- AllllSevens

- Posts

- $GPS - Gap Inc

$GPS - Gap Inc

Is this actually a great long-term stock trading at a major discount?

Disclaimer

I am not a legal professional.

The content shared in this newsletter is purely my personal opinion and for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

GPS

Gap Inc is trading at the same price as it was in 1998

Is this this a completely hopeless stock?

I think it a sleeping giant.

I’m not going to look at the financials of this company.

I’m going to analyze the price and specifically the VOLUME at historic Dark Pool levels to determine what “smart money” institutional investors have been doing to the stock.

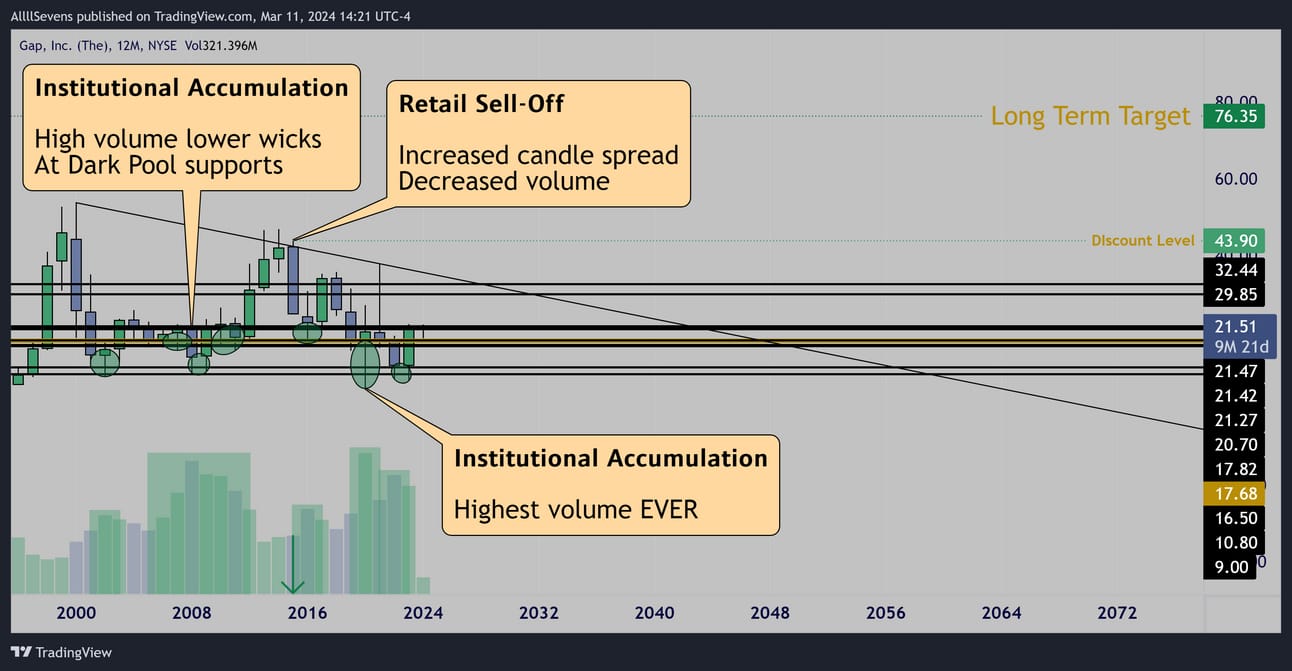

Yearly

2002

High volume hammer at $9.00-$10.80 Dark Pools

Institutional buy pressure.

2008-2009

Price retests this area again and sees even higher volume lower wicks defending the same area of support.

Also strong buy pressure now visible at upper levels $16.50-$17.82

Price rallies 400% into 2014

I notice no high volume comes in here at the highs suggesting the institutional buyers sold their positions…

2015

A lower high is formed and price pulls back.

The stock sells -40%

This is where I notice the SIZE of the candle…

It’s the largest candle seen since 2001, yet it has practically no volume.

This further confirms that institutional investors did not sell out at the highs nor did they sell out on the drop back to demand.

2016

Institutional investors buy the dip.

A strong dark pool demand now forms at $20.70-$21.47

2017-2019

Price rallies 100%

Once again, no volume comes in at at the highs, but a lower high is formed and price falls back into institutional demand.

2020

This is where things get insane.

Price has made consecutive lower lows and now retail investors are faced with the Covid-19 Pandemic. Panic ensues.

The stock breaks through all areas of previous institutional accumulation and falls to prices not seen since 1995…

Institutional buyers step in with their largest amount of capital yet.

The highest volume EVER for the stock steps in and created a massive lower wick through all the Dark Pool demands except for $20.70-$21.47

2021

Price rallies 600%!!

But, new lows were made, $20.70-$21.47 was now resistance, and once again price rejects after sweeping prior highs…Notice the volume.

Yet again, institutional investors hold strong

2022-223

Price tests the demand where it all started and attempts to create a higher low from the 2020 bottom. It holds.

Price rallies 190% and now faces the $20.70-$21.47 resistance…

What an incredible sequence of events.

This is where we are at. After forming a higher low, can this see an absolutely parabolic rally like it has in the past?

Better yet- can this be the one that finally holds?

The highest volume EVER sweeping 1955 could have set a strong low.

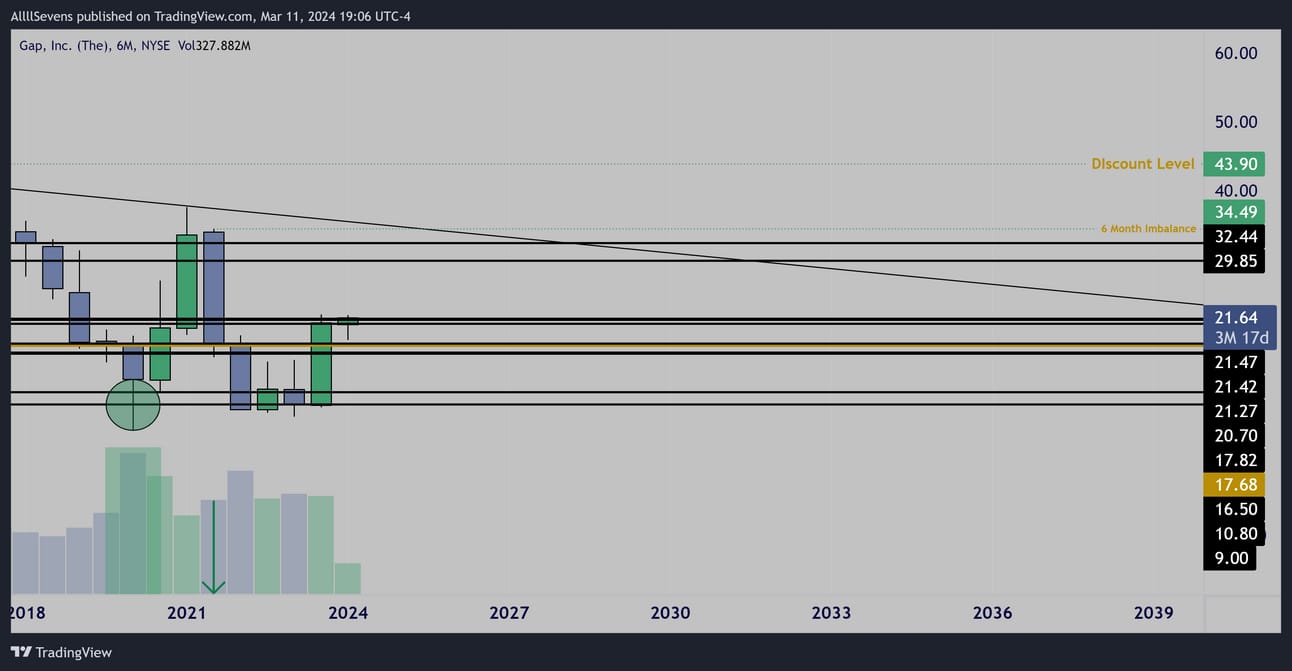

6 Month

$43.90 is a yearly imbalance and my “discount level”

$34.49 is another imbalance.

These are potential short-term targets.

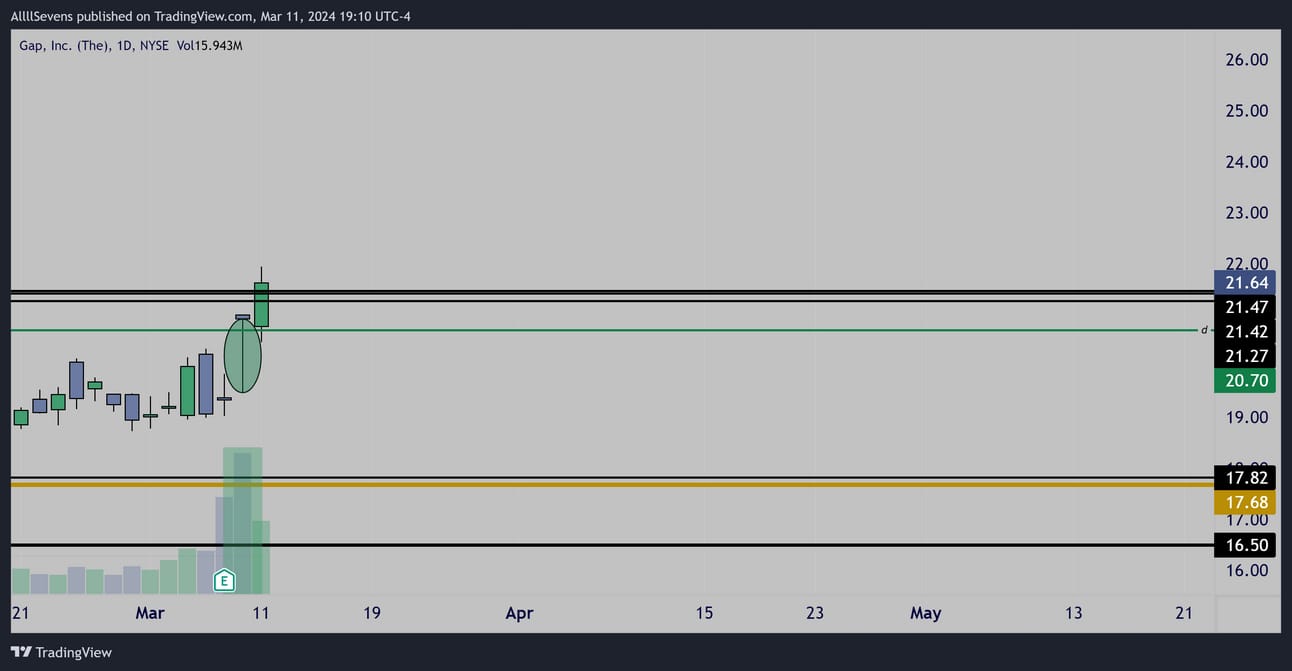

Daily

Two more imbalances are visible on the Daily chart.

Daily

A Power Earnings Gap has formed following last Thursday’s report.

This display’s strong institutional accumulation off of $20.70 and an increased probability for short-term continuation up.

$20.70 is the basis for risk here.

Primary target is the daily imbalance @ $29.82

Considering the historic parabolic rallies this has seen, I think this is extremely plausible. And over the entire year… two years… etc. who knows how big of a rally could result from this.

As shown on my yearly chart, I project a 250% rally to $76.35 is possible.

Conclusion

Cleary some sizable LONG TERM institutional investors believe this stock will go up over time. I think $76.35 is more than reasonable.

I think the 2020 low is extremely strong and will likely never be tested again. i don’t even want to see the $9.00-$10.80 demand tested again.

Above $9.00-$10.80 we have $16.50-$17.82 where the stocks largest Dark Pool on record is located. This is going to be my primary basis for risk on shares. If this area gets tested again, and a lower high can not be formed… I want out. I don’t want to bag hold GPS for 10 years.

Will $16.50-$17.82 even get retested? It could, but I am doubtful and that’s why I’m writing this newsletter today. I’ve been watching this for a long time and I believe with this PEG I’m finally seeing what I need for an A+ entry, with a possibility we retest the support below, but unlikely.

$20.70 is THE level I expect to hold in the coming weeks.

If that gets retested, and struggles to hold… Would be weird and slightly concerning. I’d be willing to hold shares to the next level but not calls.

$21.27-$21.47 becomes the nearest cluster of support.

Ideally this holds. Ideally, it does not even get retested.

I entered calls today.

My plan is laid out above.

I hope you found some value here.

AllllSevens+

Typically I only write about individual stocks to paid subscribers.

If you want more like this, upgrade for $7.77 per month.

Also get discord access where I can post WAY more than I can on twitter updating all the stocks I talk about on a consistent basis.

https://allllsevensnewsletter.beehiiv.com/upgrade

Reply