- AllllSevens

- Posts

- AllllSevens Newsletter

AllllSevens Newsletter

For the week beginning 5/23

@AllllSevens

Weekly Newsletter

Disclaimer

All of the information presented in this newsletter is entertainment and speculation purposes only. I am not a financial advisor.

Trade at your own discretion.

Let’s dive in

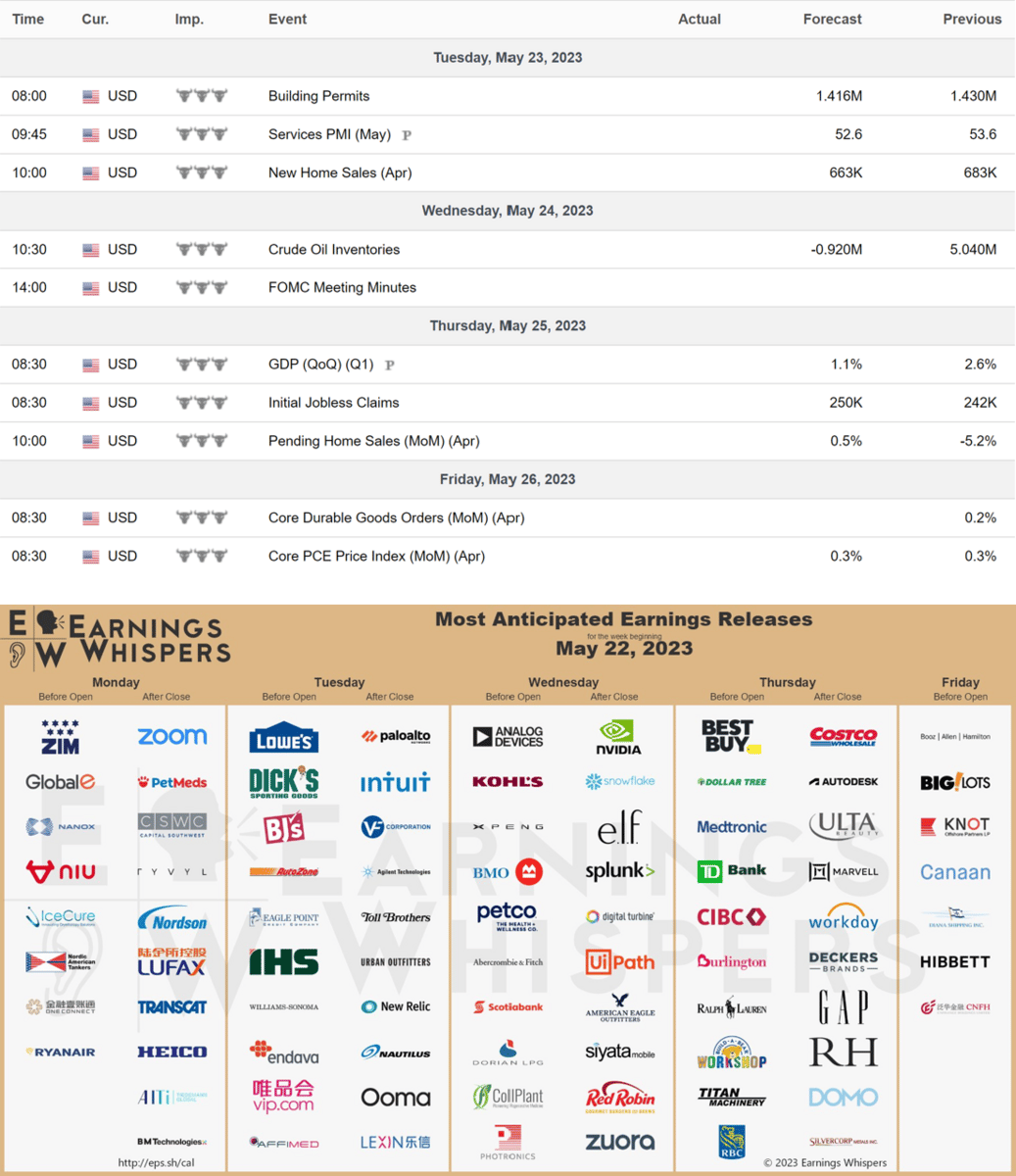

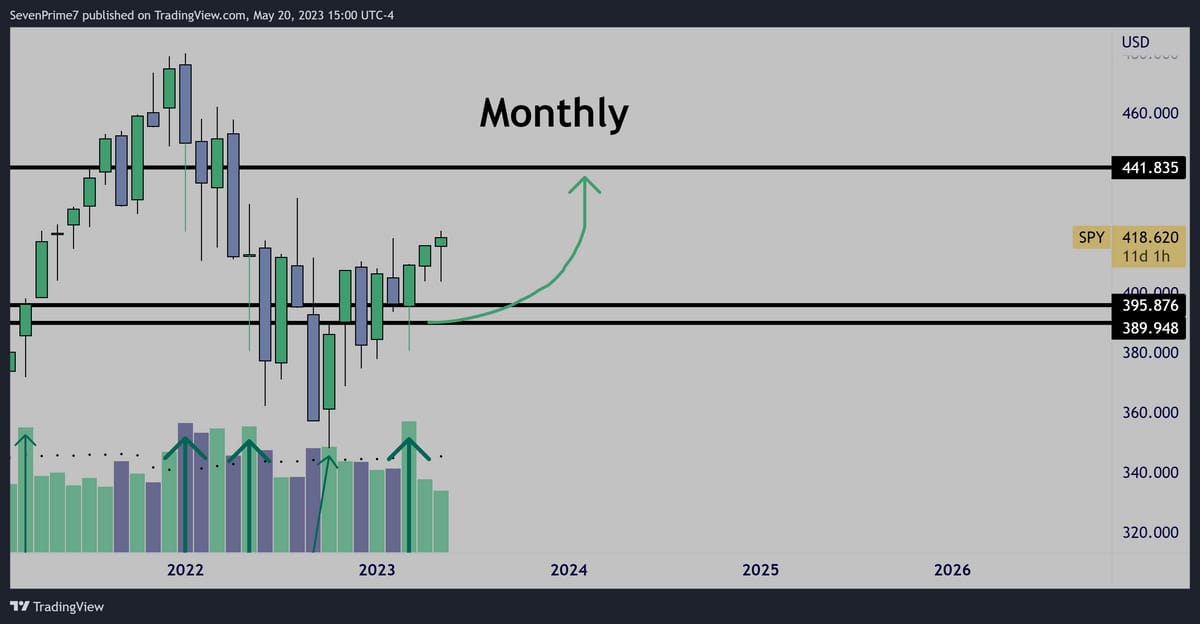

$SPY- SPDR S&P 500 ETF Trust

Extremely bullish. Expansion to $440 is confirmed.

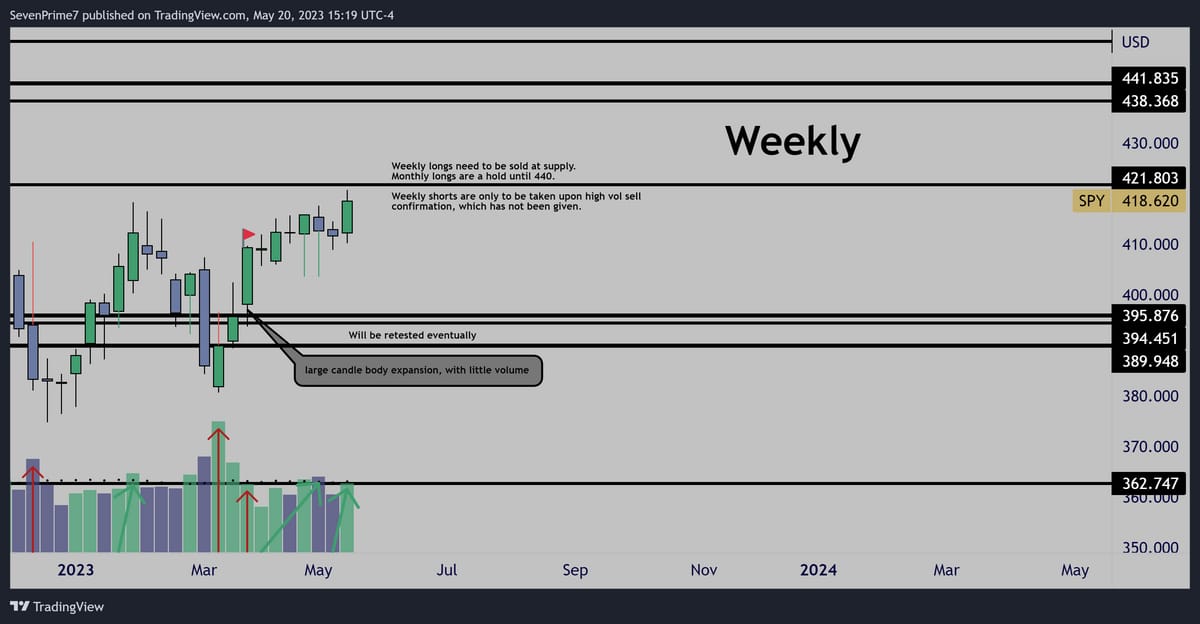

Multiple red flags. The order of events here could play out multiple ways.

Upside momentum is strong for the time being.

$390-$395 will be retested eventually.

Will price reject at $421.80? $440? Higher?

The monthly time frame is extremely strong and longs with time and good entry should be held until full target is hit-

However, I believe shorter time frame longs should be closed in this area for safety.

I will only go short if the weekly time frame AND the daily aligns and give a sell signal which it currently does not. Until then, trust in the Monthly chart expansion.

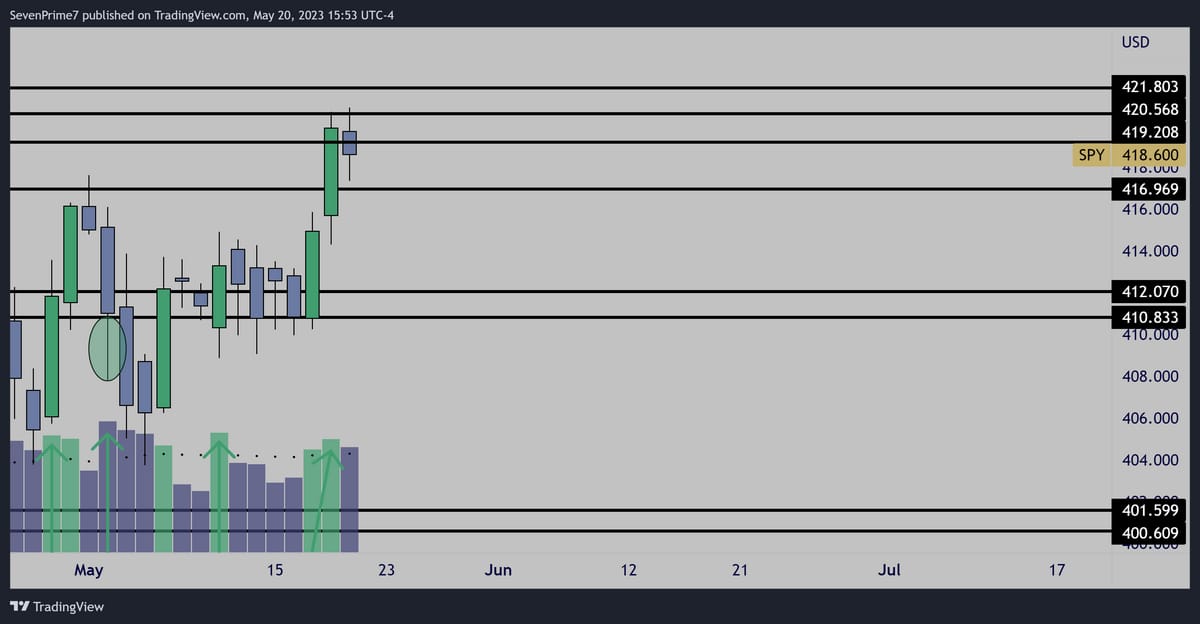

Bullish momentum- Indecision on Friday’s close-

Decreased volume inside bar could favor upside continuation over 417.

Conclusion

March candle close was an A+ long entry for the monthly time frame.

Longs entered at a good price and with time can be held.

Shorter expi longs should be closed at this resistance until another long signal presents itself.

Short expi’s must be used on a day-to-day basis because of the weekly time frame discrepancy.

Default sentiment is bullish towards $440 until something breaks on the daily and weekly timeframe, & if that happens, $390 will be targeted.

Now, let’s look at my favorite stock picks this week using institutional supply & demand with VPA & flow confluence.

Starting with my

TOP PICK

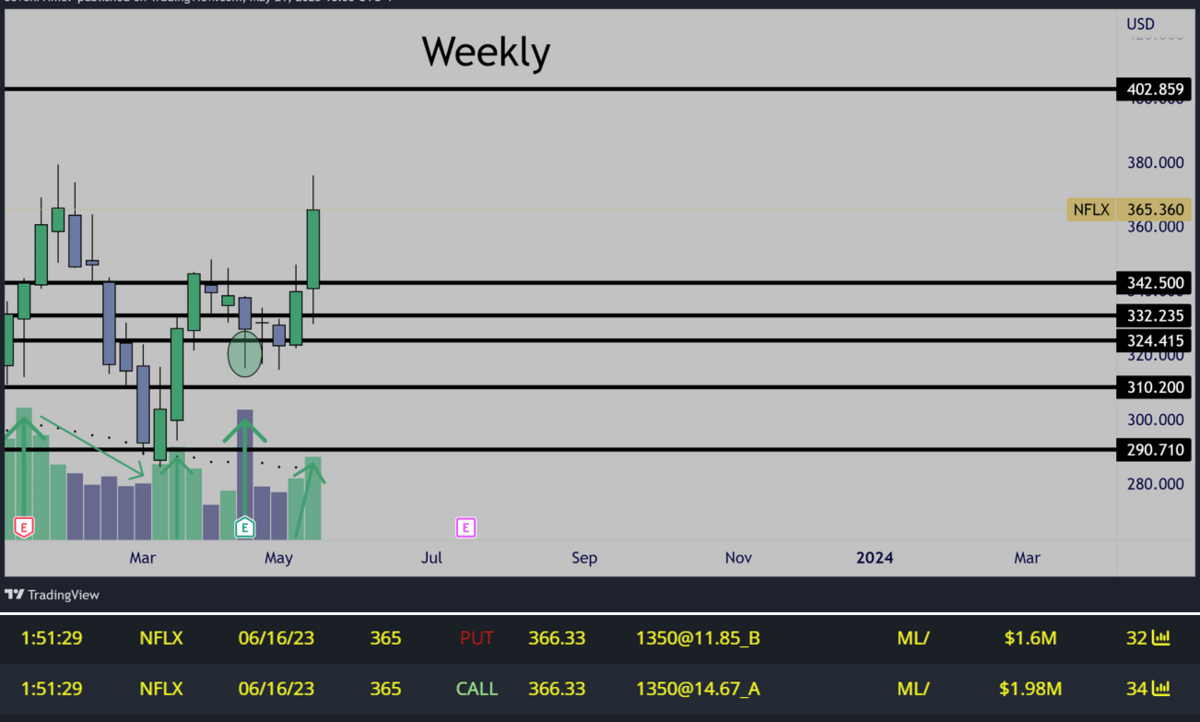

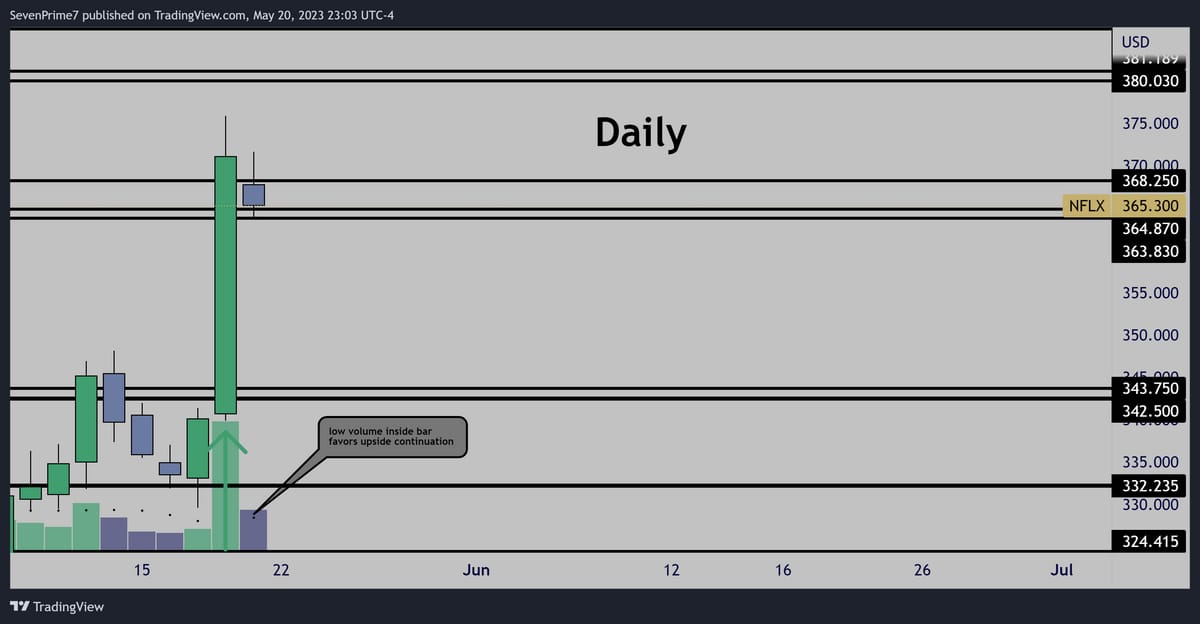

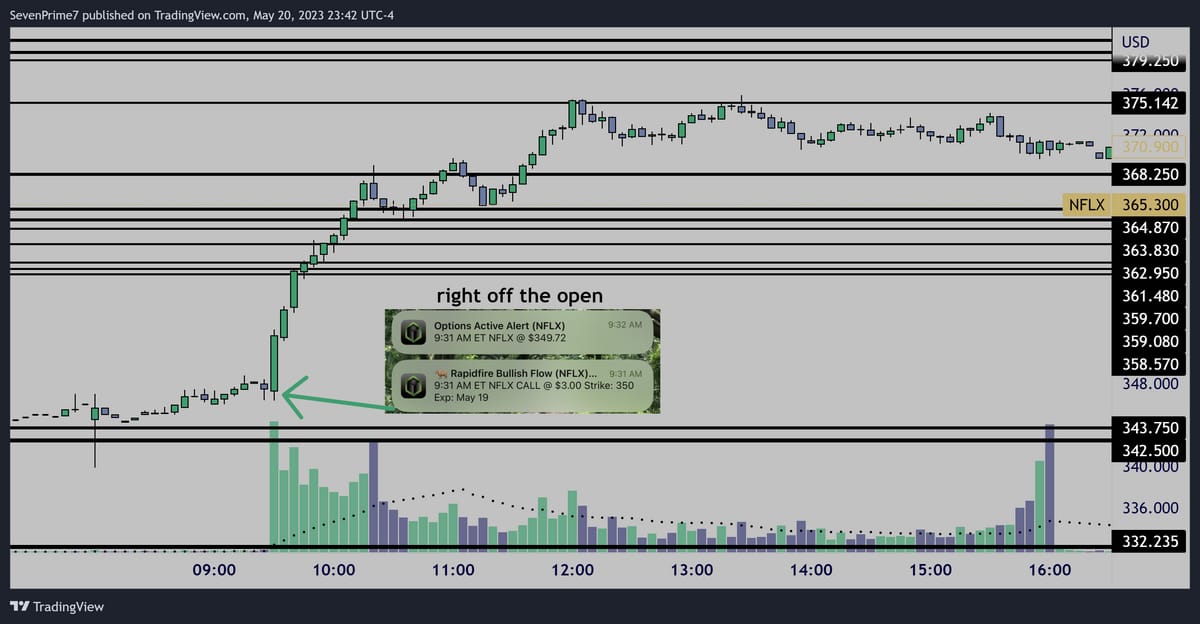

$NFLX

Bullish

My #1 focus to start this week.

This chart will have all of my attention at 9:30AM on Monday

The weekly chart has confirmed a breakout over $340, room to $400

Daily is giving an A+ pattern for potential upside continuation early in the week to $380.

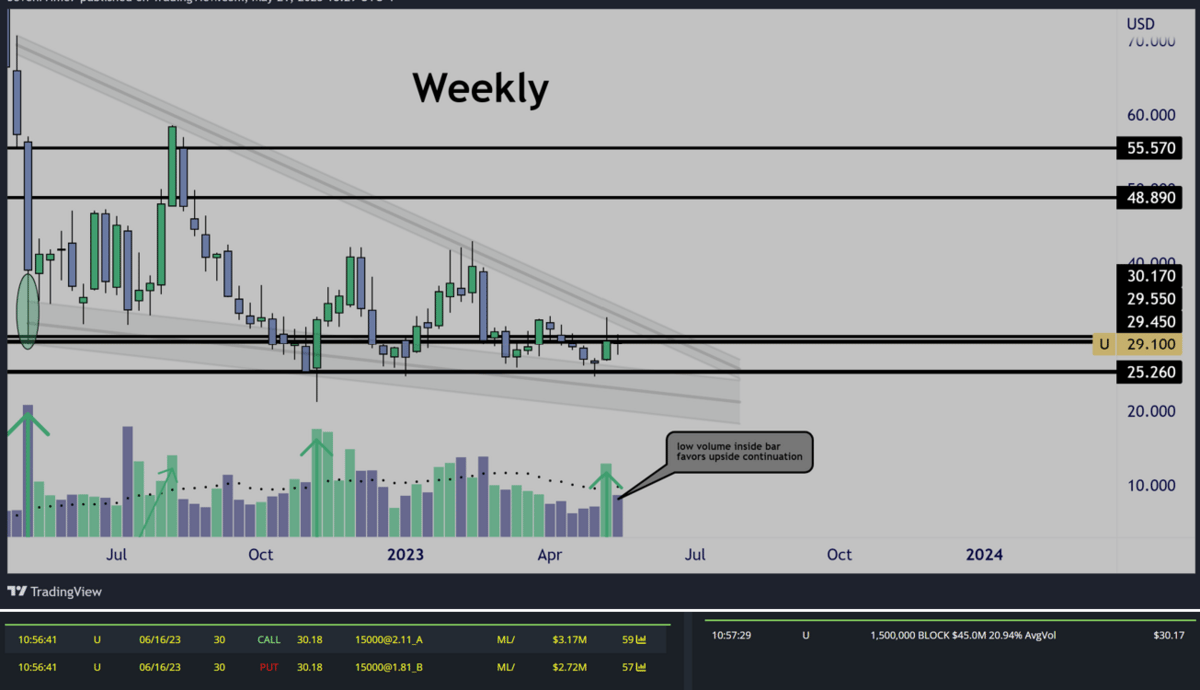

$U- Unity Software Inc.

Bullish

Great weekly inside bar setup-

Clear long triggers on break and hold over $30.17

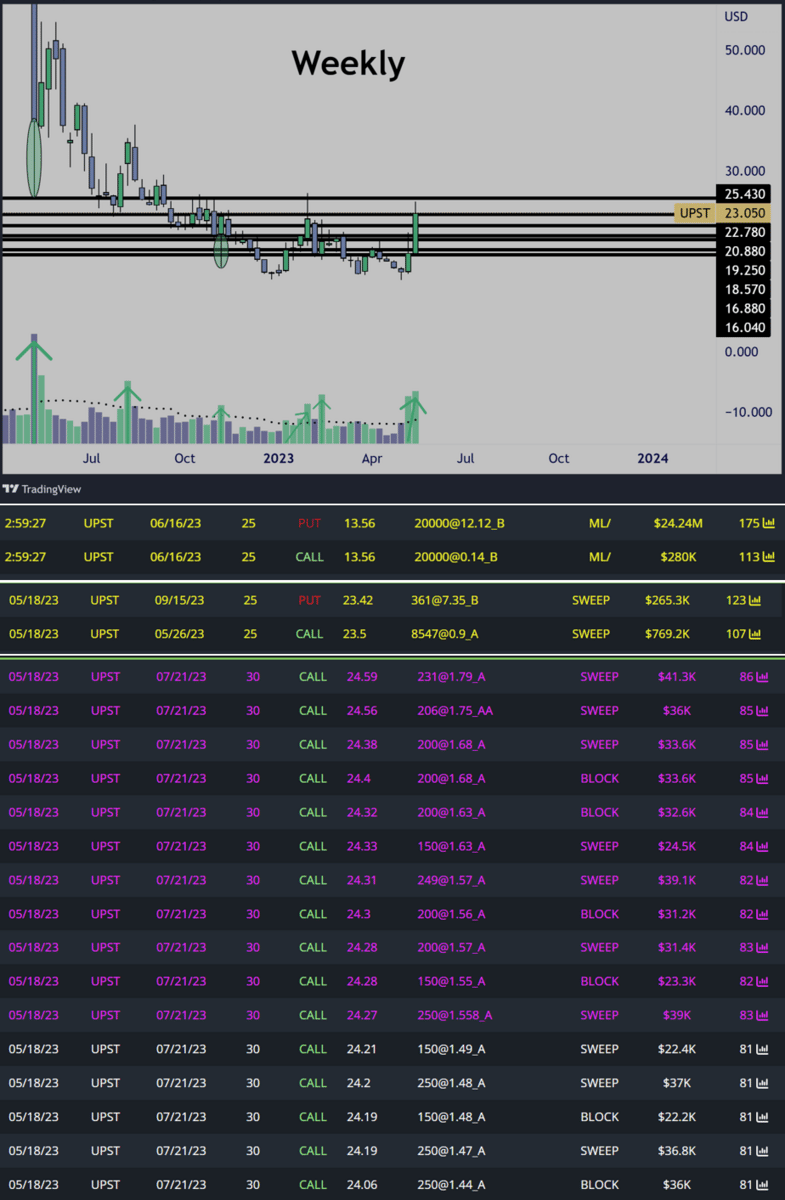

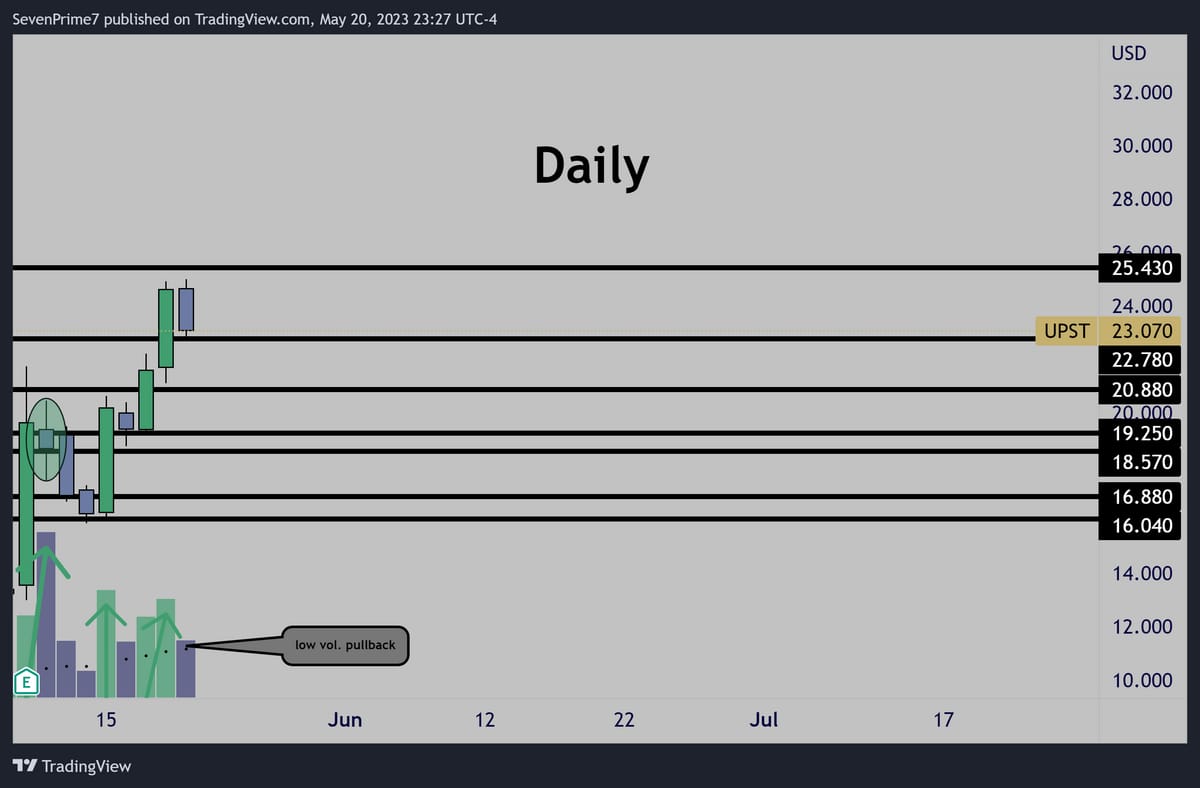

$UPST

Bullish

Beautiful accumulation on the weekly- and currently giving a strong candle on increasing volume over 22.78

The daily has a decent setup, would be better if Friday’s candle were an inside bar and did not gap up before selling off. Could be a red flag, we’ll see.

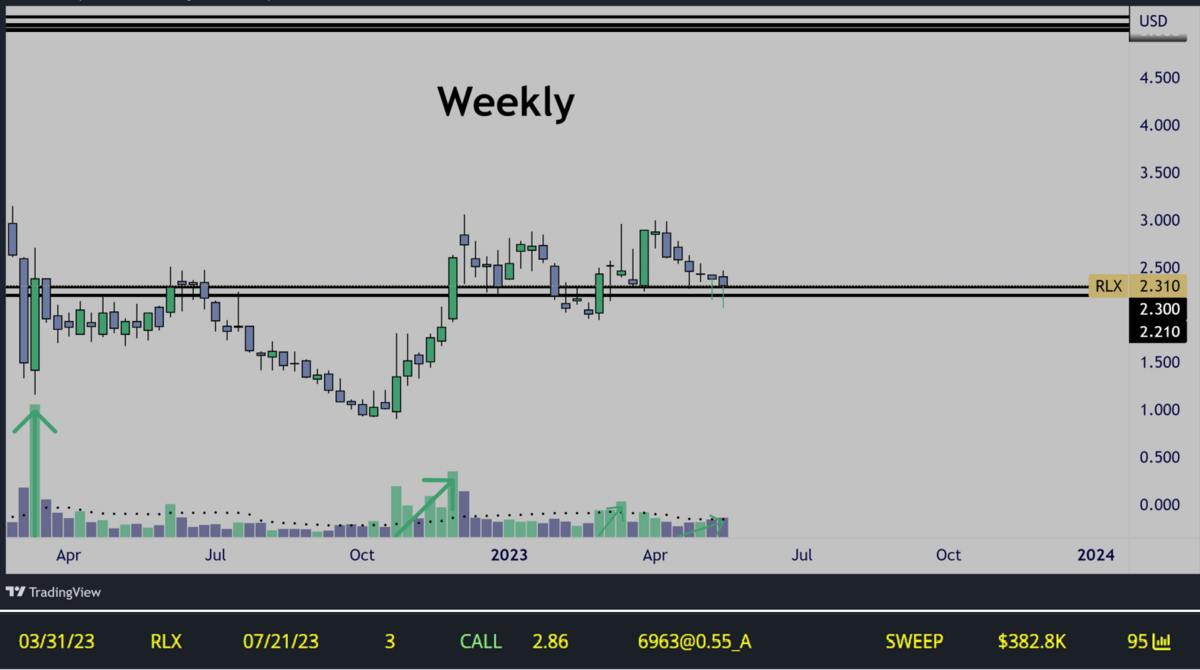

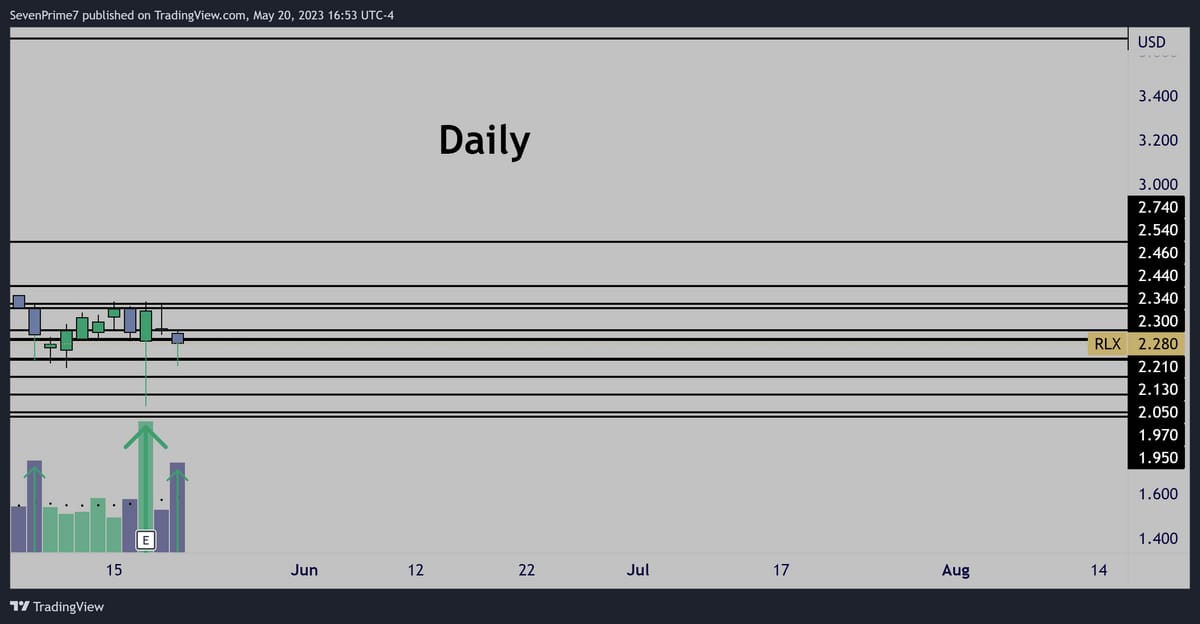

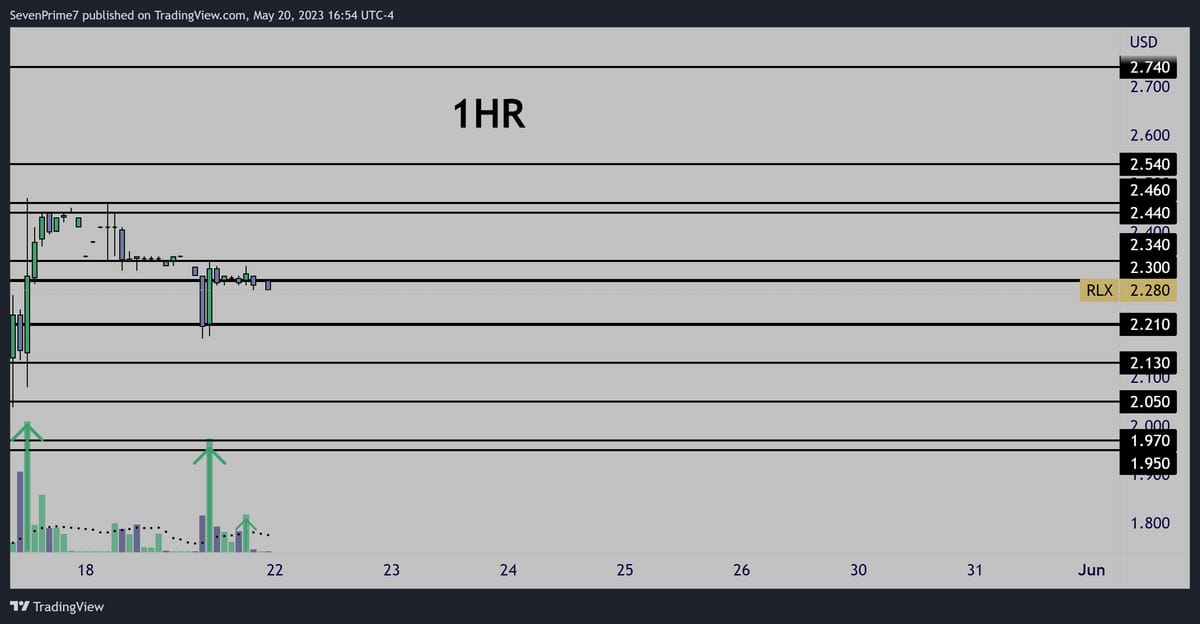

$RLX

Bullish

Weekly A+ accumulation patterns.

Daily has held very well on earnings.

1HR accumulation.

I’m willing to risk 13% or so down to $1.90 for a potential 100% return pop to $5 on this.

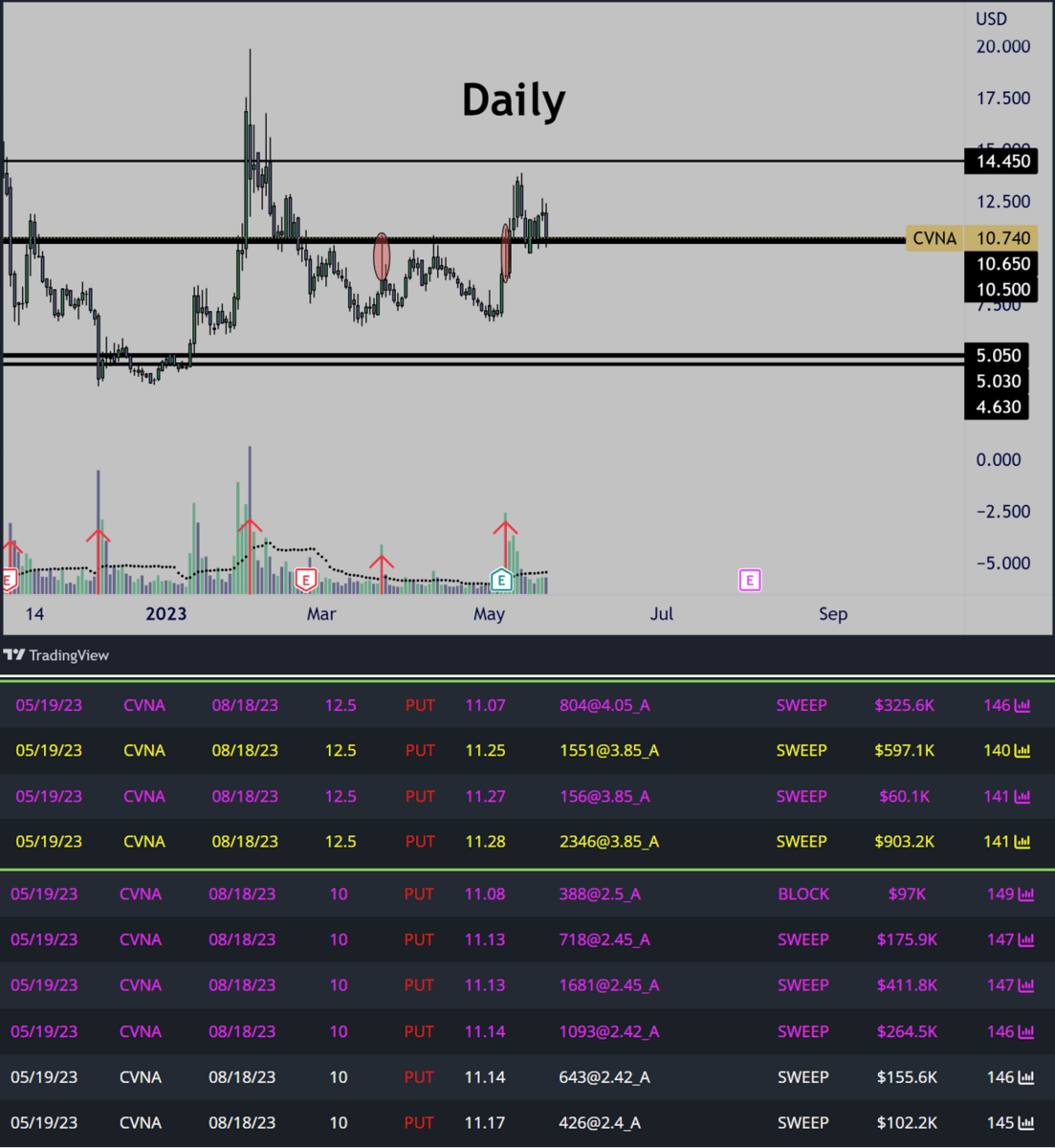

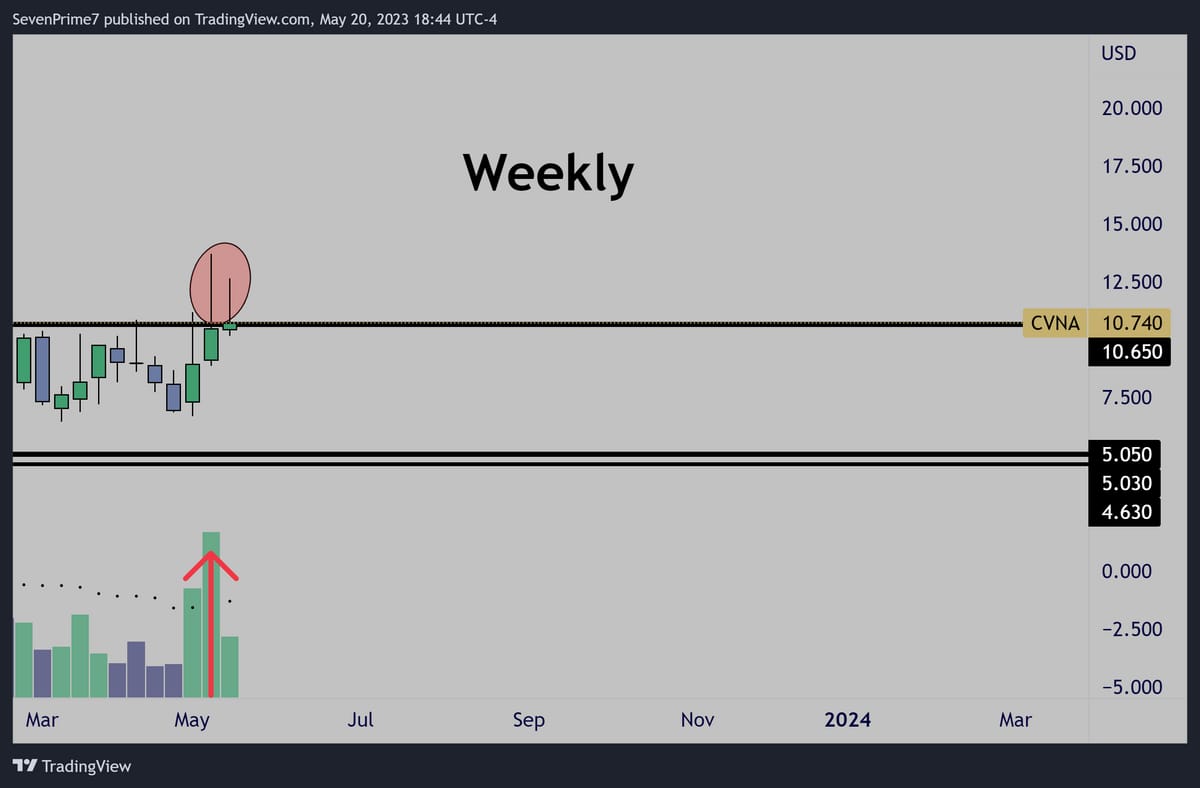

$CVNA- Carvana Co.

Bearish

This has a ton of potential to drop all the way to $5.05 once it loses $10.60 with aggression.

Bulls keep defending $10.60 on the lower time frame, so waiting patiently for this to break down on the HTF

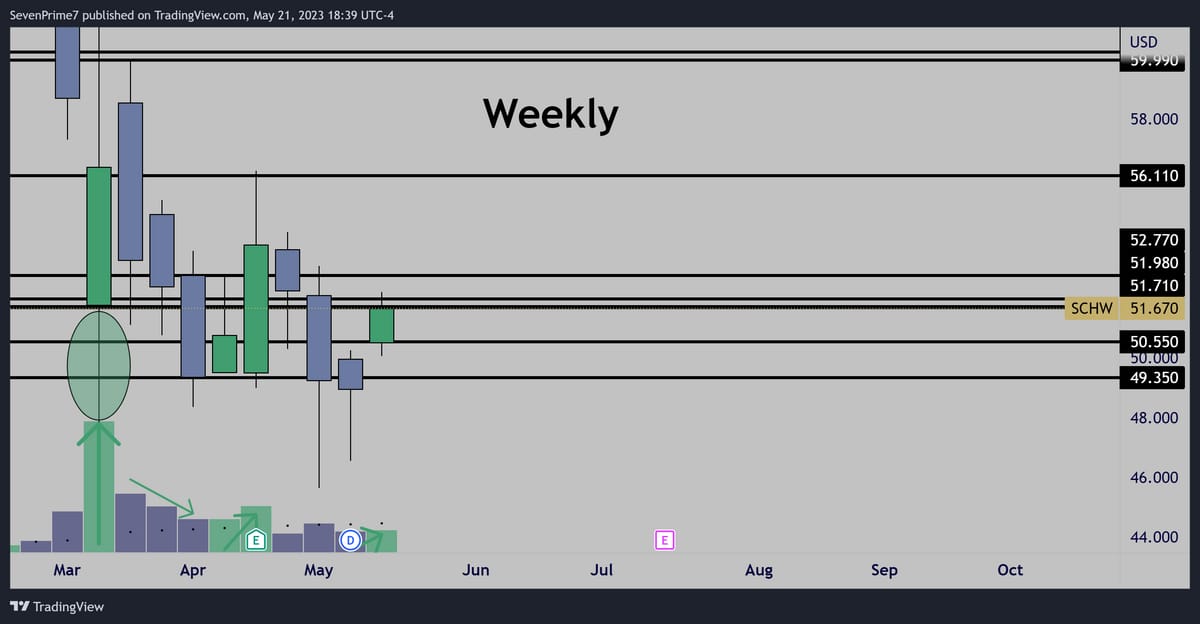

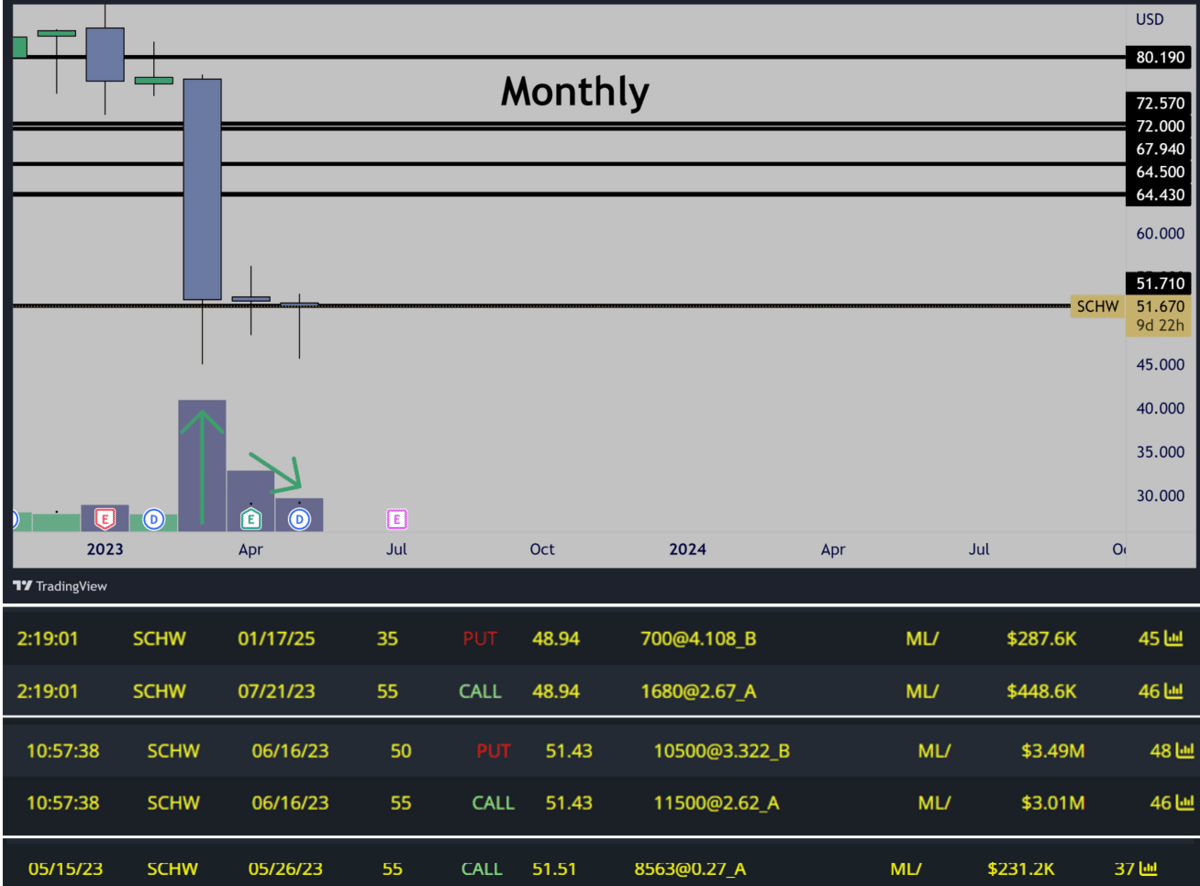

$SCWH- The Charles Schwab Corporation

Bullish

Huge potential on the monthly chart-

Increasing volume coming into this week, just needs to clear $52 resistance and range can open open to the upside.

All of the levels shown on my charts are DARK POOLS

They are institutional volume shelfs.

Price levels of highly concentrated institutional volume.

The best supply and demand levels I have ever used.

If you want access to option flow data and these dark pool levels for yourself

Use this link below for 20% off your first month of BlackBoxStocks

http://staygreen.blackboxstocks.com/SHMs

And there’s more-

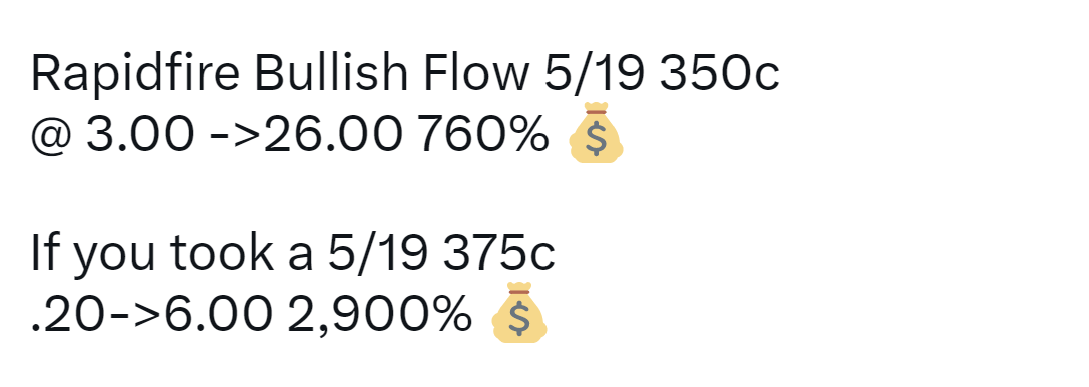

Also get options flow alerts on your phone from BBS like the one below

This was Thursday last week- 5/18

PLUS

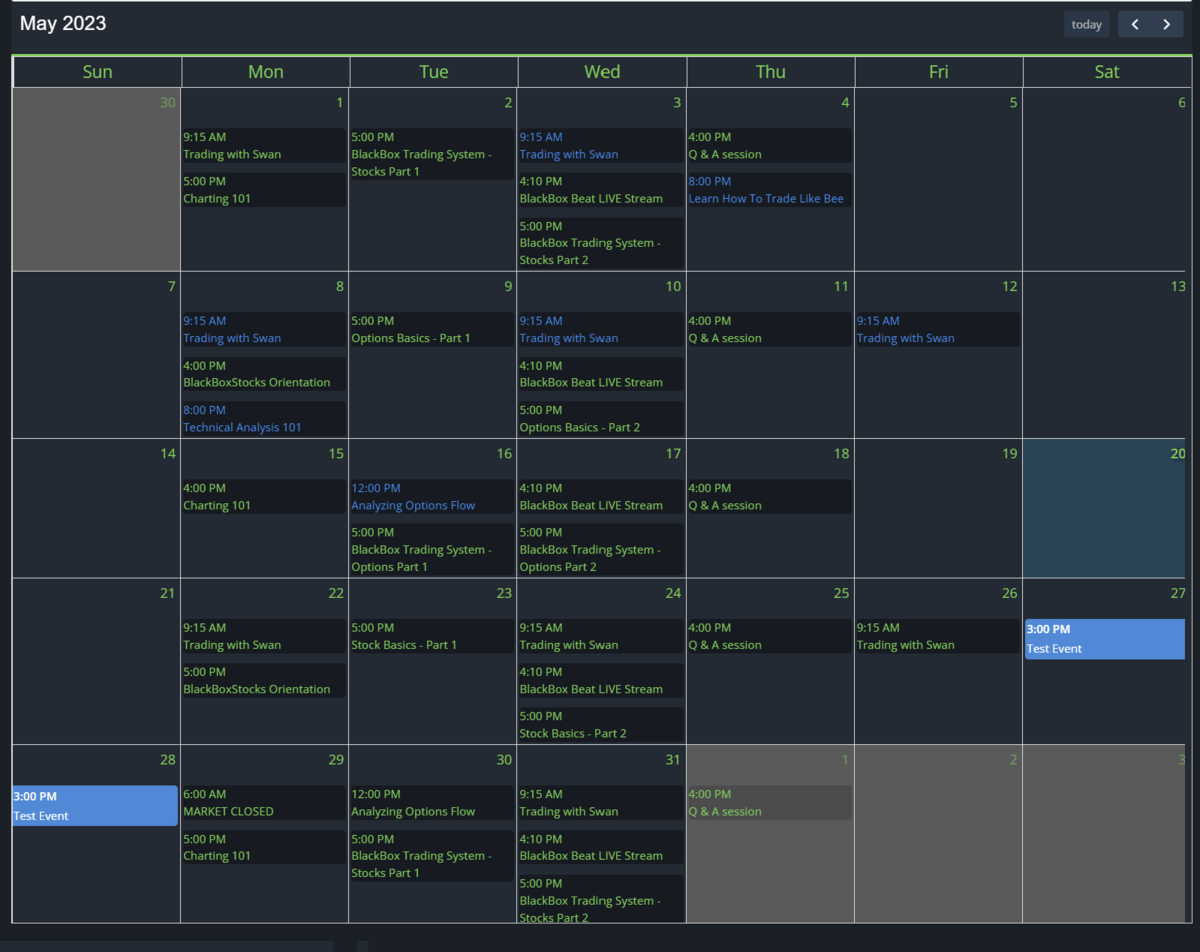

Get access to the BBS discord

PLUS

Education seminars all month long to teach you how to use the service

For bonus content, you must sign up for AllllSevens+ below!

It’s only $7 per month and a great way to show your support!

Reply