- AllllSevens

- Posts

- GOOGL & NVDA

GOOGL & NVDA

I will wait before I buy either of these.

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface:

I believe NVDA is undergoing an extremely unique “manipulation phase” that is going to allow institutions to acquire more long-term shares. This isn’t necessarily actionable right now.

It’s more of just an observation. A very interesting one.

GOOGL on the other hand… Wow.

You’re going to want to see this.

I think we could be seeing a major short-term top here.

I see at least a 10% decline in the coming months and the setup here is extremely actionable.

GOOGL

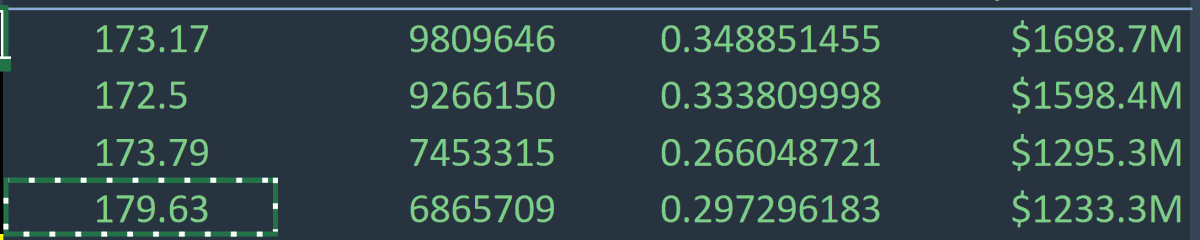

The stock’s largest largest dark pools on record just came in.

We’re seeing the stock’s largest institutional interest in YEARS come in not during a correction, but at on new ATH’s…

This is an extreme anomaly.

A massive move is brewing here, and it feels obvious which way.

Here’s my argument as to why there’s a $5.8B top being set on GOOGL

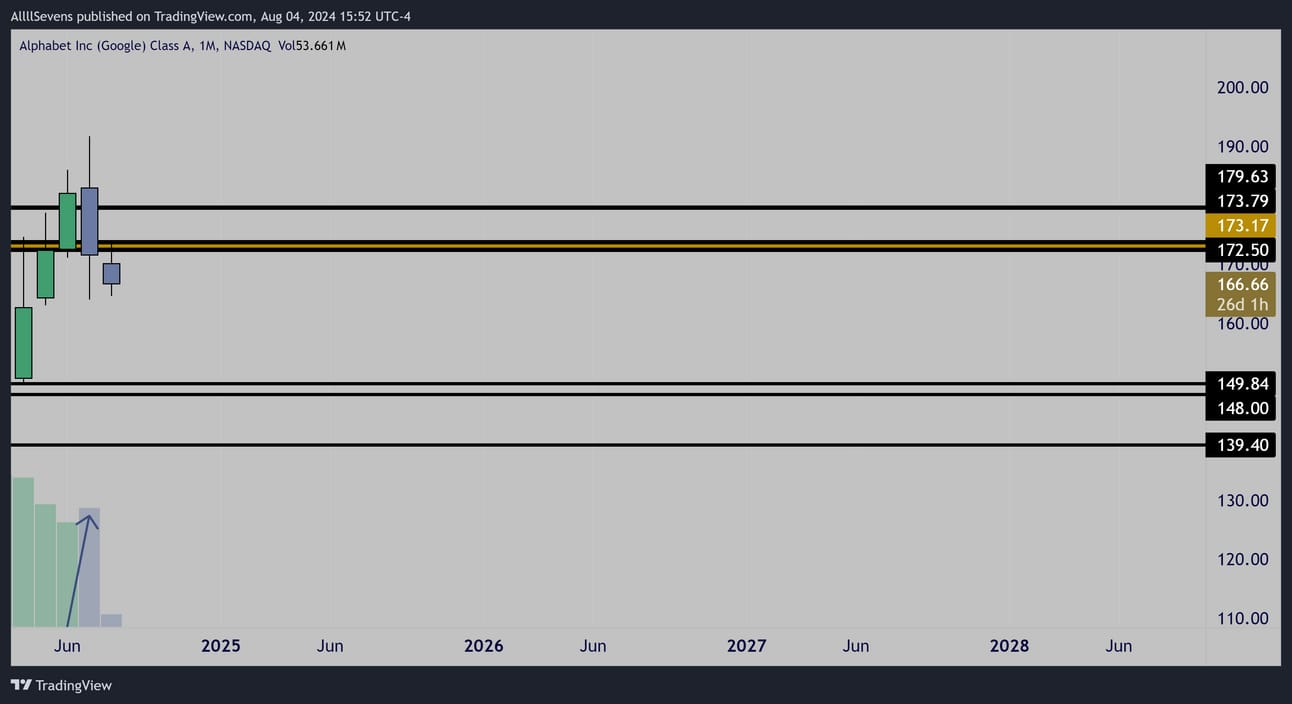

Monthly Interval

First, I want to note that July’s candle engulfed the June candle and closed below all the recent dark pool that came in.

Another fun fact:

In my last newsletter, click here, I noted that SPY traded it’s lowest monthly volume in 20 years during June

GOOGL on the other hand, just traded it’s lowest volume EVER

That’s wild! It’s very hard to be a convicted buyer at this moment.

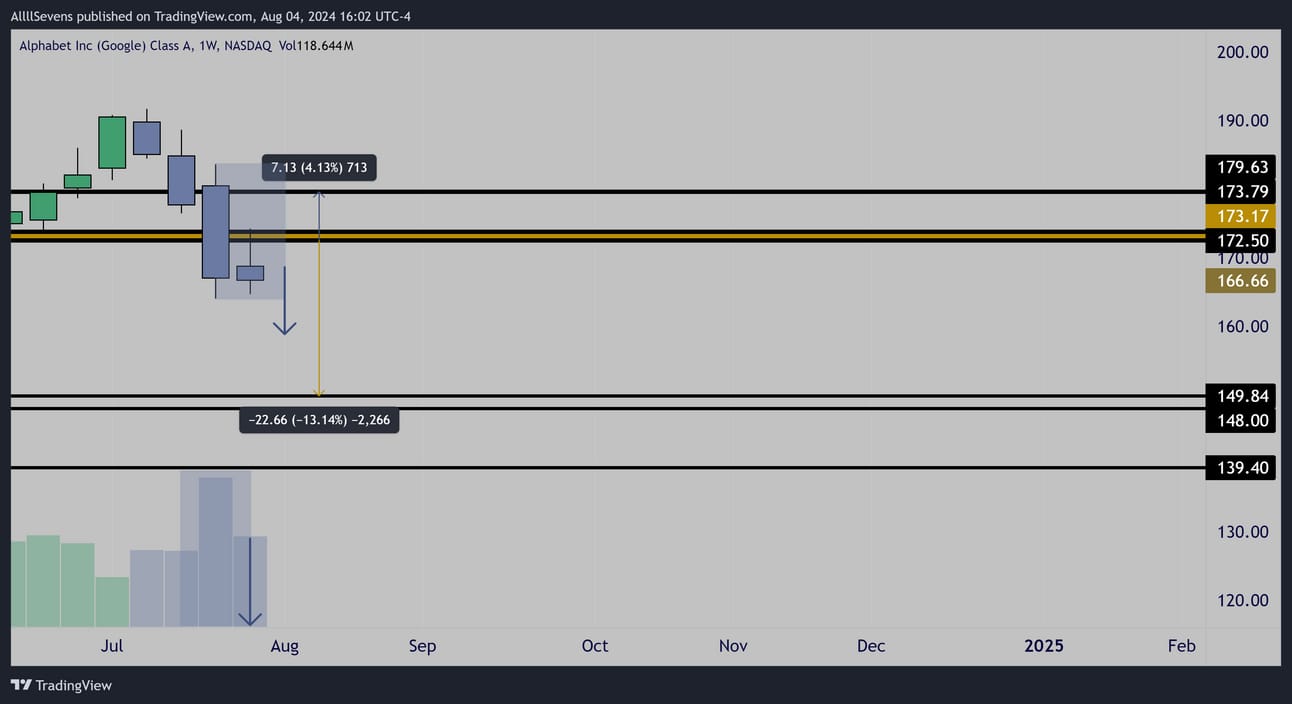

Weekly

This is where an actionable short setup really becomes very clear.

Following a high volume loss of support,

A decreased volume inside candle forms, retesting and rejecting the dark pools that are now resistance. Remember, the monthly candle is also bearish engulfing below these same levels.

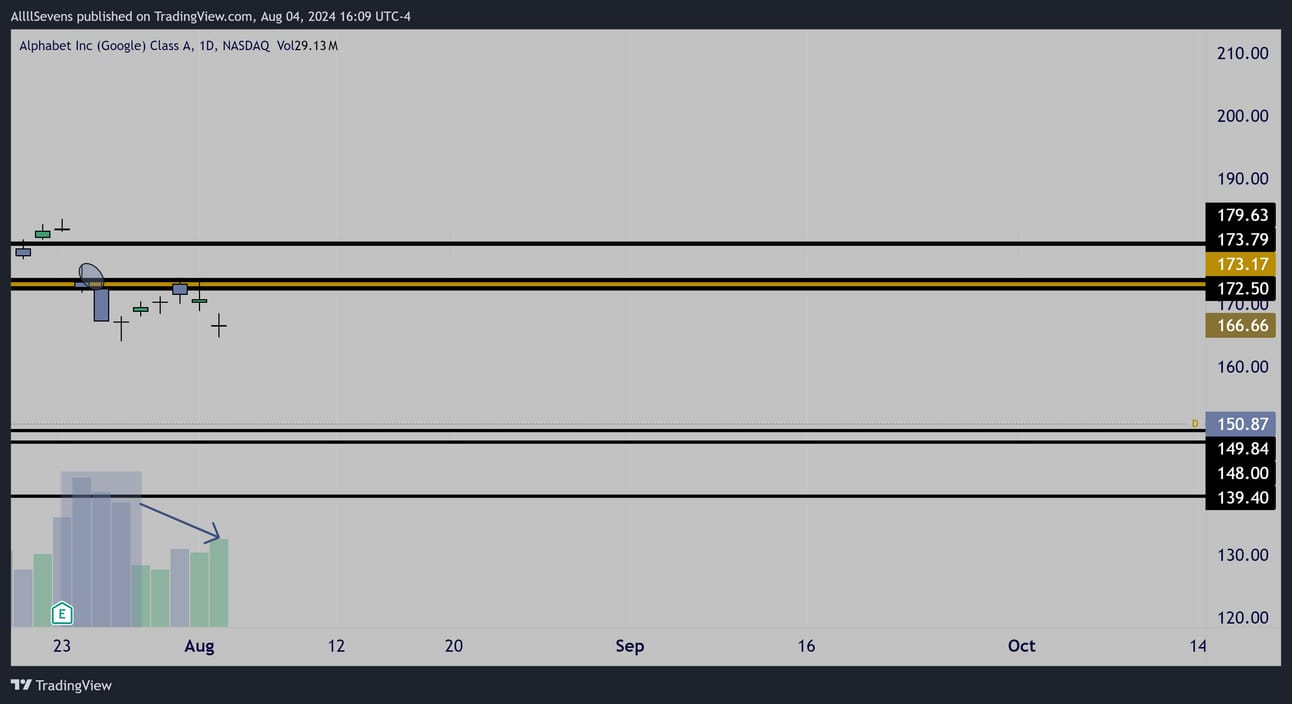

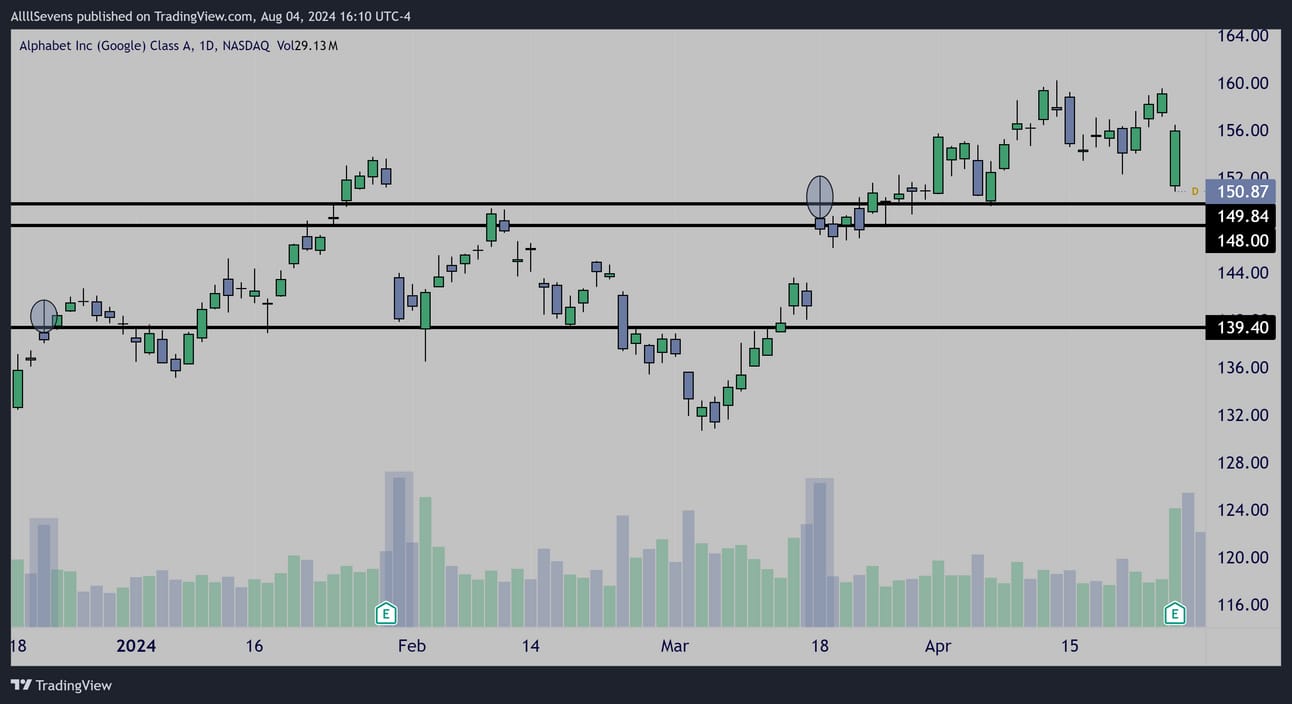

Daily

A bearish “PEG” is formed directly off these dark pools as well.

The confluence here is building off each time frame!

Daily

If we look back a bit, this bearish formation on GOOGL is a long time coming. This stock hasn’t been seeing healthy patterns all of 2024.

I won’t even be flipping bullish once $150 gets hit.

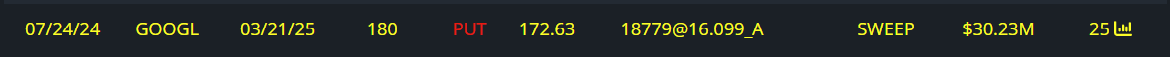

Final piece of confluence:

$30M 3/21/25 180 put BUYER

The day that the bear PEG formed, a trader bought $30M in puts…

It is EXTREMELY unusual to see flow of this size, so clean, with an A+ technical setup backing it. I do not think this is a coincidence.

Conclusion

This could be marking a multi-month top in GOOGL share price.

At minimum, a 10% decline towards the $150 dark pools

The most amazing part of this setup is the risk-to-reward.

There is a very defined risk here, being the dark pools that just came in.

Over $179.63 and clearly, the stock doesn’t want to go down yet.

Personally, I’ll even be using $173.19 as my risk for a short-trade.

$179.63 is the level where if reclaimed, my entire thesis would nee re-thought and my bear bias thrown out the window.

Once $149.84 gets hit, I’d like to secure profits and focus on rolling into another short because I think there could be more downside through those levels.

Let’s recap:

Monthly bearish engulfing✅

+

Weekly continuation pattern✅

+

Daily continuation pattern✅

+

Unusual options flow✅

=

🎰?

All the confluence is here for downside direction, plus we have an amazing risk-to-reward. Doesn’t get better than this.

NVDA

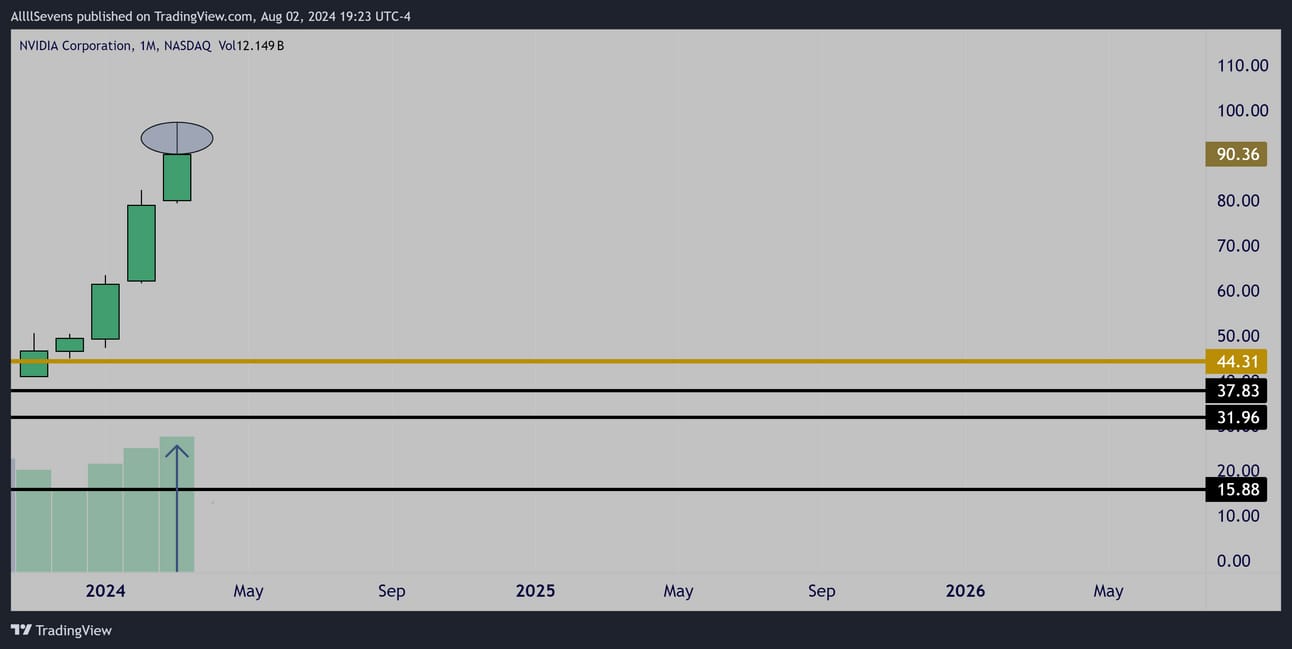

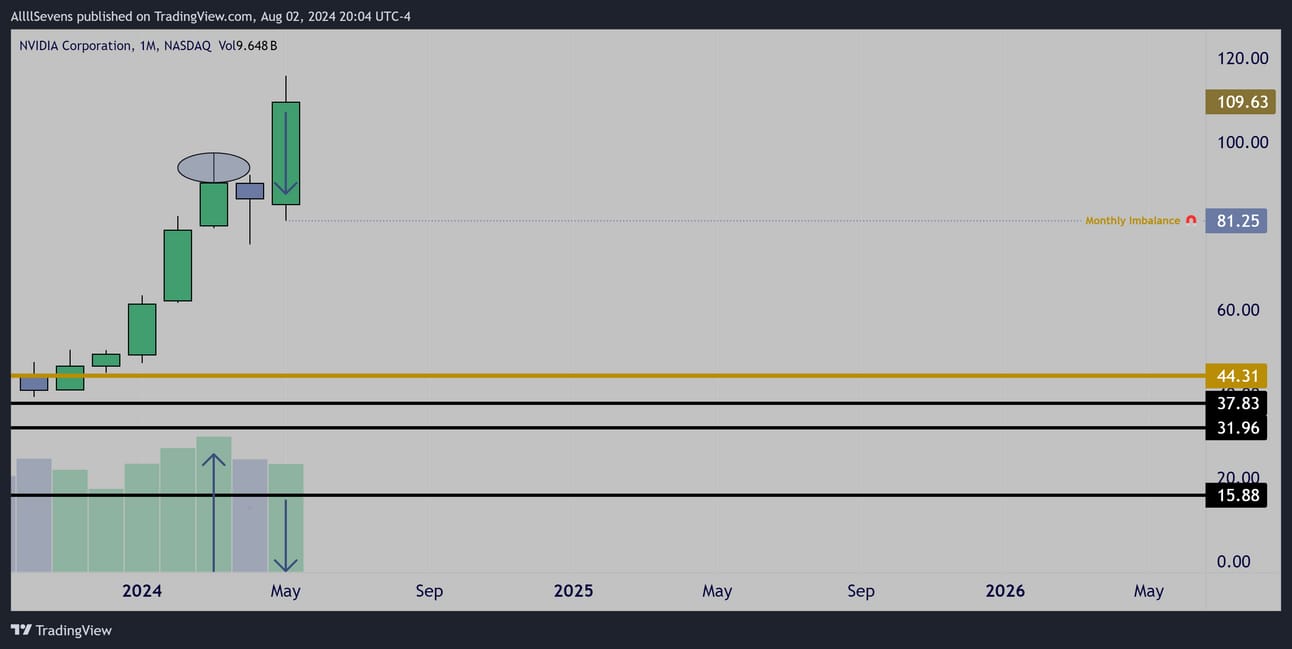

March

Textbook institutional distribution.

A decreased candle body with an upper wick and increased volume.

No dark pool comes in, and so no resistance is created…

April

An inside candle forms. In an uptrend.

Just below a major psychological level- $100. A magnet.

May

Textbook retail push.

Largest candle body on the screen, on decreased volume.

Institutions sold in March, retail kept buying in May

An imbalance between price and volume is now created at $81.25

This price should be retested in the future, potentially when a dark pool resistance gets placed…

June

The stock splits 10-1 making it even more attractive to retail.

Deliberately, institutions finally create a large dark pool resistance.

Retail traders are now extremely bullish with a resistance in place, and an imbalance 24% below…

But, hold on. This is where things get extremely interesting.

Take a closer look at June’s candle.

Decreased candle body, upper wick…

Decreased volume.

Institutions did NOT distribute this dark pool.

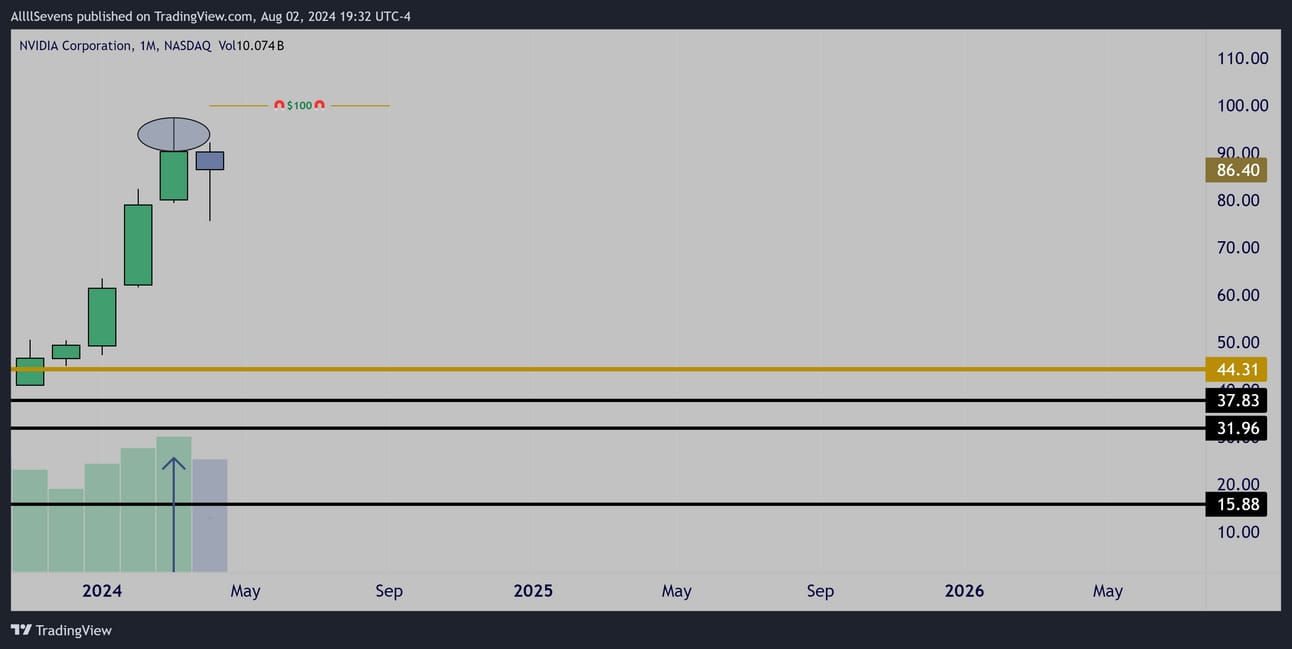

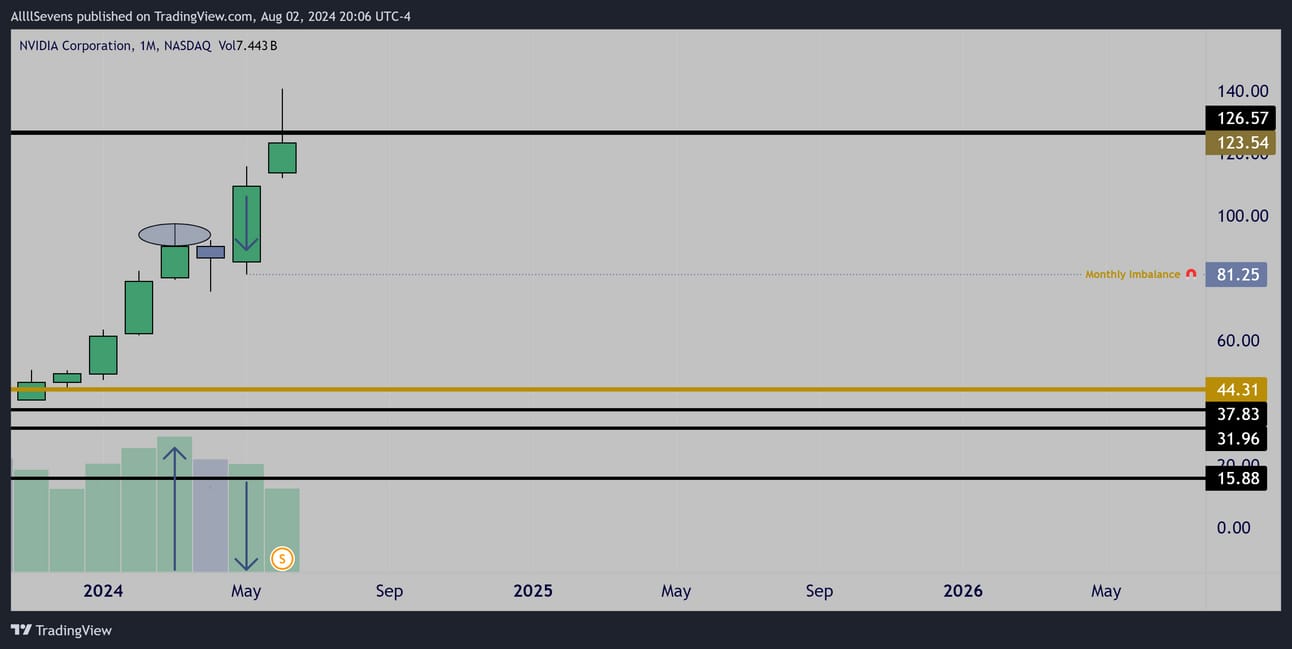

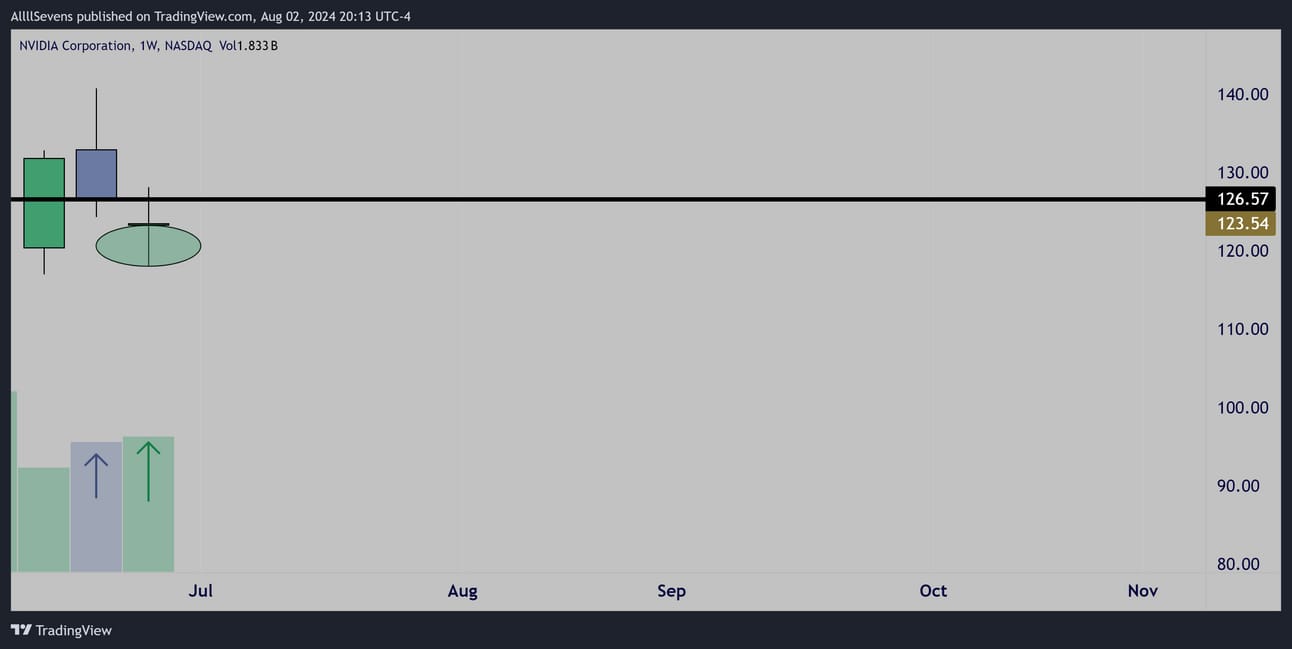

Weekly

In fact, they have began accumulating.

But, notice how they did so BELOW the dark pool…

This is so it will remain a resistance for retail traders.

Remember, we have an imbalance at $81.25

Institutions have TRAPPED retail participants into longs, so that they can start BUYING back the shares they distributed!

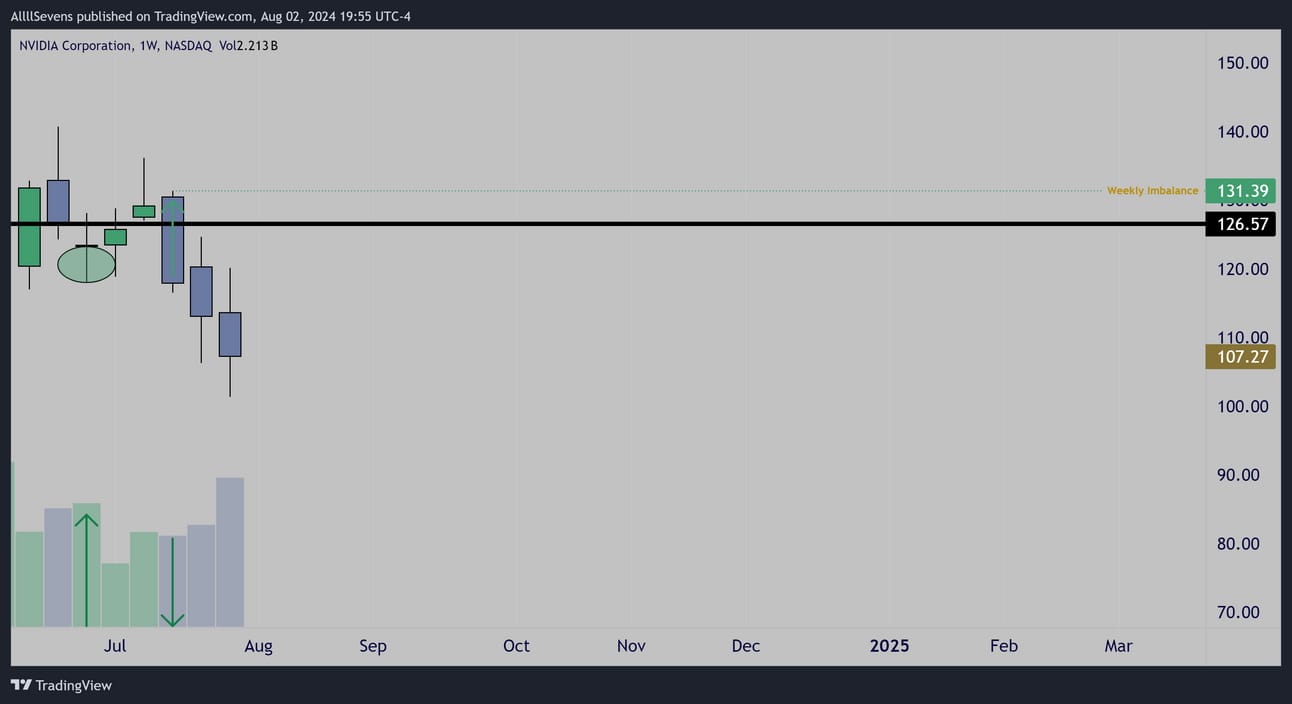

Weekly

Textbook retail push lower after the on the retest of $126.57

Their plan is working perfectly.

Retail is now in sell-mode and institutions can begin re-accumulating.

Conclusion

Institutions purposefully distributed BELOW $100 without creating a dark pool resistance letting retail would push it higher and “trap” themselves into longs. Why?

To create liquidity for future accumulation.

By splitting the stock over the $100 mark and creating an artificial resistance at $126.57, retail has no idea that they will not be able to break $126.57… They are trapped in longs.

They will eventually be forced to turn sellers

AKA, liquidity for institutions to re-accumulate for the next leg up!

How long this will take to play out is unpredictable. I can only react.

I have a feeling they are going to let retail toy around with the $100

psychological mark. I think with a recent stock split retail participants are still eager to buy the stock, so the more consolidation and dead cat bounces leading to $126.57 rejections, the better.

A hold of $100 and retail will be just as bullish as they were in May.

But, eventually, $81.25 will need rebalanced, and when that happens, retail participants are going to be extremely worn out and ready to cut losses. That is when I will start looking to buy this stock heavily alongside institutional money.

I will NOT buy this stock higher than $81.25

I’m looking to trade short if this retests and rejects $126.57

Thank you!

I deeply appreciate you taking your time to read my work.

Make sure you are subscribed for my next newsletter!

Follow me on 𝕏 (formerly twitter) : @SevenParr

Upgrade your newsletter subscription to premium if you would like to further support my work.

See you on the next one!

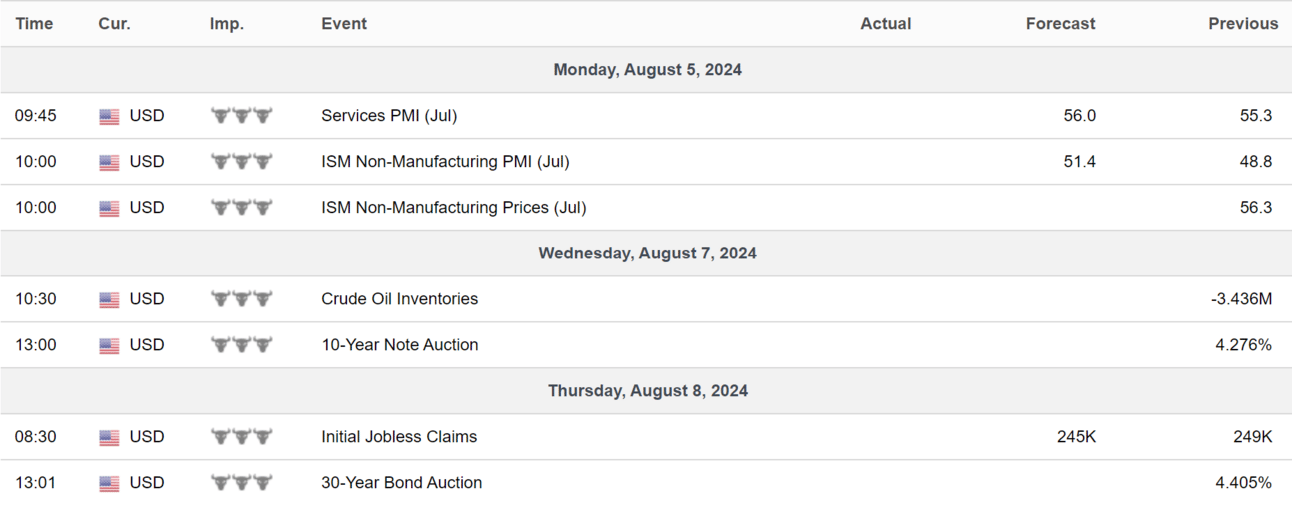

Here are important economic data and ER reports this week:

Reply