- AllllSevens

- Posts

- AllllSevens Weekly Newsletter 4/10/23

AllllSevens Weekly Newsletter 4/10/23

WDC BAC RBLX PBF CHWY RIOT CLF TFC NVDA OXY RIVN SOFI COP KGC UBER VRSK CVX SNAP

AlllSevens Newsletter

Every weekday I read & analyze the options flow, gathering what I deem to be most notable. In this newsletter, I assemble my best setups.

Not only do I look for good, directional flow-

I look for a chart that can support it. I view market structure through the lens of dark pools, which are price levels on the chart that hold concentrated institutional volume. In other words, dark pools are institutional volume shelfs.

On the charts I present to you, every single horizontal level shown is a data point collected from the dark pool. It is not hand-drawn. There is no bias involved.

They are areas of REAL supply & demand.

Please, enjoy!

As this is my first ever newsletter, I would really appreciate any feedback!

This is in early stages and will improve 10 fold over the next few months.

Disclaimer

All of the data presented in this newsletter is for entertainment / data purposes only. I am not insinuating that you make any trades or investment decisions based on the what I display. My intentions are only to convey interesting options flow and charts that may be fun to watch over the next few weeks.

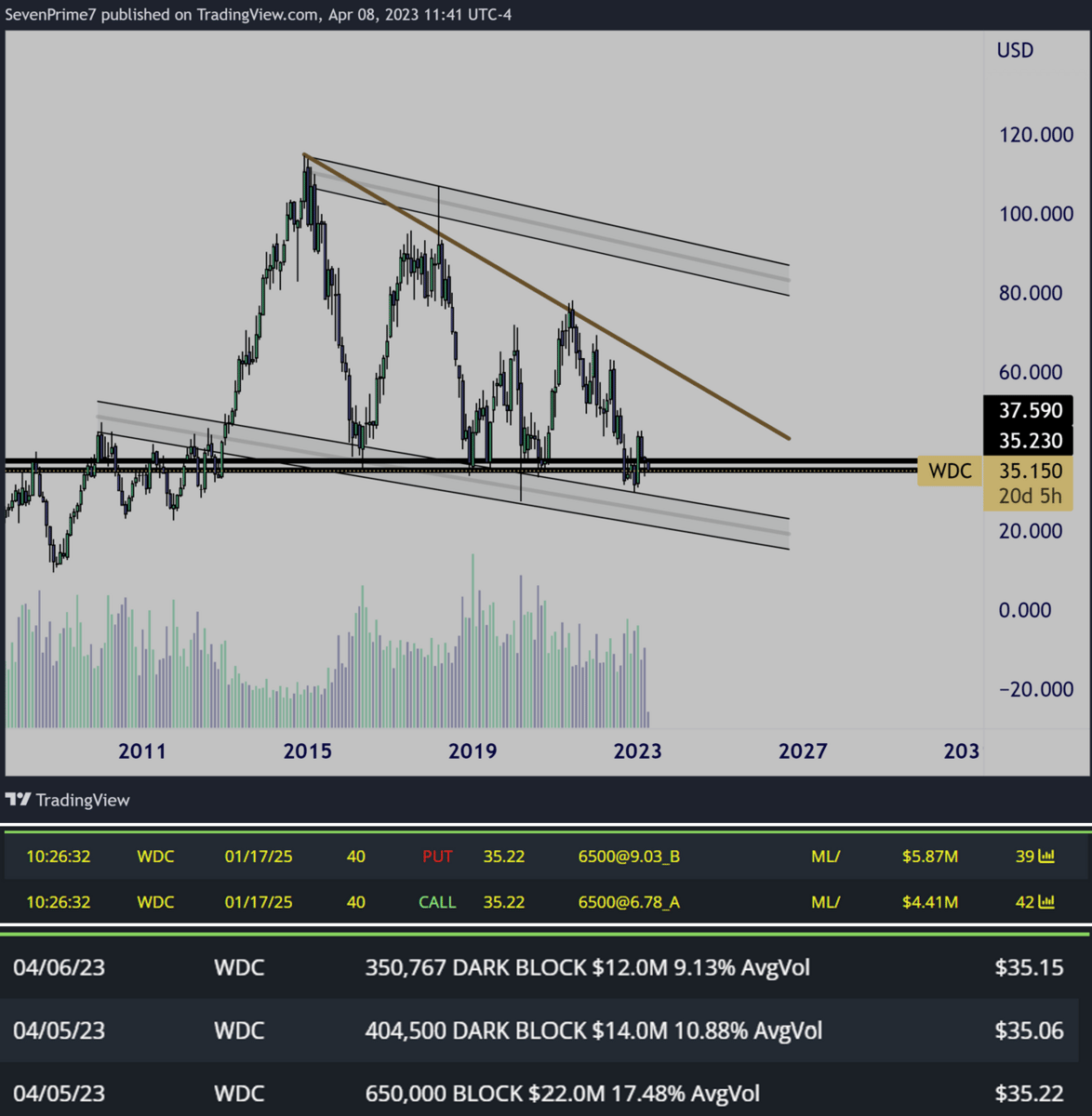

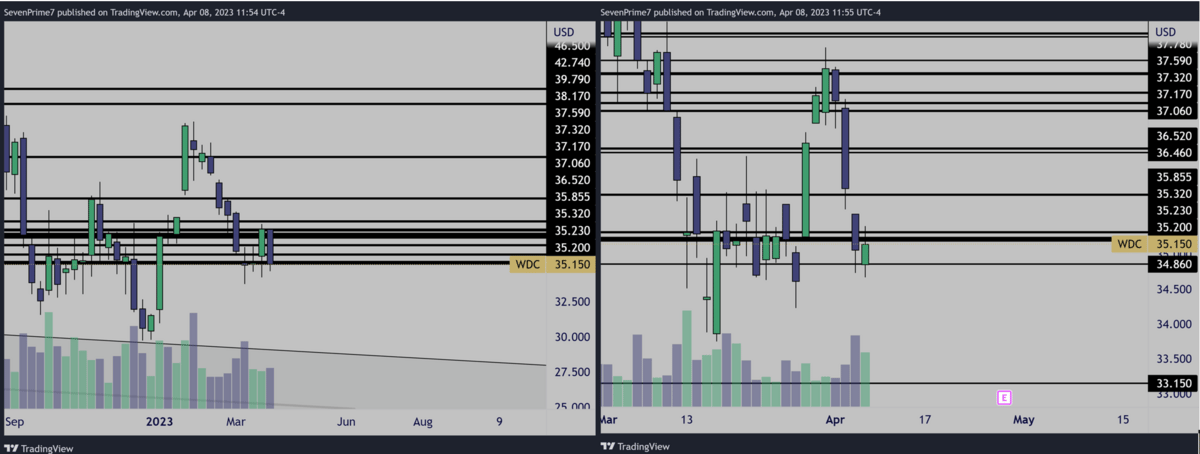

$WDC- Western Digital Corporation

1 Month chart- Bull Flag/Falling Wedge

Consolidation at it’s largest institutional volume shelf on record

$10M+ on bullish a risk reversal leap, writing puts, buying calls

Large amounts of shares actively being transacted in this area

Weekly & Daily chart

Notes-

Long-term setup.

Bullish.

Price is currently retesting a major demand zone after the monthly candle impulse over it.

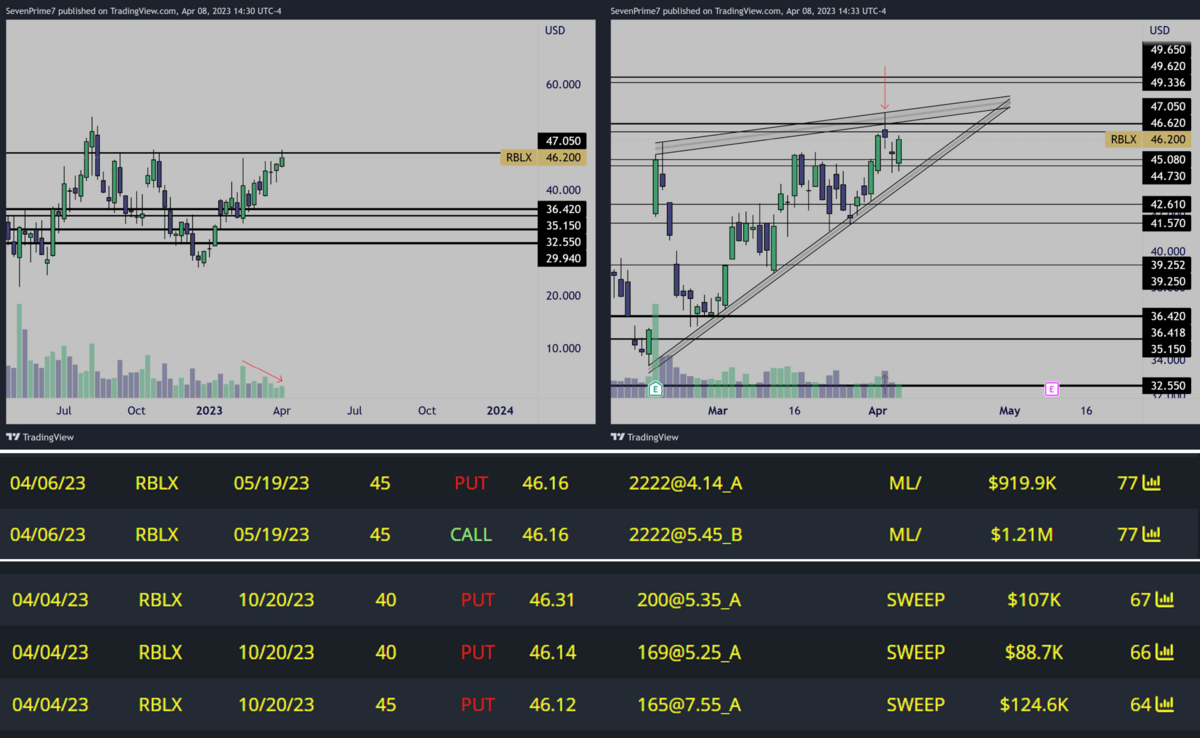

$RBLX- Roblox Corporation

Weekly & Daily Chart

$2M+ Bearish Risk Reversal, buying puts, writing calls

$300K+ in October put buys

Notes-

Short-term.

Bearish.

Weekly run-up on decreasing volume into weekly supply.

Sellers showed their presence on Tuesday’s high volume reversal.

Buyers currently defending the $44.70-$45.00 demand on lower volume.

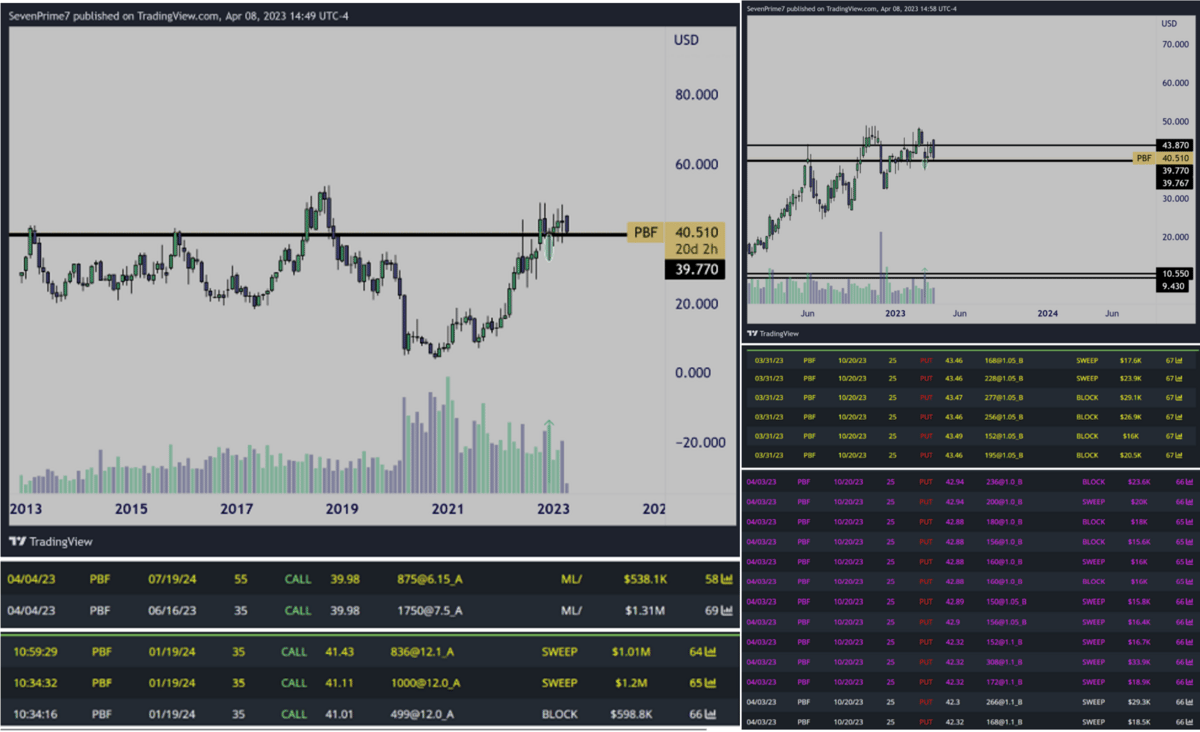

$PBF- PBF Energy Inc.

Monthly & Weekly Chart

$2M+ in leap calls purchased

$400K+ in October puts written

You may see the large red volume loss of demand In late November as a red flag…

But zoom in on the 1HR chart and you see it is bull volume & actually very bullish on key support.

Notes-

Short term.

Bullish.

Monthly candle setup.

Weekly candle currently bearish engulfed, yet holding demand.

No confirmation of a bounce has been given.

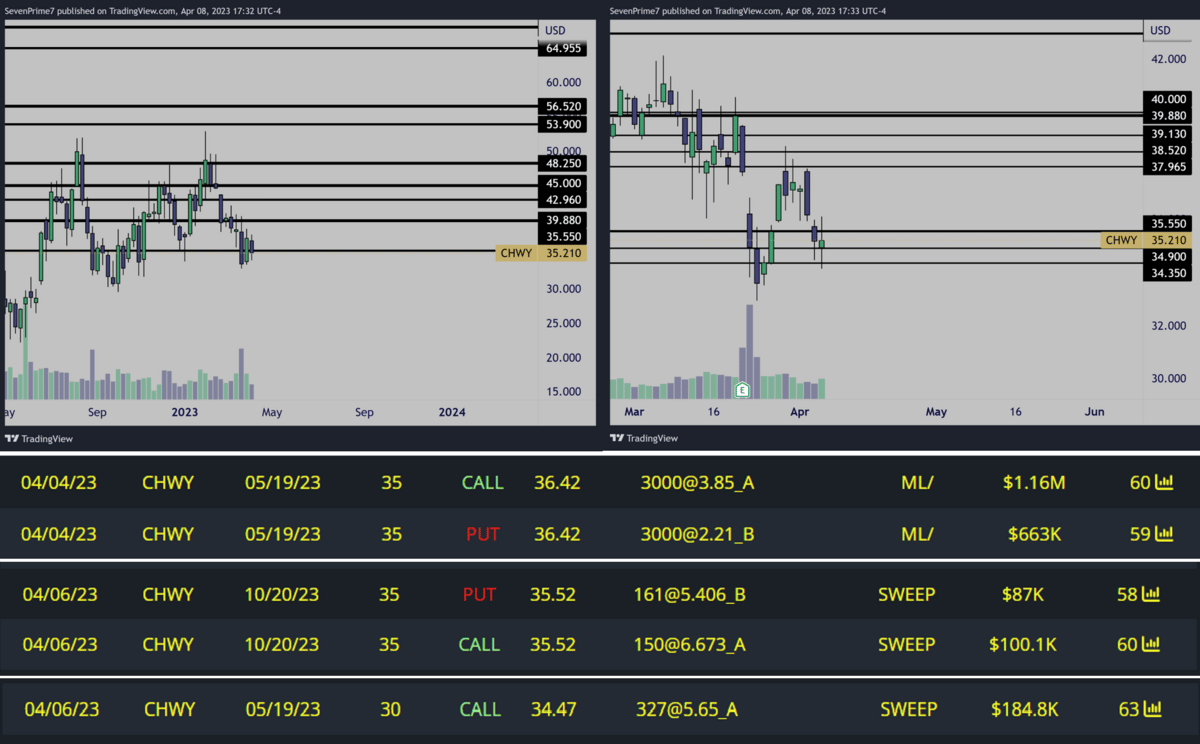

$CHWY- Chewy, Inc.

Weekly & Daily Chart

$2M+ on bullish risk reversals expiring 5/18 and 10/20, writing puts, buying calls

$180K 5/19 call buyer

Notes-

Bullish.

Double inside weeks.

Stopping volume the on daily chart at demand.

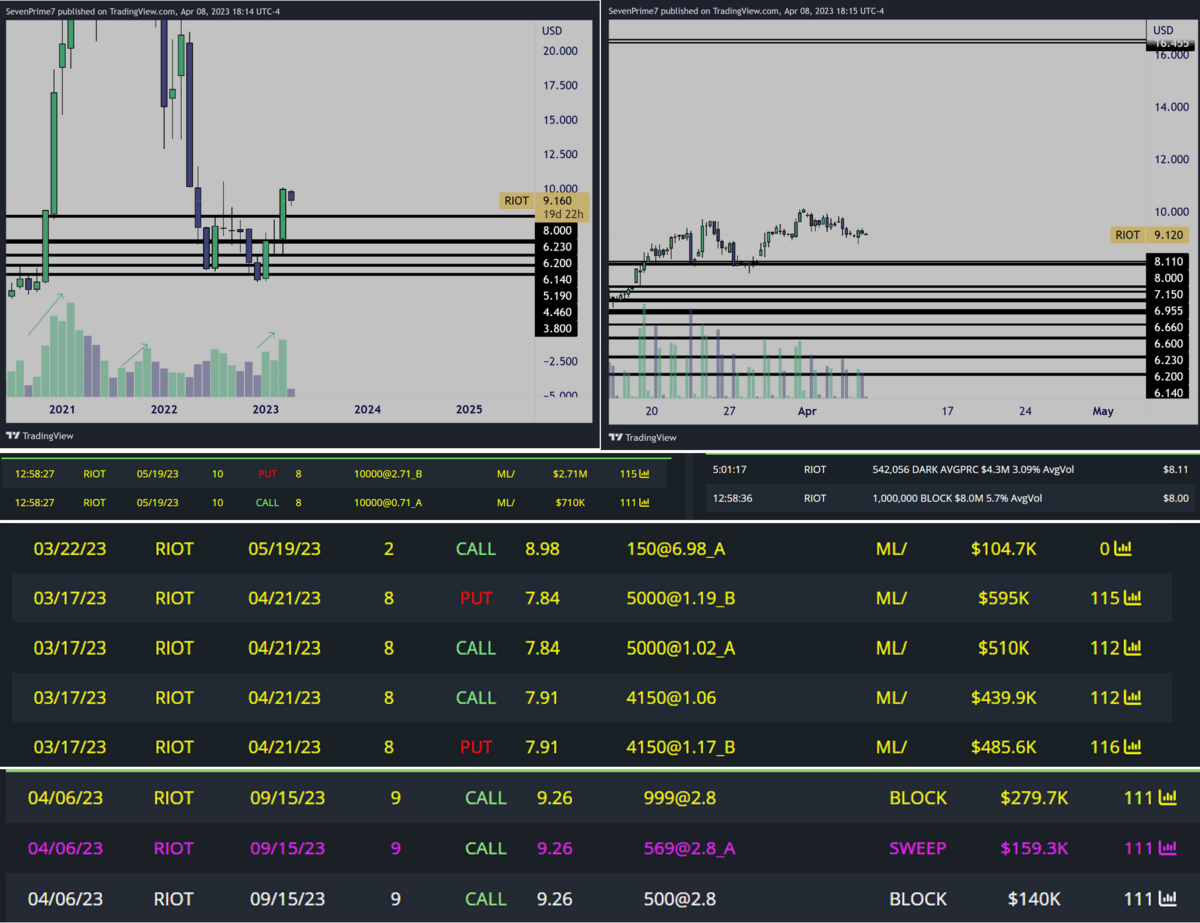

$RIOT- RIOT Platforms, Inc.

Monthly & 4HR Chart

$3M+ 5/19 bullish risk reversal tied to large dark pools, writing puts, buying calls

$2M+ 4/21 bullish risk reversals, writing puts, buying calls

$580K 9/16 call buys

Notes-

Bullish.

My absolute favorite monthly setup.

Slightly extended from the nearest demand.

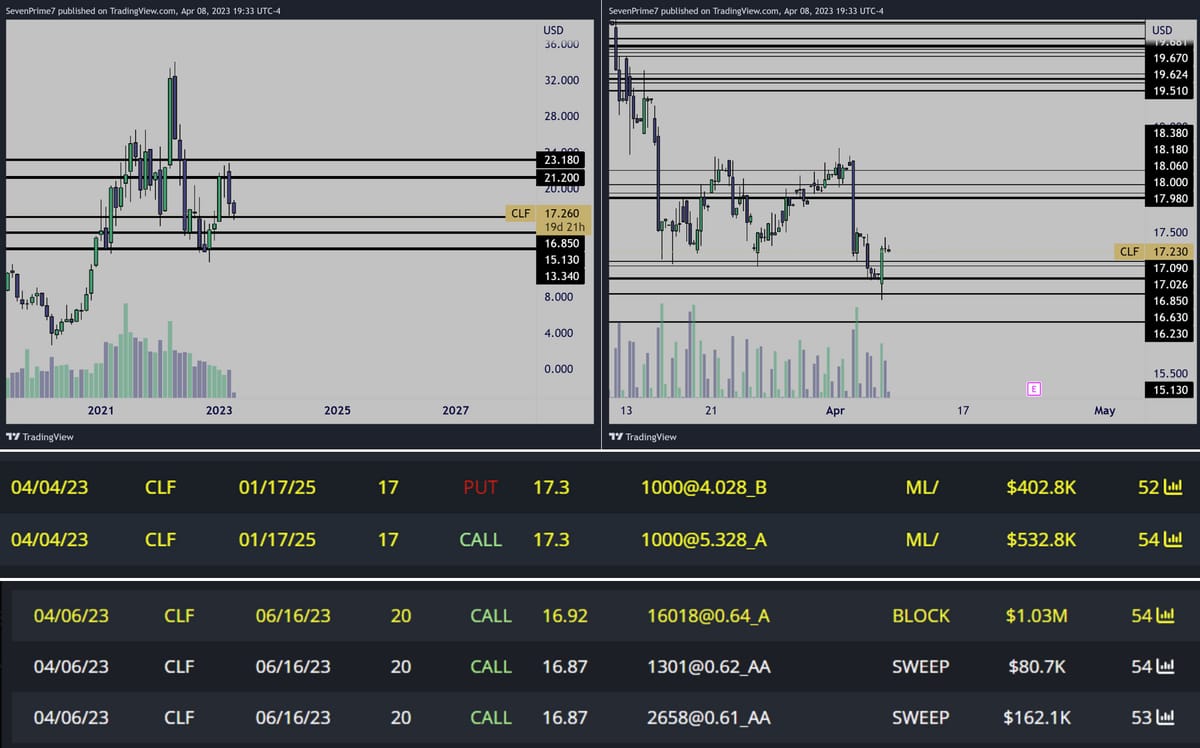

$CLF- Cleveland-Cliffs Inc.

Monthly & 4HR Chart

$900K bullish risk reversal leap

$1M 6/16 call buys

Notes-

Bullish.

Very nice consistent bull volume on the 4HR. Great defense by bulls last Thursday.

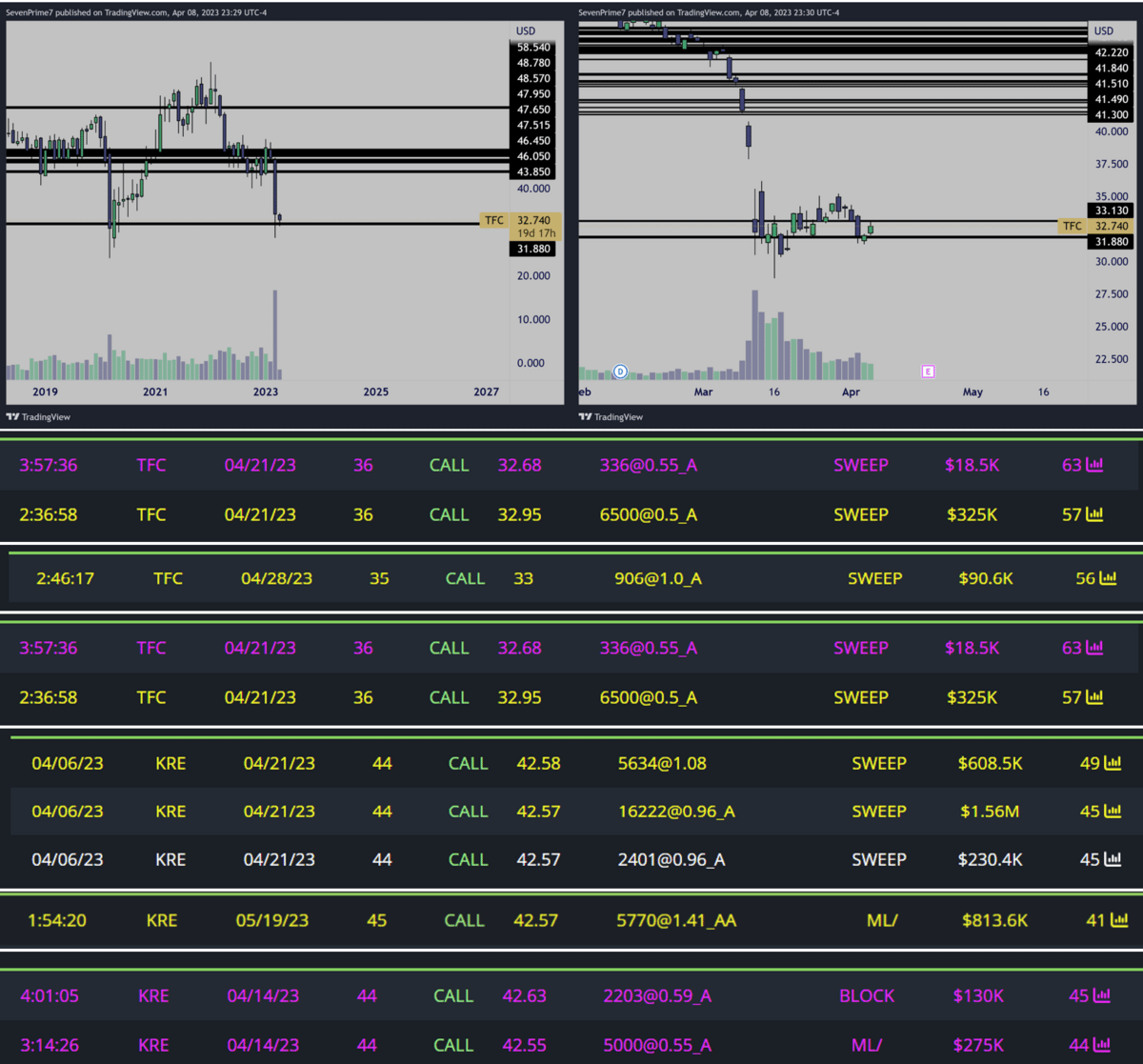

$TFC- Truist Financial Corporation

Monthly & Daily Chart

$300K 4/21 call buyer

$90K 4/28 call buyer

$2M 4/21 $KRE ($TFC #6 holding) call buyer

$800K 5/19 $KRE call buyer

$400K 4/14 $KRE call buyer

Notes-

Bullish.

Huge capitulation volume at demand.

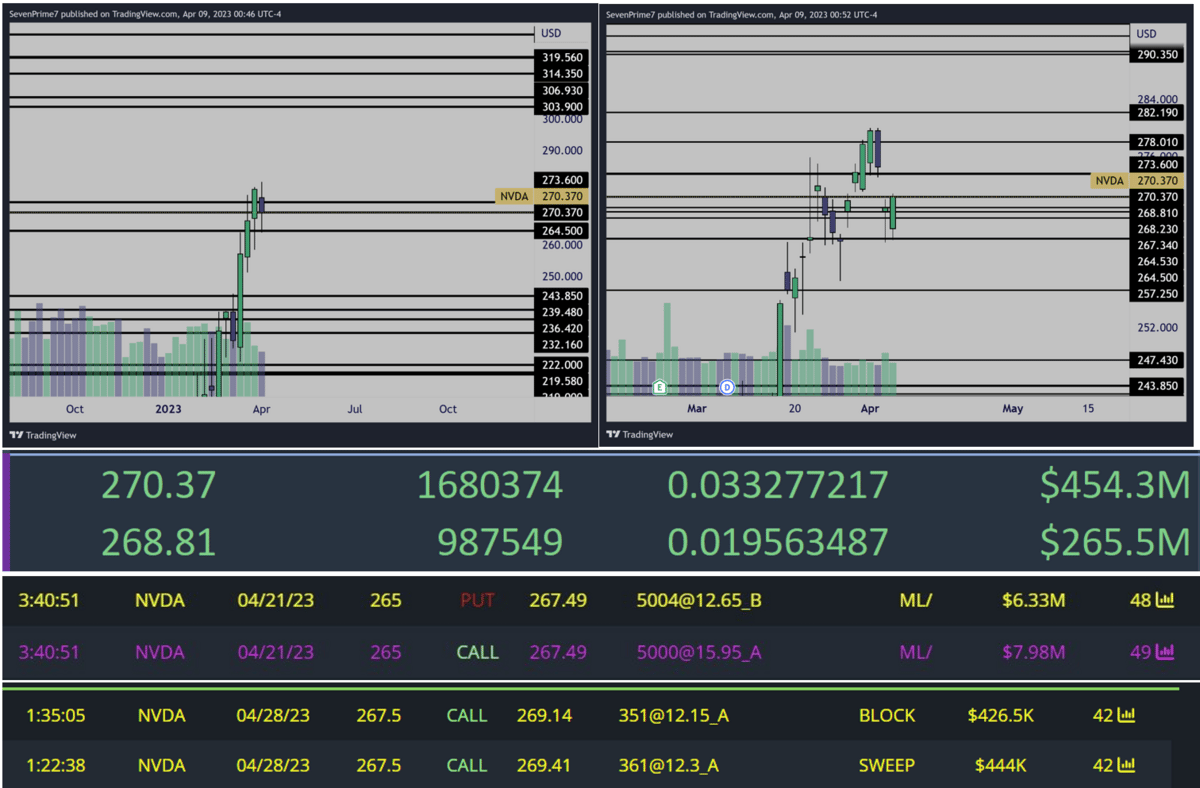

$NVDA- Nvidia Corporation

Weekly & Daily Chart

Notable recent dark pools

$14M bullish risk reversal for 4/21, writing puts, buying calls

$870K 4/28 call buyer

Notes-

Bullish.

Still below $273.60 supply where a 1HR H&S has potential if it rejects again.

Holding lower $264.50 demand well.

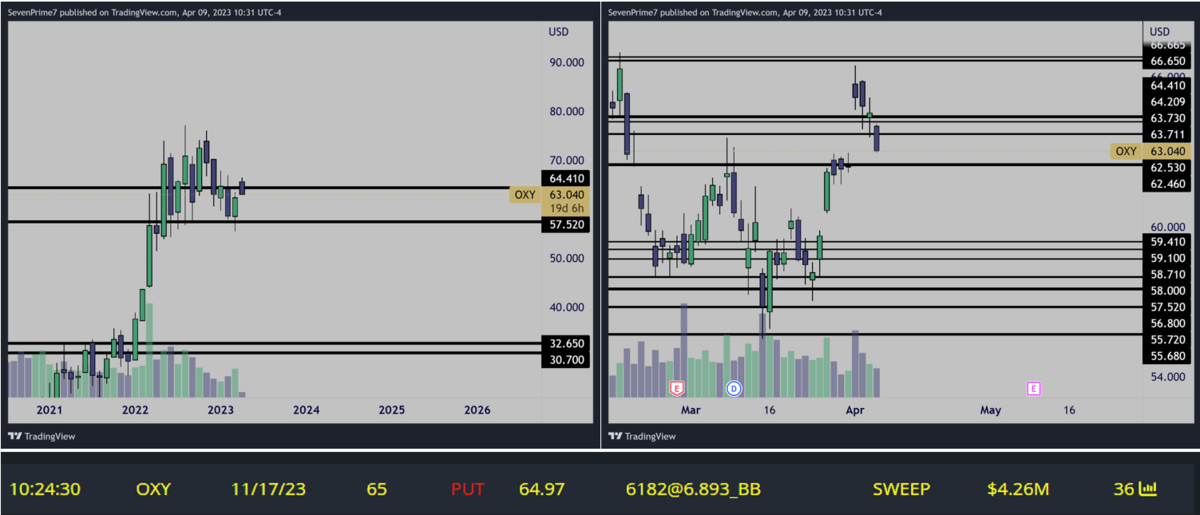

$OXY- Occidental Petroleum Corporation

1 Month & 1D Chart

$4M 11/17 put writer

Notes-

Bullish.

Large volume bounce off key monthly demand.

Active put writers into weakness tells me a retests of demands below could give good bounces.

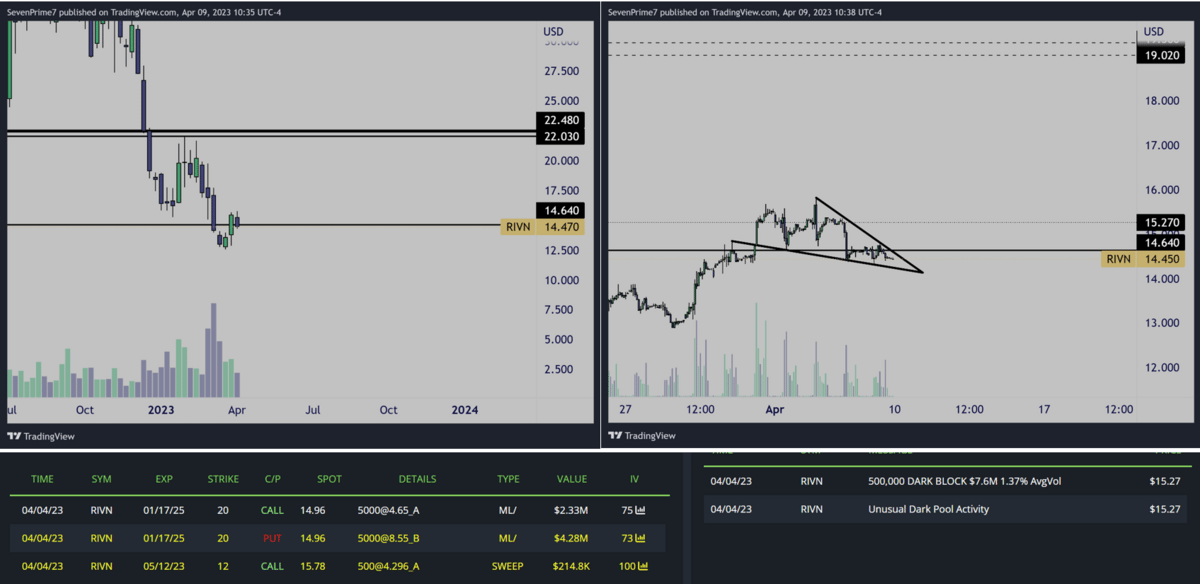

$RIVN- Rivian Automotive, Inc.

Weekly & 4HR Chart

4HR falling wedge

Large bullish leap risk reversal, writing puts buying calls tied to a large dark pool

$200K 5/12 call buyer

Notes-

Bullish

Still below $14.64 weekly supply, waiting to potentially breakout.

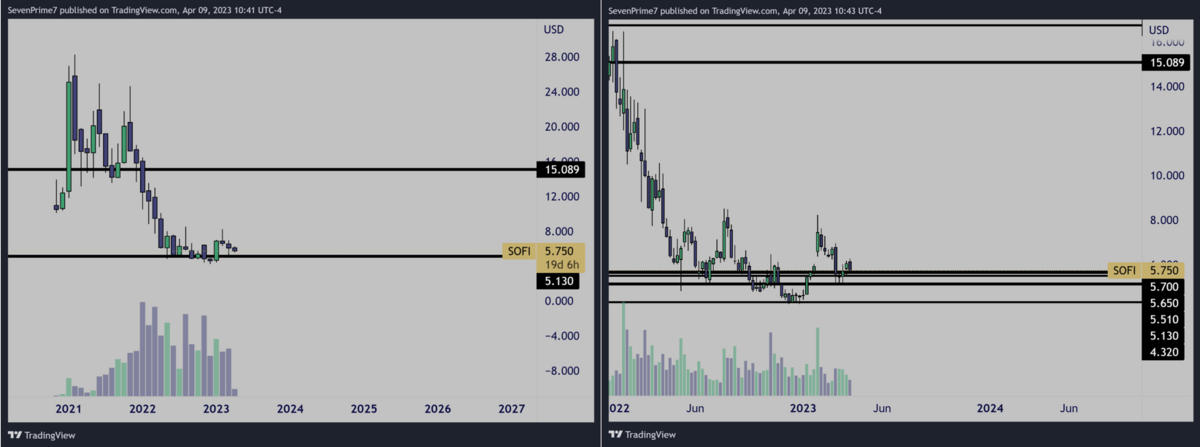

$SOFI- Sofi Technologies, Inc.

Monthly & Weekly Chart

Notes-

Bullish.

No notable flow. Just notable higher lows forming on a large demand.

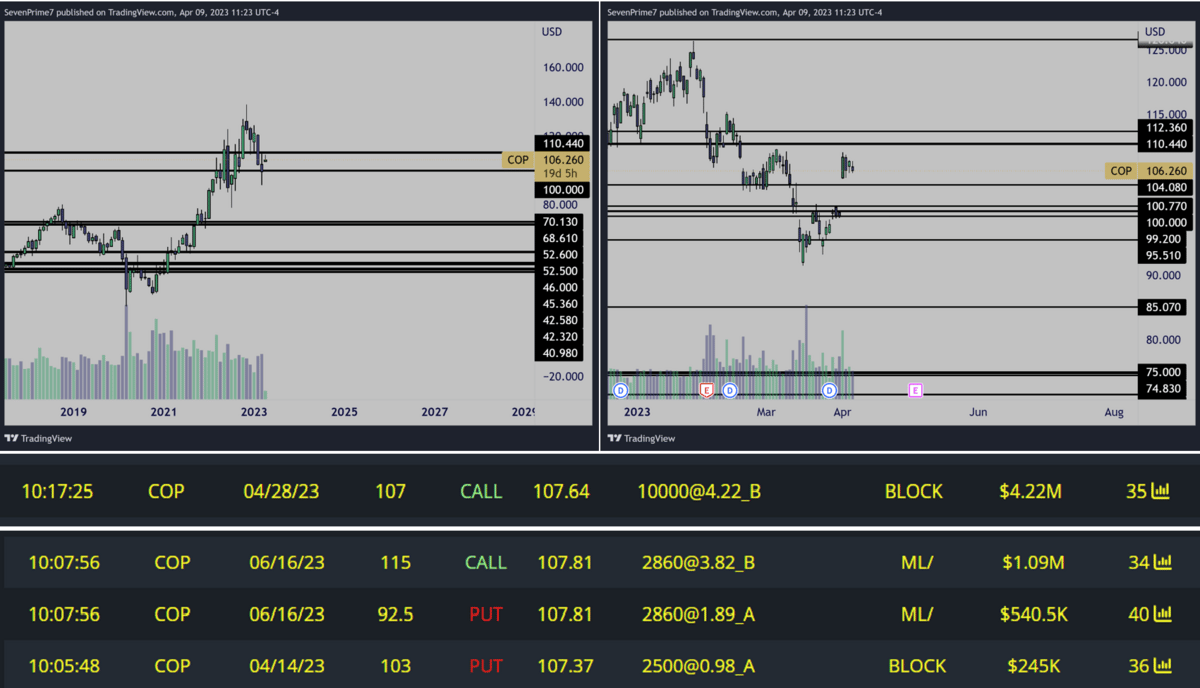

$COP- ConocoPhillips

Monthly & Daily Chart

$4M 4/28 call writer

$1.5M 6/16 bearish risk reversal, writing calls, buying puts

$240K 4/14 put buyer

Notes-

Bearish.

Monthly chart holding demand.

Poor risk-reward in no mans land relative to dark pools.

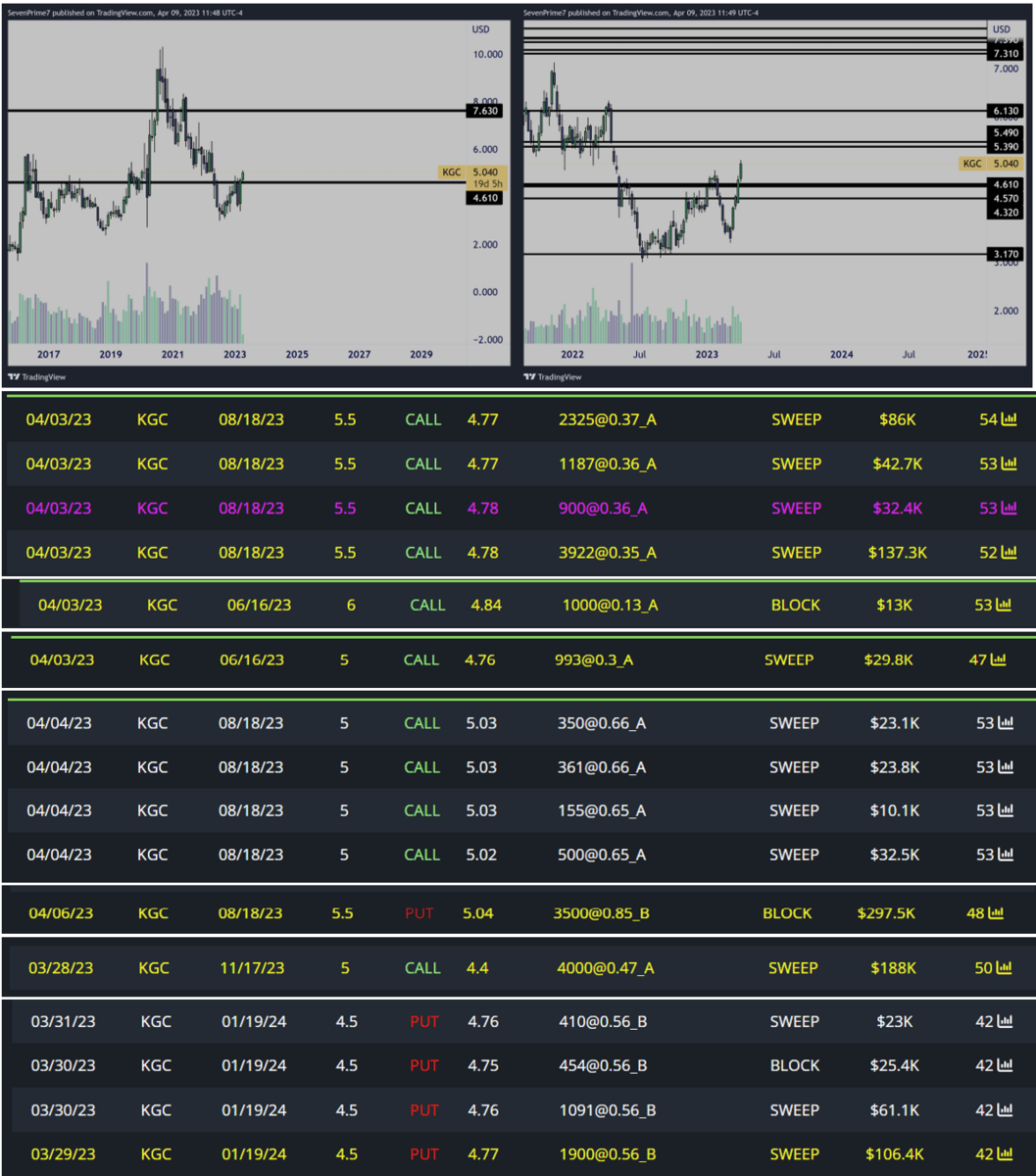

$KGC- Kinross Gold Corporation

Monthly & Weekly Chart

$380K 8/18 call buys

$40K OTM 6/16 call buys

$300K 8/18 put writer

$180K OTM 11/17 call buyer

$200K leap put writers

Notes-

Bullish.

Monthly breakout.

Weekly slightly extended from demand.

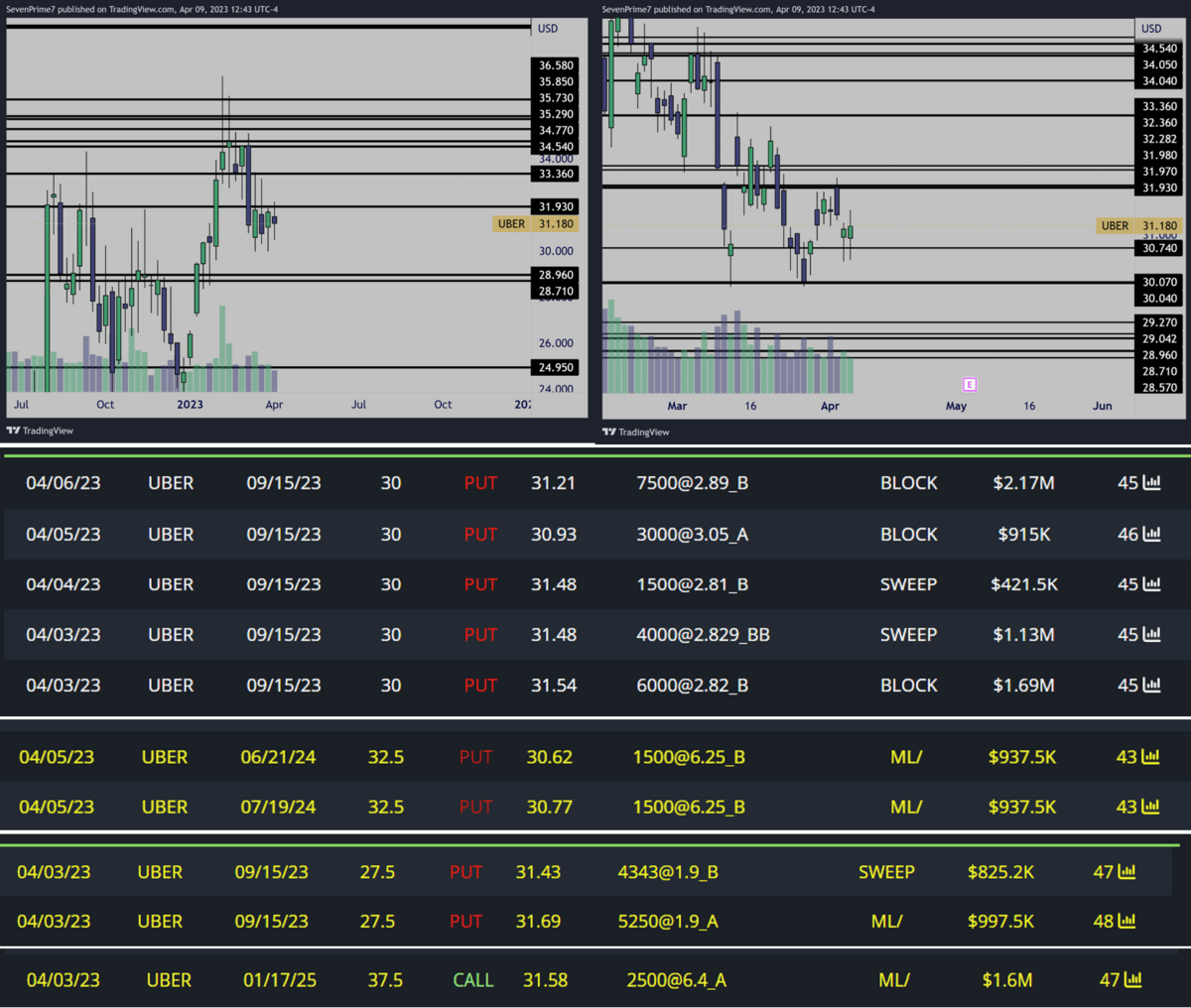

$UBER- Uber Technologies, Inc.

Weekly & Daily Chart

$4.5M 9/16 call writers

$1.8M leap call writers

$1.8M 9/16 call writers

$1.6M leap call buyer

Notes-

Bullish.

Weekly holding steadily below supply.

Daily bullish engulfing candle.

Weekly needs to reclaim supply and turn it demand.

$VRSK- Verisk Analytics, Inc.

Monthly & Daily Chart

$1.6M 9/15 call buyer

Notes-

Bullish.

Monthly breakout.

Daily at supply zone.

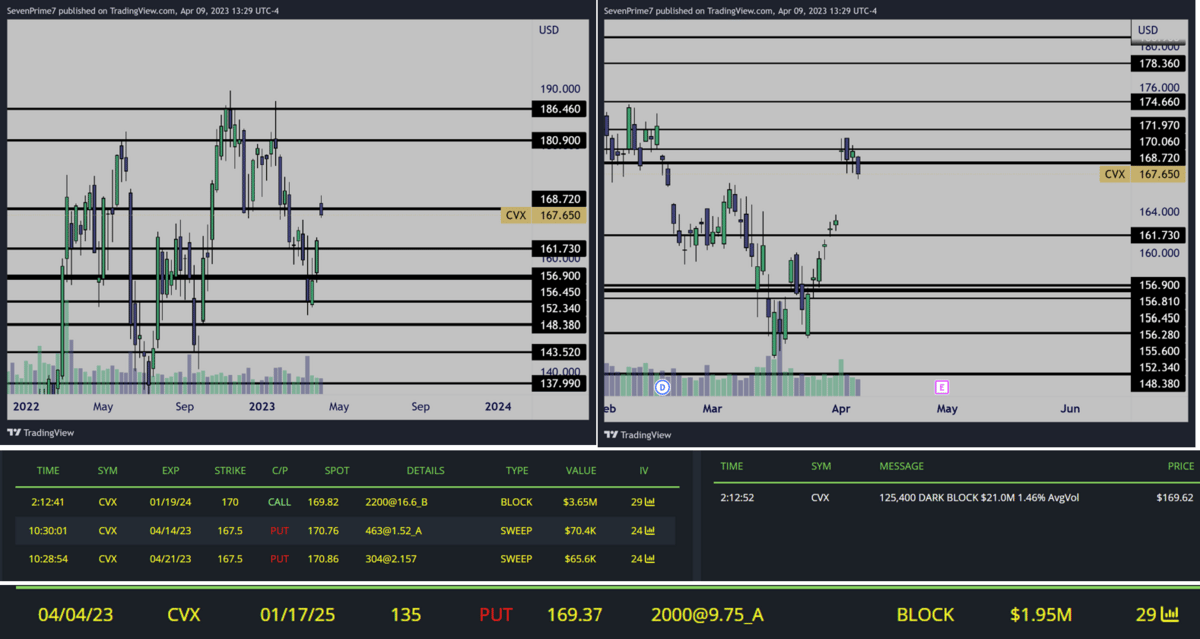

$CVX- Chevron Corporation

Weekly & Daily Chart

$3.6M leap call writing tied to dark pool

$2M leap put buyer

Notes-

Bearish.

Lots of time involved on this trade.

Large gap fill below if $168.72 area remains as supply.

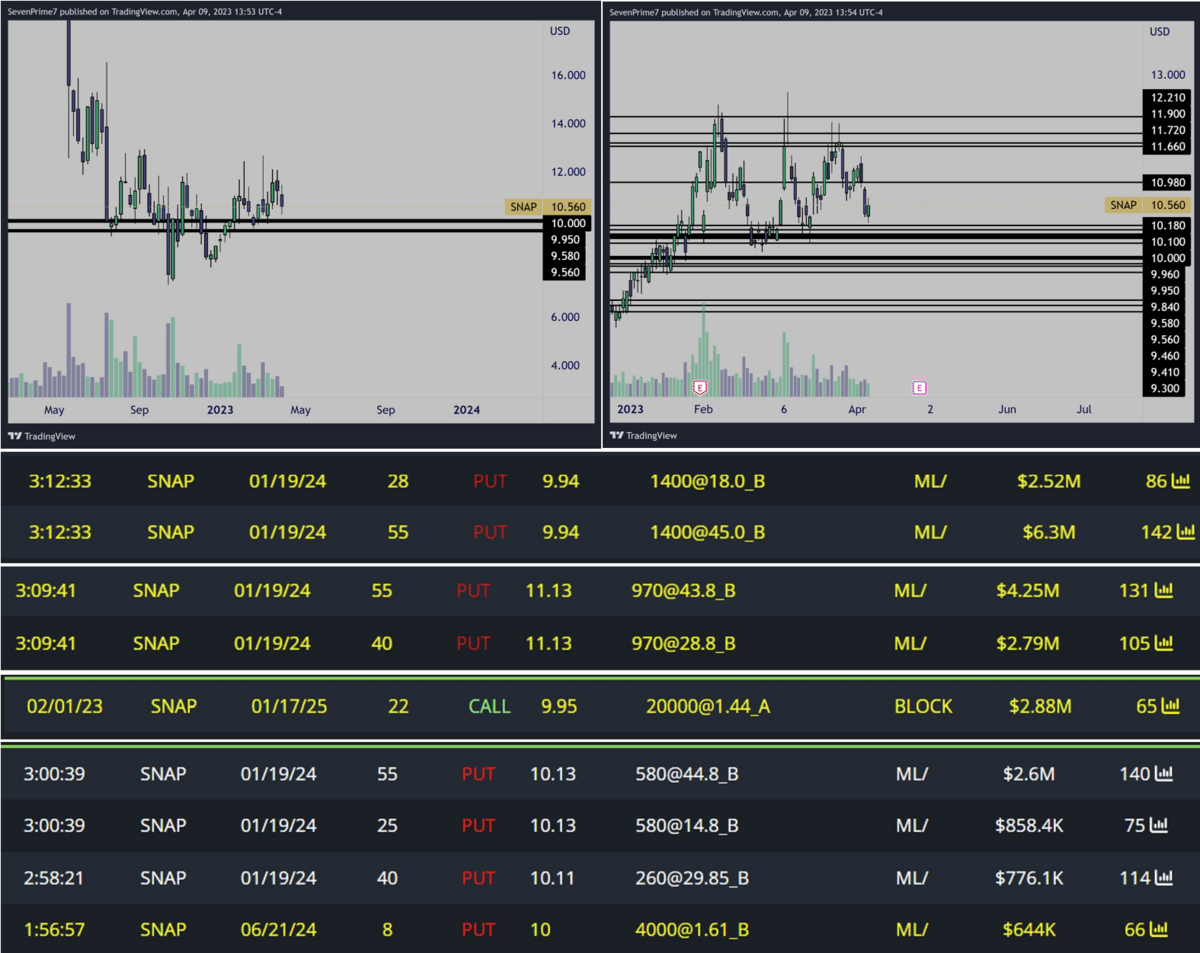

$SNAP- Snap Inc.

Weekly & Daily Chart

$20M in yearly put writing

$2.9M yearly call buys

Notes-

Bullish.

Large demand base formed with mostly just put writing.

Very long-term setup, if this demand holds the next institutional supply (other than $12) is not for a long ways up.

That’s all for this week!

Thanks for taking the time to read my very first newsletter!

I’d love any feedback, the best way to reach me is either by replying to this email, direct messaging me on twitter, or messaging me on discord.

Twitter

https://twitter.com/AlllSevens

Discord link

https://discord.gg/sB47bBT9

One last thing!

If you want access to the same data I just showed you, but in REAL-TIME, then you’re going to want to sign up for BlackBoxStocks

With the BlackBoxStocks service, you will get access to options flow and dark pool data whenever you’d like.

You also get access to their discord!

BlackBoxStocks hosts educational seminars multiple times a weak so you can learn how to understand all this information better. I’m also a great person to reach out to and learn from!

They also send alerts directly to your phone for unusual options flow as it comes in LIVE!

Use this link below for 20% off your first month

http://staygreen.blackboxstocks.com/SHMs

Reply