- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 12/11/23

AllllSevens Weekly Newsletter 12/11/23

SPY QQQ XLV XLY

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing stated is intended to be interpreted as financial or investment advice.

I present the market through the lens of an institutional trader/investor by using Volume Price Analysis at Dark Pools. (VPA @ DP)

What is a Dark Pool?

Why do Dark Pools exist?

How are Dark Pool Price Levels useful in trading & investing when combined with Volume Price Analysis?

See this tweet below if you’d like to know.

https://x.com/AllllSevens/status/1725949825307254859?s=20

Reach out if you have questions.

Preface:

The SPY is setting up for a potentially explosive upside move this week.

The QQQ is at a major pivot that will be crucial to whether or not not SPY

can breakout.

The XLV is a great long-term DCA,

Short-term it is below a large resistance.

The XLY is in the same situation-

However, it has some room to it’s resistance, and I believe if the SPY rallies this week this sector will show relative strength.

Also, make sure you check out the newsletter I sent over the weekend:

$CHWY Chewy, Inc.

https://x.com/AllllSevens/status/1733319169993523305?s=20

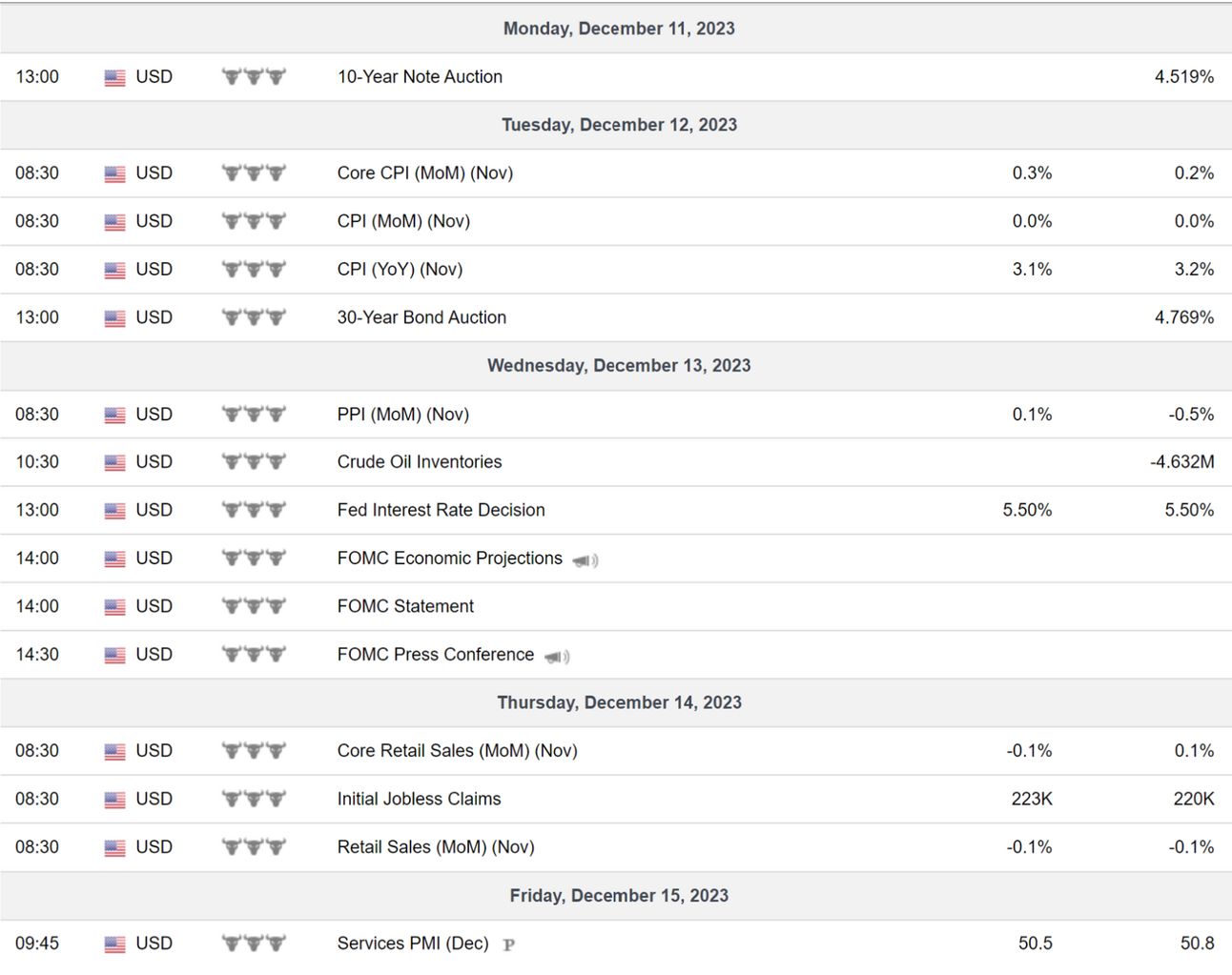

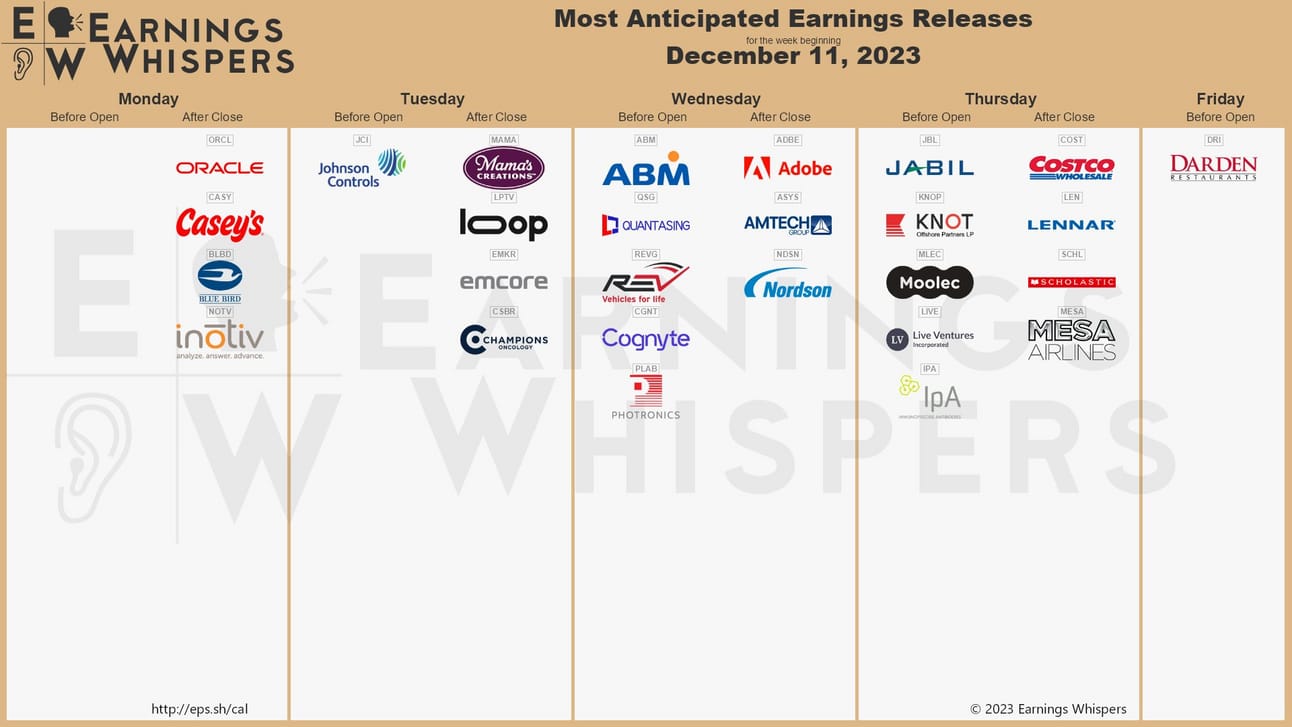

Calendar

High Impact US Economic Data

Bloomberg

SPY

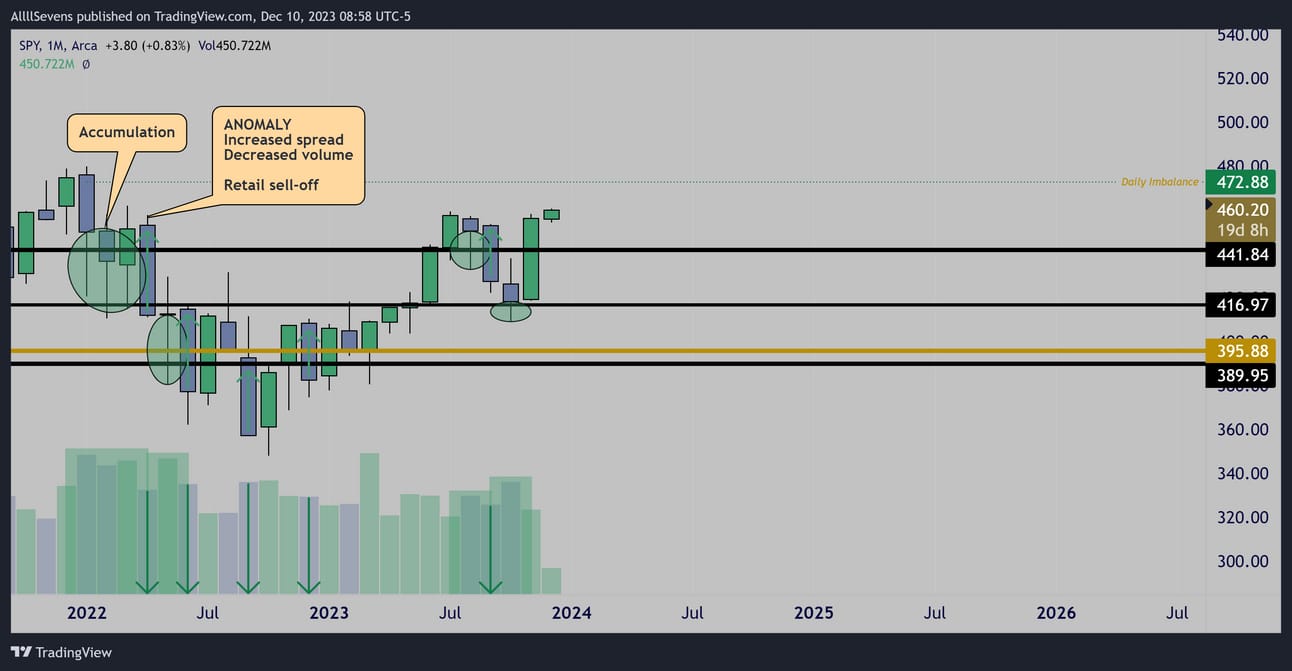

Monthly

Major Institutional Accumulation at $441.84 & $395.88 in 2022

Increased spread decreased volume candles relative to the accumulations, confirming that only impatient retail investors were driving prices lower while patient institutional investors bought.

Further accumulation has taken place in recent months.

Over $441.84, the SPY is very strong.

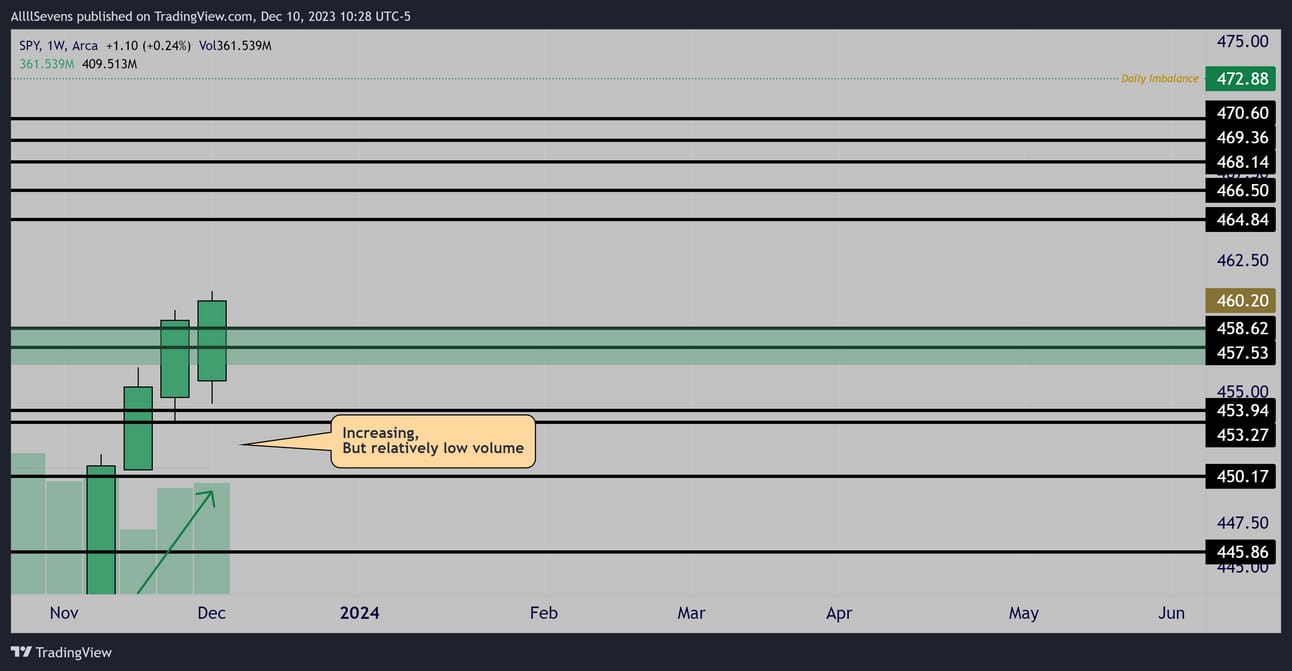

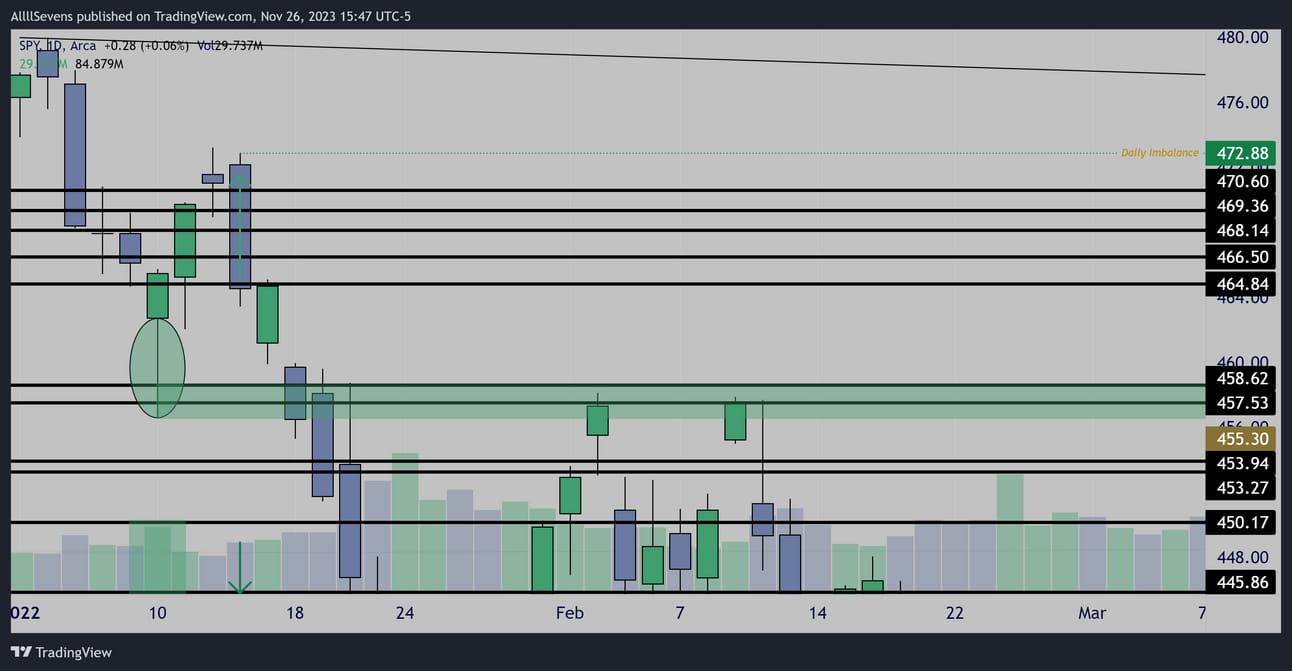

Weekly

The weekly chart is attempting a breakout over $457.53-$458.62

Potentially opening up the current range towards $464.84

Volume is increasing on this breakout, but it’s relatively low compared to recent candles.

Therefore, the best entry to execute on this break would be a retest and visible high volume defending support for a bounce.

I wouldn’t feel comfortable adding exposure here extended from support.

We have lots of economic data coming in this week, which will surely provide the volume needed to confirm or deny this breakout.

Despite the lack of volume on this breakout creating an increased probability for a retest before range truly opening up-

I already positioned long inside support before the Friday breakout.

Here’s why:

Daily

If you drop down to the Daily chart during the 2022 Monthly accumulation, you see large buyers off the $457.53-$458.62 Dark Pools…

A decreased volume increased spread candle sold price back down through support… An anomaly. Just like displayed on the Monthly chart.

The highs of these anomalies always get broke.

I call these imbalances.

There is a Daily Imbalance at $472.88

So,

Price is attempting to breaking out of a demand that was previously accumulated…

This substantially decreased the odds of a failed breakout occurring.

What would invalidate my bullish thesis?

The #1 thing I don’t want to see next week is an open BELOW $457.53

As long as price opens over this pivot zone, it’s very likely any dip would get ate, and intraday volumes would confirm this.

If price loses support, and intraday volumes do not show accumulation, then my thesis would be invalidated.

There is great nuance to this and I will be updating the SPY daily on 𝕏 !

https://twitter.com/AllllSevens

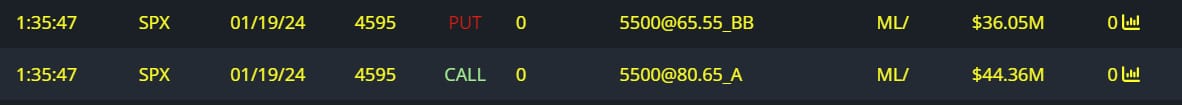

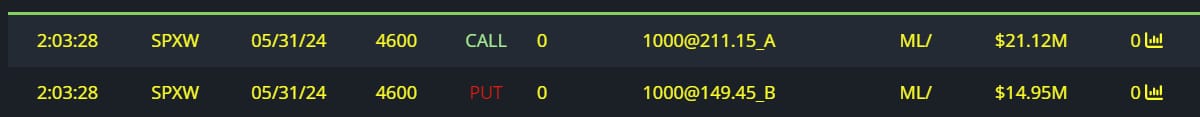

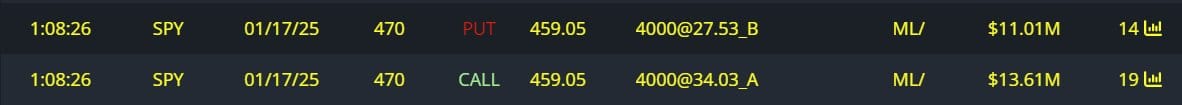

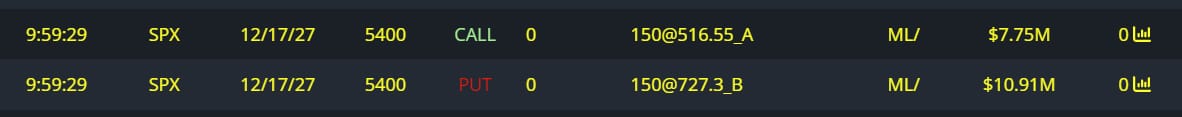

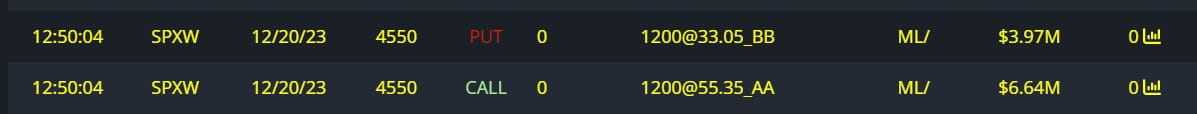

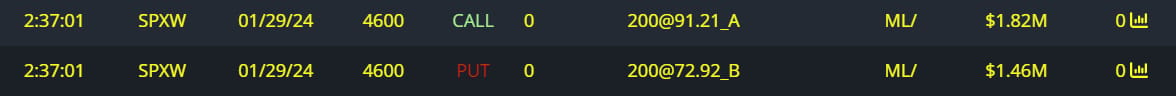

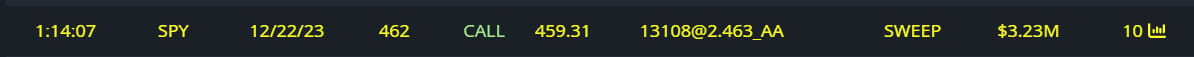

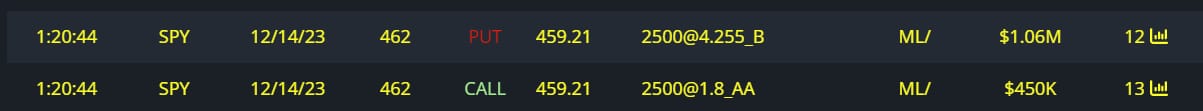

Unusual Options Flow

$80M Full Risk Bull

$36M Full Risk Bull

$24M Full Risk Bull

$18M Full Risk Bull

$10M Full Risk Bull

$4M Calls Bought

$3M Full Risk Bull

$3M Calls Bought

$1.5M Full Risk Bull

Some extremely bullish options flow this week.

Traders with LOTS of money are seeing the same lucrative setup as me.

This adds to my extreme confidence that price is going to successfully breakout and begin rallying through this volume gap.

Conclusion

This is a lucrative market setup.

-Breaking a previously accumulated level.

-Volume gap (range) for a potentially fast and trendy move.

-Massive options flow for added conviction.

I want to be long this week, risking around 456.60 max (green zone)

Ideally, price holds $457.53-$458.62 with strong volume, not slipping to the bottom of the green zone.

My main target is the top of the volume gap $464.84,

I want 12/14 462c’s for this trade.

After the volume gap fills, I expect price to continue higher, but it could get choppy, and might even reject before continuing the push higher.

My final target will be the Daily rebalance at $472.88.

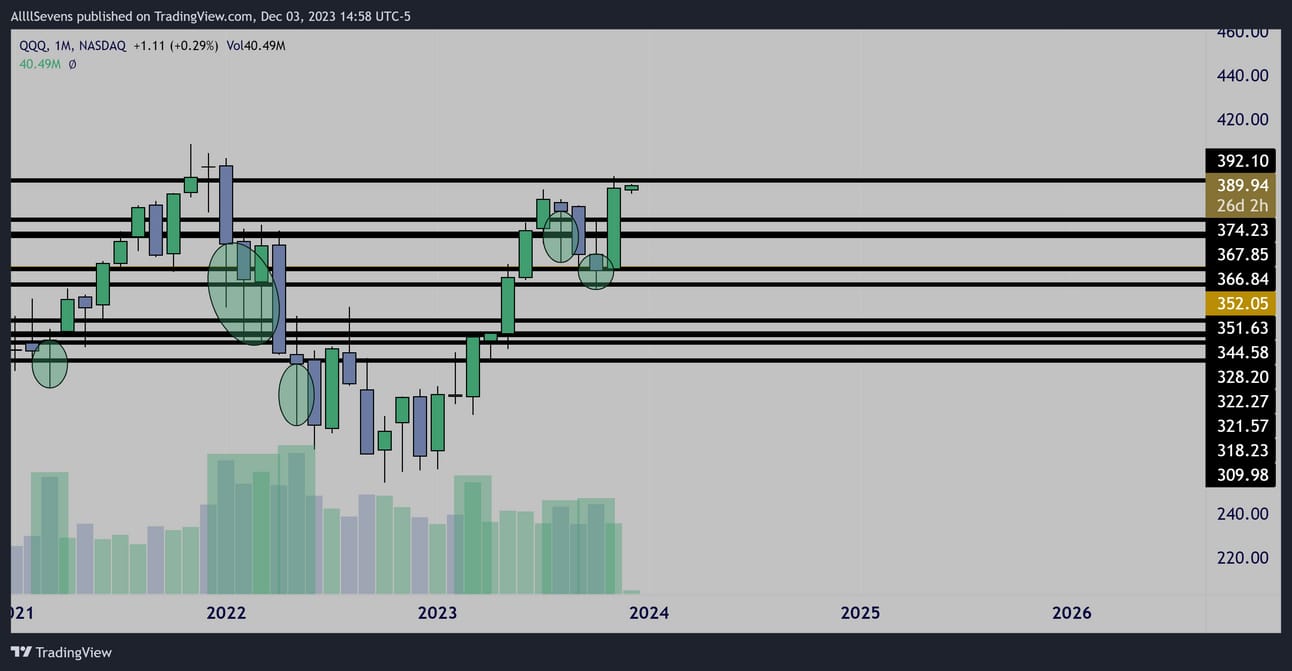

QQQ

Monthly

Even better accumulation patterns than the SPY

Makes sense it’s been relatively strong this year doesn’t it?

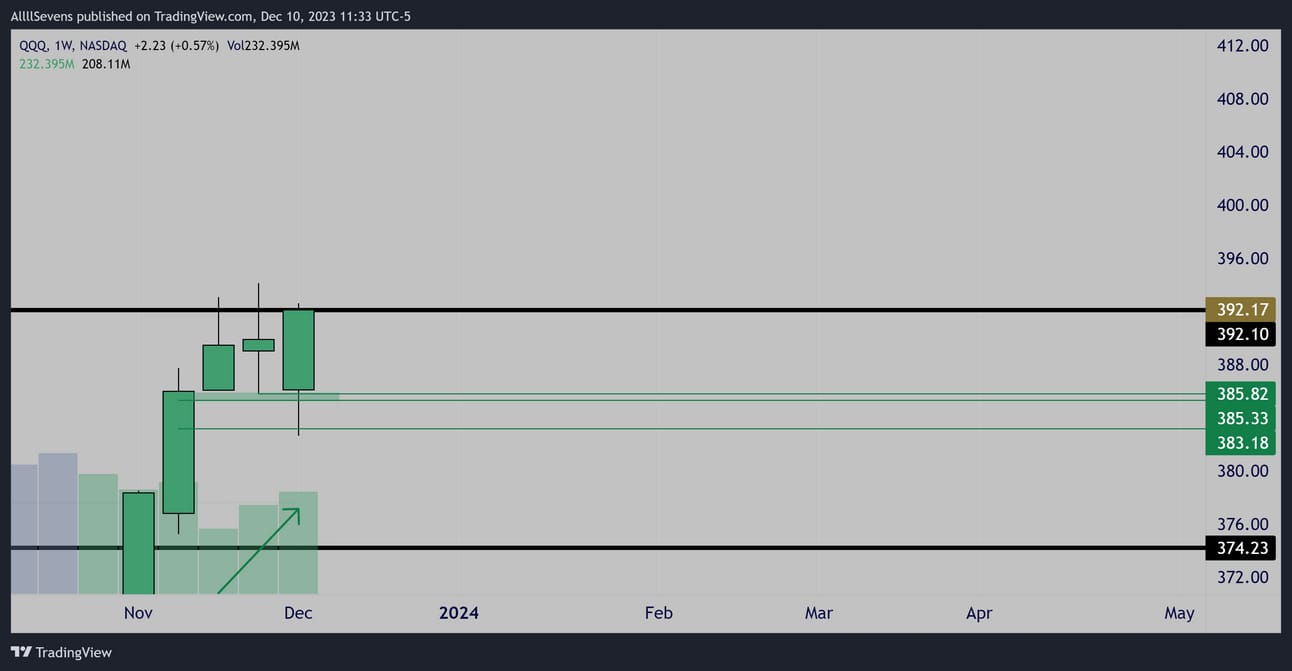

Weekly

Attempting to break a key resistance on increasing but below average relative volume. Same situation as the SPY.

This level has seen lots of intraday bull volume the past three weeks-

No signs of distribution.

Therefore, probabilities favor the breakout.

Any retest’s with continued accumulation would be buy opportunities.

Conclusion

If the QQQ opens BELOW $392.10 I think it’s likely the SPY will retest demand before making a move upwards.

If QQQ opens OVER this level, it increases the odds of a “melt-up” move with no retest of the breakout.

I’m mainly focused on the SPY chart as I am much more convicted there.

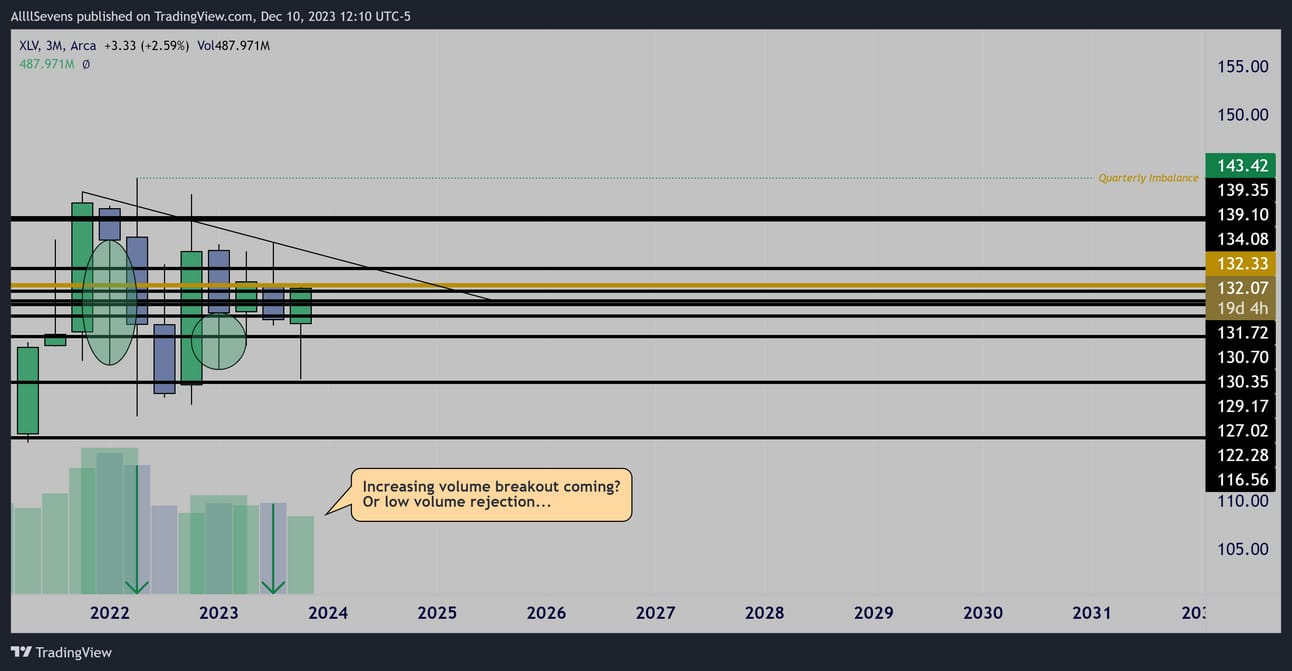

XLV

Quarterly

Large accumulation off the largest Dark Pool on record $132.33

Huge anomaly sell-off following this, creating an imbalance above all notable Dark Pools on record.

This tells me that there’s a lot of upside potential for this sector,

Long-term.

As you can see,

Price is clearly in a downtrend, and clearly BELOW the POC $132.33

Until this breaks, it is a DCA

Conclusion

This is not a short-term callout for longs.

I don’t know when this sector begins trending, I just know it will.

It’s definitely something to keep on watch on the higher time frame for any dip buys or a strong reclaim of $132.33 which could spark a large trend rotation into the healthcare sector.

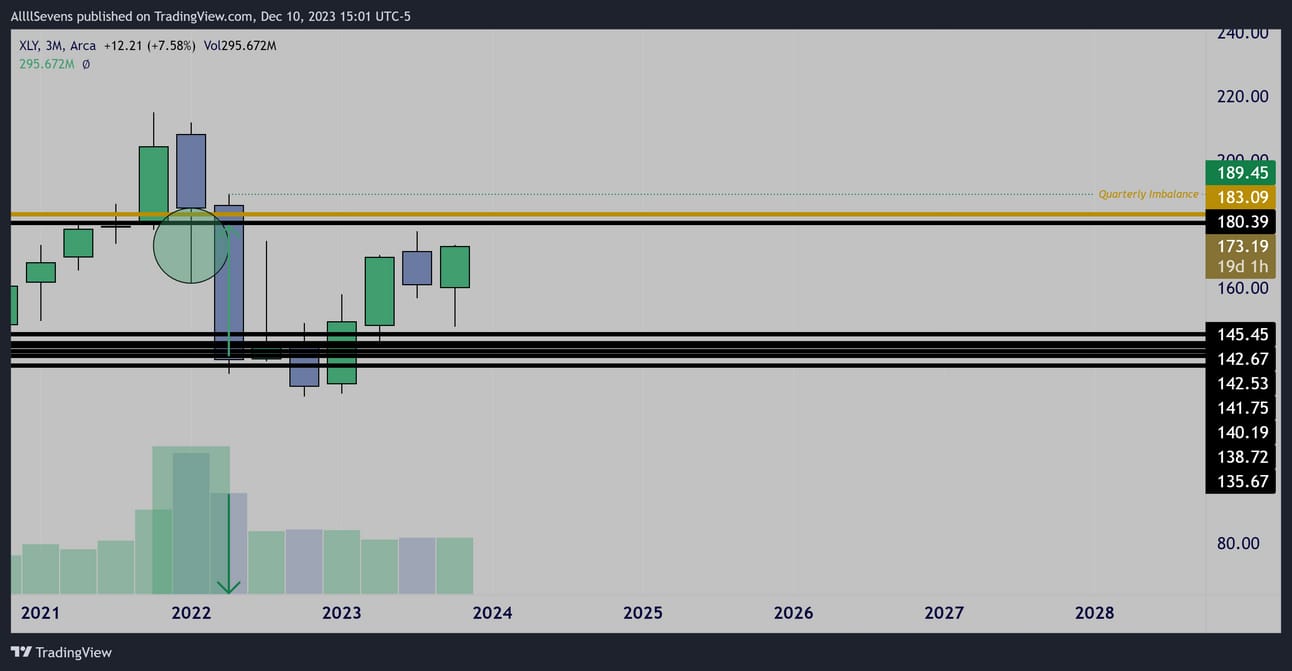

XLY

Quarterly

Accumulation off the largest Dark Pool on record $183.09

As price is below this Pivot, this ETF is a DCA

Only when it reclaims the pivot am I interested in short-term aggressive positioning. The exact scenario as the healthcare sector above!

Weekly

Heading into this week, if the SPY is as strong as I assume it will be-

The XLY breaking trend with no resistance until $180 could offer some potential relative strength in the sector.

Check out what kinds of stocks are in this sector below

https://www.sectorspdrs.com/mainfund/xly

Conclusion

A great long-term DCA

Short-term, not a major focus of mine (the ETF)

Short-term, I AM focused on individual names in this sector for possible relative strength!

AllllSevens+

I write a premium newsletter and I discuss individual stocks.

Upon signing up for the premium newsletter you also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/70Kp9cTCDSzfJtj0fe

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply