- AllllSevens

- Posts

- AllllSevens Newsletter $WBA

AllllSevens Newsletter $WBA

Walgreens Boots Alliance, Inc.

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this essay below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Don’t hesitate to reach out with any questions.

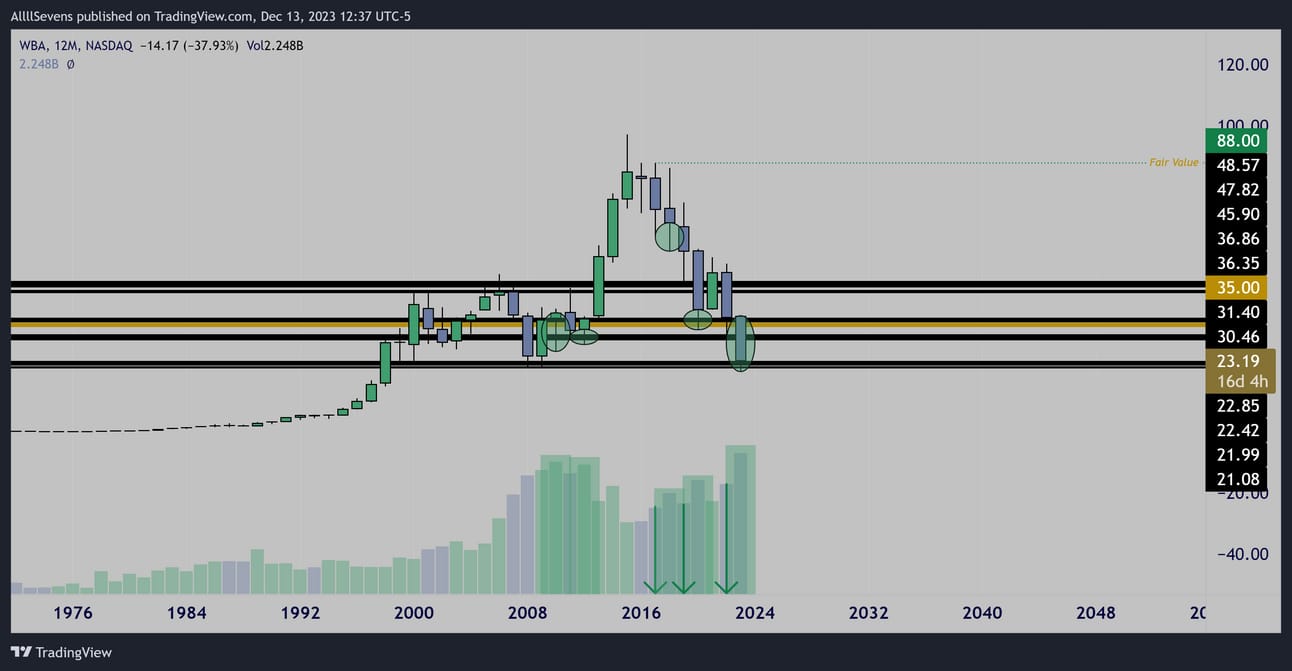

WBA

Long-Term…

The largest Dark Pool on record $35.00 is the basis for large long-term

Institutional accumulation.

As price comes to retest this area, we’re seeing the highest volume EVER.

An imbalance left behind at $88, making that the “fair value” of shares.

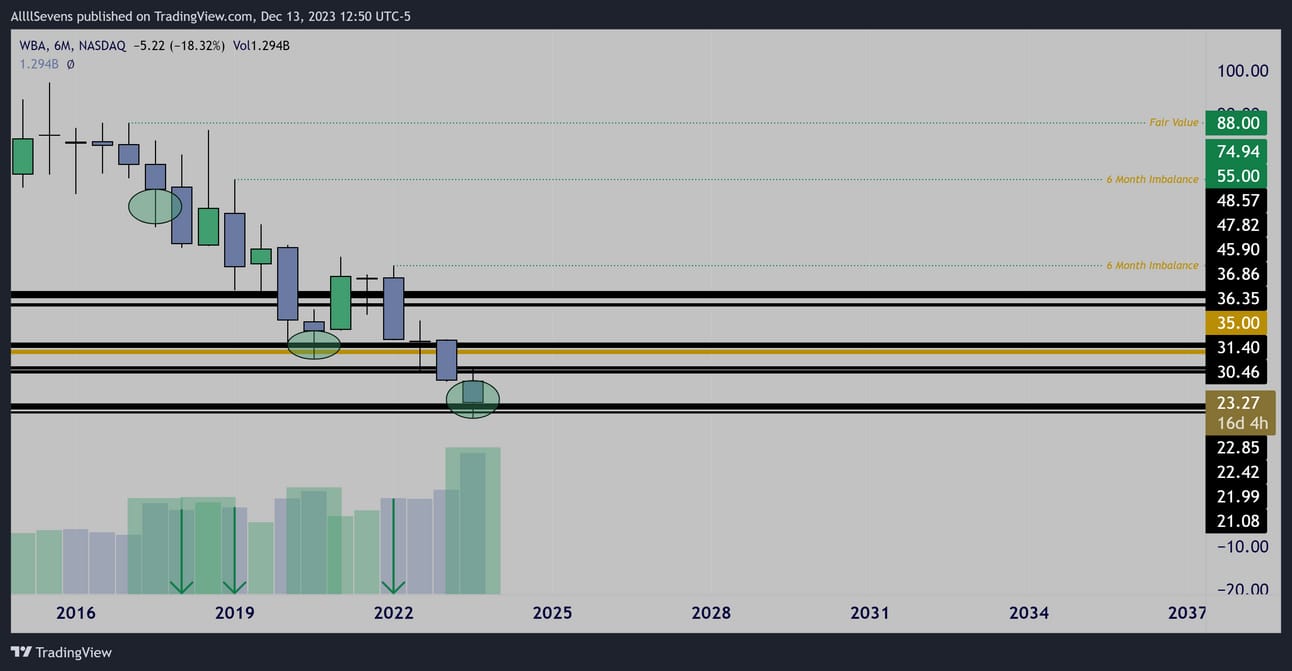

6 Month

The semi-annual chart displays the accumulation clearly.

This looks like a great long-term buy with amazing potential reward.

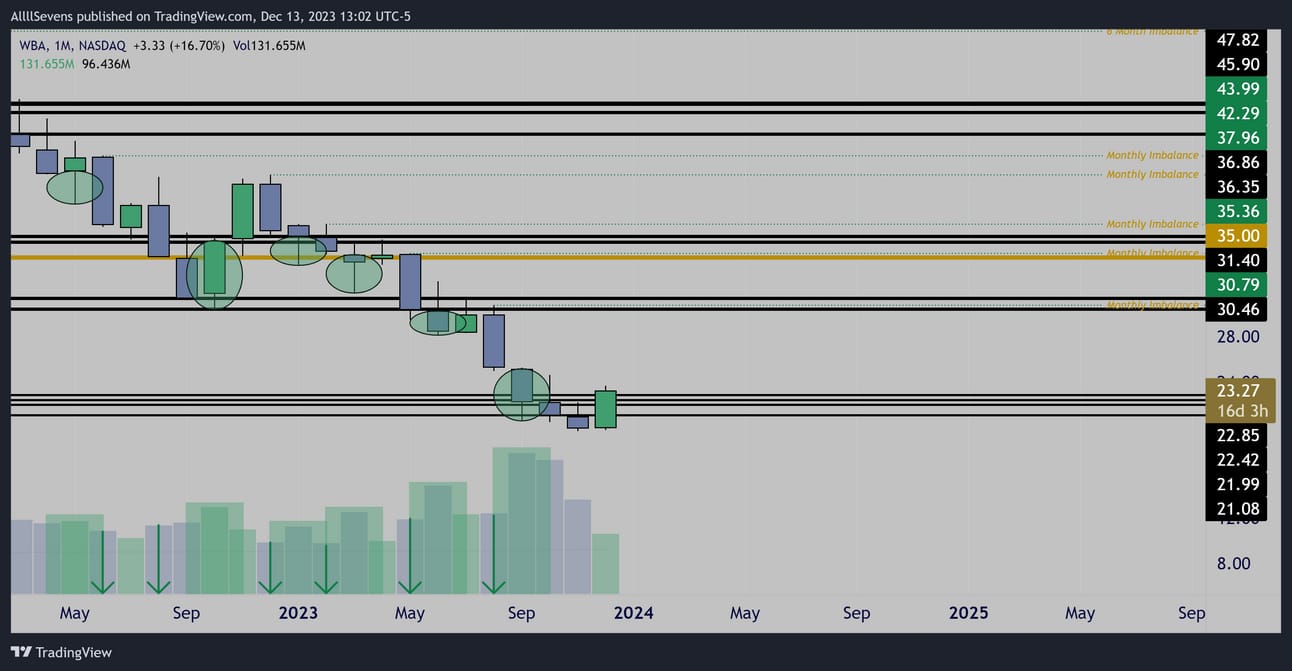

Monthly

The monthly chart displays the accumulation extremely clear.

This is a beautiful chart.

Patient institutional investors have been dollar cost averaging the entire way down… Only impatient retail investors have been selling.

Short-Term…

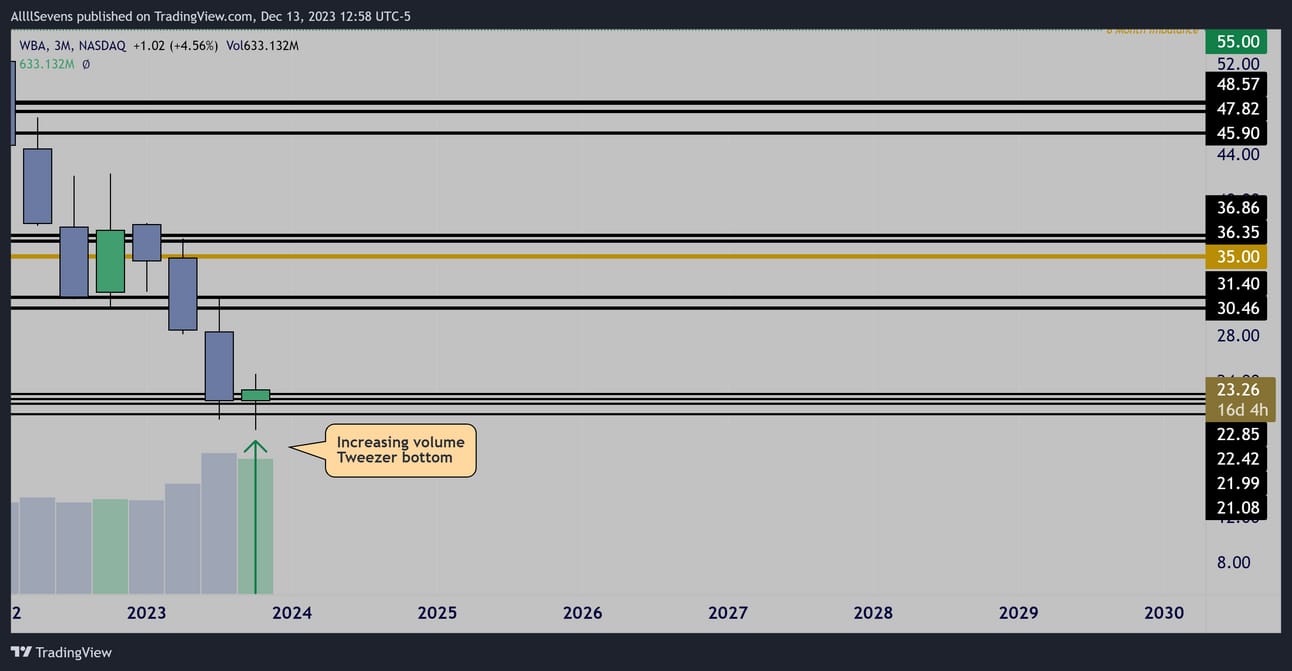

Quarterly

An tweezer bottom on the highest volume ever is forming over support…

This is not only clear accumulation, but a potentially explosive short-term shift in trend. Clear space to $30.46

Weekly

An extremely solid weekly base with perfect accumulation patterns.

Last week price broke out of the base.

This seems like a great time to add short-term risk betting that any retest’s of support below would hold and we will see expansion towards $30 into the new year.

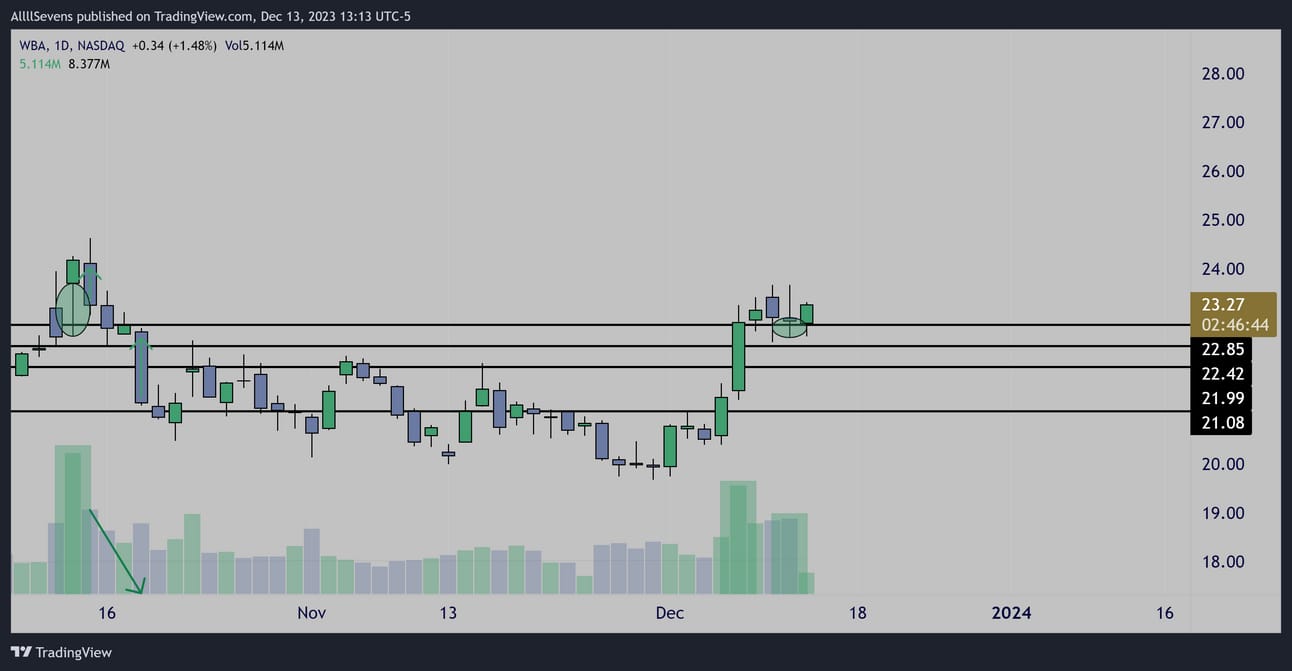

Daily

Extreme accumulation off $22.85 on the recent earnings report.

This level should be defended well short-term or something must be wrong and more chop / downside would be possible.

Long-term nothing would change.

Conclusion

As a short-term trade, this looks incredible.

If you read my WEEKLY newsletter this past Sunday, you also saw I have recently mentioned possible trend rotation into the XLV-

The entire Healthcare sector.

I think this should begin rallying now.

I do not see why any time would be wasted if this is truly ready for a short-term rally.

A weekly close below $22.85 and I’m concerned.

A close below $21.08 and I am out.

As a long-term investment, this looks amazing.

The ratio of risk-to-reward is incredible.

Risk being shares go to zero.

Reward being shares to fair value or higher ($88) +270%

AllllSevens+

Upgrade to AllllSevens+ for just $7.77 per month.

You’ll get more newsletters just like this.

You’ll get access to my Discord where I have dedicated channels for EVERY ticker I have ever analyzed with LIVE updates displaying Unusual Options Flow that comes in and volume patterns @ dark pools.

I also notify trade ideas.

The information I share is extremely valuable and I am currently charging just $7.77 per month for this service even though it’s easily worth $77.77

Why? Because I wan to help as many people as possible!

Upgrade with this link below.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtj0fe

Reply