- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 10/16/23

AllllSevens Weekly Newsletter 10/16/23

SPY NFLX

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Welcome to the AllllSevens Newsletter!

I thank you for your time and I don’t intend to waste it.

My goal is to present the market through the lens of an institutional trader/investor with no personal bias.

Institutions own over 60% of the stock market, so as far as I am concerned: They control it.

Whatever they are positioned for- I want to position for.

I use Dark Pool levels and Volume Price Analysis to determine how institutional traders/investors are positioning in the market.

Dark Pools are large institutional transactions.

These transactions create levels of highly concentrated volume.

Highly concentrated volume creates support & resistance.

Dark Pools are institutional support & resistance.

VPA with these levels reveals institution’s true intentions.

SPY

Institutions are running a bullish campaign on the S&P500.

Their current goal is to accumulate as many shares as possible in anticipation of a future bull market.

How institutions accumulate is very interesting…

They cannot buy when everyone else is buying.

There wouldn’t be enough supply to match fulfill their demand.

They must create supply.

How?

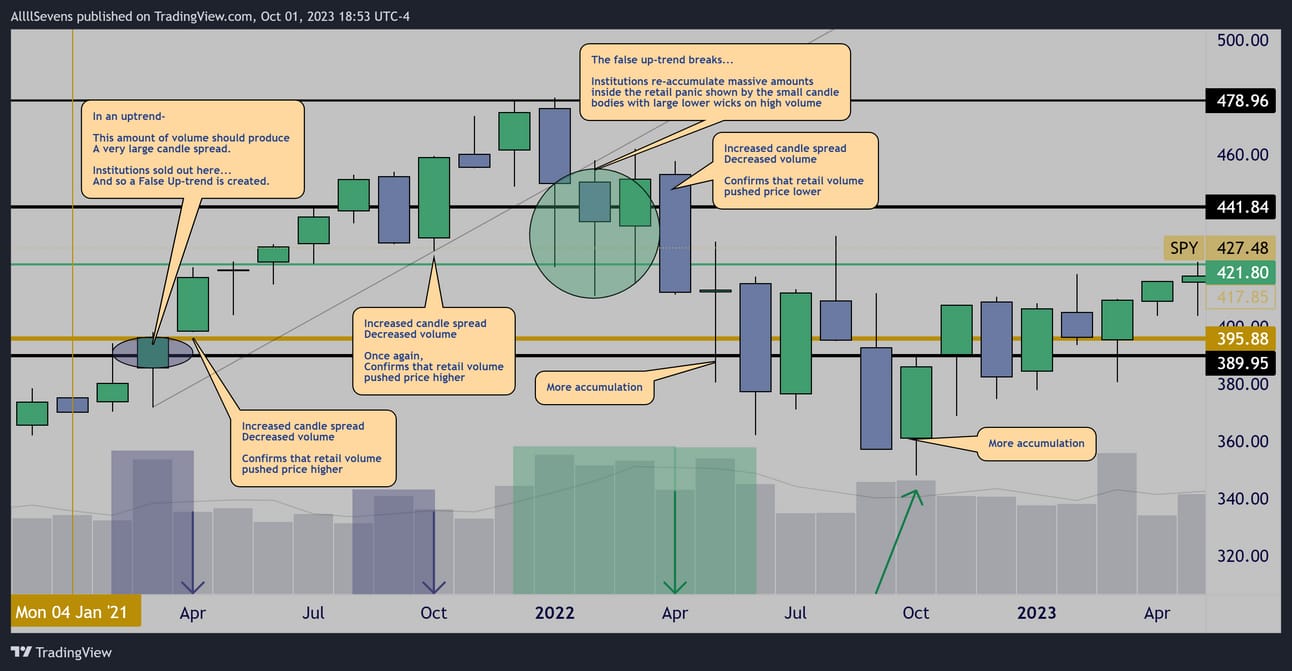

Monthly Distribution & Re-Accumulation

Supply is created by manipulating price into an false bullish trend.

Retail participants follow the trend and chase prices higher and higher…

When the bullish trend inevitably breaks-down there are an excess of sell orders (supply) for institutions to re-accumulate.

This cycle has happened once and it is now happening again.

Monthly

The current bullish trend is a manipulation creating liquidity for a re-accumulation event.

Therefore, my #1 priority right now is growing my amount of cash on hand so that I will be prepared for this future dip buying opportunity.

As you can see, price is currently testing the unsustainable trend-line…

I know it will break eventually, but do I know if it will break now?

Absolutely not.

In fact, considering the recent sell-off into this support was on low volume, the odds of potential short-term trend continuation (bounce) are increased.

Let’s drop down to the weekly chart and see if it tells the same story.

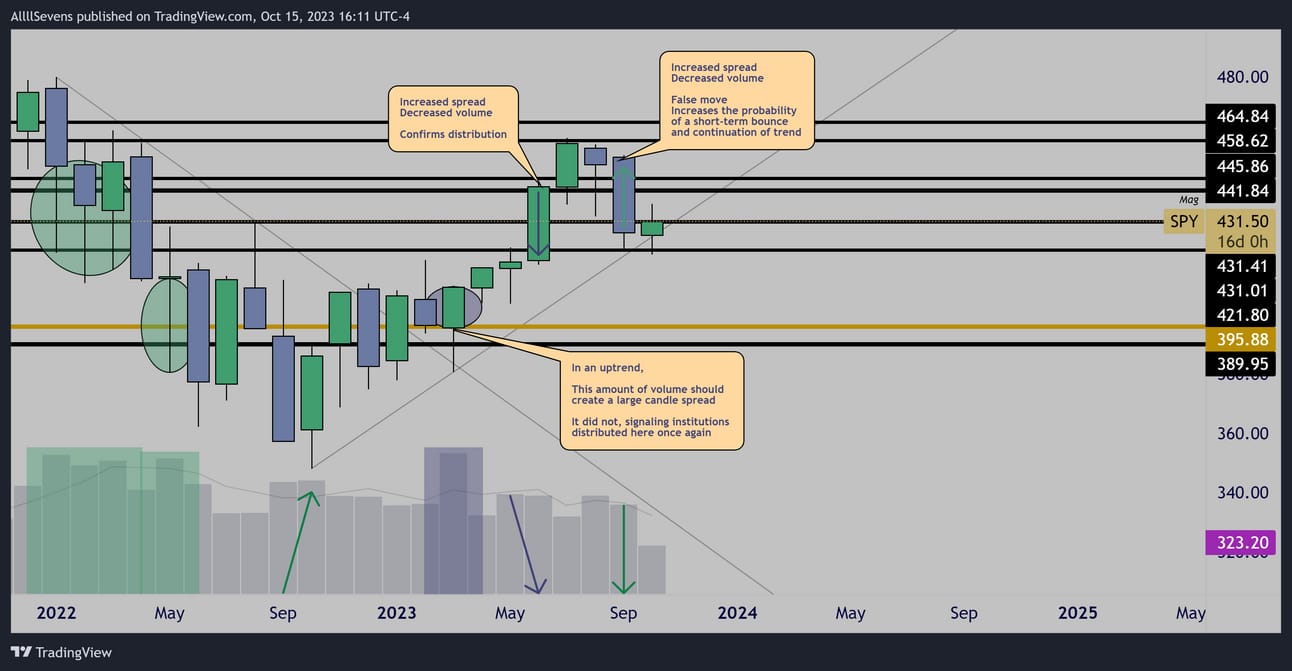

Weekly

Trend Support+ $421.80 Dark Pool

This $421.80 support is special because of the very abnormal amount of volume that occurred here in in January 2022

It was a clear accumulation candle and it was the largest volume in over two years.

This plus trend support makes for an extremely pivotal area.

A bounce could be explosive, and a breakdown could be detrimental.

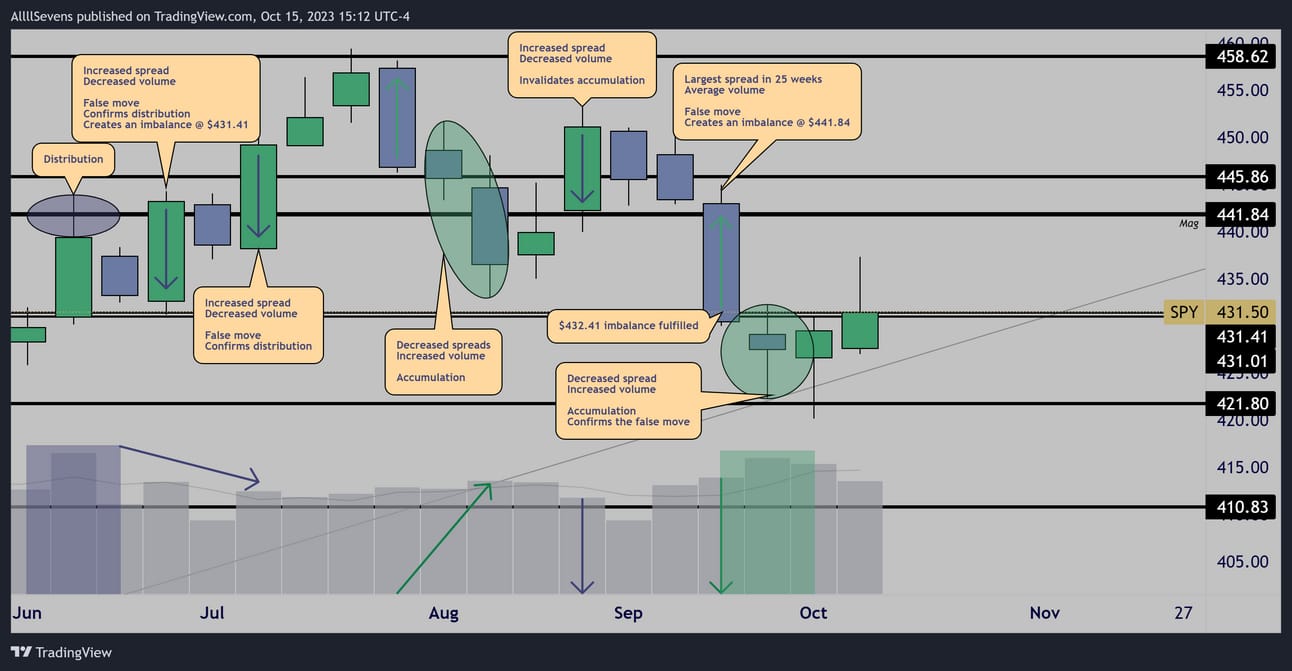

Weekly Volume Price Analysis

In June-July we saw that price was exhausted (distribution) leaving behind an imbalance at $431.41 which was just recently fulfilled.

As this imbalance was fulfilled, a new imbalance was created.

The move down from $441.84 to $431.41 was the largest candle spread in over 25 weeks… It had just average volume. This shows a false move.

This was confirmed by the accumulation seen the very next week.

It has been two weeks since this sequence- and price has struggled to reverse back towards that $441.84 imbalance so far…

$431.01-.41 seems to be the barrier.

Conclusion

My #1 priority right now is saving cash for the eventual correction.

In the mean-time I’d like to trade the short-term trend if an edge is clear.

Is there a clear edge right now?

Not necessarily. I see this is a 2-way setup which is inherently lower probability that either side plays out.

These are not my A+ conditions.

I cannot say with much confidence that I think price is ready to fully reverse to the upside here, or if the breakdown is about to happen.

So here’s my plan:

Where price opens will be extremely important.

If price opens and holds over $431.01-.41 momentum can begin shifting bullish and I would love to open swings targeting the $441.84 inefficiency.

If price opens and holds below $431.01-.42 then momentum will continue to be bearish-

I’d expect continuation back to the $421.80 area of support.

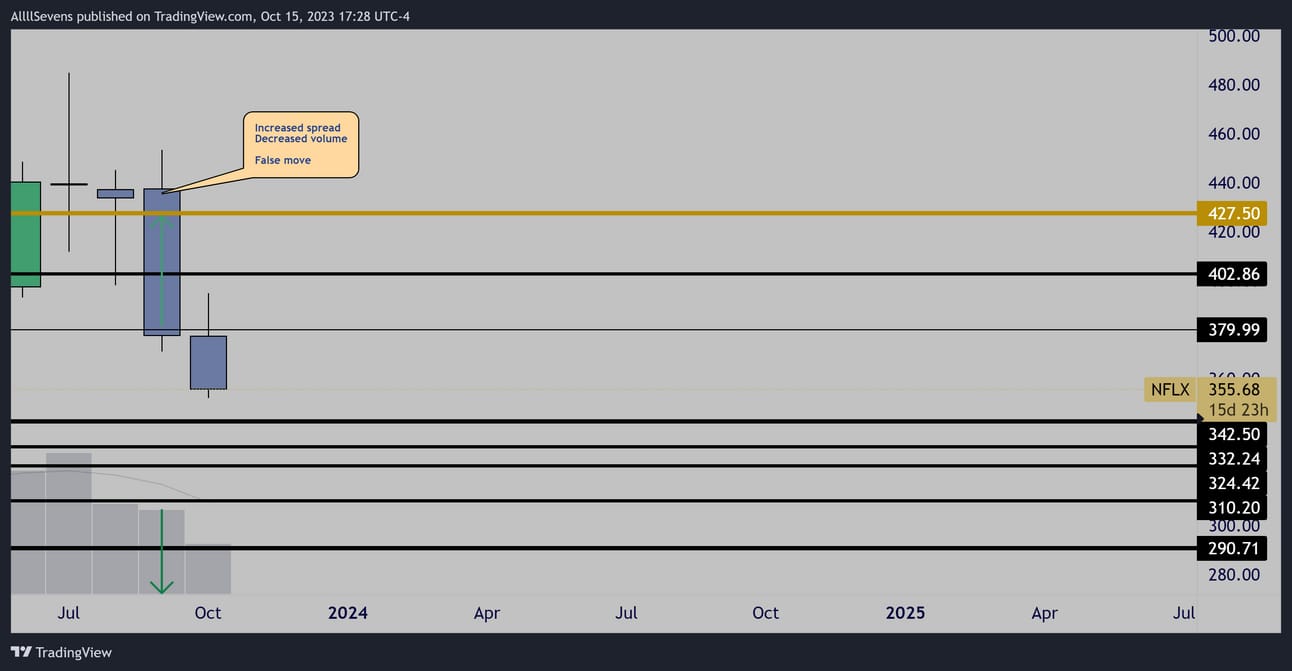

NFLX

Monthly

A huge false move on a monthly time frame-

I am watching this for any large stopping volume to signal a reversal back into the $400’s to fulfill this inefficiency.

Earnings Wed. after close could provide that volume.

Unusual Options Flow

$8.34M Full Risk Bull

Conclusion

I have been watching this stock glide downwards for a few weeks now, the entire time seeing accumulation patterns + this flow.

Earnings on Wed could be the catalyst for a bounce.

Thank you for your time.

I am very passionate about what I do and it is extremely rewarding to know that there is even one individual person opening this each week to consider my perspective. I hope you find value here.

You’ll notice this week I did not cover as much as I normally would-

That is because the market is in a very pivotal spot where I believe it is better to react than predict.

Nothing looks A+ to me.

When the market is more clear, I will discuss more.

Make sure to stick around for next weeks newsletter!

If you have any questions, concerns, or suggestions please email me or message me on twitter.

I would love to hear from you.

[email protected]

https://twitter.com/AllllSevens

If you like my style of analysis, consider upgrading your subscription…

I write a premium newsletter as well!

The premium newsletter is not sent out on a scheduled basis, I simply send it out whenever something absolutely A+ sets up often in the middle of the week.

It is only $7.77 per month!

You also get access to my Discord community!

I have channels/forums for every single stock I have ever analyzed that I update on a consistent basis with any volume anomalies or unusual options flow.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply