- AllllSevens

- Posts

- Freshpet Stock

Freshpet Stock

Institutional volume patterns and compelling consumer trends.

Disclaimer

This is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor. This newsletter represents my personal opinions and commentary for informational purposes only.

Please do your own research.

The narrative:

Studies show that Gen Z and Millennials are having fewer kids. They’re having pets instead and they’re treating them like kids.

There’s also this trend of ditching junk foods for clean, unprocessed foods…

The pet food industry is a $56B+ market in the US alone. But the market for unprocessed pet food—made up of human-grade meats, veggies, and fruits (fresh, refrigerated stuff)—is only about $1-2B right now…

To me, it’s logical to assume this “healthy” pet food is going to begin capturing much more market share over the coming years with these trends intact—and there’s this one company with a MASSIVE head start.

FRPT currently controls over 90% of this branded fresh/frozen pet food market, making them the clear number one player and the biggest potential winner as the segment grows.

You may have seen their fridge units in the dog food aisle before. Filled with Freshpet. Nothing else. No other brands. This is their competitive edge because it’s expensive for rivals to copy them—Freshpet has locked in prime shelf space with over 38,000 branded fridges in about 29,000 stores like Walmart, Costco, and Petco.

98% of Freshpet's current revenue comes from the US, leaving tons of room for long-term expansion globally (they're just starting to test Canada and Europe).

Their e-commerce sales are booming, up 45% in the last quarter. That’s insane growth.

The company's fundamentals are currently attempting to turn a corner after years of spending cash, expanding throughout the US, optimizing their online sales, and overall proving their business model. It is finally free cash flow positive.

But let's see how this whole story lines up with the chart, because that’s where the real conviction lies for me. “The narrative” is just a story to explain price. Volume truly explains what’s happening here, and that’s what we’re going to dive into next.

$FRPT - Freshpet inc

Daily

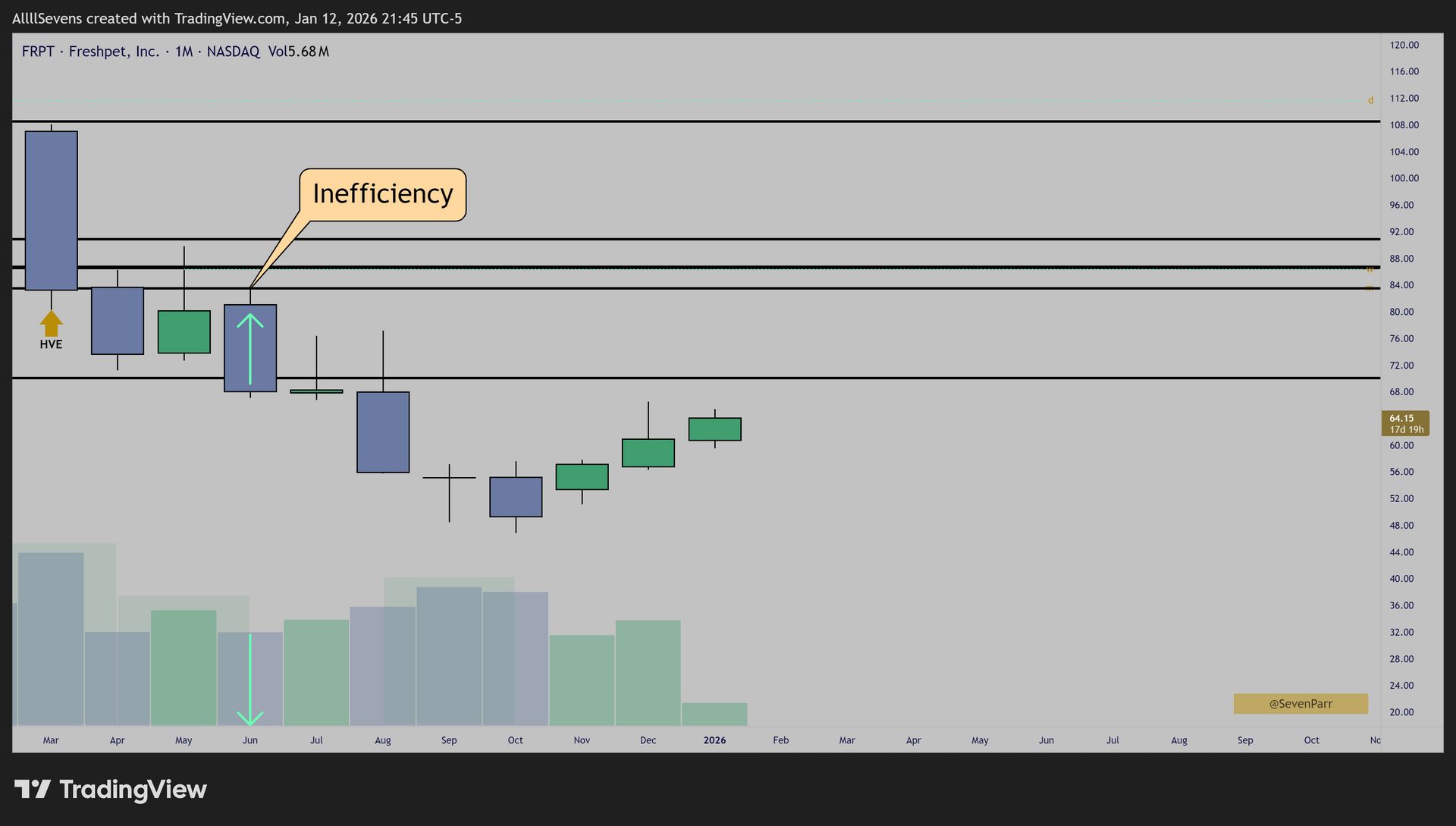

Within a massive multi-month downtrend, this stock’s largest buy volume EVER came in around the $80 mark back in March of 2025, clearly marking a major institutional investment campaign beginning.

Monthly

After that, price continued to decline within its downtrend but traded tightly before breaking down in June on significantly decreased volume. That is called an inefficiency. The institutional buyer from March clearly did not cut their position during this decline, or the volume would have increased.

Over the coming months, volume began to increase and candle size shrunk, showing continued accumulation taking place…

In fact, the stock's largest volume ever just came in, forming a hammer and defending the same $50 support zone as it did in 2022…

The $70 mark is where true confirmation of a bullish reversal occurs (AVWAP).

Conclusion:

Overall, this stock is in a major decline—down 65% from ATHs and lagging the S&P 500 by a longshot—so I want to be conservative here. It has a compelling story, and the chart shows signs that support it, but some further confirmation would be great to see. Knowing the $80 zone is where accumulation here first began and that $70 marks a long-term bullish trend (AVWAP), I expect that IF this 6-month reversal pattern works, it will strengthen through those areas. I don’t expect this to happen overnight. I think it will be a multi-quarter process, and I’m going to need to see the narrative continue to support this price action. I’ll be sure to share any updates on X!

Follow me: https://x.com/SevenParr

I also have Discord where I share analysis like this on countless other stocks on a near daily basis. There is truly so much alpha in here and it costs just $7.77

Join Here

Reply