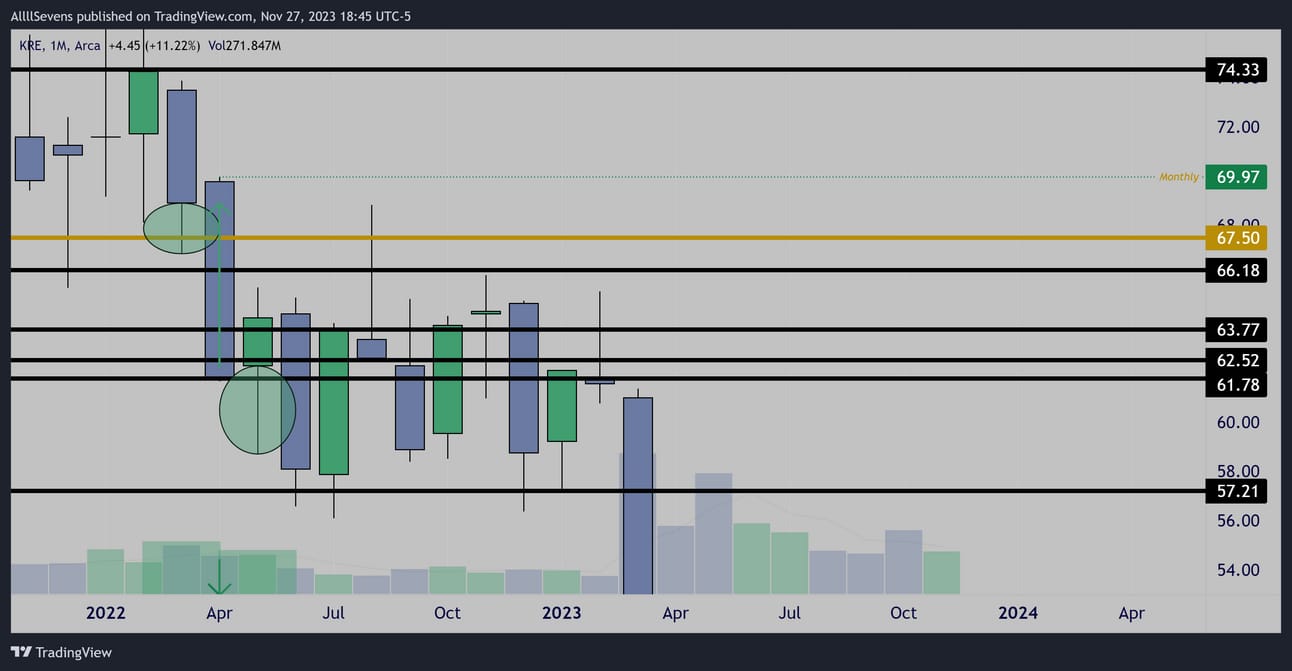

Monthly

Accumulation off the largest Dark Pool on record followed by an increased spread with decreased volume, creating an imbalance at $69.97

With price being below the Largest Dark Pool on record after this sequence, it makes for an incredibly tough resistance.

This was intentional.

Institutions let price lose the dark pool on low volume (retail selling)

So now that when retail attempts to reclaim it, they are unable to because it’s such a highly concentrated INSTITUTIONAL level.

Every time it rejected you’ll notice the high volume comes in on the dip.

Eventually, retail participants grew impatient and macro economic conditions became rather pessimistic. This created the perfect environment for an extreme panic-sell being below major institutional support… This creates the perfect environment for MASSIVE accumulation… let me show you.

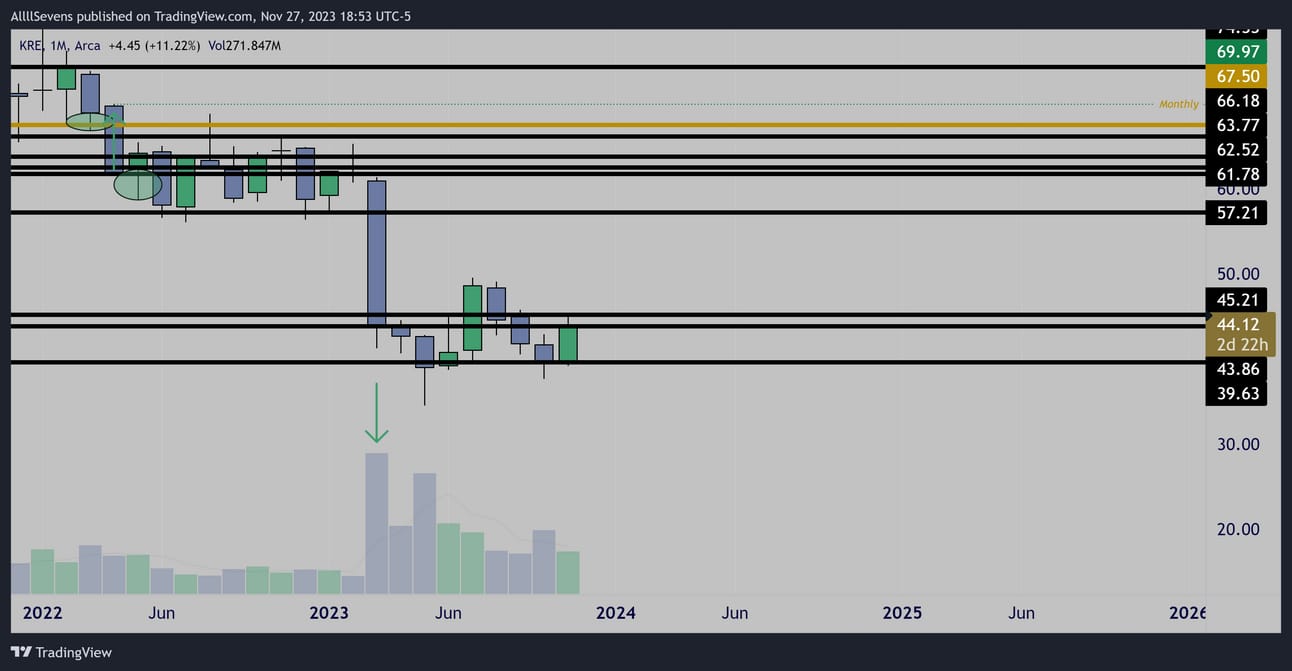

Monthly

914M Volume Candle.

MASSIVE spread.

Upon first glance, this adds up. Big volume, big spread.

Where’s the anomaly?

Let’s zoom in and see WHERE the volume is located inside this candle…

Because if you notice it closed directly at a support.

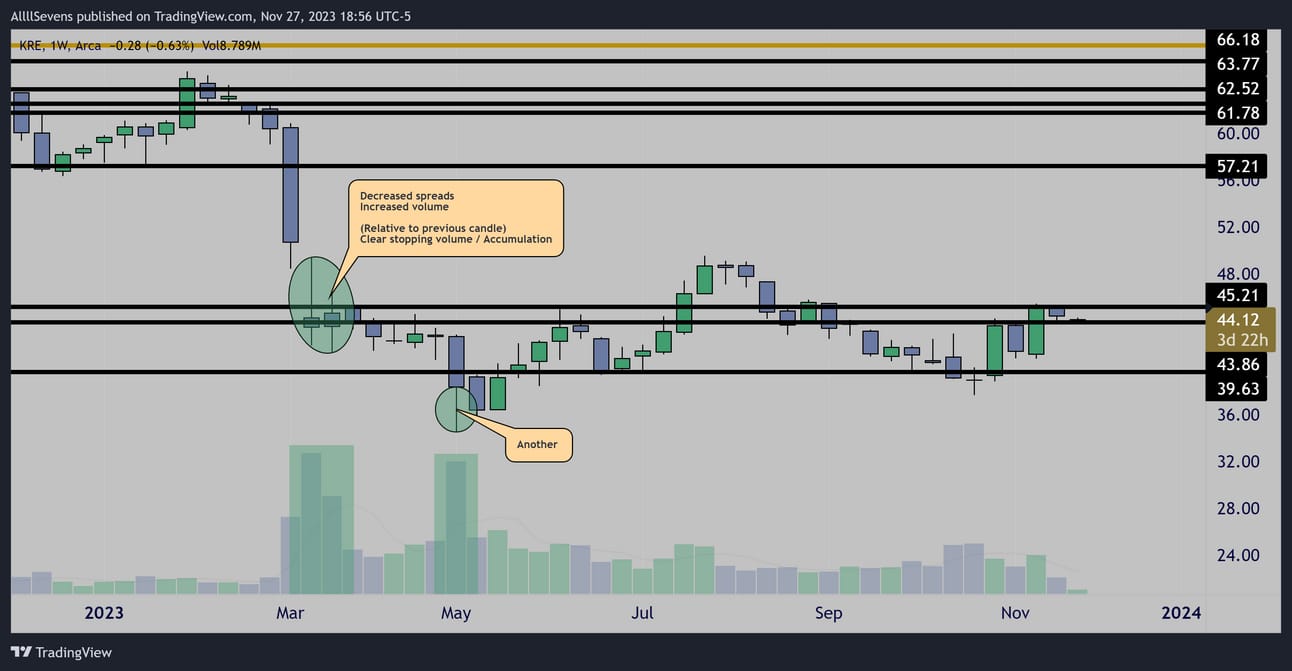

Weekly

67% of that monthly candle’s volume was concentrated at the Dark Pool support $43.86-$45.21

Clear institutional accumulation.

A second sharp trop occurred months later…

Another decreased spread increased volume candle relative to the largest candle visible. Plus, a lower wick.

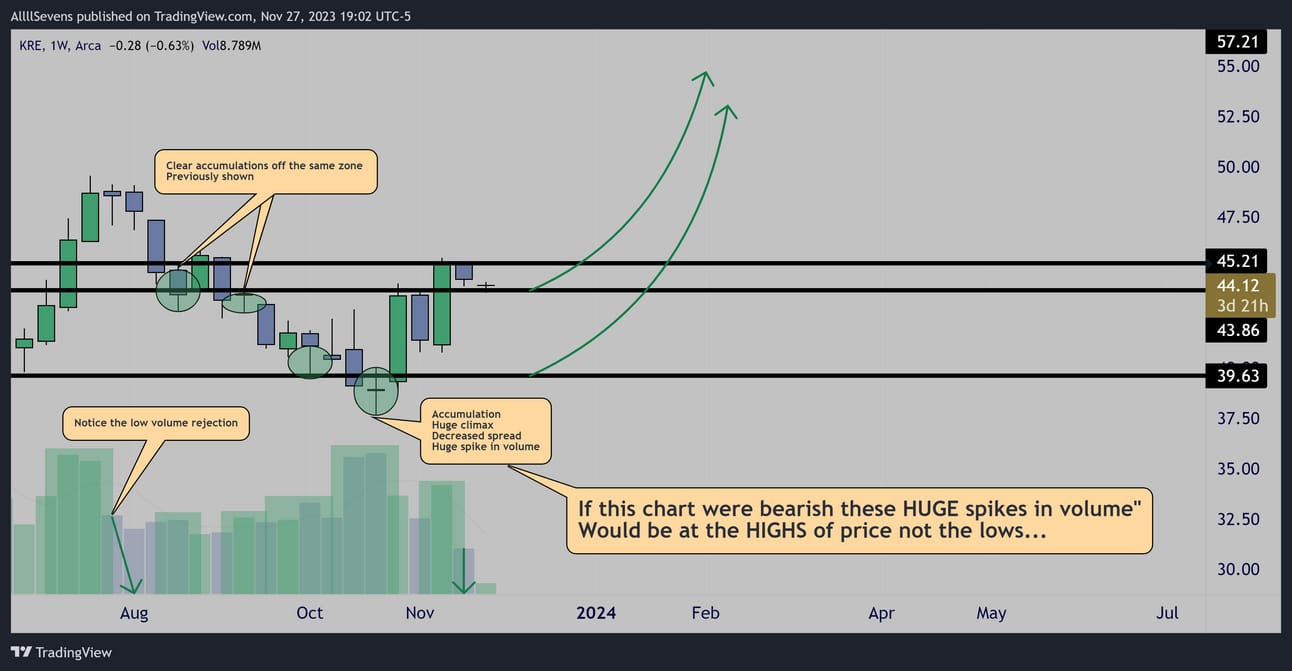

Weekly

Here is the recent weekly price action.

It does not gen cleaner than this.

Conclusion

There is no denying that “smart money” is buying the KRE

Short-term driven impatient “dumb money” is the only thing keeping price held down.

For a true reversal and uptrend to begin, price needs a clear break and hold over the $43.86-$445.21 Dark Pool cluster.

This has yet to happen.

Now is the time to dollar cost average a long position in my opinion.

AllllSevens+

Upgrade to AllllSevens+ for just $7.77 per month.

You’ll get more newsletters just like this.

You’ll get access to my Discord where I have dedicated channels for EVERY ticker I have ever analyzed with LIVE updates displaying Unusual Options Flow that comes in and volume patterns @ dark pools.

The information I share is extremely valuable and I am currently charging just $7.77 per month for this service even though it’s easily worth $77.77

Why? Because I wan to help as many people as possible!

Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

We-Bull Referral

https://a.webull.com/gzxp9cTCDSzfJtjQeA

Reply