- AllllSevens

- Posts

- Bear Trap or Local Top? SPY Headed Into FOMC

Bear Trap or Local Top? SPY Headed Into FOMC

Weekly Newsletter 3/18/24

Disclaimer

I am not a legal professional.

The content shared in this newsletter is purely my personal opinion and for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

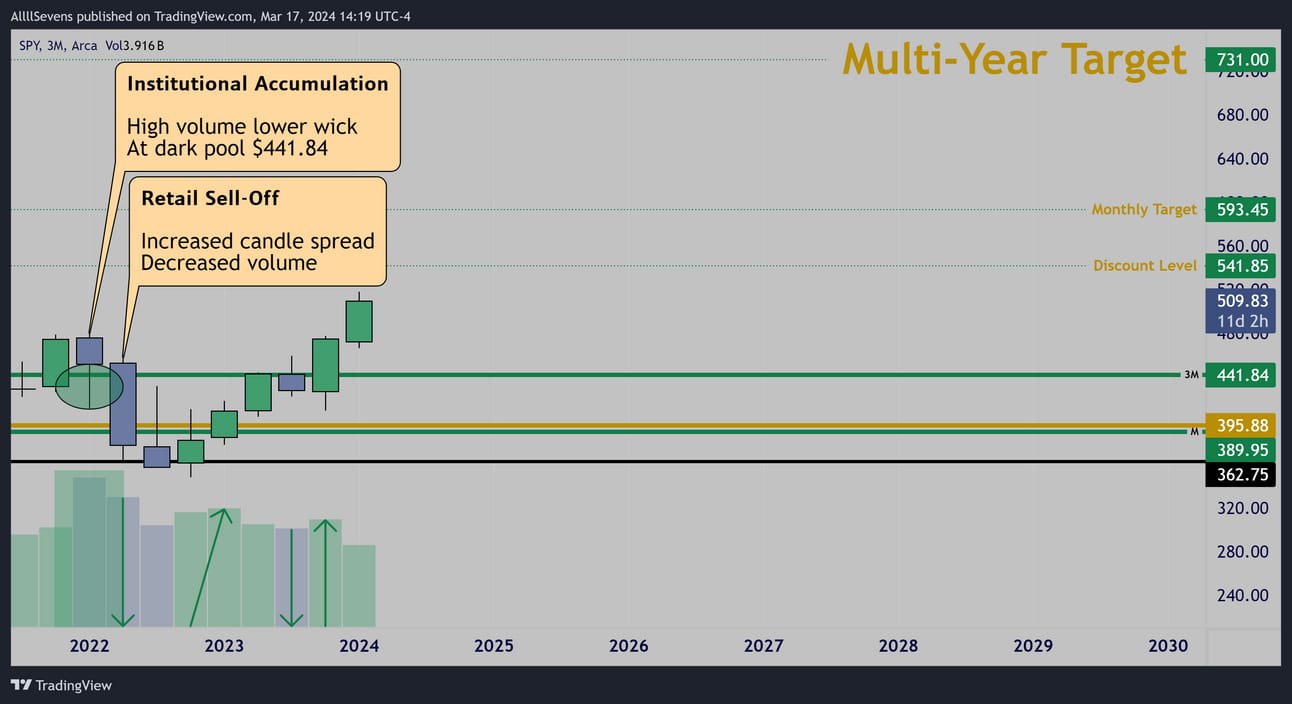

SPY

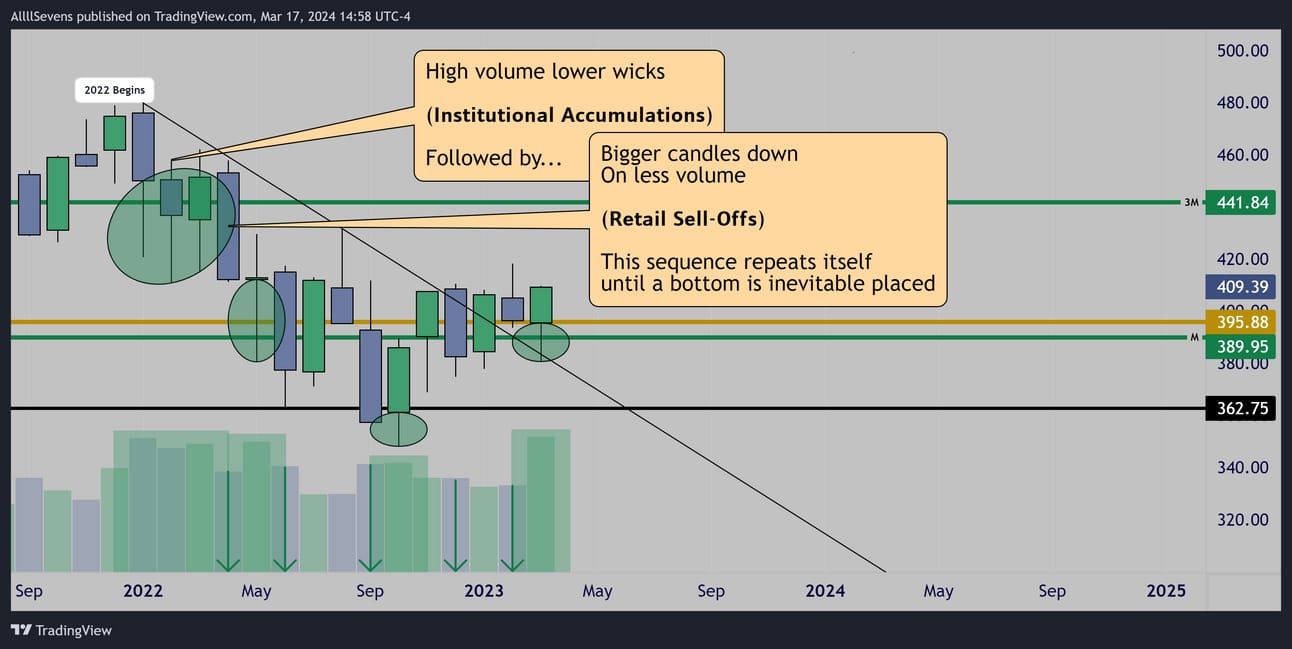

Monthly (Before)

Long-term Institutional Investors exploited the selling frenzy of 2022

Short-term focused retail participants were in a state of fear and uncertainty which allowed for long-term focused institutional participants to absorb all the shares they were selling.

When you analyze the relationship between price and volume, you see what’s happening “under the hood” of the market.

During the entire 2022 decent, high volume kept coming in on massive lower wick candles, notably at or near large dark pool levels.

This signified institutional accumulation taking place.

Following these accumulations were startling moves lower…

Huge candles… But, on drastically lower volume, further confirming the institutional accumulation taking place.

Key Take Away:

-Institutional Participants (high volume) precede price.

-Retail participants (low volume) control price in the short-term.

“The market can remain irrational longer than you can remain solvent”

-John Maynard Keynes

“Time in the market beats timing the market”

-Ken Fisher

Volume Price Analysis requires patience.

Short-term trading:

Sometimes, volume will blatantly scream which way price wants to go…

Like in January-March of 2022…

Then, it will go the opposite direction.

This doesn’t mean the volume is wrong. It just means it’s early.

This can become a struggle for many Volume Price Analysis traders because there IS certainty involved with VPA…

Institutions are either buying or they are selling. Volume doesn’t lie.

The win rate for VPA is extremely high.

In my experience, volume ALWAYS plays out.

BUT,

This gets mistaken as a certainty to where price wants to go short-term.

VPA traders develop an unrealistic confidence in short-term fluctuations which leads to oversizing, not using a stop loss, and many more unprofitable habits. With a high win rate, this typically leads to a fierce “boom & bust” cycle.

Winning trade after winning trade, and then one loss comes…

And you you didn’t have risk accounted for. Bust.

With great power (VPA),

Comes great responsibility(Patience, Flexibility, & Risk Management)

Moving on now.

If institutions spent all of 2022 accumulating the SPY,

I have two questions that immediately come to mind:

#1

Is it too late to buy?

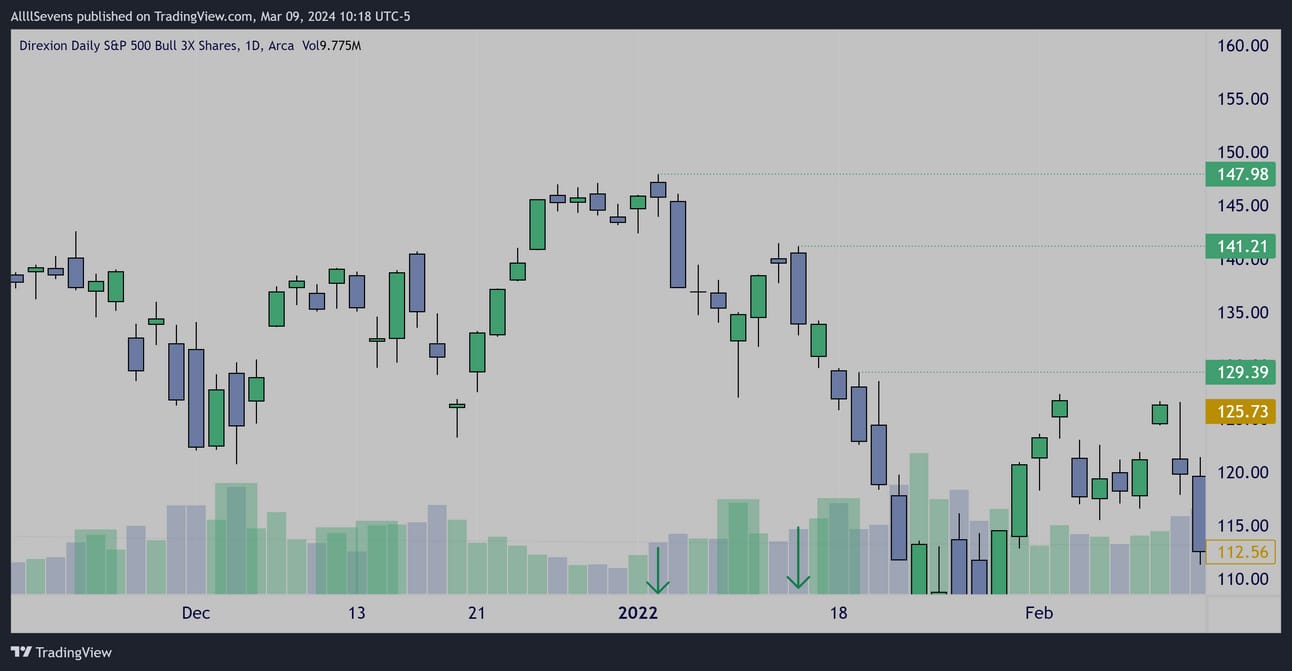

Daily

This is the $SPXL - 3x Leveraged SPY

Back in late 2021-2022 this was being accumulated.

It topped out on increased candle spreads with decreased volume.

Classic retail sell-offs tat create imbalances between price and volume.

$141.21 & $147.98 are the imbalances.

These prices are likely to be rebalanced in the future. Volume doesn’t lie.

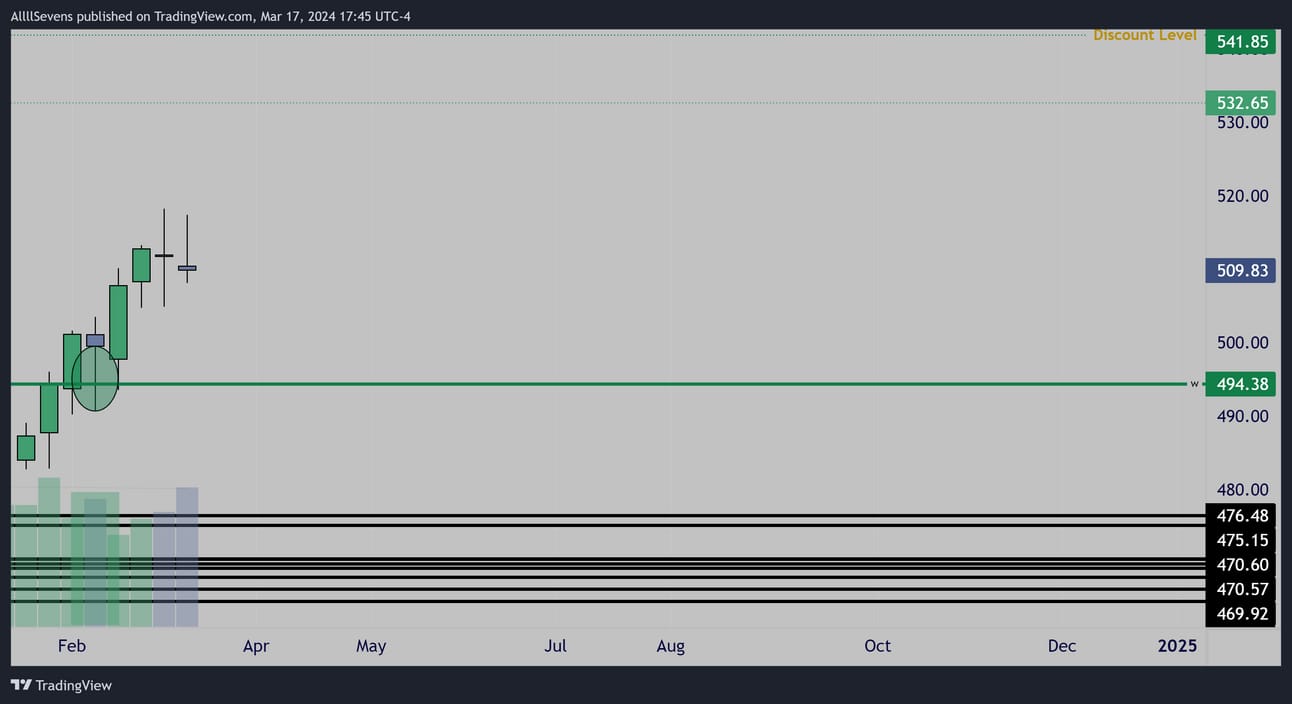

This lines up with SPY $532.65 & $541.85

Therefore, any price below $541.85 I consider to be a long-term discount. So, in conclusion, no, I don’t think it’s too late to buy SPY

However, I know irrational retail participants control price in the short-term, and I absolutely do not want to buy large amounts of shares here being so extended from major supports.

I’d like to exercise patience for any major contributions.

I don’t want to stay completely out of the market because of this.

For all I know, there could be no pullback for a long time.

I think that’s unlikely, but for this reason, I still want to make small contributions on a regular basis. Remember, time in the market beats timing the market.

Eventually, retail participants will get scared & uncertain again, pulling price lower and allowing for institutions to make large contributions visible on the monthly volumes, and that’s when I will also consider also making large contributions. Until then, absolutely no large contributions will be made up here, no matter how bad I want to.

There are many individual stocks and even sectors in the SPY that are much more attractive for sizable contributions.

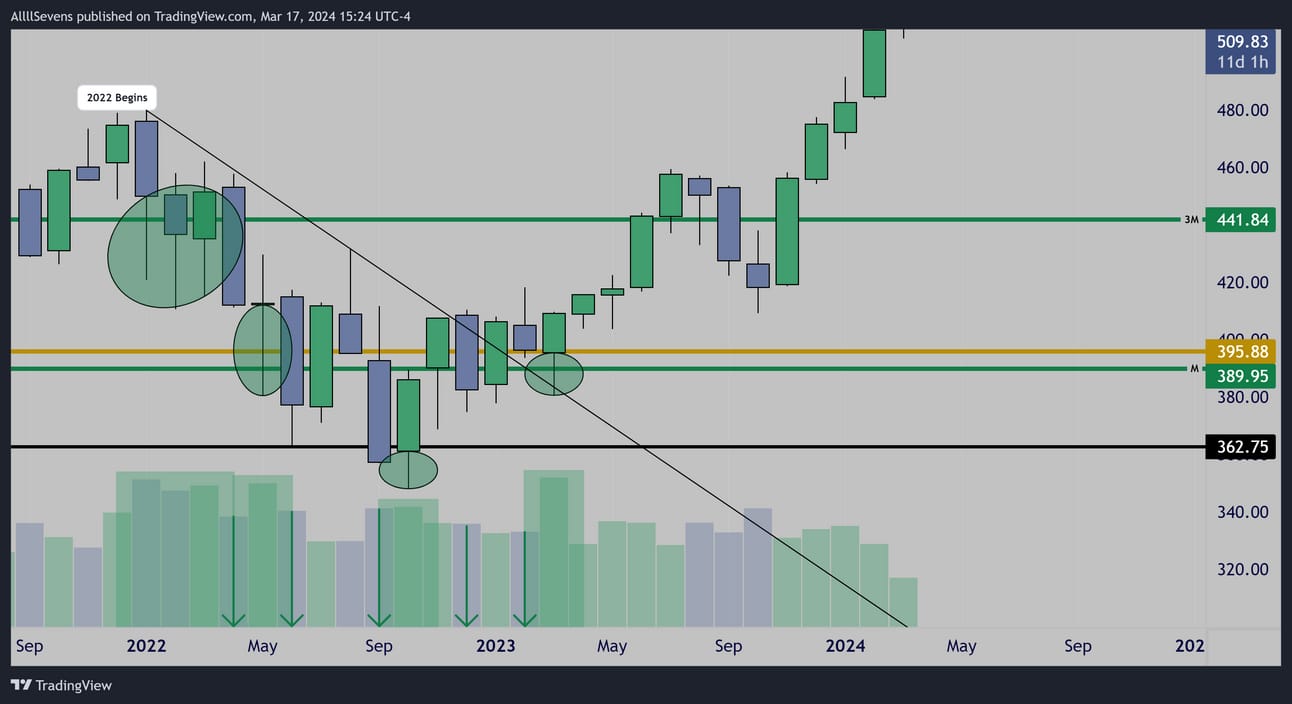

#2

How high can this go?

Quarterly (3 Month)

I project price will eventually reach $731.00 as a result of the accumulation we’ve seen over the last two years.

Right now, $441.84 is the nearest level of MAJOR support, if a monthly pullback were to occur, this is the main level I’ll be watching for buyers to appear at.

Let’s drop down to the lower time frames and identify a short-term edge since sizable long-term buys aren’t really the focus up here.

Weekly

The weekly time frame is also extended from any notable Dark Pools. $494.38 is the nearest support and with no distribution visible here, only high volume price compression, I expect any retests of this level below to be defended on the weekly time frame.

I obviously can’t be aggressively bullish here being away from support.

Naturally, I must be bearish then… right?

Unfortunately, that’s not how the market works.

In fact, I believe it preys on people who think that way.

This is a moment where everyone is ready to knee jerk trying to be a part of the the next move.

This type of environment w will likely lead to them being shook out and not even catch it. Coincidence this is the setup headed into a high impact news event like FOMC?

The best part about my methodology is it’s data driven.

Here’s the data:

There are no notable dark pools here.

There’s no institutional level to structure a quality trade from.

I can’t confidently say that we don’t retest support from here & I can’t confidently say that we do.

The reality is, the market is always moving, and just because a move will occur doesn’t mean there will be a quality setup leading up to it.

Of course, this is MY methodology. There is no right or wrong way for anyone to trade or view the market, but for me, there is.

I stick to what I know.

Daily

I see two signs of accumulation here, but being below the $512.97 support, it’s not immediately actionable.

Price needs over that level for me to go long.

Otherwise, this is a risk-off environment similar to the weekly chart and I would LOVE to see us breakdown further to retest support and see strong buyers.

Can’t go short though because there’s no signs of distribution.

This is why I’m risk off. Mixed signals. No edge = risk-off.

Unusual Options Flow

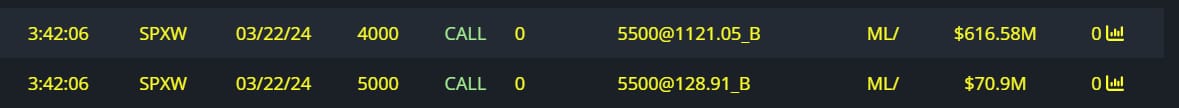

$680M+ Weekly Call Writing

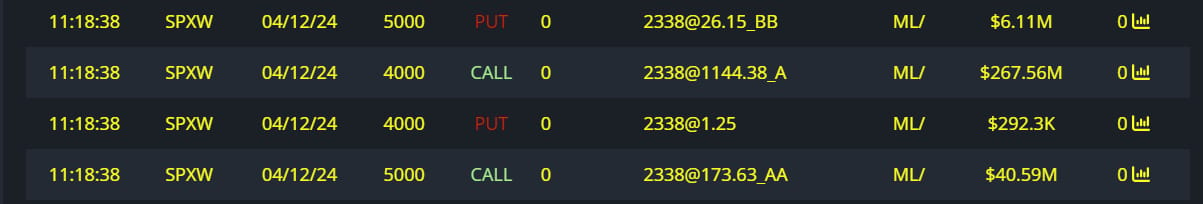

$300M+ Monthly Call Buying & Put Writing

Institutions are collecting a TON of call premium expiring next week.

This makes sense because while I see accumulations on the Daily chart,

It’s not safe to go long below $512.97

They know this. These whales are betting on sideways action or a potential drop to support below next week.

At the same time, they are positioned bullish into April 12th which also makes sense, since with all these bullish volumes, it’s unlikely that a downside move will be sustainable. As of right now, it’s likely that buyers maintain control of the weekly bullish trend over $494.38

This is something I’ll be watching for if we dip this week.

I’m overall bullish, but ready for potential blood this week.

Conclusion

Last week, key supports for strong bullish momentum on SPY ($412.97), QQQ ($435.24), and the IWM ($203.44) were unexpectedly lost, forming some ugly weekly candles.

I find them extremely unconvincing as firm tops considering no distribution has occurred prior to these candles AND they’re front-running a very high impact news event (FOMC).

BUT, losing those levels is not something that can just be ignored.

Unless $512.97 can be reclaimed on the Daily time frame, I am risk off and will let price roll lower if it wants.

However, I won’t be looking to trade the downside because there are it won’t be sustainable. It’s not backed by any distribution.

All I see are institutional buyers.

It was just retail participants who could not hold support into last week’s close. Are they being bear trapped?

Or is the trend actually going to shift?

I don’t think that’s a call that can be made pre-FOMC

This is why I will share my detailed updates QQQ and IWM charts later.

Overall, I think many people positioning themselves in this environment before FOMC will regret it.

Patience will pay & an A+ edge will develop sooner or later.

I’ll have capital ready since I didn’t speculate in an overly uncertain environment like the one we have now.

AllllSevens+

I mentioned earlier that there are many indivudal stocks I find much more attractive for sizable long-term contributions.

I typically only write about individual stocks for paid subscribers.

If you want more research like above, but on individual stocks, upgrade your your subscription for $7.77 per month.

Also get discord access where I can post WAY more than I can on twitter updating all the stocks I talk about on a consistent basis with any unusual flows, accumulations, and short-term A+ VPA patterns.

https://allllsevensnewsletter.beehiiv.com/upgrade

Reply