- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 11/13/23

AllllSevens Weekly Newsletter 11/13/23

SPY QQQ IWM SCHW

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor.

I use two tools:

-Dark Pools

Large institutional transactions that create price levels of highly concentrated volume. Highly concentrated volume at specific prices create strong support & resistance- Institutional support & resistance.

-Volume Price Analysis

Analyzing the relationship between candle spreads/wicks & volume to determine institutional accumulation or distribution.

VPA also validates or invalidates institutional participation in trend.

Preface:

A very tricky market dynamic is presented to us this week with the QQQ front-running an overall SPY market breakout.

Because of this environment, I don’t feel I have an A+ directional bet on where price is headed this week.

I believe a rejection on SPY could very well happen, and R/R favors that…

But I also know that typically this time of year is extremely bullish so I am open to the idea of QQQ leading a SPY breakout.

I’ll be focused on reacting to whatever happens at $441.84 not necessarily predicting this week.

In the case of a bullish breakout, I will be mostly focused on an individual stock: The Charles Schwab Corporation

I thank you for your time and I hope you find this valuable.

SPY

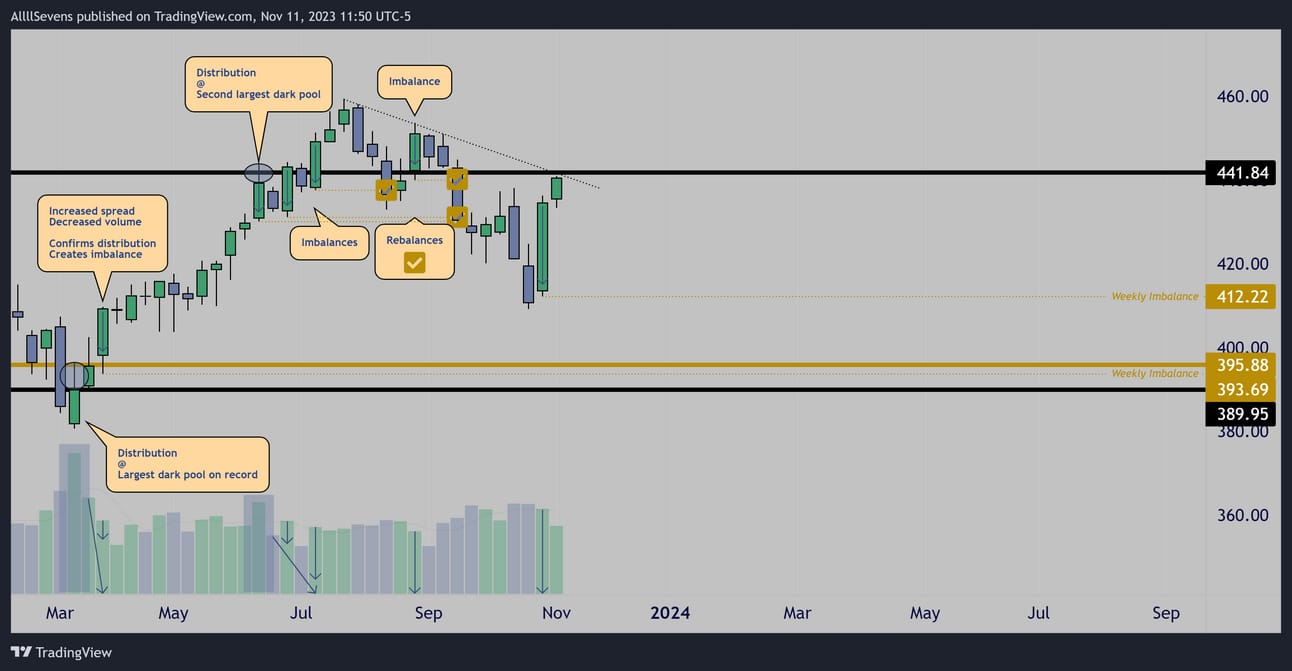

Weekly Distribution

Imbalances

There is some extremely concerning price action at the S&P500’s largest Dark Pool on record ($395.88) revealing that institutions have sold out of the market and retail participants are currently being trapped, creating liquidity for a re-accumulation event.

I am absolutely not a long-term buyer here.

Two Imbalances in price lie below, the lowest being at $393.69

Here is a video breaking down what I mean:

https://x.com/AllllSevens/status/1723821796724494576?s=20

Short-term, I am open to anything and I must follow price!

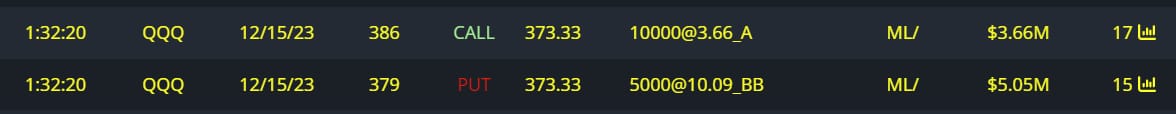

Unusual Options Flow

+$674M Bullish Flows

-$127M Bearish Flows

This week, bulls were once again in control of the flows.

Very aggressive positioning in LONGER expirations.

Decently aggressive bearish positioning in SHORTER expirations.

To see all of the orders that make up these total flows, I share those in my Discord and share some on my twitter.

Overall, the risk-to-reward is best for shorts this week and that is my focus. If I get an A+ entry signal and price does not break-out, following the QQQ, then I will be looking at these contracts below.

$14M Puts Bought

Conclusion

One thing is certain:

I do not want to buy the SPY here.

A retracement below $400 is inevitable.

One thing is uncertain:

When exactly this retracement will occur.

It is not guaranteed that retail participants are done pushing prices higher and the SPY will reject $441.84 and begin the retracement.

Due to this being a seasonally bullish time of year, I believe it is necessary to be relatively cautious going gunz-blazing short at this resistance without a confirmed rejection occurring.

I am planning to be extremely patient and will not force my bias unless I see an A+ signal.

In the case that price breaks out, I will stick to day trades as for me to swing-trade to the long side from here I’d need a breakout and a confirmed retest and hold. This is why I have not share and of the bull flows from last week, because there’s no candle formation for me to go long from here. If it happens during the week, I will share on X

My overall prediction for this week:

I have a feeling that SPY will indeed see resistance at $441.84 this week,

but the QQQ does not have resistance…

A rejection on SPY would lead to a retest of the recent breakout on QQQ which would likely lead to an overall week of consolidation.

Really, the current market dynamic with QQQ already broke out and SPY at resistance, it’s simply not the most optimal setup for me to make any bold predictions. I believe the key this week will just be reacting to whatever happens. Better candle formations can create better more defined setups.

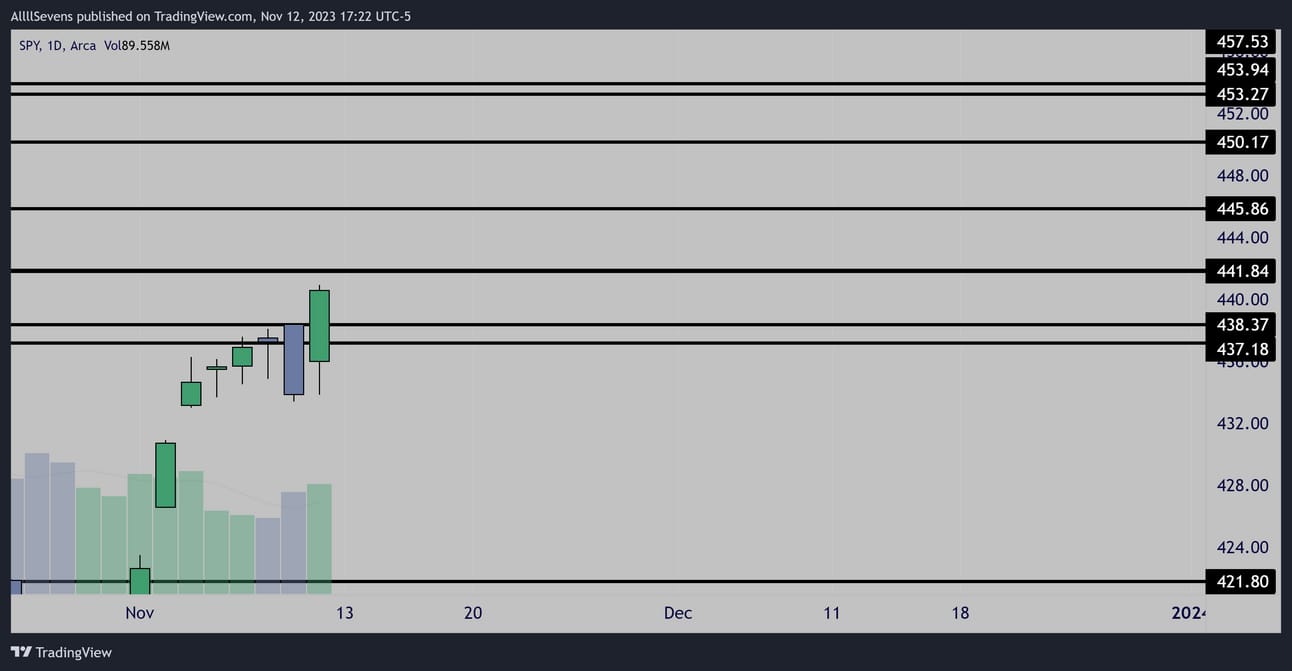

Here are the daily levels for SPY this week:

Daily Levels

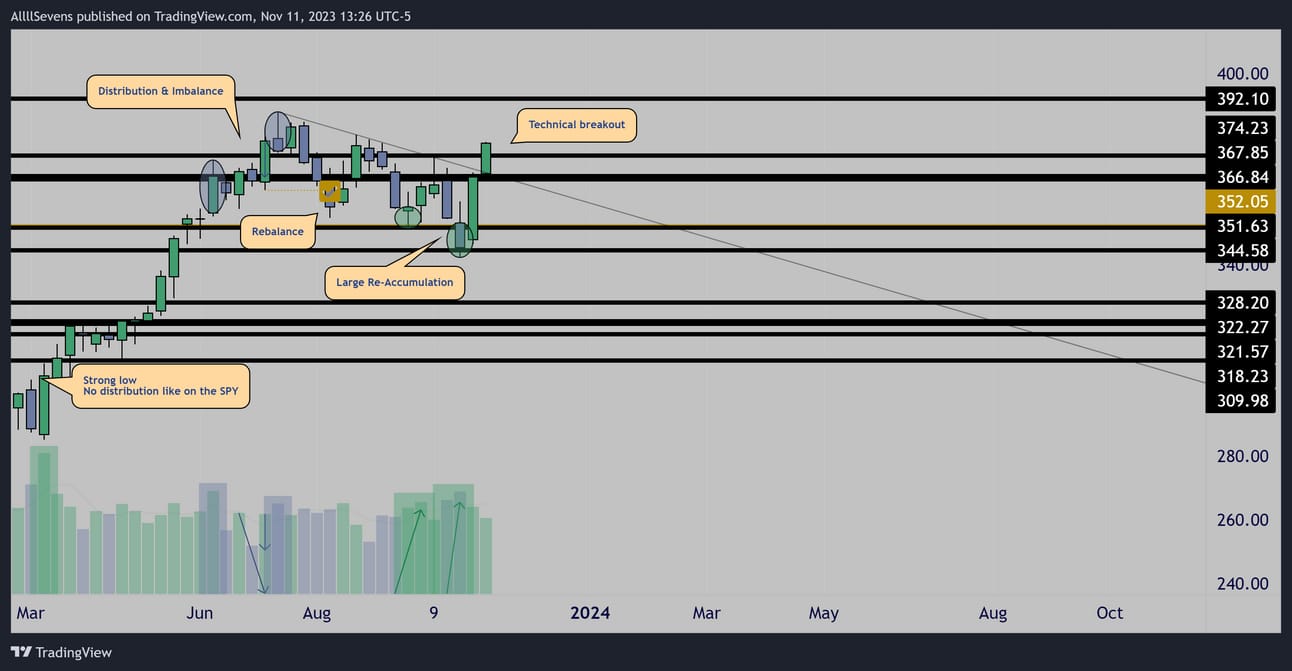

QQQ

Weekly Re-Accumulation

Breakout

The QQQ does not share the same distribution & imbalance pattern as SPY in March. This is huge. This is WHY the QQQ has been so much stronger than SPY and continues to display that strength.

Last week’s candle is a technical breakout, with next resistance being at $392.10

As you can probably tell by now, I am not a big breakout trader-

For me to actively buy this, I’d need to see a retest and hold of $374.23

Conclusion

It’s an extremely interesting market dynamic to see the QQQ front-run a breakout with SPY sitting at resistance.

If the SPY rejects, the QQQ will be retesting support.

Hence, my prediction for a potential consolidation week.

Of course, anything could still happen.

The QQQ could carry the SPY for a breakout,

Or the SPY could completely tank the market.

For me, the current setup is just not A+ to make a bold prediction.

I would truly love to see a consolidation week.

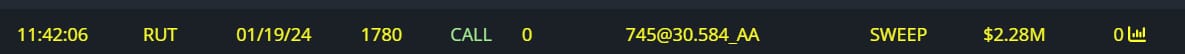

Unusual Options Flow

$9M Full Risk Bull

IWM

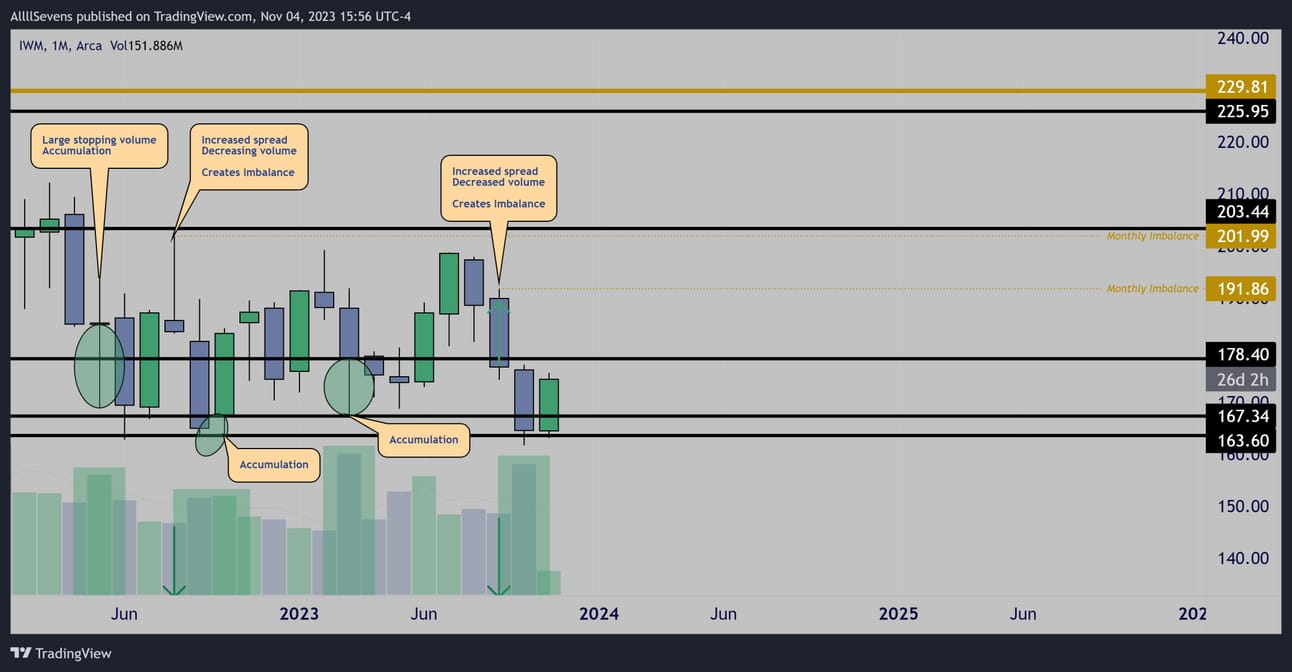

Monthly Accumulation

Imbalances

A very different chart than the SPY and and QQQ

Clear accumulation. Huge base formed.

Imbalances ABOVE- unlike the SPY and QQQ

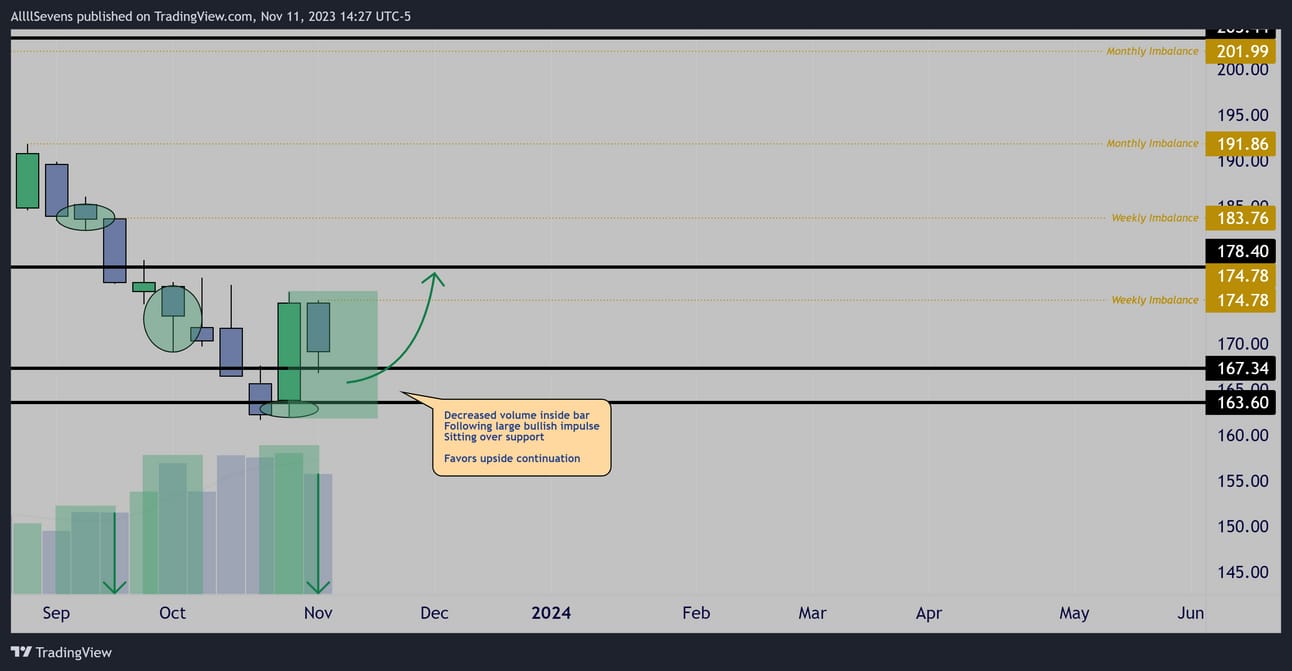

Weekly Accumulation

Imbalances

Decreased Volume Inside Bar

Clear weekly accumulation-

Large volume climax over the past few weeks leading to a large bullish impulse. Last week’s candle is a decreased volume inside bar sitting over $163.60-$167.34 support favoring upside continuation of the bullish impulse as long as support continues to hold.

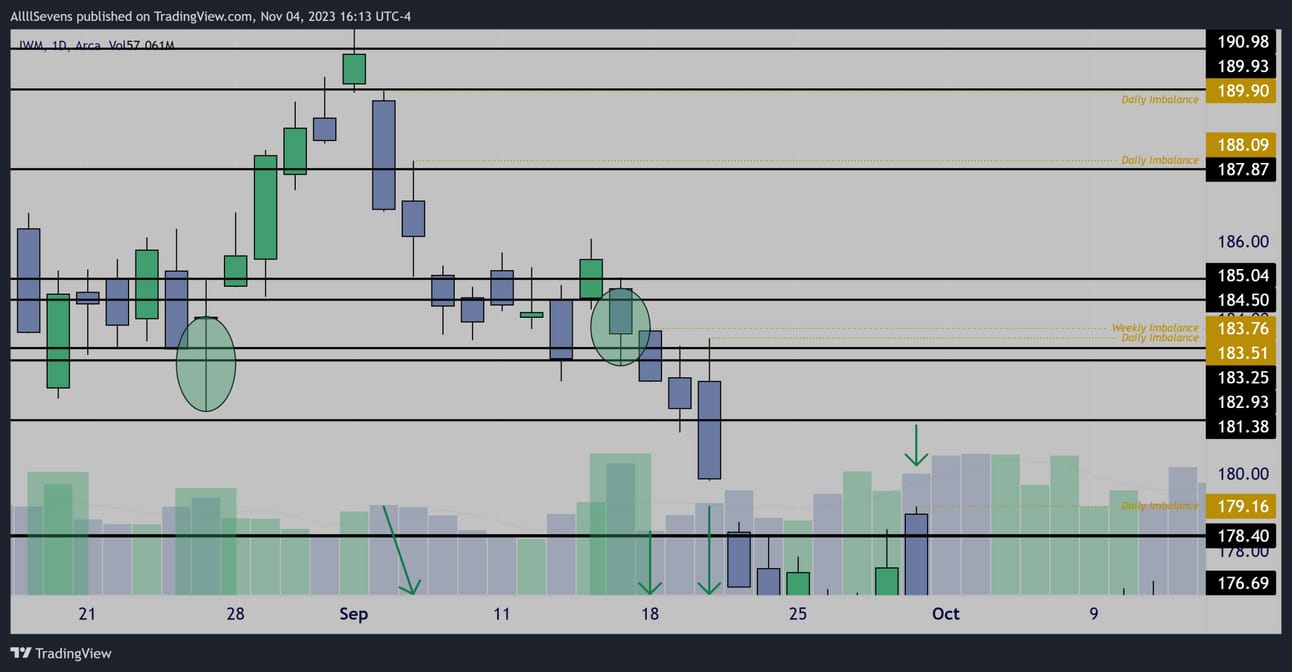

Daily Accumulation

Imbalances

Clear DAILY accumulation patterns not as visible on the other indices.

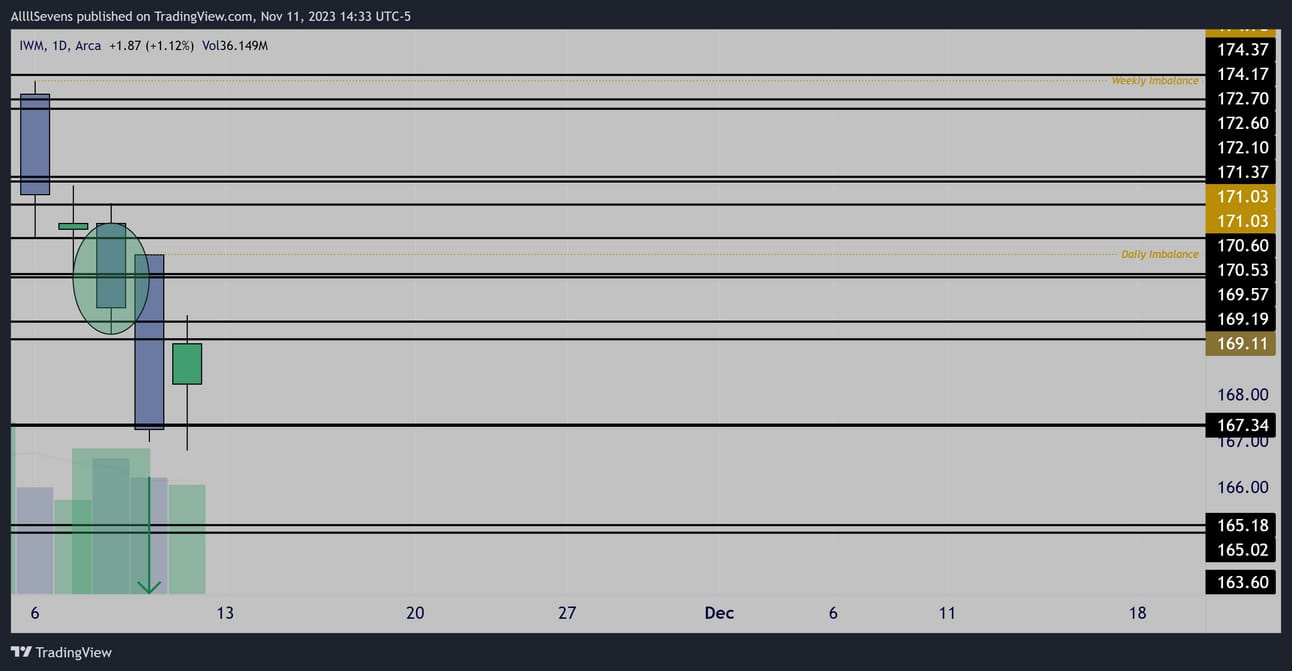

Daily Accumulation

Imbalance

Accumulation during the week leaving behind a daily imbalance.

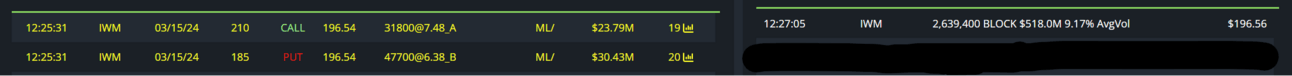

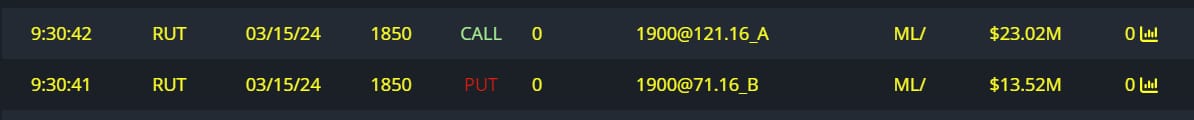

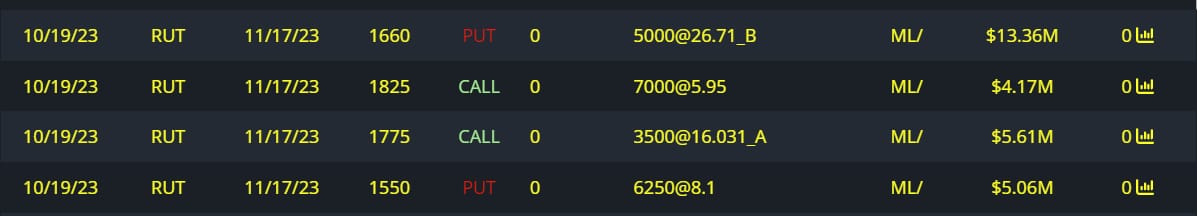

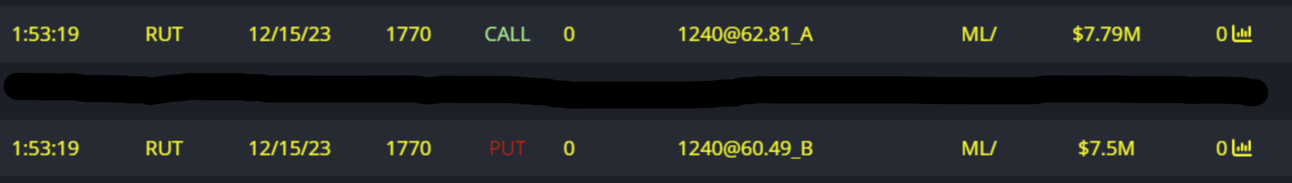

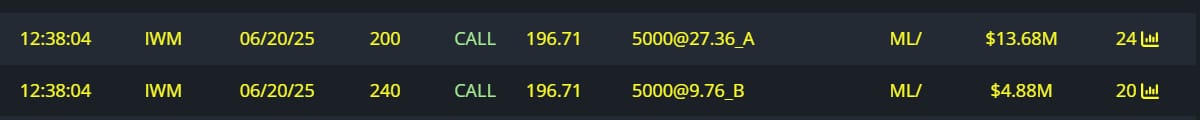

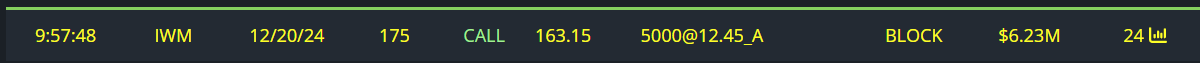

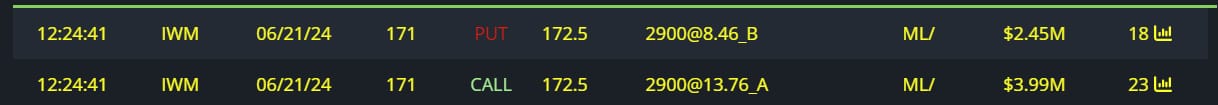

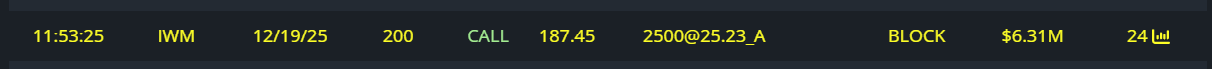

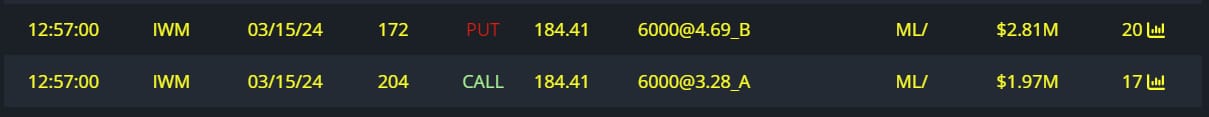

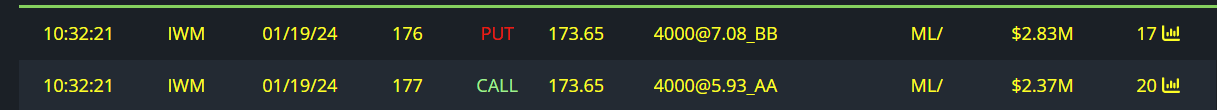

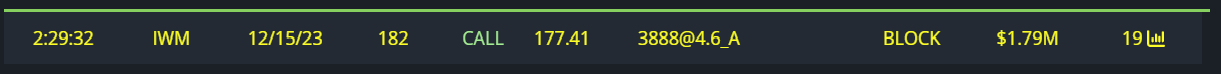

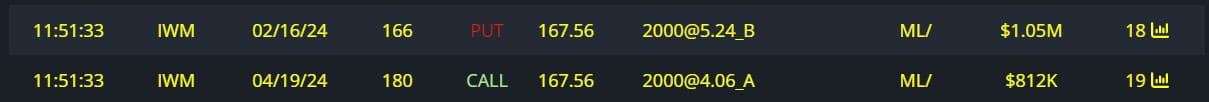

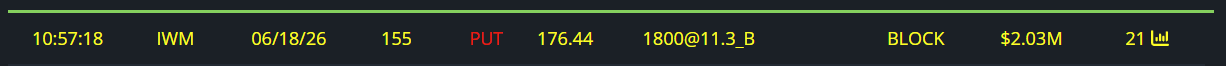

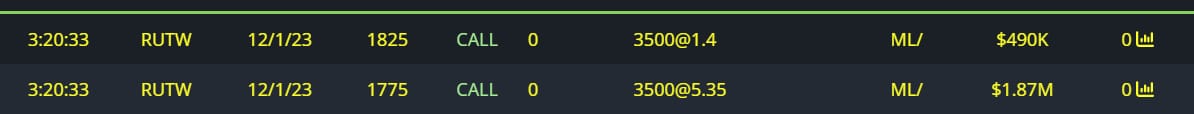

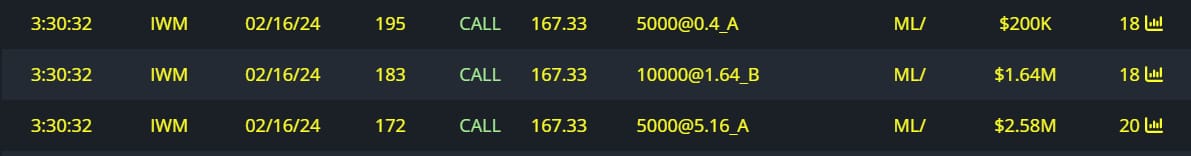

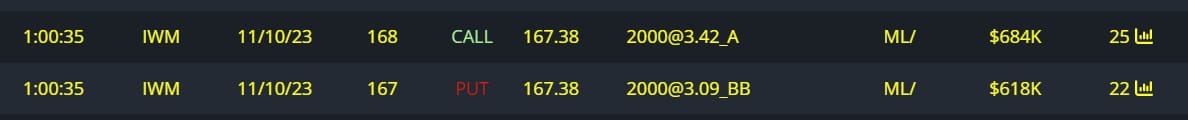

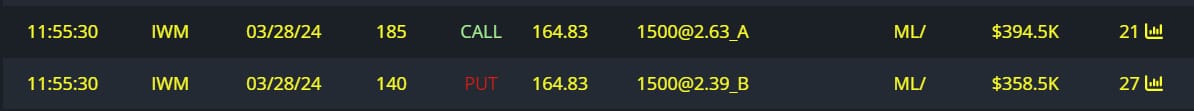

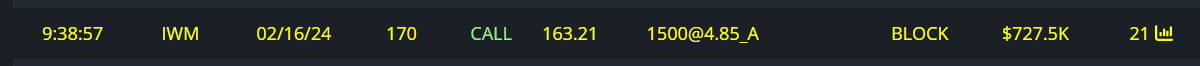

Unusual Options Flow

$180M+ Bull Flow

Mostly concentrated in March 2024+

Similar to SPY bull flow

$54M Full Risk Bull

+

$518M Dark Pool

$36M Full Risk Bull

$28M Full Risk Bull

$15M Full Risk Bull

$9M Bullish Call Spread

$6M Calls Bought

$6M Full Risk Bull

$6M Calls Bought

$5M Full Risk Bull

$5M Full Risk Bull

$5M Calls Bought

$3M Bullish Call Spread

$2M Calls Bought

$2M Full Risk Bull

$2M Puts Written

$2M Calls Bought

$2M Calls Bought

$2M Calls Bought

$1M Bullish Call Spread

$1M Puts Written

$1M Bullish Call Spread

$1M Calls Bought

$1M Full Risk Bull

$1M Full Risk Bull

$750K Full Risk Bull

$700K Calls Bought

Conclusion

Over here on IWM we have an extremely interesting setup, especially because small-caps can move separate to the overall market at times.

Great timing because the rest of the market is in a tricky two-way position.

I am already positioned in June 2024 IWM calls betting that $163.60-$167.34 support will hold over the next few weeks and lead to a substantial upside rally towards $200 which makes for a great R/R trade.

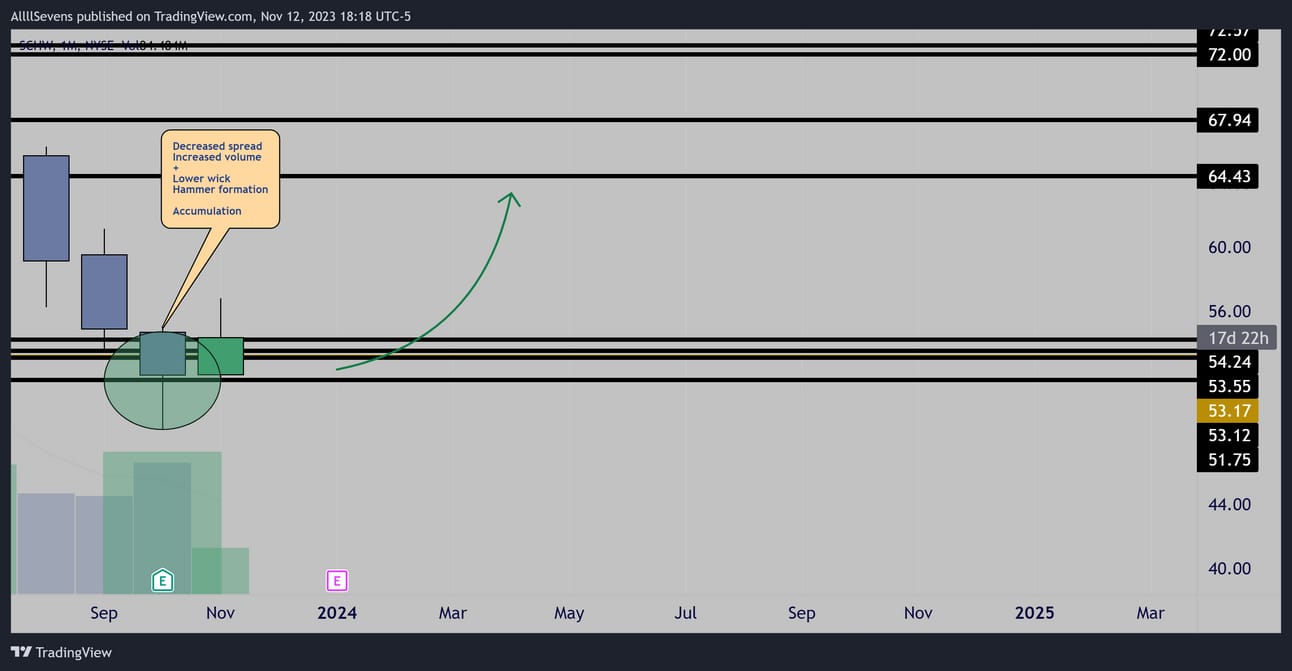

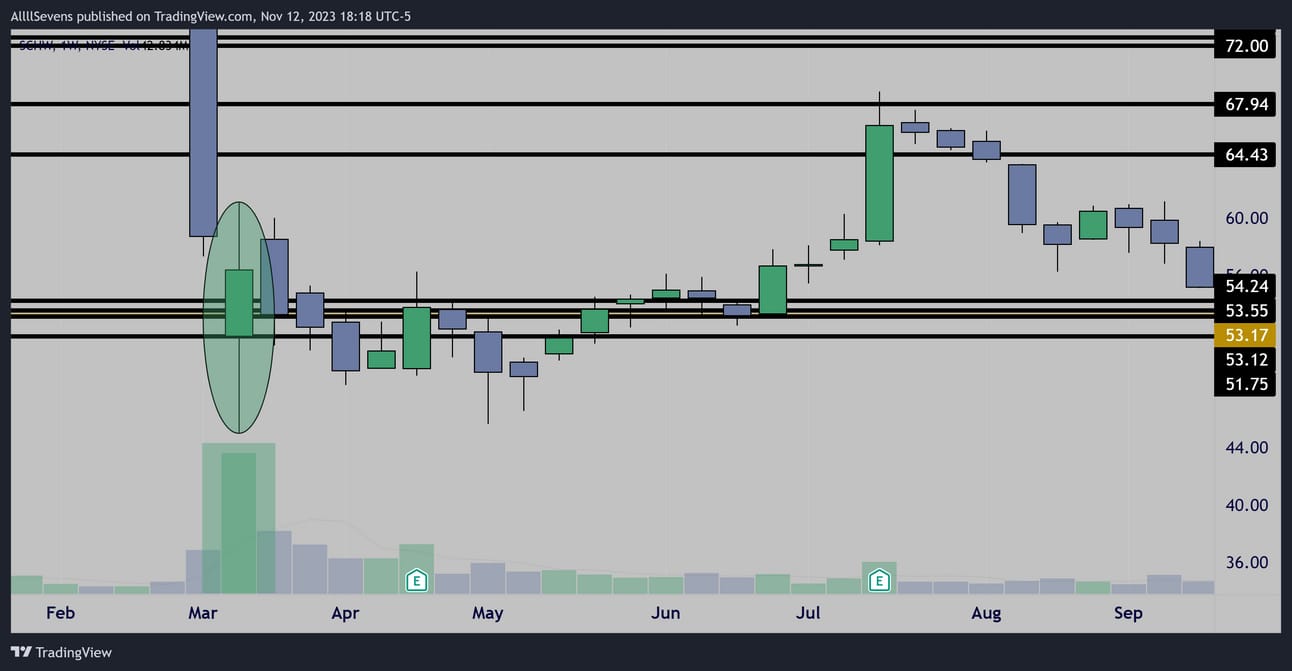

SCHW

Monthly

Monthly accumulation & reversal pattern.

Weekly Accumulation

Largest volume ever stopping price inside the current base price is

re-testing this week.

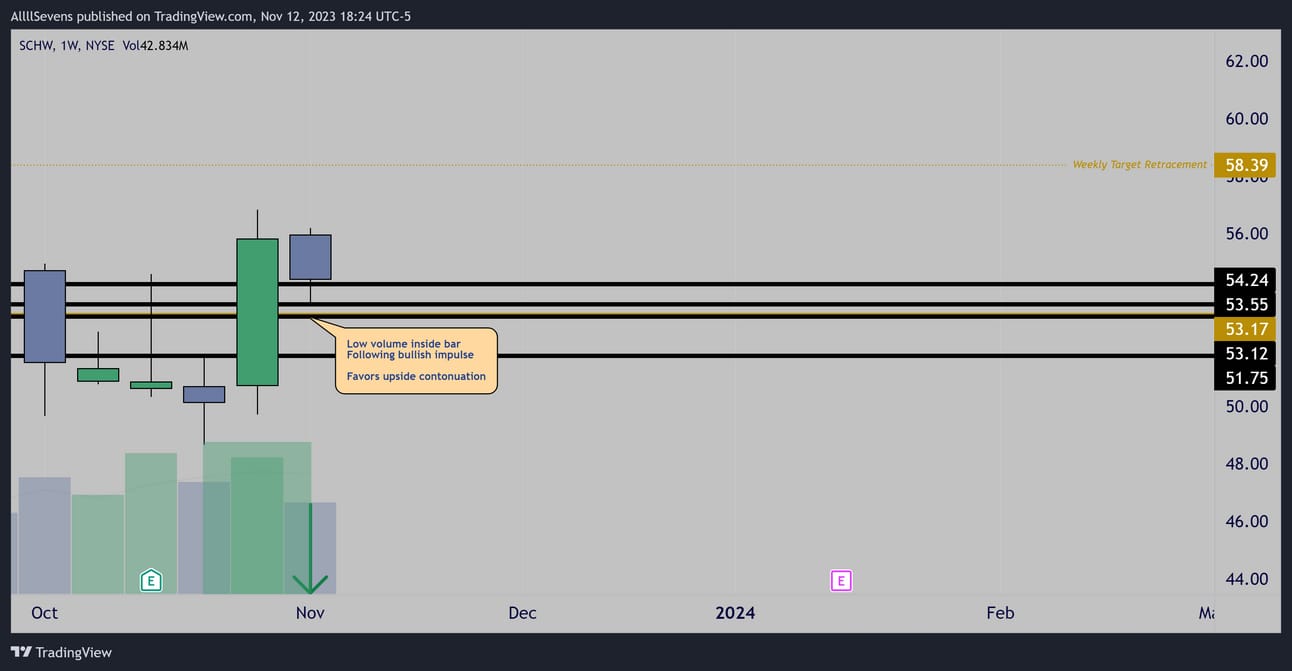

Weekly Low Volume IB

Continuation setup

A+ weekly candle setup for upside continuation of supports continue to hold. $58.39 primary target.

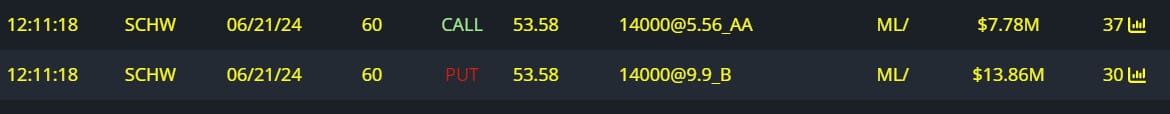

Unusual Options Flow

$22M Full Risk Bullish Order

Conclusion

I am greatly hesitating to include this in the newsletter this week because I wouldn’t be surprised if this continues consolidating at this large dark pool cluster for a longer period of time.

So please, understand TIME is the name of the game here-

While this could launch next week, it could also base out longer!

Overall market conditions make this much less A+ than it normally would be in a clear trending market.

AllllSevens+

I also offer a premium version of this newsletter where I cover individual stocks and not just indices!

I send these newsletters out (once per week minimum) whenever something sets up. SCHW is a sneak peak ;)

I also have a Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week.

I share all the flow I collect during the week there.

If you like my work and you want more of it / want to support me this is the way to do it! Would love to see you sign up!

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Trading View Referral

https://t.co/1khrLDRuP0

We-Bull Referral

https://a.webull.com/gGlp9cTCDSzfJtjShj

Reply