- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 10/9/23

AllllSevens Weekly Newsletter 10/9/23

SPY QQQ IWM ARKK GLD GE

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor.

Institutions own over 60% of the market, so as far as I am concerned:

They control it.

Whatever they are positioned for- I want to position for.

For support & resistance levels I use Dark Pool transactions.

Dark Pools are off-exchange institutional transactions.

They are so large that they cannot be executed in the regular market.

Dark Pool transactions create levels of highly concentrated volume.

Institutional support & resistance.

Accompanying Dark Pools with the utilization of Volume Price Analysis allows me to determine institutional positioning and predict future price movements in the market.

SPY

Institutions are running a bullish campaign on the S&P500

Their current goal is to accumulate as many shares as possible.

They need to fulfill an extremely large amount of orders.

The only way to do this is through manipulation.

Liquidity must be created by trapping “dumb money”

Let me show you what I mean-

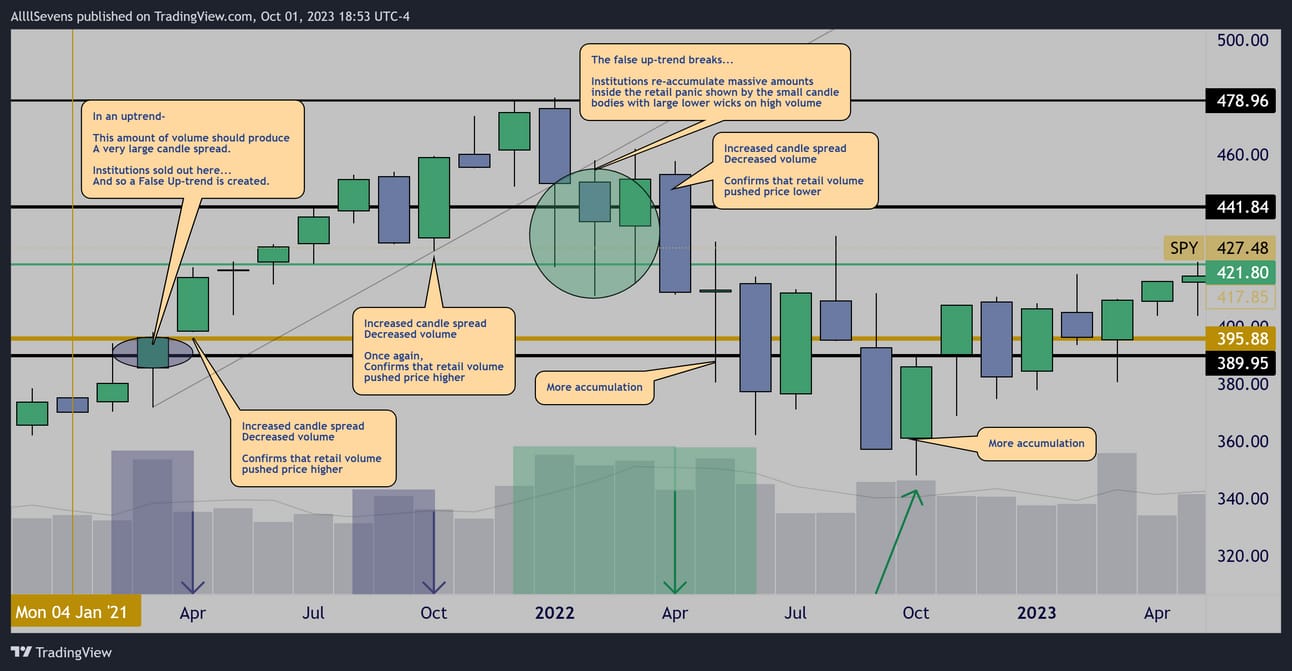

Monthly Distribution & Re-Accumulation

In March of 2021, institutions began their campaign…

They distributed shares and created a false-uptrend.

This is is how they “trap” dumb money.

Eventually, this trend breaks and they are able to re-accumulate all the shares they initially distributed, AND some.

Fast forward…

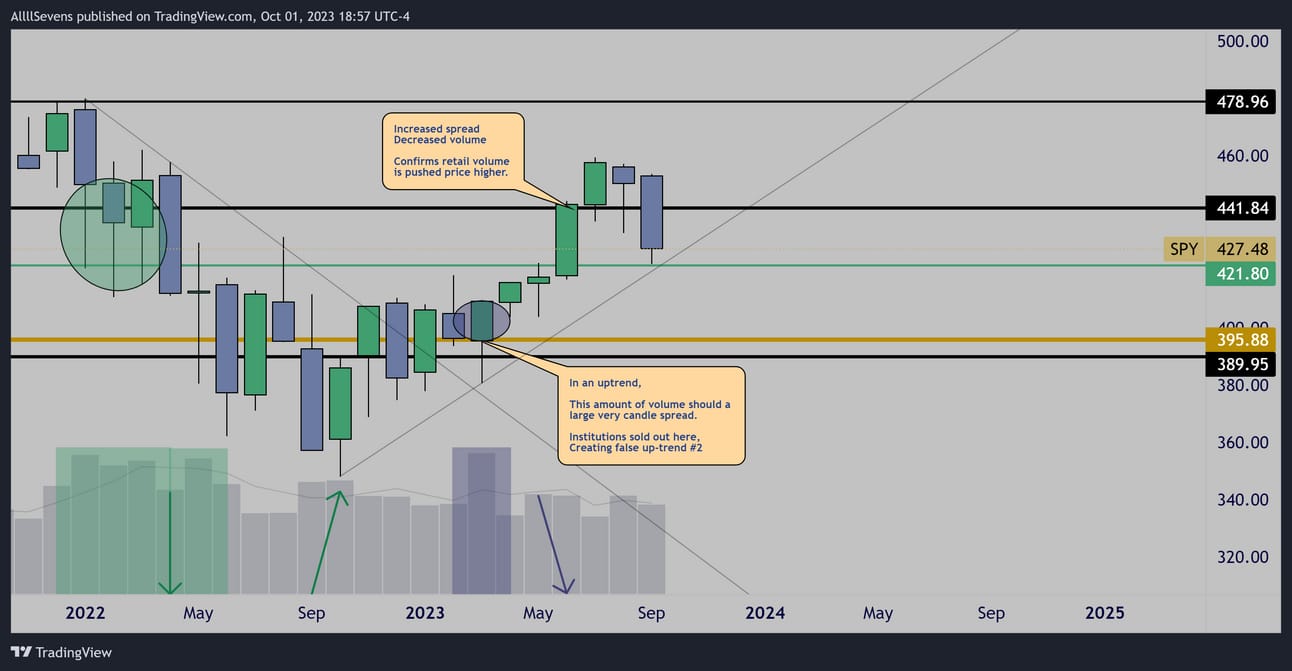

Monthly Distribution

They are doing it again…

At some point in the future this trend will break.

Institutions will again, re-accumulate.

Therefore, my #1 priority for the foreseeable future is building a large cash position for this future buying opportunity.

In the meantime, let’s drop down to the weekly chart and see if there’s an edge for a short-term trade!

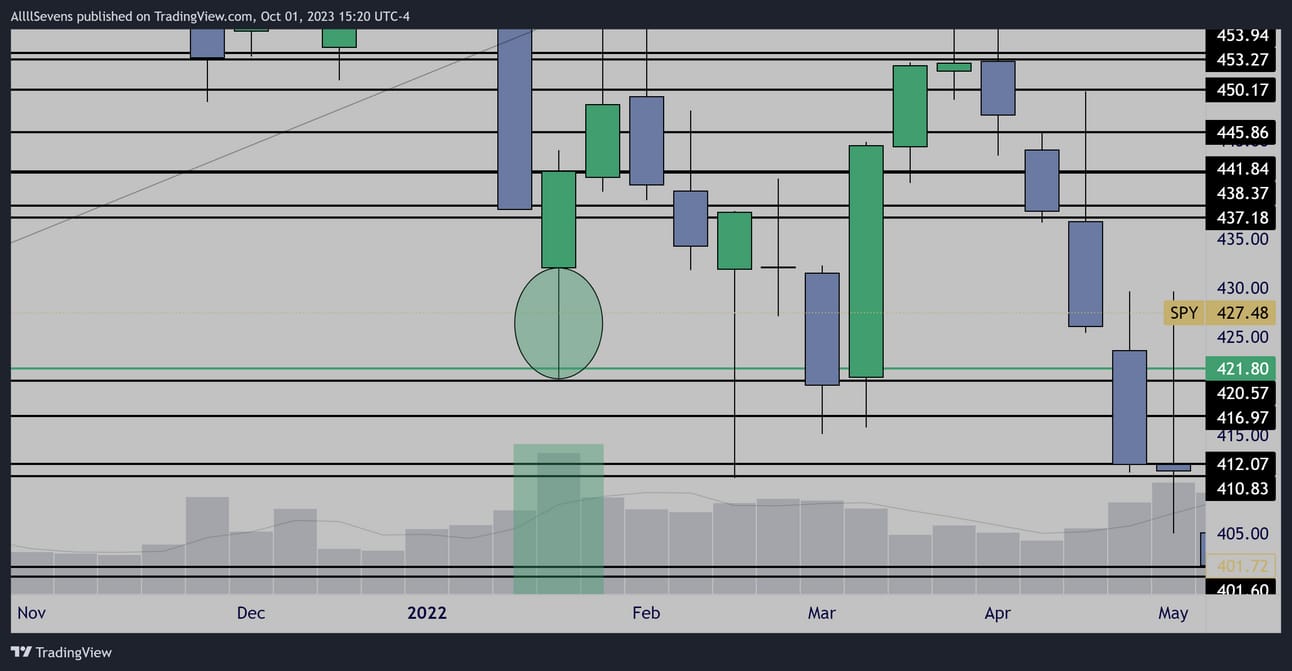

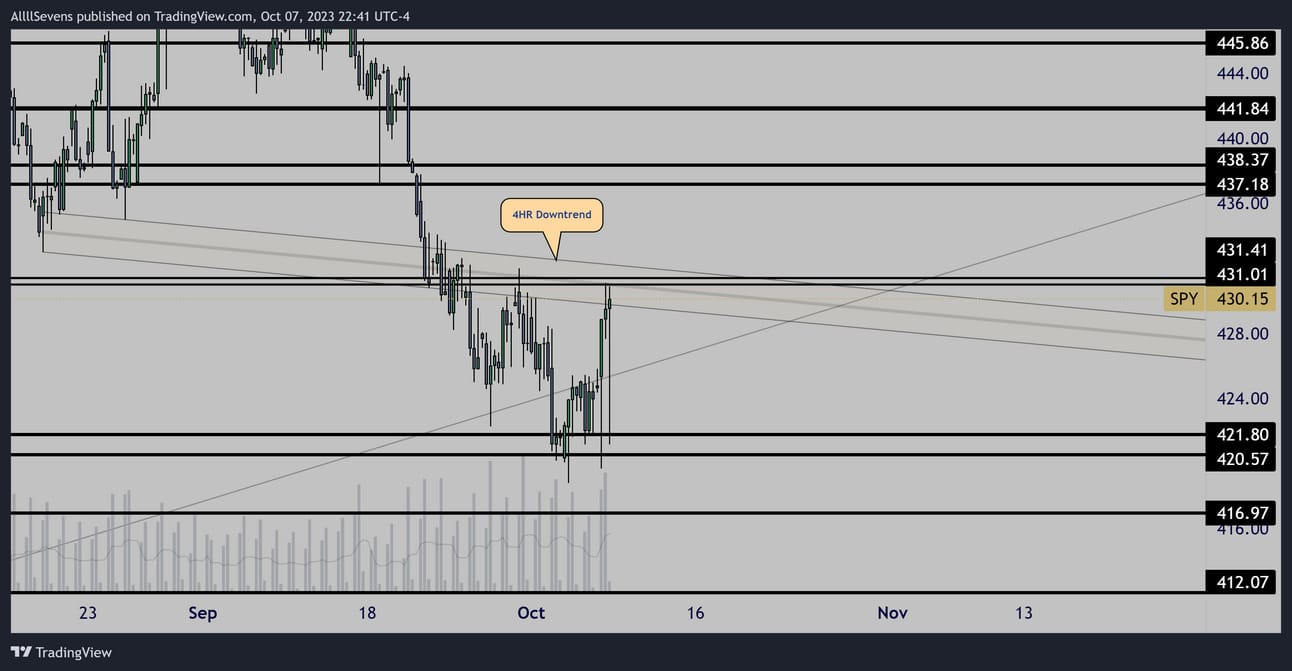

Weekly Trend + $421.80 Support

Weekly Dark Pool

This $421.80 support is special because of the very abnormal amount of volume that occurred here in in January 2022

This was clear accumulation, and it was the largest volume in 2 years.

A very notable support!

Trend + Dark Pool support makes for a extremely pivotal moment.

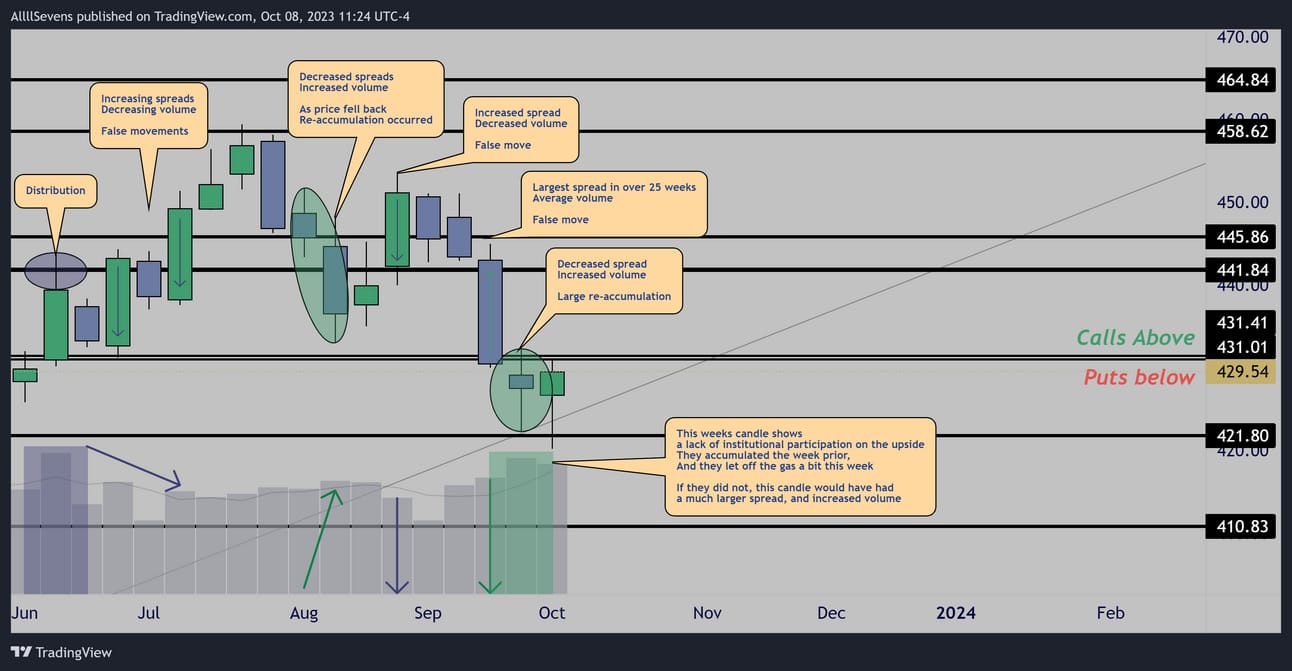

Weekly

Heading into last week, I expected a STRONG reversal from $421.80

We got the reversal… but is it strong?

It’s not an A+ strong reversal. No denying it.

I believe further confirmation is necessary.

4HR

If price can break over $431.41, then bulls can potentially show their strength. I will update this live during the week on my twitter.

if price remains below this resistance, then I think bears have the upper hand. Weekly & Monthly momentum all favor more downside despite the recent bullish volume patterns if this resistance cannot be broke.

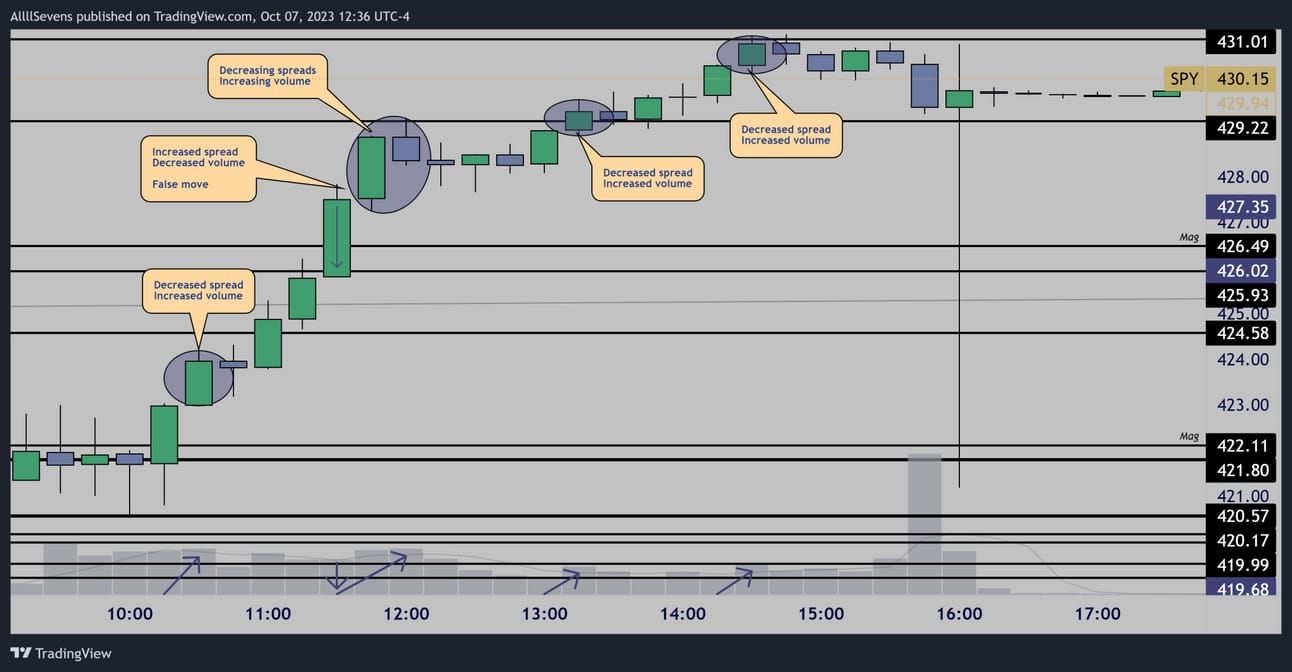

Friday 10/06 (15m)

As you know, I expected a super strong reversal from $421.80 this week!!!

I never saw the proper volume!

In fact,

As price reversed from this support multiple times during the week-

Institutions took the opportunity to re-distribute their shares.

I find this very odd, and it really puts the market in a weird spot..

Conclusion

As an investor in the stock market, I see a buying opportunity in the foreseeable future. The market will have a fearful correction once again, and that is when I want to be a buyer. I do not want to FOMO with the rest of retail while price is currently trending up!

In the short-term (Weekly time-frame) the market is looking choppy.

We see clear signs of prevailing bull patterns recently- but a lack of participation once price actually reverses…

As on Friday, we saw active distribution-

Heading into next week there is one key area to watch-

Over $431.41 bulls could start to take control, especially if we see re-accumulation.

Below $431.01, bears are in short-term control, fighting some overall bullish weekly patterns, which would most likely make for a rather choppy market environment.

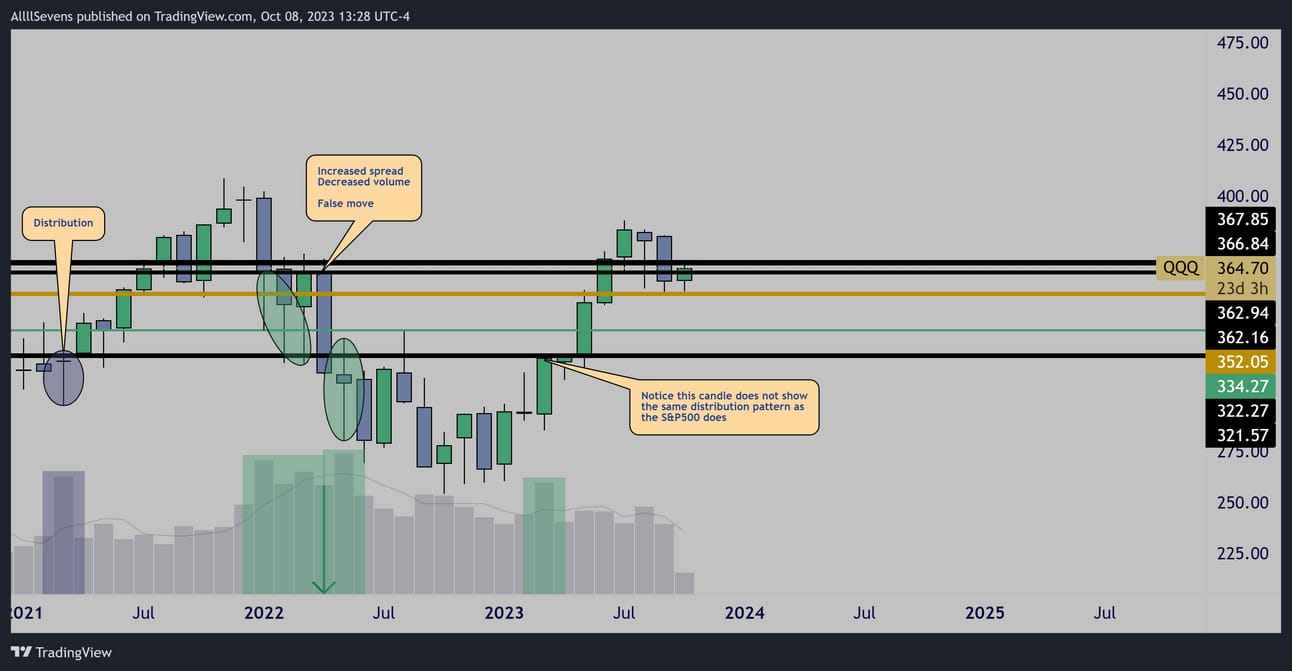

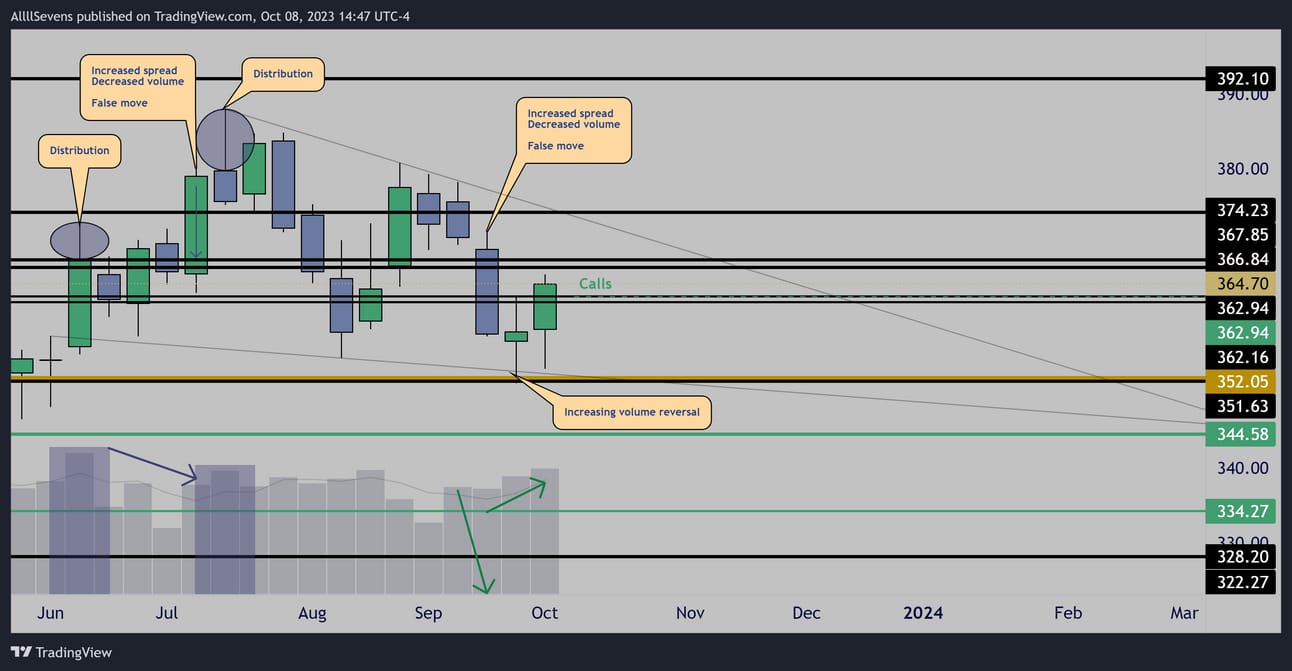

QQQ

While the Invesco QQQ is extremely similar to the SPY in structure, the current uptrend is much more sustainable.

The March candle is not nearly as small, and there was not an increased candle spread, decreased volume anomaly in June.

If the markets bounce here short-term the QQQ could outperform.

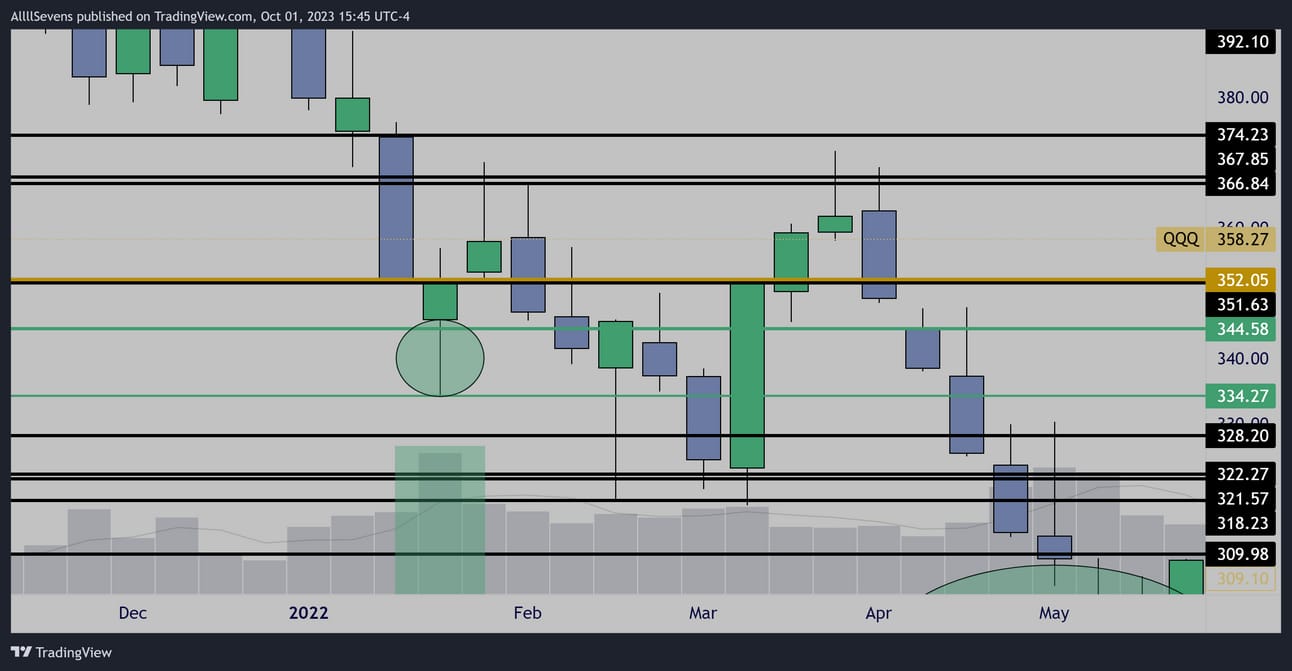

Monthly

Just like SPY, the QQQ just tested a Dark Pool that saw an extremely abnormal amount of accumulation in January 2022

The volume here was the largest in 10 years!

Weekly

Clear relative strength last week, and as long as price remains above $362.94 I’d expect that strength to continue.

Because of the distribution patterns in June and July, I have a feeling this will continue basing over the next few weeks and there’s no real reason to position for a large breakout quite yet. Resistance above needs cleared and held for me to get aggressively bullish here.

Conclusion

Clearly stronger than the SPY,

If the SPY breaks upwards this week, the QQQ would likely continue to show relative strength.

If the SPY holds below resistance this week, I would focus on it rather than the QQQ, as the QQQ may not be as lucrative to the downside-

The fact that the QQQ is over support while the SPY is below resistance further adds to the idea of a potentially choppy environment.

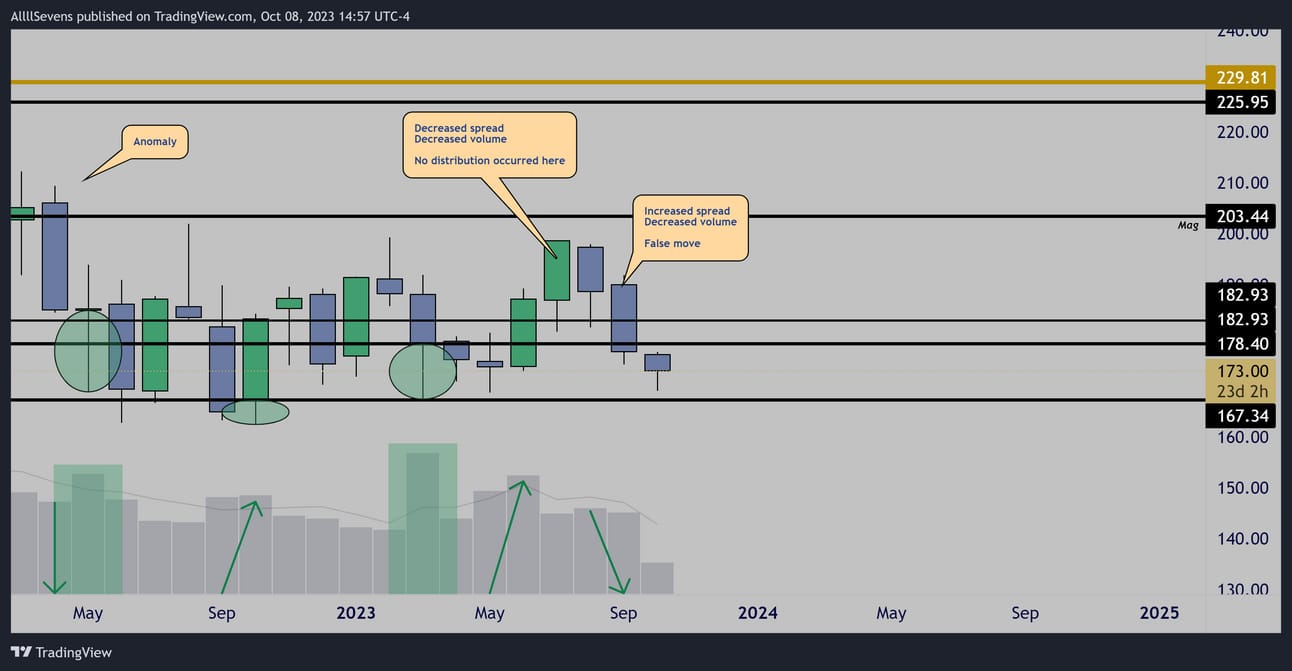

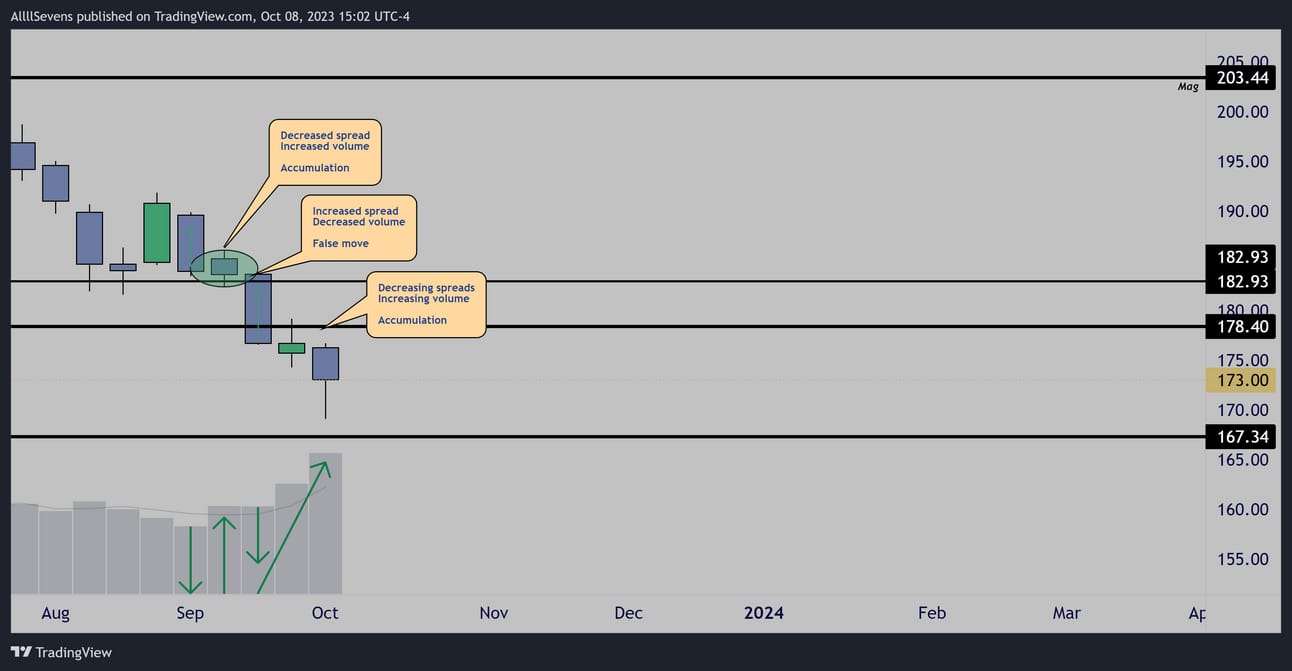

IWM

Monthly

The Russel 2000 is a unique chart, far different than the other indices.

There is clear accumulation here, and a false sell-off in April of 2022 suggesting $203.44 will be retested.

On the most recent high, there was also a false sell-off that started just shy of that resistance.

If am anticipating buyers to step in somewhere down here and take price back to the $203.44 dark pool eventually.

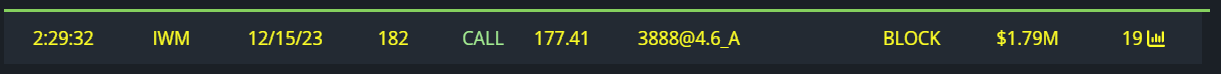

IWM

Clear accumulation on the weekly chart here as it loses support.

I have my eyes all over a reclaim, or a test of $167.34 below.

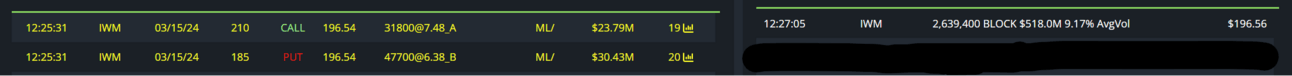

Unusual Options Flow

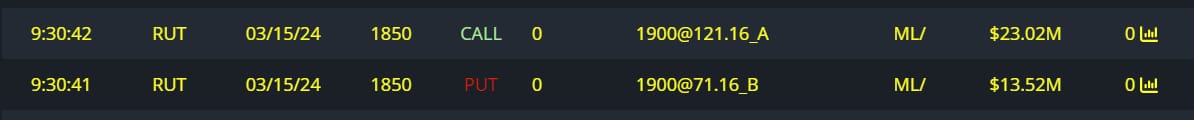

$54.22M Full Risk Bull

+

$518M Dark Pool

$36.53M Full Risk Bull

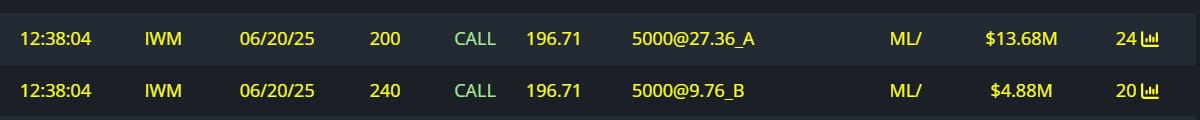

$8.8M Bullish Call Spread

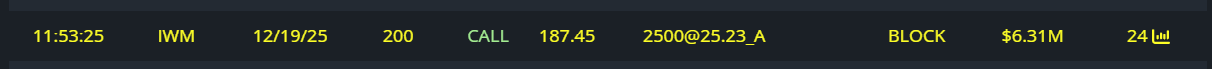

$6.31M Calls Bought

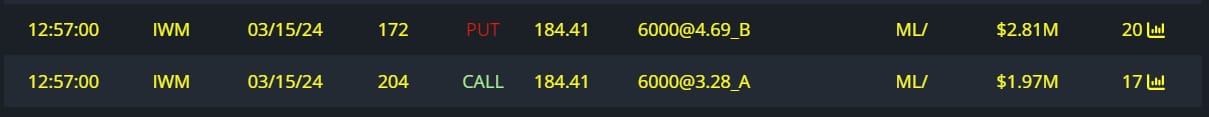

$4.78M Full Risk Bull

$1.79M Calls Bought

$1.29M Puts Sold

$1.28M Calls Bought

$472.5K Calls Bought

Conclusion

This is shaping up to be my favorite index because of the simplicity.

We are just waiting for a true reversal confirmation.

Reclaim support above, or test the support below.

For now, I’m not confident enough to slam the table. Waiting.

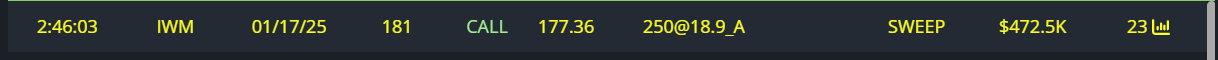

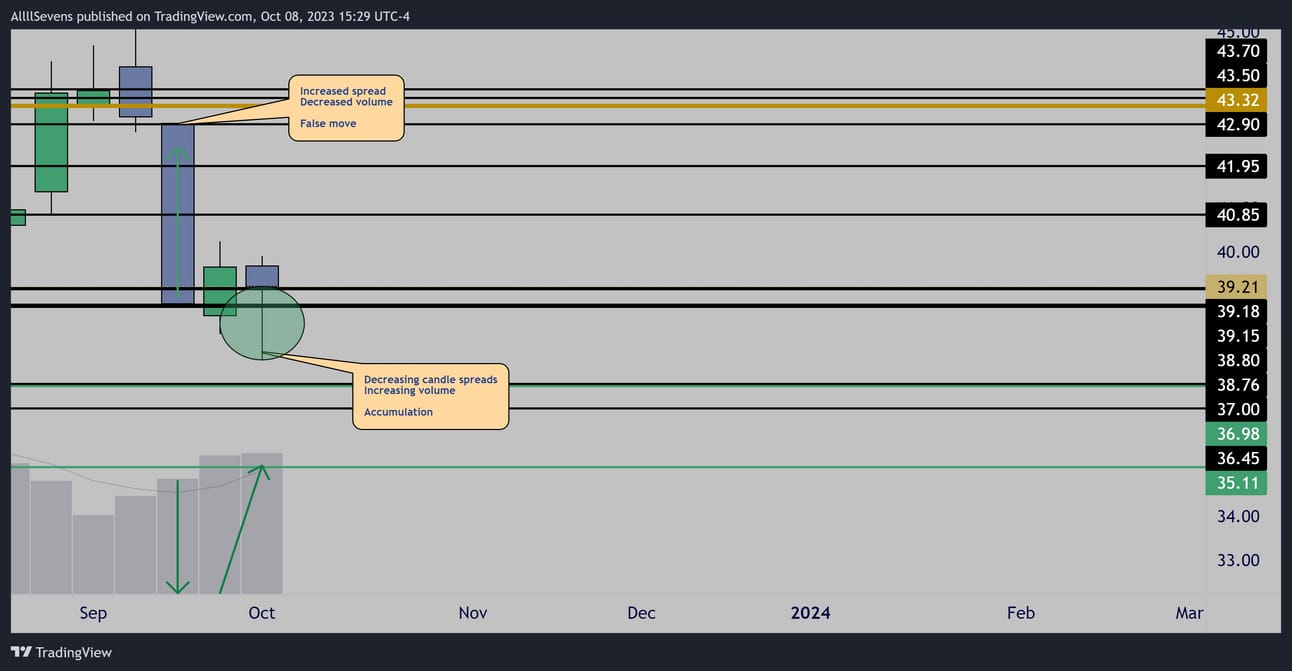

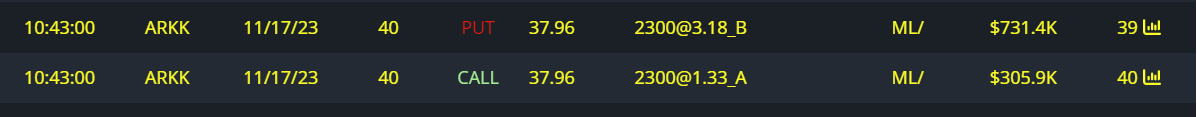

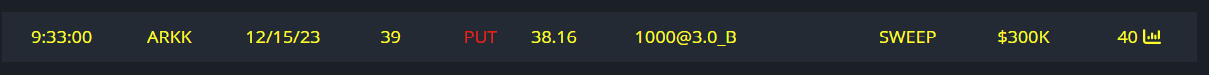

ARKK

Monthly

Huge accumulation in May 2022 creating a massive base.

Weekly

I am seeing a clear anomaly sell-off followed by some very aggressive weekly accumulation.

Unusual Options Flow

$1M Full Risk Bull Order

$300K Puts Written

Conclusion

If this $38.76-$39.18 support continues to hold this week, there could be strong relative strength on growth names, specifically in the ARKK ETF

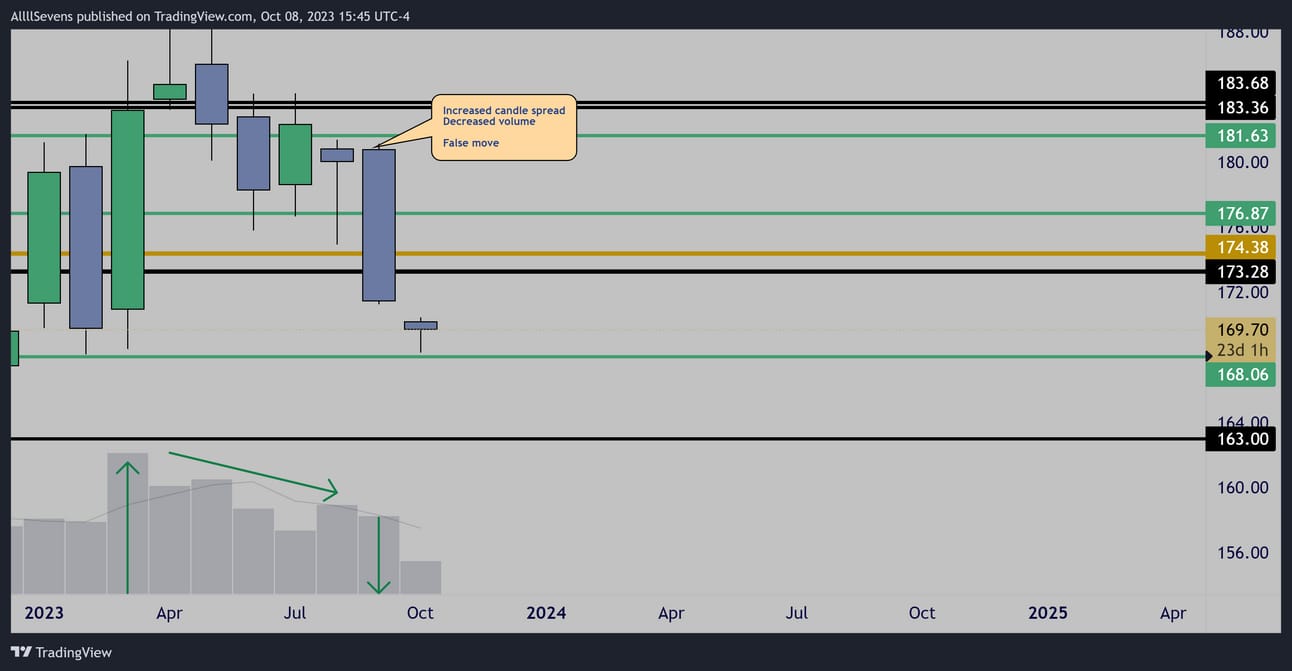

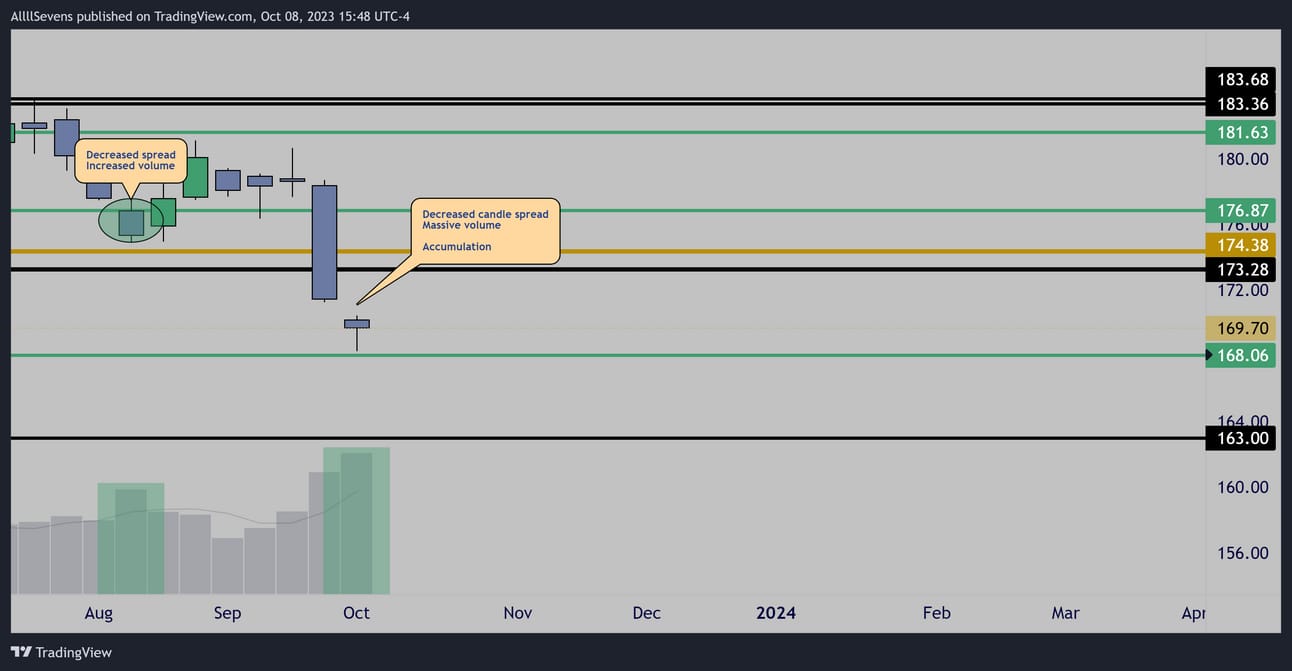

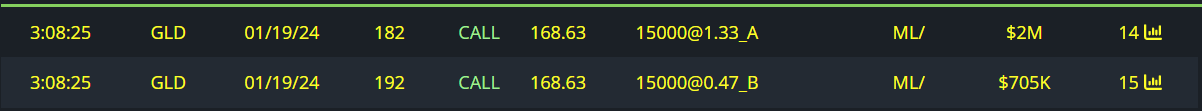

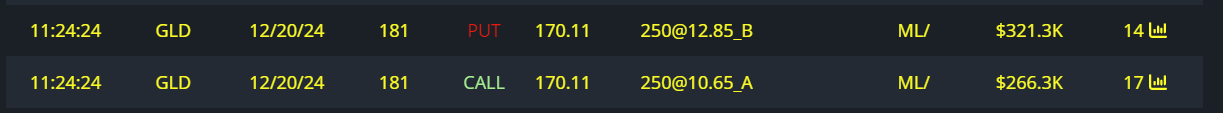

GLD

Monthly

A week sell-off on the monthly time frame…

Appears to be in a bullish consolidation.

Weekly

Very aggressive weekly accumulation-

I would love to see the $168.06 level tapped and held for an entry long.

Unusual Options Flow

$28.66M Full Risk Bull

$2.7M Bullish Call Spread

$587K Full Risk Bull

Conclusion

I alerts set for the lower support touch-

If that level can get tested and held this could see a large short-term bounce.

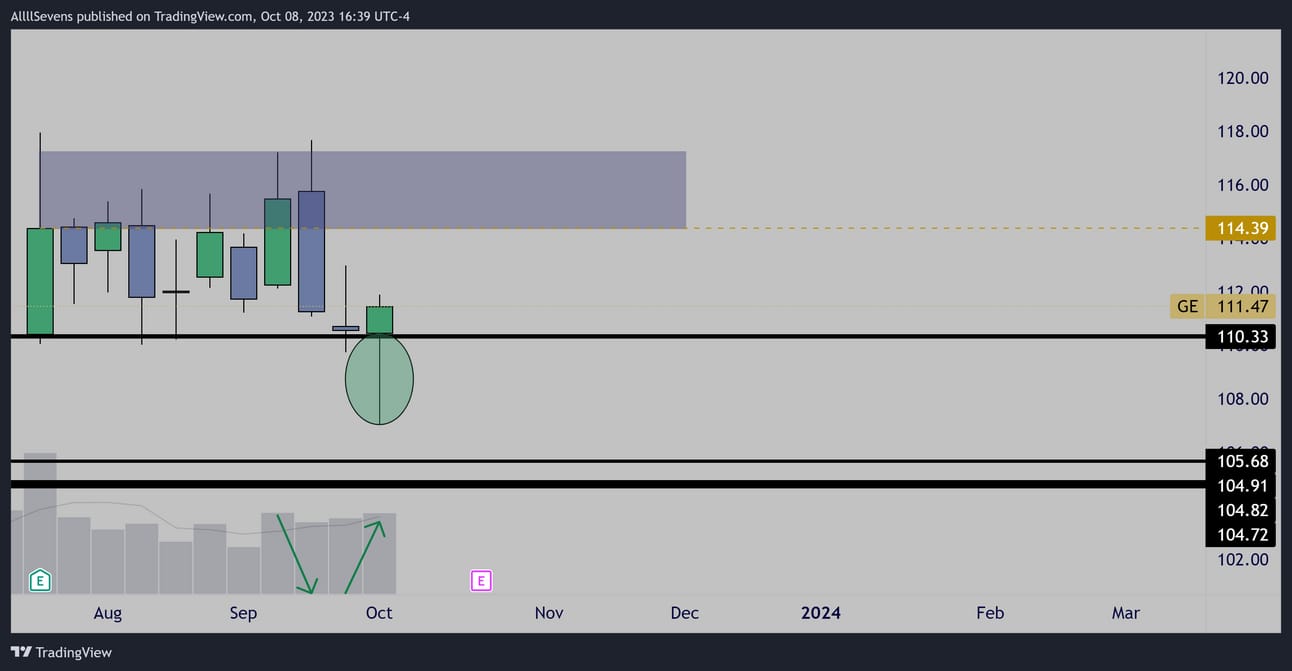

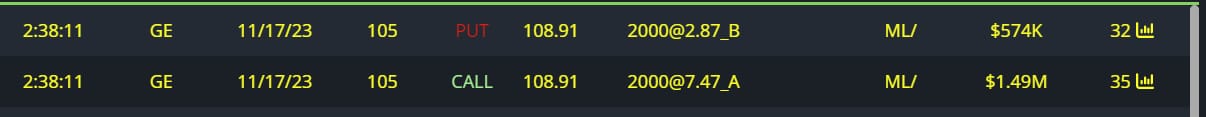

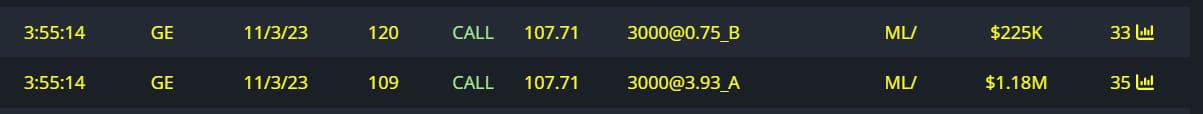

GE

Weekly

A week sell-off bringing price back to support-

Getting caught on increasing volume…

Unusual Options Flow

$2M Full Risk Bull

$1.1M Full Risk Bull

$950K Bullish Call Spread

$680K Bullish Call Spread

Conclusion

All of this flow was coming in last week below support, I sent it out live in my Discord-

Upon the weekly close this looks like their is potential for upwards continuation as long as support continues to hold.

Thank you for your time.

I am very passionate about what I do and it is extremely rewarding to know that there is even one individual person opening this each week to consider my perspective. I hope you find value here.

Make sure to stick around for next weeks newsletter!

If you have any questions, concerns, or suggestions please email me or message me on twitter.

I would love to hear from you.

[email protected]

https://twitter.com/AllllSevens

If you like my style of analysis, consider upgrading your subscription…

I write a premium newsletter as well!

The premium newsletter is not sent out on a scheduled basis, I simply send it out whenever something absolutely A+ sets up often in the middle of the week.

It is only $7.77 per month!

You also get access to my Discord community!

I have channels/forums for every single stock I have ever analyzed that I update on a consistent basis with any volume anomalies or unusual options flow.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply