- AllllSevens

- Posts

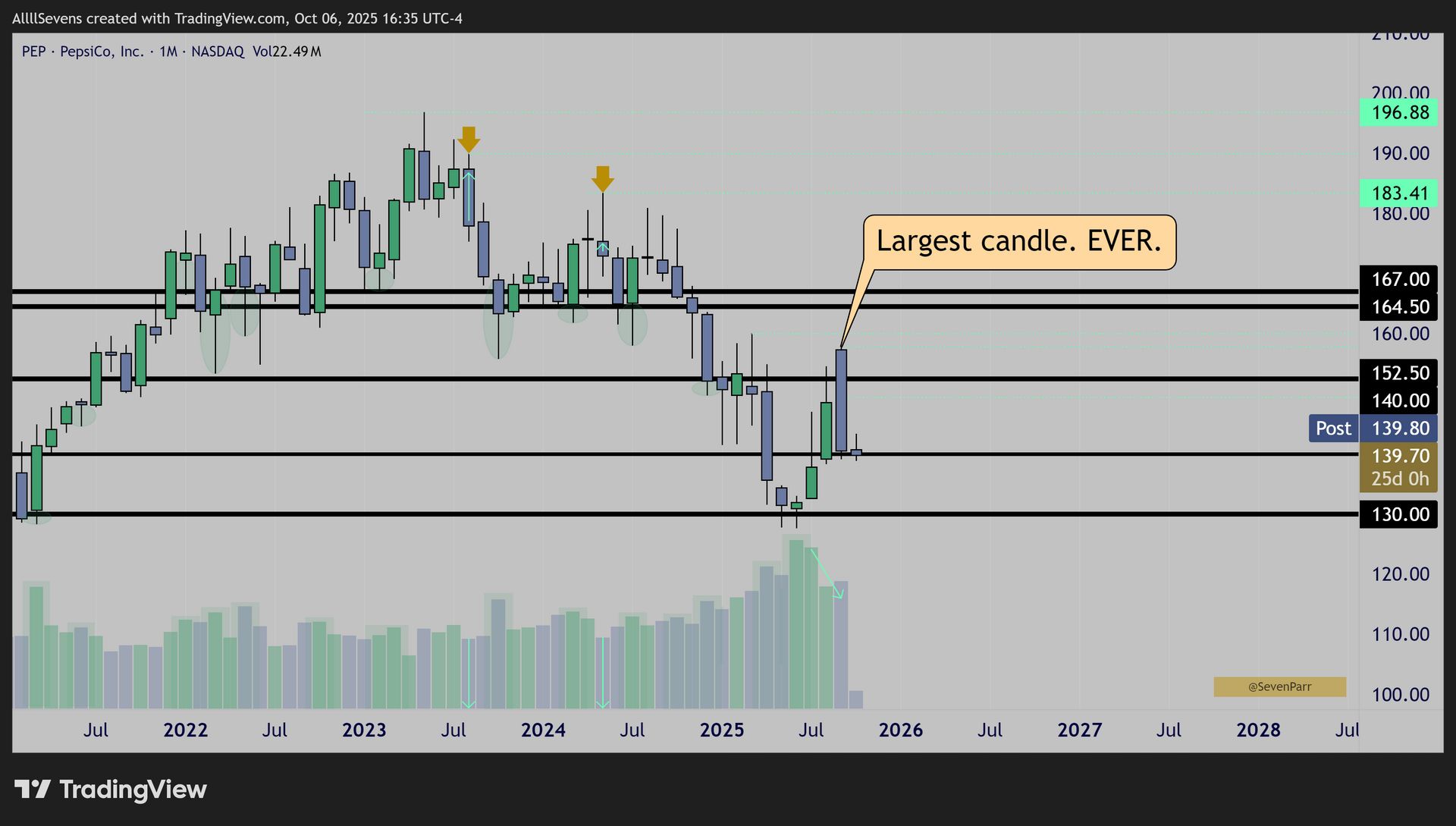

- Pepsi stock trading its highest volumes since 2011

Pepsi stock trading its highest volumes since 2011

Largest institutional investment in over a decade + it's most bearish sentiment EVER.

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions and commentary.

I am not liable for any losses incurred by others.

Preface:

With technology stocks at the forefront of the current stock market rally, I would like to bring to your attention some profound volume and price patterns on $PEP stock that most might be overlooking.

$PEP - PepsiCo, Inc.

Weekly Candles

From June-July, $PEP quietly traded its largest buy volumes in over a decade at the $130 and $140 levels suggesting extreme institutional investment occured.

Then last month, the stock rejected the $150’s creating its largest sell candle since May of 2022, three years ago…

It did so on a decrease in volume.

Such a large candle having a clear decrease in volume is a major anomaly, especially following the massive buy volumes the stock just saw.

The $130 and $140 buyers did NOT participate in this sell-off.

Matter of fact-

Monthly Candles

Last month’s sell-off is actually the largest candle, by dollar amount, in $PEP HISTORY showing a never before seen level of negative sentiment towards the stock - meanwhile institutional investors are running their largest accumulation campaign in over a decade…

They have actually been accumulating for many years now, most notably off the $164.50-$167 zone, 20% above current prices.

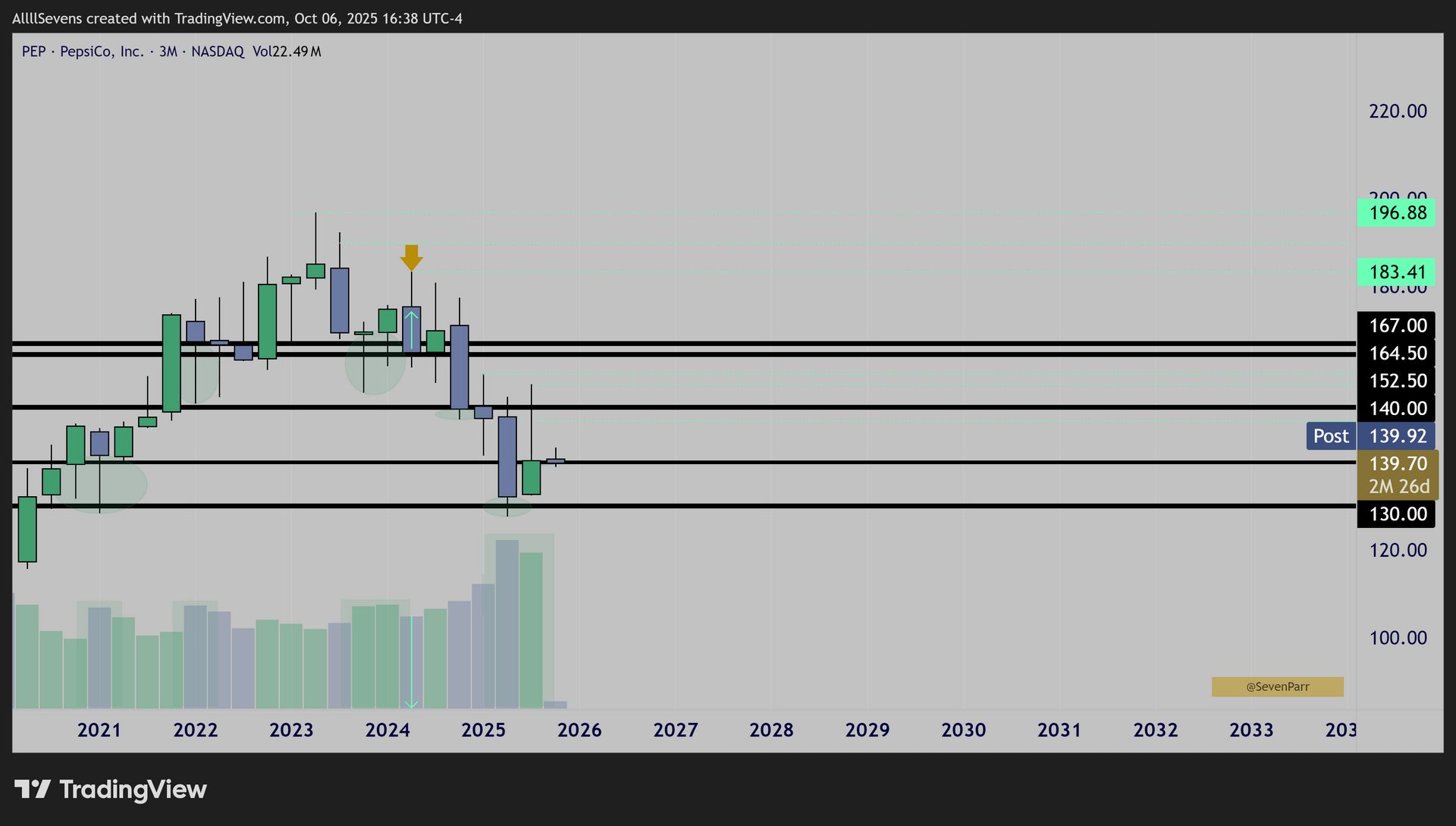

3-Month Candles

The quarterly time frame shows the $160+ accumulations best.

It also highlights clear “inefficient selling” to lose that zone, suggesting those buyers did not participate and have only continues accumulating since.

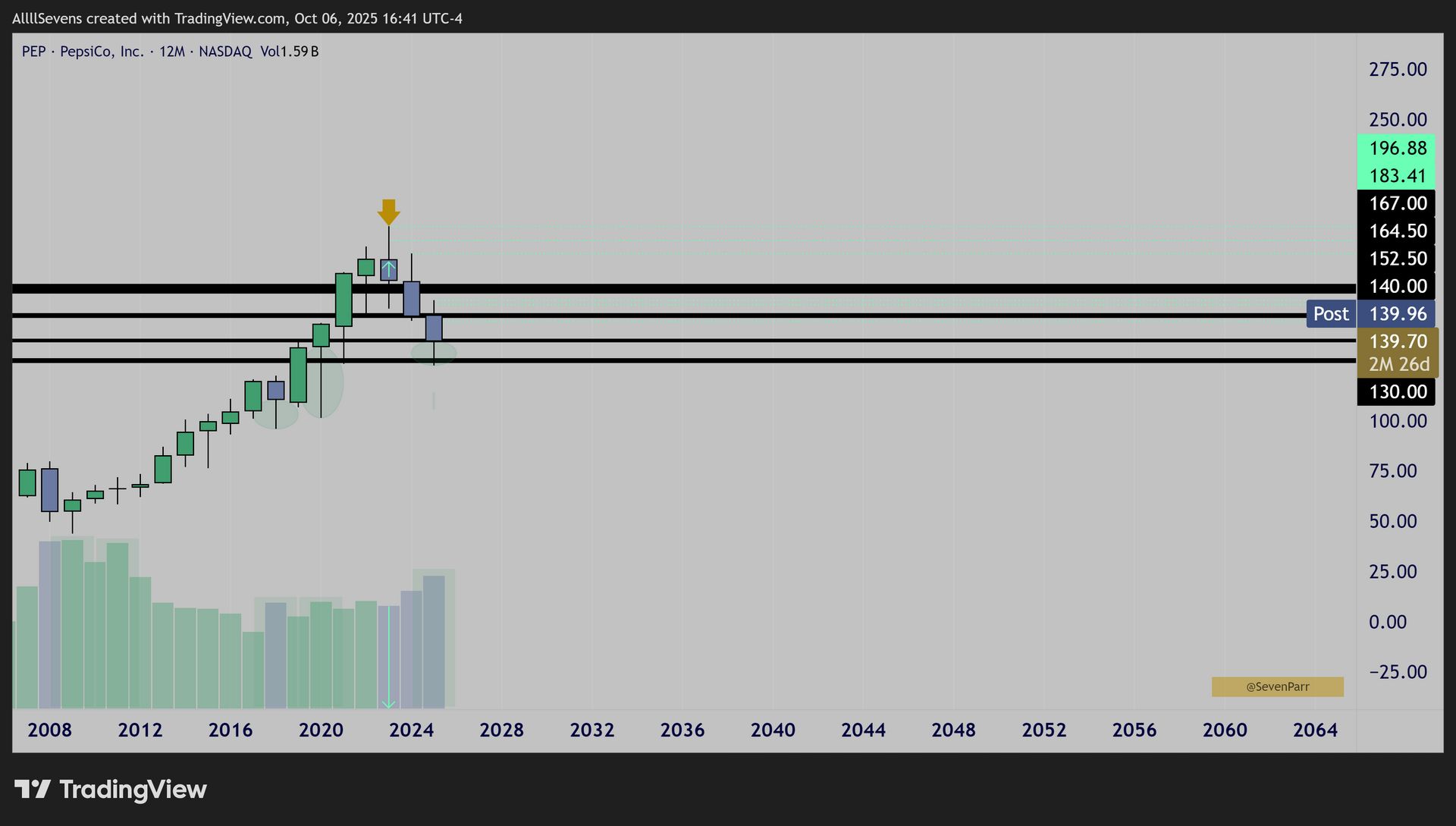

Yearly Candles

The 2023 rejection of ATH’s was on inefficient volume.

Now seeing the largest buyers in over a decade step in to defend the $130 area.

Conclusion:

With a never before seen in history level of pessimism expressed by last month’s sell-off + the largest institutional accumulation in over a decade coming in,

I think this is the perfect recipe for an outsized recovery and a bottom to be set for $PEP stock over the coming years.

I have a Discord where I share analysis like this on countless other stocks on a near daily basis.

It costs $7.77 to get in.

Upgrade Here

Reply