- AllllSevens

- Posts

- From Broken to Must-Own: XYZ’s S&P 500 Turnaround

From Broken to Must-Own: XYZ’s S&P 500 Turnaround

A Deep-Dive into Volume, Dark Pool Activity, and Why / How Smart Money Is Positioned for an Outsized Long-Term Recovery on $XYZ

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of July 20th, 2025. I am not liable for any losses incurred by others.

I collect all my dark pool and options flow data through BlackBoxStocks:

http://staygreen.blackboxstocks.com/SHQo

XYZ

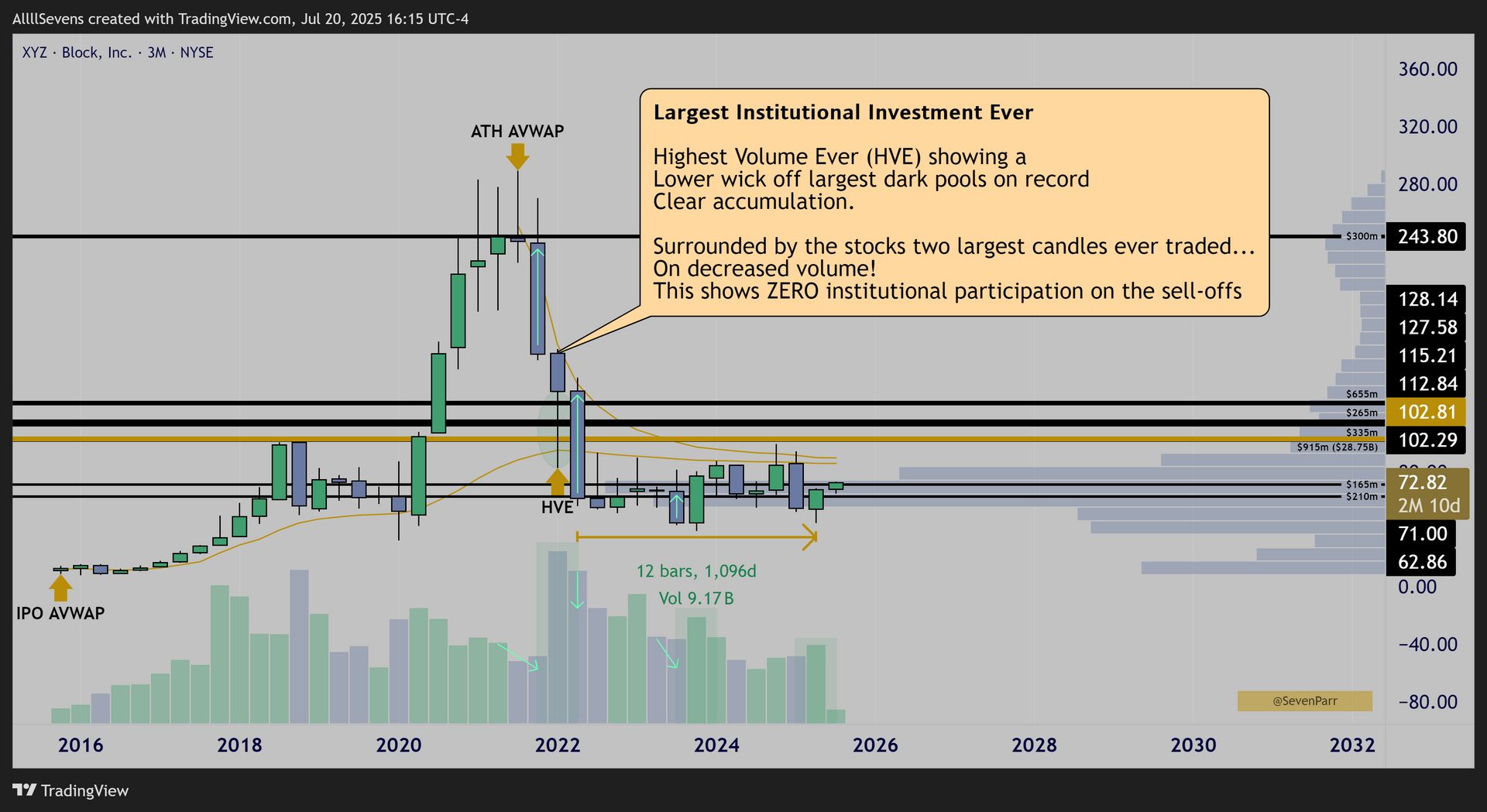

3-Month (Quarterly) Candles

In 2021, this stock sold off from a $300M dark pool @ $243.80 forming its largest candle ever...

On DECREASED VOLUME.

This is an extremely unusual anomaly between price and volume that tells us very clearly, institutional investors did NOT participate.

Then, price hit the $102.29-$128.14 range (a $2B+ cluster of dark pools), and they accumulated with their highest volume EVER.

This is yet another extreme anomaly showing the largest institutional investment ever made into this stock.

Another retail-driven sell-off occured after this, putting the stock into a state of extreme despair, sideways for an entire three years now - drastically underperforming the rest of the market.

Most investors have completely written off this stock and below its IPO AVWAP and ATH AVWAP, it technically remains in a bearish short-term trend with plenty of opportunity to improve.

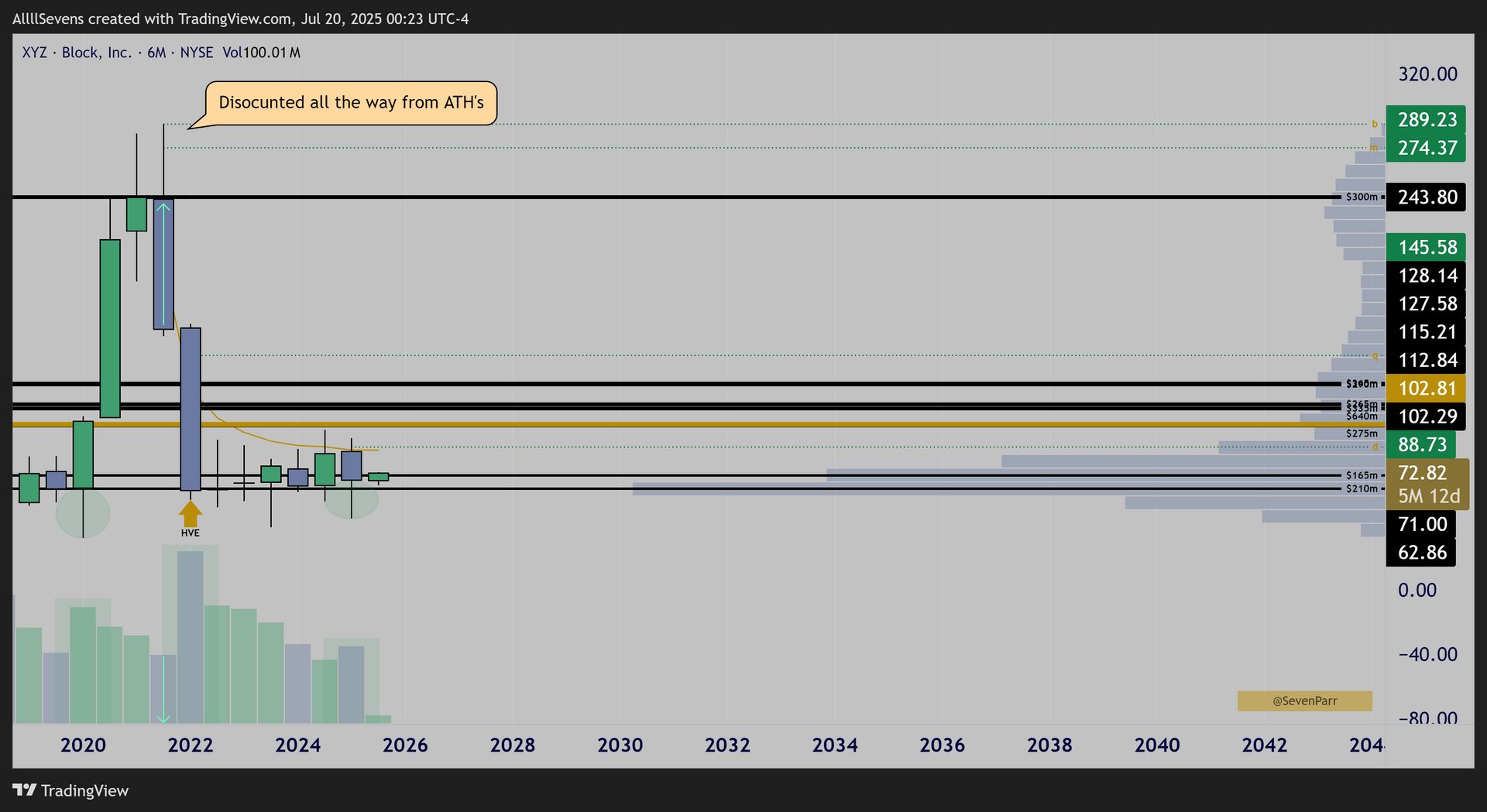

Coming as a shock to most, the company will be added to the S&500 this week.

This is a huge first step to bringing this stock back into the public’s eye.

When retail investors begin buying back in just as aggressively as they once sold out, this has potential to get extremely explosive.

Parabolic even, considering the scale of institutional investment.

I think the S&P500 inclusion is likely the first of many extremely bullish tailwinds for this stock over the coming years.

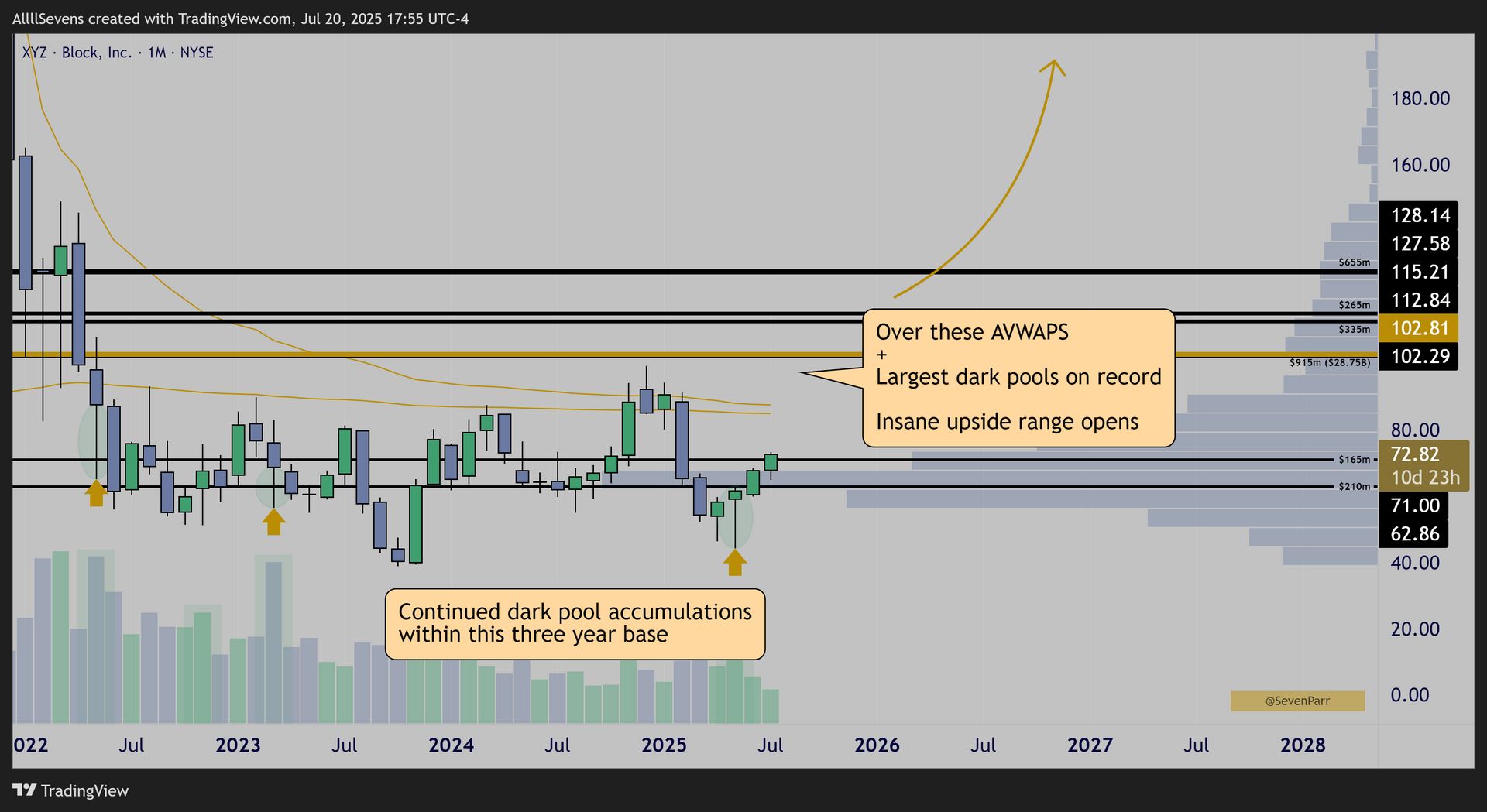

Reclaiming the $100 dark pool range is what will truly trigger an extreme short-term bullish trend. Be ready.

That is when unusual bullish option flow orders will begin to come in.

I will share them with you.

For now, I accumulate stock and let the story progress for as long as it takes.

Make sure you follow me on X and are subscribed to receive future newsletters where I’ll update this thesis!

Follow me.

Subscribe for future newsletters.

I nailed the recent low and am already up over 70% on my $XYZ position because of data I shared in a previous newsletter. Please, check it out for FREE: Click Here

I covered quite a few names in that newsletter.

Avg. +20% return. 76% hit rate.

I’m +45% on TXN, +40% on ARM, +25% on NOW, flat on HD, -30% on UNH, +8% on ASML, +60% on AMD, +35% on DDOG, +14% on SBUX, +25% on EWY, -40% on UVXY, +20% on TSLA, +60% on NVDA, +10% on CARR, +45% on TSM, flat on TEM, and +30% on TOST.

If you find value in my research, you’re going to want to upgrade to my premium subscription to gain access to Premium Newsletters like that again, but in real time. You’ll also get access to my private Discord.

All for just $7.77 Per Month

Thank you for your support.

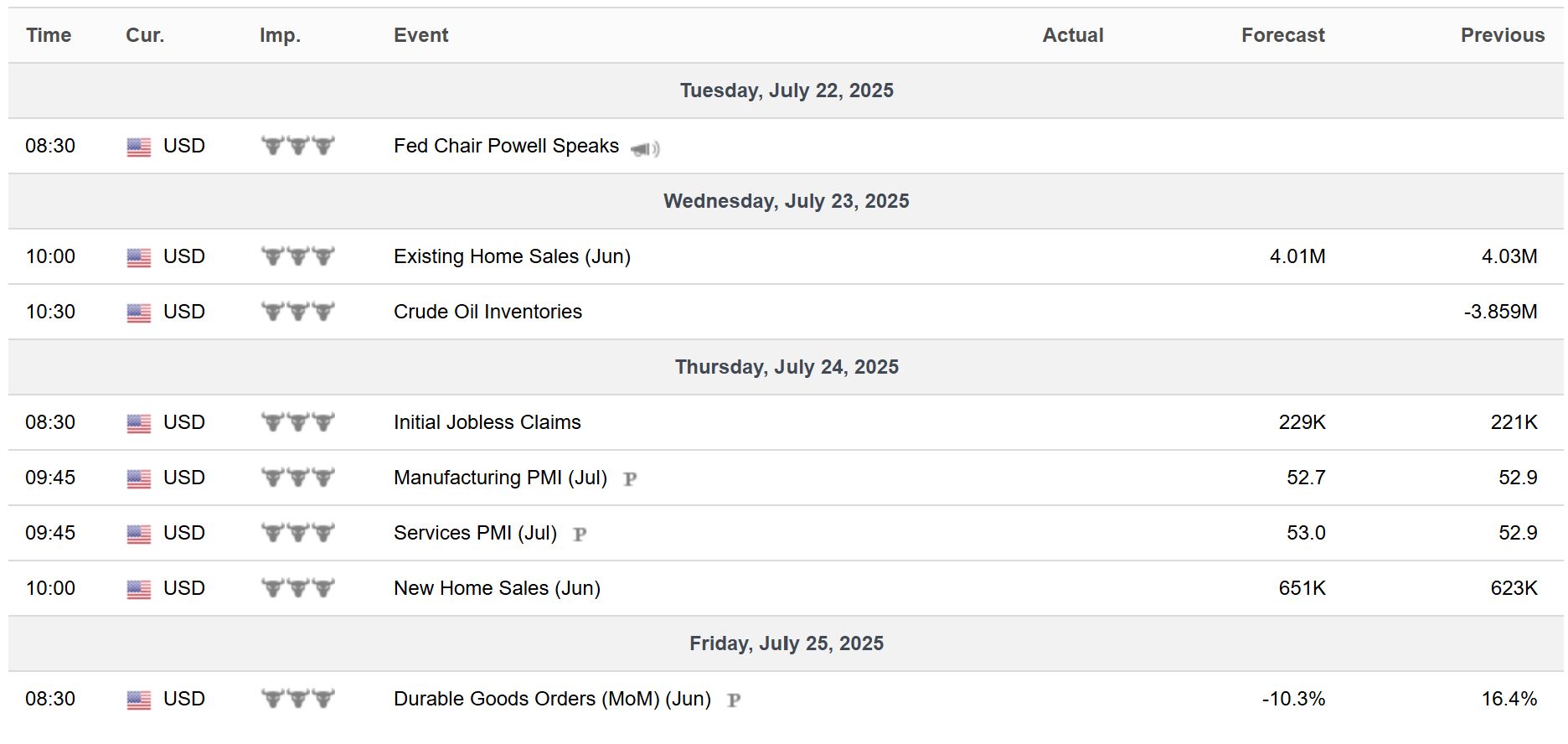

Earnings calendar & economic reports for the week ahead + bonus charts:

Reply