- AllllSevens

- Posts

- Spotlight Newsletter

Spotlight Newsletter

Honeywell International Inc - $HON

Disclaimer

All information presented in this newsletter are my personal opinions & for speculation purposes only.

Nothing is intended to be interpreted as financial or investment advice.

Preface

I won’t pretend to be a fundamental expert, but after reading a few articles I’ve found out that Honeywell International Inc is one of the top 100 companies in the United States by revenue and it plays a crucial role in the global aerospace industry.

This stock falls into the Industrial sector, which as outlined in a prior newsletter, has been compressing & accumulating for 4+ months now, and appears to be breaking to the upside.

Read that here.

If this sector-wide breakout is successful, I believe recent laggers of the bull run like $HON, could finally “wake up”.

HON

Daily Interval

After a negative reaction to earnings, there seems to be a strategic accumulation campaign being ran by institutional investors, specifically off their $199.04 & $205.45 Dark Pools.

The $199.04 DP has seen significantly more volume, creating a notable volume shelf and potential “launch-pad” for the stock as it consolidates here pinned below it’s Earnings-Anchored VWAP.

If $199.04 can remain support, and VWAP ($201.5) can be broke, this has explosive potential, at least to the top of this range.

But, I’m looking for an ever larger breakout considering the upper DP has also been accumulated, and an open gap lies above.

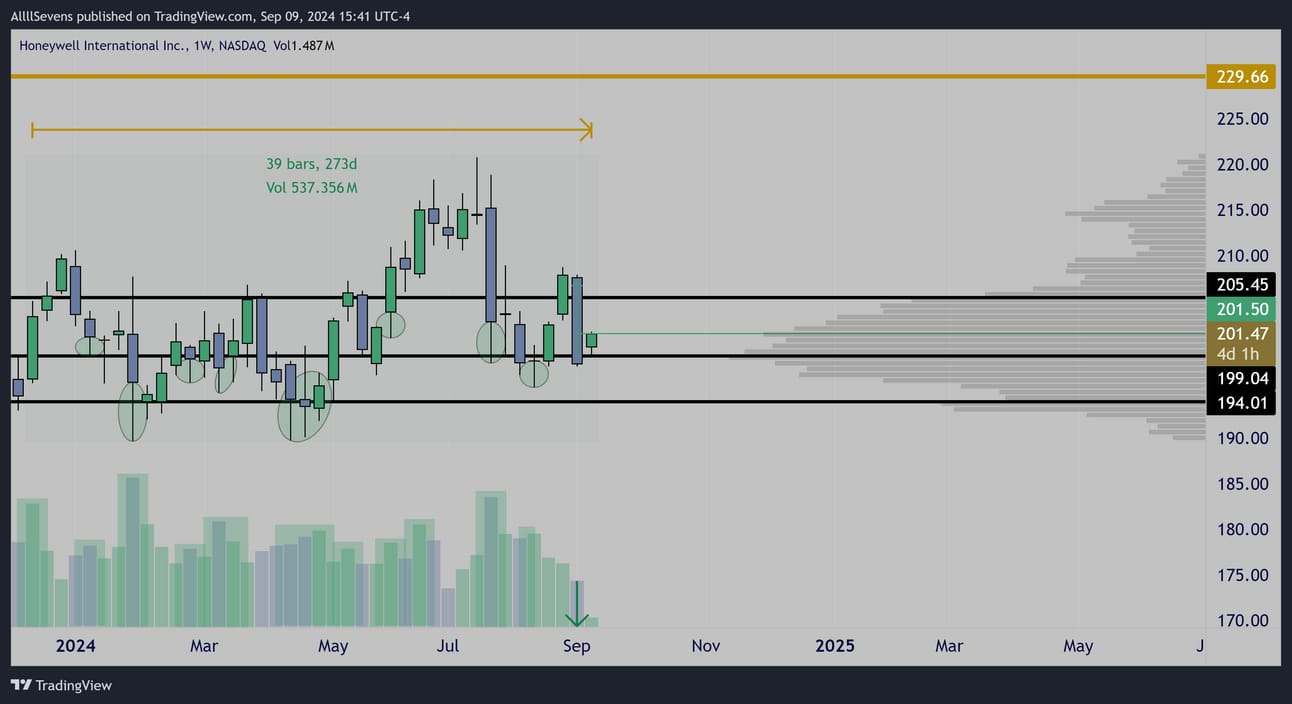

Weekly Interval

Zooming out, it appears $HON hasn’t just been accumulated since the recent earnings drop, but for almost 40 weeks now…

Last week’s candle is the second largest on the screen, and is backed by extremely low relative volume. Very notable.

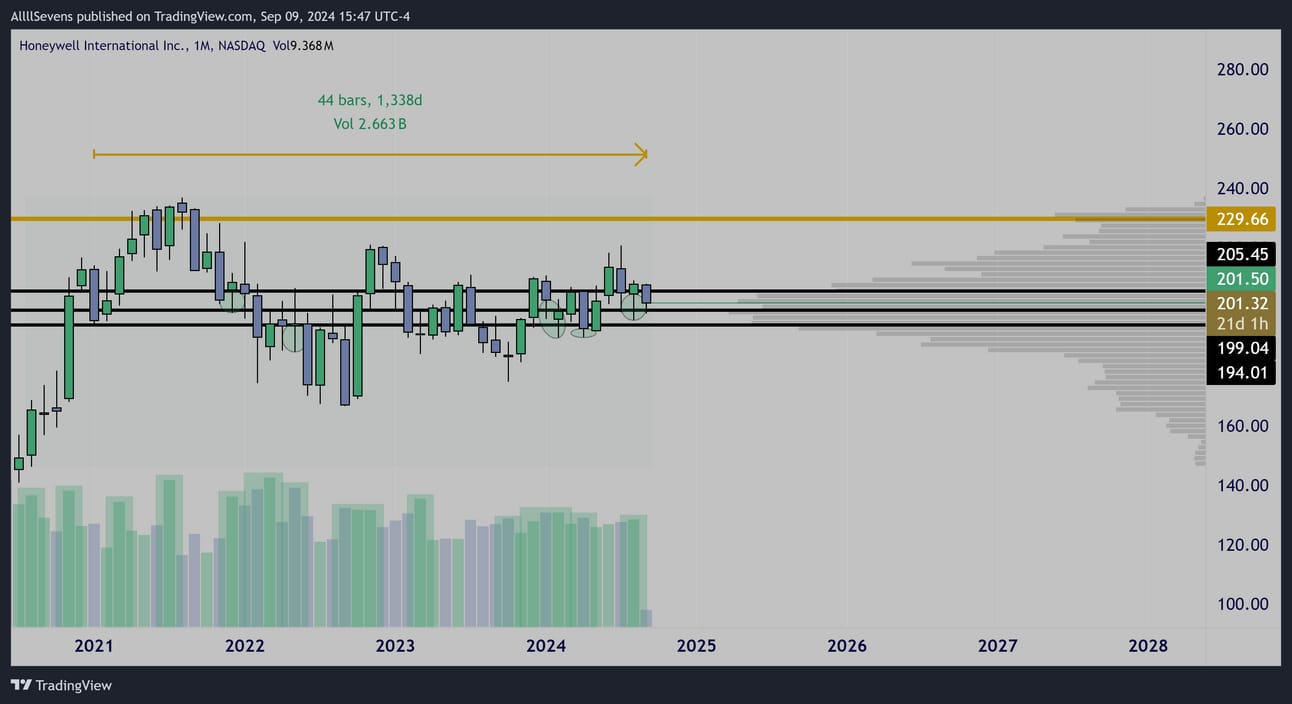

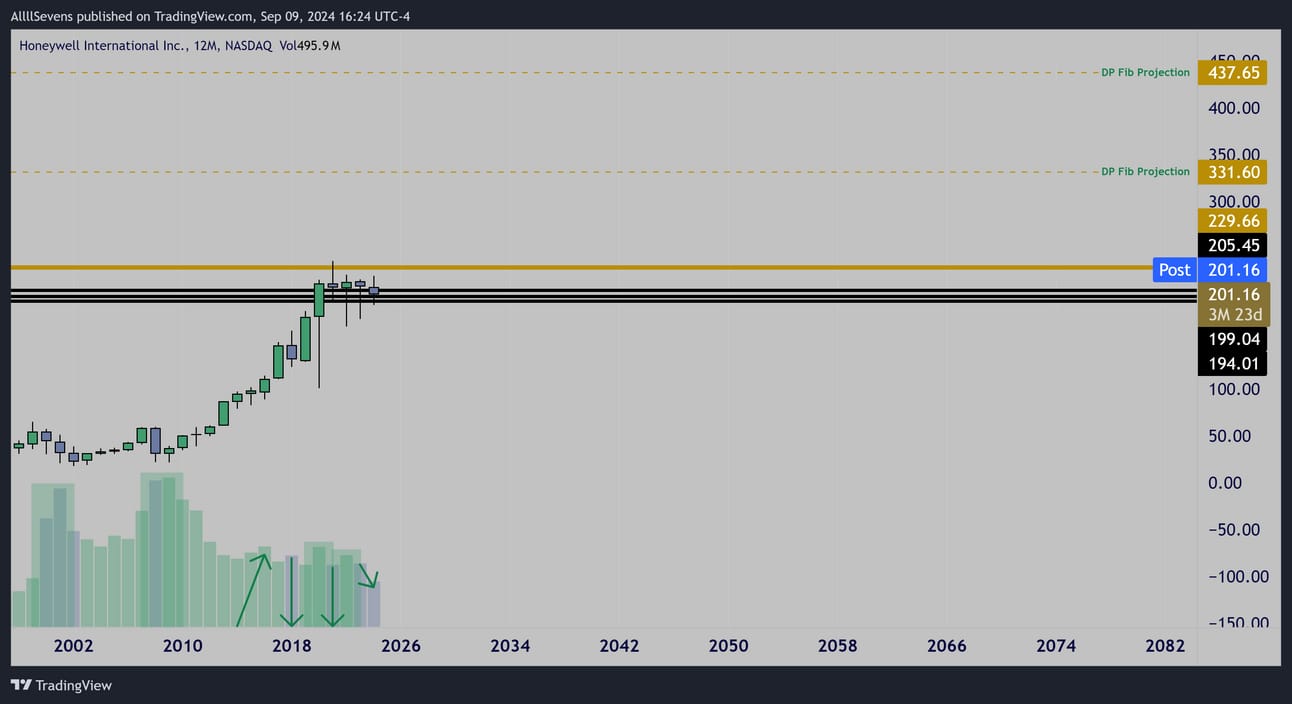

Monthly Interval

Stepping back even farther,

$HON has been compressing and accumulating for over 3.5 years.

It’s now positioned directly inside the primary Dark Pool demand & volume shelf support zone between $194.01-$205.45

This is poised to potentially make a significant breakout move in the near future. How big?

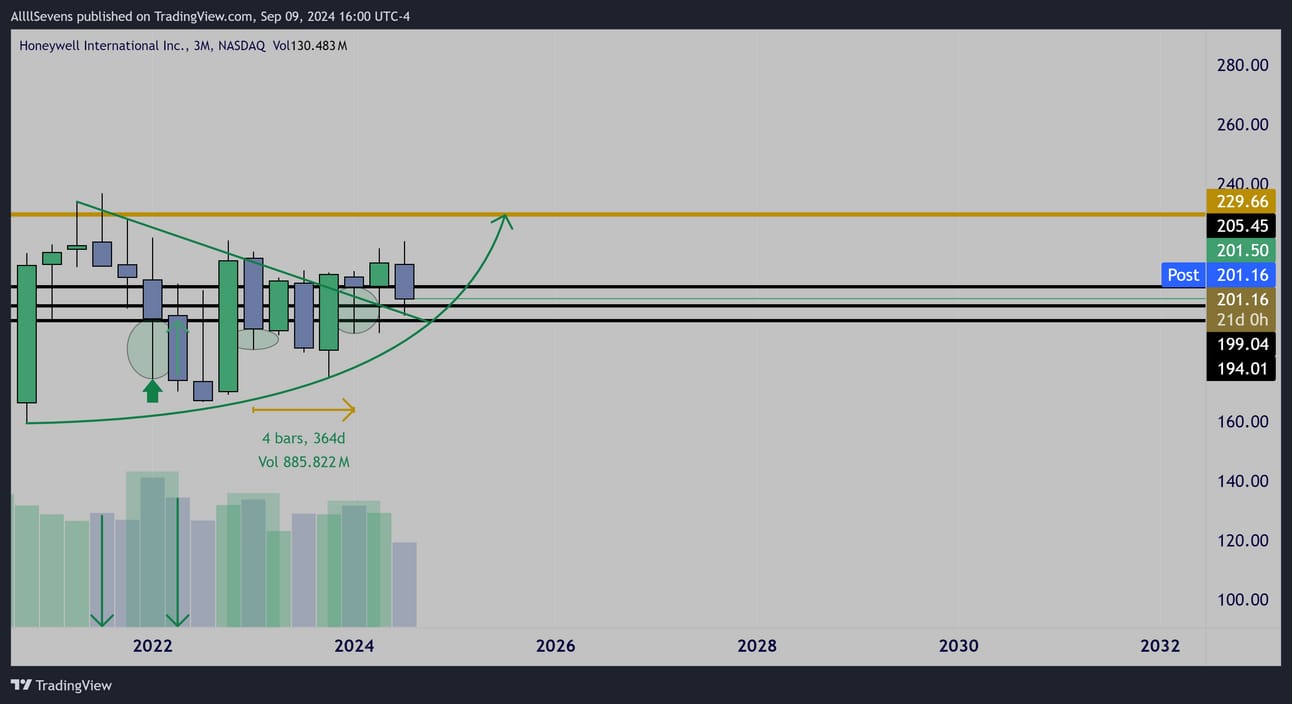

Quarterly Interval

$HON has been in a multi-year downtrend, finally on the verge of breaking out and seeing a very strong uptrend.

I like to think about the volume build up here here as “fuel” for a potential long-term rally to ensue.

Volume + Price Compression = Very Large Sustainable Moves

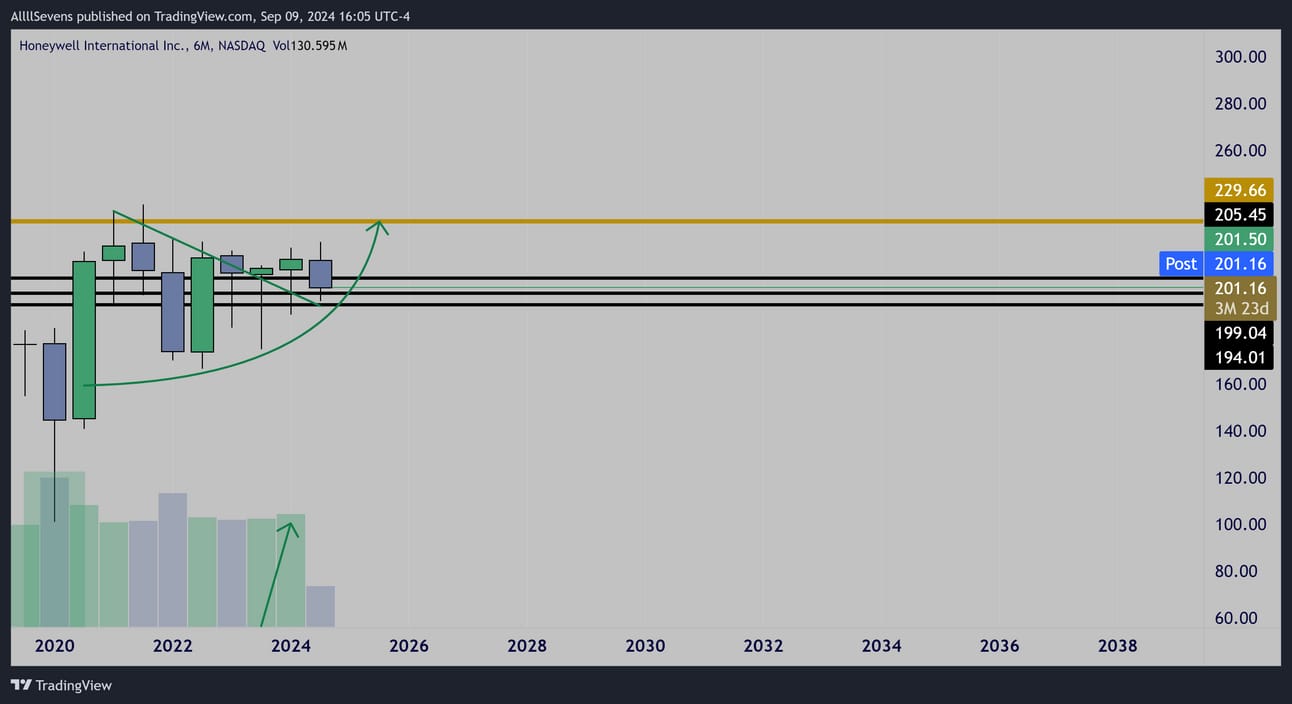

6 Month Interval

On this time frame, we can see during the 2022 dip, $HON experienced significant accumulation, which has yet to manifest itself in price…

Price simply rebounded, and has been sideways since…

This adds a whole next level to the accumulation and compression here.

I also want to point out the increasing volume “tweezer bottom” formation currently in play out of demand. Upon retesting, (the recent ER drop), institutions have been aggressively accumulating in attempt to establish a third higher high.

I’m starting to see the true scale of things here…

This isn’t just a day trade.

There is fuel here (volume) for a massive upwards price expansion over multiple years to come. Let’s zoom out one last time.

Yearly Interval

Coming off an incredibly high volume double bottom after the 2008 financial crisis, these last few years of compression & accumulation mark the first significant pause in trend since.

What if price $HON is about to get more parabolic than ever?

I have what I see as a conservative long-term projection at $331.60

My more realistic long-term projection is $437.65

I do not have a time frame for this, I just expect those prices to be hit as long as price continues to hold the Dark Pool Demand outlined above and successfully begins a rally.

If it fails short-term, I can watch for a new entry. No need to bag-hold.

I have been observing and collecting data on this stock for over a year, and only now do I see a high conviction possibility for a short-term uptrend and multi-year breakout to finally ensue.

My approach here will not be to “go all in” right now.

I’d like to make a substantial purchase, with stops below the $199.04 DP

And rather than DCA’ing into a stock that’s trending down, I’d like to DCA as this stock develops an uptrend. If my thesis is correct, this stock should push higher for a long time…

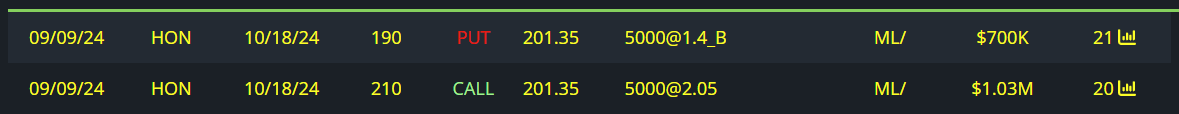

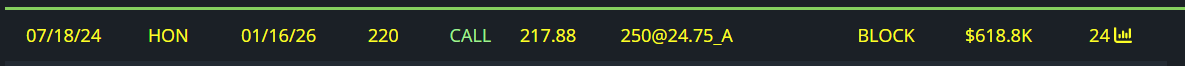

With that said, we have a very short-term bullish bet coming in today, which is a large part of why I a finally releasing my thesis on this.

This whale is betting $199.04 holds, $201.50 breaks, and $205.45 gets broke, beginning a strong uptrend.

Notice, there’s actually not a lot of flow here…

That’s because they are waiting for true trend to develop, as I mentioned DCA’ing an uptrend above.

Whales are waiting to throw bigger money into calls here.

Price is still in a heavy congestion phase on the Daily and Weekly, and it’s just never great to go all in at these moments.

When/If this breaks to the upside, and the quarterly / 6 month candles start to confirm another bounce from this demand- that’s when whales will begin putting very large size into call options.

Unusual Options Flow

$1M October Call Buyer

$700K October Put Seller

This was executed today.

$600K January 2026 Call Buyer

This was executed in July, and is down substantially from entry

Hey! Thanks for reading this.

If you found value,

Make sure you’re subscribed for my next newsletter!

Make sure you’re following me on 𝕏/Twitter @SevenParr

If you really really like my work-

Upgrade your subscription to AllllSevens+ for $7.77 per month.

-Occasional premium newsletters

-Discord access where I gather and collect data before writing newsletters is the primary perk.

Great community of like-minded individuals coming together here!

Premium is a way to show your support of my work.

It’s cheap for a reason. Most of the value I provide is for free because my goal is to help as many people as possible see the market for how it truly is. Upgrading is mostly a way to give back!

I spend hours collecting and organizing this data.

If you’re interested in tracking dark pool data and unusual options flow yourself, here’s my affiliate link for BlackBoxStocks, the platform I use:

http://staygreen.blackboxstocks.com/SHQh

If you like how my charts look, here’s my affiliate link for Trading View, the platform I use:

https://www.tradingview.com/pricing/?share_your_love=sevenparr

Lastly, if you’re looking for a Brokerage to trade stocks & options, here’s my referral link for Webull. They give you (and me) free stocks when you make an account and deposit money with this link:

https://a.webull.com/Nwcp9cTCDSzfJtjWL4

Reply