- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 11/06/23

AllllSevens Weekly Newsletter 11/06/23

SPY QQQ VIX/UVXY IWM

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor.

I use two tools:

-Dark Pools

Large institutional transactions that create price levels of highly concentrated volume. Highly concentrated volume at specific prices create strong support & resistance- Institutional support & resistance.

-Volume Price Analysis

Analyzing the relationship between candle spreads/wicks & volume to determine institutional accumulation or distribution.

VPA also validates or invalidates institutional participation in trend.

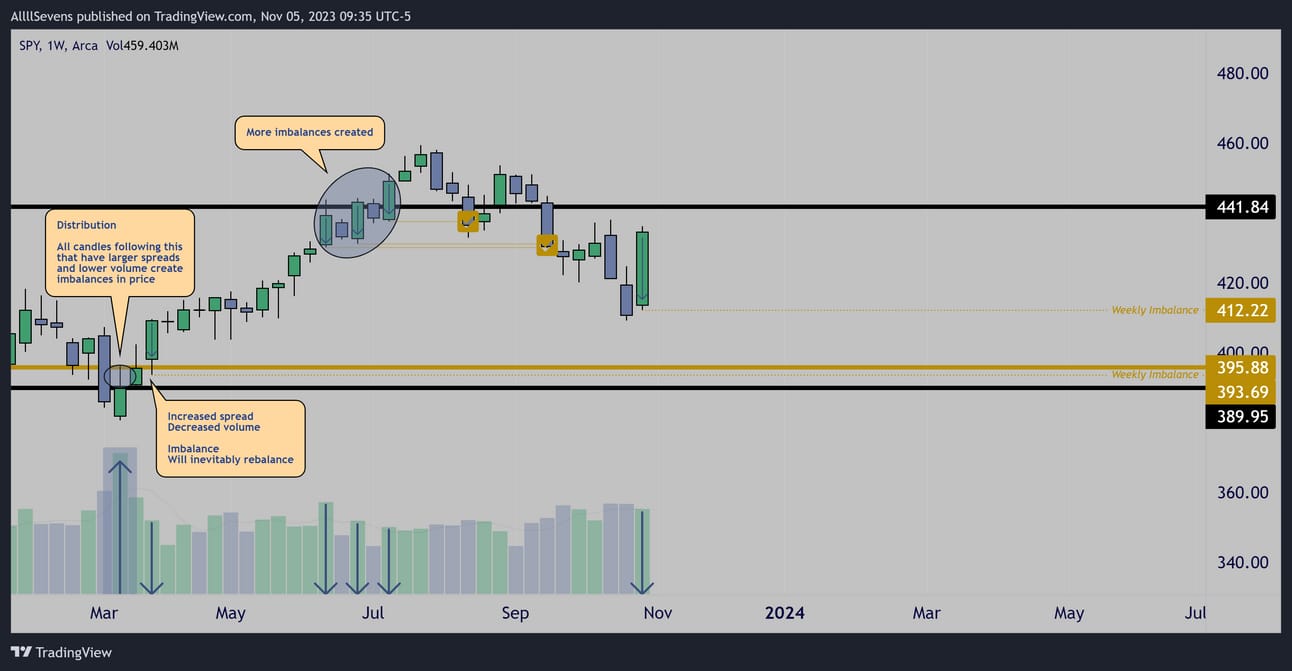

SPY

Weekly Distribution & Imbalances

There are two downside imbalances that will inevitably be rebalanced.

This is obviously my #1 priority-

Getting a swing entry short to target those imbalances.

$441.84 Dark Pool / Trend Line

A huge barrier lies just above…

It’s very possible price rejects here and continues trending down.

Of course, it’s also possible that price breaks through and continues the seasonal rally into EOY before further exhausting itself, creating more imbalances, and inevitably trends down again.

Keep your head on a swivel and always be ready for anything!

One thing is for certain.

The SPY will rebalance to the downside.

One thing is not for certain… When.

Institutions have all the time in the world.

You’ve heard the common saying;

“The market can remain irrational longer than you can remain solvent”

This is exactly the retail disadvantage and the intuition’s edge.

It doesn’t matter to them when price rebalances. Only that it will.

Keep this in mind IF the market breakout and does not remain in the short-term downtrend. Keep losses small and prepare to strike again.

Daily Dark Pools

Here are some of the largest Dark Pool levels on record for the Daily time frame and below! These levels can be extremely useful for identifying large barriers in price as well as intraday volume patterns.

You can see there are two major resistances before the $441.84 dark pool would be tested.

Conclusion

The SPY will inevitably to go down from these prices.

The weekly imbalances below are my #1 focus.

As price approaches $441.84, the R/R for shorts is extremely favorable targeting $412.22 & $393.69

However…

I want to maintain a relatively neutral bias.

And I want to place a heavy focus on where the QQQ opens and how it acts to begin the week. (read next panel)

I am well aware that this time of year is typically extremely bullish.

A scenario I must be prepared for is public participant’s euphoria pushing price through the current weekly downtrend and prolonging this extended rally- creating more downside imbalances to be executed on at a later date. This would not invalidate any prior volumes.

Most importantly it would not annoy me in the slightest. I can wait.

And I can execute longs elsewhere…

Please continue reading for my analysis on the QQQ as well as the IWM

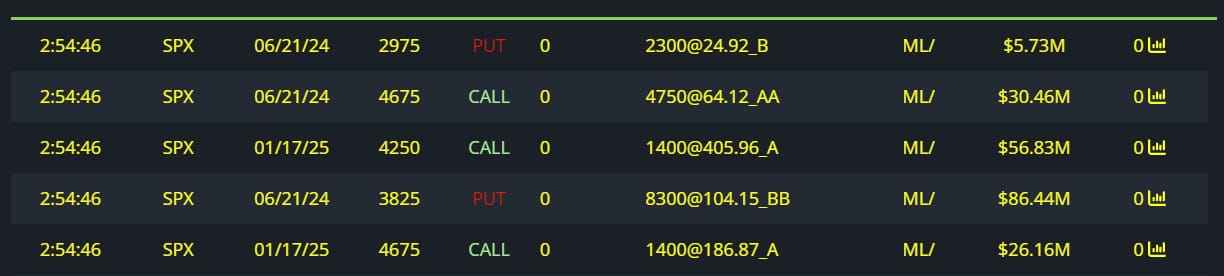

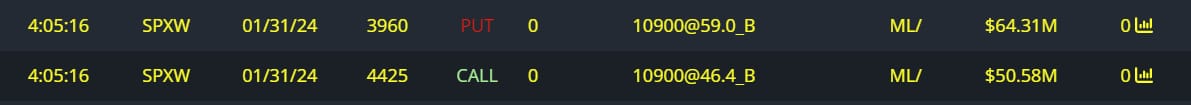

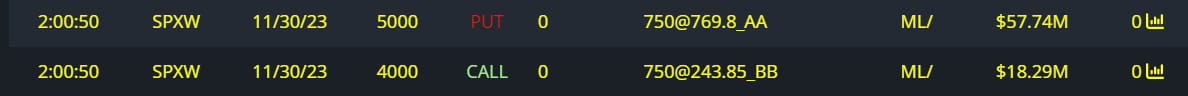

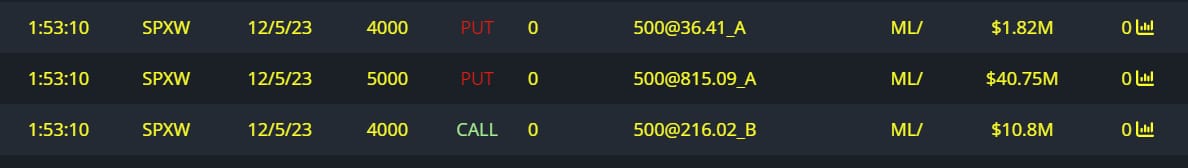

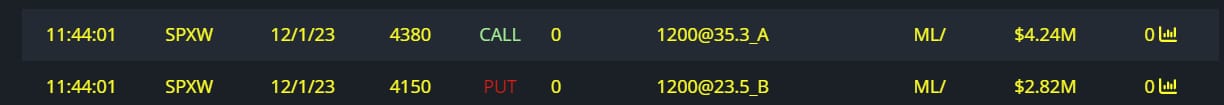

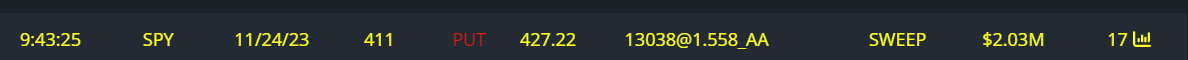

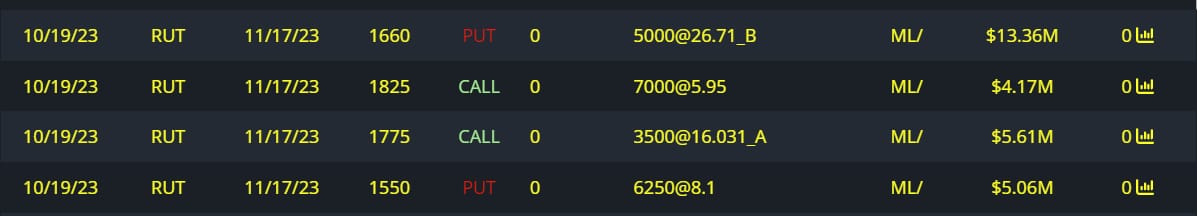

Unusual Options Flow

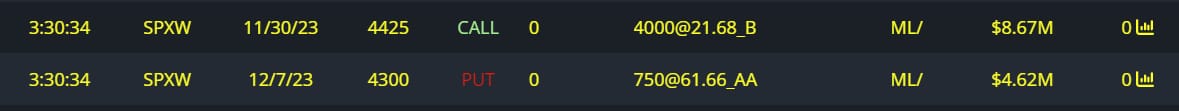

Week of 10/23-

Last week-

-$162M Bearish Flows

+$441M Bullish Flows

The flows through November were extremely bearish.

The flows staring in December were extremely bullish-

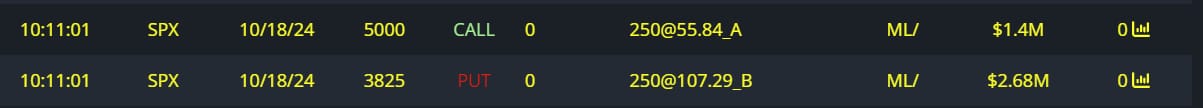

Stretching all the way to 2024,2027, and 2028 expirations.

(see last weeks newsletter for more details)

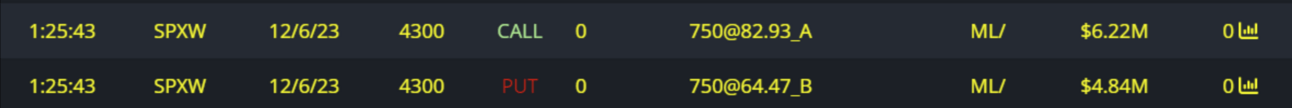

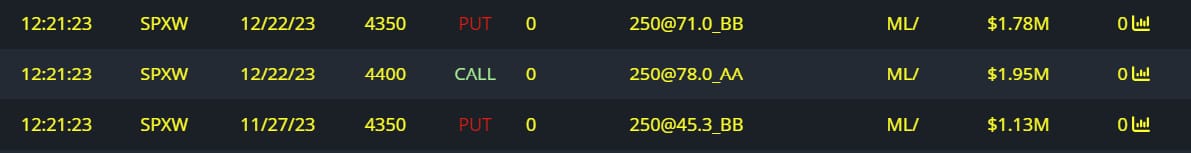

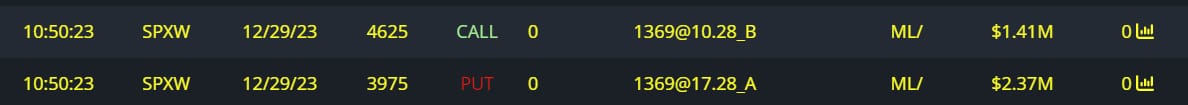

This week-

-$180M Bearish Flows

+$281M Bullish Flows

Once again, flows are predominantly bullish-

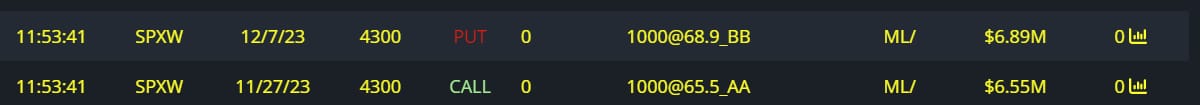

Bears taking the shorter expirations (end of November)

Bulls taking the longer dated contracts- Continuing to size heavily in 6 month + expirations.

Overall, it appears the big money is prepared for a seasonal rally and continuation of trend (hedging their short position on shares) whilst also keeping short-term exposure for a potential rejection in the coming weeks at $441.84 with riskier shorter dated contracts.

11/21 -$13M

11/24 -$2M

11/27 +8M

11/30 -$85M

12/01- +$7M

12/05 -$53M

12/06 +$11M

12/07 -$5M

12/22 +$4M

12/27 +$7M

12/29 -$4M

1/31/24 -$18M

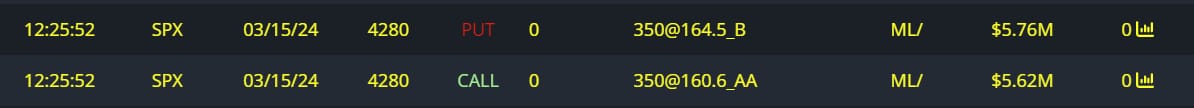

3/15/24 +$11M

6/21/24 +$123M

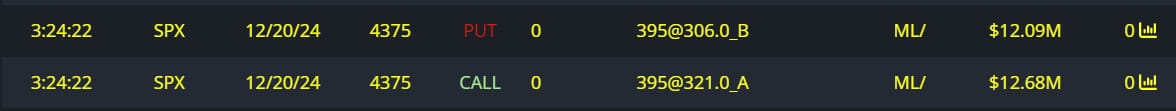

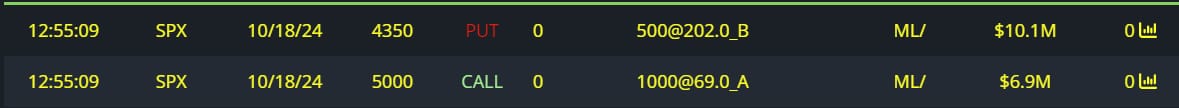

10/18/24 +$21M

12/20/24 +$24M

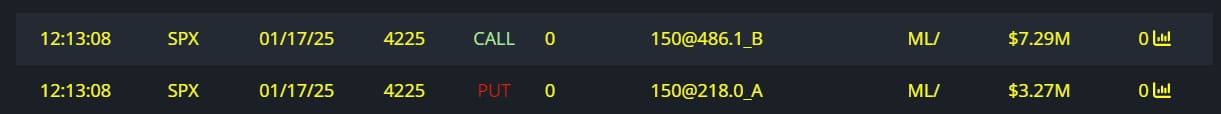

1/17/25 +$65M

$205M Full Risk Bull

$115M Premium Collection

$76M Full Risk bear

$53M Full Risk Bear

$31M Full Risk bear

$24M Full Risk Bull

$17M Full Risk Bull

$13M Full Risk Bull

$13M Full Risk bear

$11M Full Risk Bull

$11M Full Risk Bull

$10M Full Risk Bear

$8M Call Writing

$7M Full Risk Bull

$5M Full Risk Bull

$4M Full Risk Bull

$4M Full Risk Bear

$2M Puts Bought

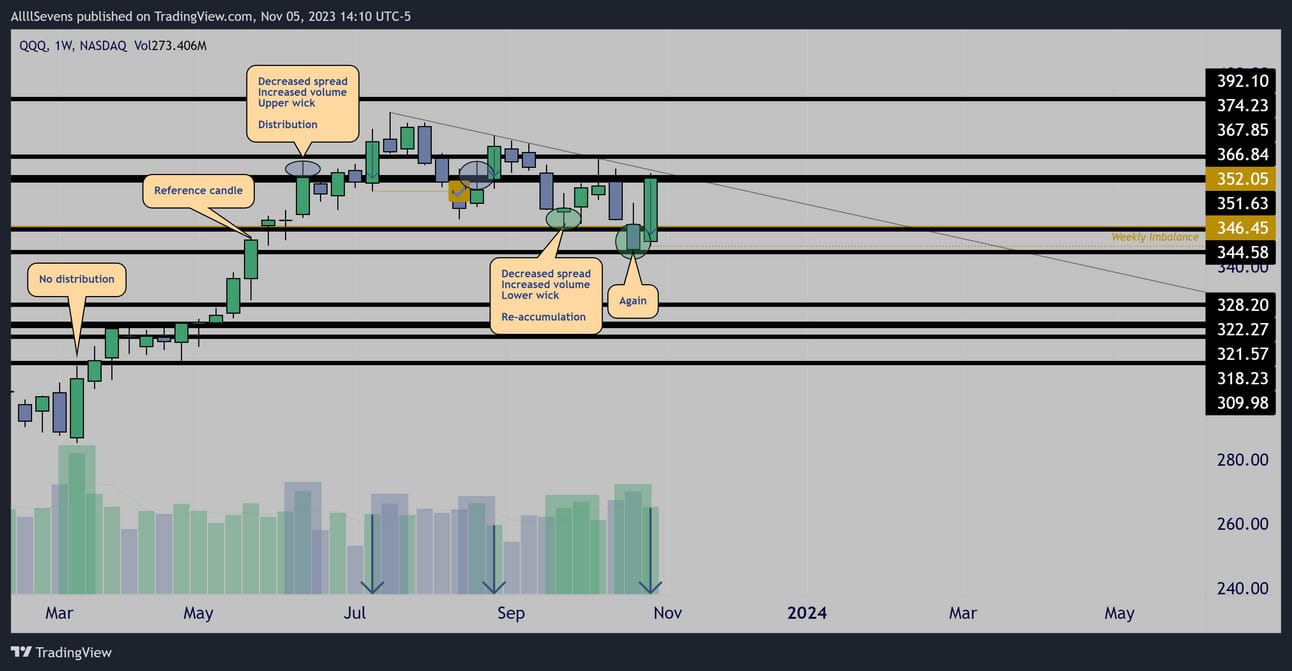

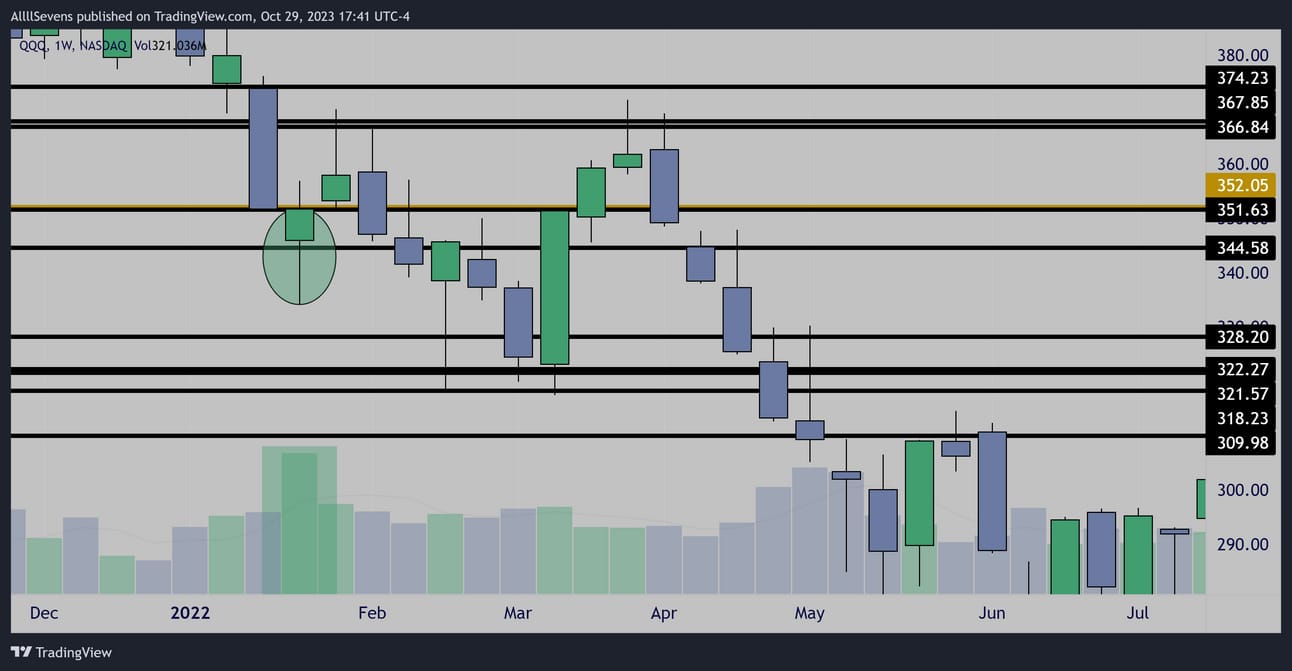

QQQ

Weekly Distribution & Imbalance

Weekly Accumulation

The QQQ does not share the same imbalance as SPY in March.

Both the SPY and QQQ have seen weekly re-accumulation on the past two lows. This heightens the probability for short-term continuation higher, despite the clear imbalances being left below just last week.

Something I’ve shared multiple times now:

Weekly Accumulation

Largest Volume In 10+ Years

Back in January of 2022, QQQ saw it’s largest volume in over ten years on an accumulation candle in this support zone.

SPY share’s a similar zone, seeing it’s largest volume in over 2 years-

Just at slightly less notable levels not visible on the weekly chart like QQQ

$352.05 is the largest dark pool on record for QQQ

It’s extremely notable this larger relative dark pool, as well as the larger relative volume (largest in 10+ years compared to largest in 2+ years) being on the QQQ

Think of it like this…

$352.05 is SPY’s 441.84…

QQQ is over it’s massive level.

SPY is under.

This makes things simple for which indice is more stable- which one should be focused on for weakness and which one for strength (On the higher time frame. Can vary day by day.)

Conclusion

QQQ is stronger than the SPY

If the market is going to continue rallying, only delaying the inevitable pullback to sub $400 levels- then I expect the QQQ to be the X factor.

Heading into this week- notice the QQQ closed directly at resistance.

These two levels (creating a zone) will be crucial- specifically to start off the week. If QQQ opens over this zone ($367.85) the odds of a red week on both indices decreased drastically.

If this happens, I am focused on trading upside until the next major resistance levels hit where I will not be so quick to go short anymore-

I will likely observe and collect data.

If the QQQ opens INSIDE this zone / below the odds of a rejection increase dramatically. The ideal short entry on SPY would still be slightly higher, so I wouldn’t be surprised to see an early week rally followed by a mid week reversal if that’s the case.

Keep reading!!!!

IWM might be the best… Saved it for last…

Unusual Options Flow

Nothing notable on the QQQ this past week-

Mostly a lot of SHORTER dated bearish orders just like the SPY (a few million)

11/10 expiration seems to be the heaviest.

If the QQQ fails to lead the way with a strong open on the week, shorts on both indices could pay well, leaning more so on SPY of course, but QQQ is at more notable resistance.

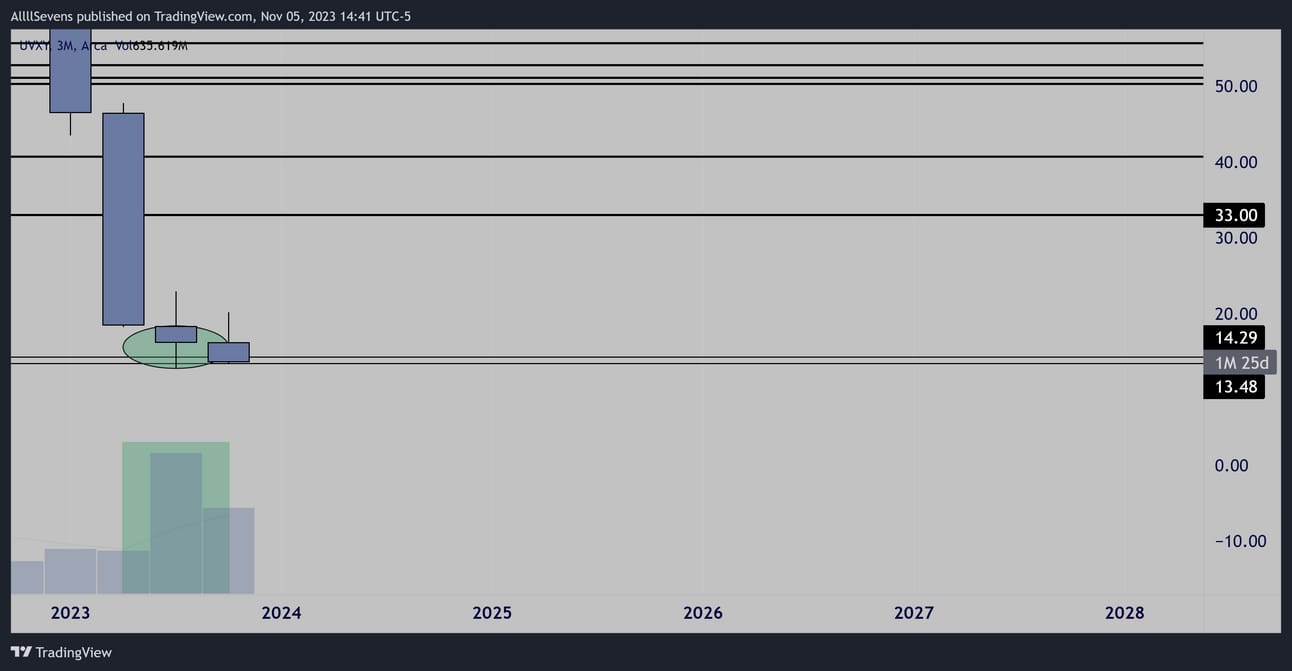

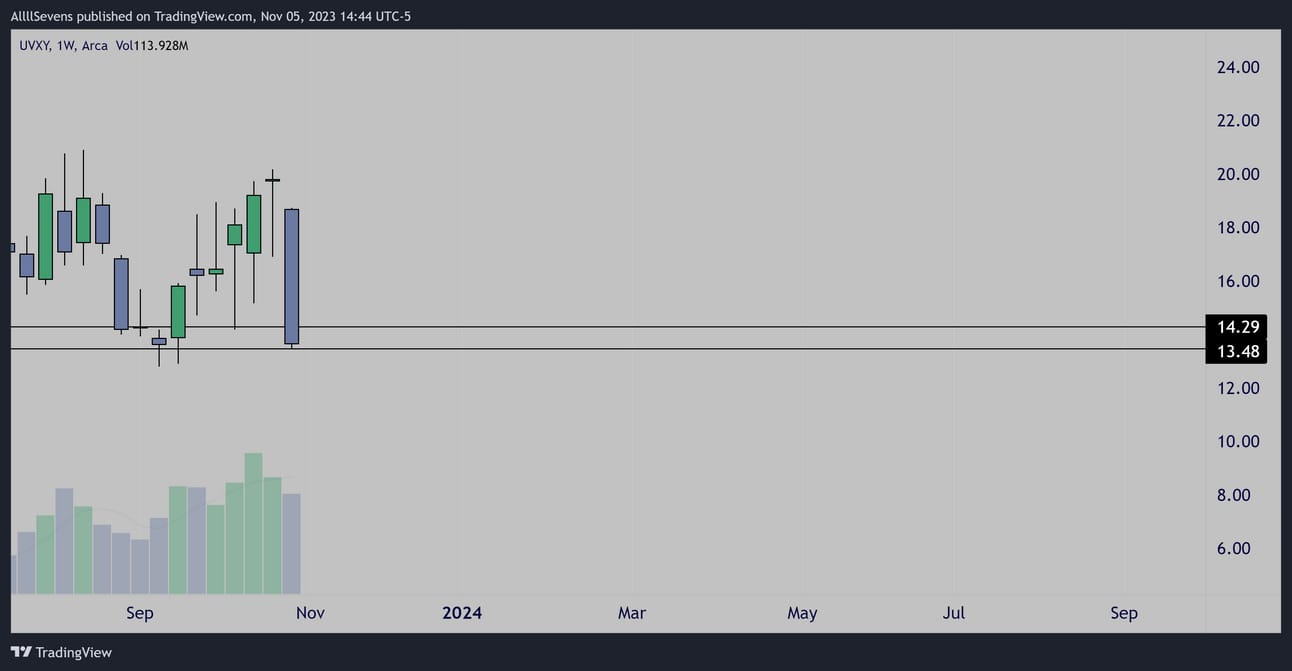

VIX/UVXY

Quarterly Stopping Volume

Now, this is extremely interesting to me.

The UVXY goes down over time. This is not my vehicle of choice to profit on downside in the market (meaning I don’t necessarily want to buy this) BUT I think it’s a great tool to measure potential sentiment and volatility.

This past quarter, UVYX has seen it’s largest volume ever on an indecision candle, suggesting some volatility is about to hit the market.

(Usually bearish)

Weekly Support

These levels marked are very small dark pools, that could act as potential support- similar to the QQQ resistance.

I have a feeling that if the market is going to fold back next week-

QQQ needs to open inside or below its resistance and UVXY needs to open over / inside this support.

If that doesn’t happen, I’m prepared for more short-term upside.

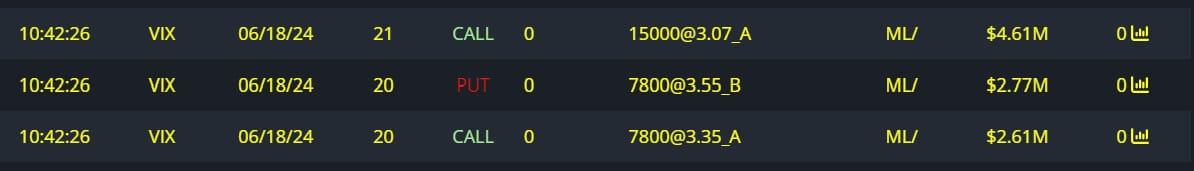

Unusual Options Flow

$10M Full Risk Bull

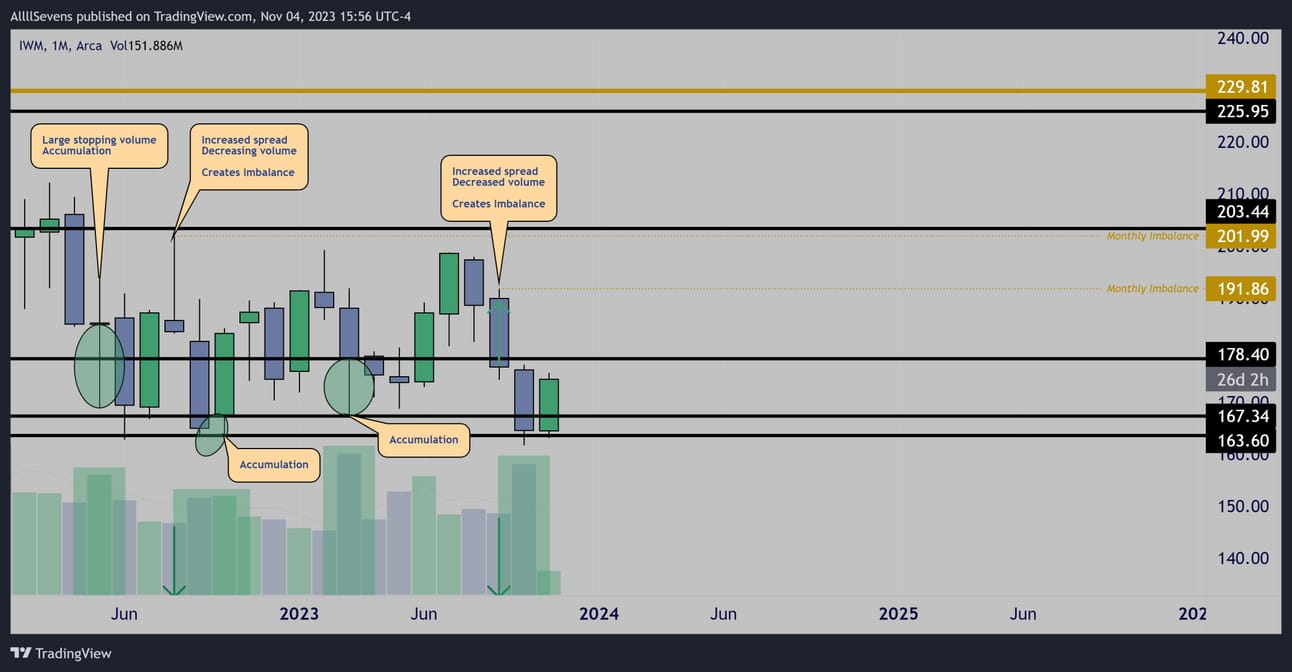

IWM

Monthly Accumulation & Imbalances

A very different chart than the SPY and and QQQ

Clear accumulation. Huge base formed.

Imbalances ABOVE- unlike the SPY and QQQ

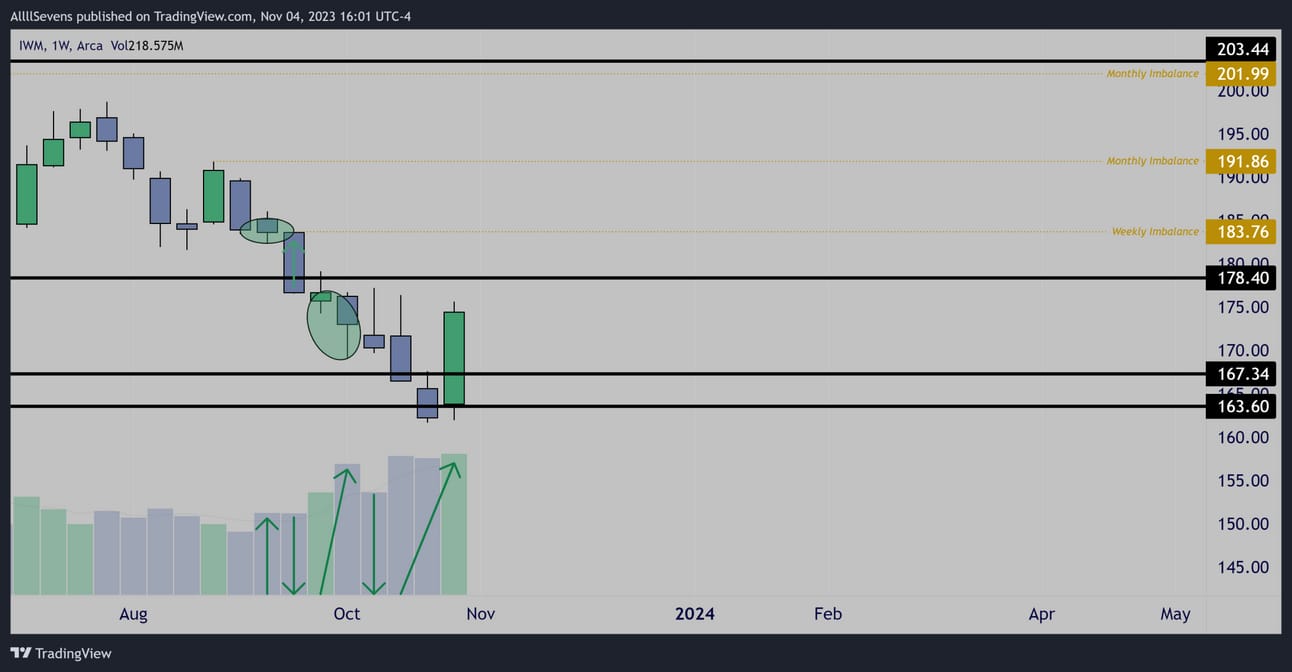

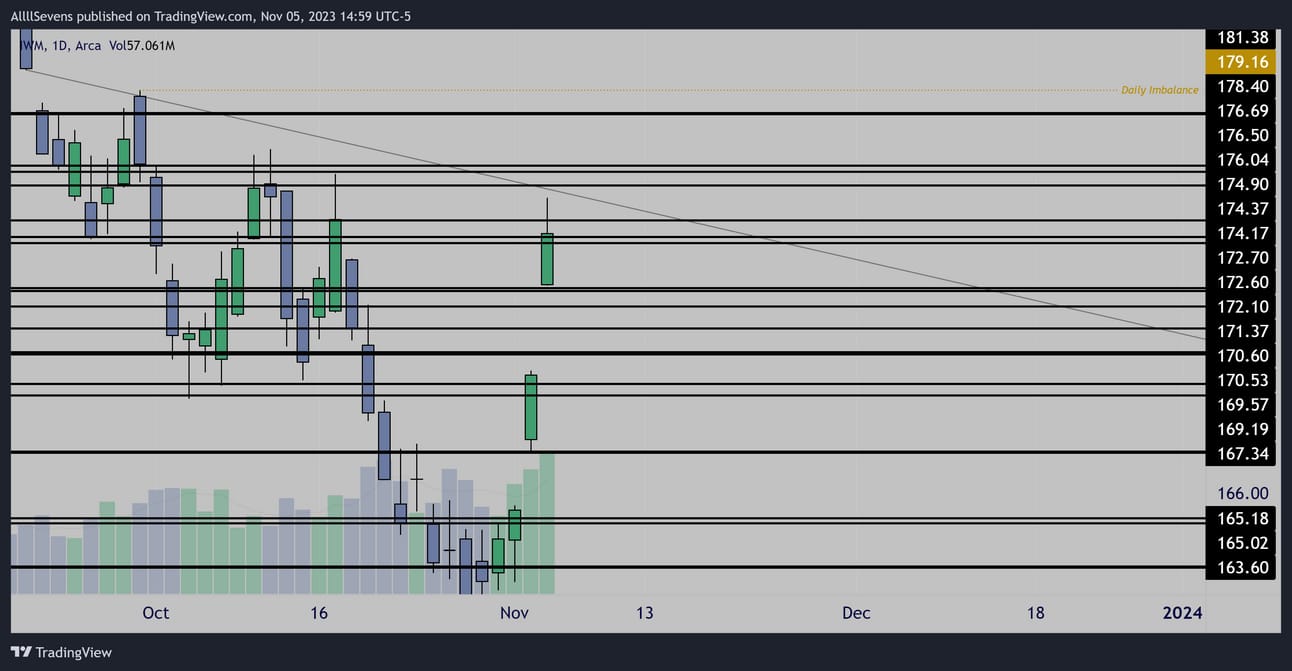

Weekly Accumulation & Imbalance

Finally, a sign of life from IWM after the constant accumulation this has been seeing (have talked about it multiple times)

As long as this support below continues to hold, I gotta say, I think this might be ready to really take off.

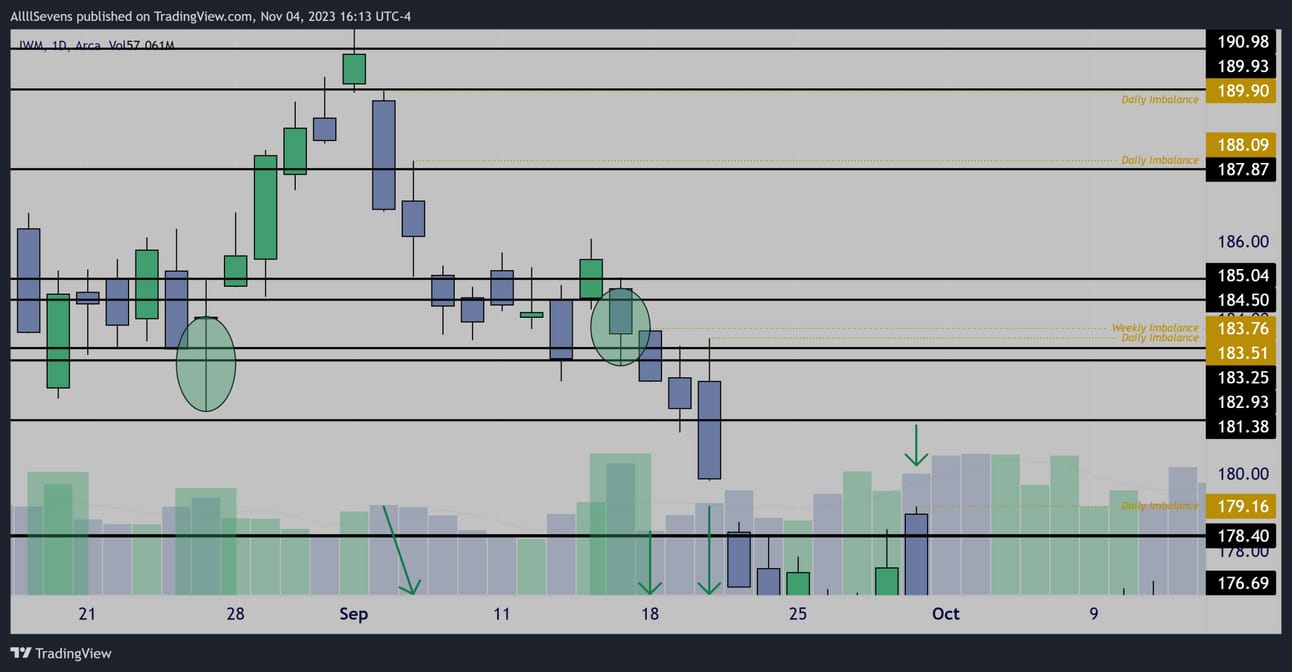

Daily Accumulation & Imbalances

Clear DAILY accumulation patterns not visible on the other indices.

Daily Levels / Trend Line

Just like the other indices-

A key downtrend is being tested / about to be tested.

This is also a better view for all the dark pools in this area if you want to use them on your own charts.

If the market begins to truly breakout, IWM is going to be #1 focus.

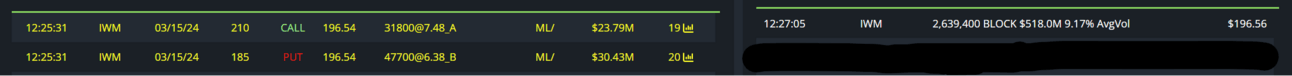

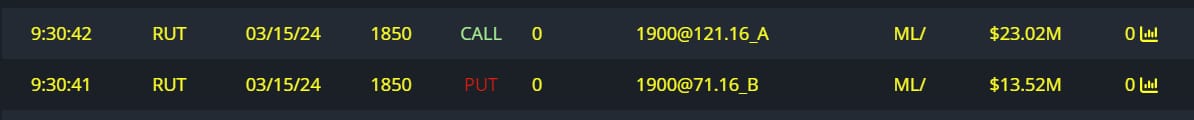

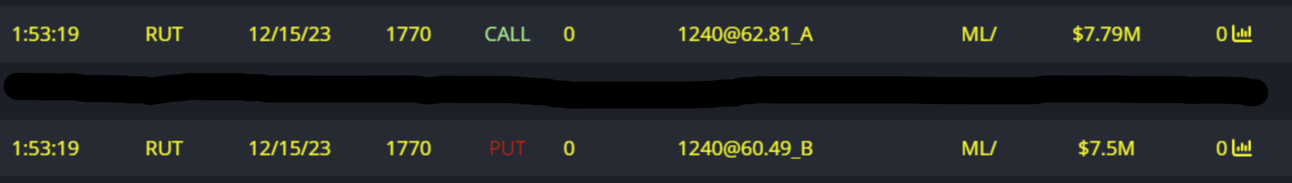

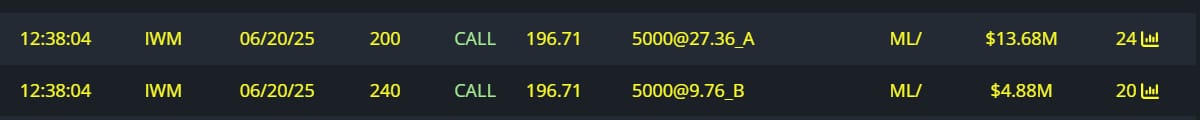

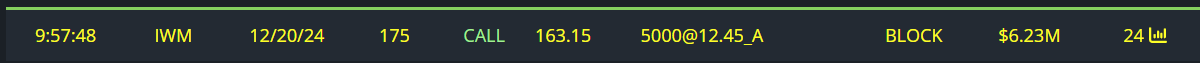

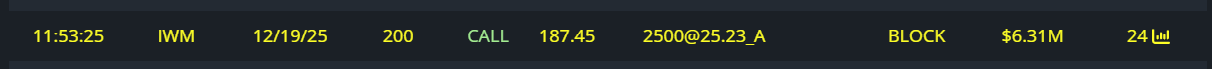

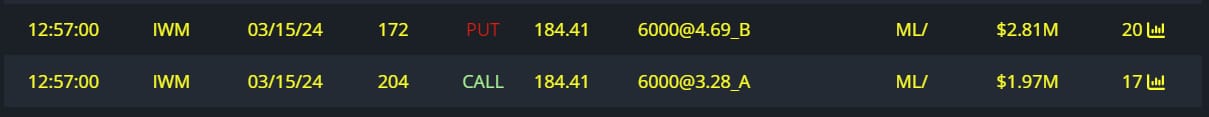

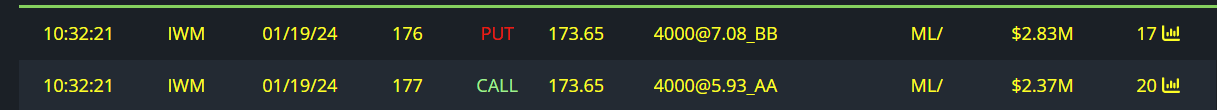

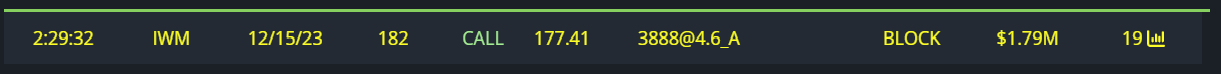

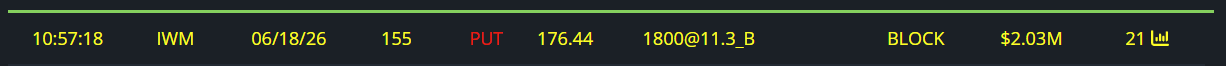

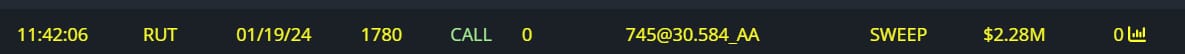

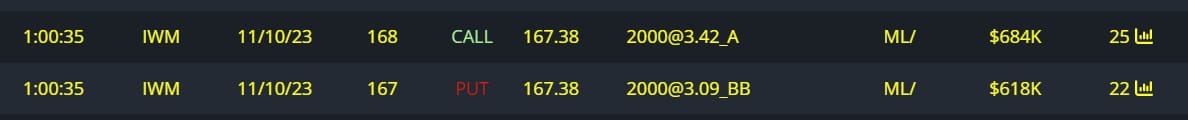

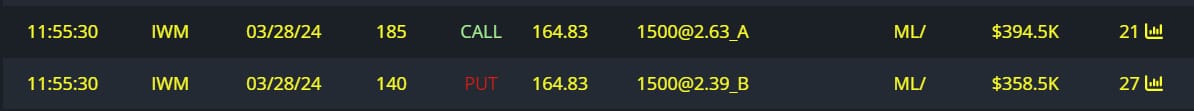

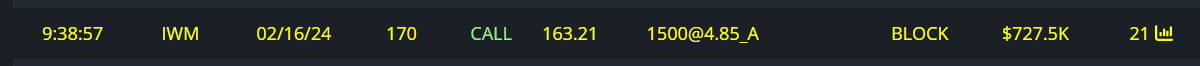

Unusual Options Flow

$180M+ Bull Flow

Mostly concentrated in March 2024+

Similar to SPY flow

$54M Full Risk Bull

+

$518M Dark Pool

$36M Full Risk Bull

$28M Full Risk Bull

$15M Full Risk Bull

$9M Bullish Call Spread

$6M Calls Bought

$6M Calls Bought

$5M Full Risk Bull

$5M Full Risk Bull

$5M Calls Bought

$2M Calls Bought

$2M Puts Written

$2M Calls Bought

$2M Calls Bought

$2M Calls Bought

$1M Puts Written

$1M Calls Bought

$1M Full Risk Bull

$1M Full Risk Bull

$750K Full Risk Bull

$700K Calls Bought

AllllSevens+

I offer a premium version of this newsletter where I cover individual stocks and not just indices!

I also have a Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week.

If you like my work and you want more of it / want to support me this is the way to do it! Would love to see you sign up!

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Trading View Referral

https://t.co/1khrLDRuP0

We-Bull Referral

https://a.webull.com/gGlp9cTCDSzfJtjShj

Reply