- AllllSevens

- Posts

- AllllSevens Newsletter 9/25/23

AllllSevens Newsletter 9/25/23

SPY & AAPL

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only. It is not intended to be interpreted as financial or investment advice.

I talk in certainties that do not exist; the market is often be random and uncertain, especially in the short-term.

Please be aware of the risks involved with the stock market and do your own due-diligence before buying and selling securities.

Good Evening

First, I want to thank you for your time.

I am very passionate about what I do and it is extremely rewarding to know that there is even one individual person opening this each week to consider my perspective.

My goal with this newsletter is to present the market from the lens of an institutional trader/investor with absolutely no personal bias.

Institutions own over 60% of the market so as far as I am concerned-

They control it. Whatever they are positioned for, I want to position for.

This allows me to achieve the highest probability trading/investing conditions I can with clearly defined and favorable risk.

The levels you see on my charts are Dark Pools.

I do not draw magic lines. They are data points. No bias is involved.

Millions of shares are transacted at these levels creating very concentrated institutional volume at specific prices.

Highly concentrated volume creates support & resistance.

Dark Pools are institutional support & resistance.

In conjunction with Dark Pool levels, I analyze the relationship between candle spreads and the volume backing them to determine how institutional money is positioned and how to best manage risk.

Each newsletter begins with a breakdown of the broader market.

The S&P500 is what I use to do this.

Let’s get into it.

SPY

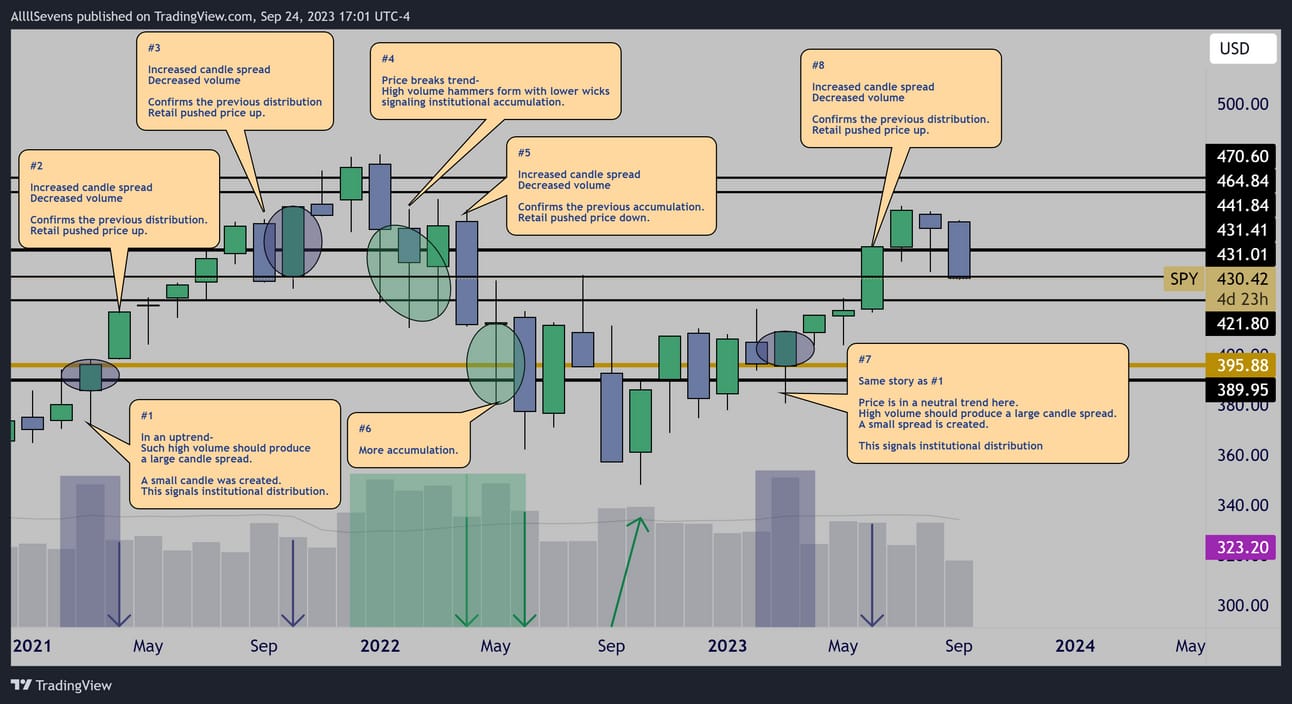

Monthly

The S&P500 should be relatively range-bound for the foreseeable future.

Institutions are both distributing and accumulating shares-

They are doing this to create liquidity for an eventually explosive move.

As of right now, I see two scenarios-

#1

Price bounces in this $420-$440 range and pushes into $460-ATH’s before correcting under $400

#2

Price breaks the current uptrend, loses $420 and corrects under $400

On a monthly time frame, the only thing to do right now is wait and sit on cash in my opinion.

I do not believe there is good reason to buy or sell here.

Let’s drop to the weekly chart and see if there is any action to take.

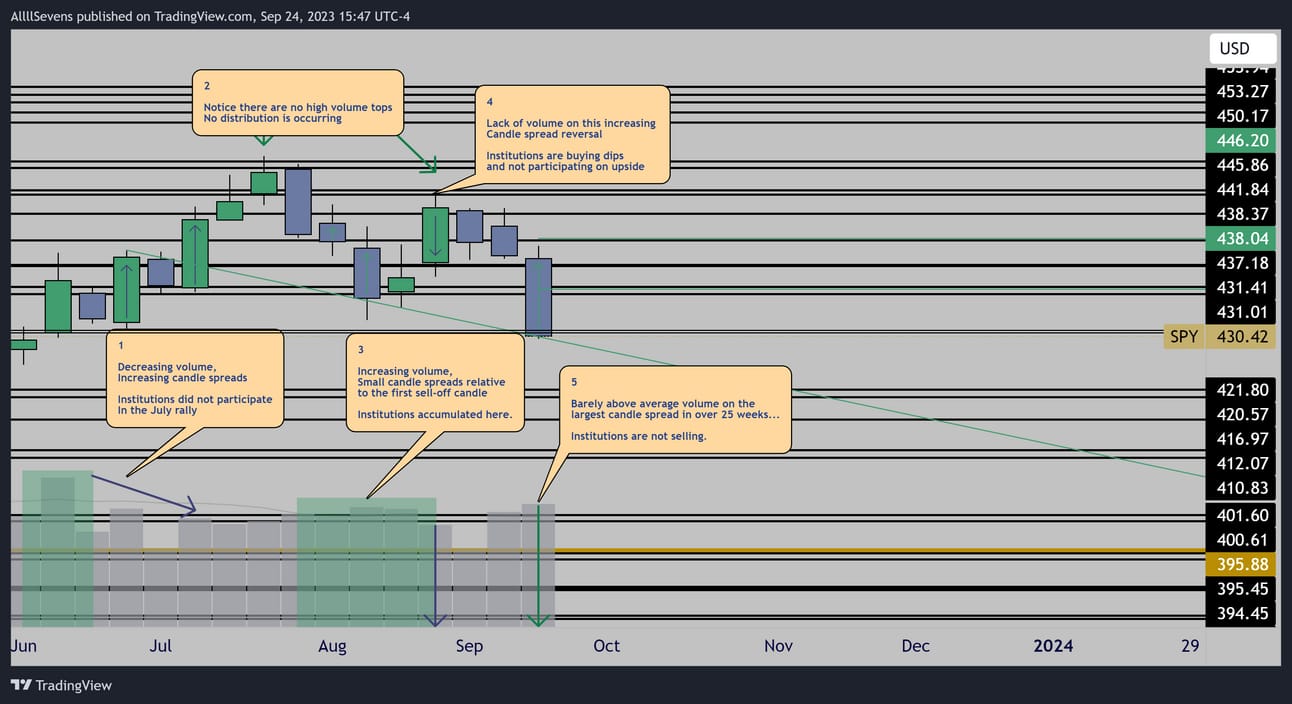

Weekly

Monthly momentum is neutral and weekly momentum is is down.

Volume shows that institutions are buying dips and letting retail push price up, then letting them push it right back down.

Last week’s candle is extremely notable.

This was the largest candle spread we have seen in over 25 weeks…

If institutions were selling out, the volume here would be massive.

It was slightly above average.

I see two high probability scenarios for this week-

#1

Stopping volume / accumulation candle.

Weekly momentum is strong to the downside right now.

This means while I am anticipating a possible accumulation candle,

I am likely not going to trade SPY to the upside this week.

$445.86-$446.20 is the current resistance to clear if I want to trade up.

#2

Continuation down.

Below $445.86-$446.20 weekly momentum favors downside.

I’m generally bearish below this zone for the week.

I am looking to scalp downside as long as price remains below this zone.

Only below $431-$431.40 do I expect strong downside continuation.

Conclusion

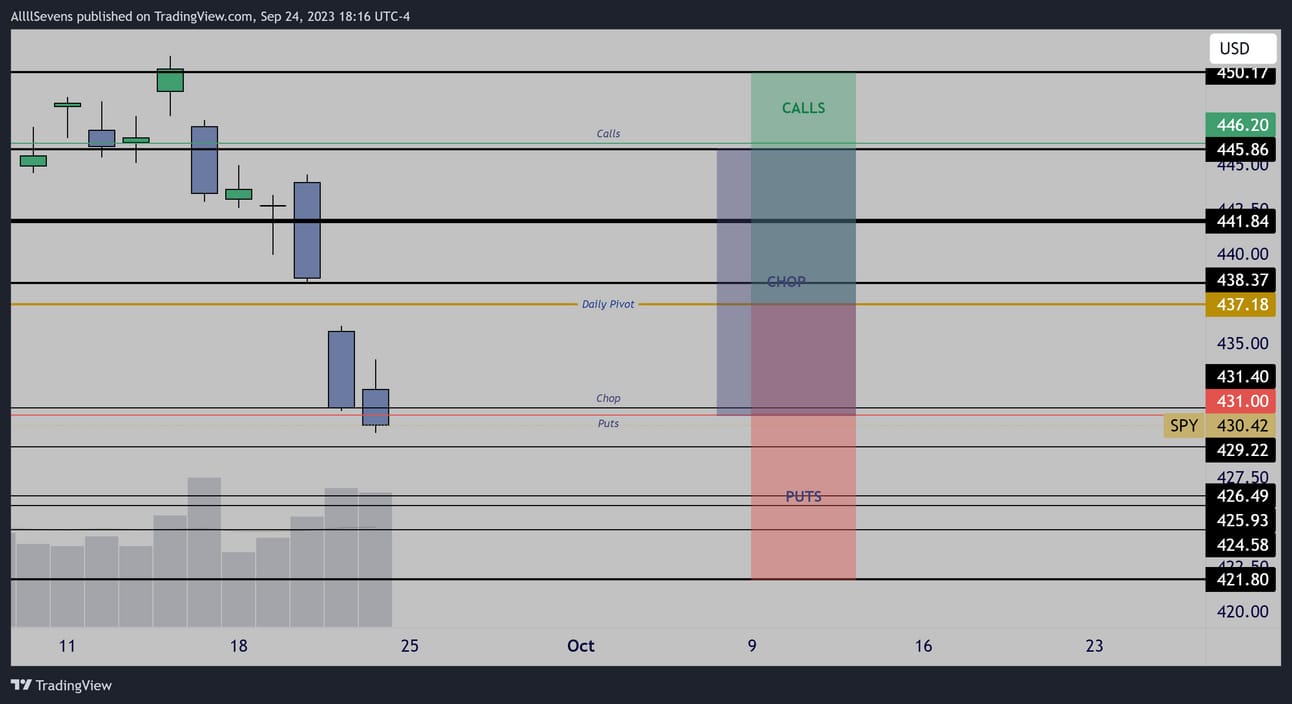

Daily

Below $431.00 I am very bearish.

Below $437.18 (Daily Pivot) I am still bearish, but expecting a choppy environment with not much follow through.

Above the daily pivot, I become slightly less bearish, and I expect an extremely choppy environment.

Above $446.20 I become bullish.

On a monthly time frame, there is nothing to do right now but wait.

Happy trading!

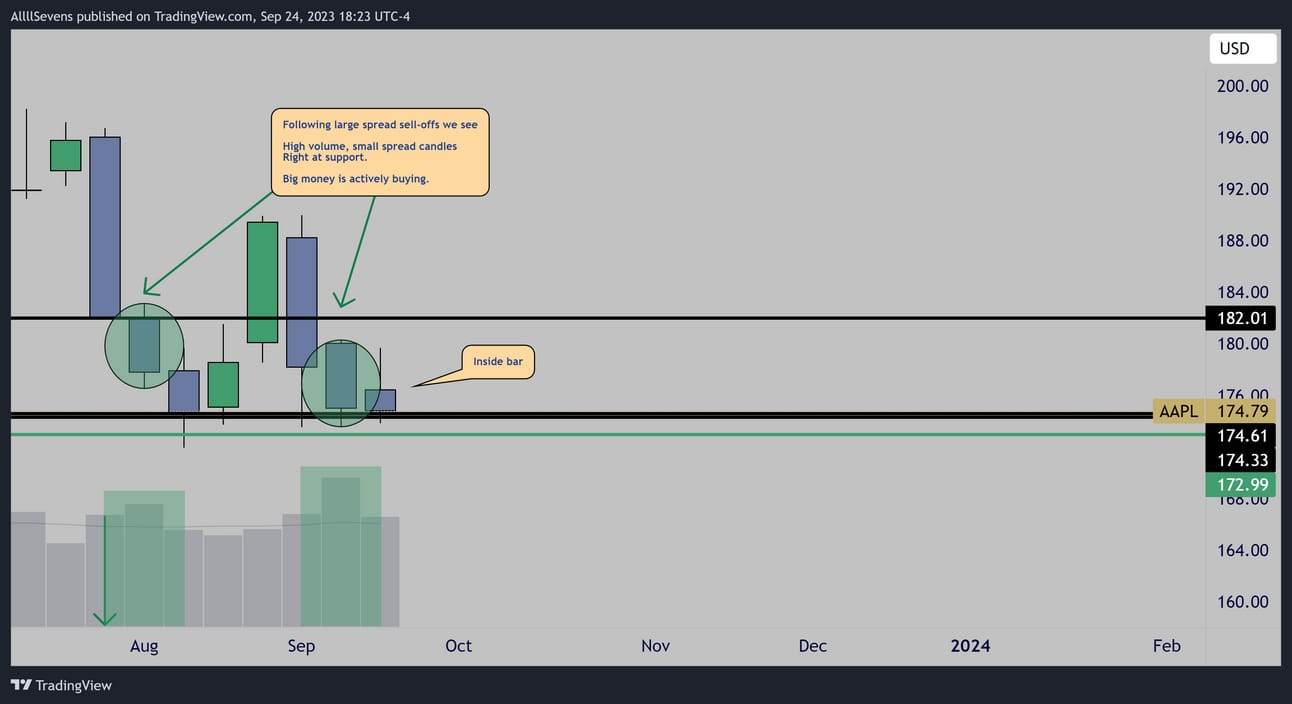

AAPL

Weekly

If you look at AAPL’s weekly chart and compare it to the rest of the market it is astonishing how well it held up…

I think there is a high probability this breaks to the upside.

For me to trade a bounce here though it is crucial the SPY is not below $431.00

If AAPL loses $172.99, I don’t want to be long.

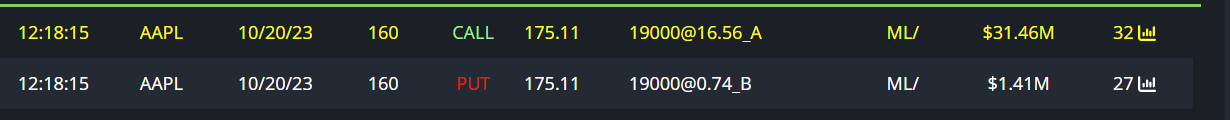

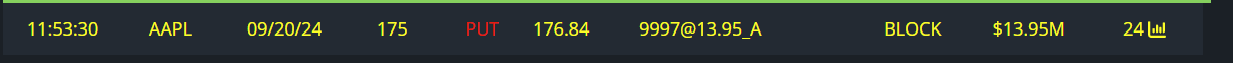

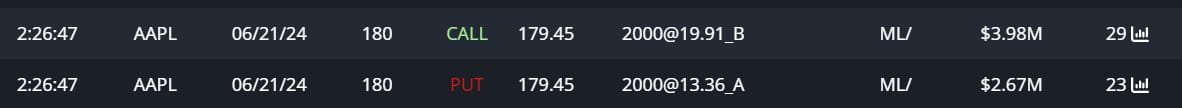

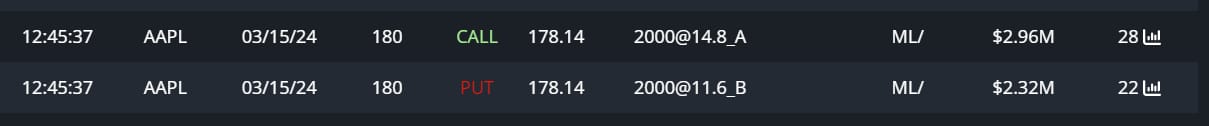

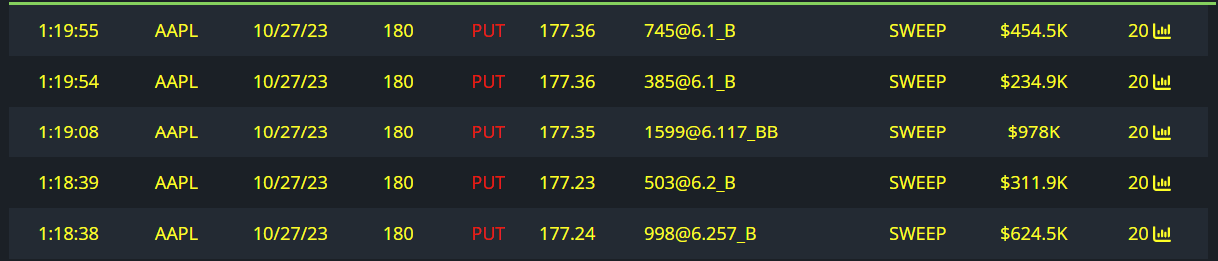

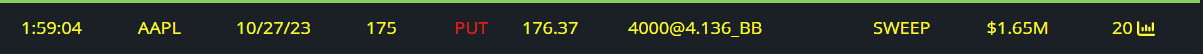

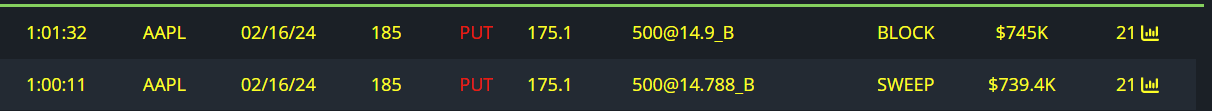

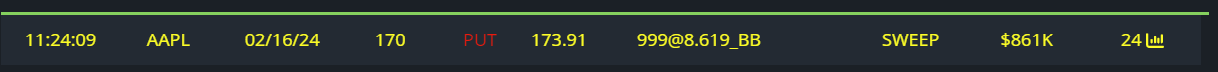

Unusual Options Flow

$46M Bullish Flows

$20.6M Bearish Flows

$33M Full Risk Bullish Order

(Buying Calls & Writing Puts)

$14M Puts Bought

$6.6M Full Risk Bearish Order

(Buying Puts & Writing Calls)

$5.3M Full Risk Bullish Order

(Buying Calls & Writing Puts)

$2.6M Puts Written

$1.6M Puts Written

$1.5M Puts Written

$860K Puts Written

$560K Calls Bought

$540K Calls Bought

$220K Calls Bought

I hope you found this newsletter valuable.

Make sure to stick around for next weeks!

If you have any questions, concerns, or suggestions please email me or message me on twitter.

I would love to hear from you.

[email protected]

https://twitter.com/AllllSevens

If you like my style of analysis, consider upgrading your subscription…

I write a premium newsletter every week as well.

It will be sent out shortly after this.

It is only $7.77 per month!

You also get access to my Discord community!

It is very much in it’s early stages- mostly being used for data collection.

I have channels/forums for every single stock I have ever analyzed that I update on a consistent basis with any volume anomalies or unusual options flow.

https://allllsevensnewsletter.beehiiv.com/upgrade

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and dark pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/SHMs

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply