- AllllSevens

- Posts

- QQQ Nasdaq Update

QQQ Nasdaq Update

Leverage

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of July 14th, 2025. I am not liable for any losses incurred by others.

Preface:

The Nasdaq has not seen the short-term resistance I predicted in my last newsletter.

The long-term institutional investment I highlighted has continued to strengthen.

Price has pushed over all resistance and flows have become unusually bullish.

QQQ

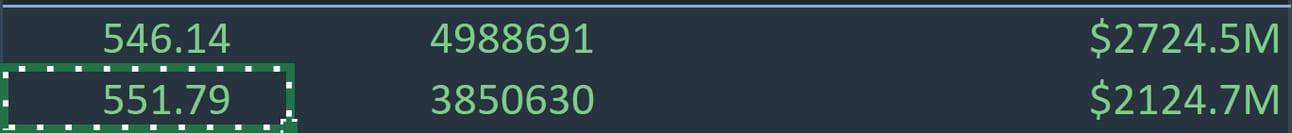

$4.8B Recent Unusual Dark Pool Activity

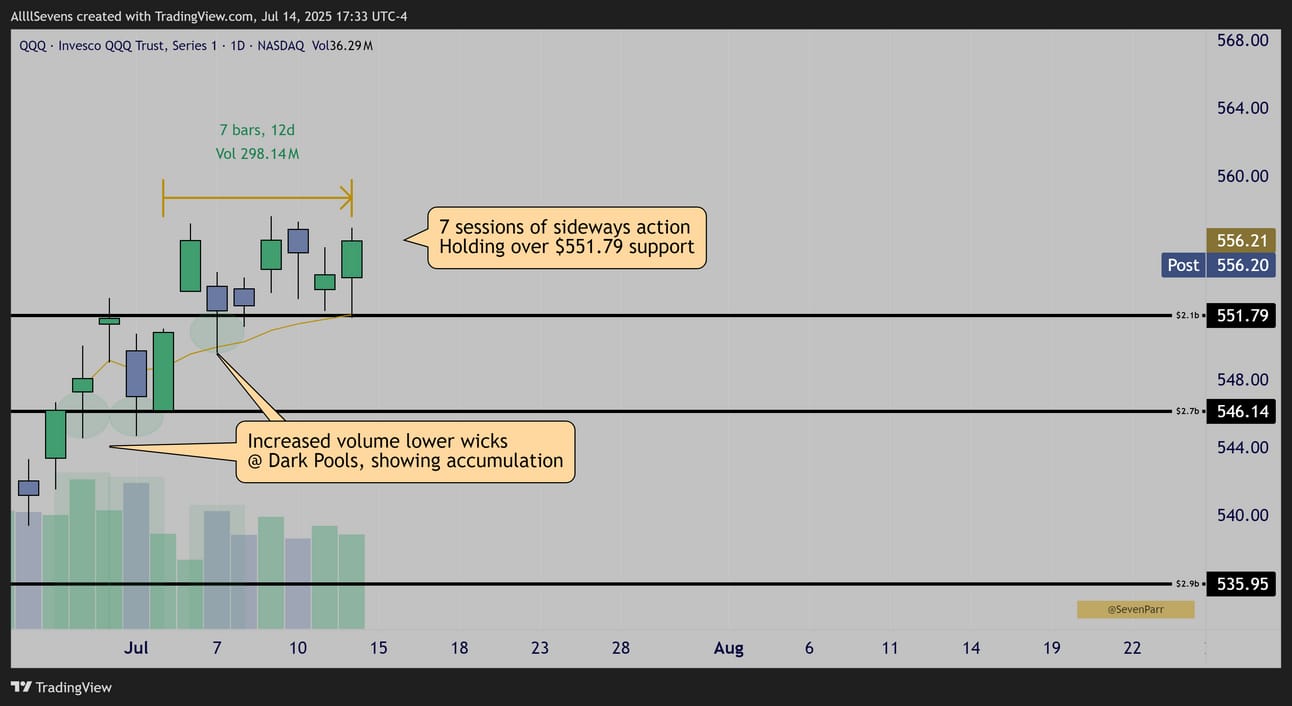

Daily Candles

Institutions are actively accumulating a $4.8B+ long-term position through these larger than normal dark pool levels.

Short-term, price is extremely coiled, setting up for an explosive move to the upside over the $551.79 dark pool.

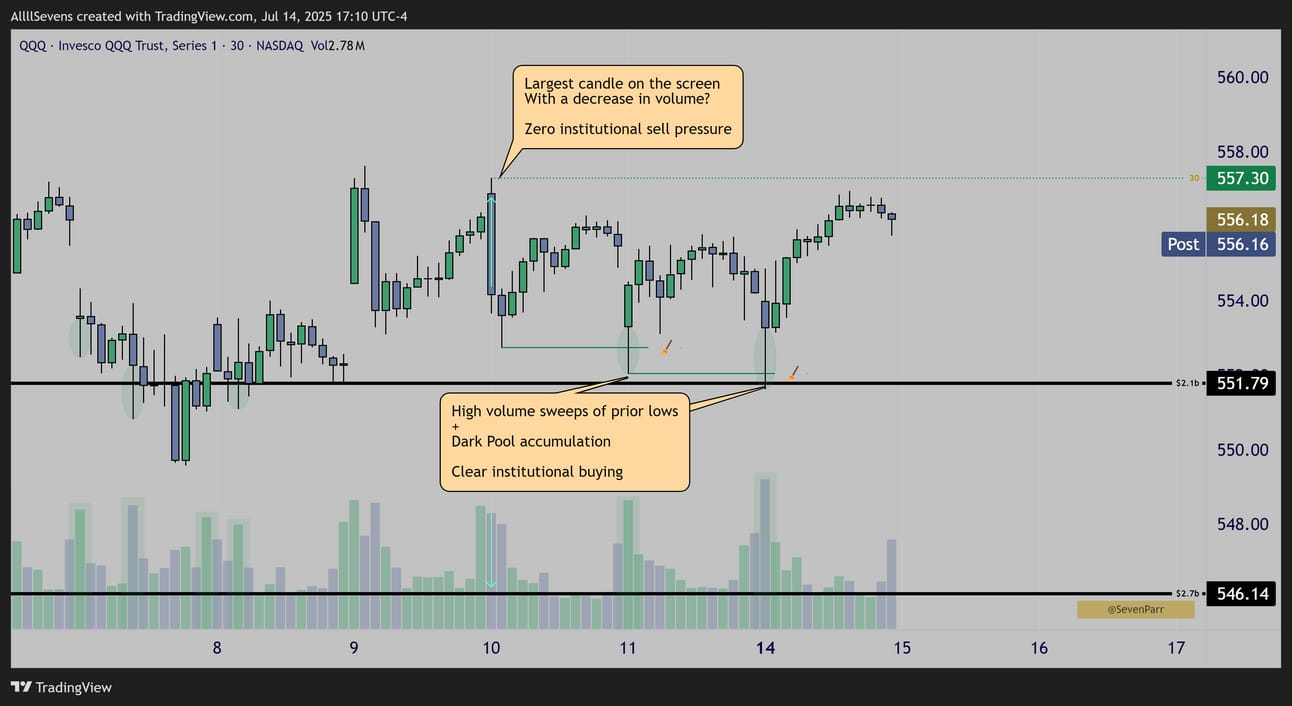

30m Candles

Textbook accumulation patterns over this 7 session compression.

Especially the last two days.

$19.07M Call Buyer tied to a $200M dark pool

An institutional trader placed this bet on July 9th

I assume the $200M DP is a long-term investment

Then, the’re also buying $19M worth of call options…

You don’t see this type of flow everyday - directly tied to a dark pool, confirming it is a very large institutional trader & investor.

The willingness for an institution to be accumulating a multi-billion dollar long-term position AND put on a short-term leveraged trade here got me curious…

I decided to look into the leveraged QQQ ETF…

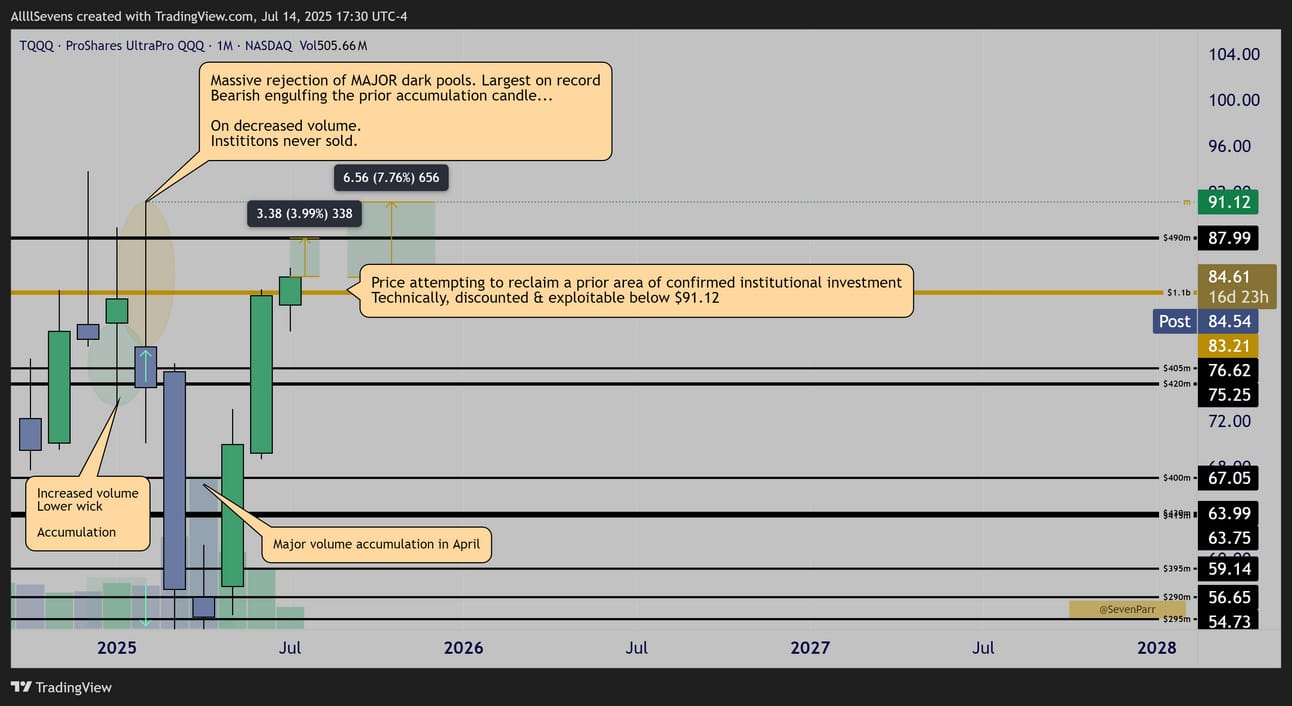

TQQQ Monthly Candles

Back in February a major anomaly discount formed.

An increased spread candle, rejecting major institutional levels…

On decreased volume.

Off institutions' largest dark pools on record, they clearly did not sell or the volume would have been MASSIVE. They’re using these largest dark pools on record to run their largest accumulation campaign over the last 5 years…

Right here. Right now.

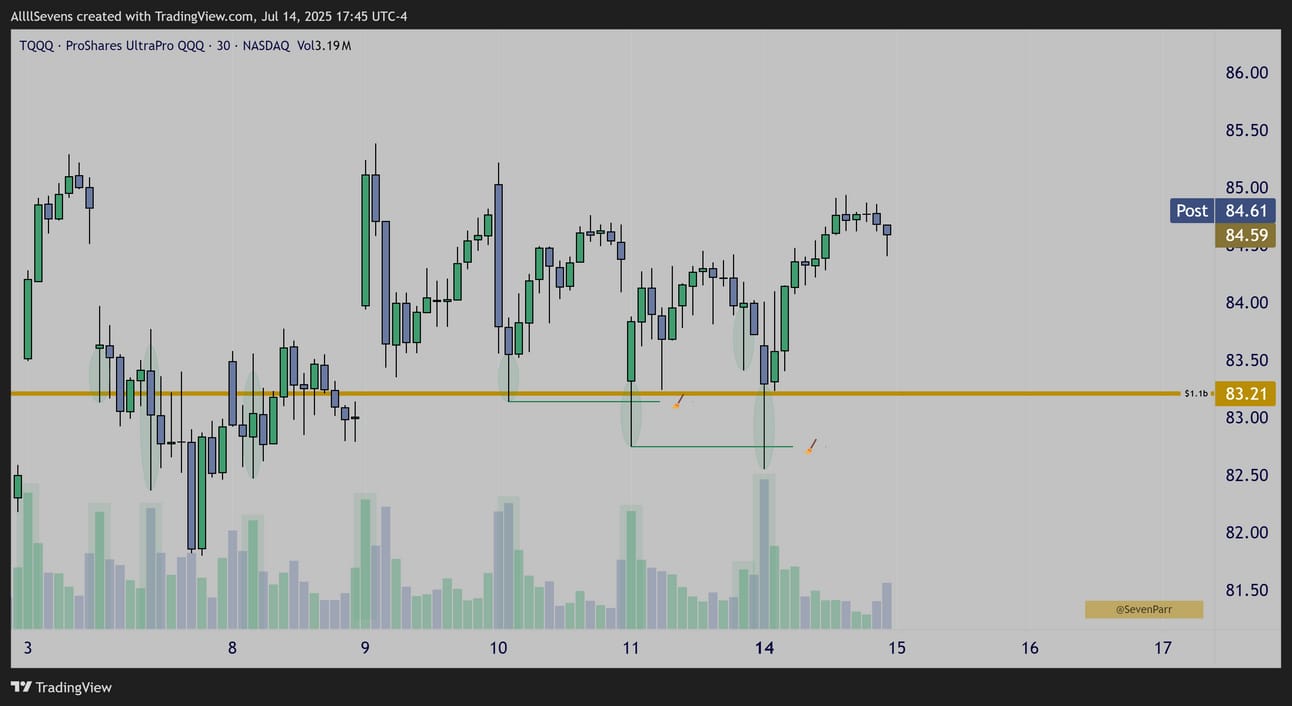

30m Candles

This shows the same accumulation as QQQ over the last 7 sessions.

For this though, right off its largest dark pool on record…

Below February’’s candle high, I believe TQQQ is discounted and this accumulation is highly exploitable and advantageous.

Conclusion

With the stock market at ATH’s, long-term institutional investors remain extremely active, accumulating a $4B+ position in QQQ, a $1B+ position in TQQQ. Below $92.12 TQQQ is discounted. QQQ is not trading at a discount, just 100% continuing to see risk-appetite from smart money.

This is just the data. This is what smart money is doing. Period.

Thee’s a $200M+ short-term bet active on QQQ (dark pool flow)

Over $551.79, it probably works.

Over $83.21 for TQQQ.

I think it’s always important to note the difference in size between the raw long-term dark pool accumulations $4B, $1B, and the short-term trade just $200M

The core edge here is the long-term institutional investment.

That’s the core edge of the stock market in general. Never forget that.

I use BlackBoxStocks to collect all my options flow & dark pool data.

Use this link below to try it for yourself.

http://staygreen.blackboxstocks.com/SHQo

Reply