- AllllSevens

- Posts

- Spotlight Newsletter

Spotlight Newsletter

Salesforce Inc - $CRM

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

Today’s newsletter may seem a bit strange, as CRM reports earnings after the bell- a very “random” and volatile event that could make me look very very dumb… or very very smart.

I think regardless of THIS report, CRM will prosper over the coming few years as long as it holds supports I outline below.

It has been lagging the broader market (SPY) for quite some time now, and the volumes suggest this will soon come to an end.

I’ve also been seeing some major bull flows that agree.

CRM

Monthly Interval

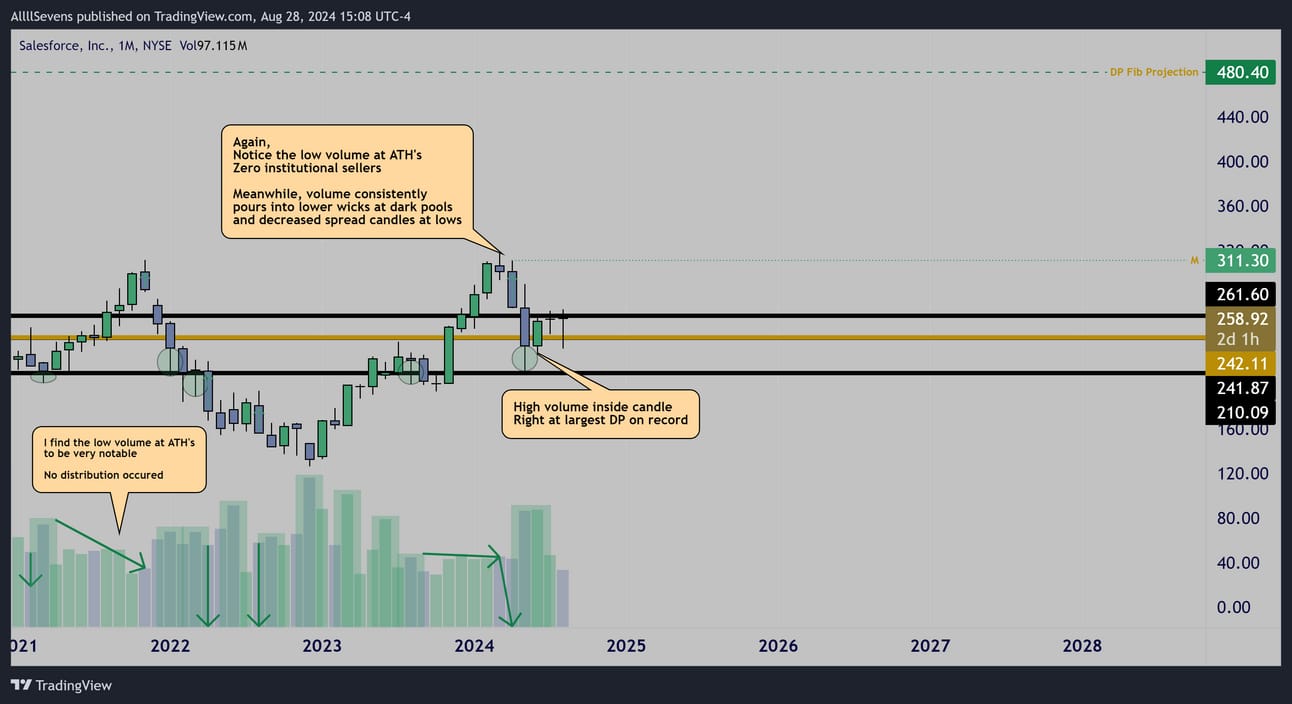

Here we have the last 3.5 years of price action on display for $CRM

Let’s start off with March 2021 when we see our first accumulation.

A high volume lower wick at the $210.09 dark pool, notably following a very low volume rejection of the DP above @ $242.11

This is extra significant because $242.11 is actually CRM’s largest DP on record. So, we see very clearly they did NOT sell off that level-

They used it to let retail reject, and buy the dip off $210.09

Over the next 6 months, ATH’s are made- and rejected.

I immediately look to the volume… none.

Specifically relative to the March accumulation.

Price falls sharply, as did the entire stock market during this time.

What we see next are two more accumulations off the $210.09 DP

Price actually ended up losing this level as the overall market trend and sentiment was severely negative, with not a single positive headline hitting the markets. Pure fear. Pure panic. Pure short-term thinking.

Institutions were the only ones with their heads on straight…

Notice the volume backing this loss of support.

The April 2022 sell-off losing $210.09 was backed by DECREAED volume.

The prior accumulations stand. Institutions held. Retail sold.

In the following months, even larger volumes come in-

With no dark pools left, we need to focus on the size of the candle bodies. Major volumes came into lows… creating very small candles.

Tons of effort (volume) producing very little result (candle bodies).

This signals stopping volume. AKA more accumulation.

Finally, in December of 20222 while the rest of the market (SPY) has already placed a bottom, CRM marks it’s low.

Dark pools begin to get reclaimed and price surged straight back to ATH’s over a year’s time.

Again, price rejects.

Again, on low relative volume.

Institutions are STILL holding shares they’ve now spent the last three years accumulating despite a second ATH failure.

For the last 6 months, price has pulled following this rejection.

It did not directly test the well-known $210.09 dark pool, instead institutions were extra eager this time around- accumulating just above it and forming a very high volume decreased spread candle right at / above the largest DP on record @ $242.11

The volume we see here buying the dip during May-June is the highest volume seen since March 2023 when $CRM first began reversing from lows. Very notable volume.

Not only do we see notable accumulation here-

We see a “high volume inside candle” form, which is also probabilistic upside reversal pattern, especially off a stock’s largest DP on record.

Now, this is where things get interesting-

How’s the options flow looking on $CRM this year & during the recent pullback?

$15M Call Buyers for December 2026

$15M Call Buyers for June 2026

$1M Call Buyer for January 2026

$7.5M Call Buyers for June 2025

Whales on the options flow have absolutely bombarded $CRM with leap call options. Most of them are notably OTM

These look like very clear directional bets-

Conveniently, lining up perfectly for the monthly reversal pattern we’re seeing off out largest DP on record.

We even have a full blown degenerate throwing $1M into two-week expiration call options ahead of today’s report.

$980K Call Buyer for EARNINGS

Thank you for taking your time to reading this newsletter.

If you found value,

Make sure you’re subscribed for my next newsletter!

Make sure you’re following me on 𝕏/Twitter @SevenParr

If you really really like my work-

Upgrade your subscription to AllllSevens+ for just $7.77 per month.

I will occasionally send a premium newsletter & you will also get access to my Discord where I gather and collect my data throughout the week.

Premium is a way to show your support of my work.

It’s cheap for a reason. Most of the value I provide is for free because my goal is to help as many people as possible see the market for how it truly is. Upgrading is a way to give back!

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Feel free to DM me on twitter for the colors I use.

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply