- AllllSevens

- Posts

- AllllSevens Newsletter- The S&P500

AllllSevens Newsletter- The S&P500

SPY XLF XLY QQQ

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing stated is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this tweet below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Reach out if you have questions.

Preface:

In this week’s newsletter I present my best work yet.

I go extremely in depth on the S&P500 and what to expect long-term as well as short-term.

The market is coming to an extremely pivotal next few weeks/months.

The SPY has a very simple pivot watch this week in order to determine if bulls or bears are going to be in control.

Overall, I anticipate the QQQ will show relative strength this week especially if SPY bulls are in control over the pivot.

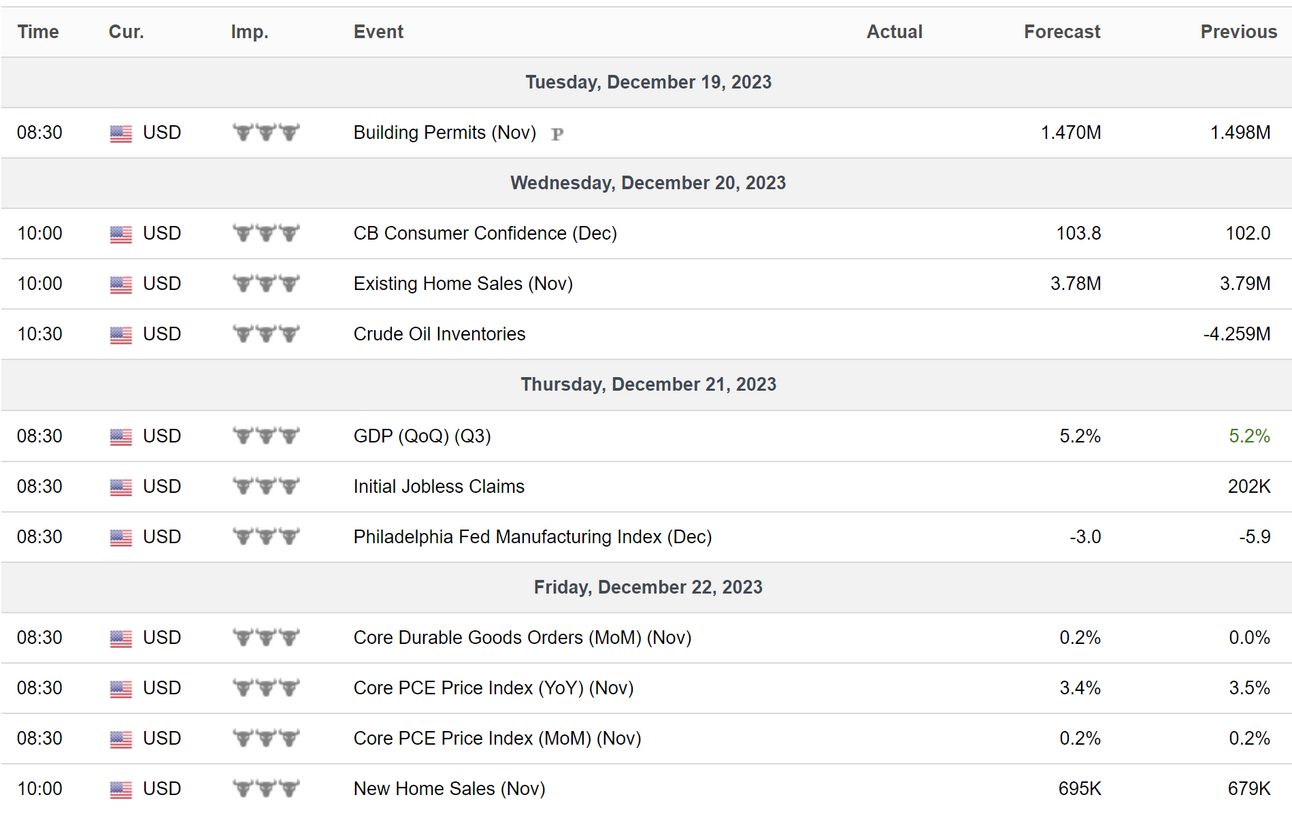

Calendar

Bloomberg U.S.A. High Impact Economic Data

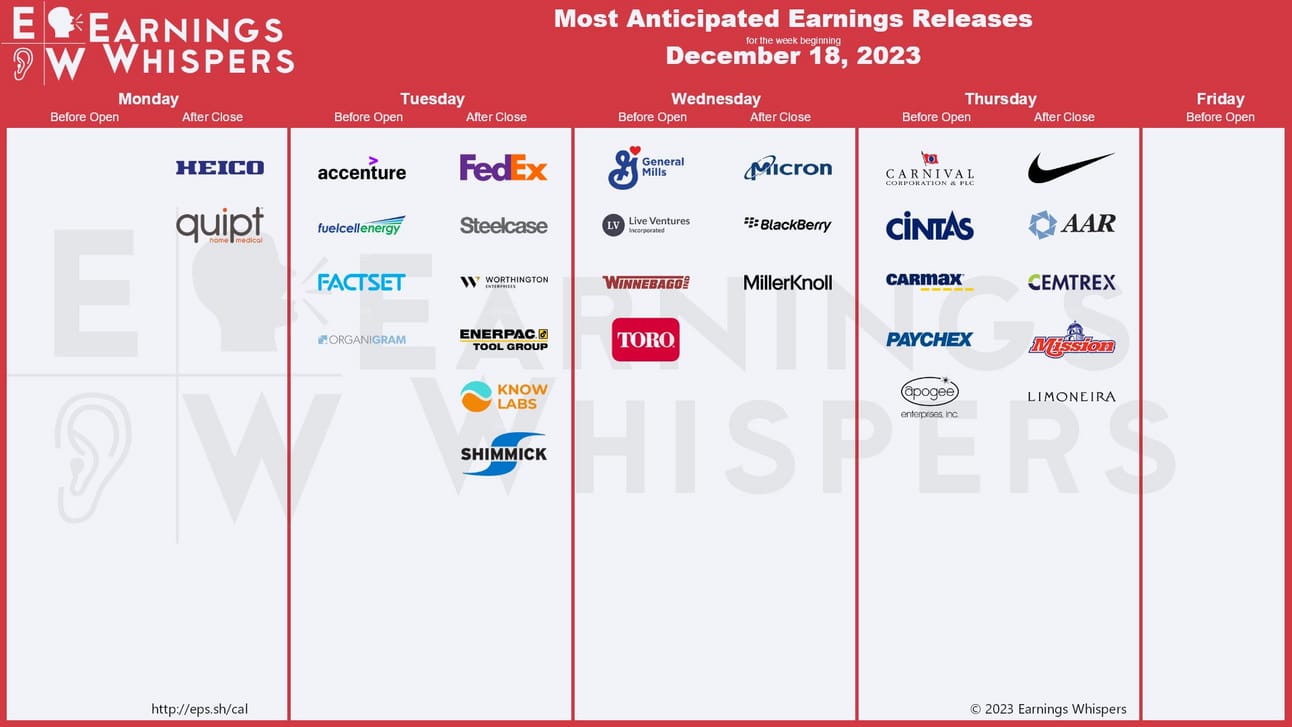

$ACN, $FDX, $GIS, $MU, $CCL, $NKE

SPY

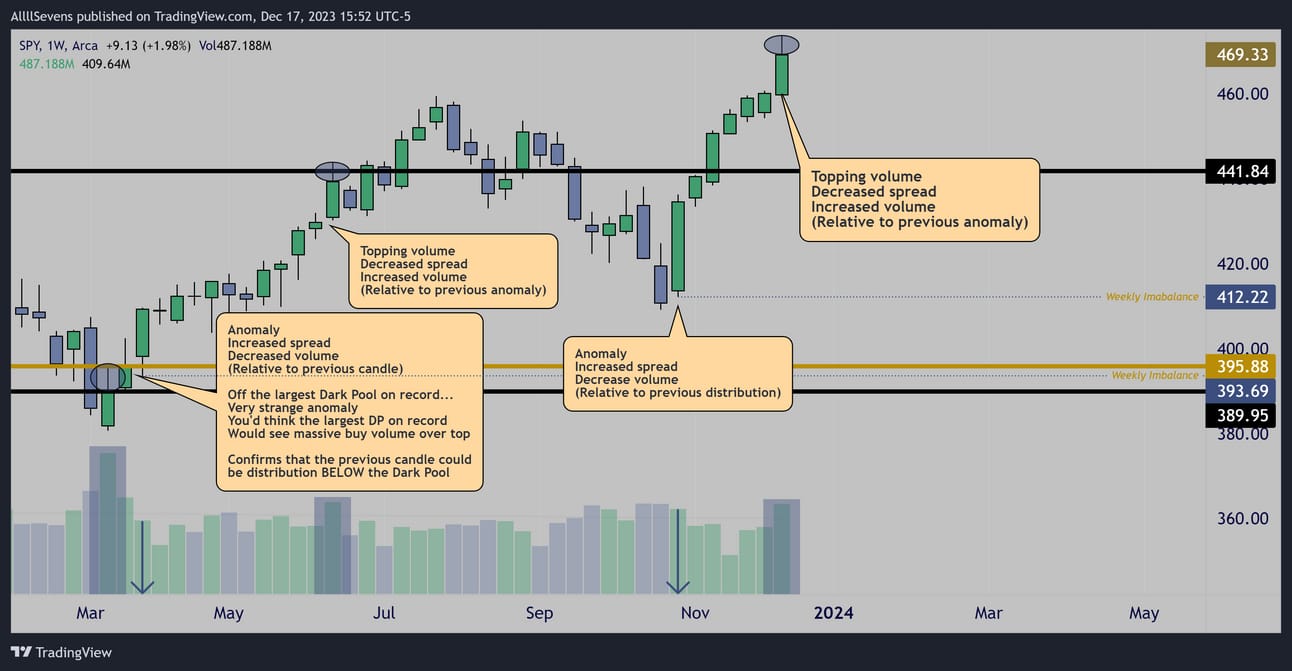

Long-Term

Major Institutional Accumulation has taken place over the last two years,

Visible through decreased spread candles with lower wicks and increased volume directly at the largest Institutional Dark Pools on record.

$395.88 is the largest.

Following almost every accumulation there is an increased spread candle with decreased volume taking price lower…

These are anomalies confirming that only retail participants drove prices lower on each sell-off.

Using a .618 Fibonacci with the current low of the market, and the highest major Dark Pool that was accumulated, I predict a reasonable minimum long-term target for the S&P500 is $593.45

This of course could take YEARS

I will talk more short-term shortly.

Daily

Zooming into the daily chart, the highest imbalance in price and volume is at $477.98.

Therefore, the fair value of the S&P500 is $477.98

Any price below is a long-term discount.

For me personally, the SPY is not something I’m buying right now.

While it’s obviously still discounted, it’s not THAT discounted…

I want to buy individual stocks that display the SAME institutional accumulation patterns as the SPY in 2022….

But are still on a deeper discount right now, just like the SPY months ago.

I wish I wrote this newsletter a year ago and I could say how much I love SPY longs below $440!

Short-Term

There is a very interesting market dynamic upon us-

There are two individual sector ETF’s that will be extremely critical to what happens in the next few weeks.

Those sectors are Financials and Consumer Discretionary.

Let’s take a look.

Monthly

This is the Financial sector ETF for the SPY. The XLF.

Like the SPY itself, there has been massive institutional accumulation over the last few years.

The largest Dark Pool on record is $38.01 and it’s where most of the accumulation has occurred.

Long-Term, any price below $41.39 is a discount.

Short-Term, the largest Dark Pool on record could act as huge resistance.

While we know this level has been heavily accumulated by institutions in the past, price can only break over when retail participants are ready to do so.

If you haven’t noticed from my charts by now,

Institutions do not TIME the market…

They have time IN the market.

As short-term trader, it is only logical to not get aggressively long directly below a resistance.

I’ll be watching for a confirmed breakout here on the weekly & monthly.

Until then, a short-term rejection is not off the table.

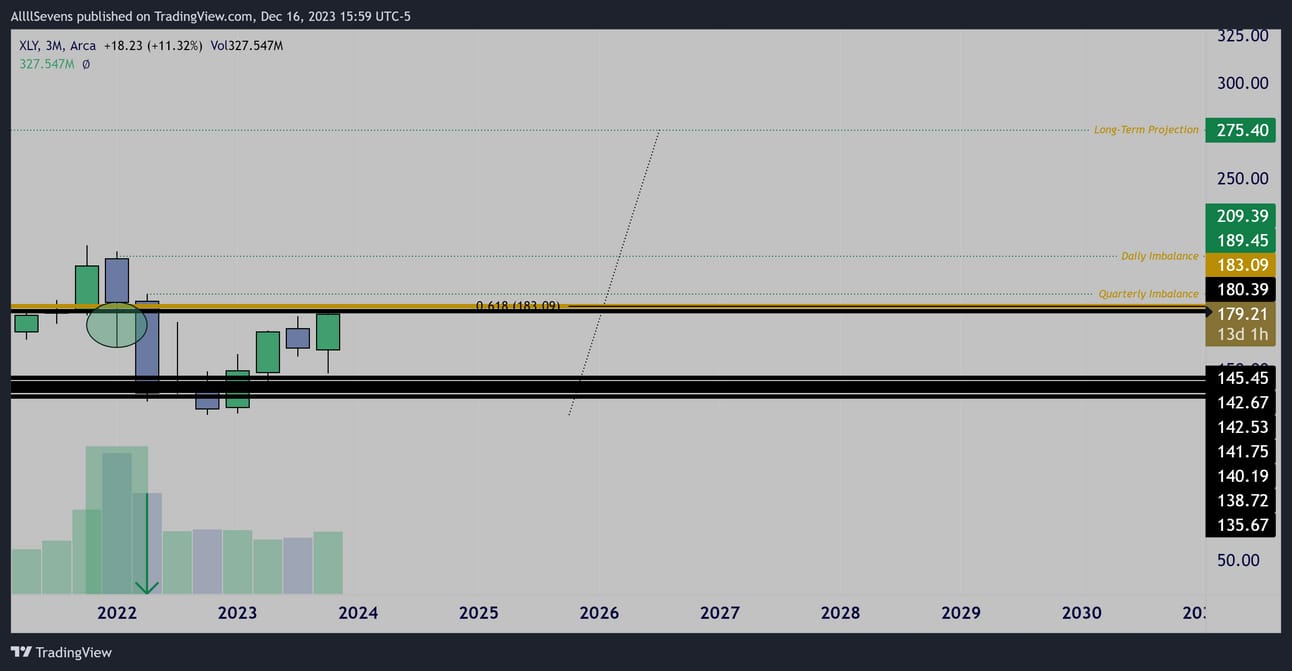

Quarterly

This is the Consumer Discretionary sector of the SPY. The XLY.

Just like the SPY and XLF, this has seen major institutional accumulation over the last few years as well.

Similar to the XLF, mostly off it’s largest Dark Pool on record, $183.09

Long-Term, any price below $209.49 is a discount.

Short-Term, this is the same exact situation as the XLF…

Conclusion

As the SPY approaches new all-time-highs, the 3rd and 4th largest weighted sectors, XLF & XLY, are approaching their largest Dark Pools on record which could result in two things:

#1

A pullback. The sector ETF’s see a short-term, retail driven rejection of their Dark Pool resistances which would spark an extremely healthy pullback for further institutional accumulation at lower prices, increasing the likelihood that the next attempted breakout will be successful.

#2

A breakout. The sector ETF’s reclaim their largest Dark Pools on record with have already been previously accumulated-

Sparking massive continuation of the current S&P500 rally

Which scenario is more probable?

Now, this make catch you off guard-

And I will happily be wrong about this…

But I believe a short-term correction is most likely.

Until I see a confirmed breakout on the XLF and XLY, that is what I anticipate to happen in the coming weeks/months.

Why?

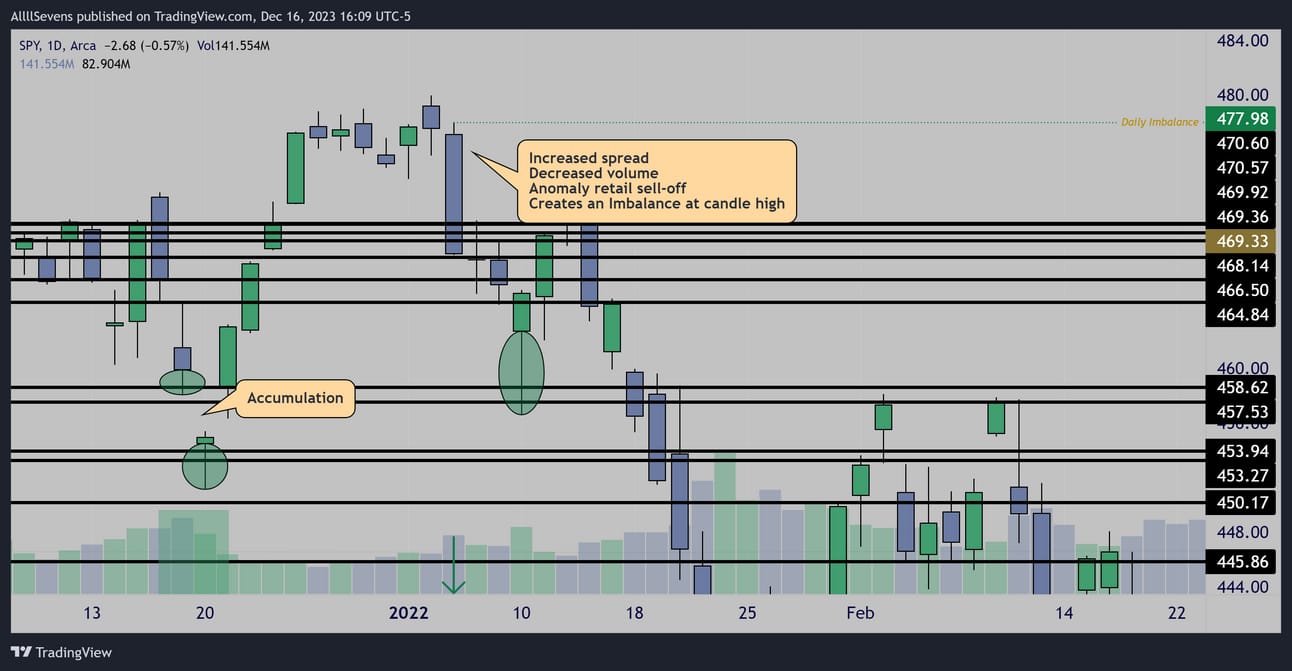

Weekly

I see a major anomaly on the weekly time frame.

A massive volume upper wick off the largest Dark Pool on record sparking the 2023 rally followed by a break and retest of the Dark Pool

which produced a large increased candle spread bounce…

On decreased volume.

I find this extremely odd. An anomaly.

If institutions were heavily accumulating here, why would the break and retest of the Largest Dark Pool on record not be on extremely high volume? It doesn’t make sense.

I believe institutions purposefully created an “imbalance” at $393.69

Why would they do this?

To create liquidity, allowing for more accumulation on an eventual correction. What exactly does that mean?

Well, if I am correct and an artificial low has been made, and $393.69 needs to be retested before the XLF and XLY can breakout-

Think about all the people who have bought the market during this rally…

If price were to reject in the coming weeks/months all of those traders would get stopped out and be the “liquidity” for further institutional accumulation. If you think about it, institutions can only absorb massive amounts of shares (accumulate) when a massive amount of people are selling out of the market.

It makes perfect sense to me.

Conclusion

I’m anticipating a possible rejection in the coming weeks/months that leads to a substantial pullback in the SPY

I’m also fully prepared to be WRONG and to buy the breakout.

If the XLF and XLY get confirmed breaks over their largest Dark Pools on record in the coming weeks/months then I think that would obviously mean my pullback thesis is completely invalid.

I am excited to see how this plays out.

Whatever happens, there is major opportunity in the foreseeable future, and regardless of what happens short-term the SPY is looking great for the long-term investor.

Let’s talk more on THIS coming week now:

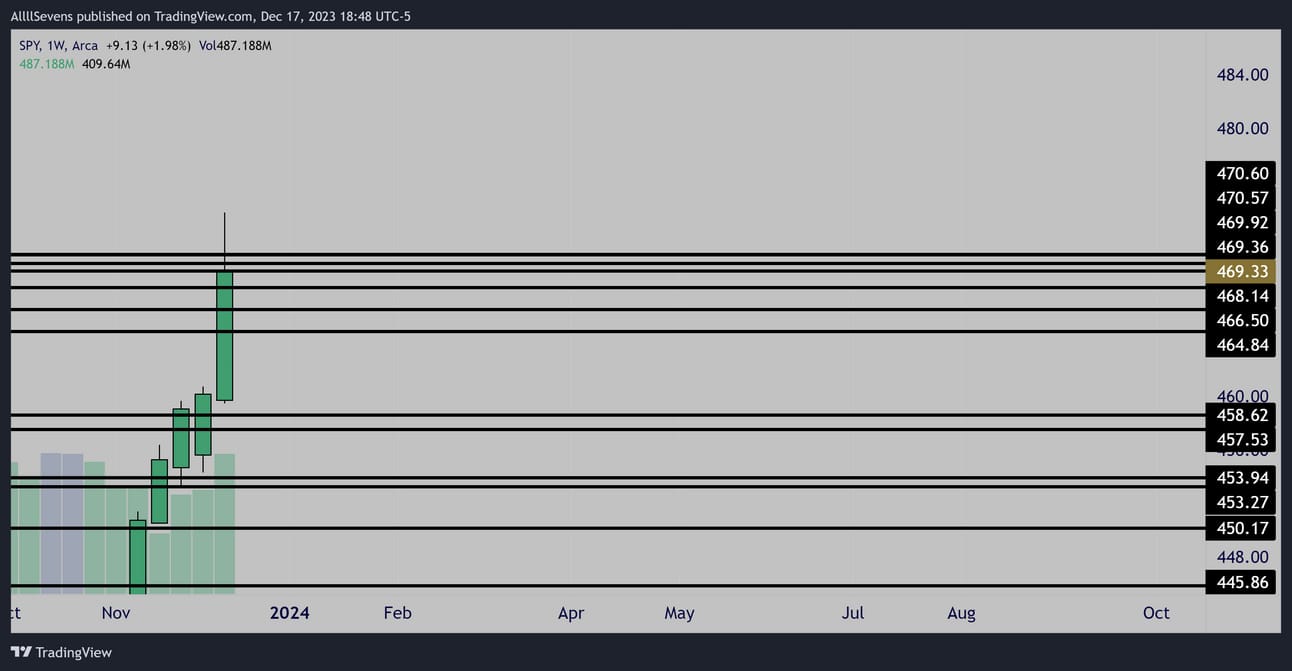

Weekly

Here are the current Weekly levels for SPY

While this candle is technically topping volume as seen on my previous weekly chart, I have my doubts.

On the previous topping volume at $441.84, I saw the same thing-

While the weekly candles are clear topping candles,

The intraday price action tells a completely different story…

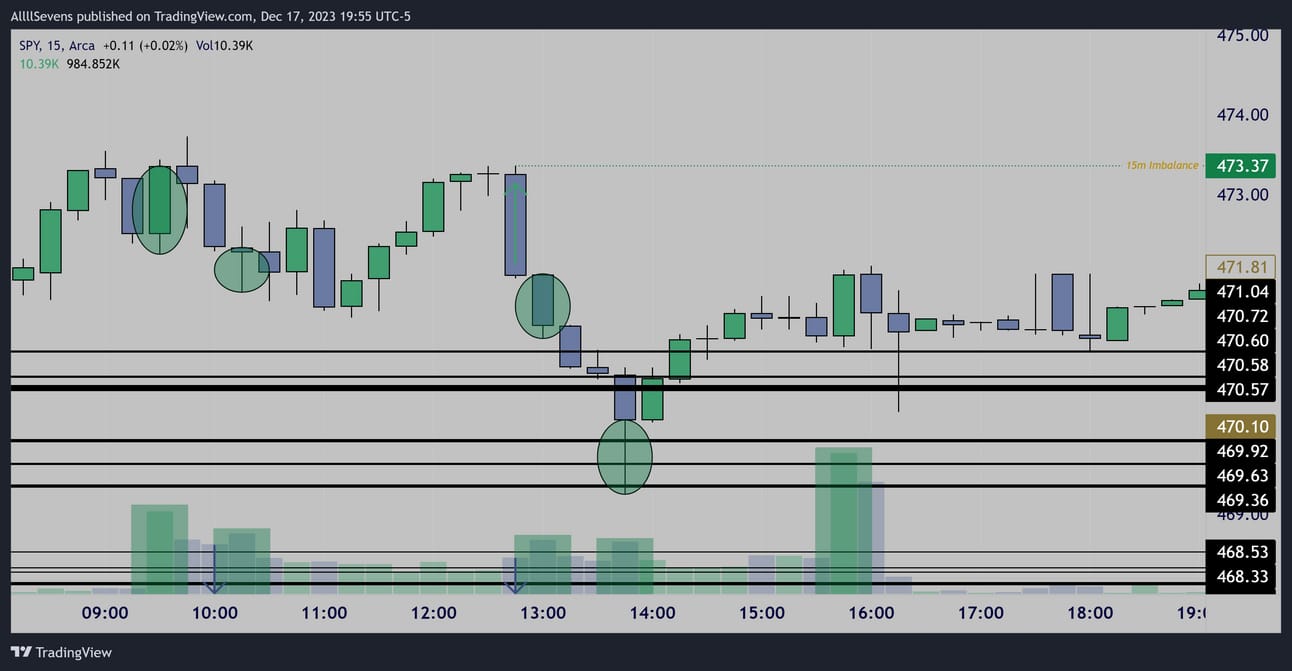

Thursday 12/14/23

Thursday’s reversal candle was full of institutional accumulation.

An imbalance was created at $473.37 when price sold-off o it’s largest candle spread of the session… with almost no volume backing it when compared to the accumulation earlier in the day.

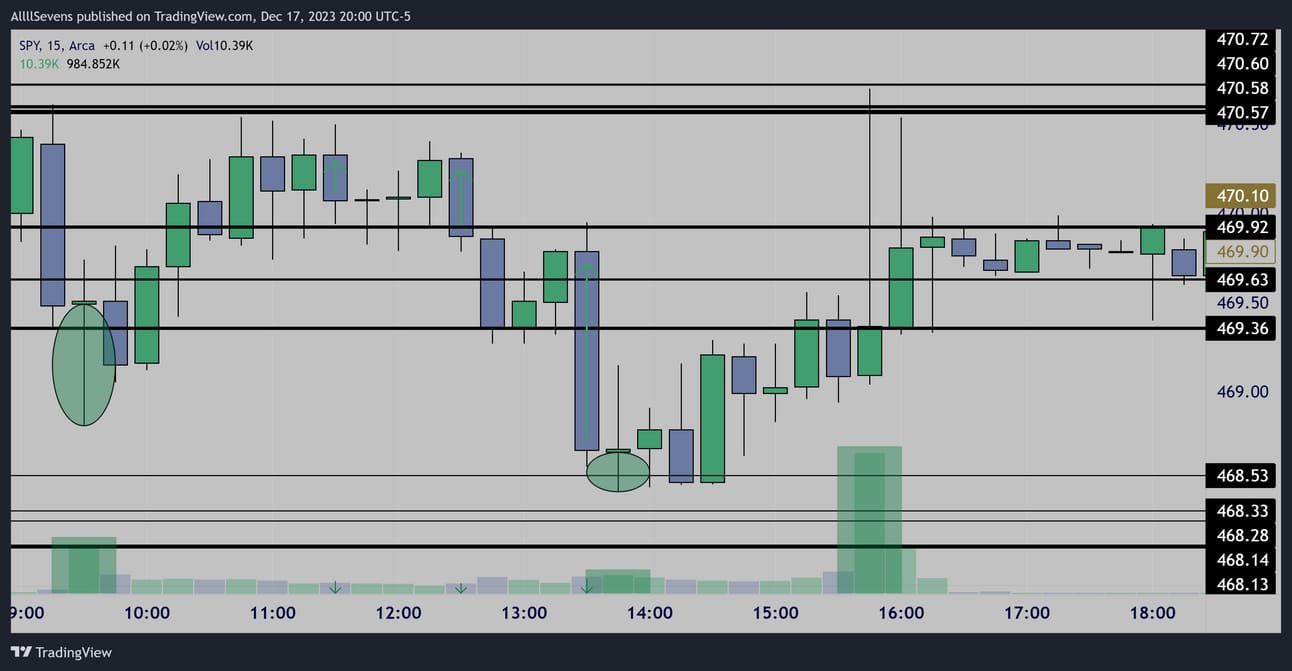

Friday 12/15/23

Friday’s candle was chock full of institutional accumulation as well.

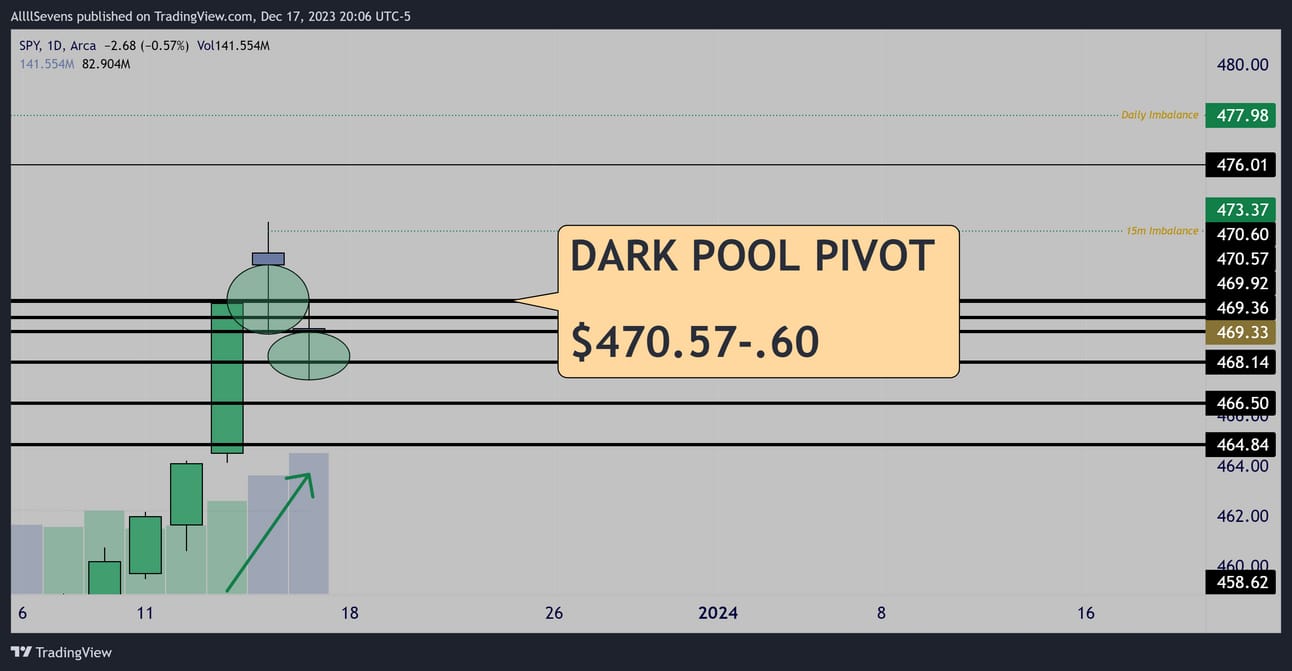

Daily

This is where things become simple.

On Friday, there were massive Dark Pool prints across the market on large stocks in the market including the SPY itself.

$470.57-.60 will be a critical pivot this week.

If price opens OVER this area, bulls are likely in full control with seemingly no resistance until $476.01

The $473.37 imbalance would be my primary long target.

If price opens below this pivot, bears are in control.

The clear accumulation in the past few days does not matter if PRICE sentiment points down. Retail participants will sell, and the institutional accumulation will continue. These types of environments are extremely tricky to trade because volume constantly points up on the lower time frames, yet price can fall rapidly for seemingly “no reason” if you do not understand the power of a Dark Pool pivot.

Below $470.57-.60 I am not interested interested in longs whatsoever.

I’d wait for the reclaim and focus on shorting low volume pumps into resistance. You’ll notice high volume will come in at lows… but there is typically a lack of volume on the actual upside move, and that’s where you’ll see downside continuation for further accumulation.

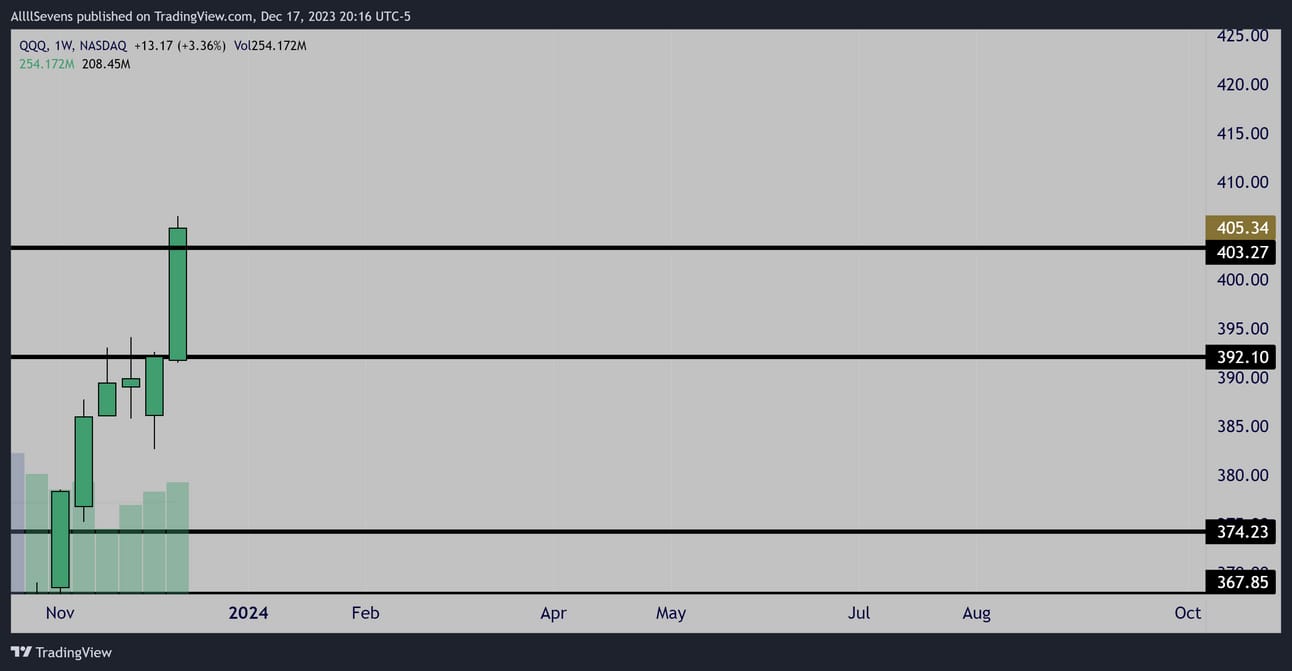

QQQ

I’m not going in depth on the QQQ this week-

But I’m going to skim the surface.

A very notable Dark Pool came in on the QQQ Friday @ $403.27

This will be an extremely important area to watch volumes at.

Weekly

You will notice the QQQ weekly candle does not display the same “topping volume as the SPY…

You’ll also notice the QQQ closed OVER it’s major pivot…

This tells me to anticipate relative strength on the QQQ this week.

1HR

Also notable is ZERO resistance on the QQQ heading into next week as long as it remains over support.

All time highs could act as a magnet here.

AllllSevens+

I write a premium newsletter where I do the same analysis, but on many more ETF’s and stocks. If you find my work valuable you will absolutely love my premium content.

Upon signing up for the premium newsletter you also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

I also notify trade ideas.

It’s also a great environment to learn the concepts I discuss.

Right now, it’s only $7.77 per month and you can upgrade with this link just below.

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtj0fe

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply