- AllllSevens

- Posts

- The Real Estate Sector

The Real Estate Sector

A deep dive on an extremely underappreciated group of stocks.

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

Preface

I was initially going to keep this analysis exclusive to AllllSevens+ premium subscribers-

But, I’m deciding to make it free so you can get a sneak peak at the type of content I share.

The Real Estate sector seems long forgotten, down over 25% from from ATH’s and has not participated in the recent market rally whatsoever.

In this newsletter, I’ll breakdown why I believe the sector will undoubtably catch up to SPY and offer massive ROI over the long-term potentially rallying over 100% from current prices.

After breaking down the sector ETF, I will be picking my top individual stocks for premium subscribers.

Let’s dive in.

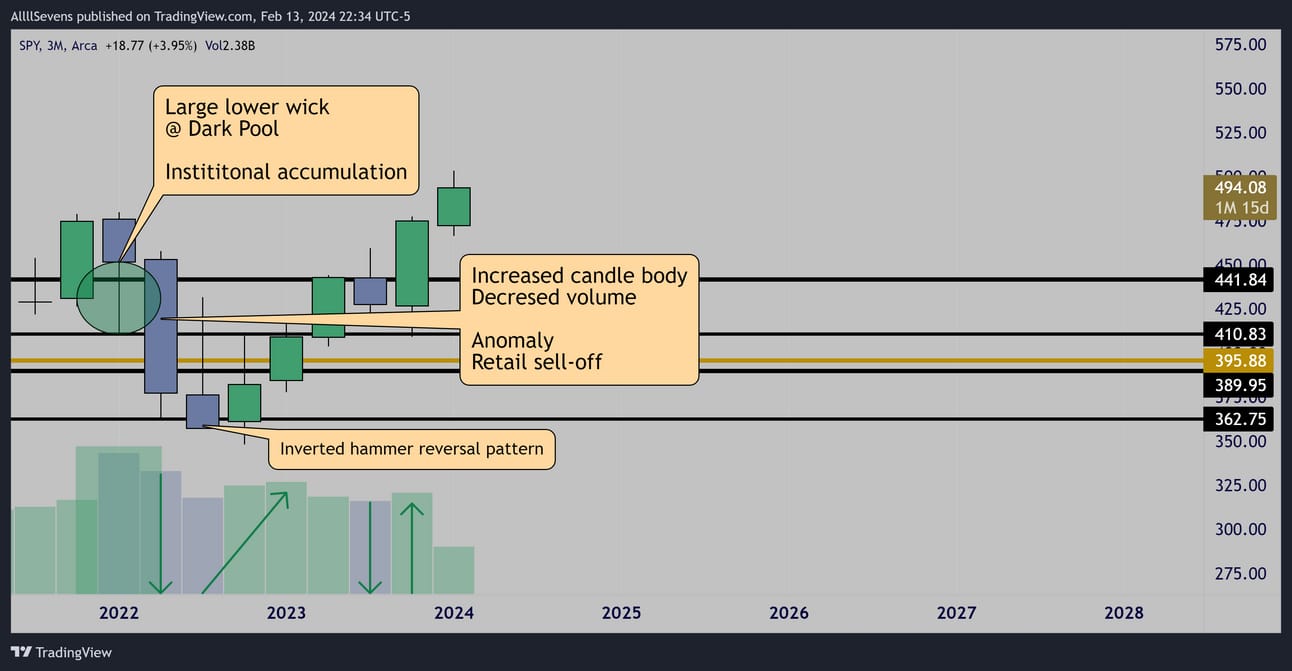

First, I let’s look at the patterns that led to the current $SPY rally.

Quarterly (3 Month)

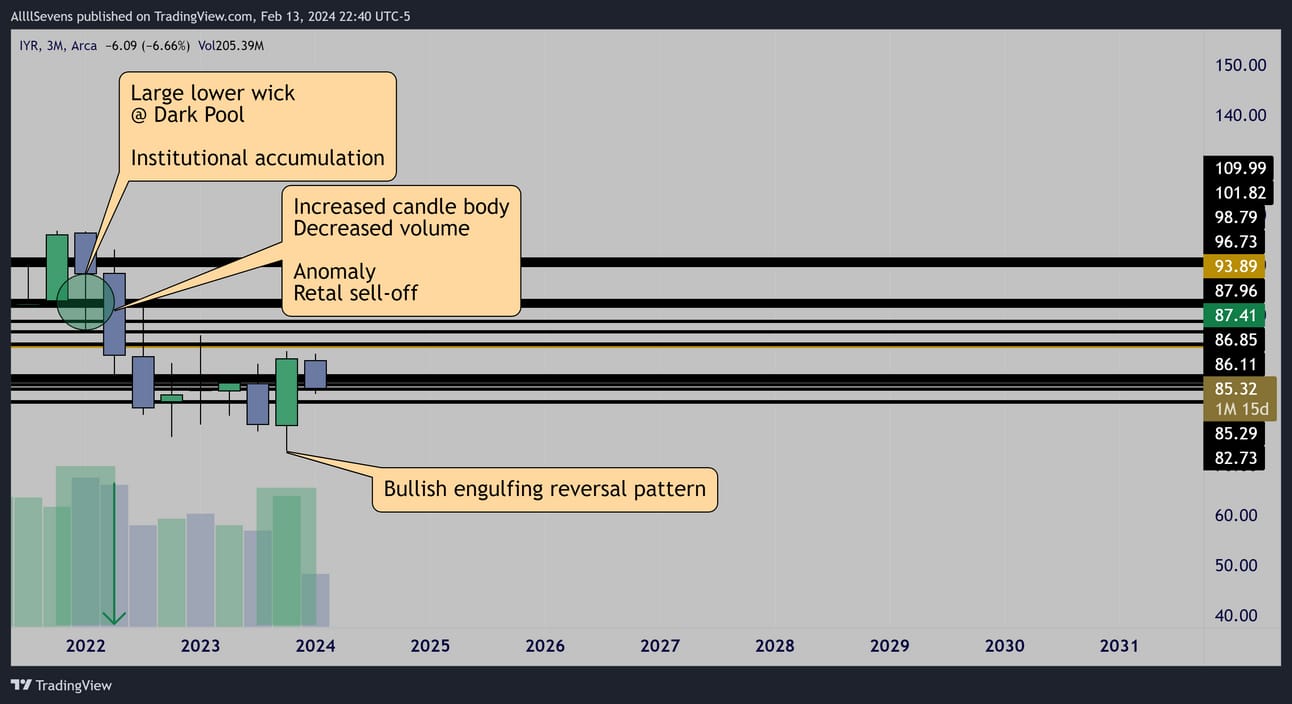

Now, let’s look at the Real Estate sector ETF…

I use the $IYR over the $XLRE due to much more market cap being traded there- more liquidity.

Quarterly

The same accumulation pattern.

The only reason this has not rallied yet is a lack of attention from retail participants.

This massive bullish engulfing candle last quarter makes me think that people will soon take notice and this will begin a rally.

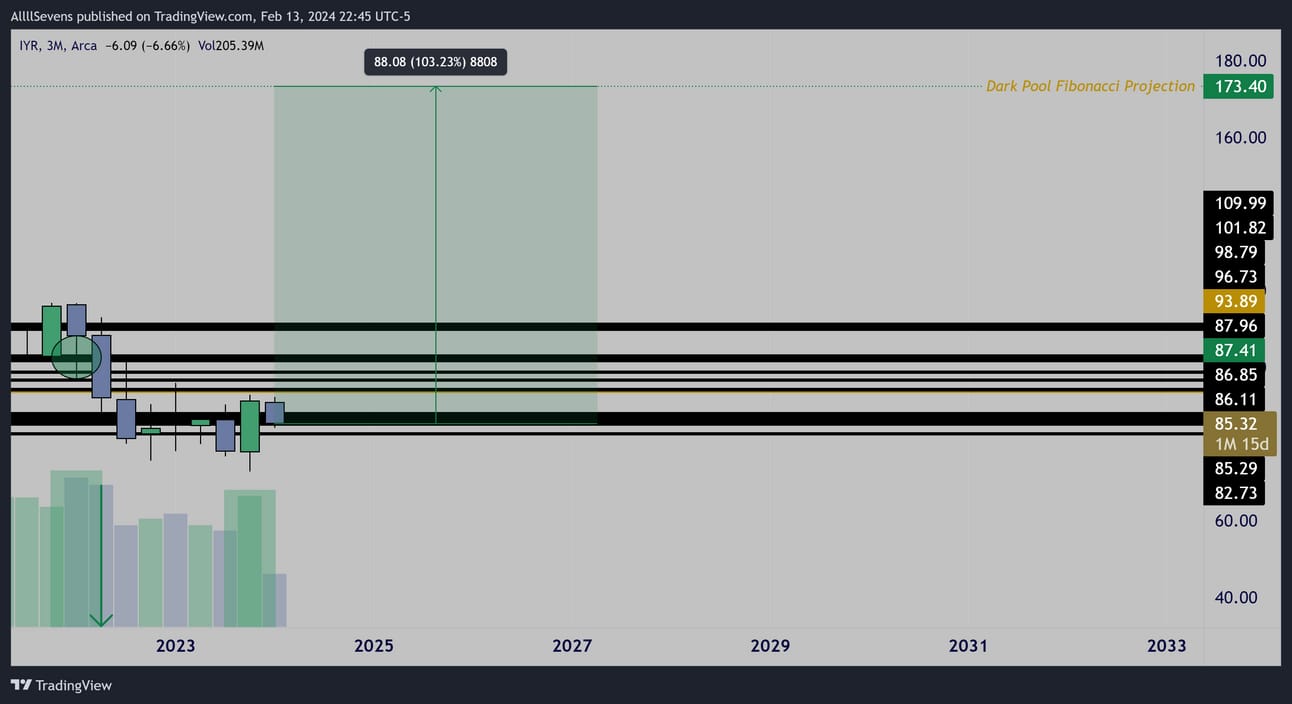

Quarterly Long-Term projection

I project this will double over the long-run.

Keep in mind this is a 10yr+ target. I’m not at all saying this happens in a flash- it will take multiple years.

So, we have a strong reversal pattern on the quarterly chart…

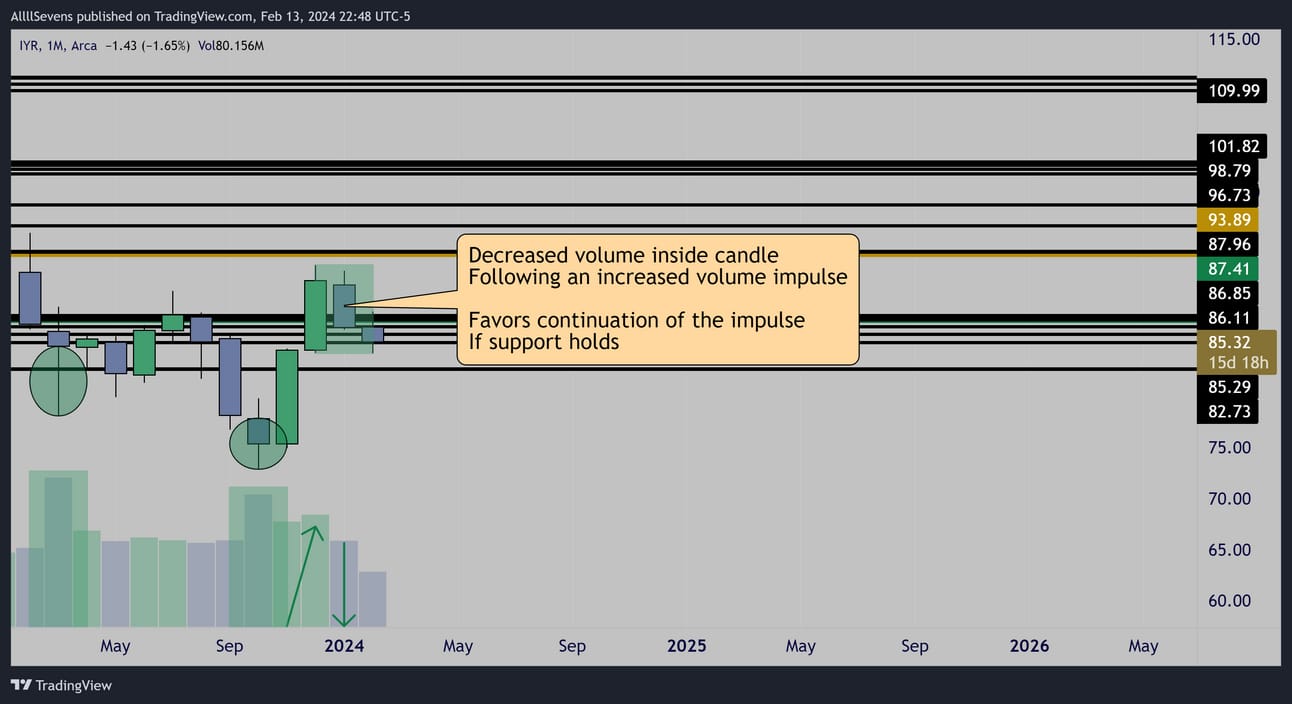

Monthly

And a strong continuation pattern on the monthly chart.

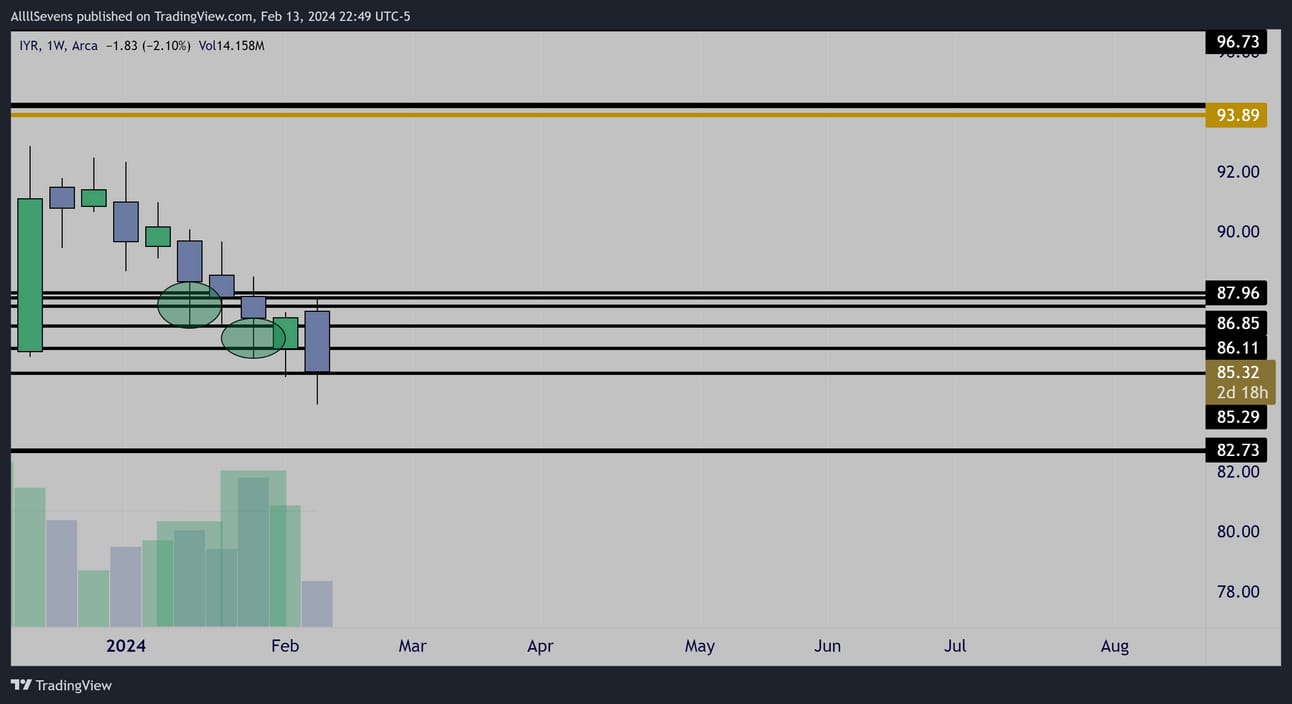

Weekly

Buyers clearly stepping in as support is retested.

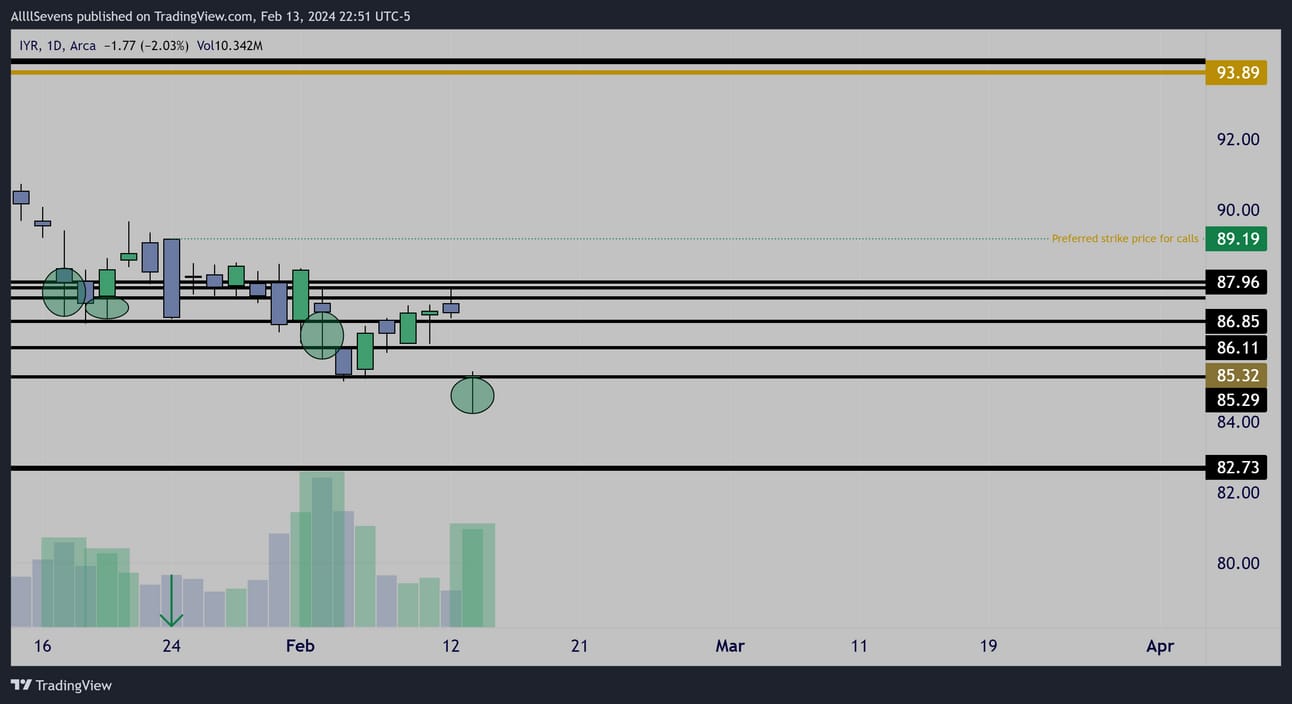

Daily

Some of the most aggressive accumulation patterns I have ever seen…

(Proffered strike price is for shorter dated calls, not for the longer dated contracts I plan on trading. Will explain in a moment.

I do also want to look at the $XLRE chart here.

Daily

This ETF just saw it’s largest daily volume in almost two years!!!

Conclusion

I think investing in the Real Estate sector for a long-term recover is an absolute no-brainer. The entire market seems to have forgot this sector even exists… and there’s nothing wrong with it. Institutions have been and still are loading it to the teeth. When others are uncertain and fearful, it’s likely a great time to be a long-term buyer.

So, regardless of whether or not the short-term reversal works-

It COULD completely fall on it’s face and the long-term analysis remains the same. In fact, the chart begins to look even more attractive the lower it potentially goes. But, I’m confident in the short-term reversal and I will be looking to trade call options on this. Here’s my plan:

Unfortunately, the open-interest on leap contracts right now is terrible.

There’s not enough liquidity for me to feel comfortably buying those.

My plan then is to trade a shorter dated contract and eventually roll into a leap with profits if the OI increased by then which I assume it will.

So, the real edge here is on the following time frames:

Quarterly reversal pattern (Bullish engulfing)

+

Monthly continuation pattern (Decreased volume inside candle)

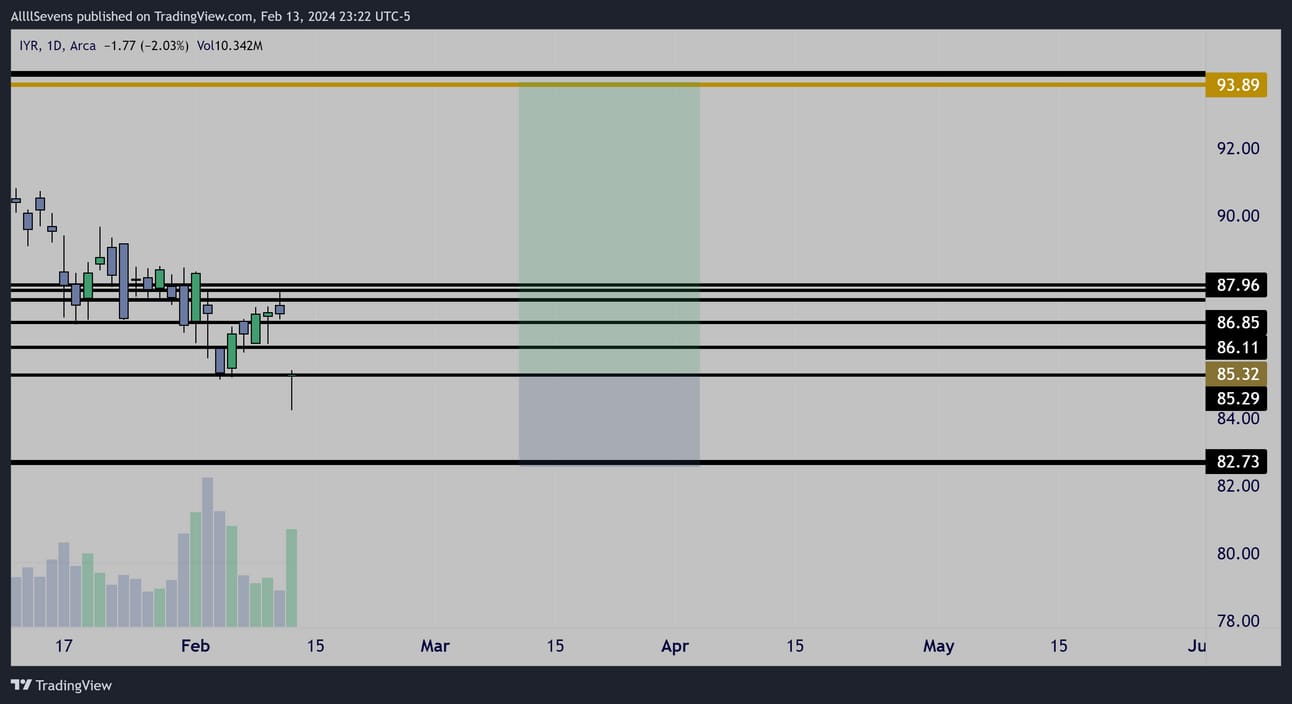

There’s a high probability that the IYR expands at least to the $93.89 level by the end of this quarter.

I have two contracts I’m interested in:

6/21 93c is THE perfect contract @ 1.40 right now

Plenty of time for this to go in-the-money by expiration.

3/15 89c’s also look great @ .75 right now

Ideally, the current Daily candles lead to a reversal.

I want to take starters on both expirations right now.

But, I do want to leave some capital on deck for an average down if for some reason the Daily reversal fails and we test lower support.

A $3 drop from here would be a brutal drawdown on call options and it wouldn’t necessarily invalidate my thesis so I’d want to add more.

Now, IF this that does happen, it will be critical that the monthly candle leaves a lower wick and recovers by the end of month closing over 85.29

If it doesn’t, then a stop-loss will need to occur and a re-assessment will be made.

I’ll update this thesis consistently on 𝕏

WOW, right?

If you’re intrigued by the potential of this sector ETF, you’ll love some of these individual stocks behind the paywall break just below👇

Reply