- AllllSevens

- Posts

- AlllSevens Newsletter 4/24

AlllSevens Newsletter 4/24

Outlook for 4/24

@AlllSevens

Weekly Newsletter

Disclaimer

All of the data presented in this newsletter is for entertainment purposes only.

I am not encouraging you to make trades or investment decisions based on this information. My intentions are only to convey interesting options flow and my personal speculation on them.

Let’s dive in

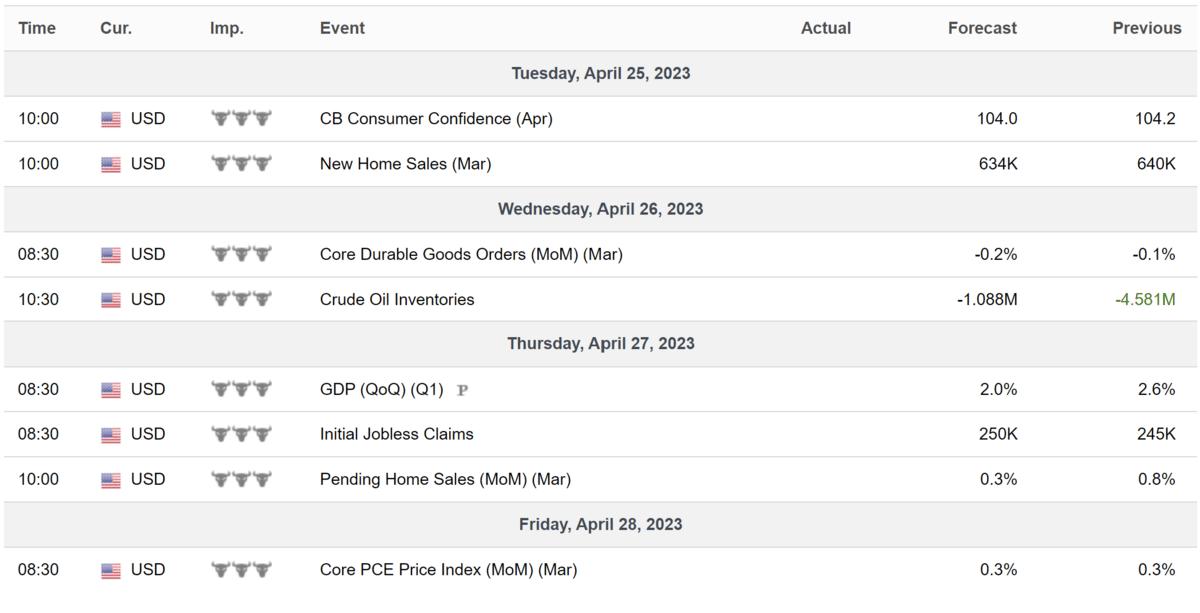

$SPY

Weekly

The $SPY made an extremely high volume 1-2 reversal pattern last month.

This creates a potentially large & strong demand at the $390 area.

From this strong base- price has rose on questionable volume, and leaves hints that these levels will be lost in the future for a retest of the strong demand.

Can this keep rising on a strong base and weak structure? Yeah- as long as structure holds. My plan is to keep trading and expecting upside until structure breaks. Once structure breaks I expect weak demand zones and $390 target.

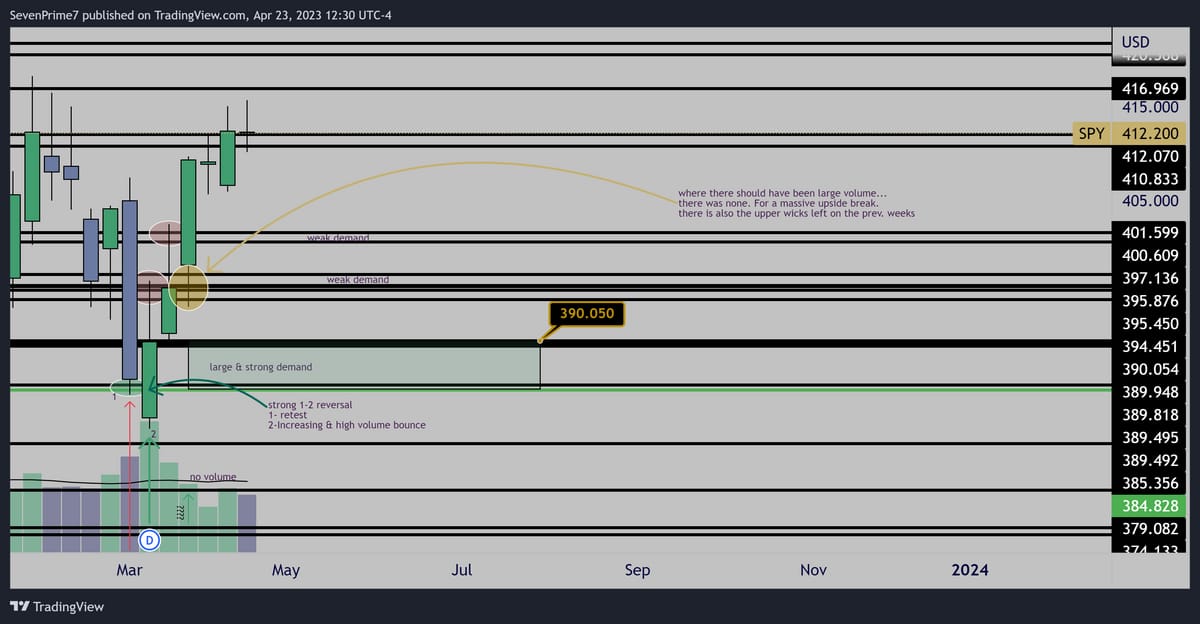

30minutes

The 1HR looks very enticing for longs as $410.40 holds.

Price could target the weak highs at $415.70

If this demand is lost, that would be considered a break of structure.

Inside the $SPY there are 11 sectors. Each of these sectors has an ETF.

In relation to the $SPY, I have analyzed the individual sector charts to identify potential for relative strength and for relative weakness…

Then, I find relative strength and weakness on the individual name in that sector.

So, if the $SPY moves up $4 or 1% this week, it’s likely the relative strength name will move up much more. And vice versa if $SPY moves down.

More on this later!

Now, let’s look at a few individual names that have my attention

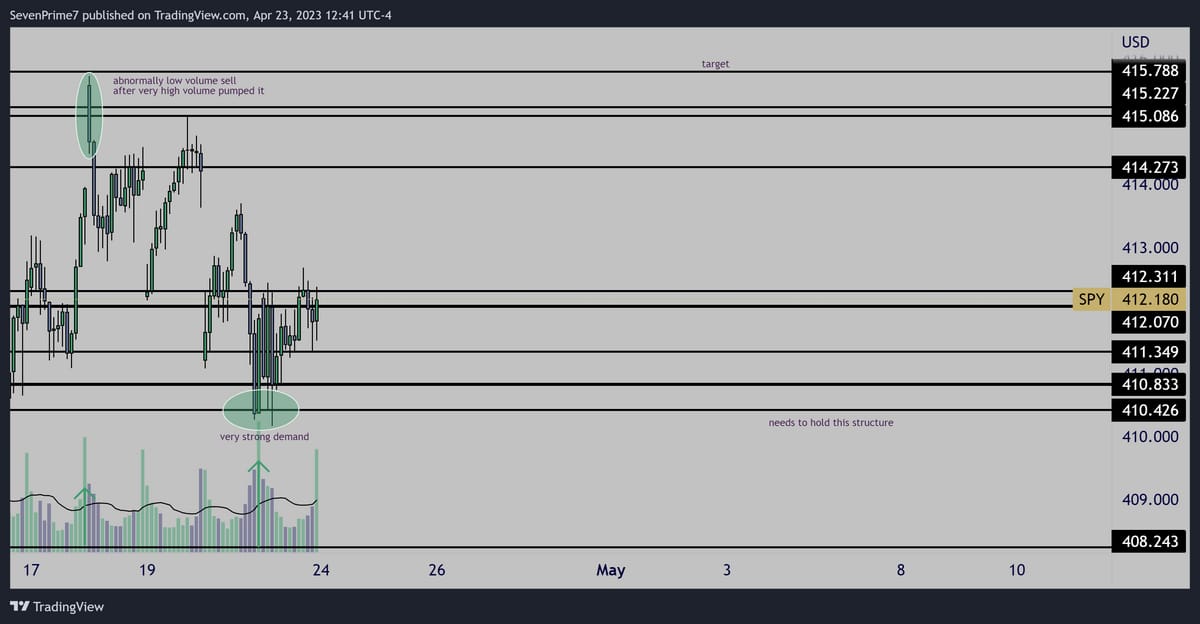

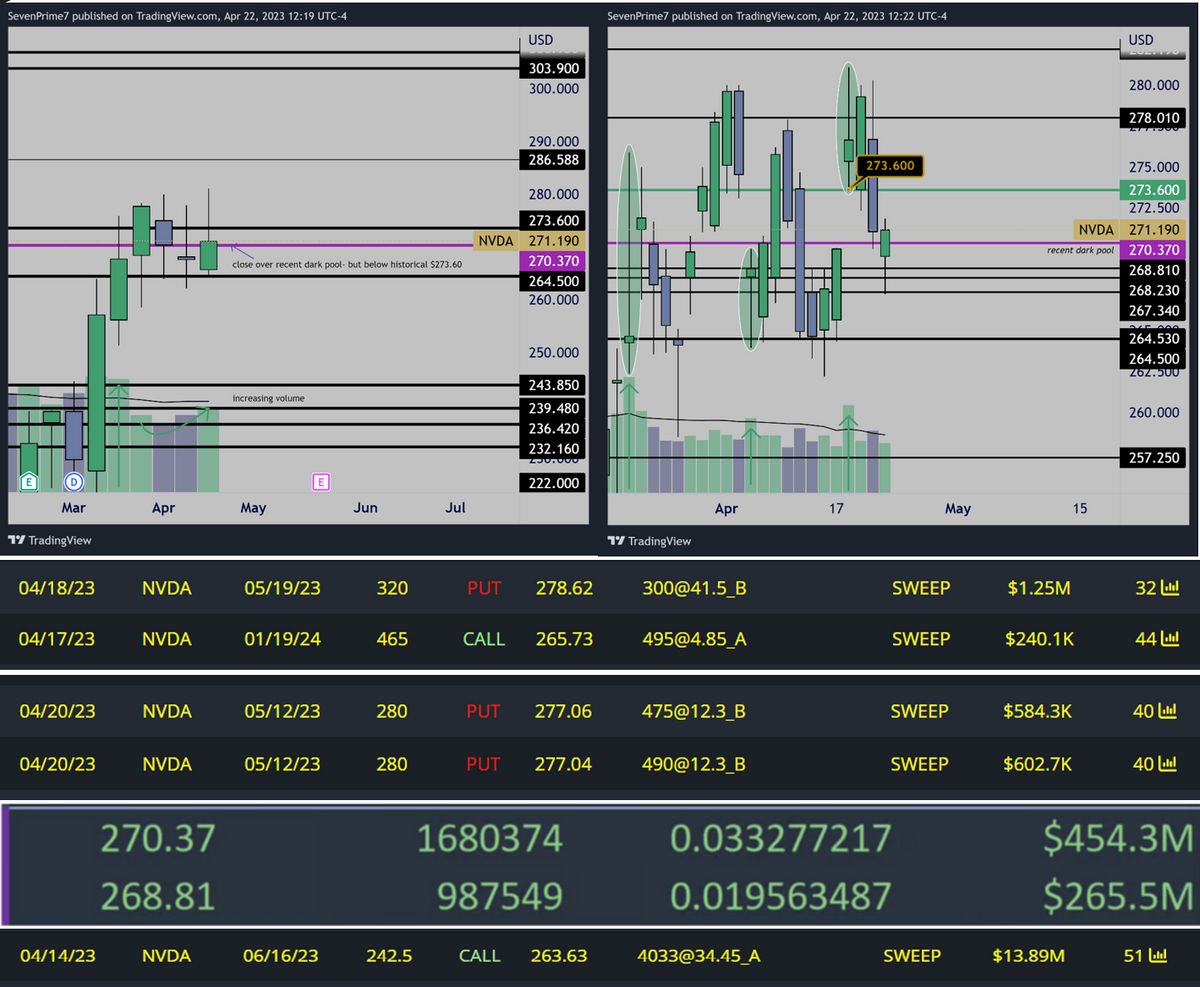

$NVDA- Nvidia Corporation

Weekly & Daily

put writing and call buying

large dark pool activity

large 6/16 call buyer

Bullish

Increasing weekly volume as anticipated last week.

No close over the 273.60 level yet.

Need a large volume move over $273.60 to confirm June swings targeting $300+

So far, price is constructive.

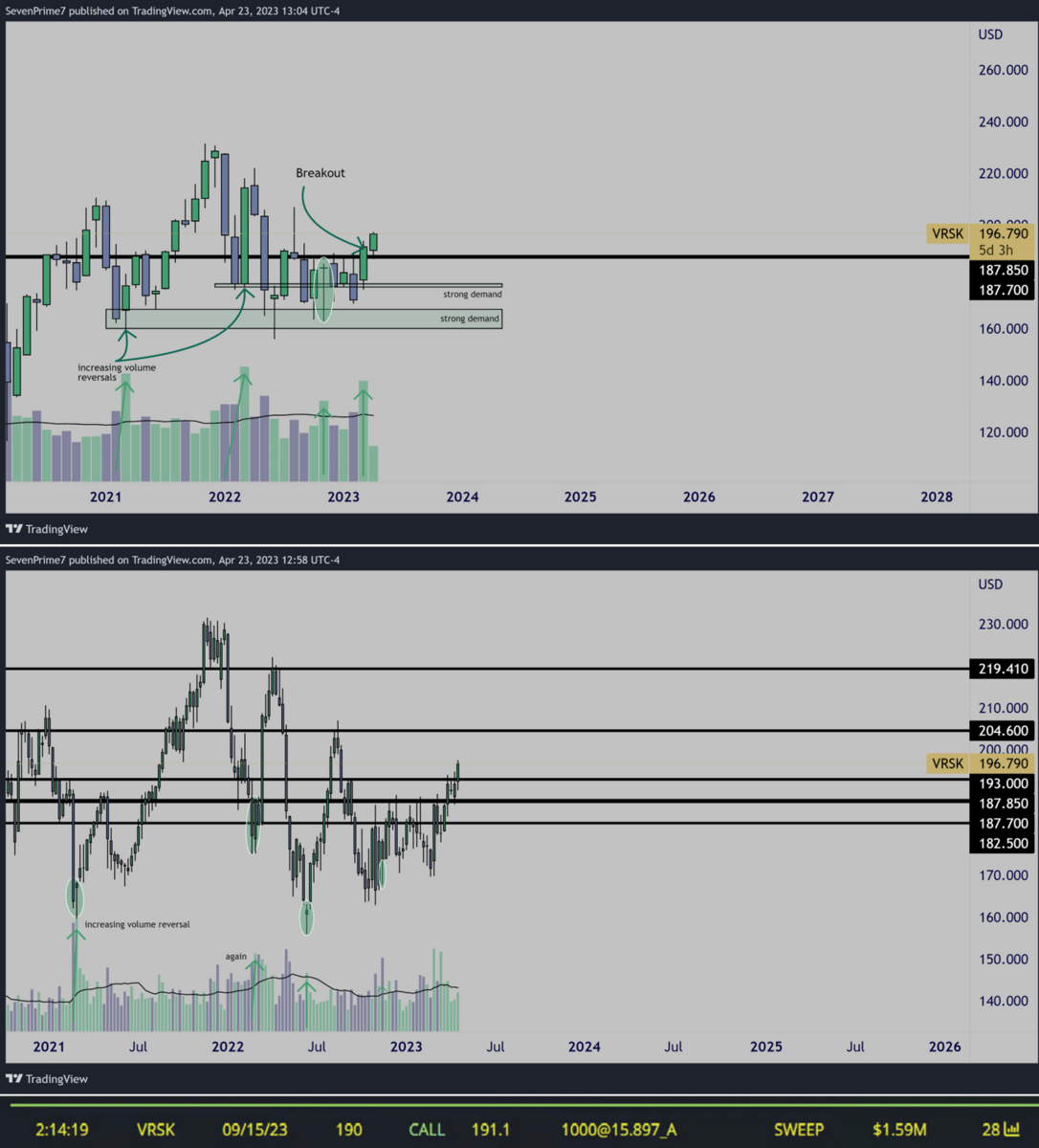

$VRSK

Monthly

Weekly

Bullish

Huge breakout on the monthly chart.

Weekly breakout out on increasing volume.

$TSLA

Daily

Bearish

Very large bears writing calls and buying puts.

Low volume inside bar favors downwards continuation.

Watching this heavily for a breakdown below $161

$CHWY

Daily

Bullish

Very consistent bullish flow & notable dark pool activity.

Potential stopping volume on the original test of $33.50.

Very low volume since then & no confirmation of bulls taking control has been shown, other than the flow.

My eyes are glued to the daily chart, watching for some large green volume.

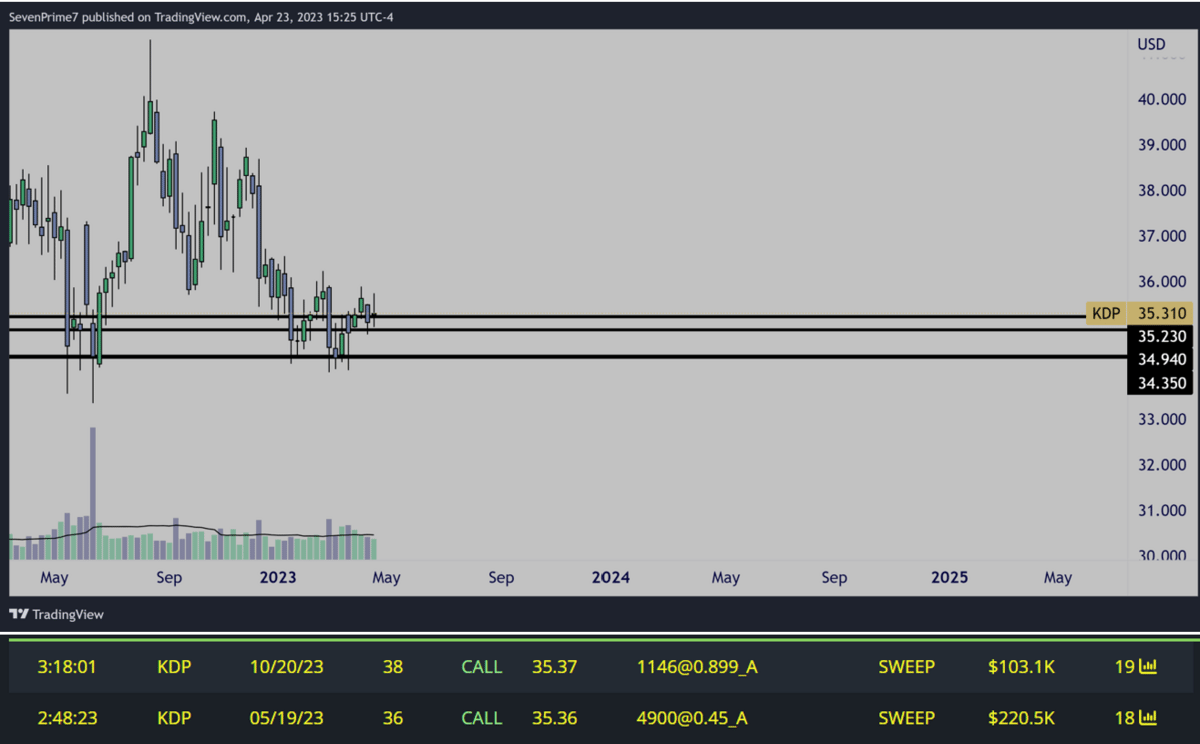

$KDP

Weekly

Bullish

Very interesting weekly chart. Earnings in a few days.

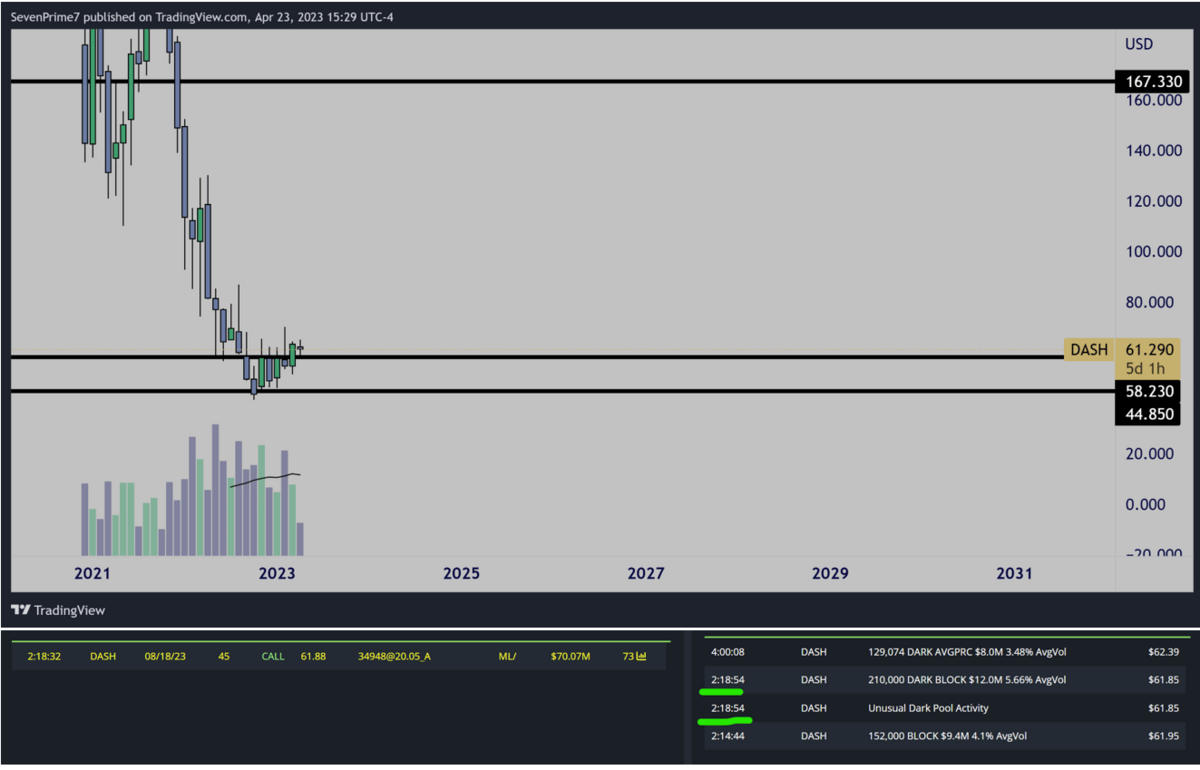

$DASH

Monthly

Bullish

The risk-to-reward here is insane. How likely is it to happen? I do not know.

The volume patterns do not stand out to me currently.

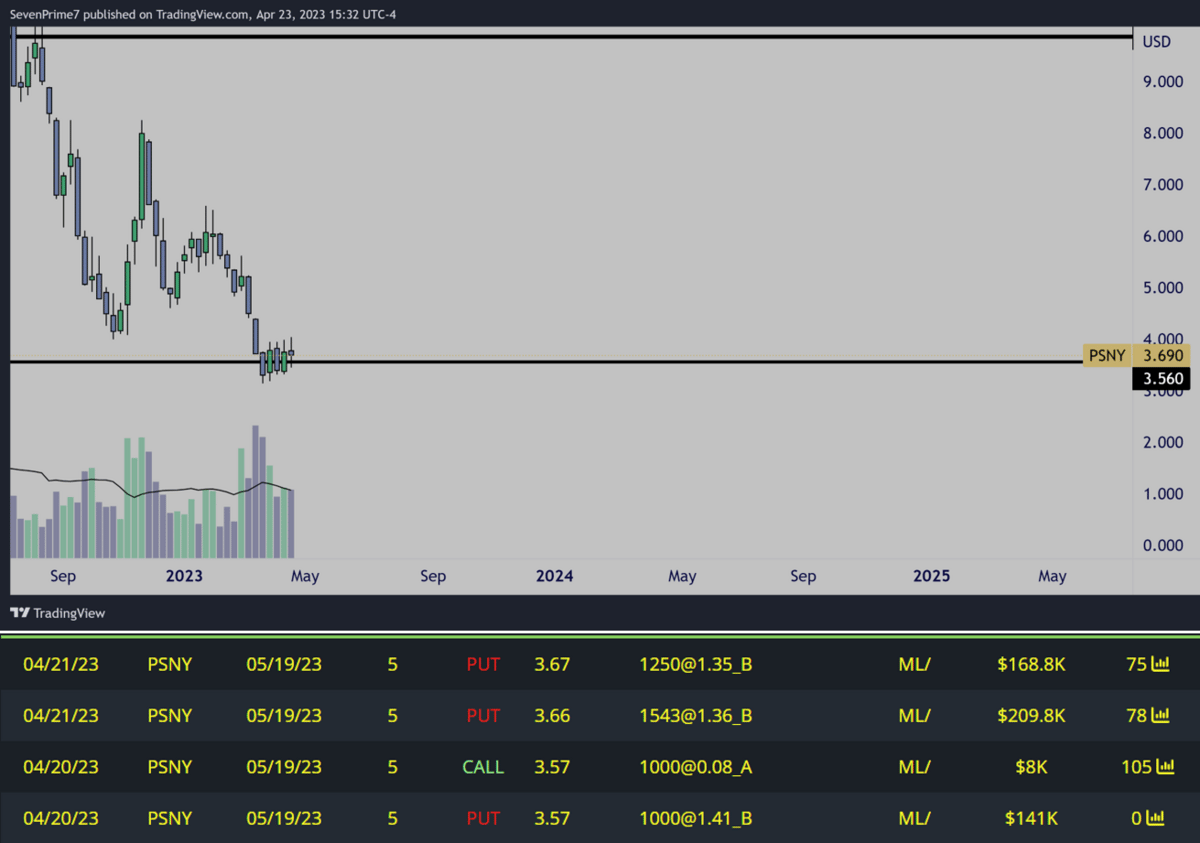

$PSNY

Weekly

Bullish

This one is…. very, very, interesting.

Huge range above. Recent dark pool right here-

Nothing stands out on the volume to me,

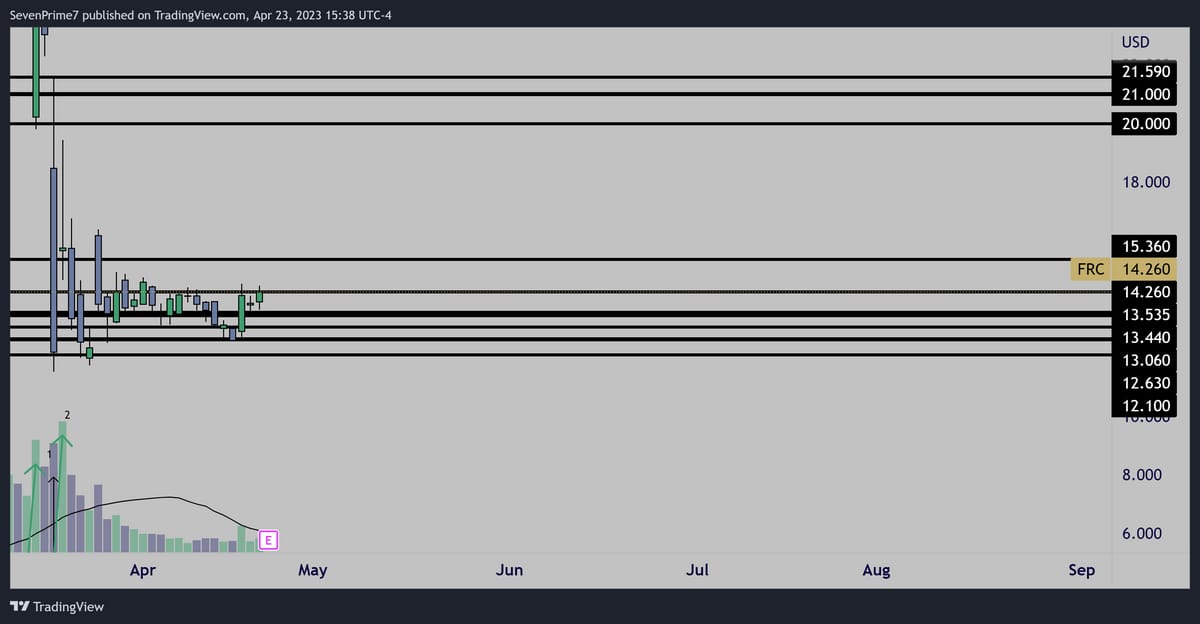

$FRC

Weekly

Bullish

I really love the reversal capitulation pattern on the initial drop here. 1-2.

If earnings beats, and this gaps over the levels shown-

The road to $20.00 would be a highway.

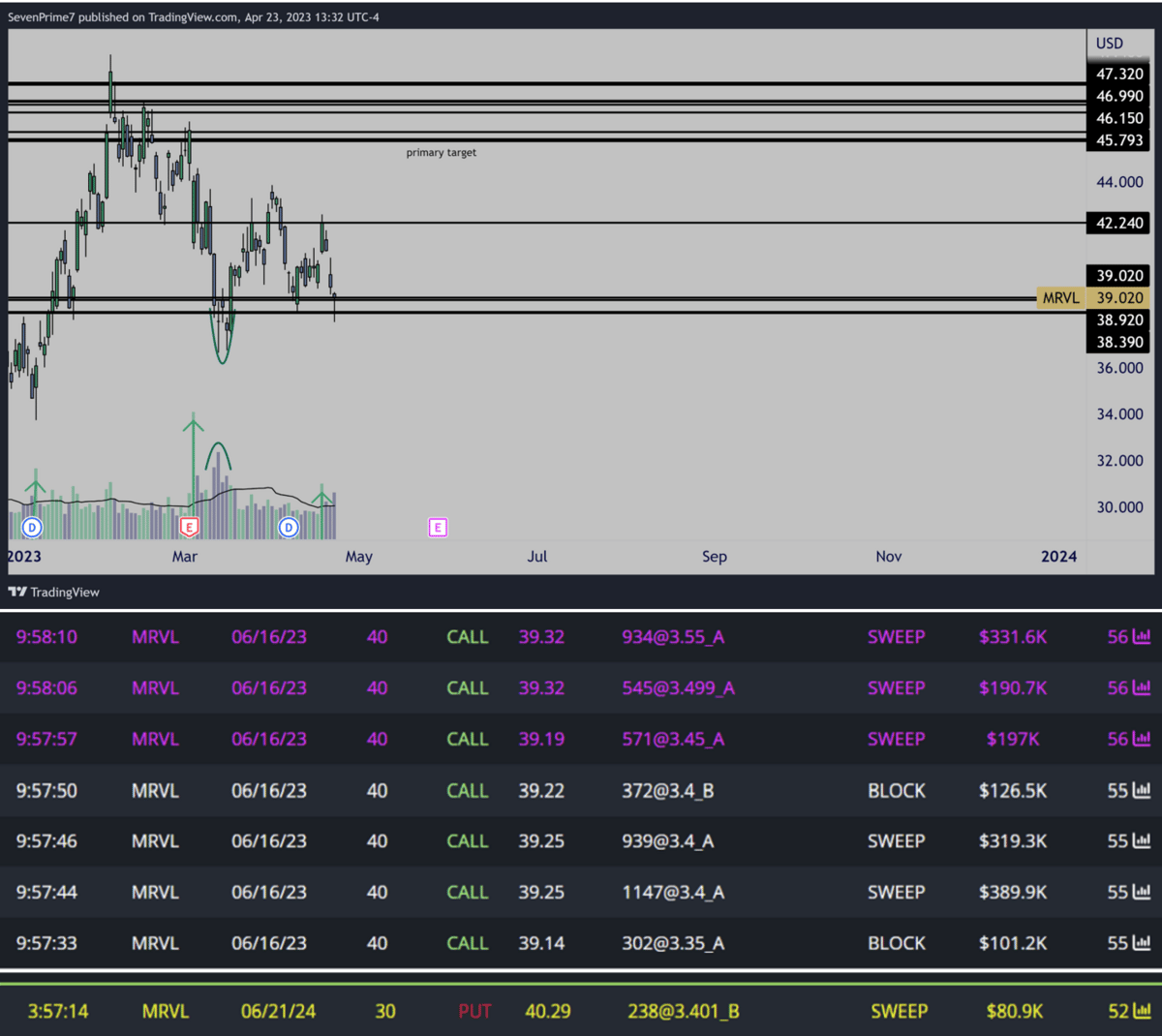

$MRVL

Daily

Bullish

Watching for a gap and hold over $39.00.

If this does not gap up, I will be weary for longs still until I see large bull volume.

If you want access to dark pools and options flow,

Use this link below for 20% off your first month of BlackBoxStocks

http://staygreen.blackboxstocks.com/SHMs

Also get options flow alerts on your phone, discord access, educational seminar access, etc.

Don’t go yet!

My weekly “Top Pick” is available only to premium subscribers viewable below.

I like it more than all the setups listed above.

Along with that, as I talked about earlier-

I have analyzed each sector in the $SPY and determined the strongest and weakest name inside the $SPY this week.

+ Get access to my discord

Reply