- AllllSevens

- Posts

- AlllSevens Newsletter 5/01

AlllSevens Newsletter 5/01

Outlook for 5/01

@AlllSevens

Weekly Newsletter

Disclaimer

All of the data presented in this newsletter is for entertainment purposes only.

I am not encouraging you to make trades or investment decisions based on this information. My intentions are only to convey interesting options flow and my personal speculation on them.

Let’s dive in

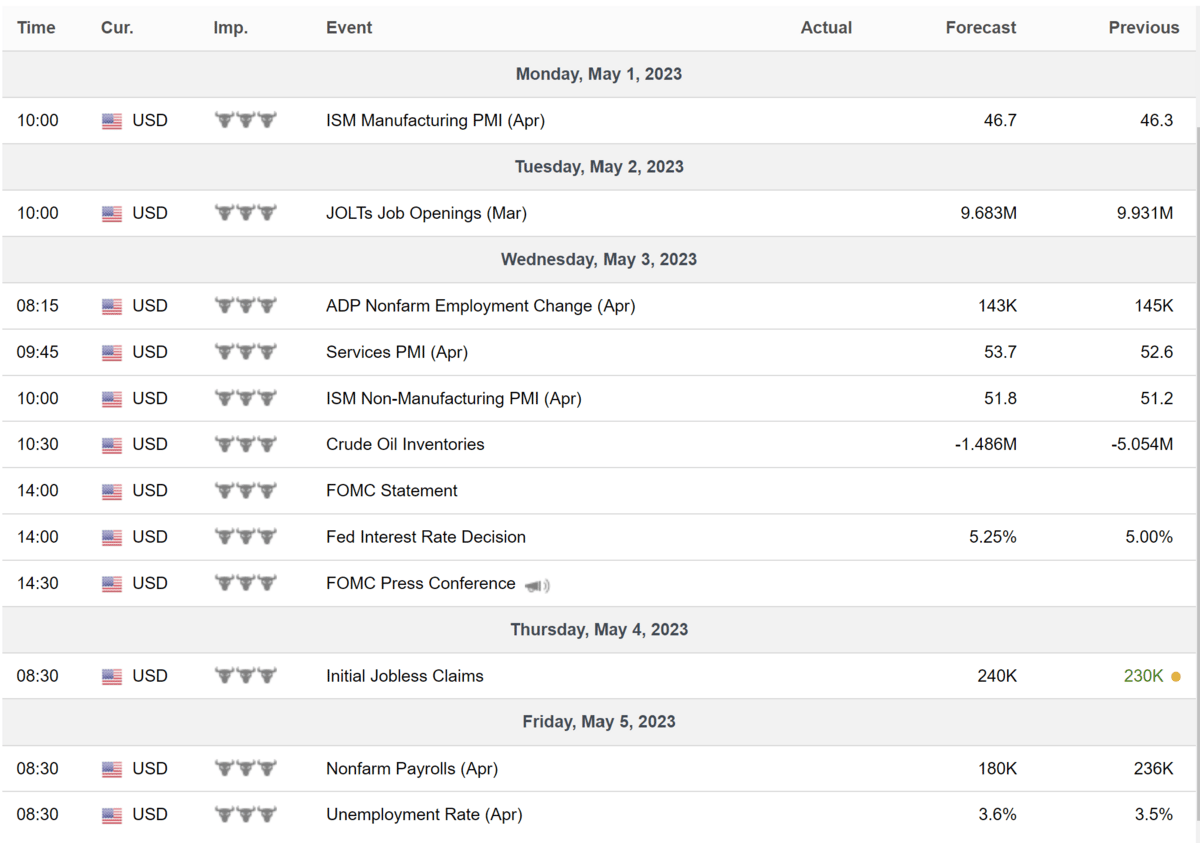

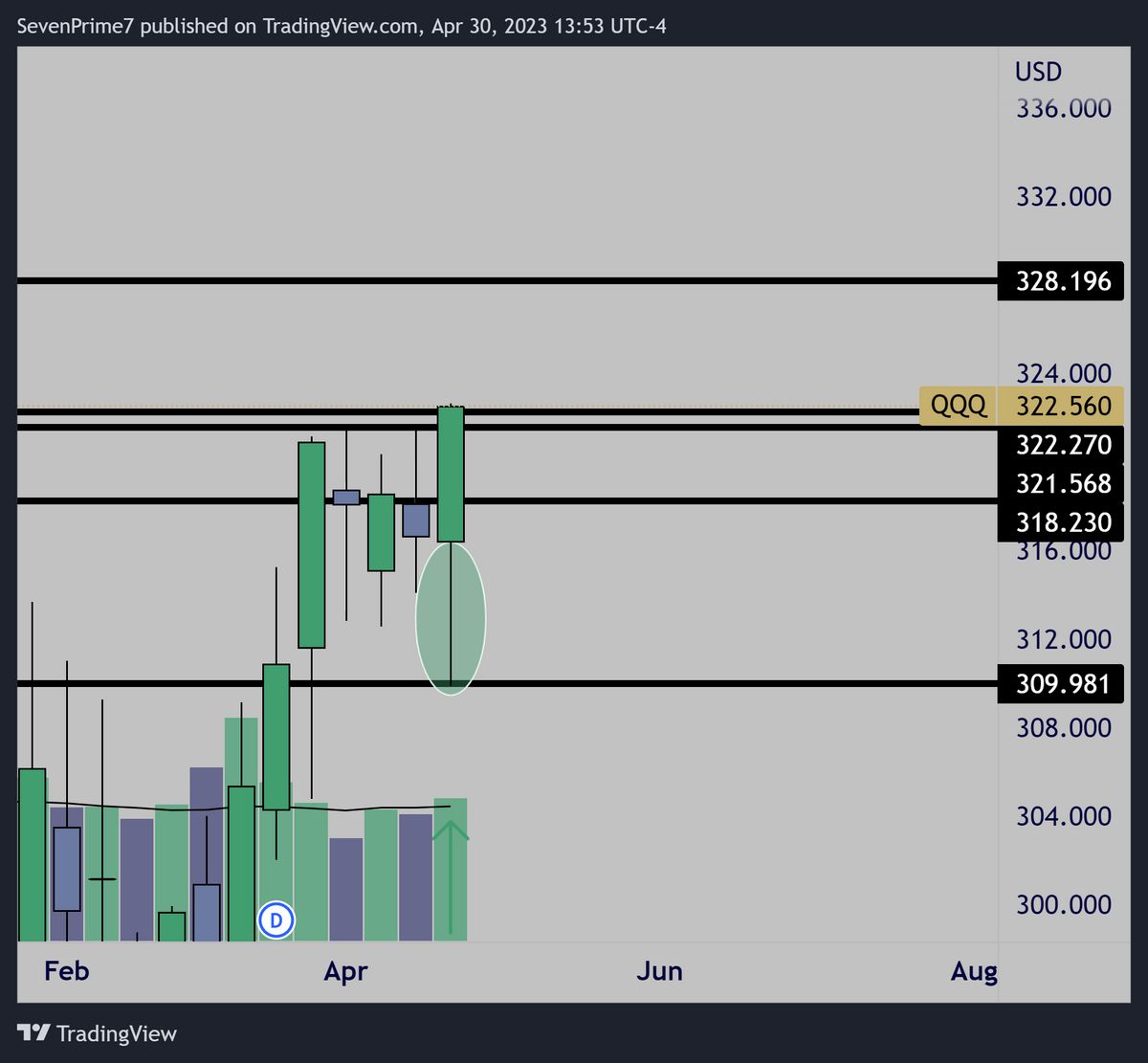

$SPY

Monthly

Monthly remains bullish. Room to $440 potentially as $390 holds.

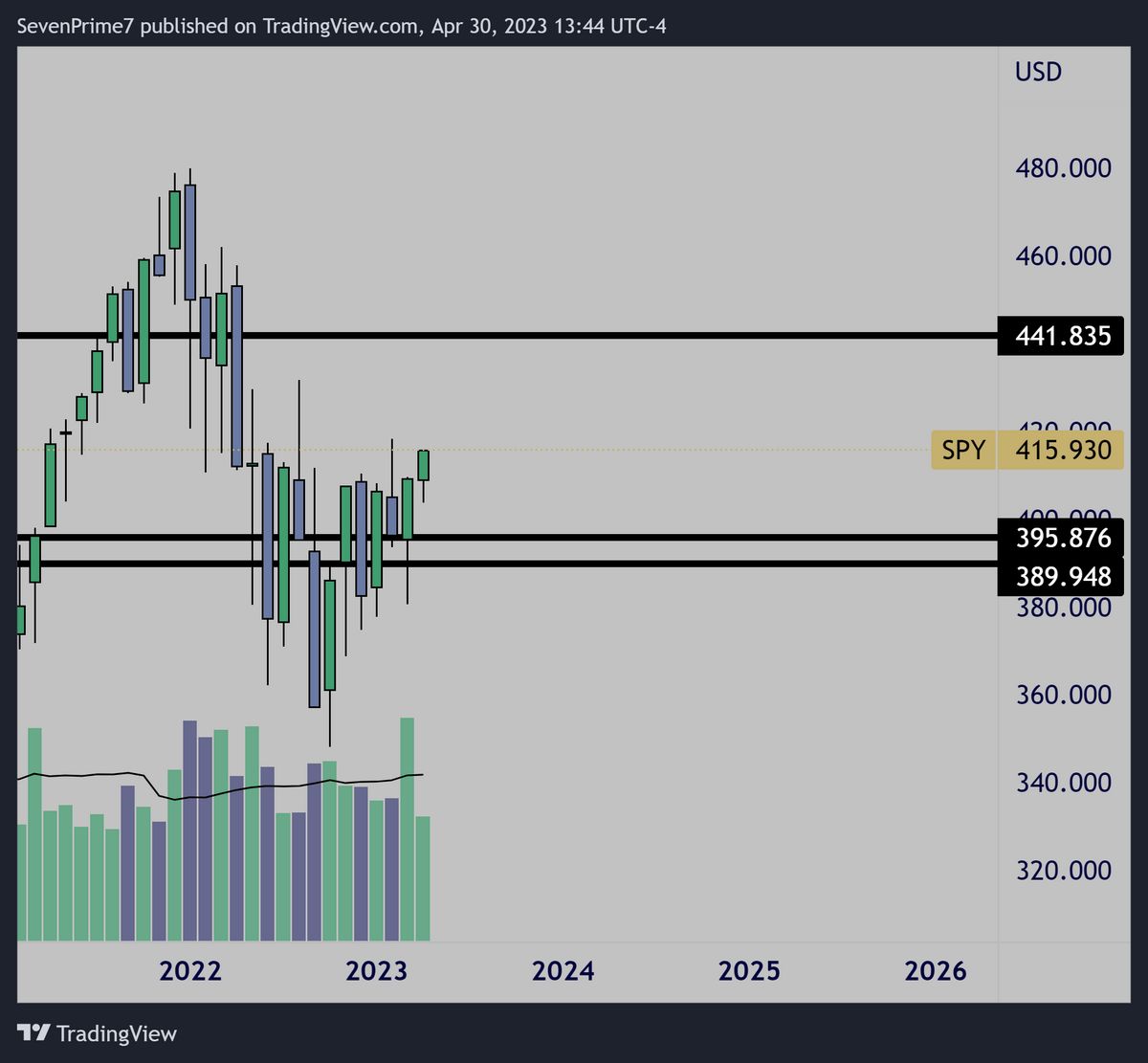

Weekly

Bears gave it a great shot mid week, bulls pulled it up with volume.

$416.70 should come quite easily next week.

I assume that it will get broke, and $420+ will be tested.

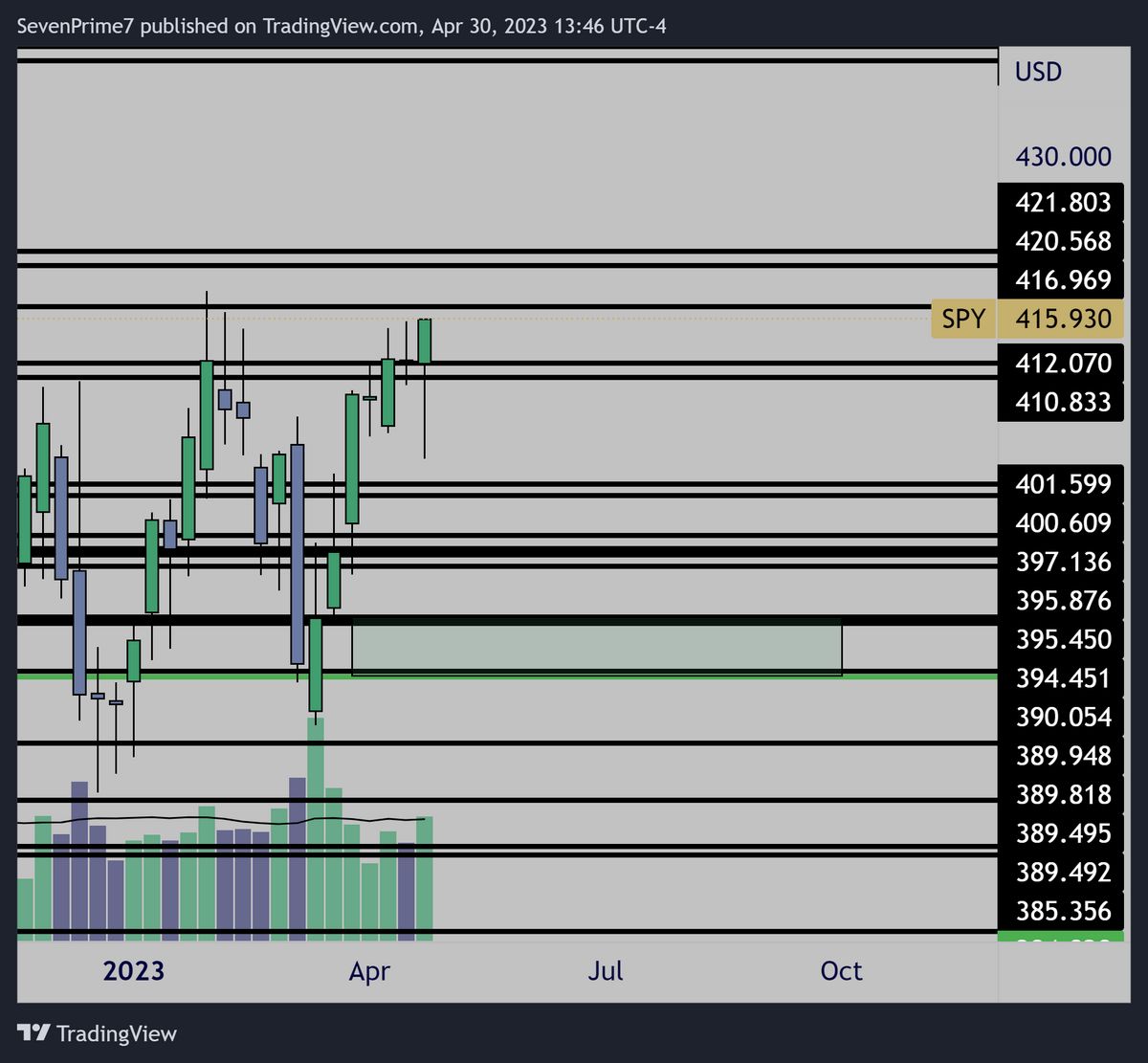

This is because the $QQQ is also breaking out. It has room to $428, which would but the $SPY around $420. See chart below.

Weekly

Once $SPY hit’s 420 and $QQQ 428, it will be time to reevaluate and see if we want WAY higher or if we reject.

OR of course, if structure breaks before this happens and 410.80 is lost.

Then, we’d be looking at a sharp drop.

There are 500 stocks inside the S&P. They’re organized into sectors and typically groups move together-

In AlllSevens+, I dive into each sector and speculate on what group of stocks could make a relatively strong or weak move. I also dive into which specific name could correlate the most. This can result in astonishingly strong moves.

Now, let’s look at my favorite stock picks this week using institutional supply & demand with VPA & flow confluence.

Starting with my

TOP PICK

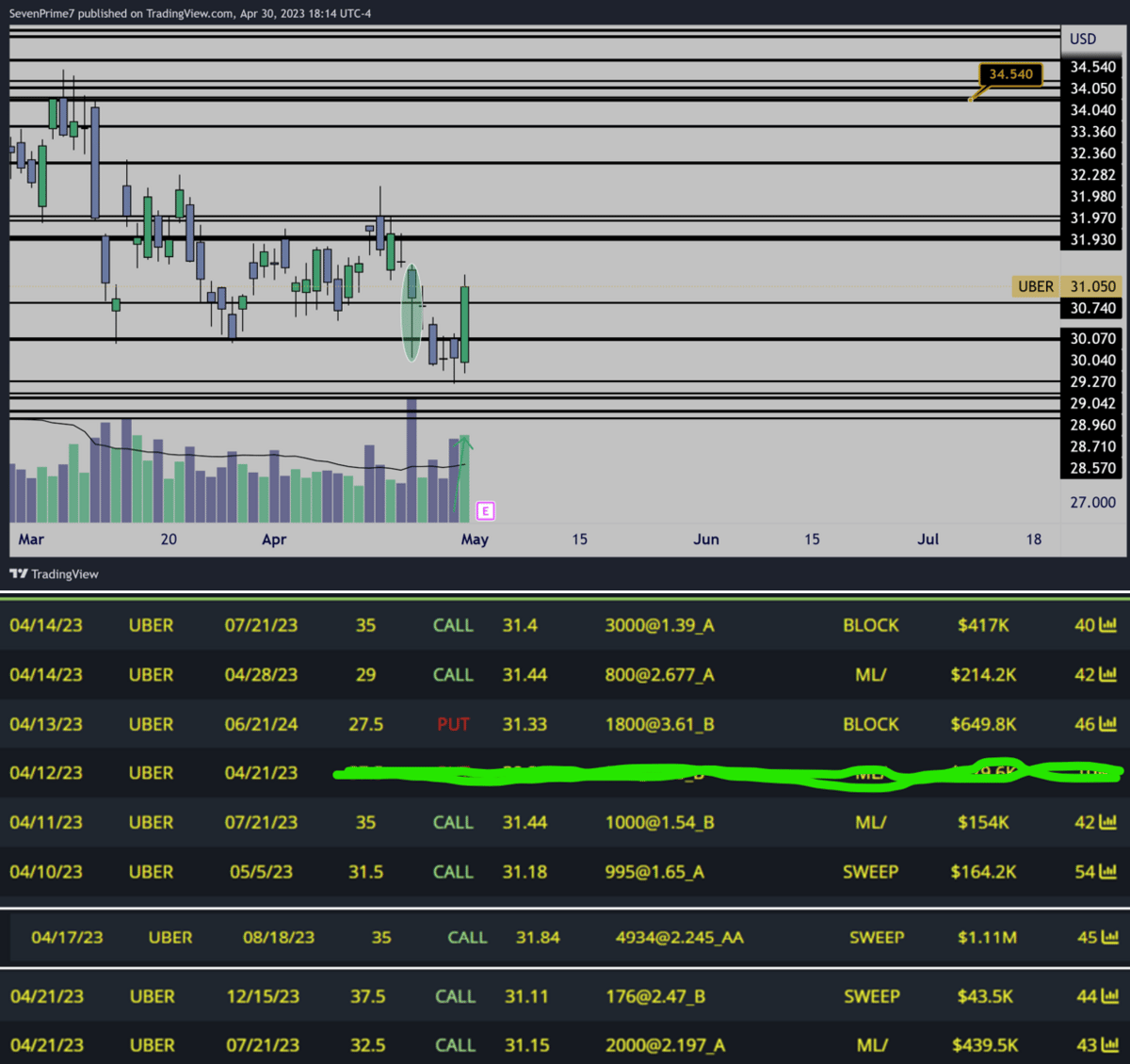

$UBER

Daily

Bullish

At the beginning of the week I was bullish because of Fridays candle (highlighted)

I never got a great GO signal until This Friday’s close…

Increasing & above average volume, reclaiming the demand that there was massive stopping volume at PLUS flow confluence.

This is my #1 watch this week for some upside continuation off this reversal.

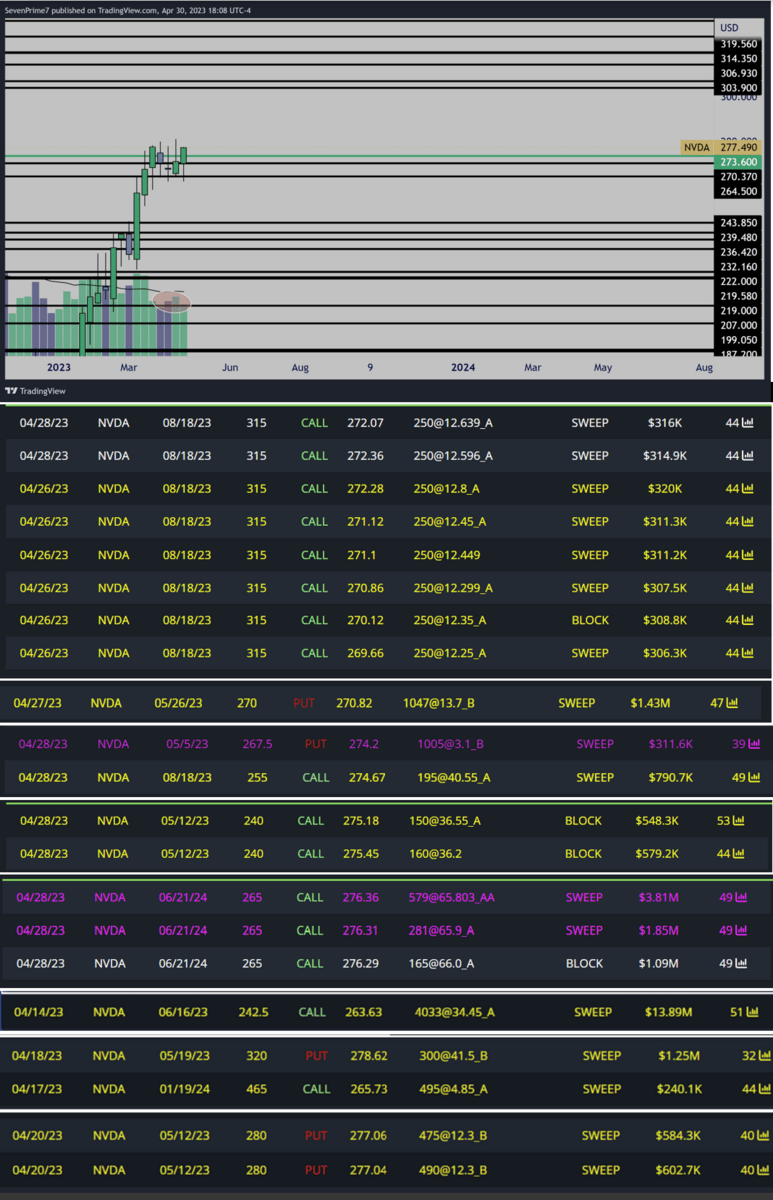

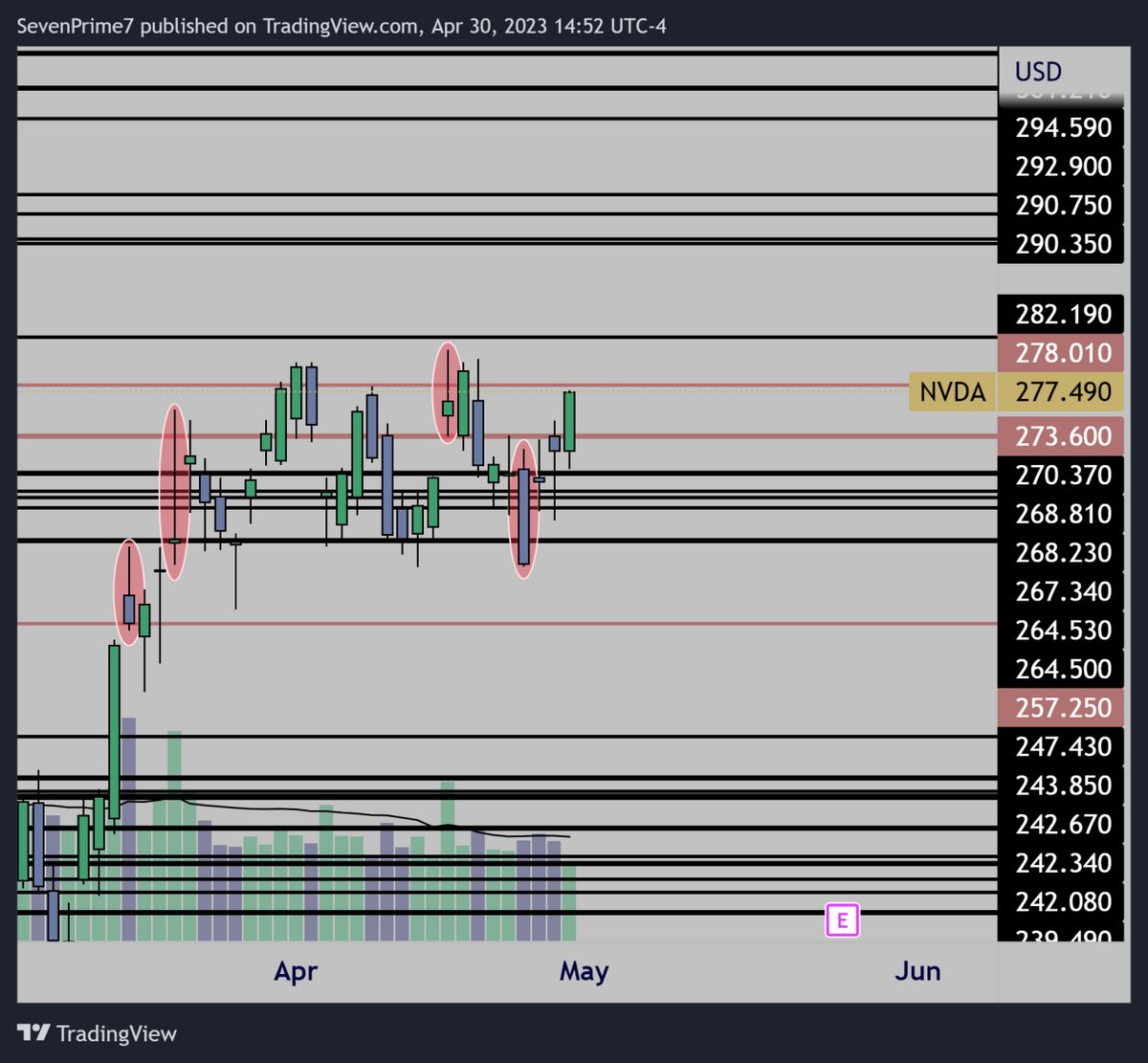

$NVDA

Weekly

Bullish-Bearish

Weekly breakout, very constructive for upside.

My only problem is the low volume, and on the lower time frame…

Daily

Signs of distribution.

I remain bullish the weekly, but if trend breaks, I know why and I am convicted to short this. I’d expect 257.25 to be lost and a highway to 247 after that.

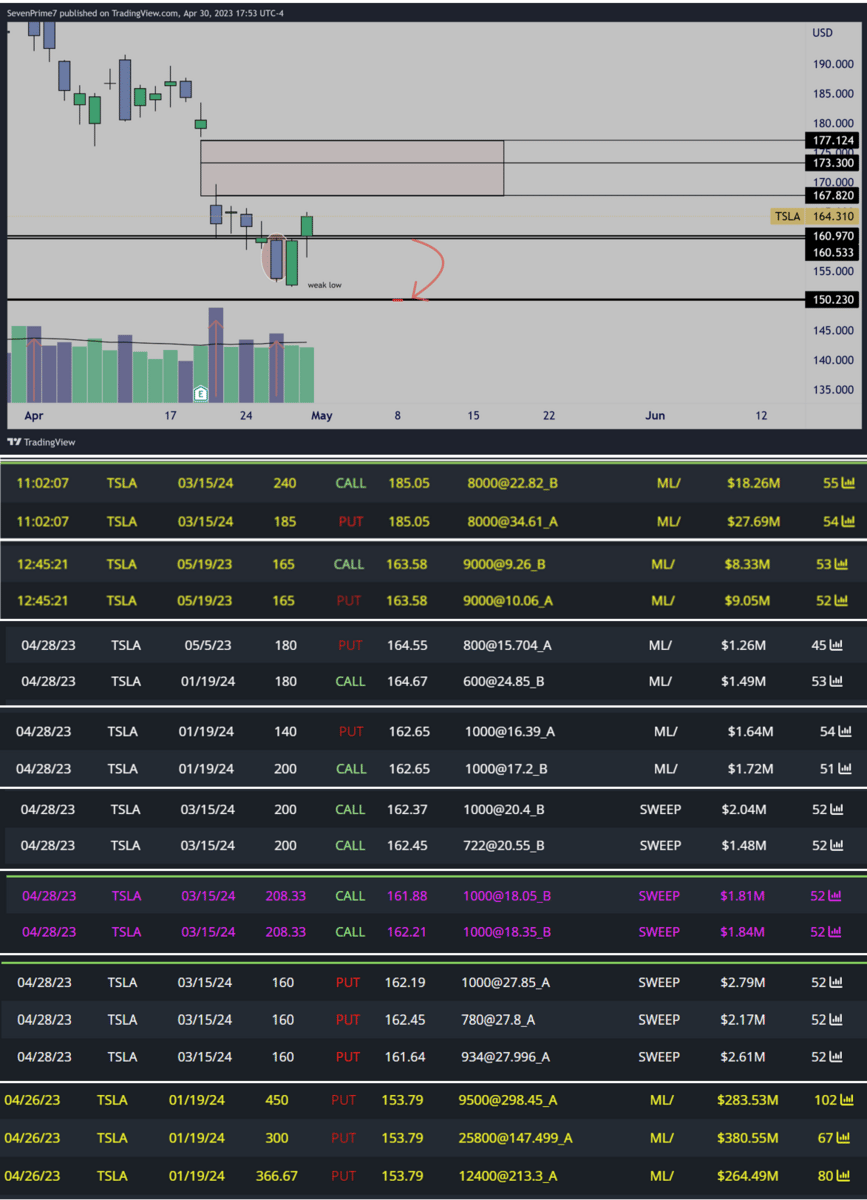

$TSLA

Daily

Bearish

150.23 will be tested, it’s just a matter of time-

As you can see, the flow has a lot of TIME on most of their position.

In the short term, $TSLA can go as high as 177 if 161 remains support.

I’m simply watching for a breakdown to play much shorter expirations OR a swing entry if this moves much much higher and I have $SPY bear confluence

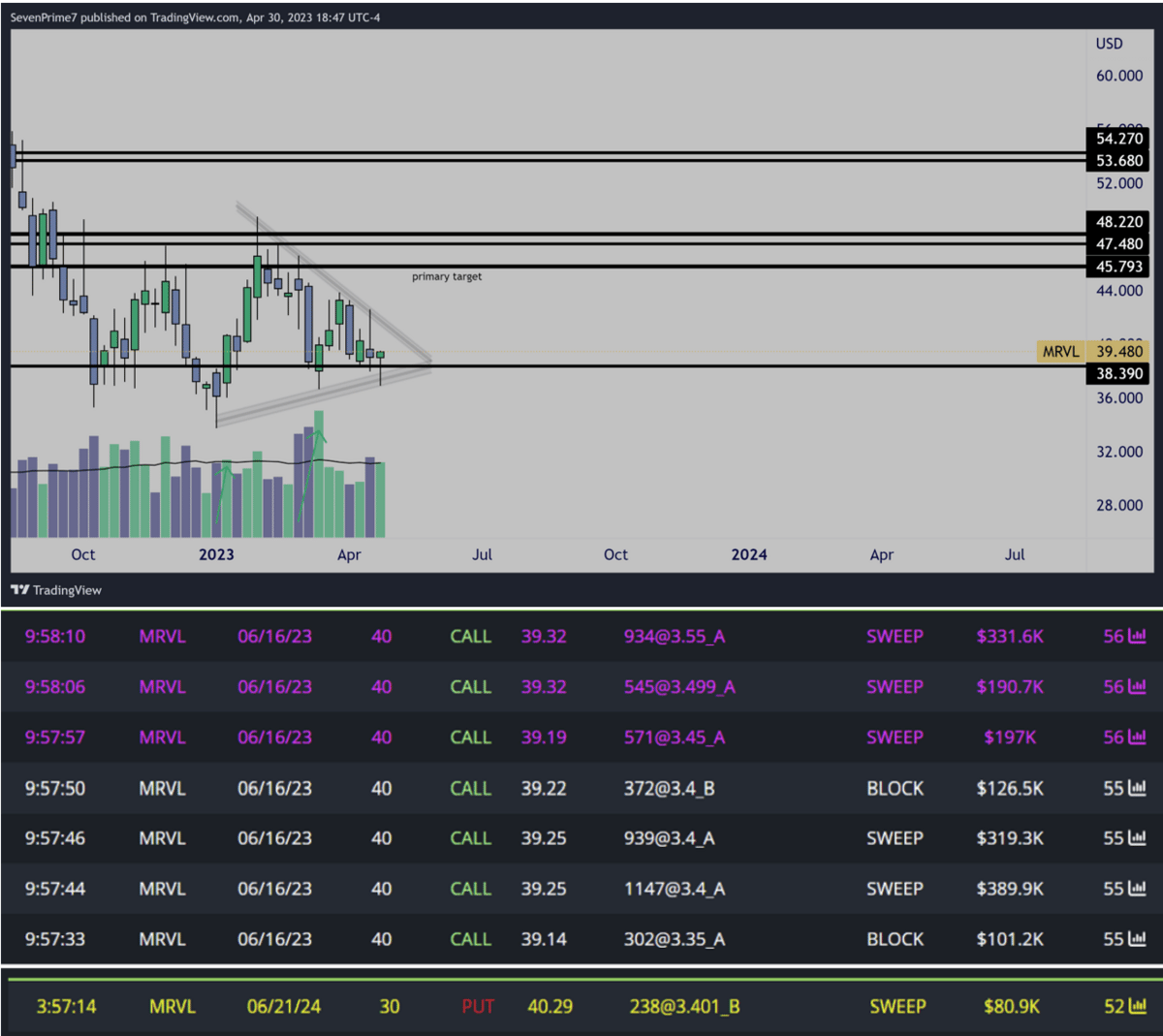

$MRVL

Weekly

Bullish

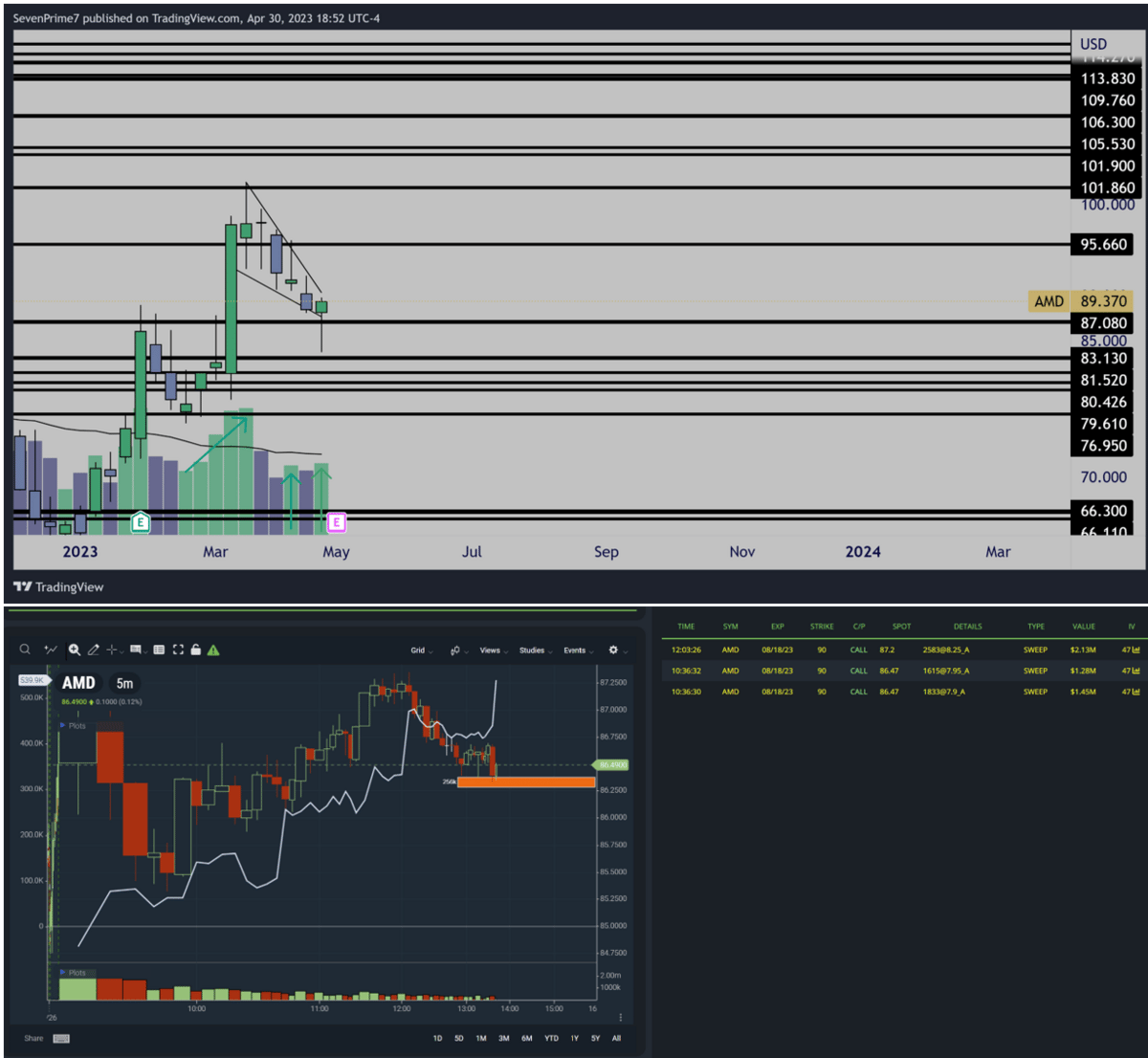

$AMD

Weekly

Monthly

Bullish

One of, if not the, best bull setup out there.

Inside monthly bar on low volume favors continuation.

Weekly is about to break a falling wedge.

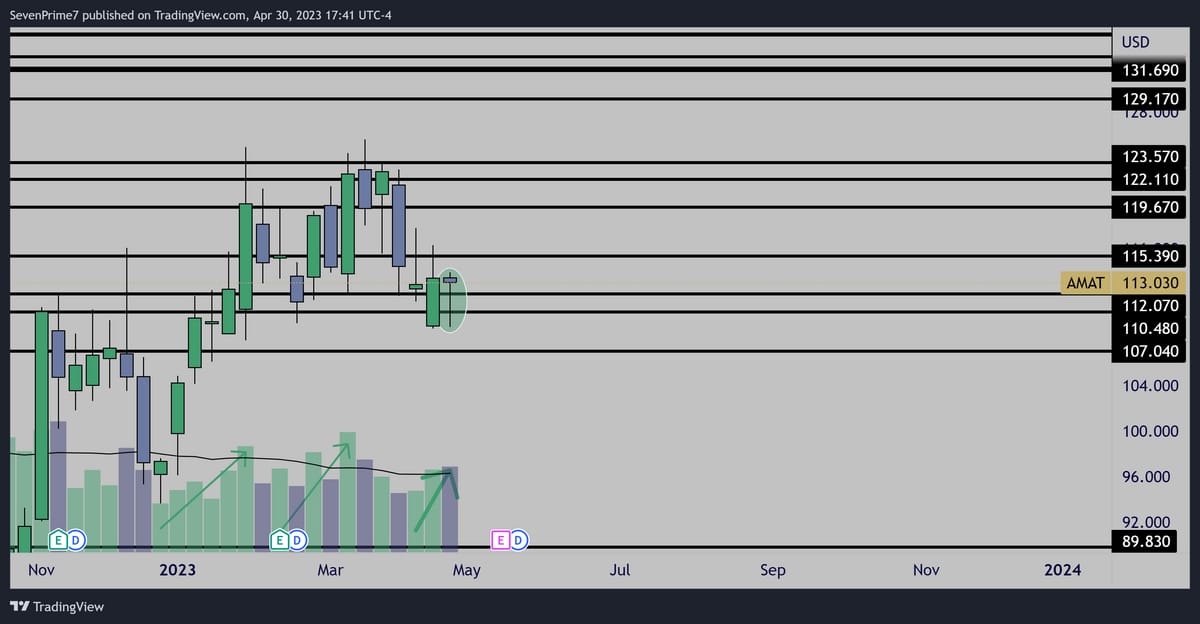

$AMAT

Weekly

Bullish

High volume inside bars favor reversals

A break over $115.39 sends this.

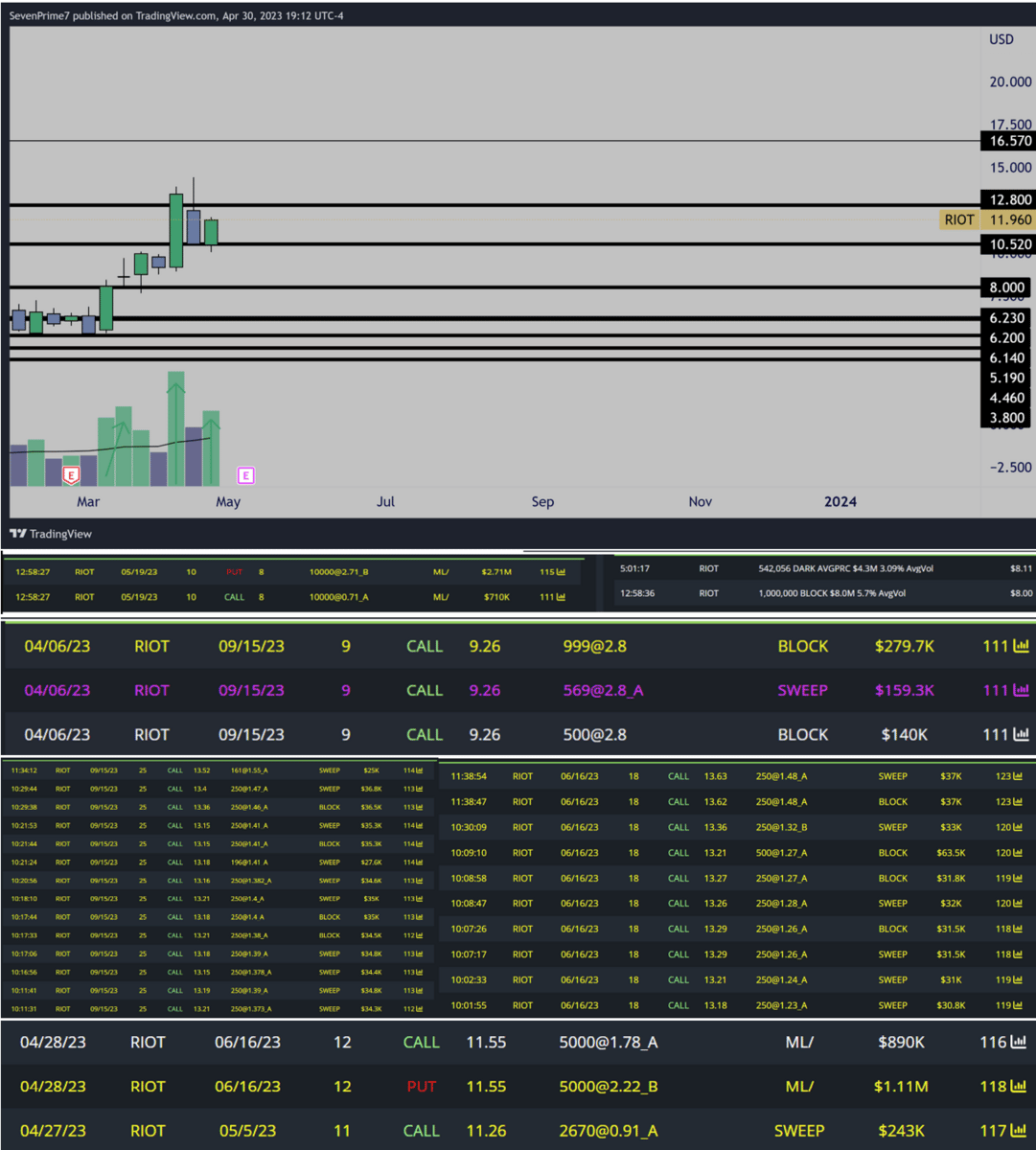

$RIOT

Weekly

Bullish

Very bullish weekly VPA

Very nice flow

Monthly is very bullish as we already know, been long $RIOT since $8.00 seeing $30+ as a possibility.

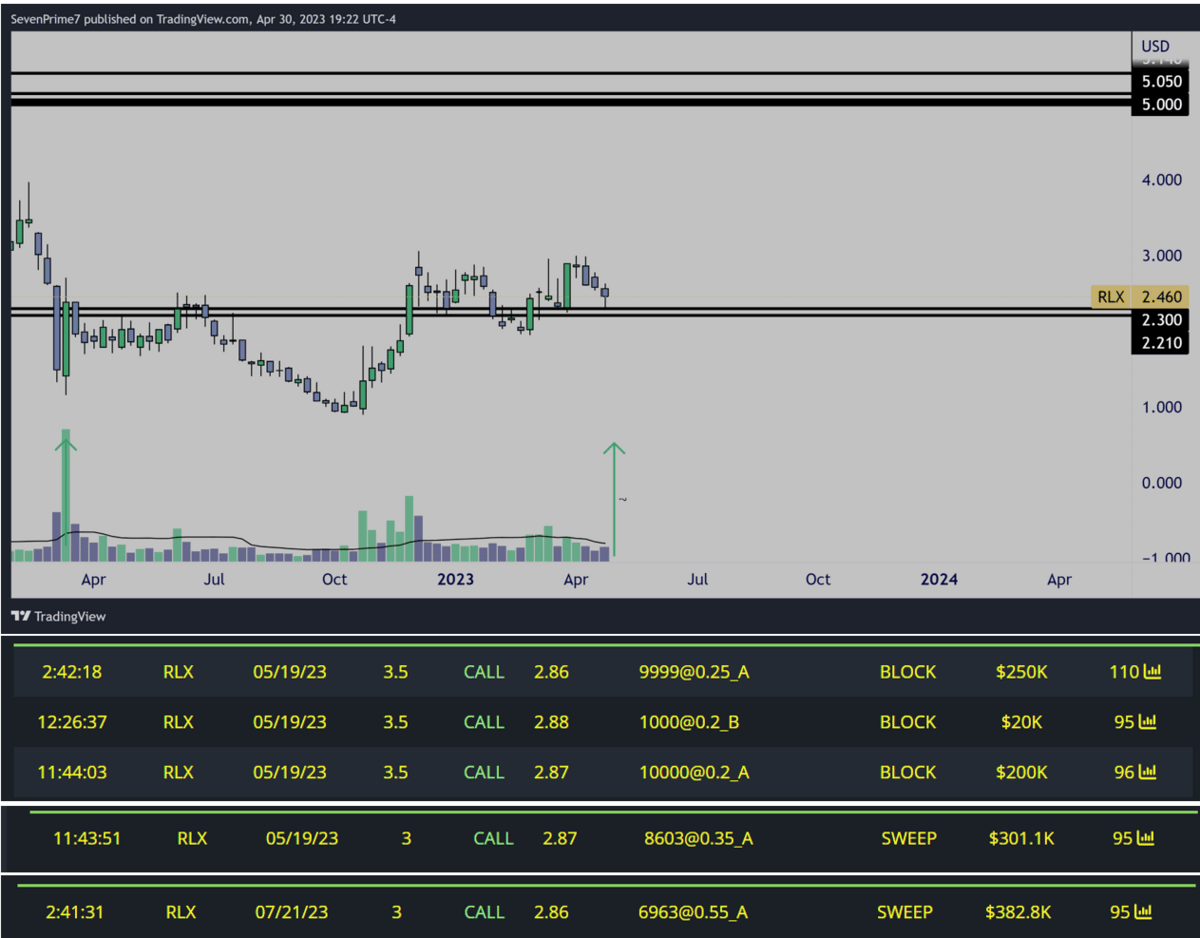

$RLX

Weekly

Bullish

If you want access to dark pools and options flow,

If you want access to this data for yourself in real-time,

Use this link below for 20% off your first month of BlackBoxStocks

http://staygreen.blackboxstocks.com/SHMs

Also get options flow alerts on your phone, discord access, educational seminar access, etc.

Reply