- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 10/23/23

AllllSevens Weekly Newsletter 10/23/23

SPY XLK XLV XLF XLY XLC XLI

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Welcome to the AllllSevens Newsletter!

I thank you for your time.

I don’t intend to waste it.

My goal is to present the market through the lens of an institutional trader/investor with no personal bias.

Institutions own over 60% of the stock market, so as far as I am concerned: They control it.

Whatever they are positioned for- I want to position for.

I use Dark Pool levels and Volume Price Analysis to determine how institutional traders/investors are positioning in the market.

Dark Pools are large institutional transactions.

These transactions create levels of highly concentrated volume.

Highly concentrated volume creates support & resistance.

Dark Pools are institutional support & resistance.

VPA with these levels reveals institution’s true intentions.

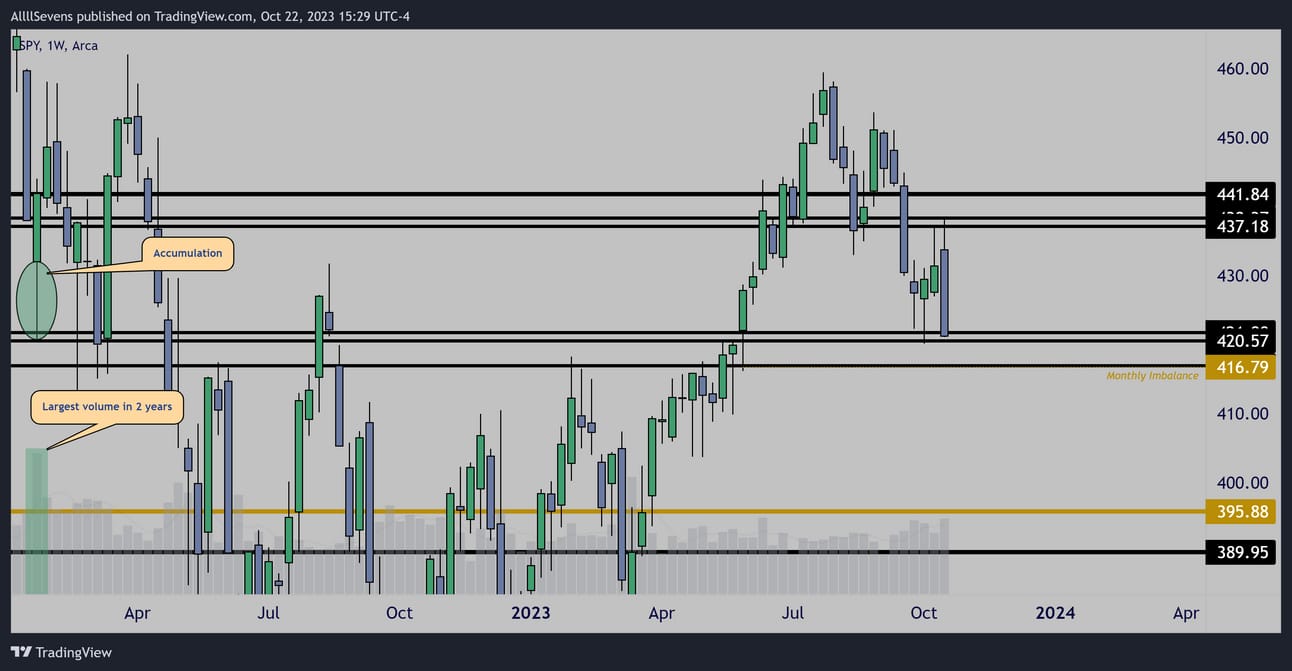

SPY

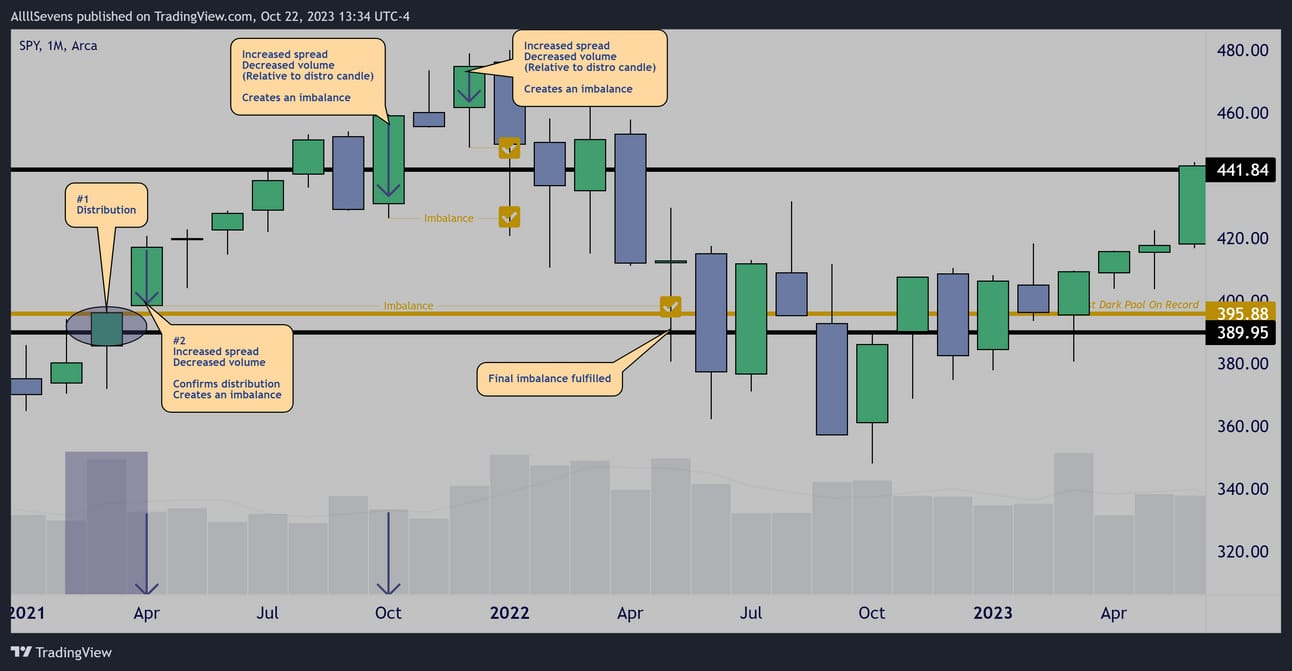

First, let’s discuss why the bear market of 2022 occurred.

The entire event was orchestrated by institutions.

2021 Distribution & 2022 Rebalance

#1

March 2021 was a distribution candle.

Such large volume in a clear uptrend should have produced a massive candle spread (candle body) to the upside… It did not.

The logical conclusion here is that institutions sold out.

#2

The following candle was an increased spread with decreased volume:

Confirming institutions sold out of the market and retail participants are the force behind rising prices.

This candle also creates the first imbalance in price at the candle’s low that will later be re-balanced.

As price continues to rise, two more imbalances are created before price eventually reverses and fully rebalances.

What was the point of this sequence? Why did institutions sell out?

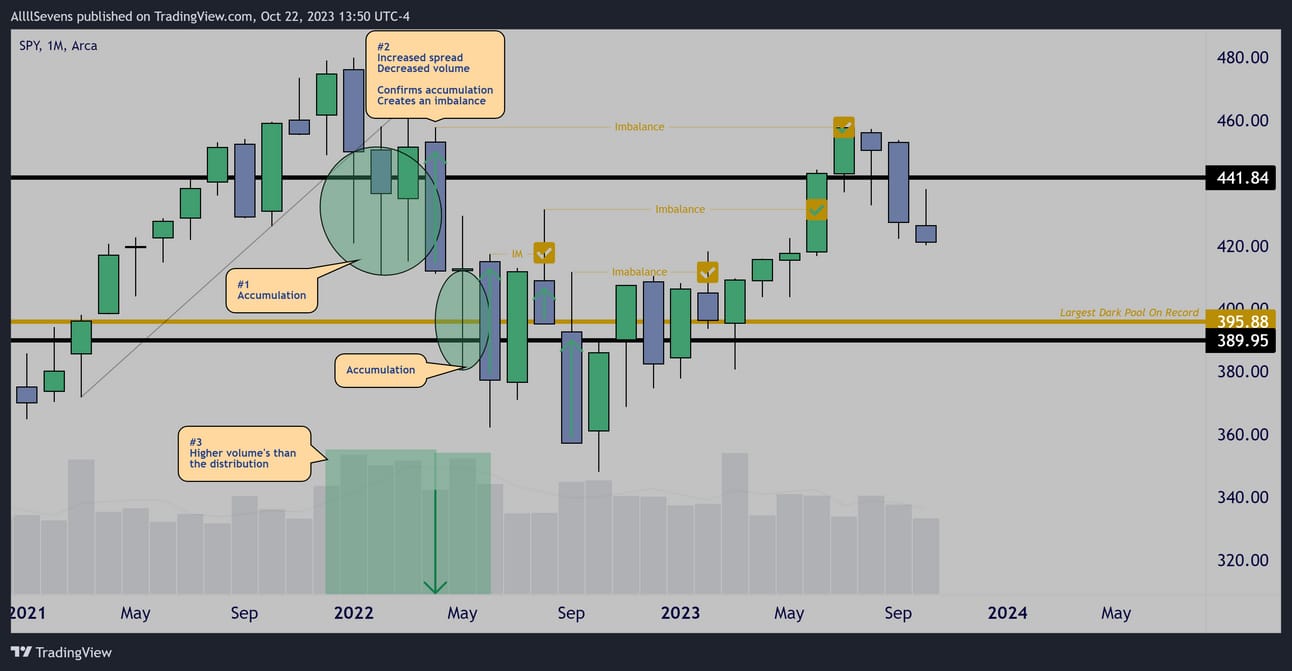

2022 Rebalance, Re-Accumulation & Rebalance

The purpose of the 2021 distribution was to “trap” retail participants and

create liquidity/supply that would be able to full-fill their massive demand when they re-accumulate inside the fear and panic of the trend-break.

When all the FOMO buyers from 2021 started to sell out in 2022, this created the ideal environment for institutions to start re-purchasing the shares they distributed AND some.

Perfectly orchestrated!

#1

As soon as price broke trend, institutions began accumulating.

Visible by the extremely high volume candles with large lower wicks.

#2

Following the accumulation, much like during the distribution;

An increased spread candle with decreased volume pushed price down, confirming the accumulation, showing us that retail participants are driving prices lower, not institutions.

Another large accumulation takes place, and three more imbalances are created relative to this candle.

#3

You’ll notice the volume during this accumulation is higher than the distribution from 2021, confirming that this was a RE-accumulation and the end-goal was to become net-long the market.

So, now you should have an understanding of how this all works.

What’s happening now and why is the 2021 sequence relevant today?

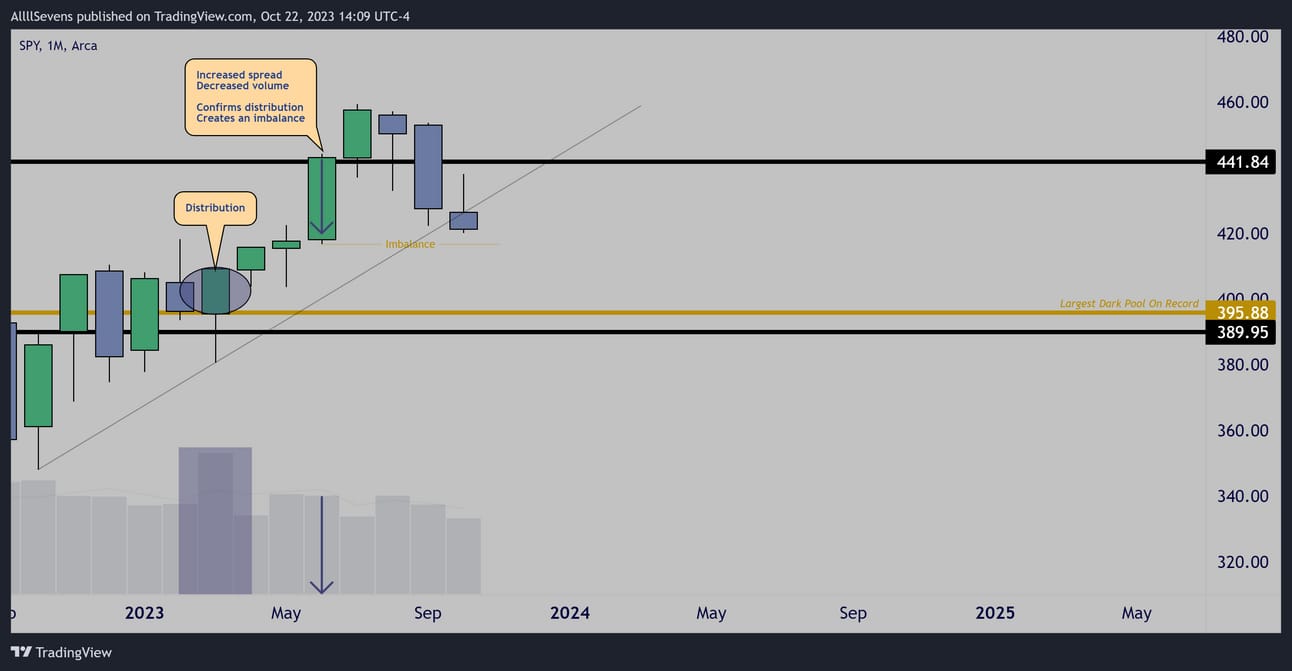

2023 Distribution & Imbalance Creation

The same exact pattern as 2021 has repeated itself.

At some point this imbalance will be fulfilled and institutions will likely re-accumulate once again.

2023 Distribution & Imbalance Creation

Weekly

On the weekly time frame you can see this recent distribution with even more clarity. You can also see an imbalance below $400

Also notable is price currently breaking a multi-week false up-trend.

Conclusion

As a long-term investor in the market, there is no reason to be an aggressive buyer at this time.

Whether the market bounces here short-term or if it is on it’s way to rebalance right now-

The imbalances below WILL get fulfilled and price will be sub $400 eventually.

When that happens, I will still be writing this newsletter, and theoretically, upside imbalances will have formed and it will be time to start accumulating shares!

Until this happens, my overall stance on the market is bearish.

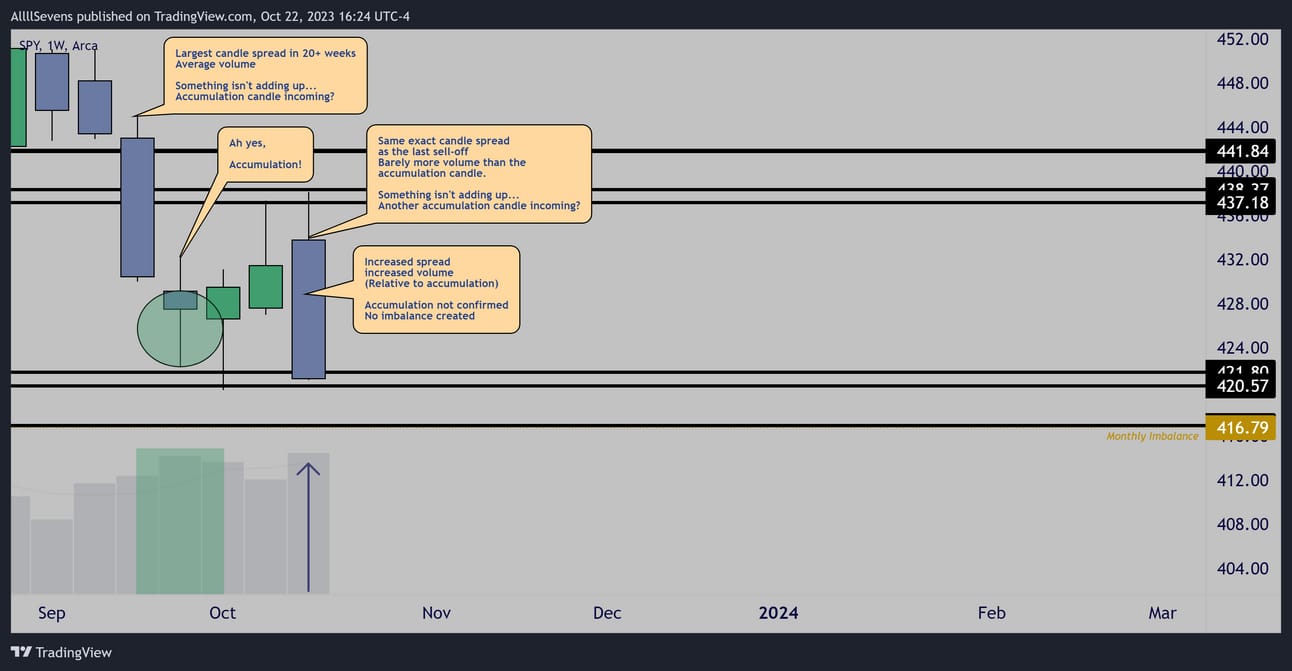

Let’s talk more short-term:

Is this current breakdown tradable?

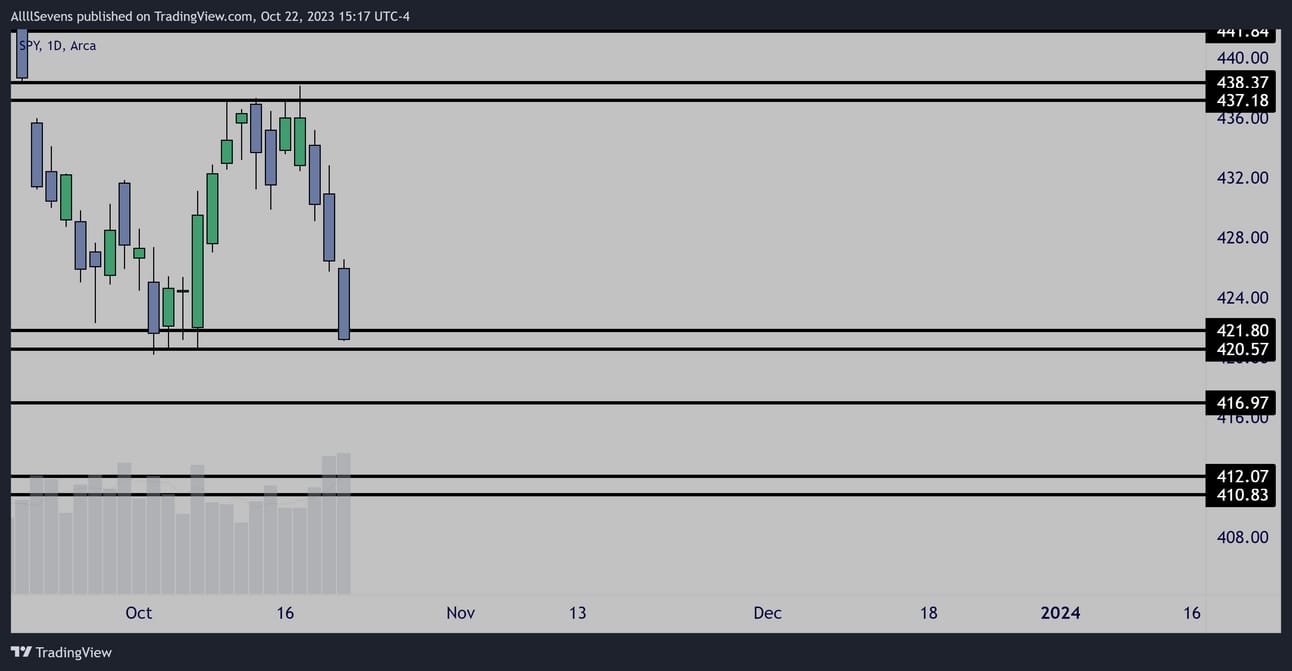

Daily Dark Pools

As you drop the the Daily chart, many more Dark Pool levels are visible-

These levels will act as great support/resistances in the coming week.

Back to the weekly chart:

Weekly

Previous area of Daily dark pool accumulation

As the weekly chart breaks a multi-week trend and bearish engulfs on high volume, it is sitting right at a DAILY support, with the monthly imbalance lying just below those supports.

Last week’s candle (relative to the accumulation candle) was an increased spread and a slight increase in volume, technically not creating an imbalance and so I’m not seeing a long signal here.

At the same time, things aren’t adding up for the bears-

This candle should have much higher volume.

Conclusion (short-term)

There are only downside imbalances right now-

So it’s rationale to prepare for / expect more downside from here.

However, like I was just saying, this recent weekly candle should have much higher volume-

There are some large names reporting earnings this week almost guaranteeing this week’s candle will be larger in volume…

And if we look at what happened a few weeks ago after a “weak” sell-off, there was an accumulation candle that formed.

I think there’s a chance the same thing happens this week.

Even if this happens, there are no upside imbalances in play, so I am not planning on going long this week.

Overall, anything can happen, and this volume that’s about to come in could also be the death blow! We will see.

Again, there are only downside imbalances right now-

So accumulation candle this week or not, there’s not an actionable long setup here.

Whatever happens-

The fact that these large candle spreads are not backed by large volume confirms the idea that this second round of monthly distribution is once again for re-accumulation purposes.

Institutions have sent price into this false up-trend just to re-buy all of the shares they sold AND SOME when retail starts panicking…

Which is clearly beginning to happen right now!

But, until upside imbalances are created and downside imbalances are fulfilled, there us no reason to buy here yet!

Patience!!!!

When things line up, lives will be changed.

Impatience destroy future opportunity.

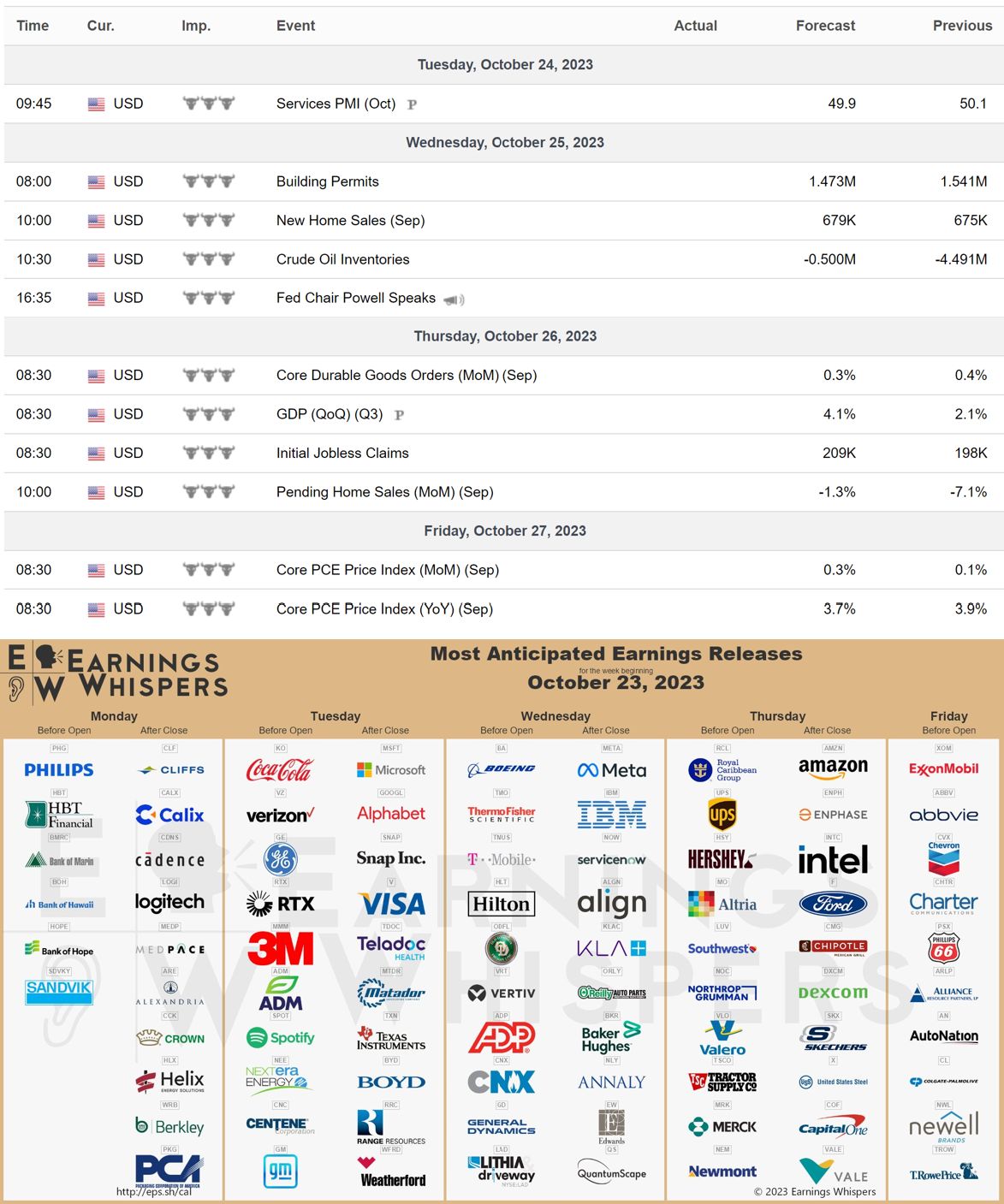

here are the high impact economic events along with the most anticipated earnings releases for the week:

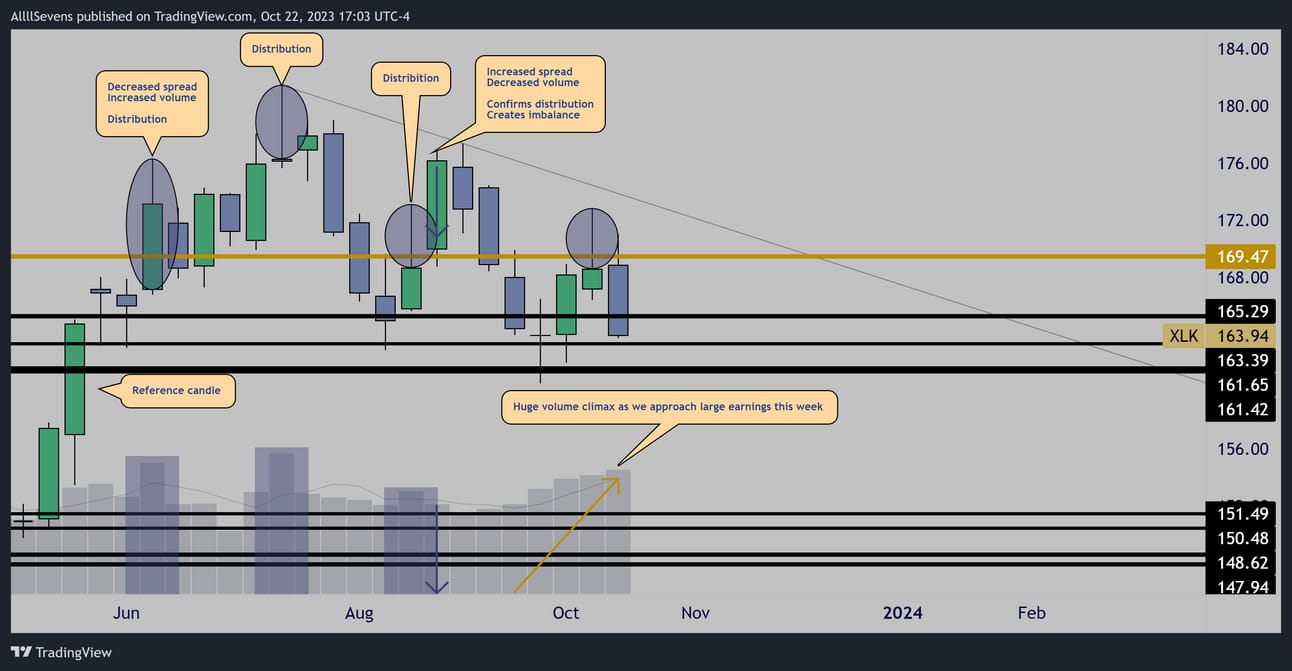

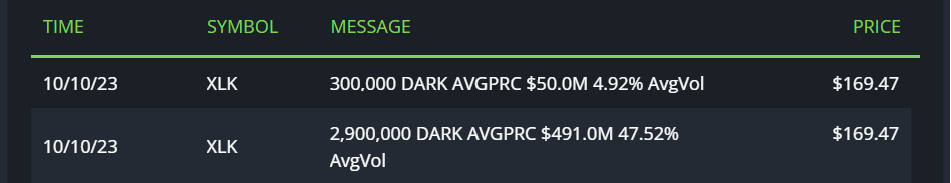

XLK

Weekly Distribution

Massive distribution patterns.

Still sitting over support and has yet to create any downside imbalances.

For an A+ short, I’d love to see this break UPWARDS on an increased spread and decreased volume.

Until that happens, I’m not a breakdown trader-

I’d need to see a break and retest here.

I’m definitely not actively buying the XLK here.

Notable:

Largest Dark Pool On Record

XLK had it’s largest dark pool transaction in almost 3 years the week before last. Extremely notable.

Institutions are definitely preparing for a large move.

This is the #1 weighted sector on in the S&P500

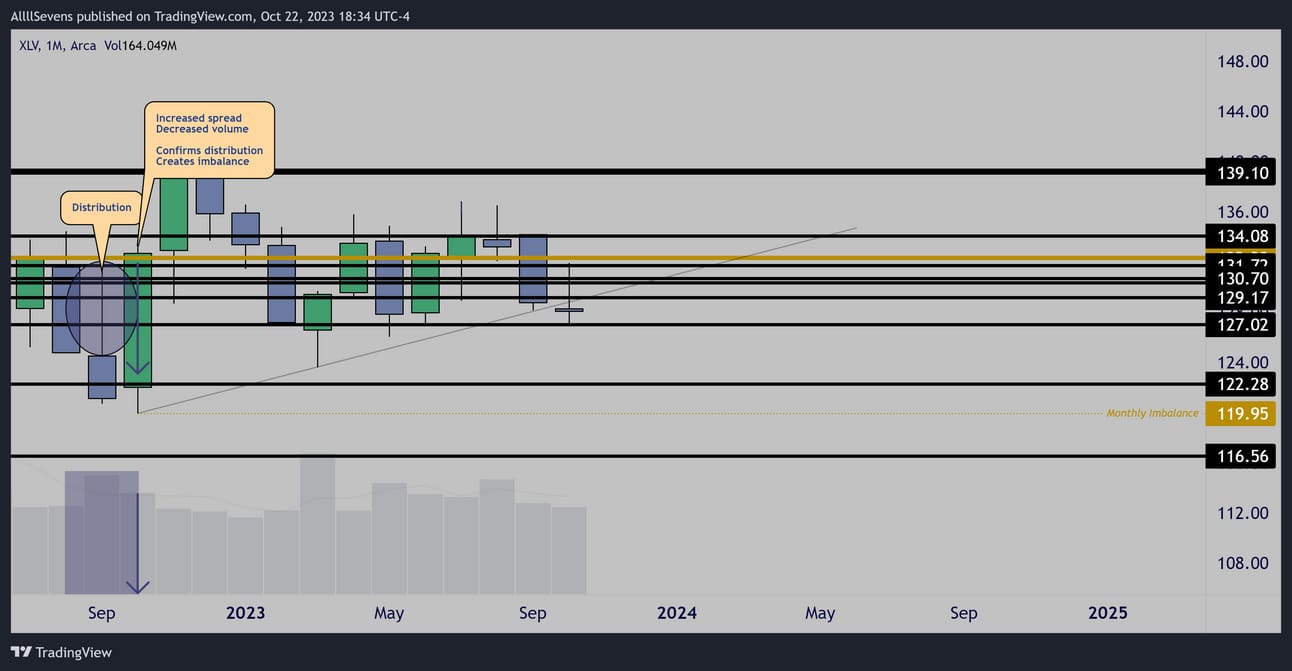

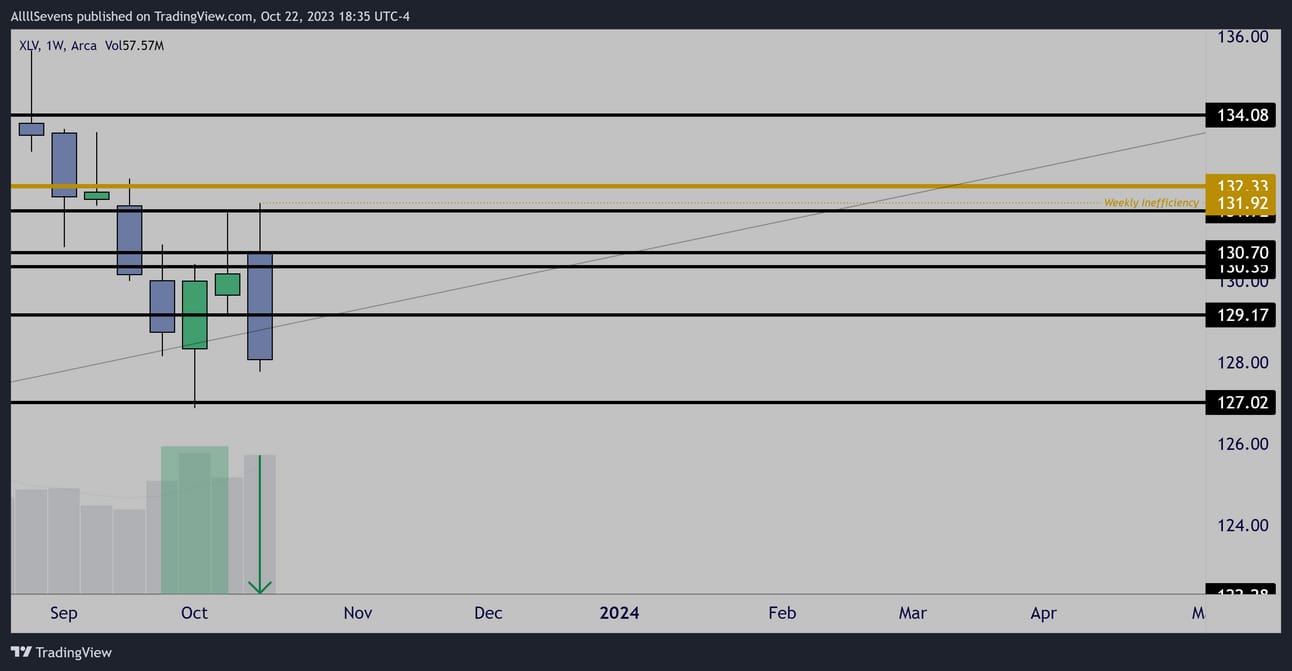

XLV

Monthly Distribution & Imbalance

First off, healthcare is an extremely choppy sector.

Not my favorite to trade.

I am simply waiting for the downside rebalance and I want to buy lomg-term.

Accumulation & Imbalance Creation

The weekly chart already shows aggressive re-accumulation as this is starting to lose trend support.

When this rebalances to the level far below I am a buyer.

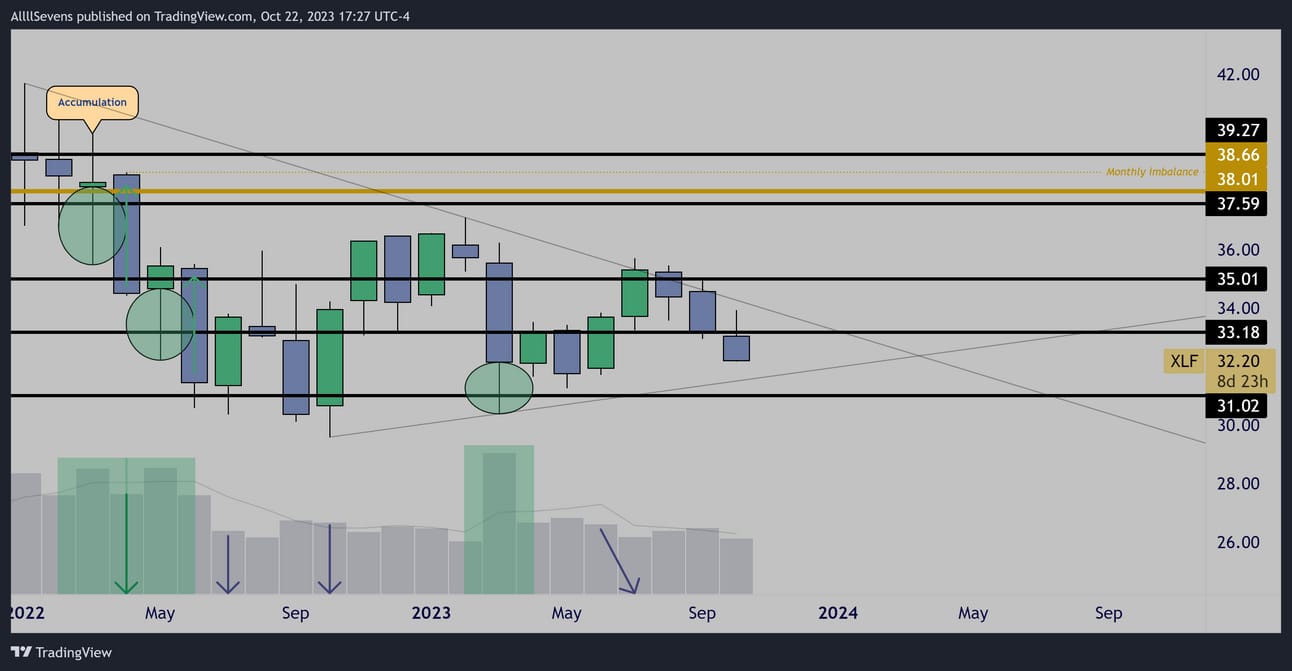

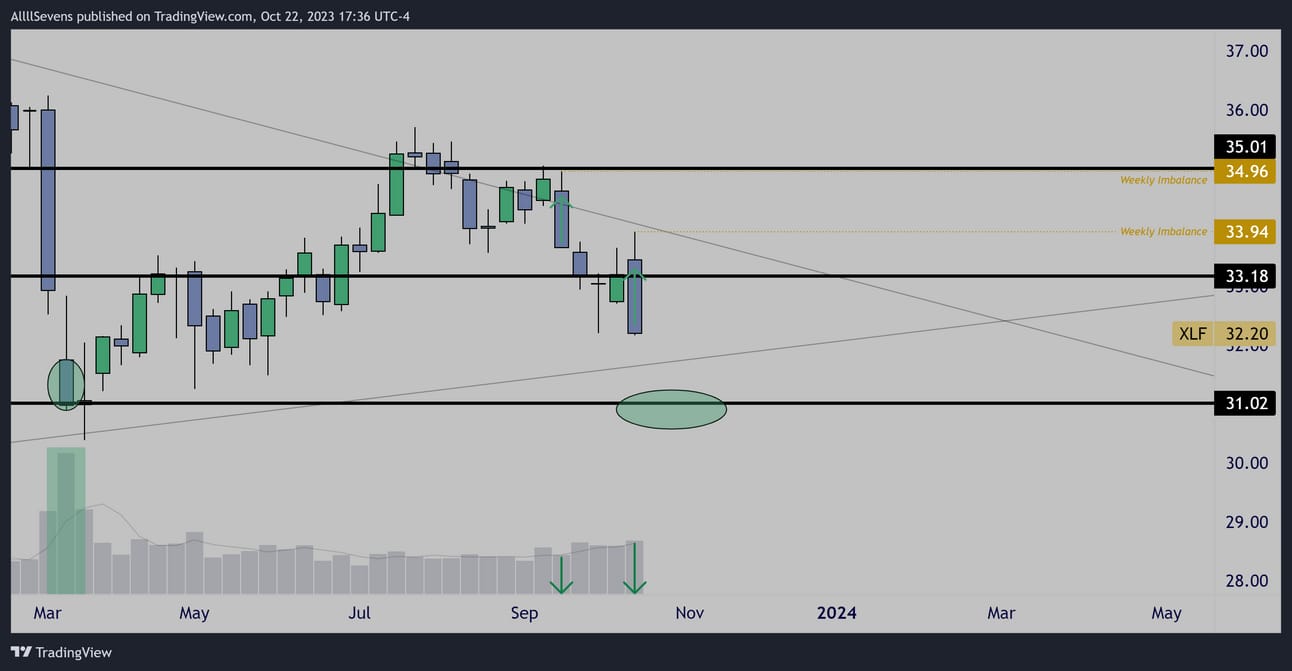

XLF

Monthly Accumulation and Imbalance

Financials look great long-term.

It’s just about timing the entry unless willing to hold for a long time through some uncertainty.

Ideally this bottoms out alongside with the SPY itself.

Weekly Accumulation & Imbalances Created

Just a waiting game…

Don’t really want to go long when price is clearly range-bound / trending down. The options flow is so early on this one unless it makes a freakish reversal in the middle of nowhere and breaks out.

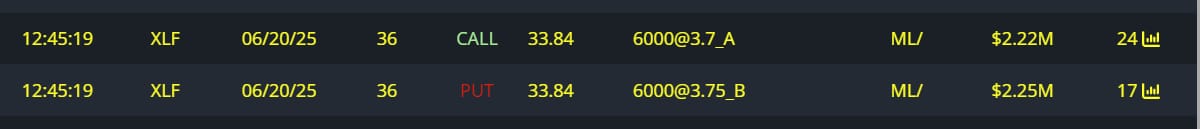

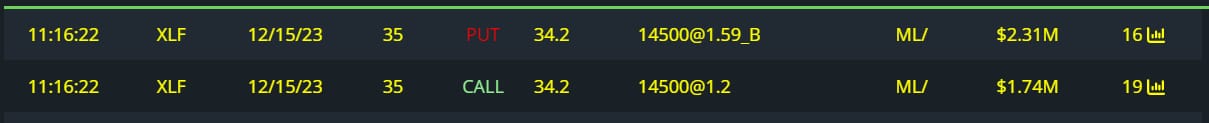

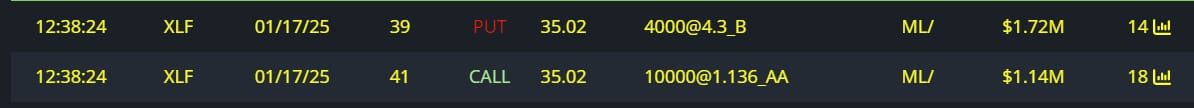

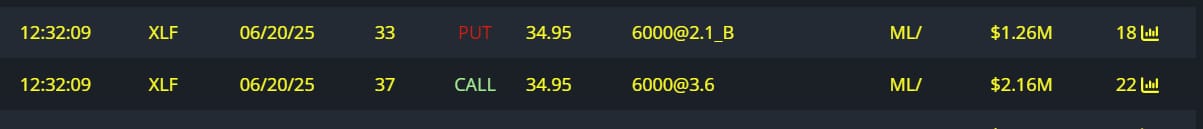

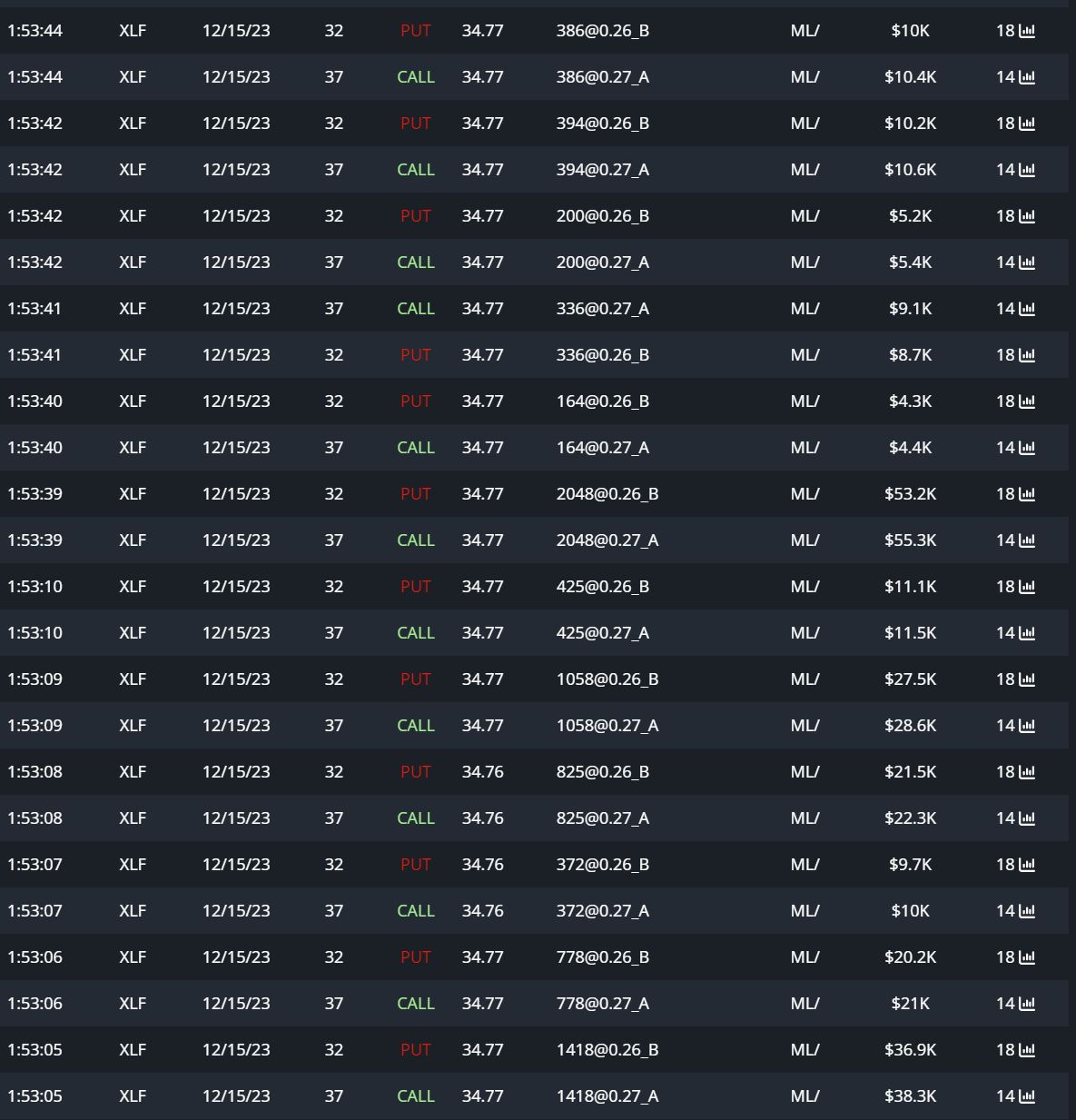

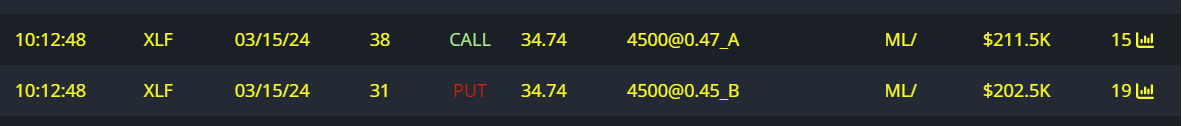

Unusual Options Flow

$4.47M Full Risk Bull

$4.05M Full Risk Bull

$2.86M Full Risk Bull

$3.42M Full Risk Bull

$447K Full Risk Bull

$414K Full Risk Bull

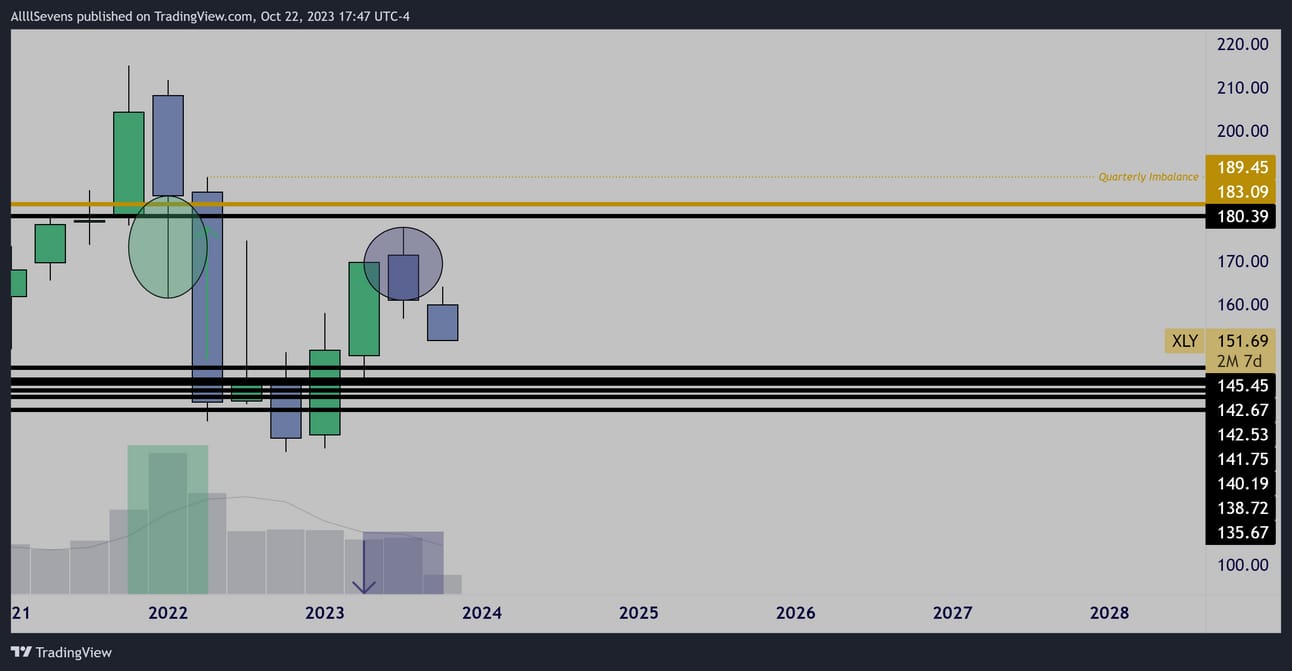

XLY

Quarterly Accumulation & Imbalance

Consumer discretionary has massive upside potential-

My #2 next to financials.

I’d love to see stopping volume at the base below at some point.

For now, there’s no real reason to expect a bounce in thin-air.

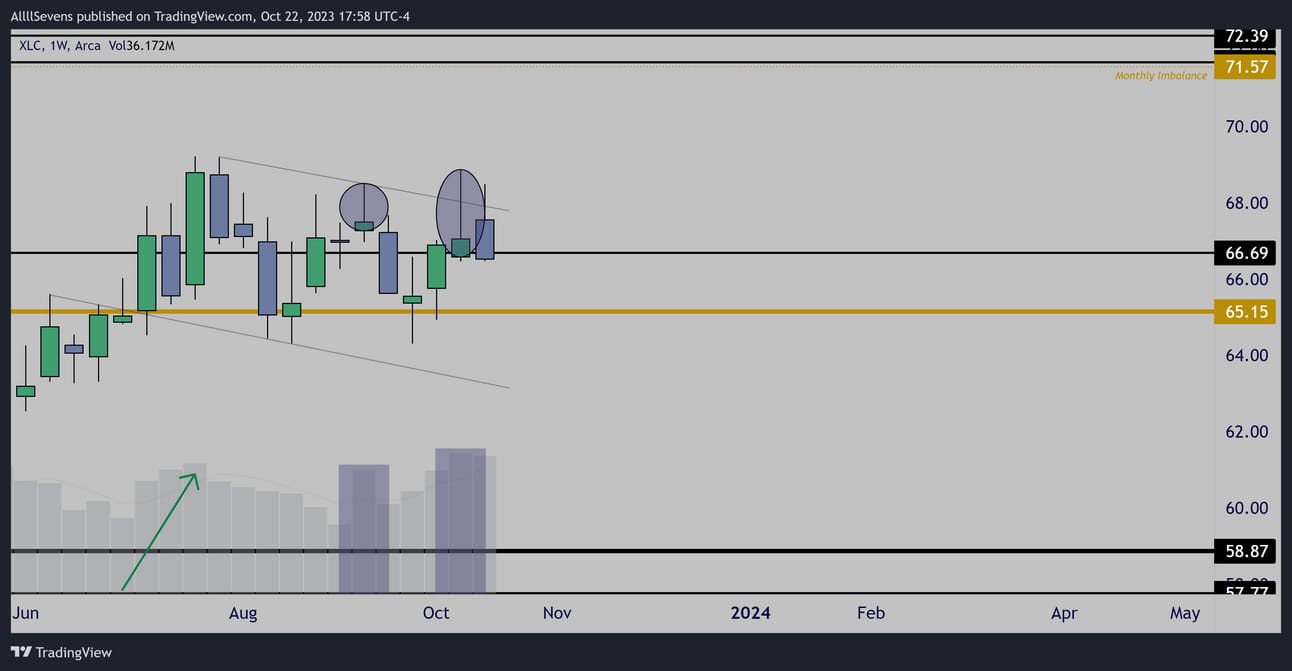

XLC

Accumulation & Imbalances

Communication Services has clear upside potential here-

Price flagging over support,

A very unique look compared to the rest of the market.

But if the rest of the market is not ready to go up, I doubt this would go up all by itself…

Distribution, no imbalances

On a weekly time frame it’s clear institutions are beginning to distribute.

Bulls want to see price continue to hold support and it doesn’t matter that distributions is already beginning, the monthly upside re-balance will occur first.

Definitely a top watch if the market were to turn bullish short-term.

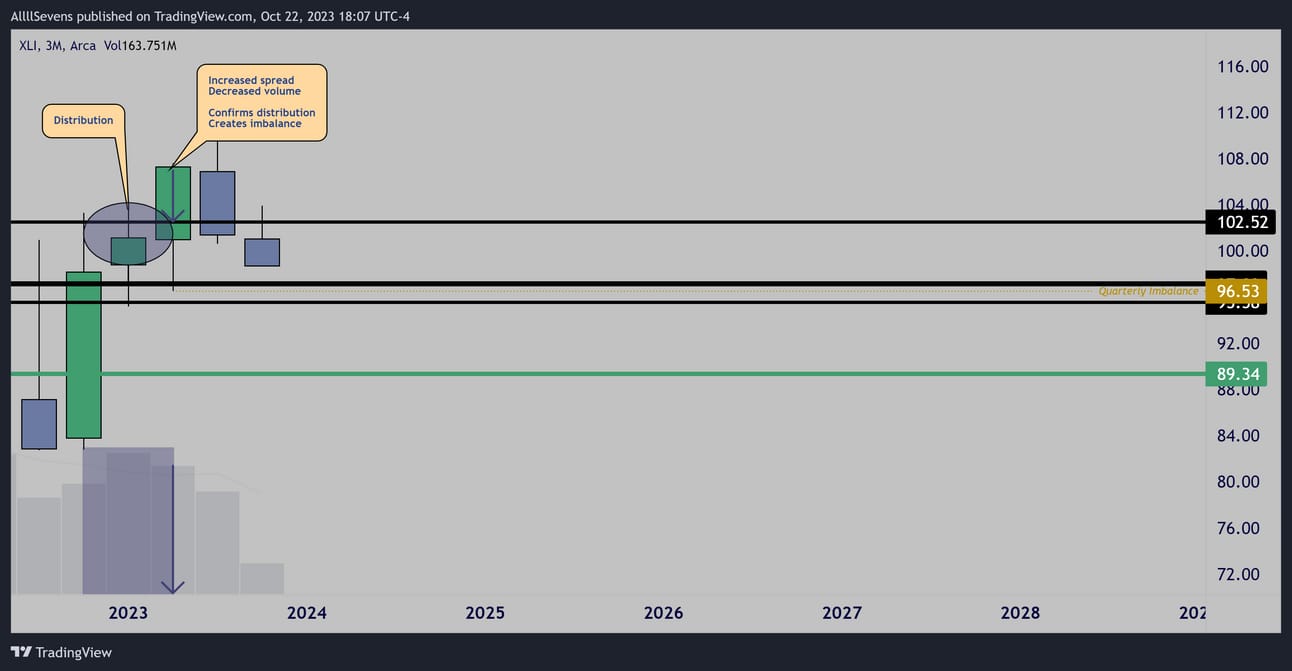

XLI

Distribution & Imbalance

Industrials clearly need a reset and accumulation at lower prices.

Not my go-to sector to trade so not really interested at all right now.

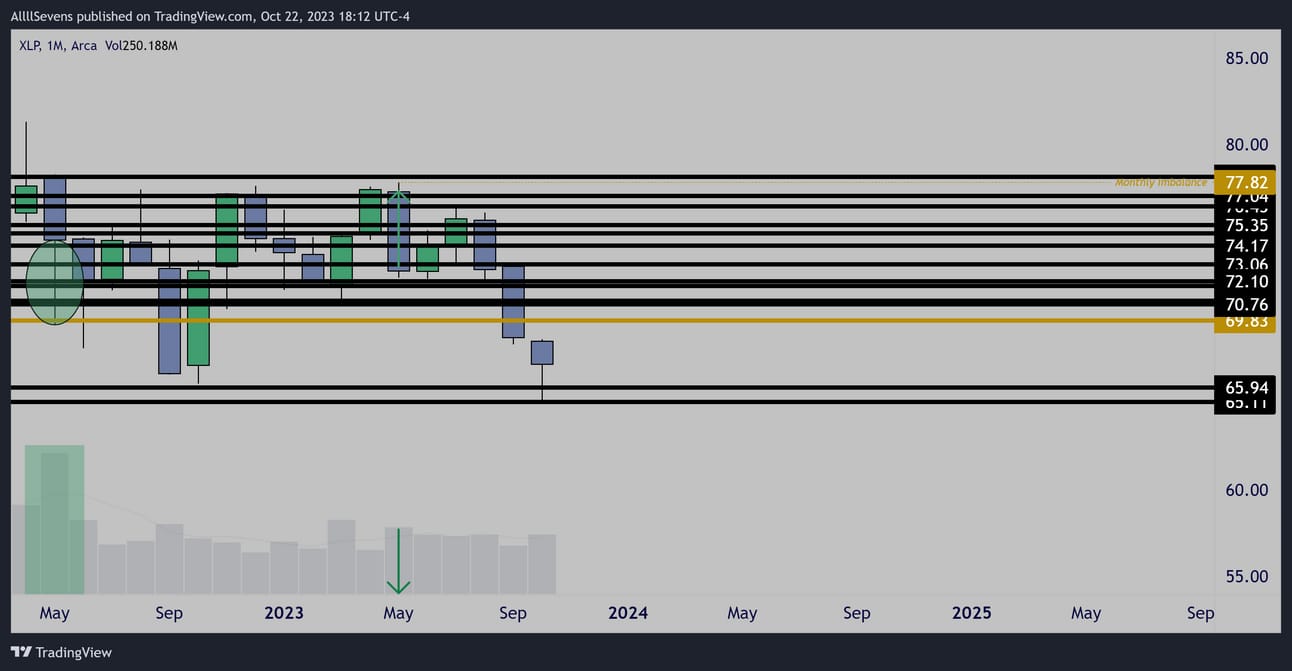

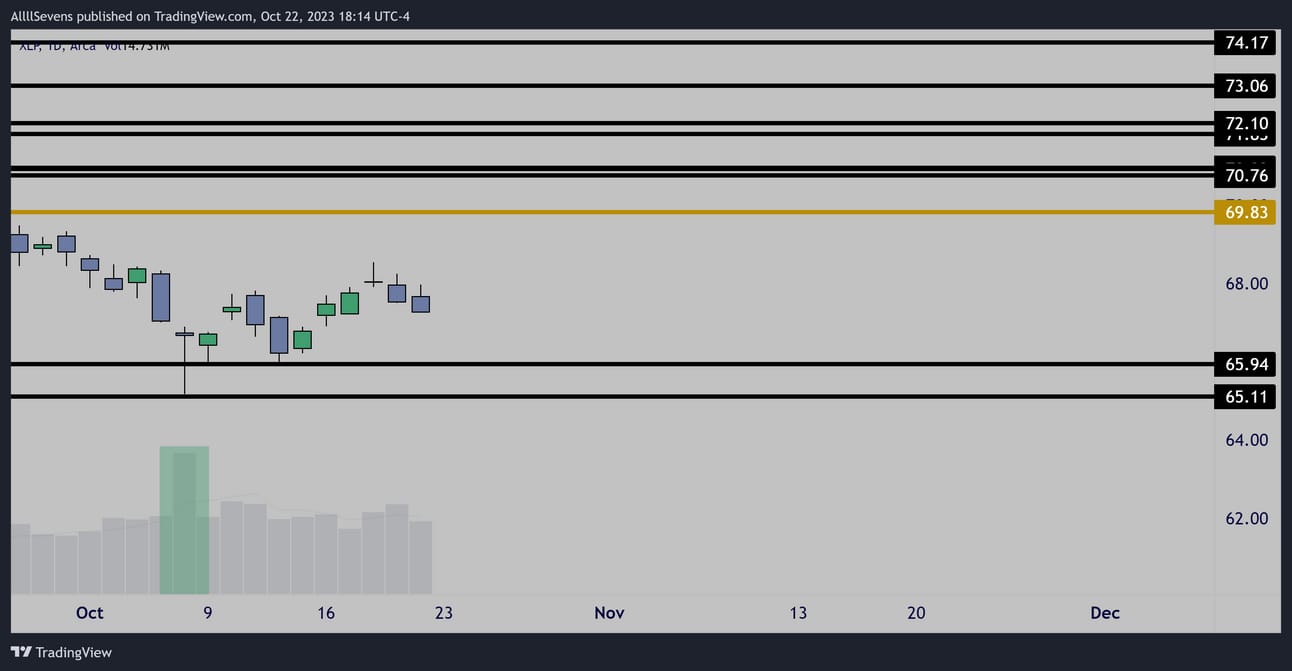

XLP

Accumulation & Imbalance

Accumulation

I think this will base out longer before an A+ entry.

I’d like multiple weeks of consolidation over this support.

One that could outperform whenever tech begins to roll, so i like to see this at lows while XLK is at highs being distributed.

I’m not currently interested in other sectors.

Not until the SPY shows more clear short-term direction.

AllllSevens+

I offer a premium version of this newsletter where I cover individual stocks and not just indices!

I’ll be analyzing hundreds of names to find which ones will outperform or underperform inside the sectors I just covered above.

I also have a Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week.

If you like my work and you want more of it / want to support me this is the way to do it! Would love to see you sign up!

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply