- AllllSevens

- Posts

- Spotlight Newsletter

Spotlight Newsletter

Apple Inc - $AAPL

Disclaimer

Before you read this newsletter, it is crucial to understand the following:

-Background: I am a 22 year old college dropout with no formal education or professional experience in the fields of finance, investing, or stock market operations.

-Content Nature: All information I share is purely speculative and represents my personal, abstract opinions.

-Take With Caution: Approach the ideas, concepts, and data presented with a healthy dose of skepticism. They should not be considered as definitive or accurate information.

-Not Financial Advice: This content should in no way be interpreted as financial or investment advice. It does not constitute a recommendation to buy, sell, or hold any securities or financial instruments.

-Investment Risk: Investing and trading the stock market involves significant risk, including the potential for substantial financial loss.

-Professional Consultation: Always consult with a licensed financial advisor or perform thorough personal research before making any financial decisions involving the market.

-Liability Disclaimer: I bear no liability for any financial losses that could result from actions taken based on the information provided.

XLK

The Technology Sector currently accounts for over 30% of the $SPY’s holdings, highlighting its critical importance and significant impact within the ETF.

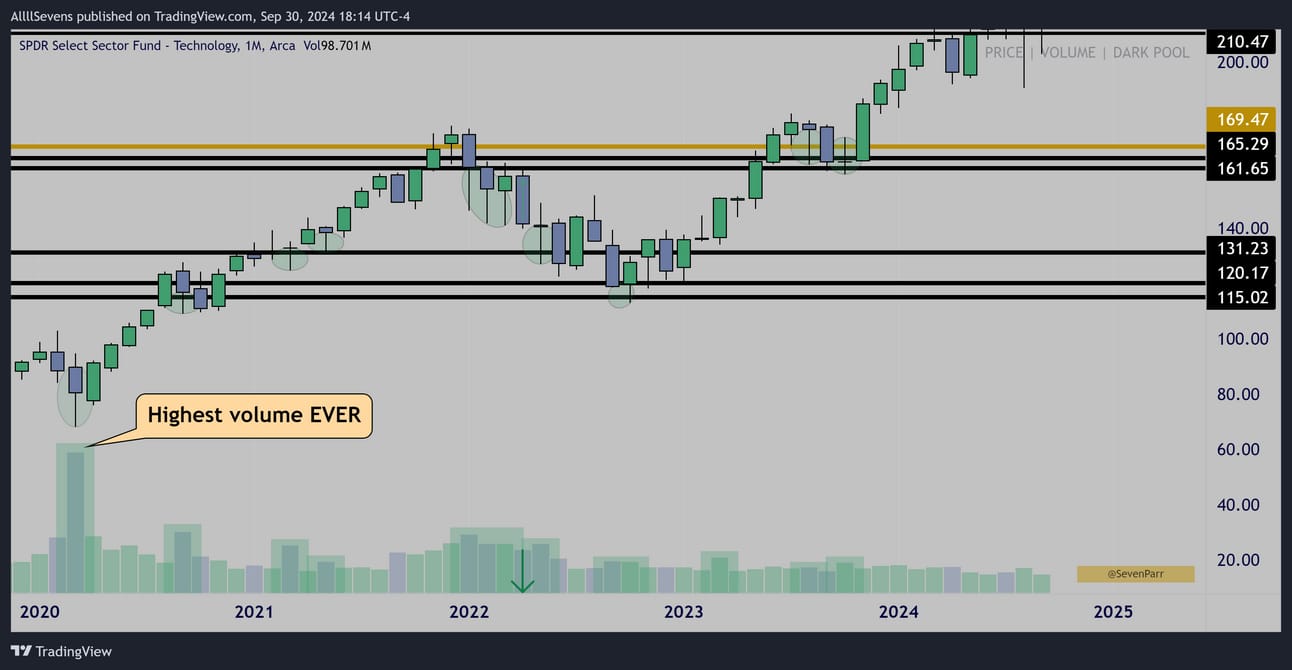

$XLK Monthly Interval

During the 2020 COVID “crash”, this ETF experienced its highest trading volume ever, characterized by a prominent lower wick, indicating what I see as the largest institutional investment ever made into the Technology Sector.

This substantial level of investment has lead to the sectors recent outperformance!

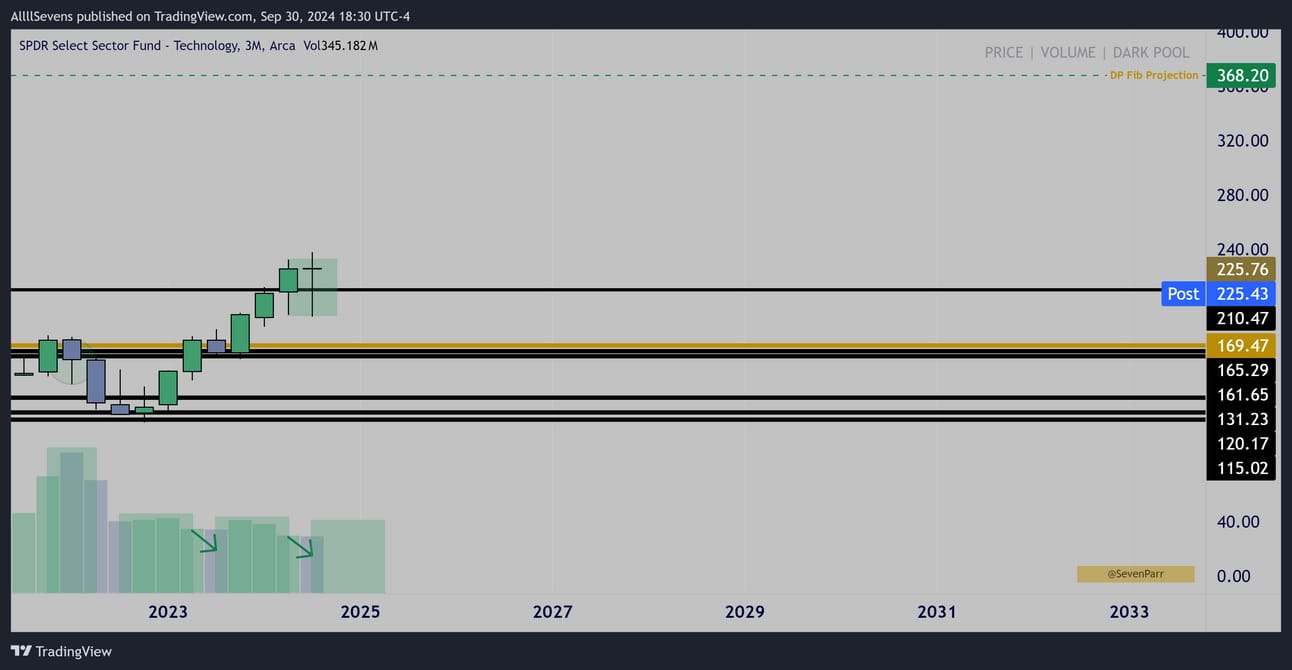

Quarterly Interval

Within a strong up-trend, phases of decreased-volume sideways action supported over Dark Pools present significant opportunity, typically signaling the prelude to explosive upside continuation. For the last three months, price has done exactly this, basing over the $210.47 Dark Pool.

Oddly enough, the last time a phase like this occurred was almost precisely at this same time last year. Price stalled during the summer and went sideways over Dark Pool support for multiple months until eventually expanding upwards for a classic end-of-year rally. It appears history could be repeating.

If I am correct, and this happens, I don’t have a short-term target.

Only a Long-Term Dark Pool Fibonacci Projection @ $368.20

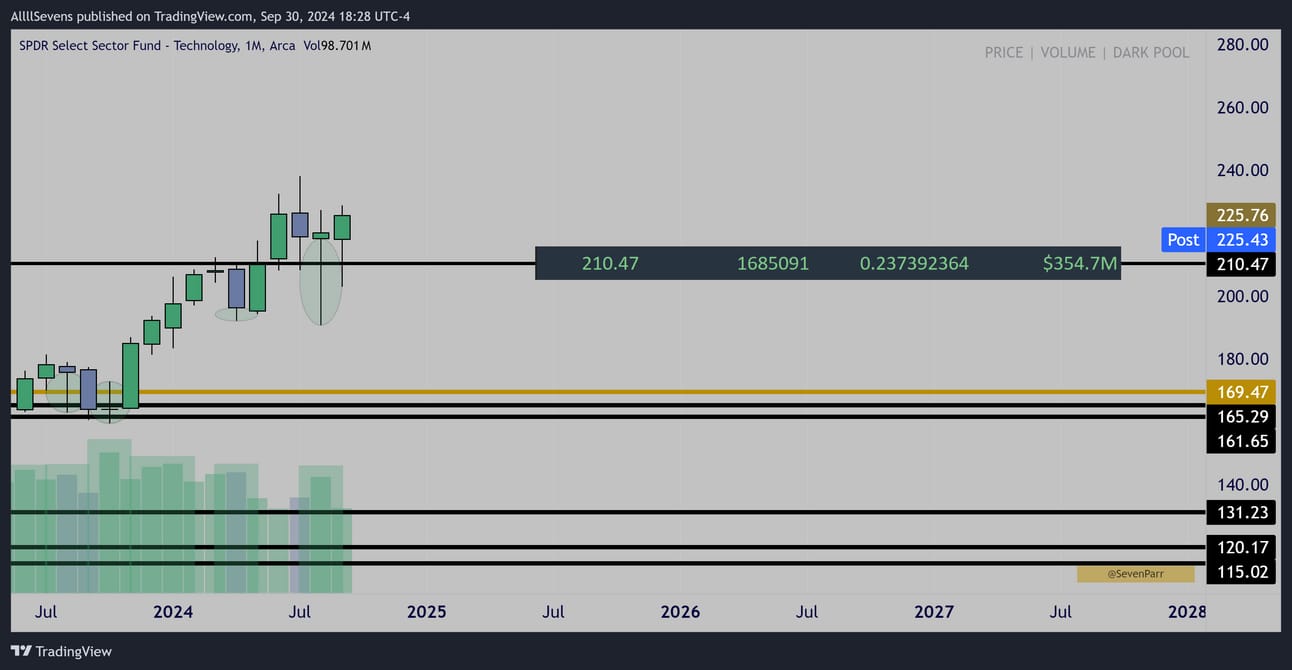

Monthly Interval

This time frame directly illustrates an institutional buy presence off the $350M Dark Pool that price has been supported from.

Weekly Interval

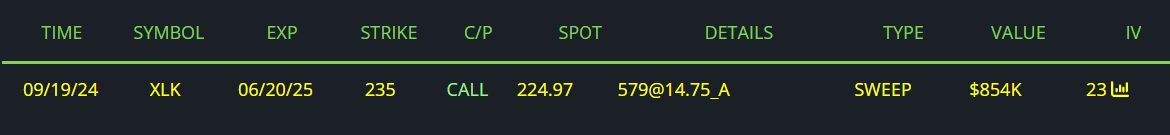

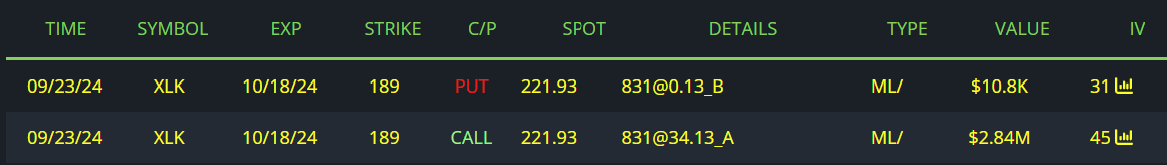

Unusual Options Flow

$850K Call Buyer Into 6/20/25 235c

$2.84M Call Buyer Into 10/18 189c

Bonus: Smaller $58M Dark Pool clearly being accumulated

See tweet here

Conclusion

We have the largest Sector inside the $SPY setting up for an explosive EOY rally if it can continue holding support.

What about the largest holding in the $XLK? (also the largest individual stock in the $SPY. The largest stock by market cap in the world actually)

That is the true purpose of this newsletter.

$AAPL

This recently saw it’s largest Dark Pool activity on record.

In fact, it has seen a series of unprecedented Dark Pool transactions.

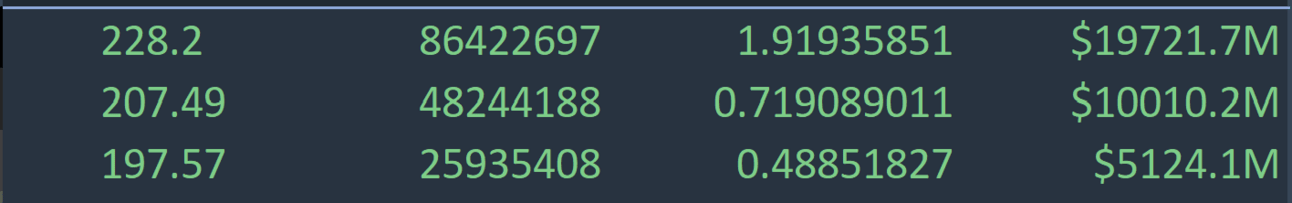

Share Price Volume % of Avg. Daily Vol Notional $

Three consecutive largest Dark Pools on record have came in for $AAPL, each time 2x as big as the other… Just like outlined in this week’s newsletter covering the $SPY $VOO & $IVV, AAPL has not seen activity like this for years!

Very large amounts of shares are exchanging hands.

Someone must be buying all the shares Buffet has sold…

Anyways,

AAPL has had a strange year, lagging the rest of the market tremendously for the first Quarter and after finally breaking out, it has been sideways for yet another quarter, but this time alongside the entire $XLK.

With this finally coming into synch with the rest if the market, I think it can really help fuel this next leg higher, LEADING and outperforming into the EOY.

In the remainder of this newsletter, I will detail the distinctive patterns on AAPL as well as some significantly unusual options flow that suggest this potential outperformance is on the horizon.

Detailed $AAPL analysis 👇

Reply