- AllllSevens

- Posts

- Is QQQ better than SPY?

Is QQQ better than SPY?

Weekly Newsletter 3/4/24

Disclaimer

I am not a legal professional.

The content shared in this newsletter is purely my personal opinion and for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

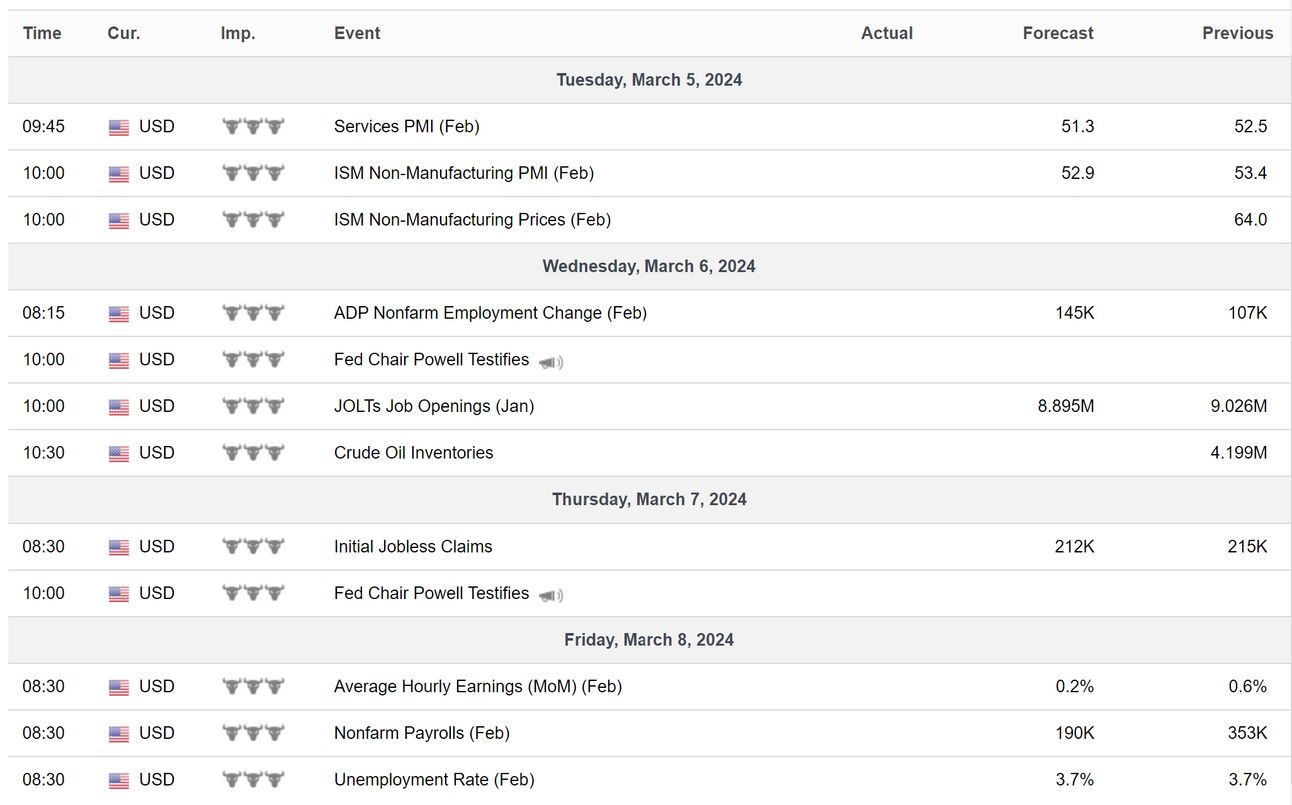

Calendar

SPY

Monthly

On a monthly time frame, the S&P500 shows heavy institutional accumulation over the last two years.

I believe this will result in a short-term rally to the $590’s and a long-term rally to the $730’s

Notice this:

The largest candle bodies on this chart are all on decreased volume… This tells me something.

Retail participants (low volume) are the drivers of short-term trend.

Institutions are not adding long up here with notable capital.

They do that only during pullbacks like shown above.

They’re also not selling out / shorting the market.

They’re simply enjoying the ride.

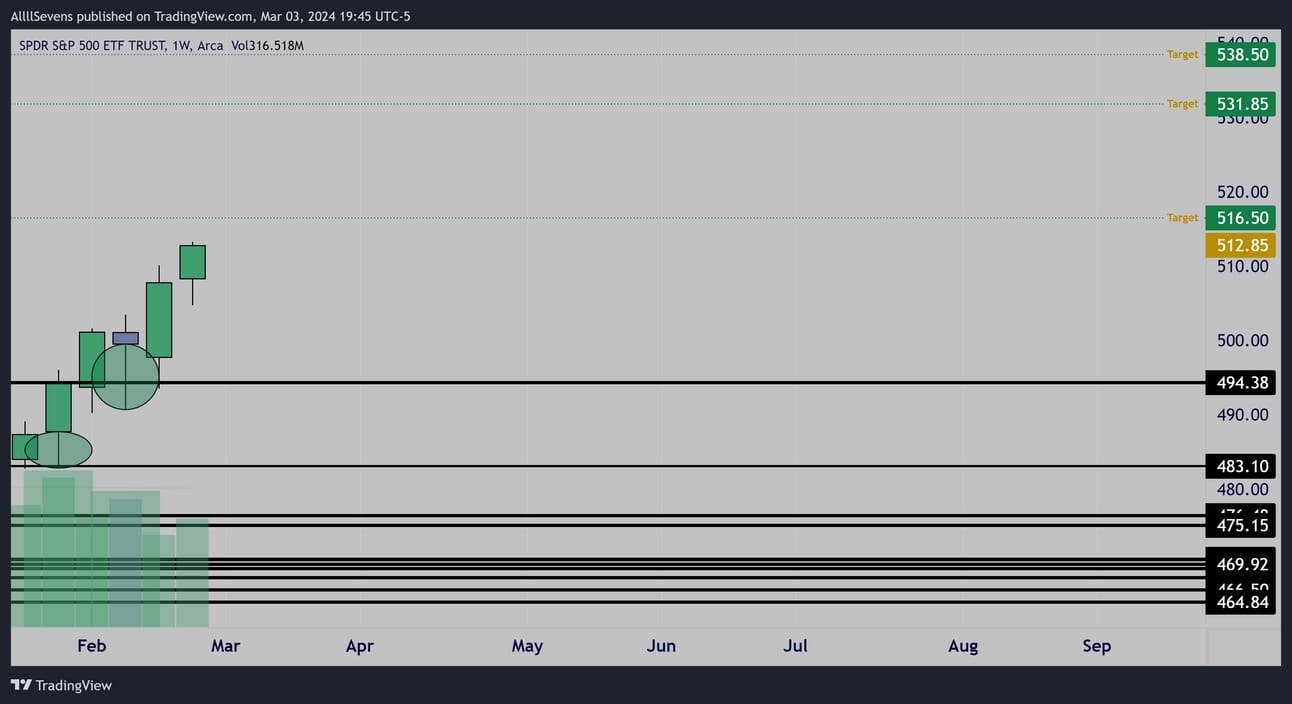

Weekly

On a weekly time frame, we see a similar situation.

Institutions added the dips @ $483.10 & $494.38, now they’re holding while retail participants push price higher.

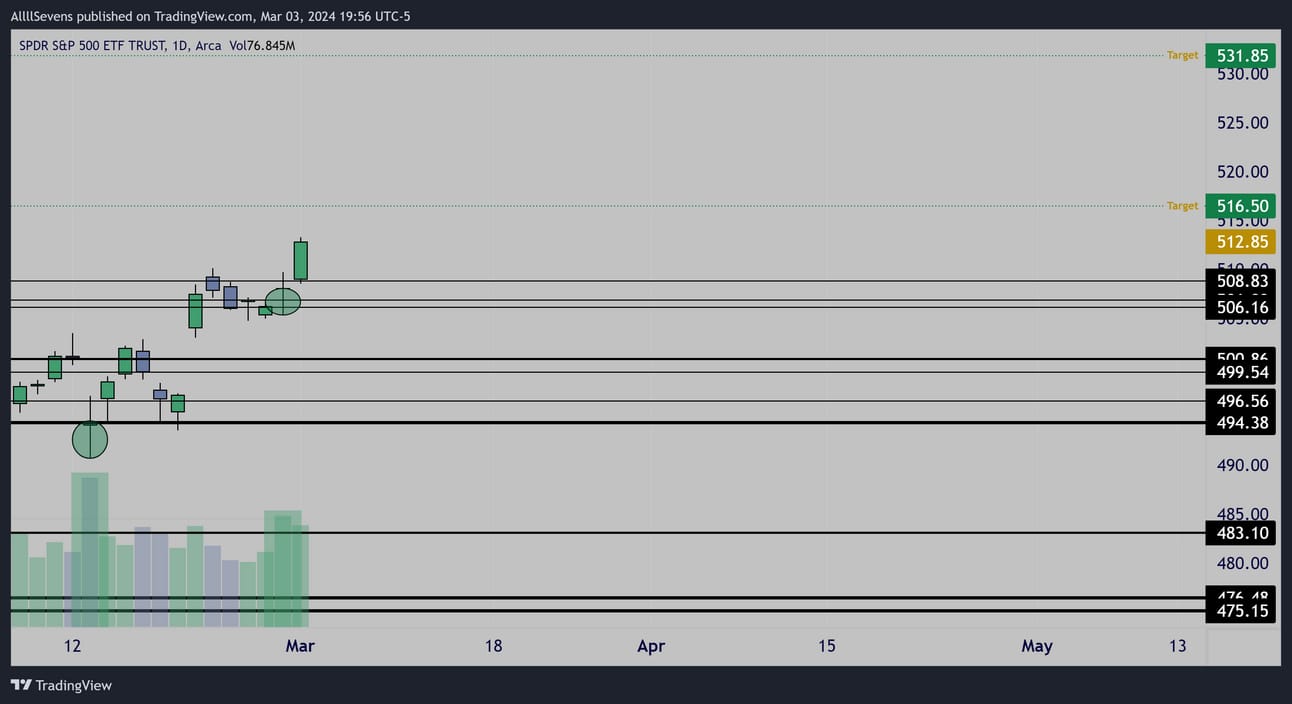

Daily

On a Daily time frame, institutions added the dip on Thursday and are now holding.

Conclusion

I like to conclude things by giving my plan from the perspective of someone sitting in pure cash.

As an investor:

I don’t want to be adding large amounts of capital long here- period.

I want to have cash ready for when a monthly accumulation candle appears. When will that happen? Will it happen? I have no idea.

I just know institutions aren’t adding big here so neither will I.

I do know they are continuing to add small amounts on a weekly and daily basis specifically on dips. I want to do that as well- still always keeping cash on deck for when a real buying opportunity occurs on a monthly time frame.

My perspective as a swing trader:

Clearly I want to focus on long-side trades.

While a pullback is what I need to see for me to get an entry, I have absolutely no interest in trying to time when one will occur.

That’s a losers game for me.

I understand that is not my edge in this kind of environment.

I will be patiently waiting for any dips to support to add longs if I see institutional buyers stepping in once again.

I will update daily on 𝕏 if I see anything actionable.

As a day trader:

I will update this pre-market daily on 𝕏!

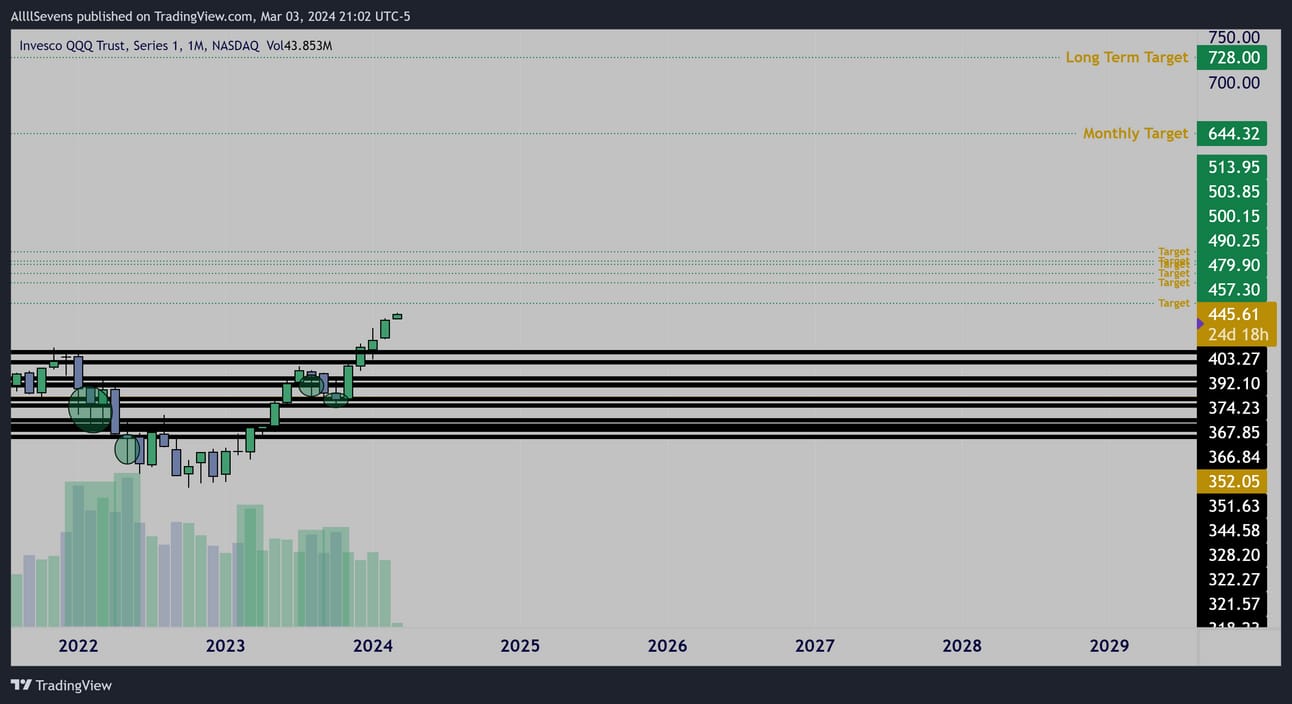

QQQ

Monthly

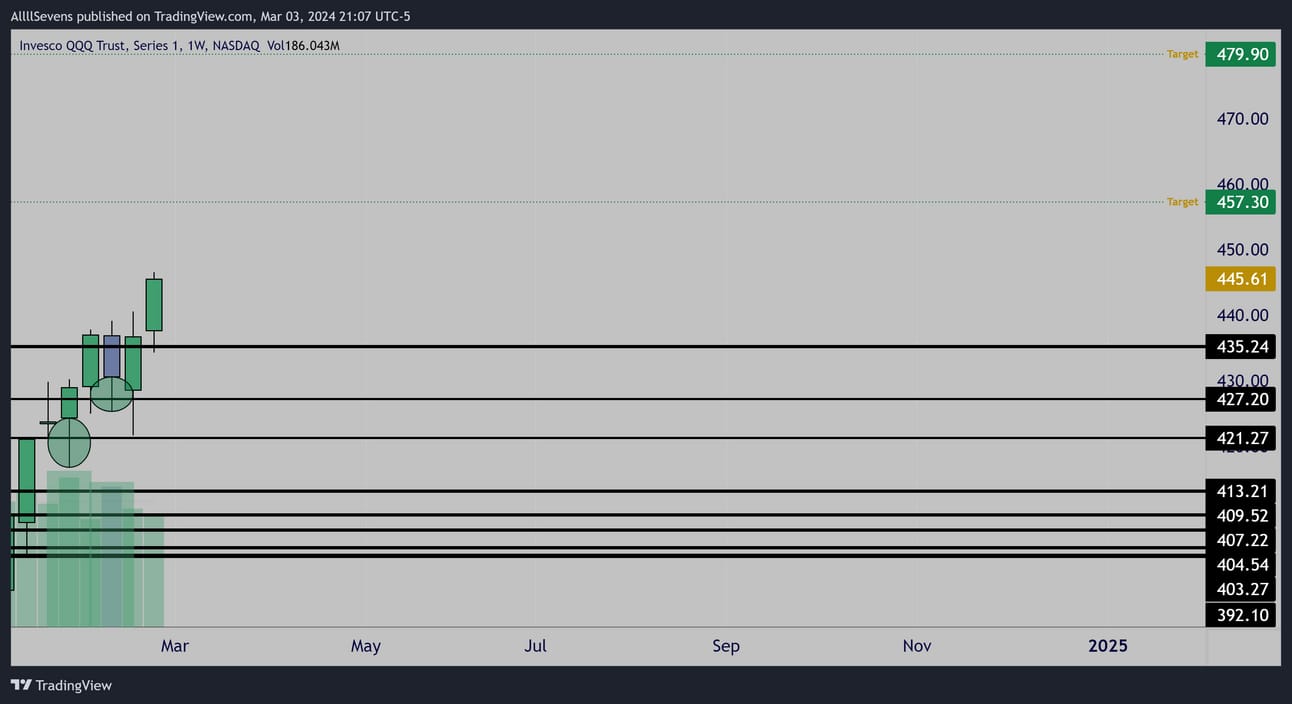

Weekly

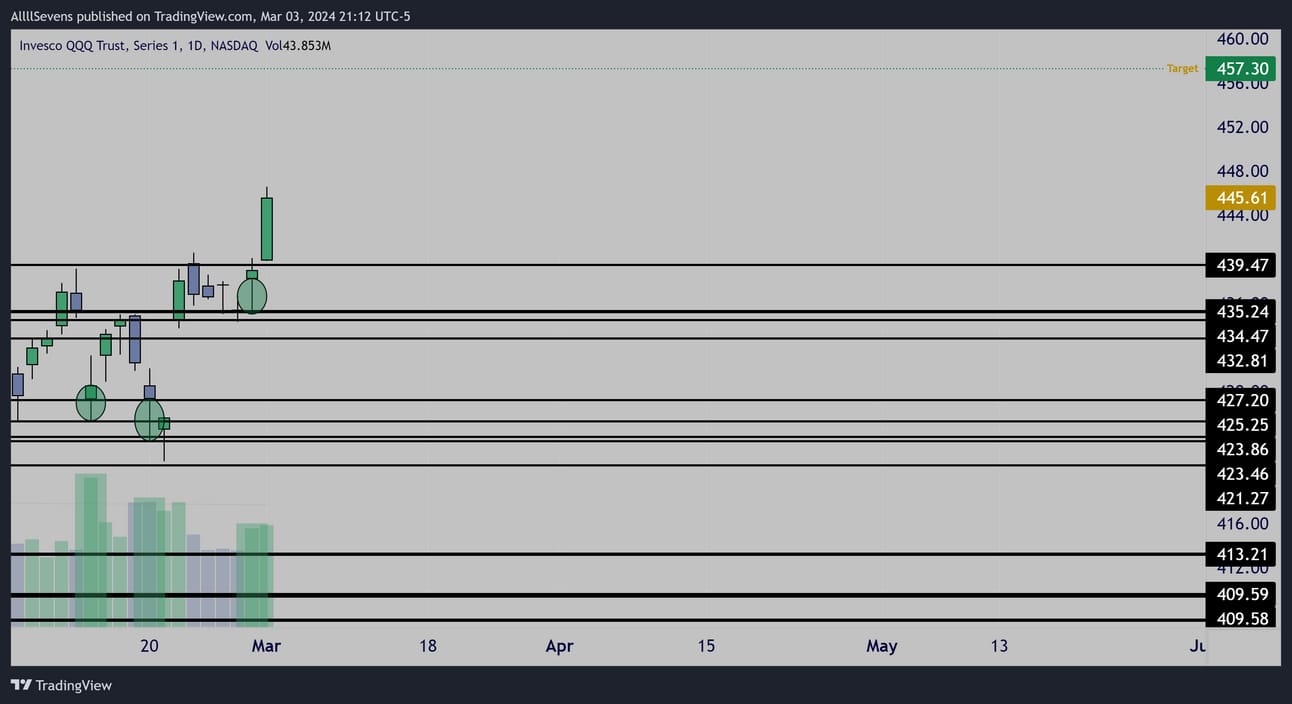

Daily

Conclusion

I’d simply be repeating myself word for word for what I explained QQQ in detail as well. Same ideas explained on SPY are valid here.

The real take-away on the QQQ: IMPORTANT!

Notice it has practically the same long-term projection as SPY…

$700

Yet it’s cheaper…

This is no coincidence.

I believe the QQQ will continue to outperform the SPY over the next few years by roughly 50%

Here’s why:

When the 2022 correction began, institutions loaded both indices.

But, the QQQ saw something historic.

This accumulation candle displayed above was the largest volume QQQ had seen in 10+ years!!!

That’s major institutional rotation into the QQQ over the SPY and perfectly explains the relative strength we’ve already seen over the last year and why it’s likely to continue.

SPY saw this same accumulation, but did not have the same notable historic volume behind it.

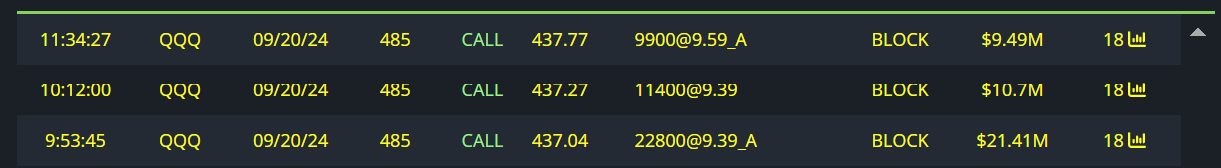

I’ll also not some extremely unusual options flow that came in on the QQQ recently, that was not seen on the SPY.

$41M Calls Purchased on 2/26

AllllSevens+

Upgrade your subscription to gain access to my premium newsletters where I cover indivudal stock picks using this same style of analysis.

Many individual stocks are still in monthly accumulation bases just like the SPY and QQQ last year- they just haven’t woke up yet.

Those are my top focus’s for adding serious capital into with the indices currently trending up and not offering an A+ opportunity to make large purchases at this time.

Also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow.

It’s only $7.77 per month. Try it out!

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjPDr

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply