- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 9/18/23

AllllSevens Weekly Newsletter 9/18/23

SPY, XLF, BAC, IWM, KRE, AAPL, CLF, PFE

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

SPY

This month-

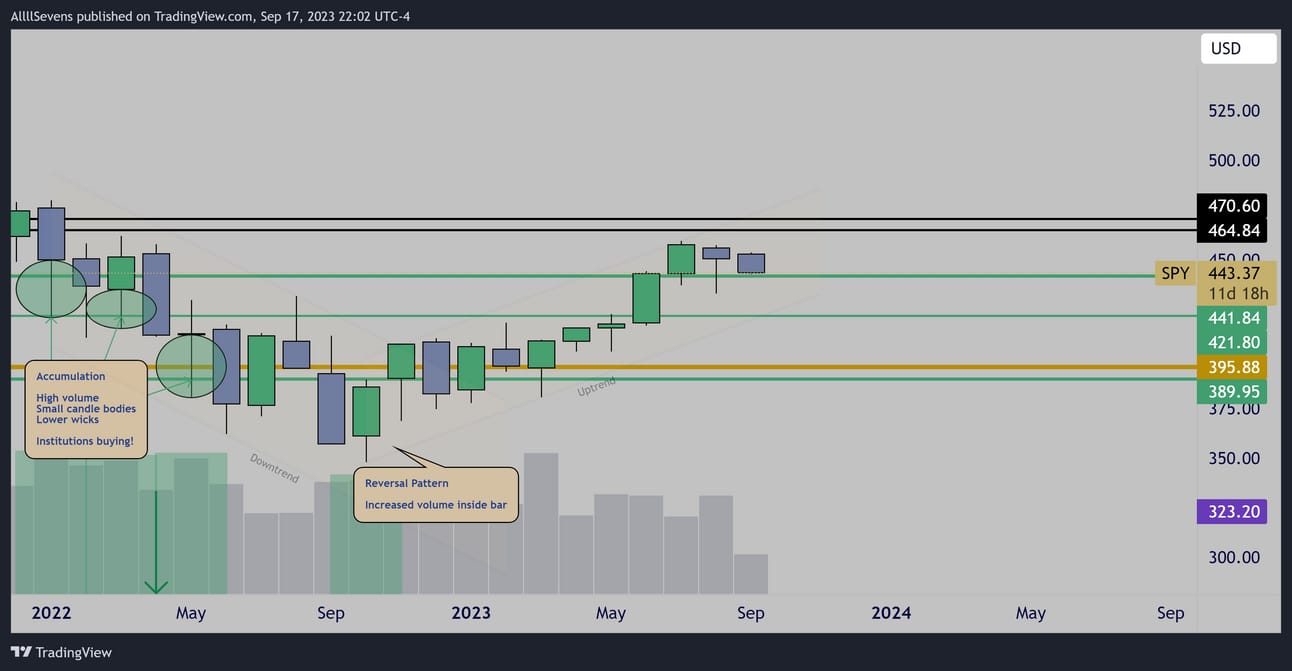

Institutions are long the SPY (S&P500).

They accumulated in Jan-May of 2022.

Monthly

Is now a good time to buy?

Monthly

I don't think so. It is a good time to hold.

Price is currently trending up, but bearish anomalies suggest a pullback will come, providing a better opportunity to buy.

Conclusion

Own it, but don’t buy it.

Price is currently trending up. Over $441.84 upside momentum is strong.

If it is lost, momentum could begin to fade.

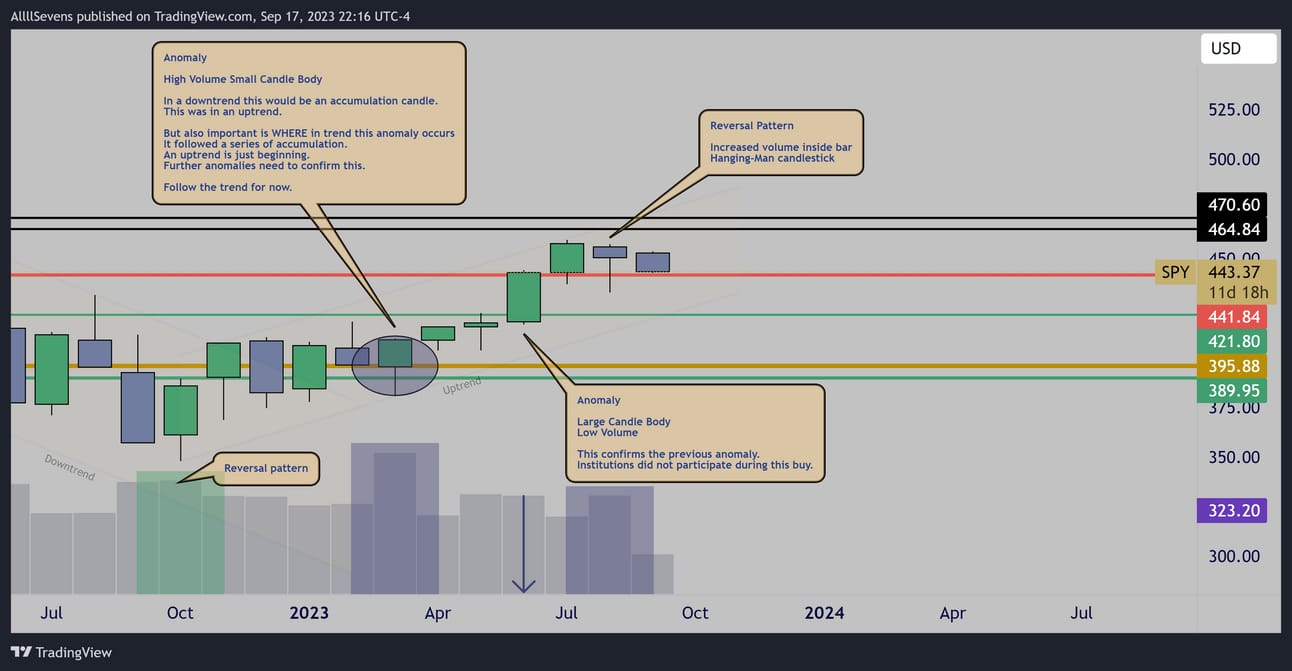

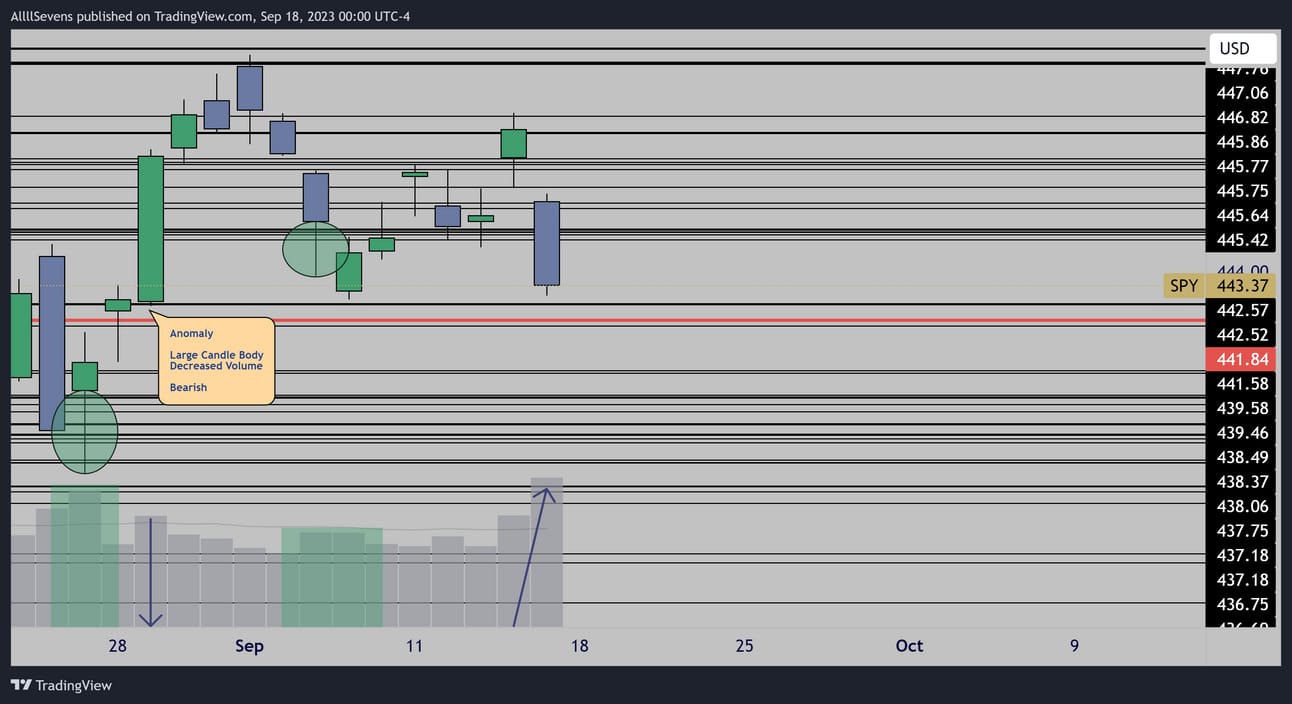

This week-

3 week inside bar consolidation.

Price is also in a pennant consolidation.

Above $445.40-.90 monthly momentum is up and weekly is up creating a strong bullish environment,.

Weekly

While institutions are actively accumulating, they are not participating on the upside runs. Just like on the monthly…

Institutions are trapping retail longs.

Below $441.84 monthly momentum is fading and weekly momentum is strong down, creating a moderately bearish environment.

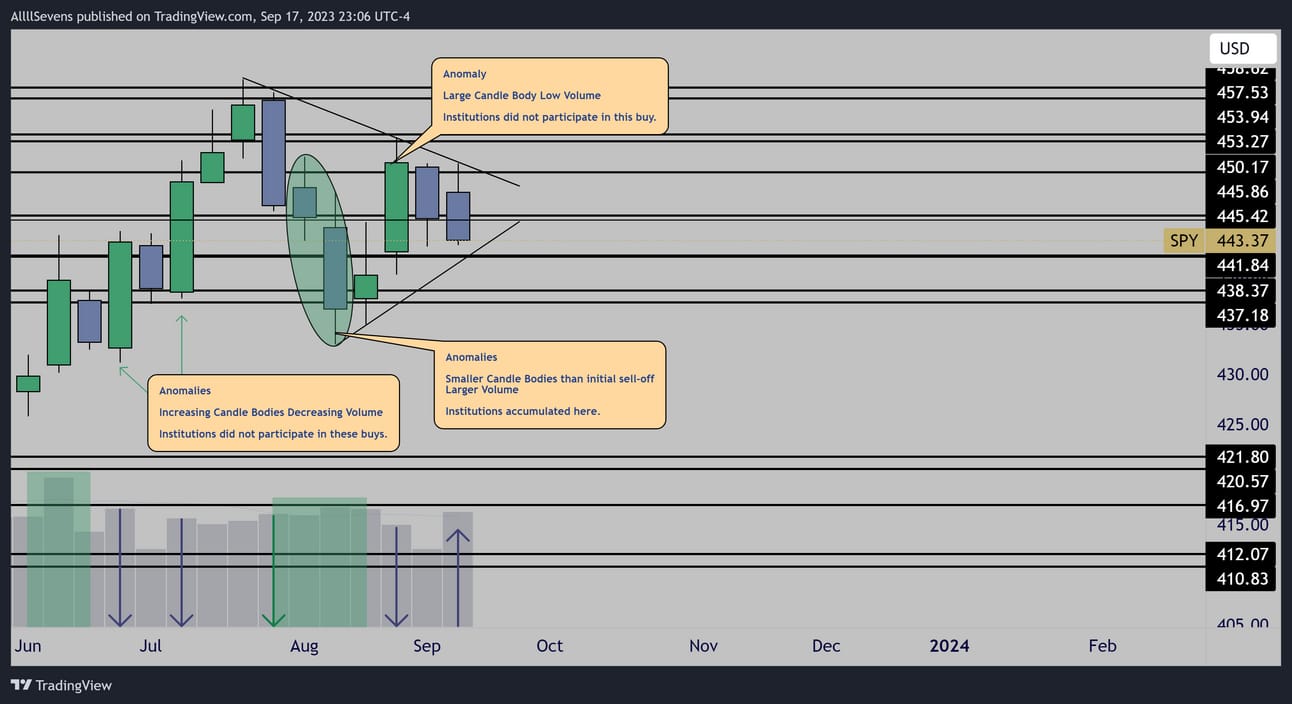

Daily

The daily chart shows the same patterns as the weekly and monthly.

Institutions have been trapping longs.

Price is trending down aggressively here, showing a trend of aggressive buyers on aggressive dips. Will that repeat?

Conclusion

There is reason to anticipate a pullback at some point and to not actively buy into the SPY right now.

Until that happens, momentum currently favors upside, unless price begins to break down and gain momentum.

Momentum is mixed on the weekly chart, ready to go either way this week. $445.40-.90 is the pivot to watch.

Bullish above and bearish below.

Momentum is strong to the upside on the monthly chart.

$441.84 is the pivot to watch.

Bullish above and risk-off below.

XLF

Monthly

Bullish accumulation patterns.

Pennant consolidation.

Weekly

Not necessarily A+ weekly patterns for an upside break.

Not A+ for a short either.

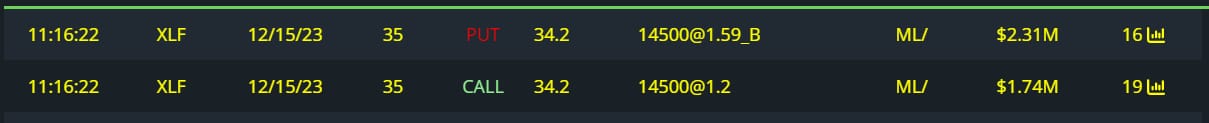

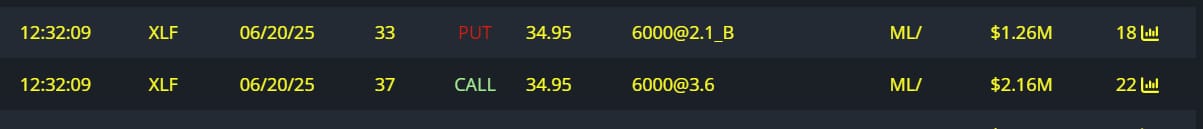

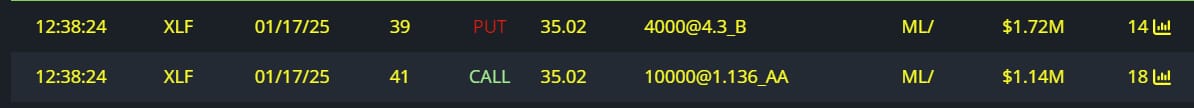

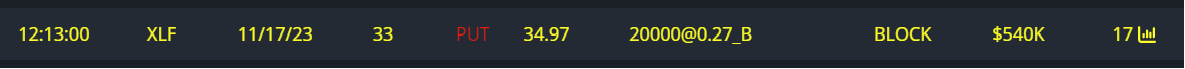

Unusual Options Flow

$15.3M Bullish Flow

$4.47M Full Risk Bull

$4.05M Full Risk Bull

$3.42M Full Risk Bull

$2.86M Full Risk Bull

$540K Puts Written

Conclusion-

These monthly accumulation patterns are serious,

But price is still consolidating. Confirmation of a breakout is needed before I get too excited. The options flow seems convinced already.

The weekly patterns don’t show a crystal clear picture yet.

Need to see more candles develop.

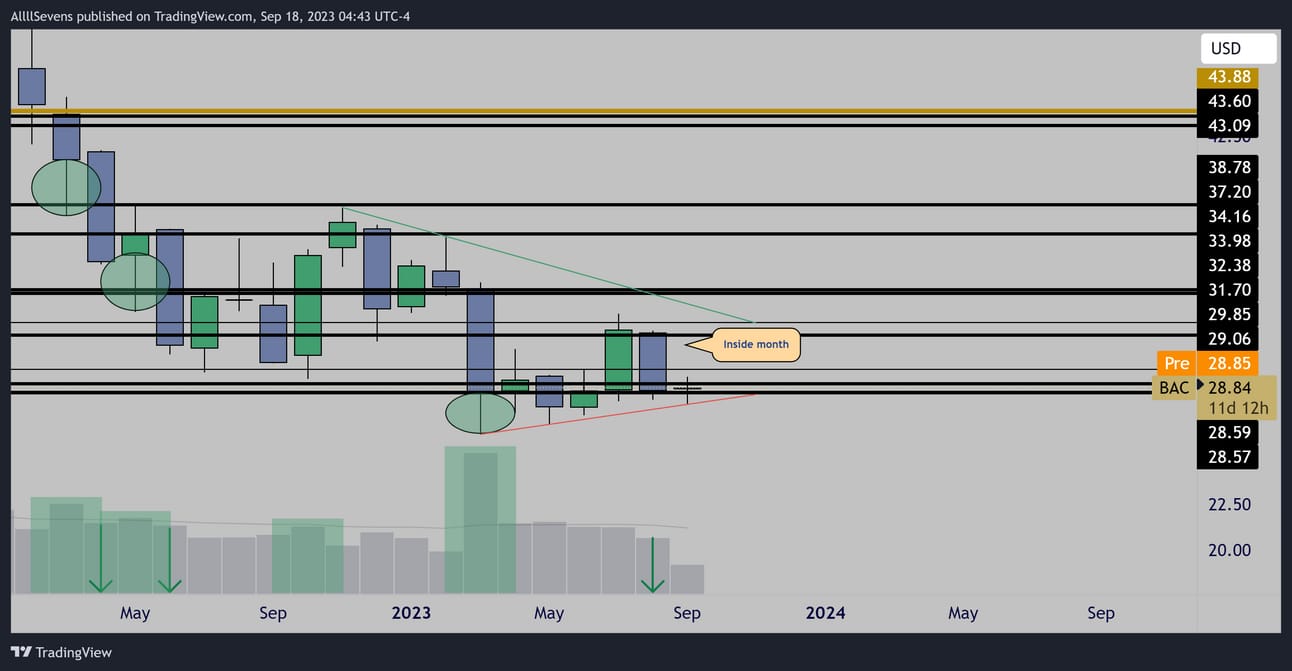

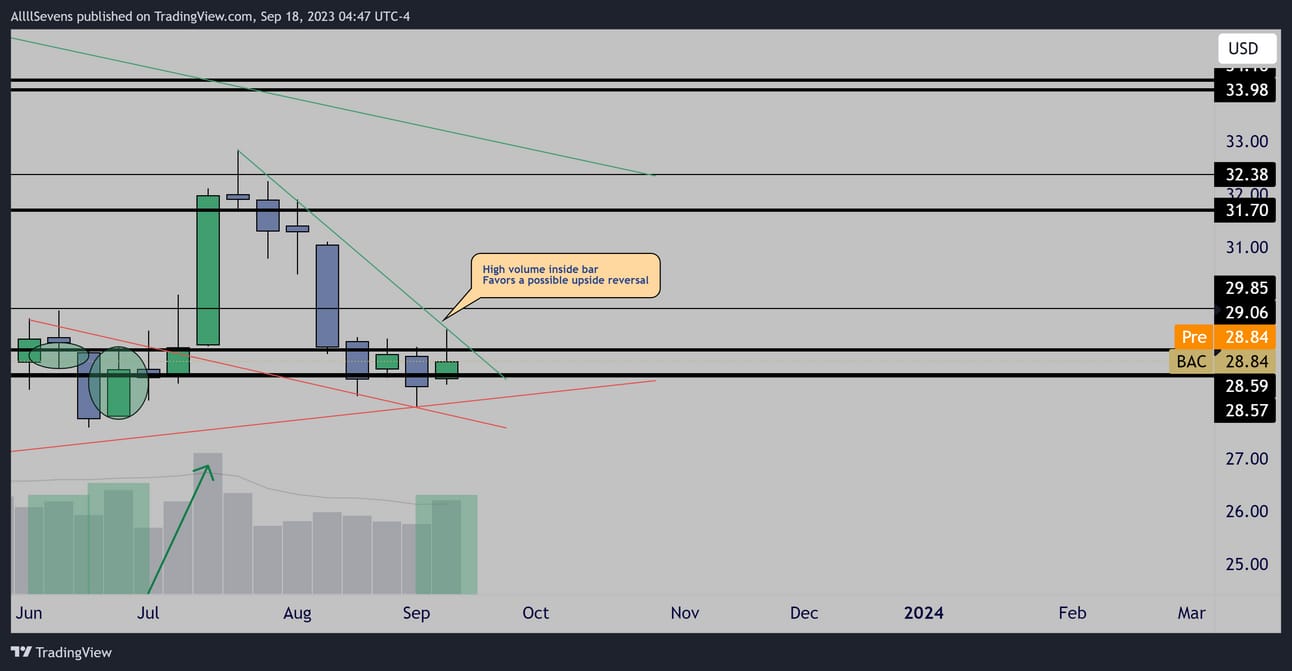

BAC

Bullish accumulation patterns.

Pennant consolidation.

Weekly accumulation patterns.

Falling wedge consolidation.

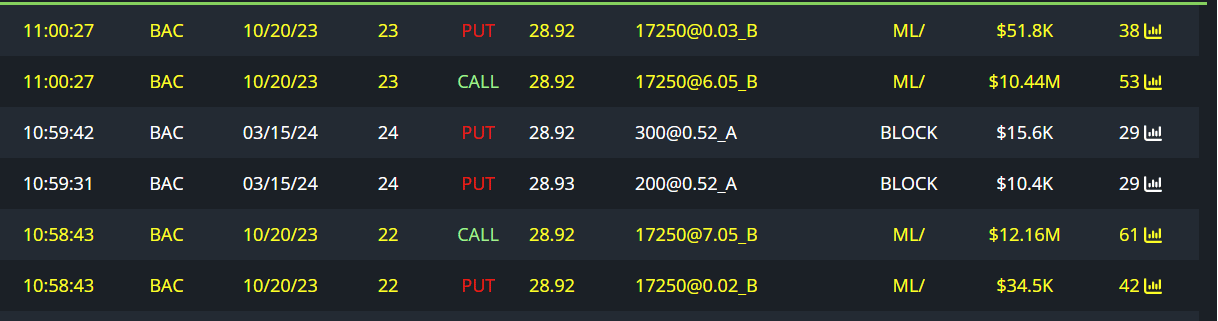

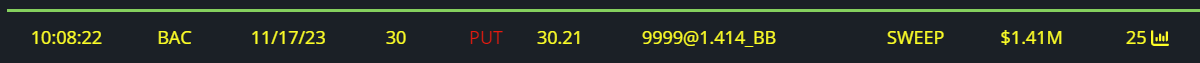

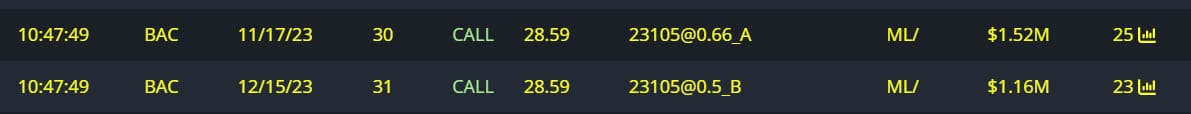

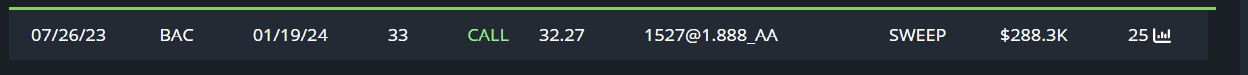

Unusual Options Flow

$22.6M Calls Written

$1.4M Puts Written

$360K Bullish Call Spread

$288K Calls Bought

Conclusion-

One of my favorite monthly charts.

There is no confirmed trend here yet.

The weekly very looks promising if it can hold support.

The options flow is very mixed right now, lots of premium collectors.

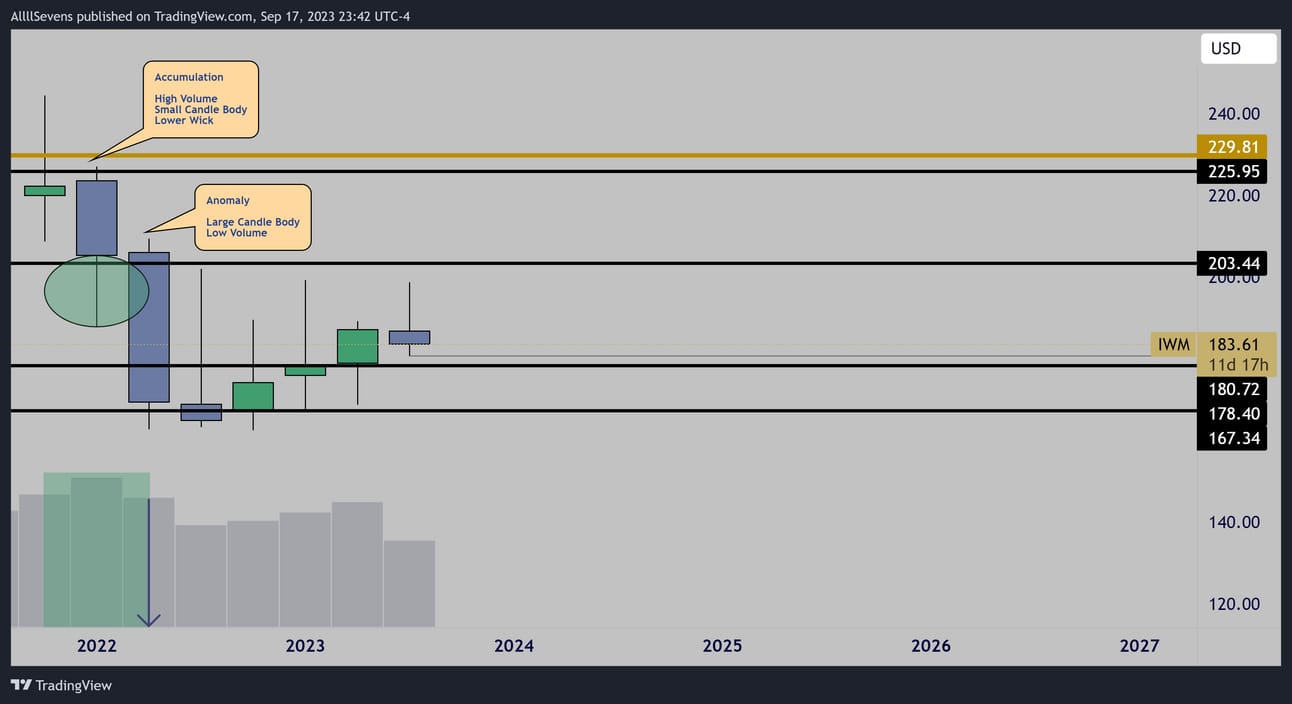

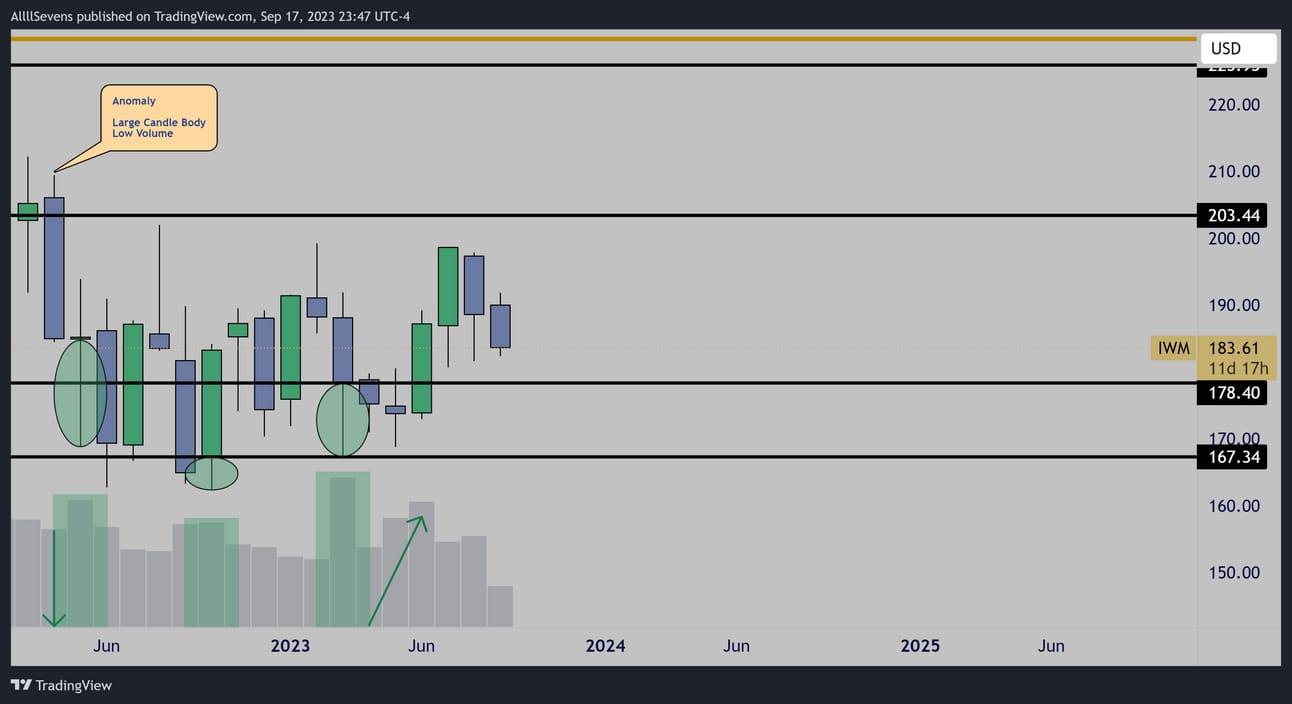

IWM

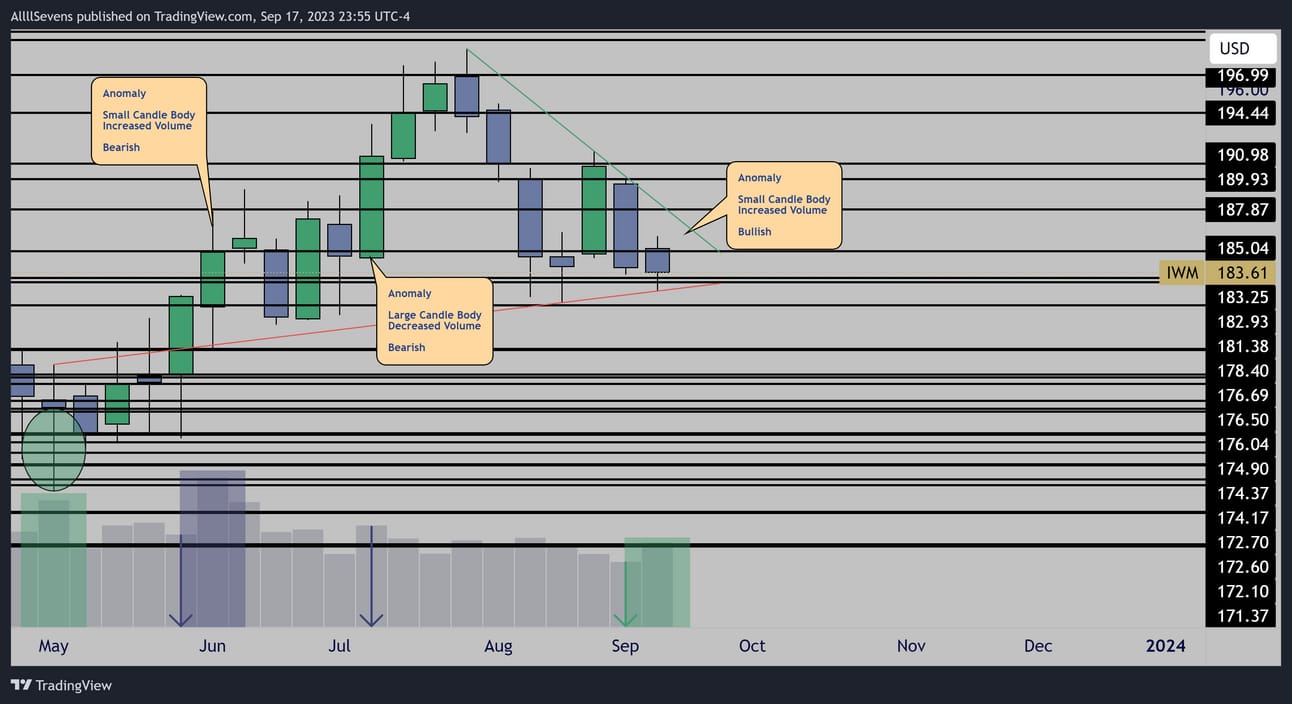

Quarterly

Incredible accumulation & anomaly.

Monthly

Bullish accumulation patterns.

Bear flag / pennant consolidation.

Weekly

Mixed signals.

Initially looked like price would no doubt breakdown and retest $178.40

Now there is a bullish anomaly just before the breakdown.

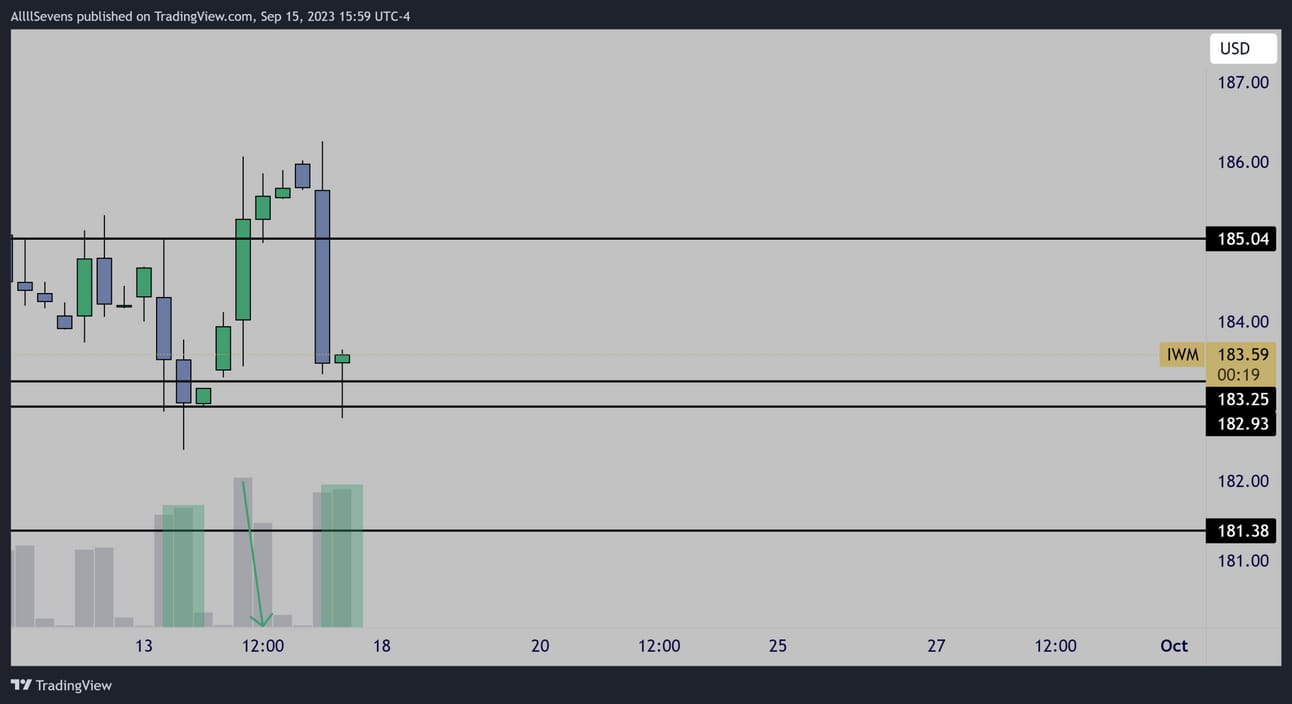

Daily

Accumulation patterns.

Triple bottom potential.

4HR

A+ accumulation the past few days.

High high was made, now attempting a double bottom.

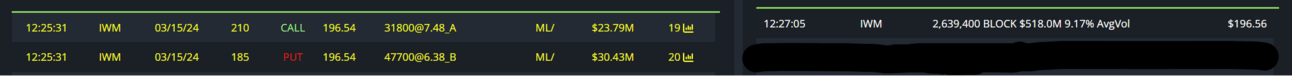

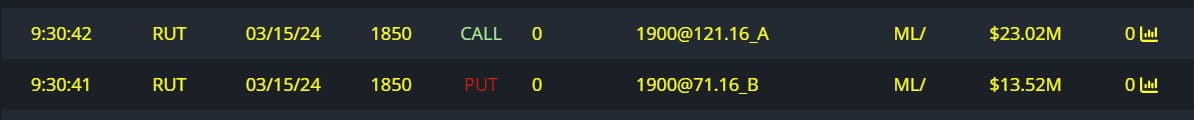

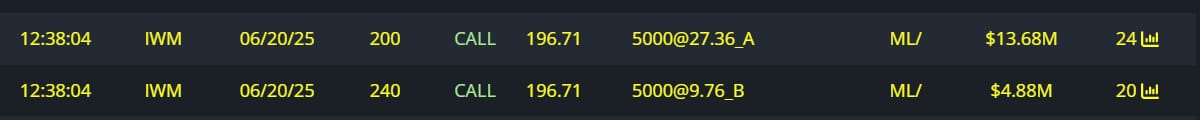

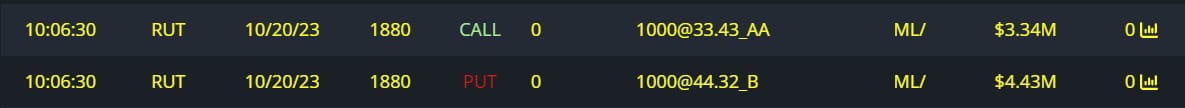

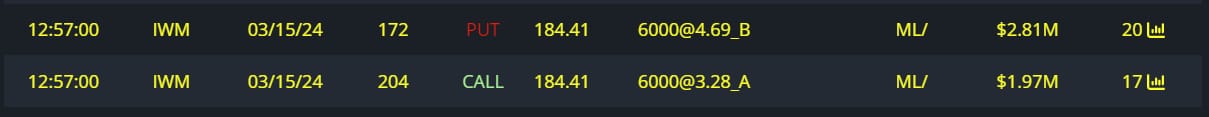

Unusual Options Flow

$122M Bullish Flow

$54.22M Full Risk Bull

+

$518M Dark Pool

$36.5M Full Risk Bull

$8.8M Bullish Call Spread

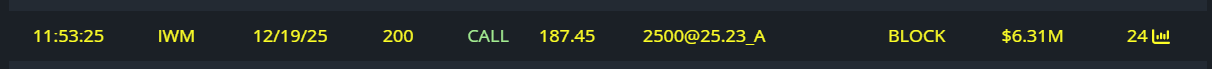

$7.77M Full Risk Bull

$4.78M Full Risk Bull

$6.3M Calls Bought

$2.79M Full Risk Bull

$1.3M Puts Written

Conclusion-

Incredible accumulation patterns on the quarterly and monthly charts.

Trend is up, and currently pulling back.

On the weekly price is consolidating at a very pivotal spot.

A confirmed volume bounce here would be huge.

Daily and 4HR patterns are A+ for a bounce right now.

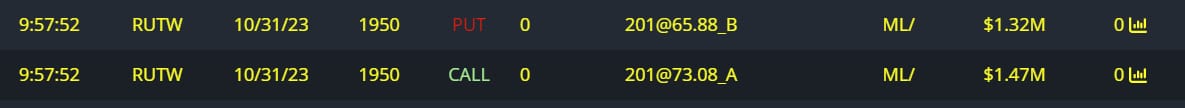

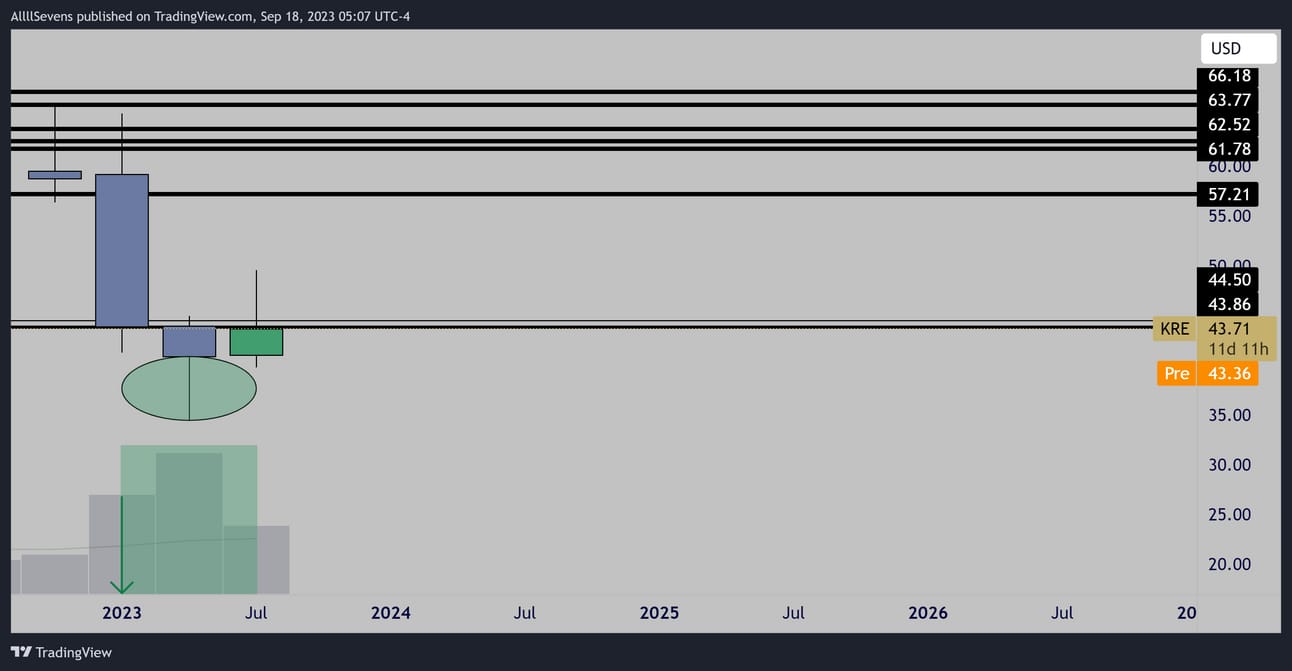

KRE

Quarterly

Massive stopping volume / accumulation.

Monthly

Bullish accumulation patterns.

Decreasing volume pennant consolidation.

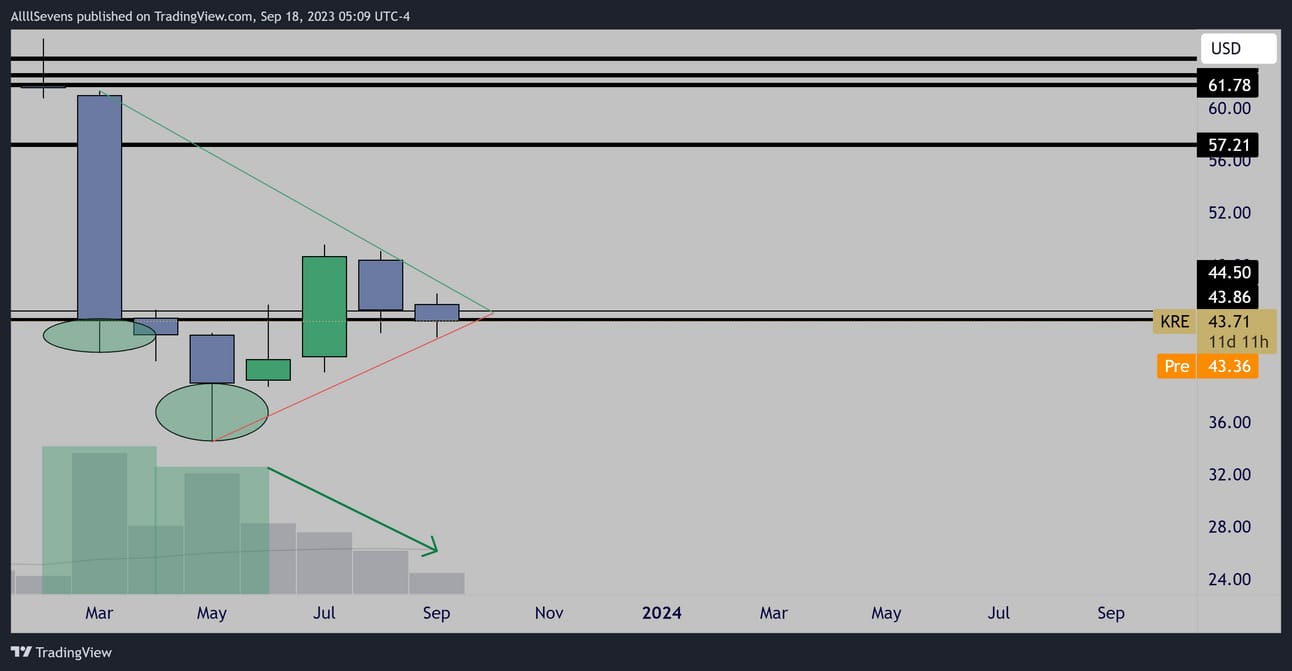

Weekly

Accumulation patterns.

Falling wedge consolidation.

Unusual Options Flow

$68K Calls Bought

Conclusion-

This looks extremely bullish IF price can get over $43.85-$44.50 and maintain bullish momentum and give a confirmed breakout.

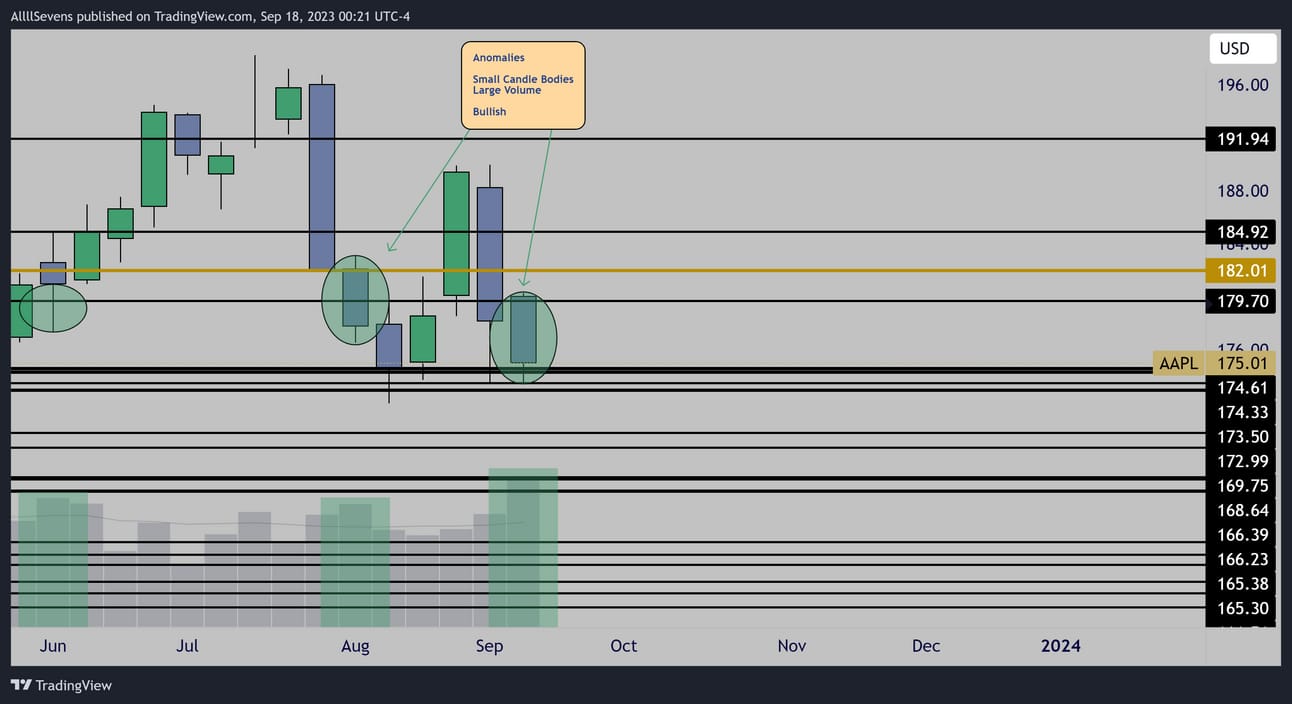

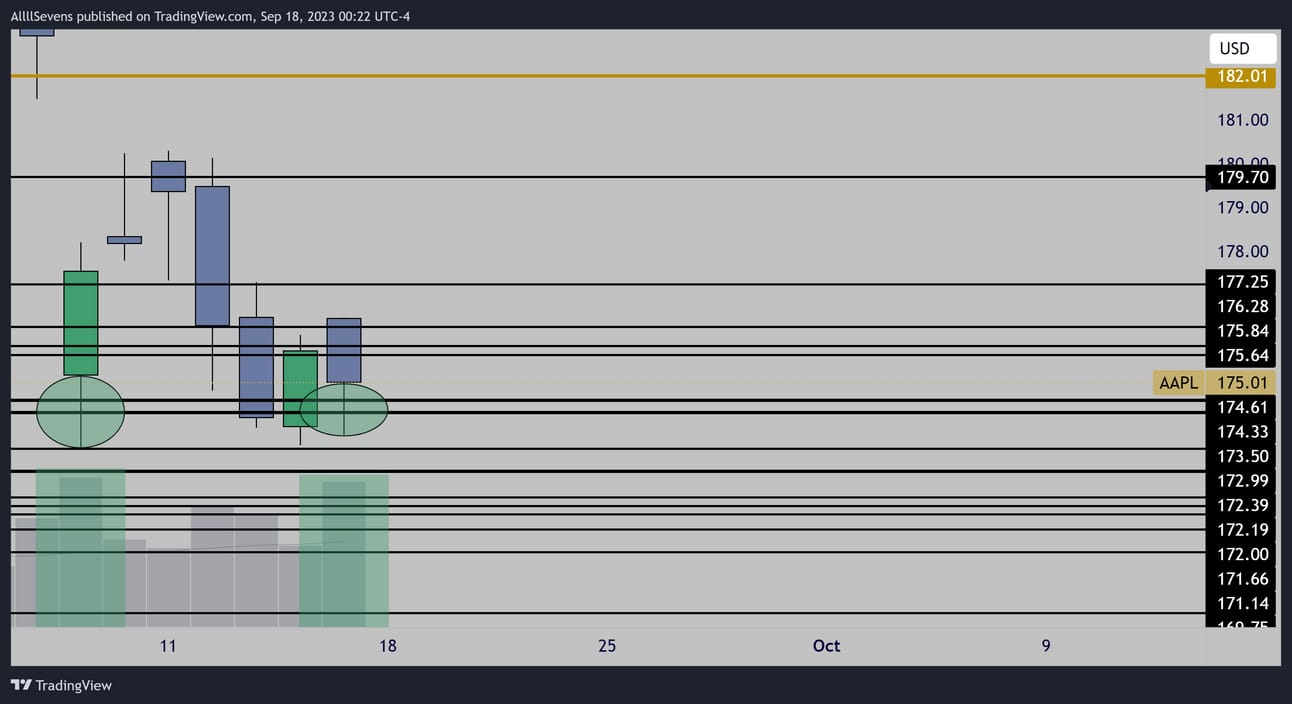

AAPL

Monthly

Bullish accumulation.

Not a lot of high volume for a long time.

Weekly

Bullish accumulation patterns.

Double bottom potential.

Daily

Accumulation patterns.

Double bottom potential.

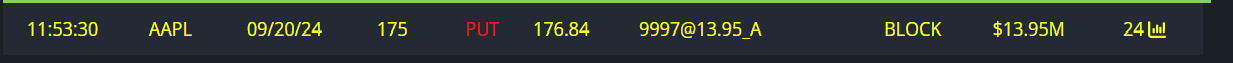

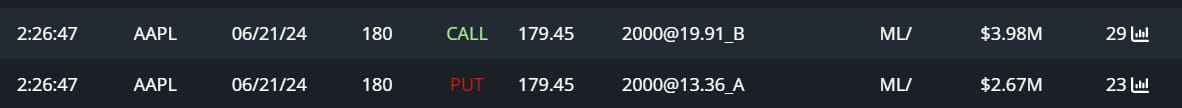

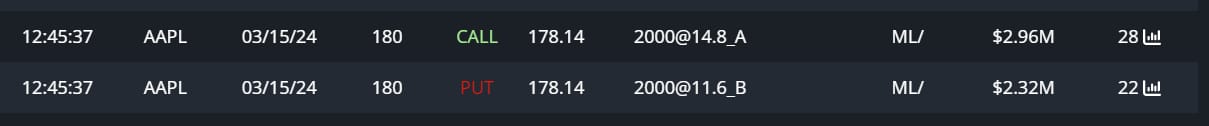

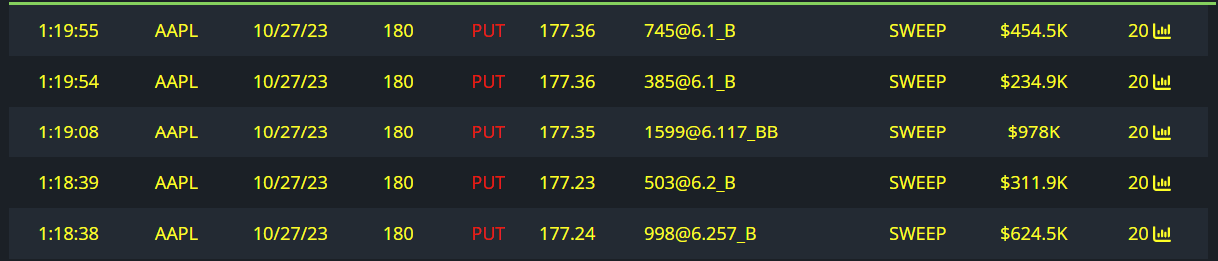

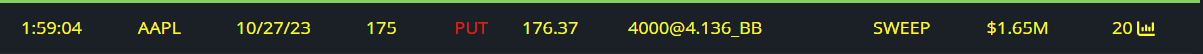

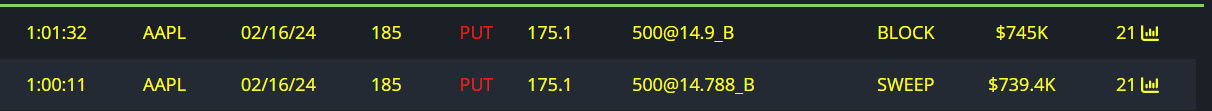

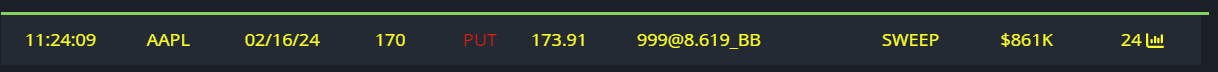

Unusual Options Flow

$12.9M Call Flow

$20.5M Bearish Flow

$14M Puts Bought

$6.5M Full Risk Bear

$5M Full Risk Bull

$2.6M Puts Written

$1.65M Puts Written

$1.5M Puts Written

$860K Puts Written

$560K Calls Bought

$537K Calls Bought

$220K Calls Bought

Conclusion-

On a monthly basis I’d love to buy at lower prices.

The weekly and daily show severe buy pressure with double bottom potential.

The options flow is very mixed, leaning down.

$174.30 must be held for a bounce.

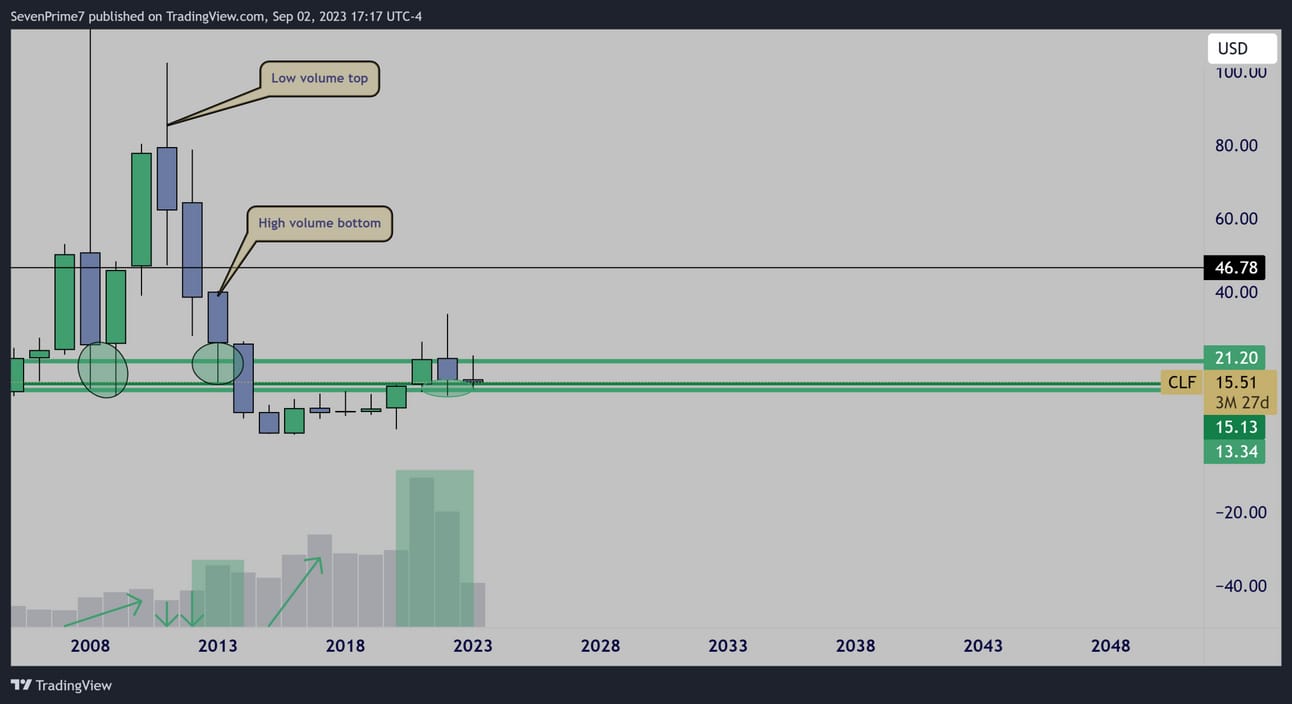

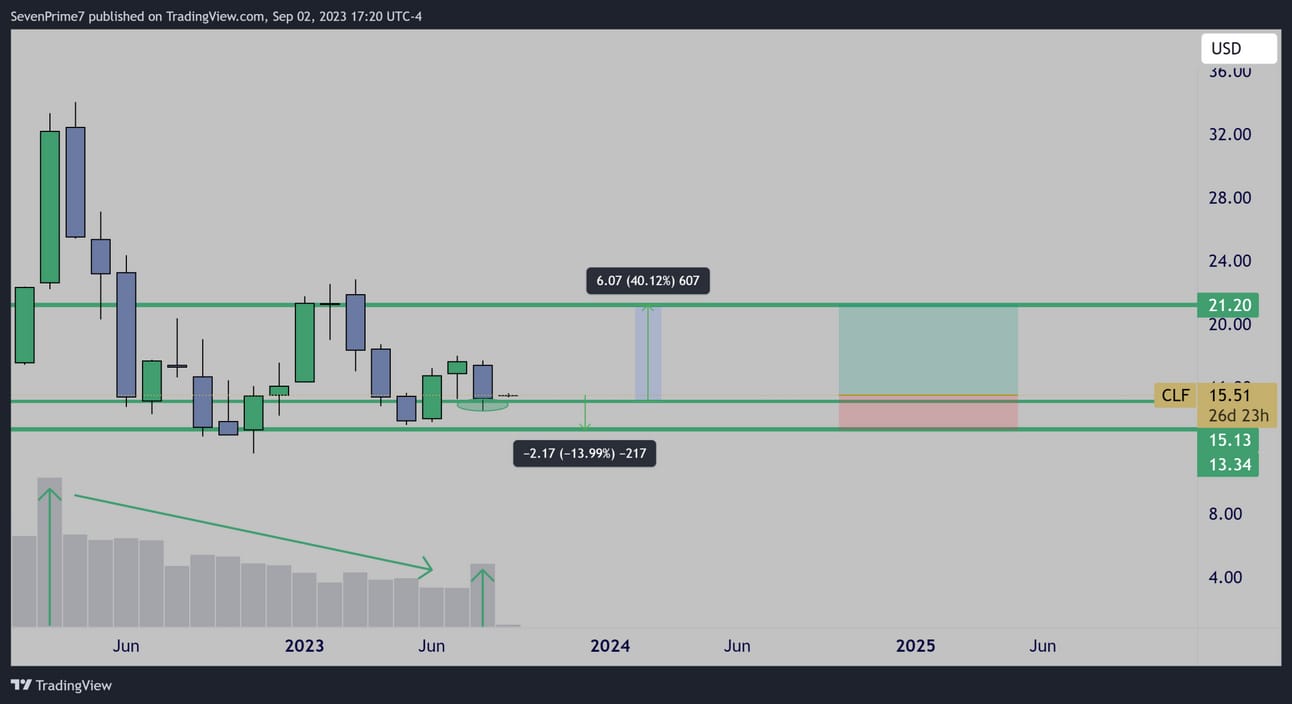

CLF

Yearly

Bullish accumulation patterns.

Monthly

Accumulation patterns.

Falling wedge / bull flag consolidation.

Weekly

Incredible accumulation patterns.

Clearly in a downtrend.

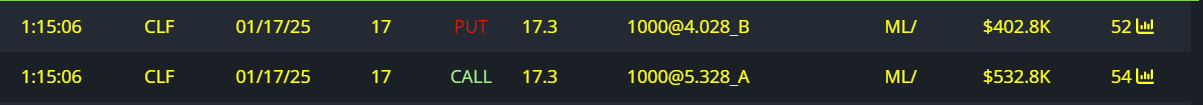

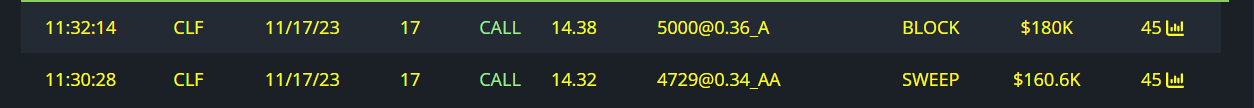

Unusual Options Flow

$930K Full Risk Bull

$340K Calls Bought

Conclusion-

A high volume large candle body on the monthly would confirm a multi-month move beginning.

The weekly is clearly in a downtrend.

Over $15.13 bullish momentum could be gained.

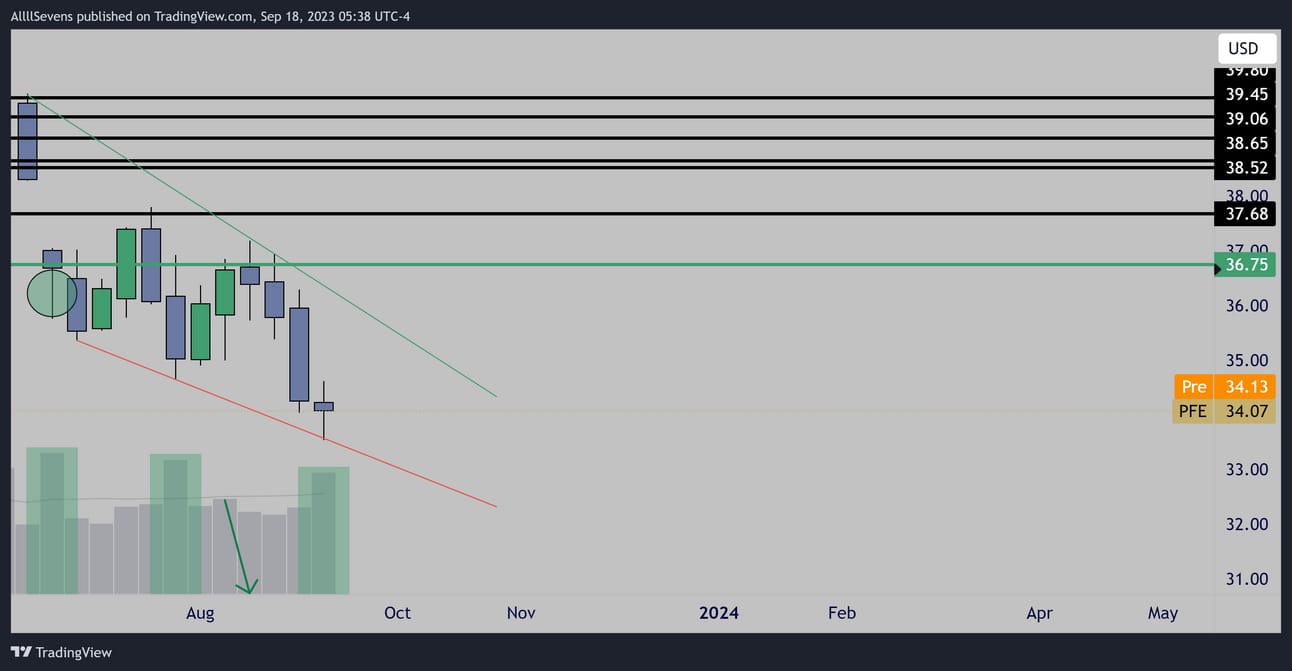

PFE

Monthly

Bullish accumulation patterns.

Clear downtrend.

Weekly

Accumulation patterns.

Falling wedge consolidation.

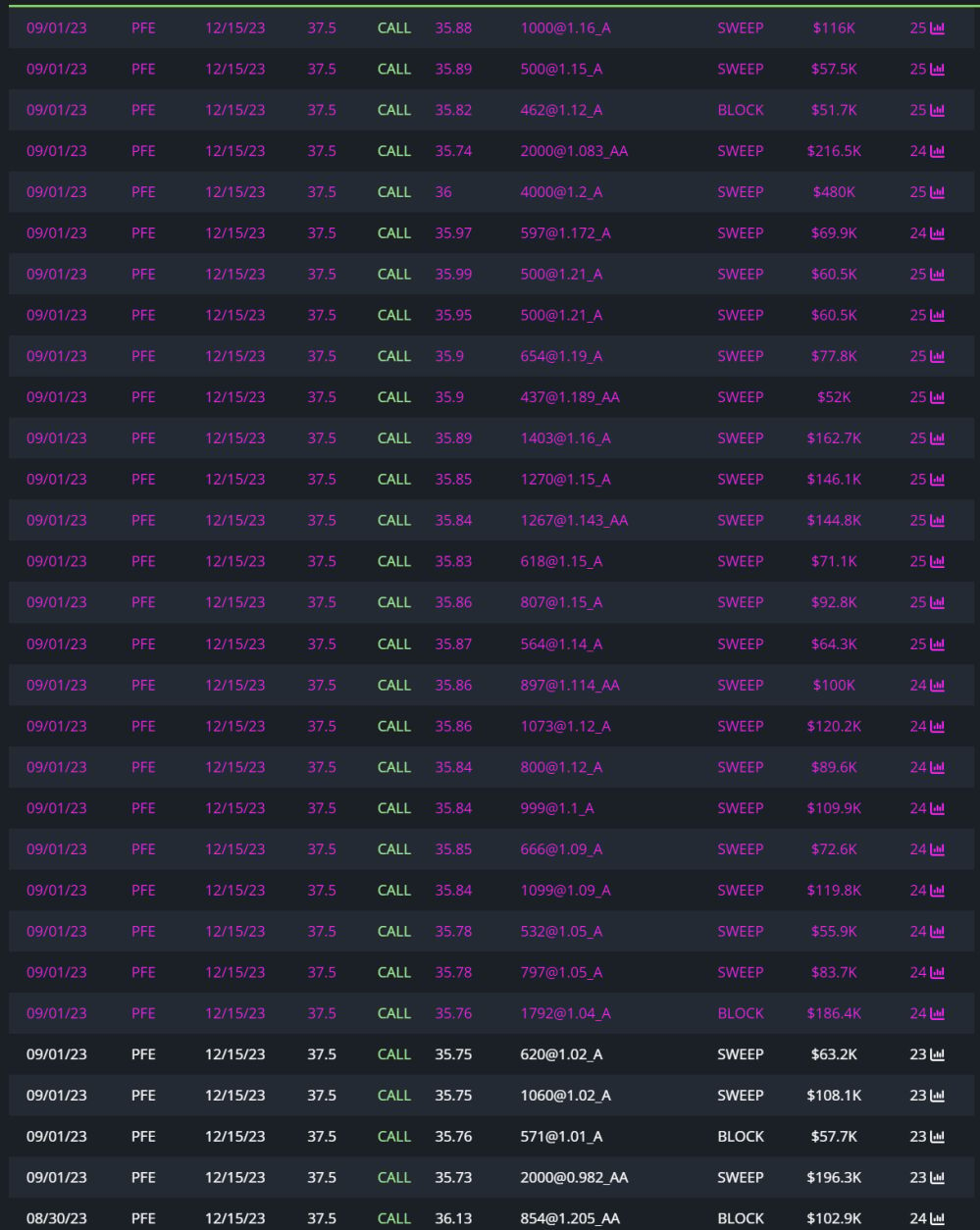

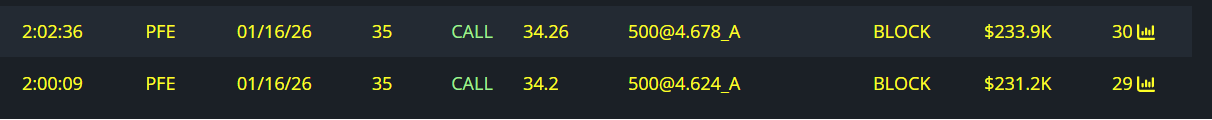

Unusual Options Flow

$3.4M Calls Bought

$460K Calls Bought

$150K Calls Bought

Conclusion-

Clearly in a downtrend on all time frames.

A weekly bounce looks promising.

A confirmed breakout could lead to monthly expansion.

I write a premium newsletter every week as well-

It’s $7.77 per month! Upgrade with this link below.

Also get access to my Discord.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply