- AllllSevens

- Posts

- Cleveland-Cliffs Inc

Cleveland-Cliffs Inc

America's Last Independent Steel Play

Disclaimer

This is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor. This newsletter represents my personal opinions and commentary for informational purposes only.

Please do your own research.

The narrative:

After U.S. Steel (Ticker: $X ) was bought out by the Japanese company Nippon Steel in 2025, it leaves $CLF as America's last major independent steel company.

CLF strongly benefits from U.S. tariffs of up to 50% on many imported steel products because it makes foreign steel far more expensive and supports strong pricing power in the American market. This positions them to capitalize on any long-term resurgence in U.S. manufacturing and infrastructure demand as the go-to supplier of homegrown steel.

That’s the “story” behind this stock, which supports, to me, an even more compelling story being told by price and volume… Let’s dive in!

Please make sure to show some love to this article on my twitter page if you found value! +Subscribe for more!

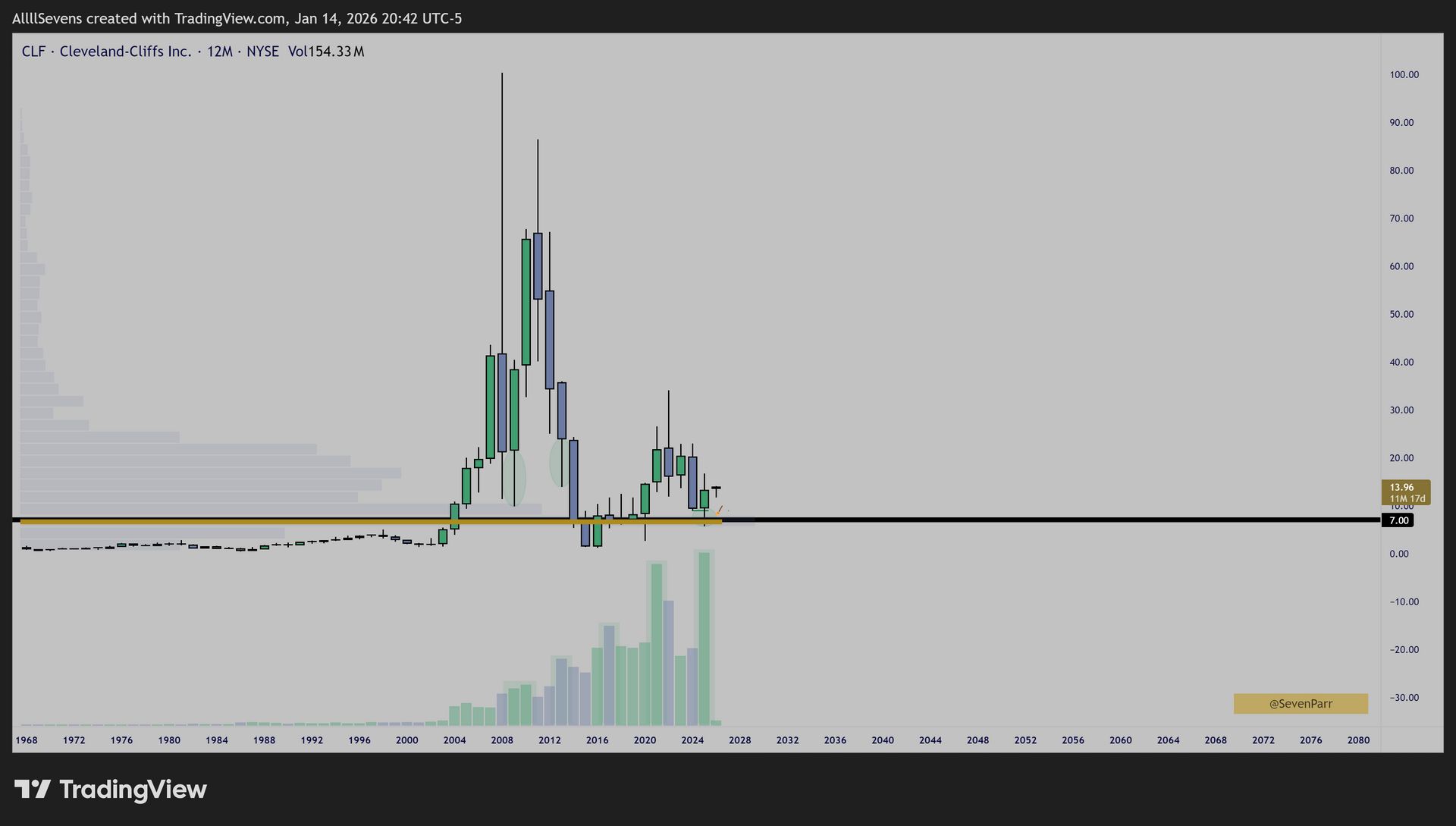

$CLF - Cleveland-Cliffs Inc

Yearly Candles

$7 is the largest support on record for CLF ever since it’s 1968 IPO

Last year, it was defended on it’s largest buy volume ever

Quarterly Candles

Coming off the yearly buy volume, price now faces a downtrend resistance, which if broke, opens the door for very large upside potential considering the volume and price patterns I’ve also highlighted.

You see, last year isn’t the first large buy volume that has occured on this stock.

It really began in 2021 and 2022 fro $15-$20 before the massive sell-off…

On decreased volume.

The drop in volume as price collapsed from $30 and back through $15-$20 shows that the prior HIGH buy volumes (long-term institutional participants) did not participate in this LOW volume sell-off.

Short-term traders dumped the stock.

Now, Institutional buyers are finally back and being on the highest volume ever, there’s a good chance that all the retail sellers are now completely exhausted.

More on this in a moment.

If this downtrend breaks, the stock shifts into 2nd gear.

An eventually reclaim of the previously accumulated area from $15-$20 sends this into 3rd gear.

Daily Candles

The latest earnings report sparked arguable one of the most euphoric buying sprees the stock has ever seen… Surging +36% in just a month on massive buy volumes. It just doesn’t feel like it because the stock is still -80% from it’s ATH and written off by many investors- but mostly, traders.

So much so, that it immediately declined nearly -40% over the next month.

On extremely abnormal low volume of course…

But shown by the yearly candle, price was able to recover into the new year.

Traders got bullish again, and then boom! -16% crash below support and VWAP.

Only to reclaim very quickly!

And that’s why I am mentioning this NOW.

After putting in a historic yearly candle, I think the recent volatility on the daily chart, shaking traders in and out has created the perfect environment for this stock to begin a sustainable rally.

I’m long shares as well as January 2027 22 call options, risking the recent low of the failed breakdown. If price breaks down again and takes out that low, I will be managing risk on this trade, waiting for a possible re-entry.

I’ll be sure to share any updates on X!

Follow me: https://x.com/SevenParr

I also have Discord where I share analysis like this on countless other stocks on a near daily basis. There is truly so much alpha in here and it costs just $7.77

Join Here

Reply