- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 11/20/23

AllllSevens Weekly Newsletter 11/20/23

IWM SPY QQQ SU

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing stated is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this tweet below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Preface:

I have no edge on SPY or QQQ for a swing trade at this moment.

All I know is I don’t want to be a long-term buyer of the SPY here.

I’m day trading both indices live on X (twitter) everyday with no bias.

My main focus for a swing is the IWM which shows an incredible base full of accumulation over the last two years that has not broke out yet.

I’m also focused on SU for a swing into the $40’s

IWM

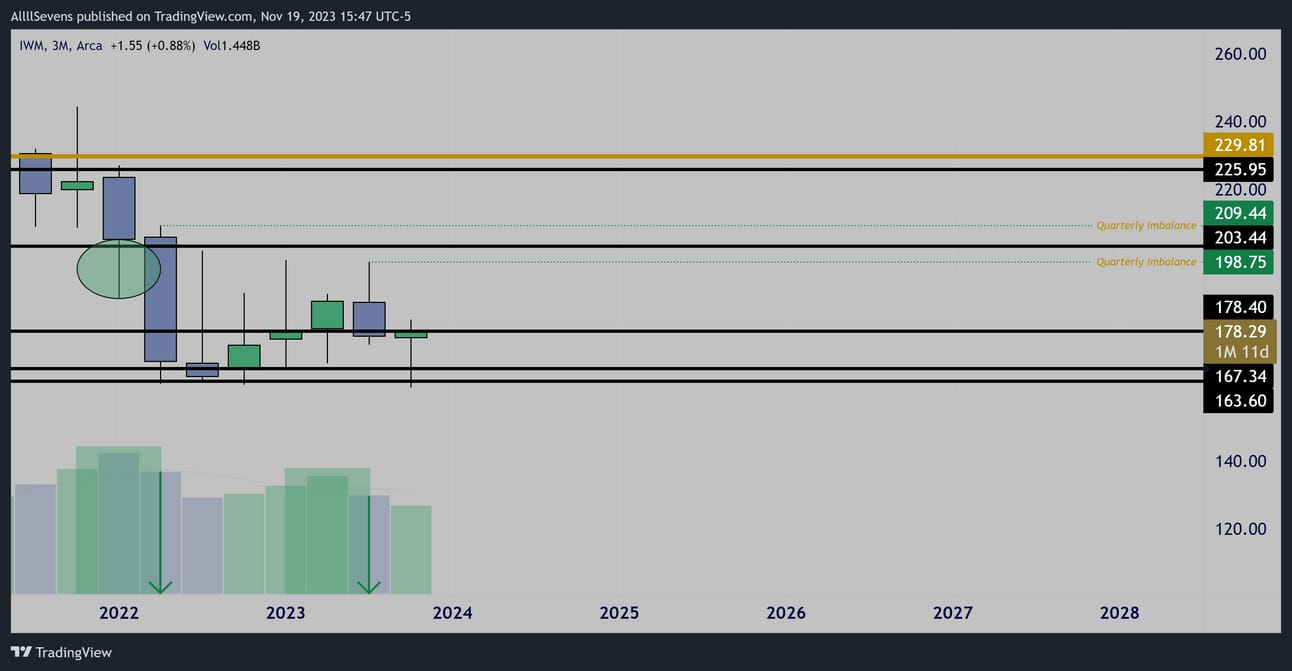

Quarterly

A+ Quarterly accumulation patterns and 2 Imbalances left behind.

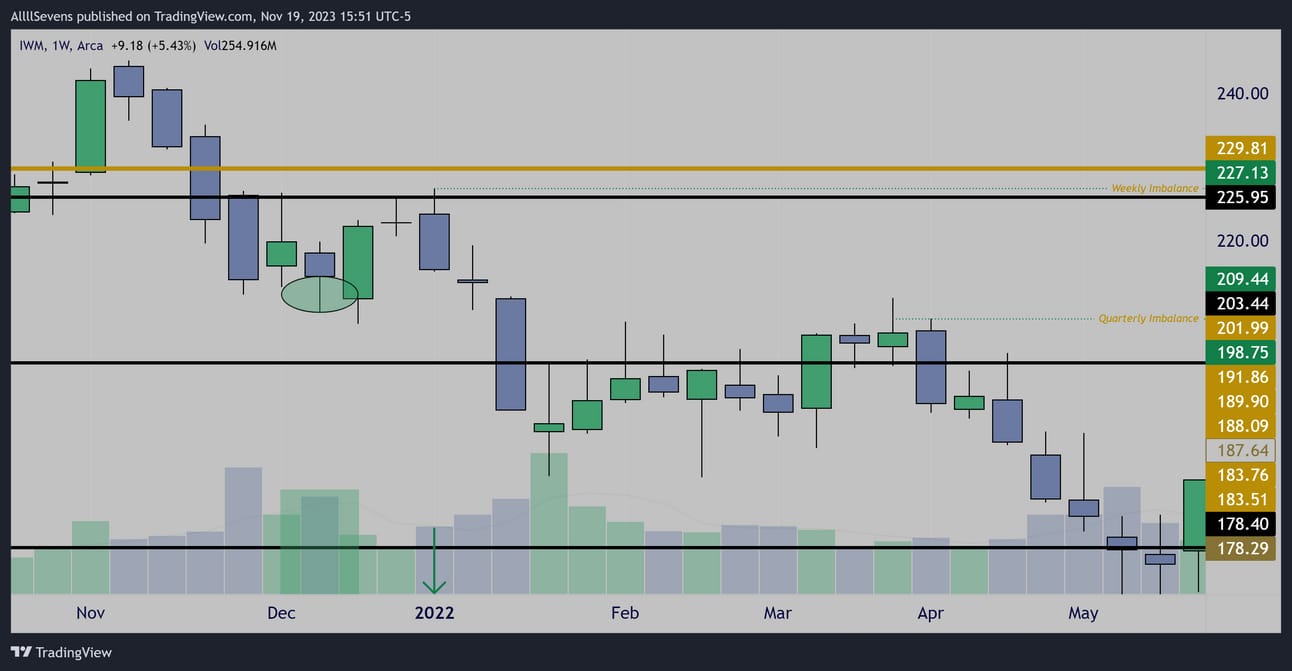

Weekly

Weekly accumulation on the loss of $220 leading to an artificial rejection (increased spread & decreased volume) off the $225.95 dark pool creating an imbalance at $227.13

Weekly

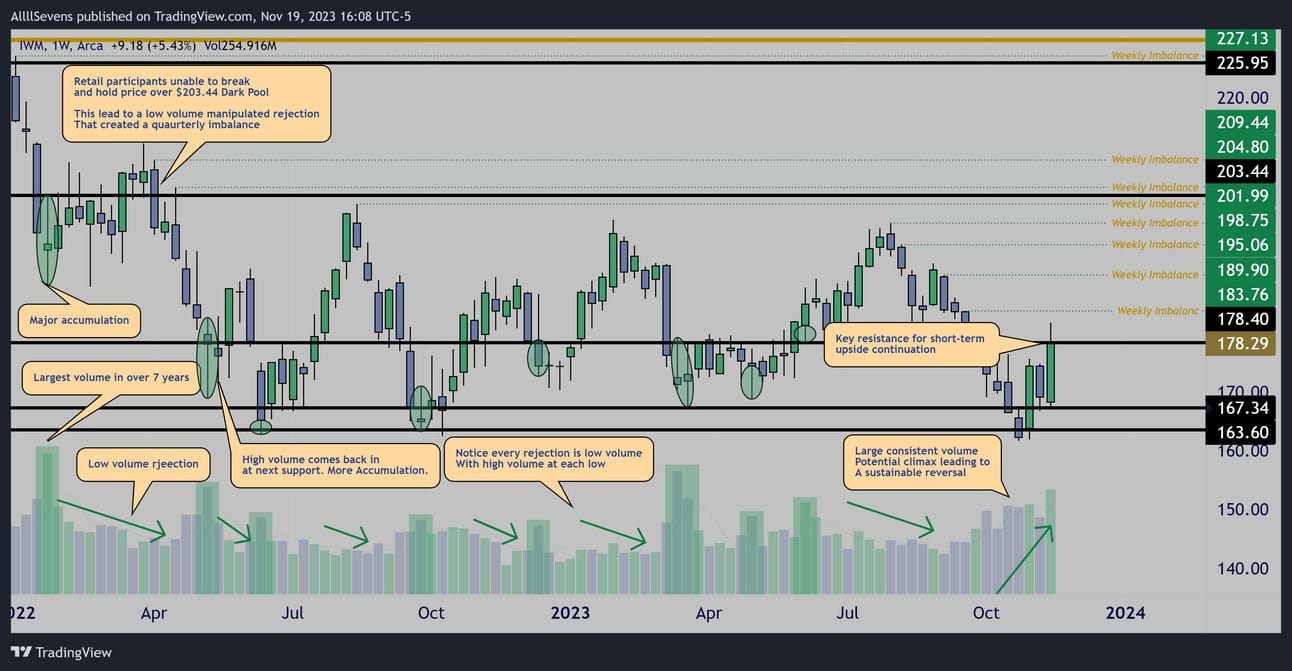

Overall incredible weekly accumulation patterns for the last 2 years.

The largest volume in 7+ years came in and created the $209.44 quarterly imbalance.

Notice how ALL the volume on this chart consistently comes in at the lows of each wave, NOT at the highs. It’s only a matter of time before this explodes to the upside.

Right now price is battling the $178.40 dark pool.

It’s always possible retail participants fail to break and hold this level leading to further accumulation and lower prices so keep that in mind!

Over this level, range really begins open up and a beautiful trend move could be ignited!

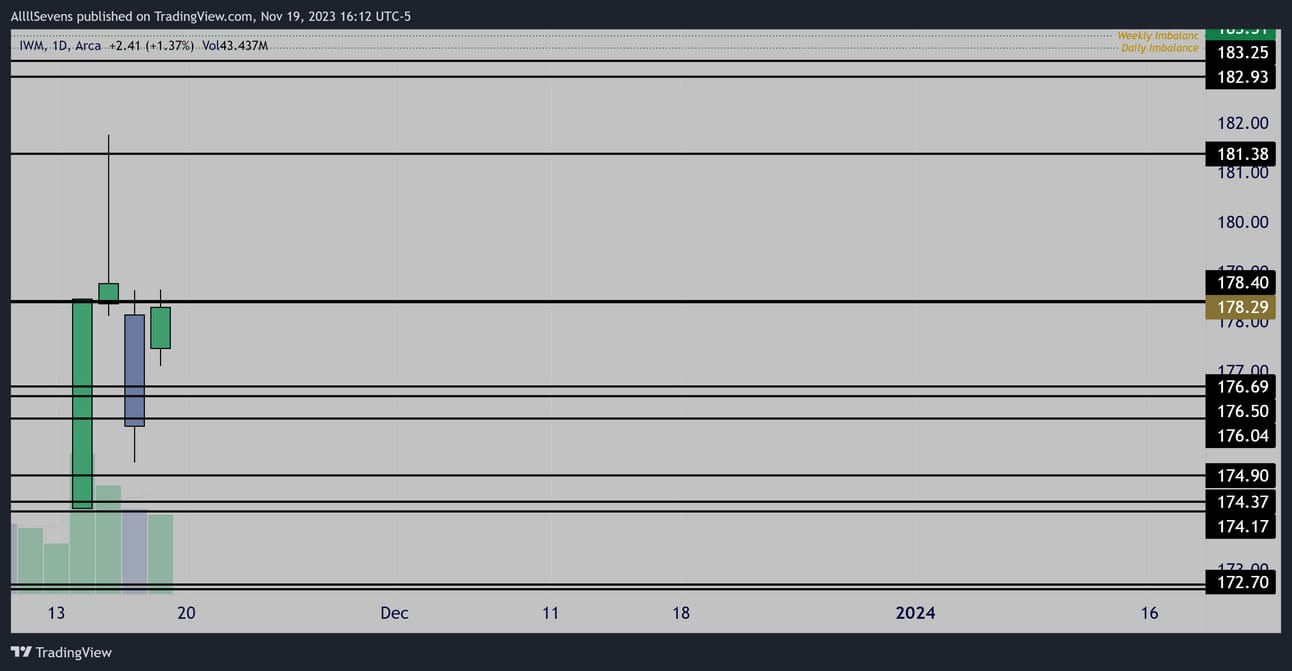

Daily Levels

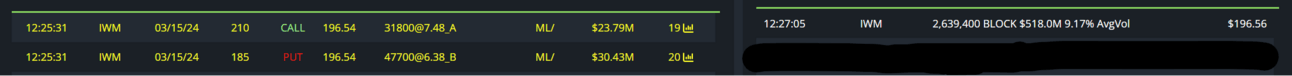

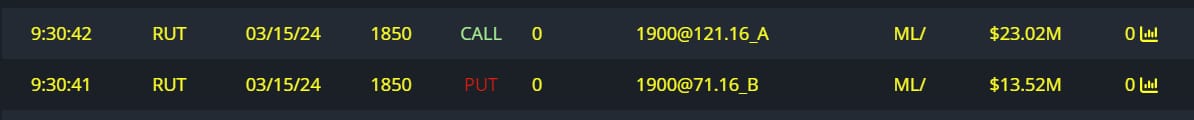

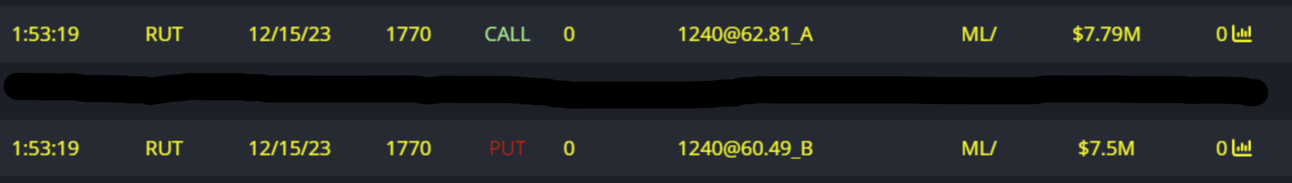

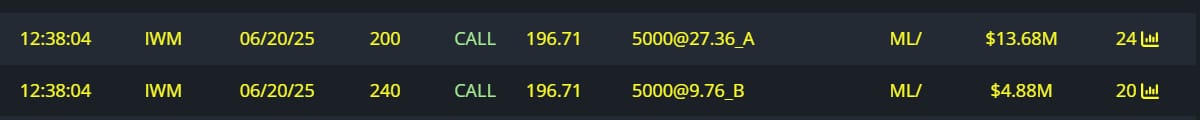

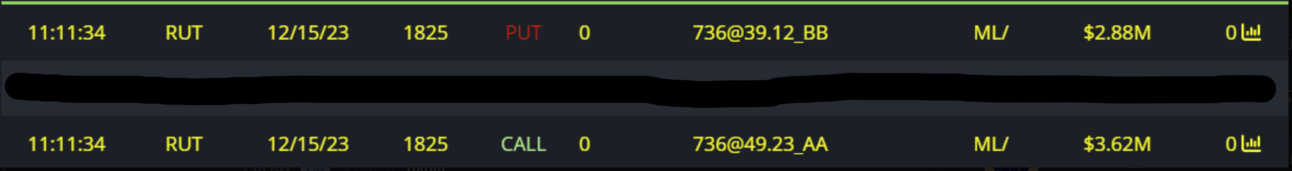

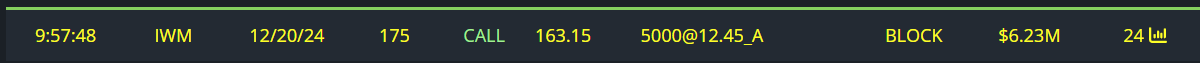

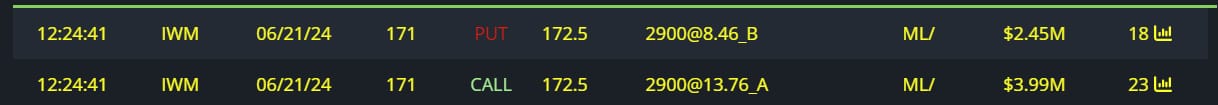

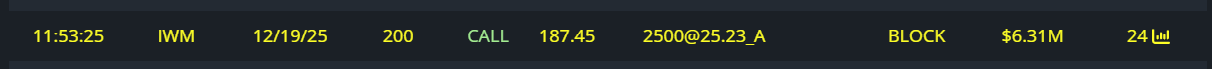

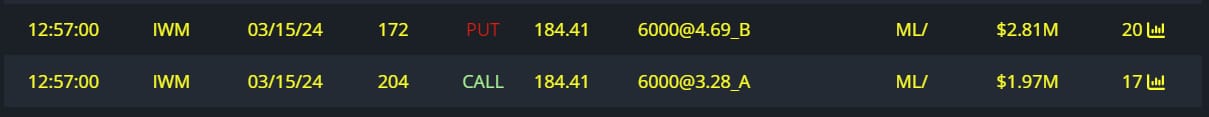

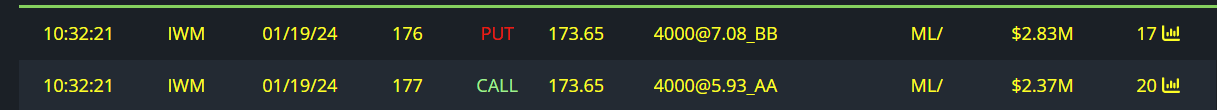

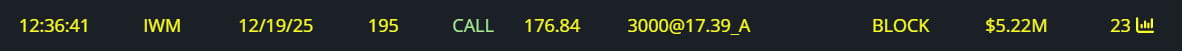

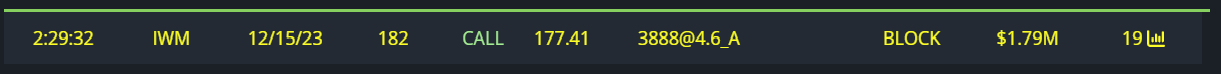

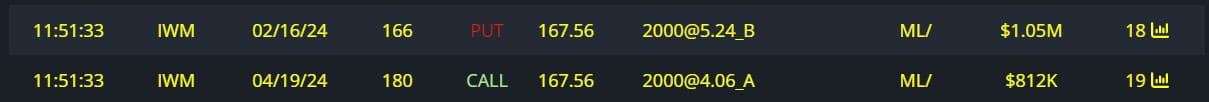

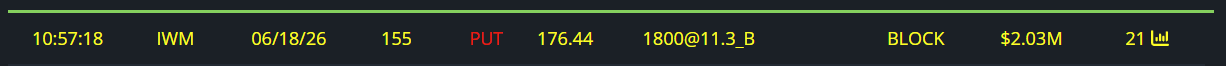

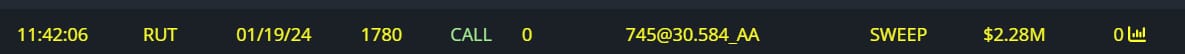

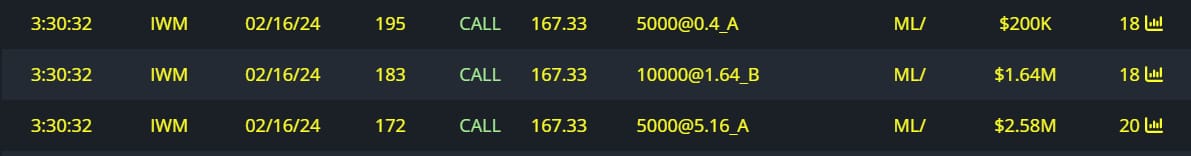

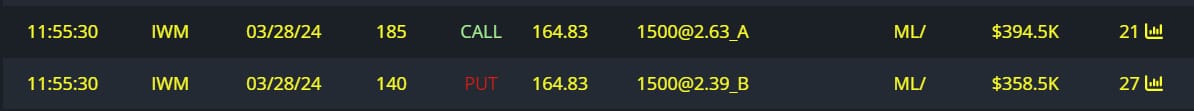

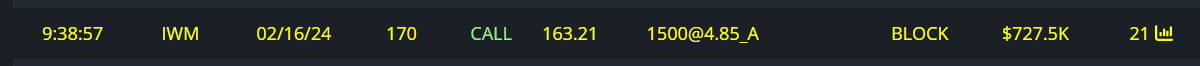

Unusual Options Flow

$180M+ Bull Flow

Mostly concentrated in March 2024 and beyond.

$54M Full Risk Bull

+

$518M Dark Pool

$36M Full Risk Bull

$15M Full Risk Bull

$9M Bullish Call Spread

$6.5M Full Risk Bull

$6M Calls Bought

$6M Full Risk Bull

$6M Calls Bought

$5M Full Risk Bull

$5M Full Risk Bull

$5M Calls Bought

$5M Calls Bought

$4M Full Risk Bull

$3M Bullish Call Spread

$2M Calls Bought

$2M Full Risk Bull

$2M Puts Written

$2M Calls Bought

$2M Calls Bought

$2M Calls Bought

$1M Puts Written

$1M Bullish Call Spread

$1M Calls Bought

$1M Full Risk Bull

$750K Full Risk Bull

$700K Calls Bought

Conclusion

An absolutely incredible setup.

As a long-term investor I want to buy this.

As a swing trader I want to be in March 2024 or further expiration calls. as low as $163.60

As a day trader I want to focus on this index for potential relative strength when it breaks over the current resistance at $178.40

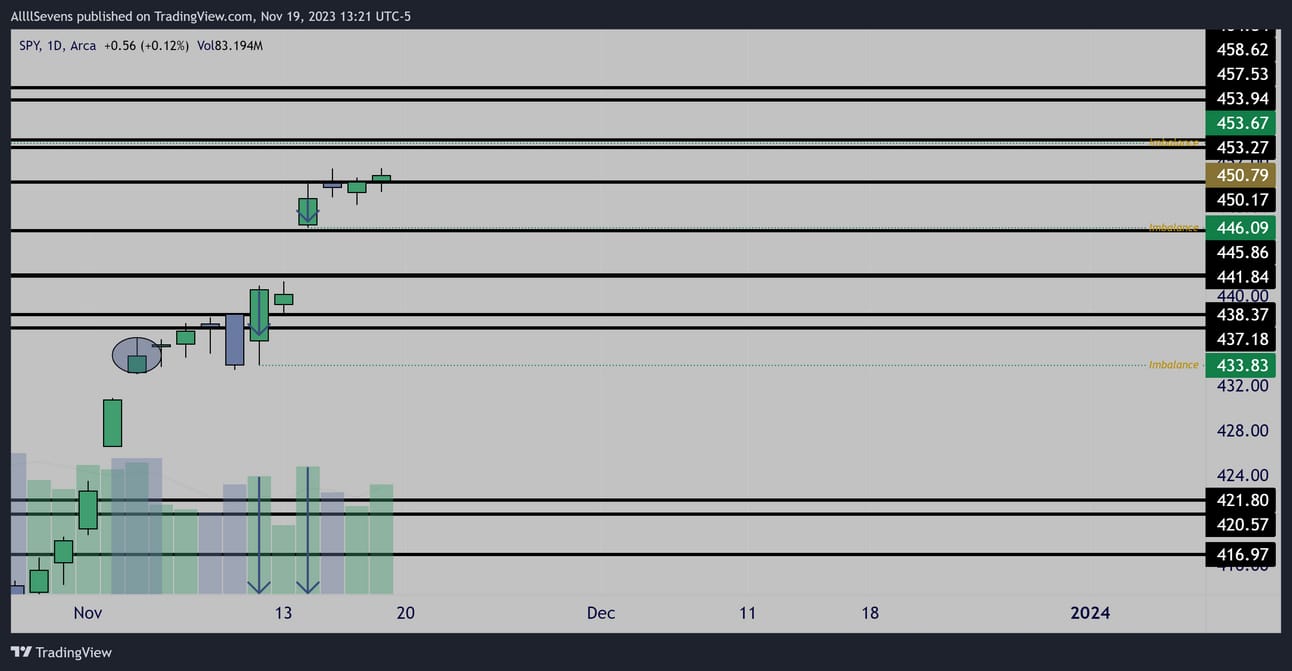

SPY

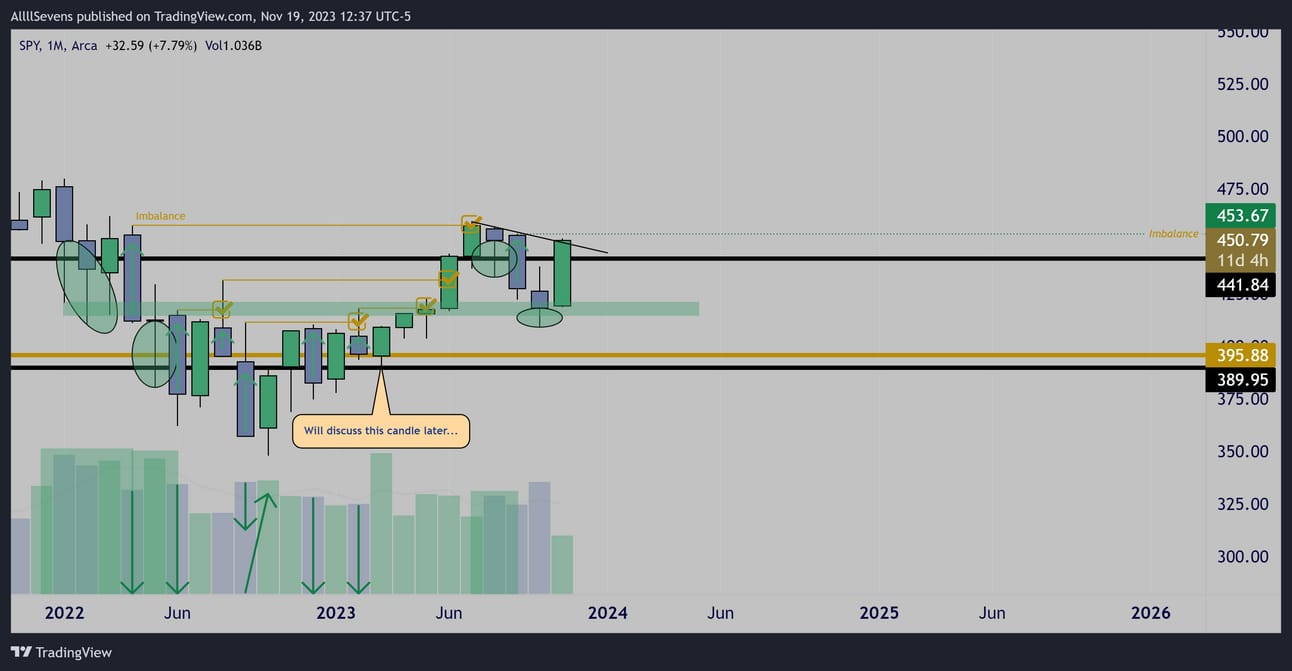

Monthly Accumulation

Imbalance @ $453.67

VPA @ DP explains the entire 2023 rally.

The recent August-October pullback showed continued accumulation and a new imbalance resting at $453.67

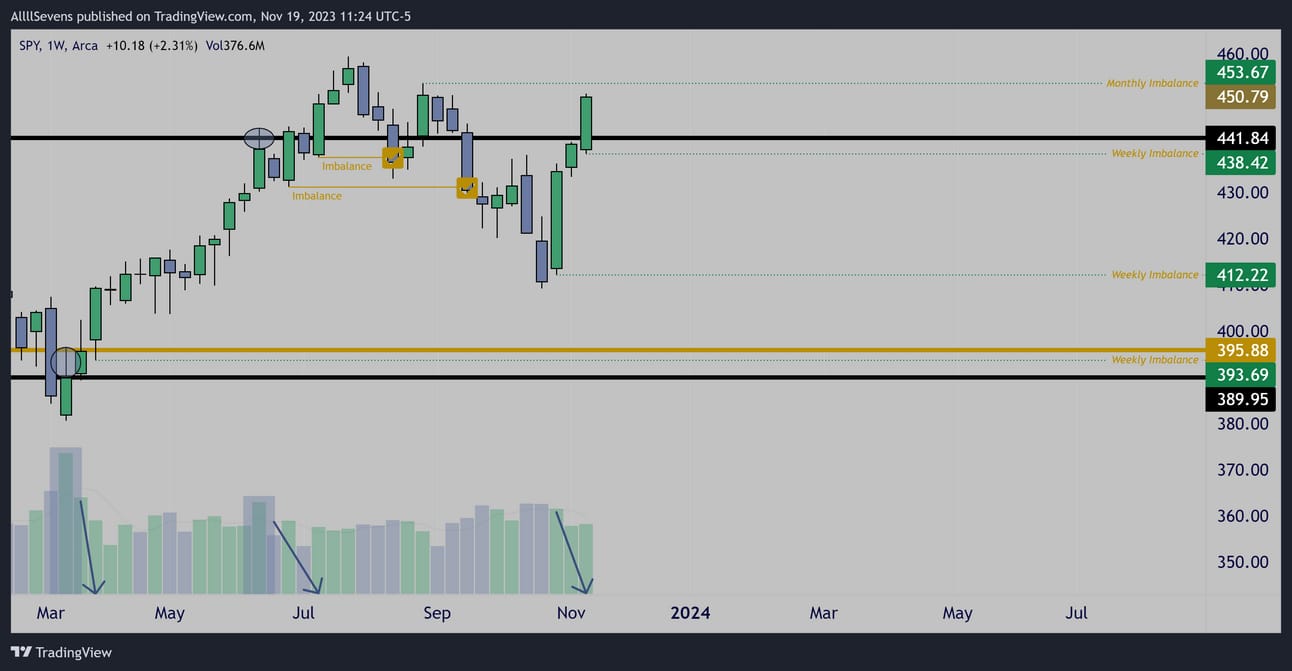

Weekly Accumulation

Accumulation patterns during the recent correction.

Decreased spreads and increased volume at each low.

Weekly Distribution

The March low is not stable.

While bulls are clearly in control over the last few months, they won’t be for ever. Let me explain.

The highest volume in over a year came in at the largest Dark Pool on record, leaving a prominent upper wick…

FOLLOWED BY an increasing spread decreasing volume move up off the dark pool…

Clearly showing distribution and lack of institutional participation as price rose away from the level, creating an imbalance at $393.69

Watch this video for further clarity.

https://x.com/AllllSevens/status/1723821796724494576?s=20

What does this mean?

As an investor, it means I do not want to buy here.

I can wait however long it takes for sub $400

As a trader, it doesn’t mean much until the chart begins to shift momentum towards the downside.

At this moment price is over all major resistances-

Not the ideal environment to go short with a favorable R/R

At the same time, I’m not a breakout trader so I can’t open short-term longs here. The best thing to do for me is to wait for a retest of $441.84

Unusual Options Flow

If you’ve been following the newsletter for the last 4 weeks you know that the flow has been overwhelmingly bullish on LONG EXPIRATIONS and notable downside flow with much shorter expirations.

This same theme continues.

With price not being at support or resistance there’s no real edge to be executing new trades here in my opinion, so I have nothing to share.

Conclusion

As an investor, I know I don’t want to buy above $393.69

As a swing trader, the monthly imbalance at $453.67 interests me.

The ideal entry for this target is as close to $441.84 as possible.

Being right below this level, the risk-to-reward is not favorable so I’m not letting this create any kind of bias for me. I’m mostly focused on day trading the SPY for the time being.

As a day trader, I have no bias. I will trade either direction based on intraday imbalances and my daily / intraday dark pools.

I trade on live voice every day on 𝕏 !

https://twitter.com/i/spaces/1zqKVqvjljLxB

Here are my Daily Dark Pools for SPY as well as two downside imbalances that have recently been created.

Daily

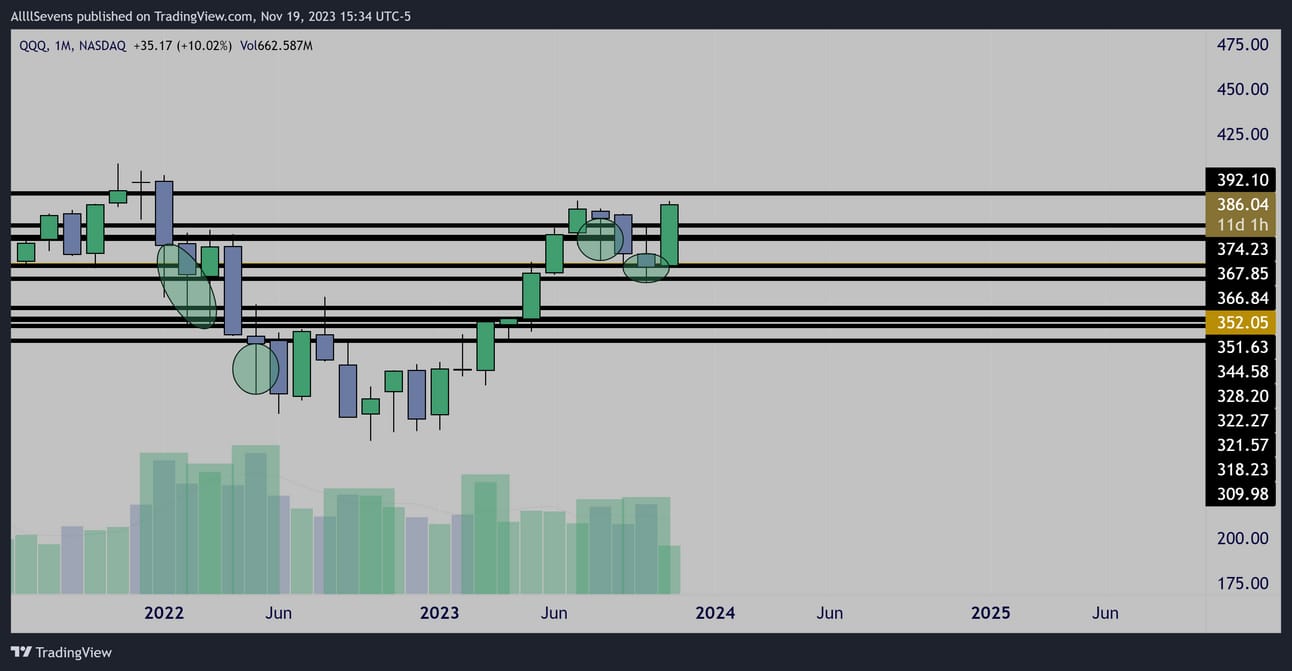

QQQ

Monthly

The same patterns as SPY-

And showing relative strength, already testing July highs.

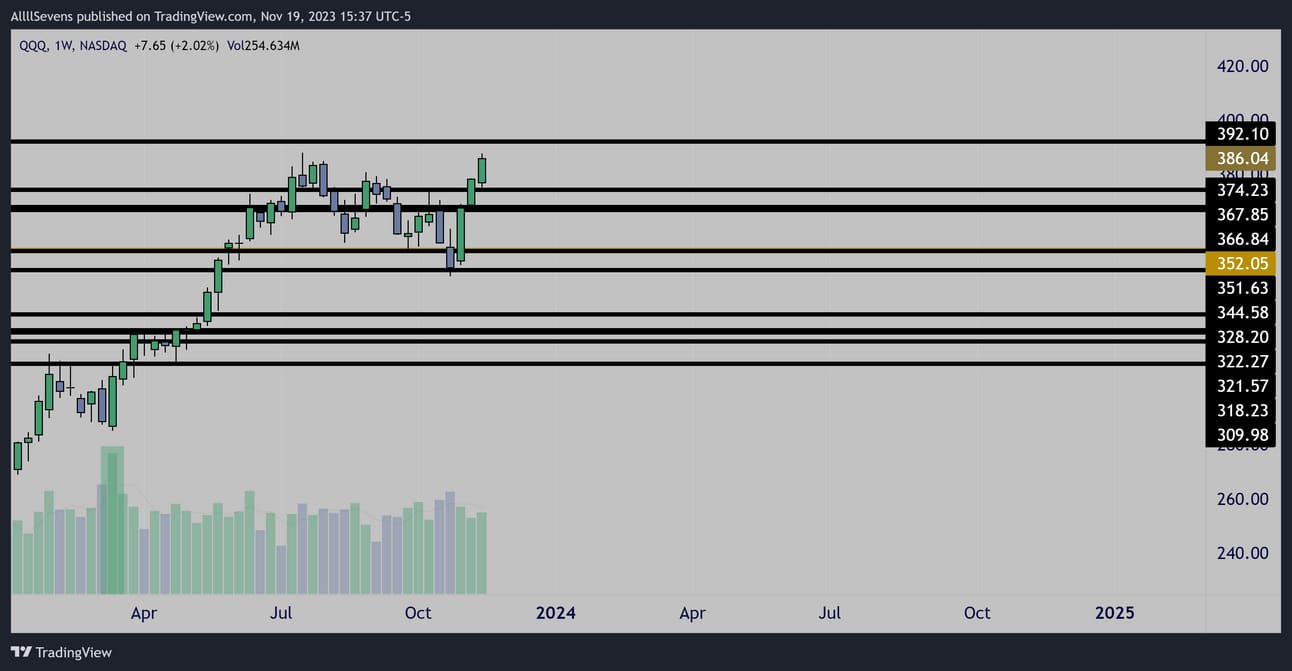

Weekly

Notice the QQQ does not show the same distribution pattern as the SPY in March. This is part of the reason why the QQQ is relatively strong.

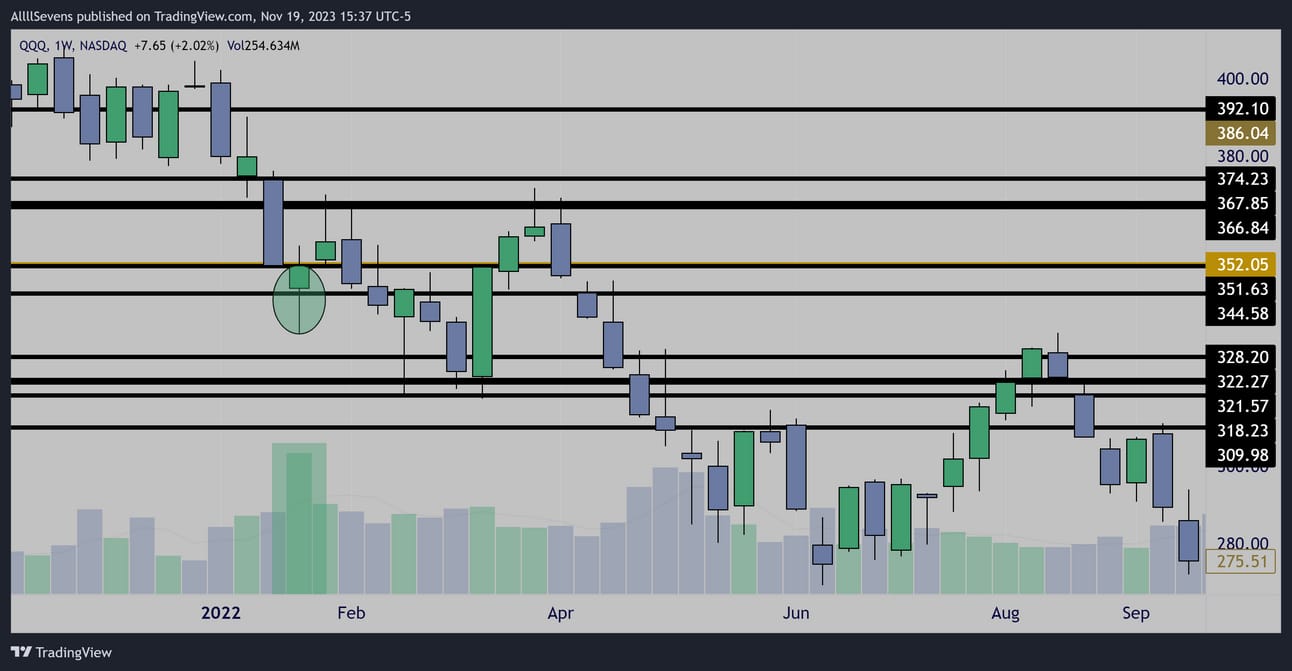

Weekly

The second reason is the 2022 accumulation.

The QQQ saw it’s largest weekly volume in over 10 years at the $352 dark pool (largest on record) on an accumulation candle.

After retesting this level in October the QQQ has blasted towards 52w highs at a much more rapid pace than the SPY

Conclusion

With the SPY over all major resistances, and QQQ with open space towards $392.10 that’s the direction I see the market currently heading.

Once that resistance gets hit, the SPY monthly imbalance should be rebalanced and that could ignite a pullback in the market. We’ll see.

Just like the SPY,

I have no swing trade here.

I’m simply waiting for resistance to get hit to consider short swings,

Or waiting for supports below to get retested to consider long swings.

SU

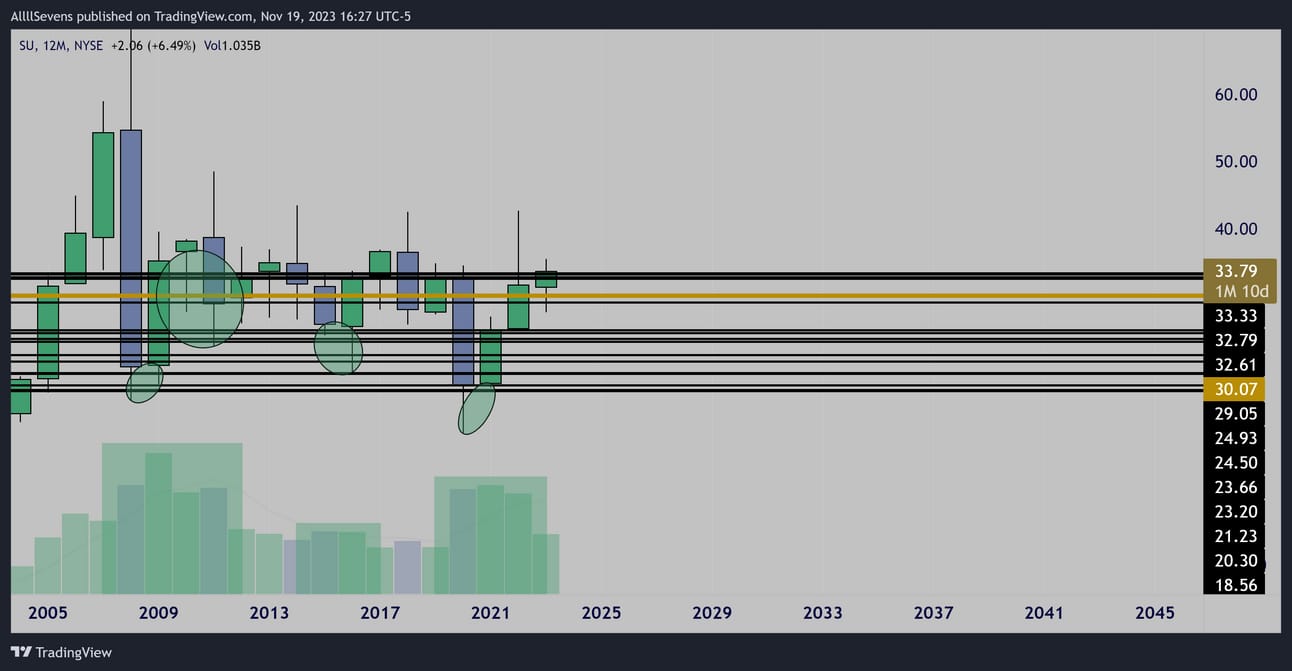

Yearly

Massive yearly base has formed with multiple high volume lows.

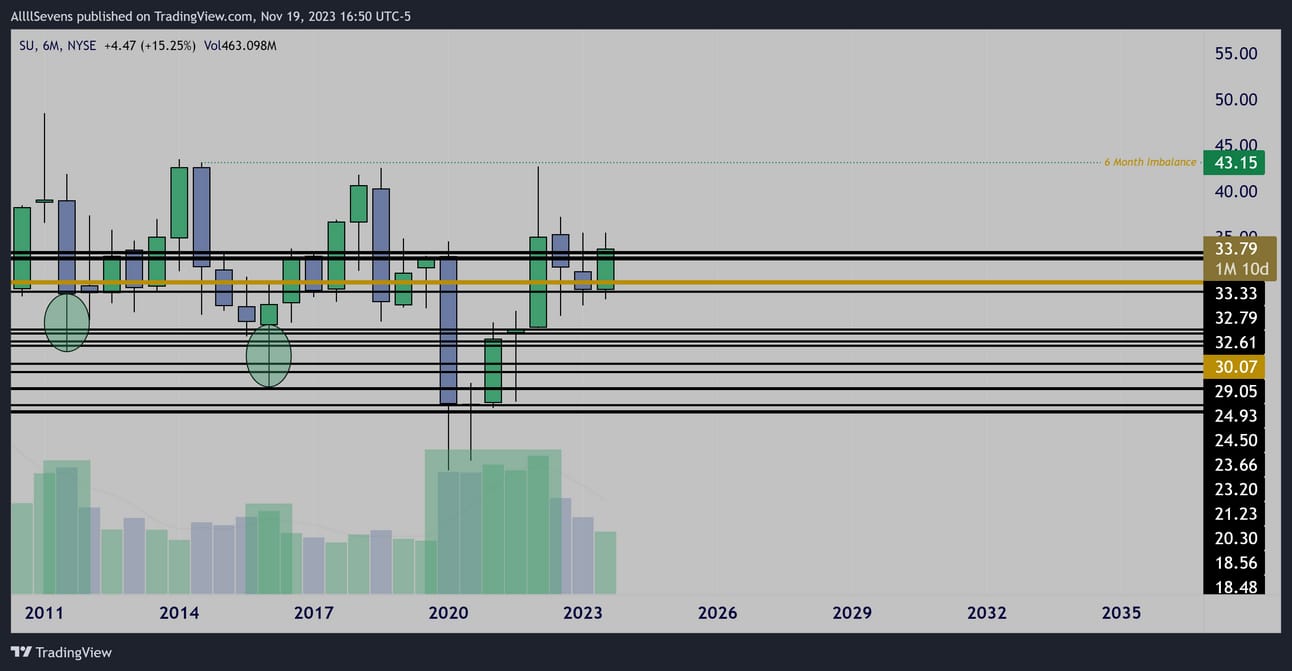

6 Month

6 Month Imbalance at $43.15

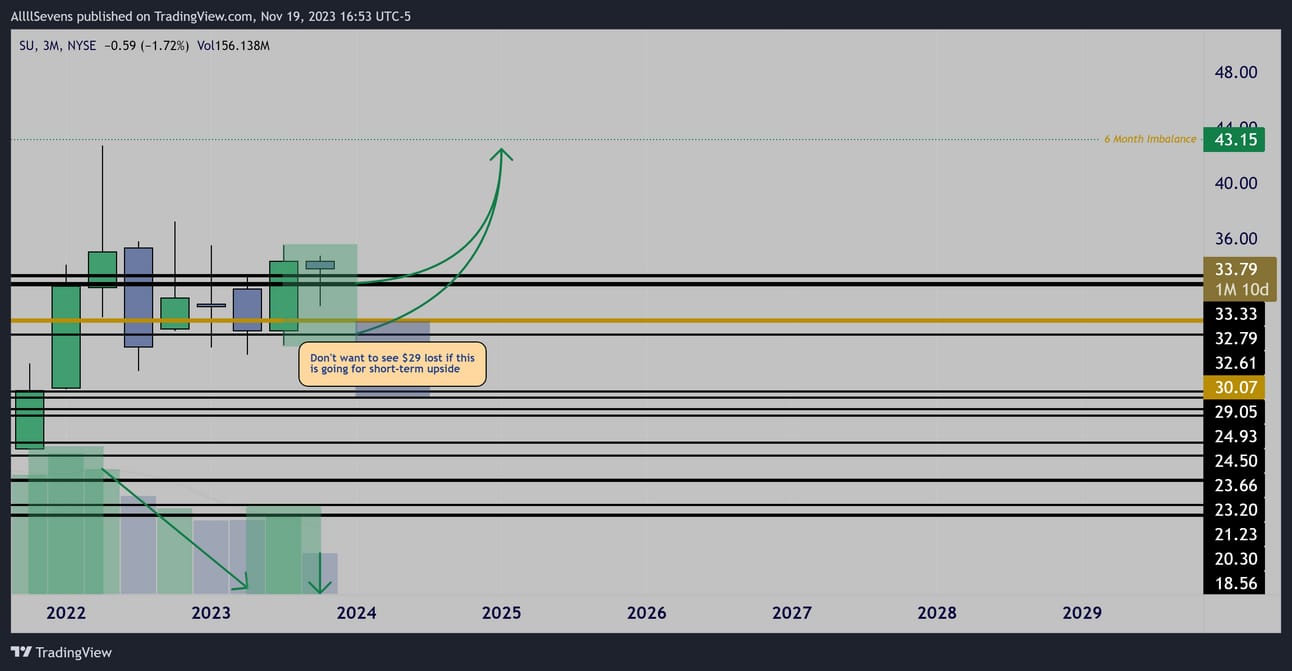

Quarterly

Low volume consolidation basing over the largest dark pool on record

($30.07) for almost two years now.

Low volume inside bar forming following a bullish impulse last quarter favoring potential upside continuation this quarter or next quarter.

If $29-$30 gets lost this likely falls into lower supports for further accumulation and attempt at a bullish run longer down the road.

I’m looking at that level to hold for short-term upside towards $43.15

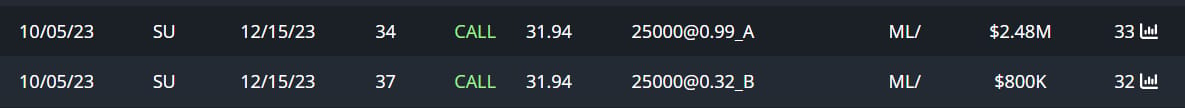

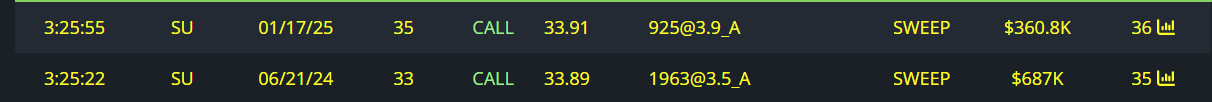

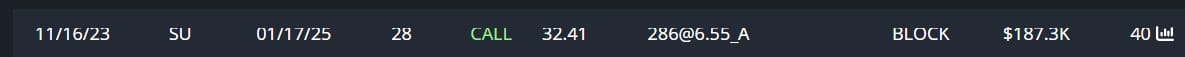

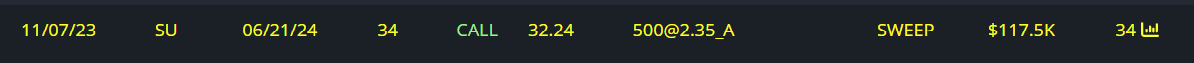

Unusual Options Flow

$1.7M Bullish Call Spread

$1M Calls Bought

$180K Calls Bought

$100K Calls Bought

Conclusion

Very coiled chart on all time frames.

Good risk-to-reward here if planning to hold as low as $30

Incredible risk-to-reward from here if planning to only hold as low as $29.60, looking for a move NOW and not later.

AllllSevens+

I also write a premium newsletter.

I save the BEST stock picks for AllllSevens+ members.

$SU is a sneak-peak.

Upon signing up for the premium newsletter you also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/gzxp9cTCDSzfJtjmSj

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply