- AllllSevens

- Posts

- AllllSevens Newsletter- The S&P500

AllllSevens Newsletter- The S&P500

SPY XLF XLY

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing stated is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this tweet below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Reach out if you have questions.

Preface:

Is the S&P500 escaping to new all-time highs?

Is this rally the real thing? Would it be dumb to buy now?

Will it go down again?

The answers are not as random or uncertain as you may think.

In this newsletter,

I provide extreme clarity on the future direction of the SPY-

Both long-term and short-term.

The S&P500 is at an extremely pivotal crossroads for short-term direction.

Two of the largest sectors in the index:

Financials (XLF), and Consumer Discretionary (XLY),

are facing large short-term resistances as the SPY itself tests ATH’s.

Whatever decision these sectors make in the coming weeks / months will determine whether or not the S&P500 Index is ready to enter a massive bull run or if a pullback and further consolidation is necessary.

Long-term, the market is extremely bullish.

Notice I said the XLF and XLY are facing “short-term” resistances.

These resistances have already been accumulated by institutions in 2022 anticipating a long-term recovery and reclaim of these levels.

It is only a matter of “when” these levels get reclaimed and launch the market into an extreme bull run.

Short-term, until these levels get broke there is a very real threat of short-term rejection and further consolidation in 2024 before the bull run.

My overall stance for the time being is “hands-off”

Let the market make this decision.

For this week specifically,

It’s looking rather choppy / bullish.

This means I’m looking to only buy supports, and I don’t want to get aggressive for breakouts over resistance.

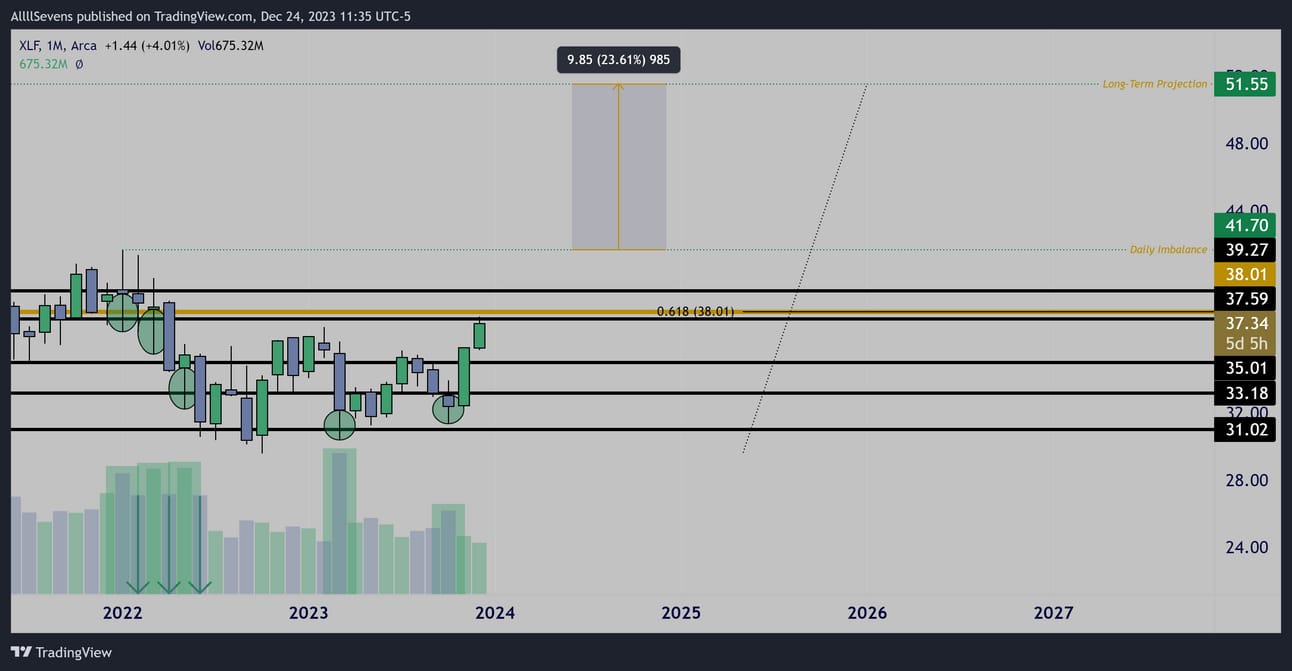

Calendar

Bloomberg High Impact U.S.A. Economic Data

SPY

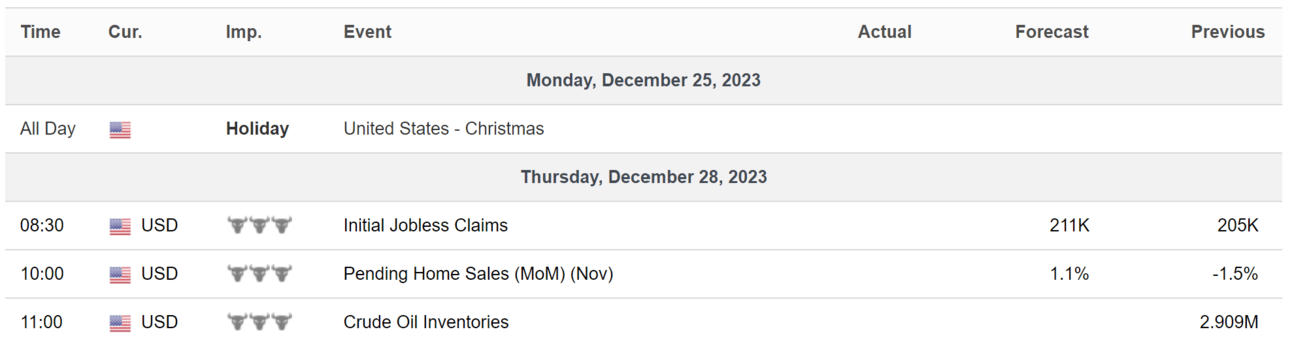

Long-Term,

Major Institutional Accumulation has taken place over the last two years,

Visible through decreased spread candles with lower wicks and increased volume directly at the largest Institutional Dark Pools on record.

The largest Dark Pool on record is the gold level, $395.88

Following almost every accumulation there is an increased spread candle with decreased volume taking price lower…

These are anomalies confirming that only retail participants drove prices lower on each sell-off.

Using a .618 Fibonacci with the current low of the market, and the highest major Dark Pool that was accumulated, I predict a reasonable minimum long-term target for the S&P500 is $593.45

Zooming into the daily chart, the highest imbalance in price and volume is at $479.98 (ATH’s)

Therefore, the institutional fair value of the S&P500 is $479.98

Any price below ATH’s is technically a long-term discount.

Short-Term,

The XLY and XLF are at major short-term resistances.

These two sectors are a MAJOR component of the S&P500 index.

If they can breakout, the SPY can really pick up steam to the upside.

If they reject, it’s possible the SPY makes an inside candle on the yearly and begins a short-term correction.

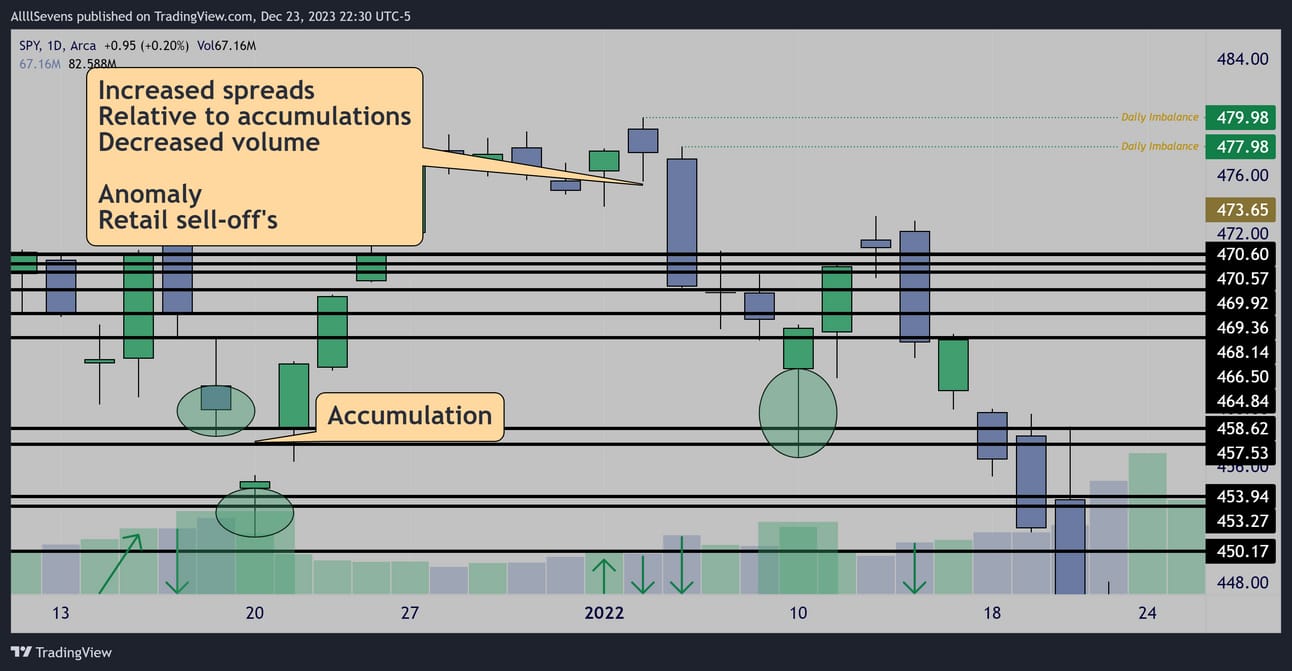

XLF Monthly

Just like the SPY itself, the Financial Sector has undergone severe institutional accumulation over the last two years.

However, you’ll notice a key difference between this and the SPY-

SPY’s largest dark pool is far below, as support.

XLF’s largest dark pool is just above, as resistance for now.

Long-Term,

Any price below ATH’s is a discount.

Short-Term,

Until this resistance is broke, it’s not very safe to be getting aggressively long here, especially with call options…

I’ll be watching for a confirmed breakout here on the weekly & monthly.

Until then, a short-term rejection is not off the table…

The same exact accumulation and structure as the XLF is present.

I’d argue though, institutions have rotated MORE money into financials than they have consumer discretionary thus far.

Long-Term,

Any price below $211.81 is a discount.

Short-Term,

Until this resistance is broke…

There’s just no reason to front run a breakout.

Conclusion

As the SPY approaches new all-time-highs, the 3rd and 4th largest weighted sectors, XLF & XLY, are approaching their largest Dark Pools on record which could result in either a breakout and continuation of the current market rally…

Or

A short-term retail participant driven pullback, potentially even creating an inside candle on the SPY yearly chart.

One thing is absolutely certain:

LONG-TERM,

These resistances will be broke and price will head for the long-term Fibonacci projections. These Dark Pools have already seen HEAVY accumulation in the past, and nothing changes that.

If we do see a short-term rejection, we will see MORE accumulation on the pullback.

One thing is absolutely uncertain:

SHORT-TERM,

When will the breakout occur? We simply don’t know until it happens.

As price is sitting just below resistance, the most logical thing to do is sit on our hands and let the market decide where it wants to go.

I find this extremely convenient considering the Holiday season is upon us. We could all use a break from the market this time of year.

Now, what I’m about to show you next further confirms that the best thing to do here as a long-side focused trader is to sit on your hands…

How probable is a short-term rejection?

There’s a very credible thesis I’m about to share that suggest a short-term retail participant driven rejection over the next few weeks / months would not be very surprising at all.

Now, because of how extremely bullish these levels are long-term I am definitely not going short here.

But the data I’m about to present to you makes me 100% certain I do not want to front-run the breakout. I want to wait for it to be confirmed.

I will happily be wrong about this… I’m not a perma-bear pessimist.

I never have been. But I believe a short-term correction is most likely.

Here’s why:

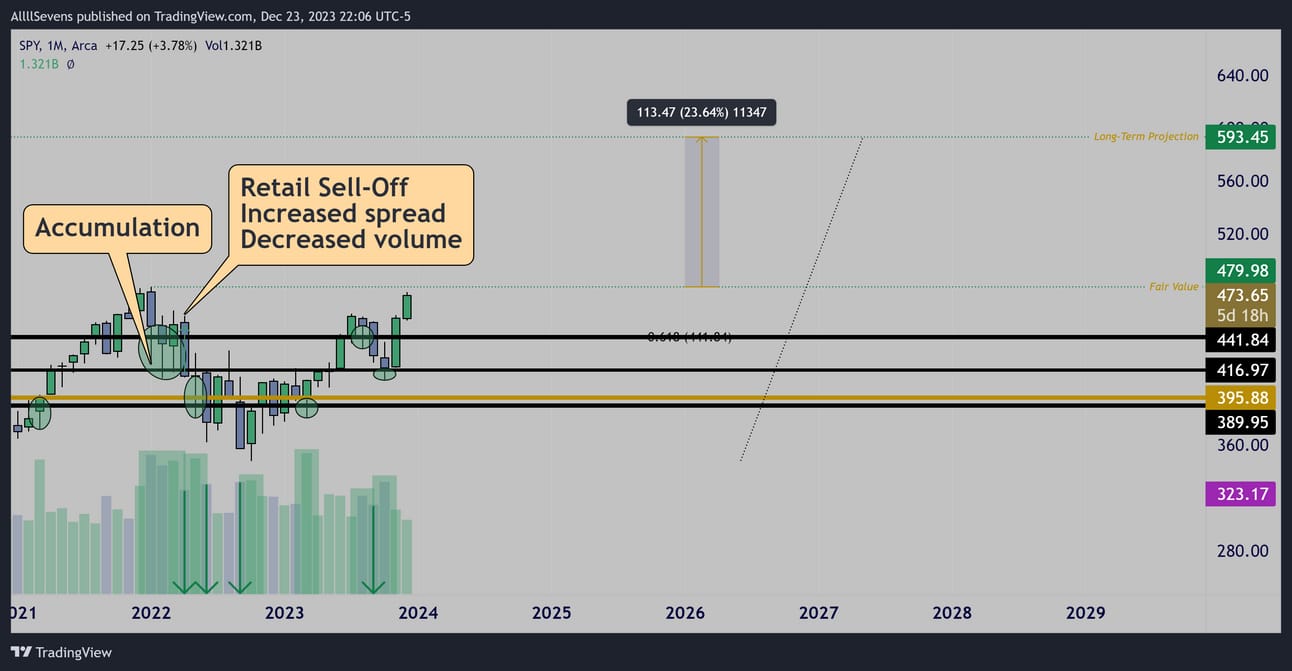

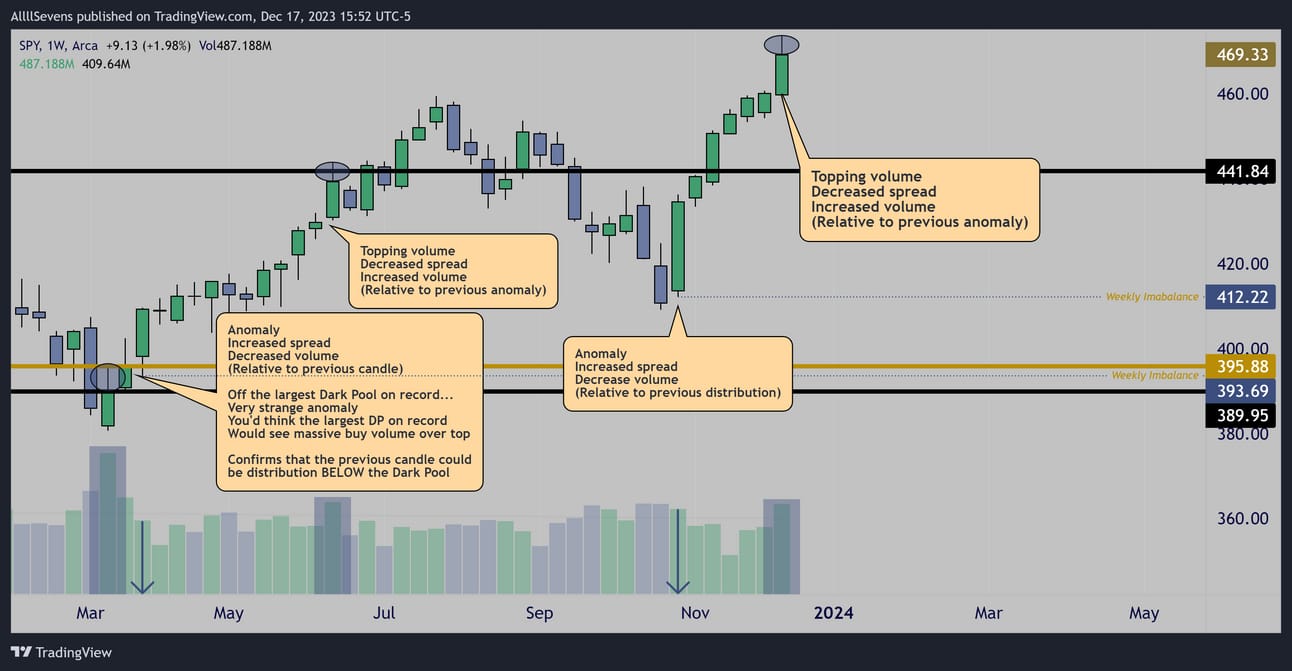

Weekly

I see a major anomaly on the weekly time frame.

A massive volume upper wick off the largest Dark Pool on record sparking the 2023 rally followed by a break and retest of the Dark Pool

which produced a large increased candle spread bounce…

On decreased volume.

I find this extremely odd. An anomaly.

If institutions were heavily accumulating here, why would the break and retest of the Largest Dark Pool on record not be on extremely high volume? It doesn’t make sense.

I believe institutions purposefully created an “imbalance” at $393.69

Why would they do this?

To create liquidity, allowing for more accumulation on an eventual correction. What exactly does that mean?

Well, if I am correct and an artificial low has been made, and $393.69 needs to be retested before the XLF and XLY can breakout-

Think about all the people who have bought the market during this rally…

If price were to reject in the coming weeks/months all of those traders would get stopped out and be the “liquidity” for further institutional accumulation. If you think about it, institutions can only absorb massive amounts of shares (accumulate) when a massive amount of people are selling out of the market.

It makes perfect sense to me.

One more thing I find very interesting:

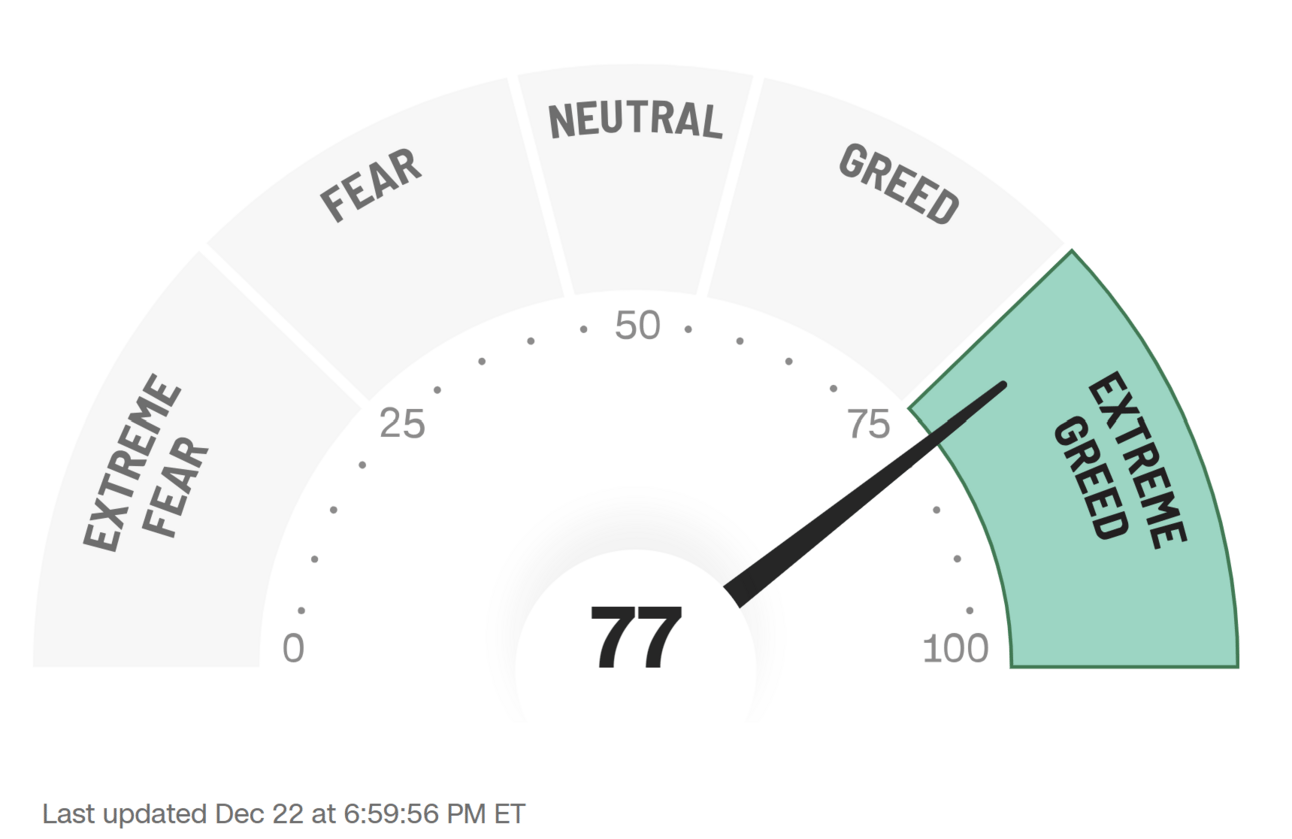

Fear & Greed Index

https://www.cnn.com/markets/fear-and-greed

Convenient timing for market sentiment to reach an extreme…

Conclusion

I’m anticipating a possible rejection in the coming weeks/months that leads to a substantial pullback in the SPY.

I’m also fully prepared to be WRONG and to buy the confirmed breakout.

This newsletter is not meant to be a bear thesis.

It’s meant to be a an extremely unbiased and institutional perspective on the market.

As a long-term investor, this market looks incredible.

As a short-term trader, I see reason for caution, until proven otherwise.

I am very much looking forward to seeing how this plays out.

I will gladly be proven “wrong” on this bearish thesis,

As I do not care about being correct, I care about preserving my capital and compounding it over time.

Right now, I see extremely valid reason to protect my short-term capital until proven otherwise.

Let’s talk more on THIS coming week:

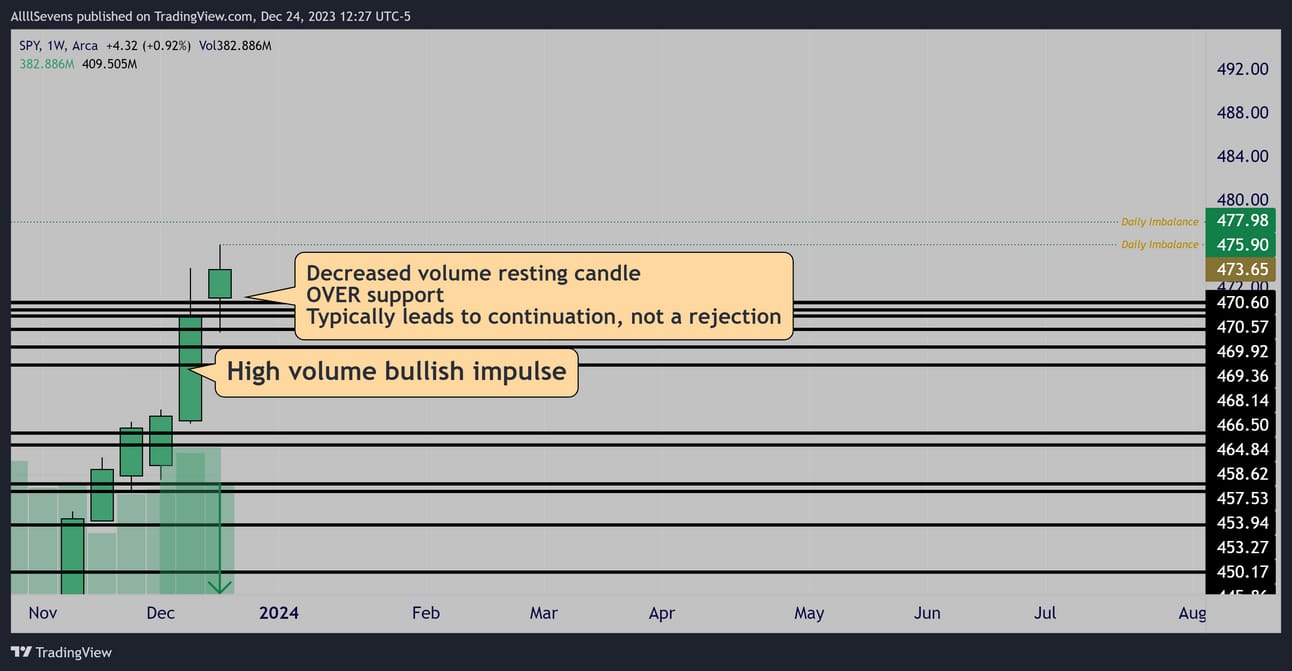

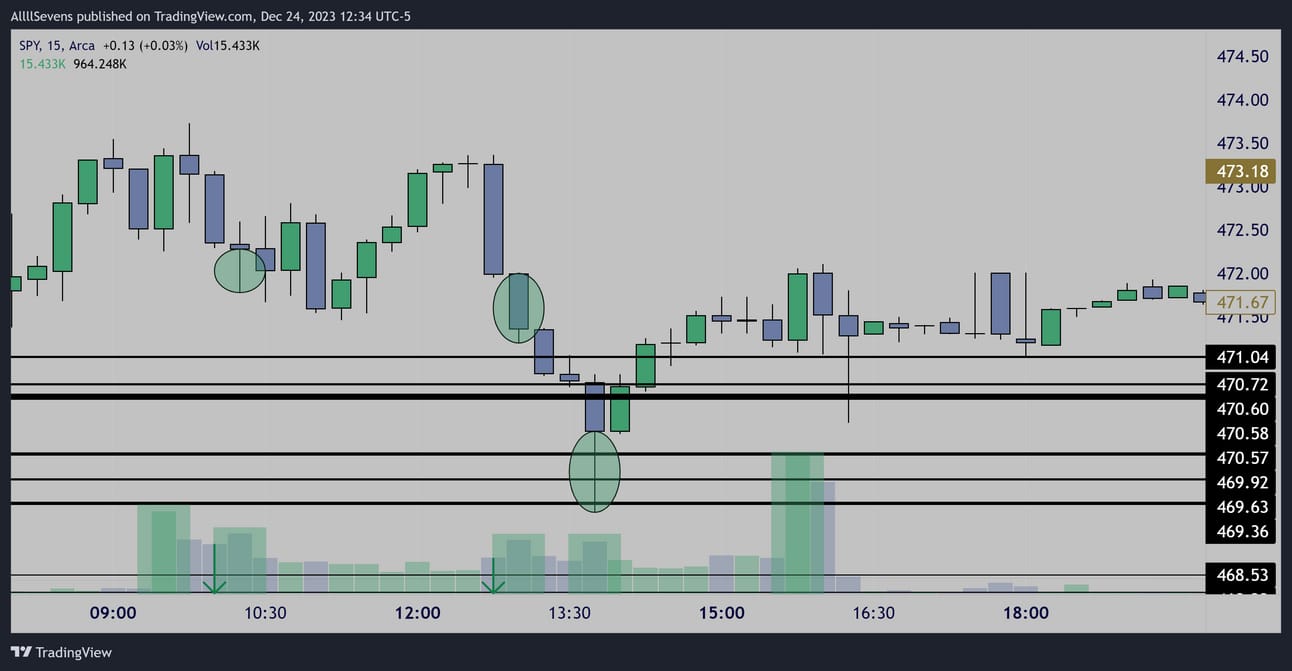

Weekly

Here are the current Weekly levels for SPY

It’s pretty hard to be bearish here.

As you can see,

There are conflicting market dynamics right now.

If it weren’t for the XLF and XLY at major resistances, I’d be slamming the table for more upside on SPY this coming week.

Here’s how I see it,

I’m “cautiously bullish” as long as SPY holds $470.57-.60

I do NOT want to be short. I said this previously,

While I expect a rejection, I am not short. There’s also too much of a chance we do breakout. The best thing to do for me, is to stay hands-off and let things become more clear. I wouldn’t be surprised to see lots of chop / an upward move next week.

Another reason I am not actively slamming the table SHORT,

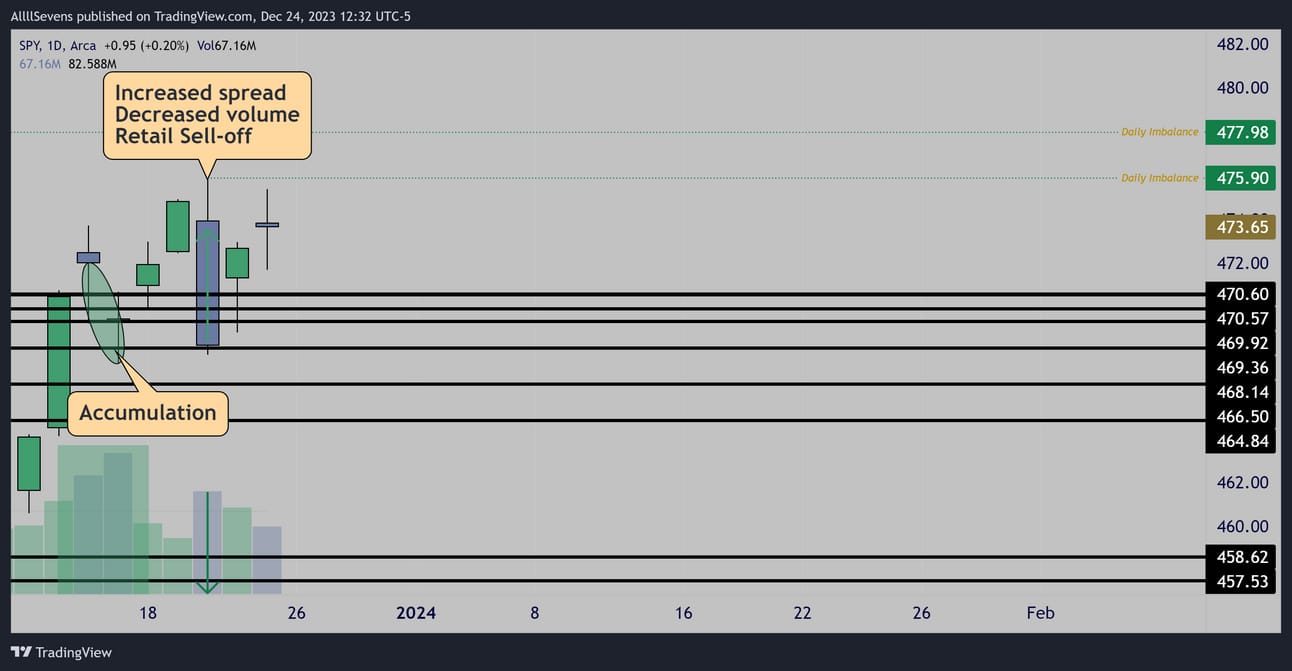

Daily

There are no signs of bears on this daily chart.

Only bullish imbalances above and supports below.

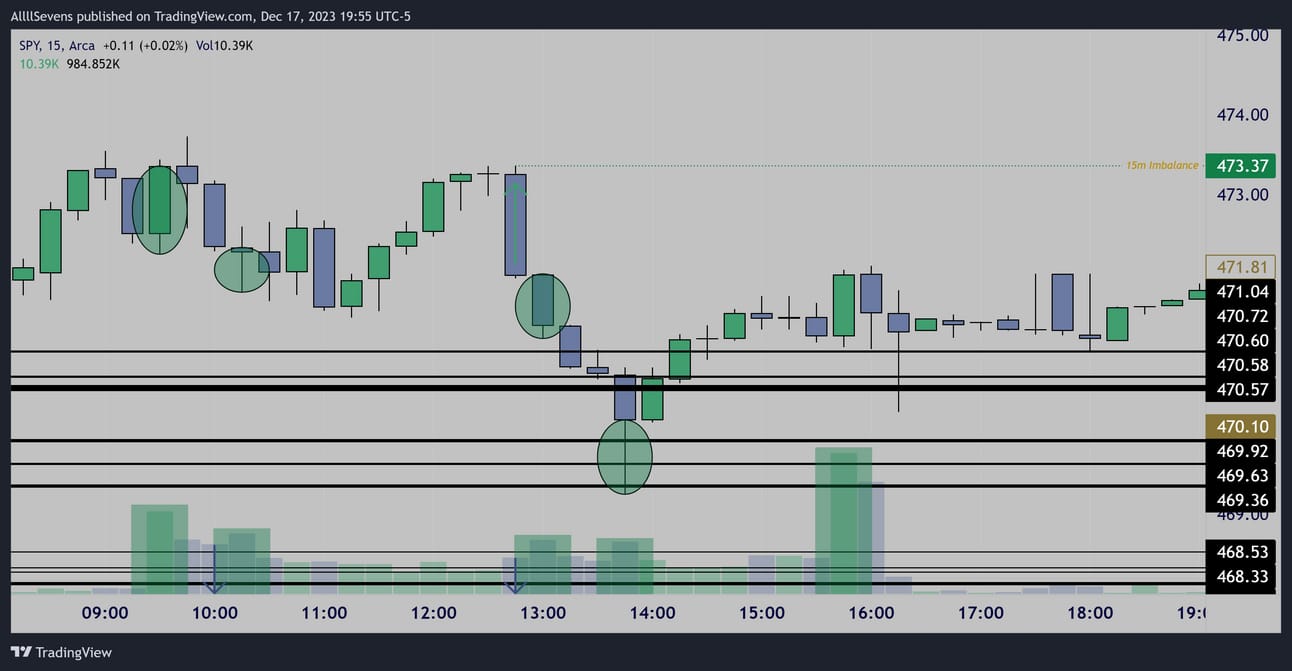

Thursday 12/14/23

Friday 12/15/23

Wednesday 12/20/23

Further confirmation that Wednesdays’ sell-off last week was retail driven, creating an imbalance on the daily candle’s high.

Institutional investors loaded the bottom, shown by the highest volume of the session being at daily Dark Pool supports on a decreased spread hammer candle.

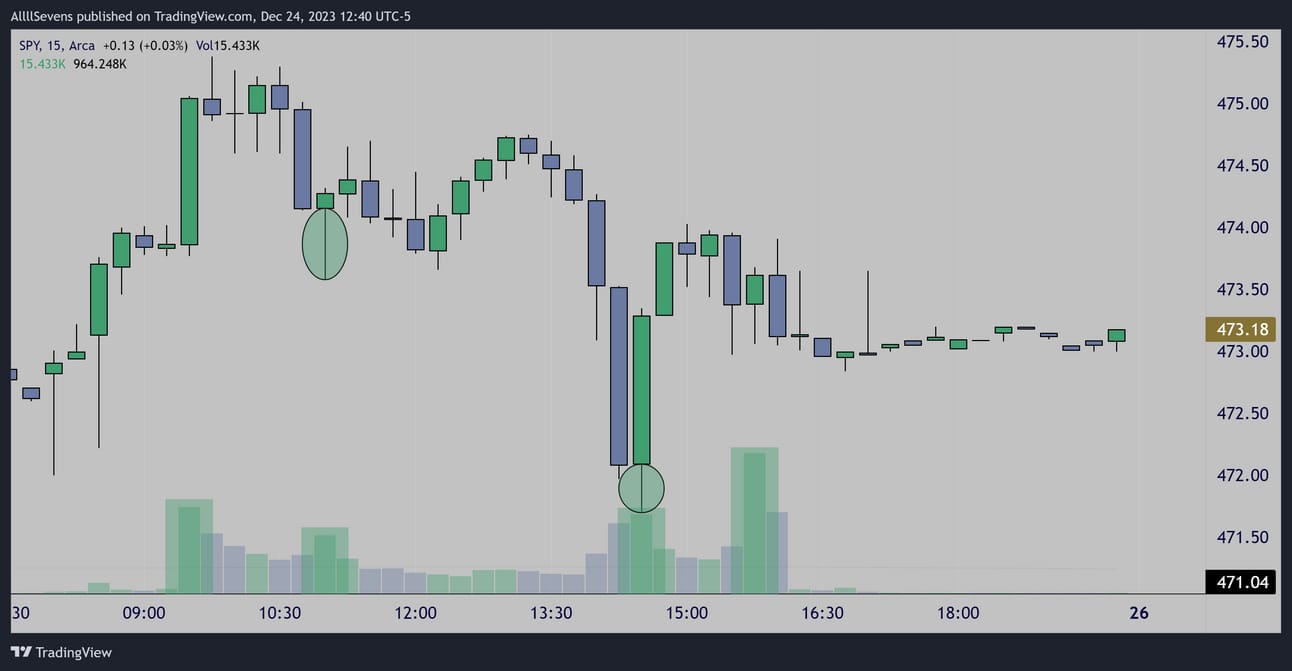

Friday 12/22/23

Even on Friday, we see institutional volumes are clearly bullish.

IF a rejection does occur in the coming weeks / months I assure you it will be purely retail driven, and we will see constant accumulation as price pulls back. Understand this:

Institutions do not necessarily TIME the market…

They have time IN the market.

This is why short-term despite the clear buying pressure by institutions,

We need to wait for resistance to actually be cleared.

The only reason institutions are able to continue accumulating at these levels is because retail participants are taking risk out of the market as overhead resistance is approached… ATH’s and XLY + XLF lagging.

Conclusion

I don’t want to be aggressively bullish as the XLF and XLF are at large resistances and the market is in extreme greed…

At the same time,

I see no bearish structure to work with on the SPY…

So, my plan is to only buy the SPY at the daily supports below.

It is too risky to buy away from support as the XLY and XLF will be at resistance.

Overall, this is a pretty hands-off environment unless something absolutely A+ presents itself.

Once the XLF and XLY breakout to the upside it’s hands-on again.

Or

If they reject, and bearish structure is created below the Daily dark pools I’ve displayed, it’s hand son again.

IF the spy were to GAP DOWN below $470.57-.60 the market would be entering a controlled bearish environment and I would NOT BE BULLISH whatsoever. I’d be focused on finding low volume bounces to short.

If this were to happen, it could be the start of the reversal.

As long as we open over that pivot, I’m leaning bullish, but choppy.

QQQ

Here are the QQQ supports I’d be looking for A+ reversal entry’s at for this week.

AllllSevens+

I write a premium newsletter where I do the same analysis, but on many more ETF’s and stocks. If you find my work valuable you will absolutely love my premium content.

Upon signing up for the premium newsletter you also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

I also notify trade ideas.

It’s also a great environment to learn the concepts I discuss.

Right now, it’s only $7.77 per month and you can upgrade with this link just below.

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjrgd

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply