- AllllSevens

- Posts

- SPY Weekly Outlook 2/5/24

SPY Weekly Outlook 2/5/24

Something is happening in the Real Estate sector...

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

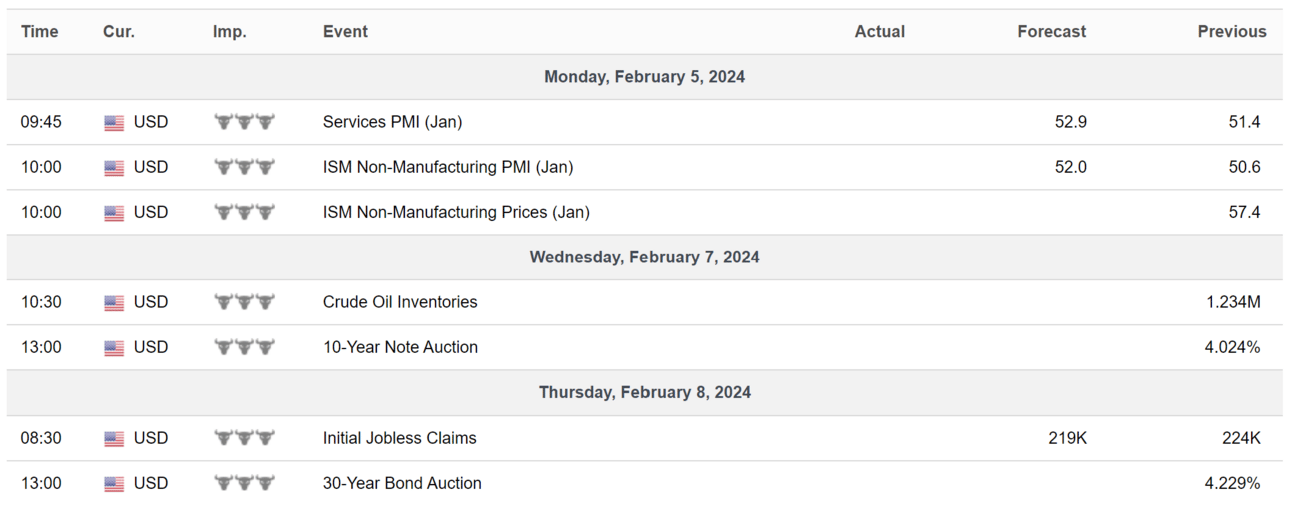

High Impact Economic Data

SPY

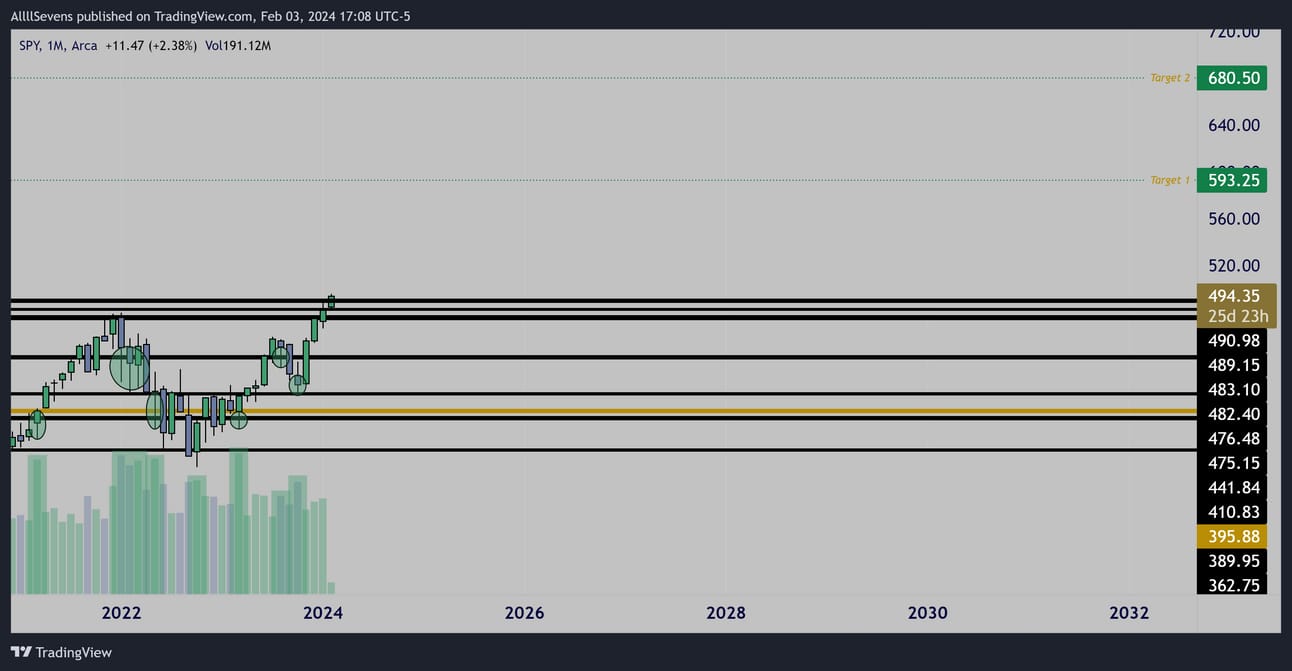

Long-Term Outlook:

Monthly

Over the last three years institutional players have been BUYING in anticipation of a long-term rally towards $680

This is visible through accumulation patterns directly at Dark Pool levels:

High volume lower wicks followed by decreased volume selling confirming the accumulations.

There’s never been a better time to own the S&P500!

Keep in mind this is a 10yr+ perspective.

If the market were to collapse later this year, none of this changes.

This is why I have a…

Short-Term Outlook:

Three weeks ago, I called for longs. $475 to $490. Done.

What now?

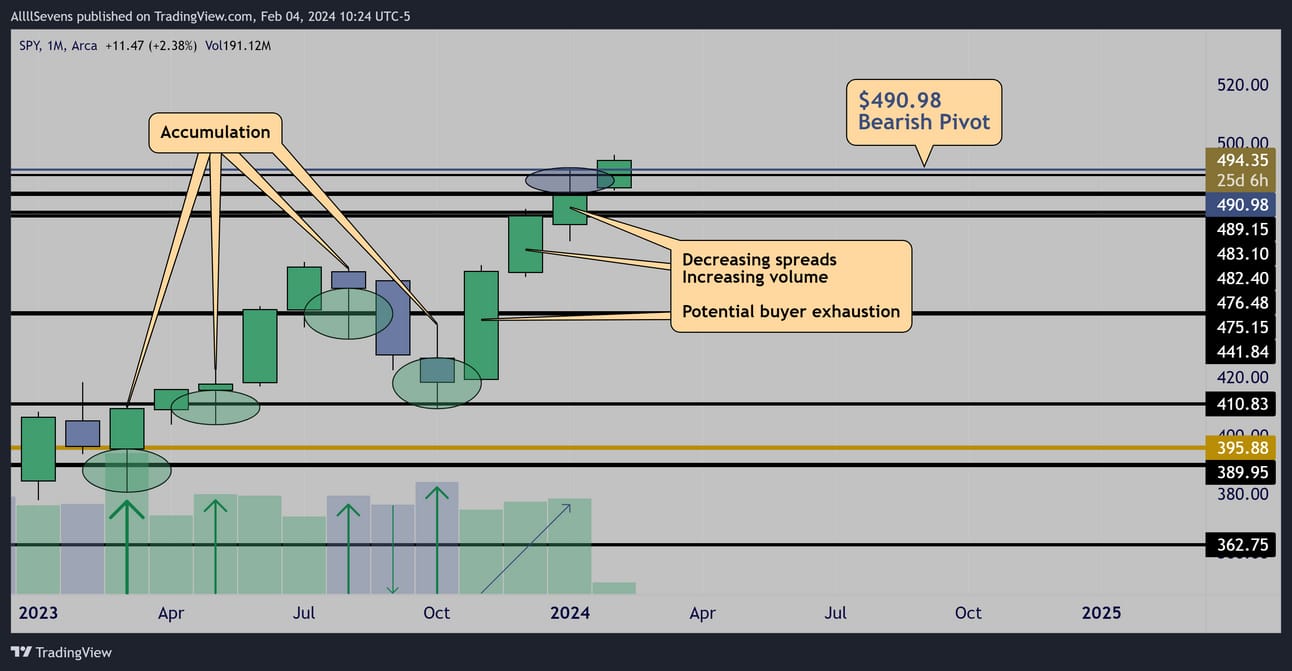

Monthly

The last three monthly candles show signs of topping volume…

It’s still relatively low volume or I’d be extremely concerned here.

Since it’s not, I believe bulls remain in control until a loss of $490.98 confirms a monthly tweezer top forming.

Until/unless $490.98 is lost, I think it’s crazy to be short here.

Now, typically topping volume like this would mean institutions are distributing shares… But I assure you that is not the case here-

Let me explain…

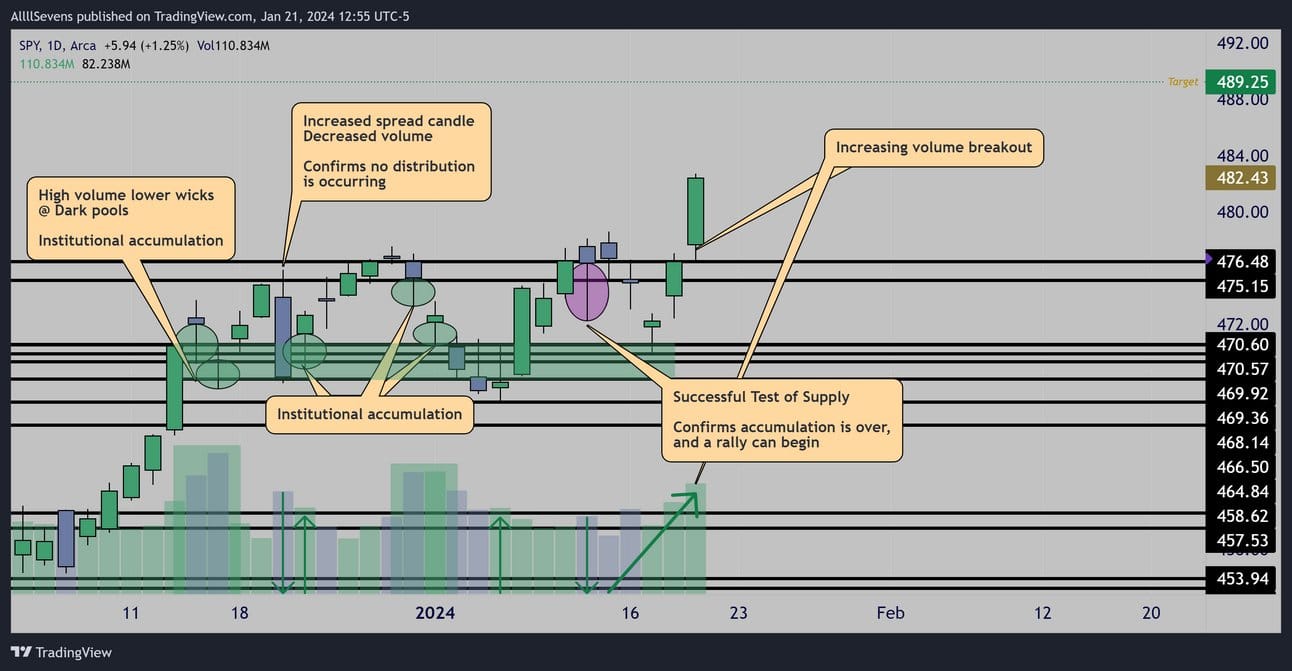

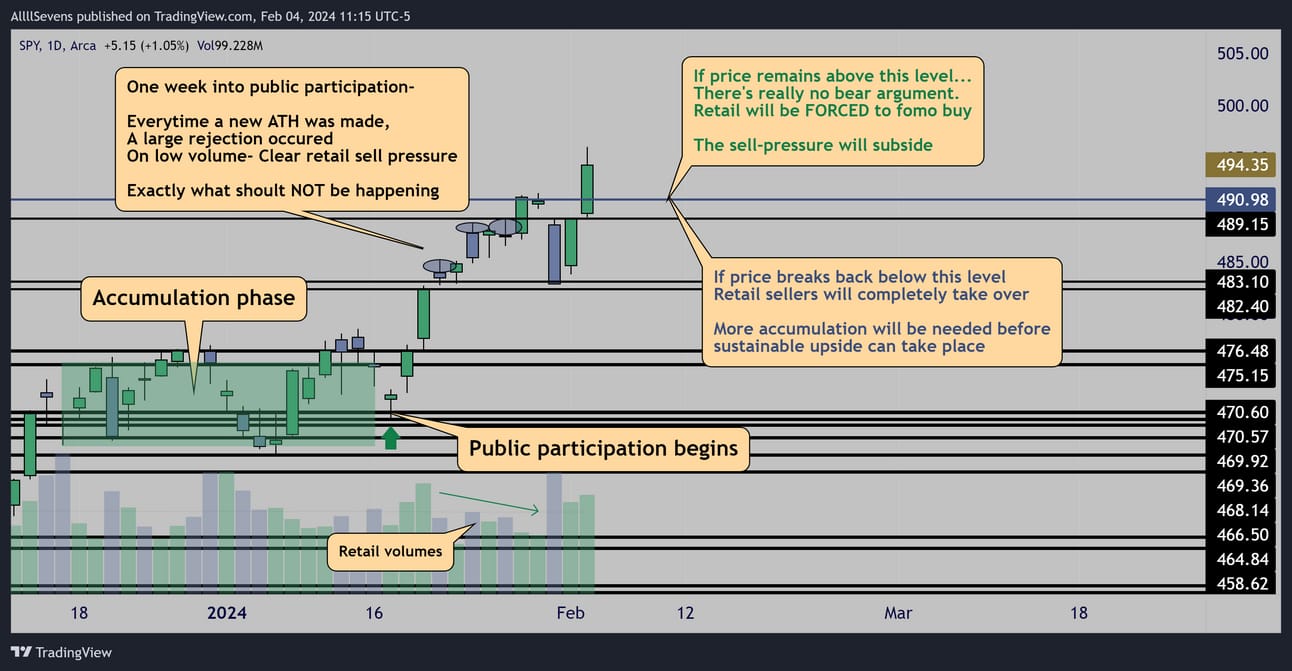

Daily

December-January was a Daily accumulation phase.

This was the setup for the recent rally that I called in a previous newsletter. $475-$490

This means while the monthly chart display’s topping volume, there’s no actual distribution happening here.

Long-Term institutions are actively buying.

So why is this even notable? If institutions are buying then why is $490.98 even something to consider?

Retail participants move price. Not institutions.

Take a look back at the monthly accumulation I shared under the long-term outlook. Price dropped for months on end despite very blatant institutional accumulation. This is why it’s important to gauge current retail participant’s sentiment on the market…

Let’s break this down in detail.

Price moves in stages-

#1-Accumulation (Dec, 14th → Jan, 16th)

The only way institutions can accumulate is if there is someone on the other side selling… Retail Participants.

During an accumulation stage, institutions let price remain in a sideways, uncertain environment, or even a downtrend, buying the troughs of trends while retail is selling the most. They let price naturally reject the top of the current range or downtrend so they can repeat the process…

Eventually, retail participants will run out of shares to sell.

The top of the range or downtrend will be breached.

#2- Public Participation

Over time, price will inevitably gravitate upwards and the institutional buyers will win. Again, think back to the monthly accumulation patterns during the 2022 sell-off. It was only a matter of time for a bull run to resume. The idea of the public participation stage is that all the participants who just sold out during the accumulation will quite literally be FORCED by their emotions to FOMO back into the market as it inevitably returns to an uptrend. This is how price moves.

This is how wealth is consistently transferred from the impatient, poor/middle class, risk-averse retail participants, to the patient, rich, extremely risk tolerant, participants (mostly institutions) over the years.

So what phase is SPY in right now?

Following the recent month-long accumulation phase and price’s ability to finally aggressively break to the upside, one would assume we are now in a public participation upside rally phase.

Retail participants should be FOMO’ing into the market right now, pushing prices higher with very little help from institutions as they have already done their job.

This is where I have a concern…

Retail participants are still clearly trying to sell out of the market.

Daily

After just a week of exiting the accumulation stage and potentially entering a public participation rally, retail sell-pressure was blatant.

Every new ATH that was made, retail volumes formed a large upper wick…

I noticed this and called to close all longs headed into FOMC.

That was a great call…

But, I never got a signal to re-load… and price has accelerated to new highs without me. Did I make a mistake?

Only time will tell.

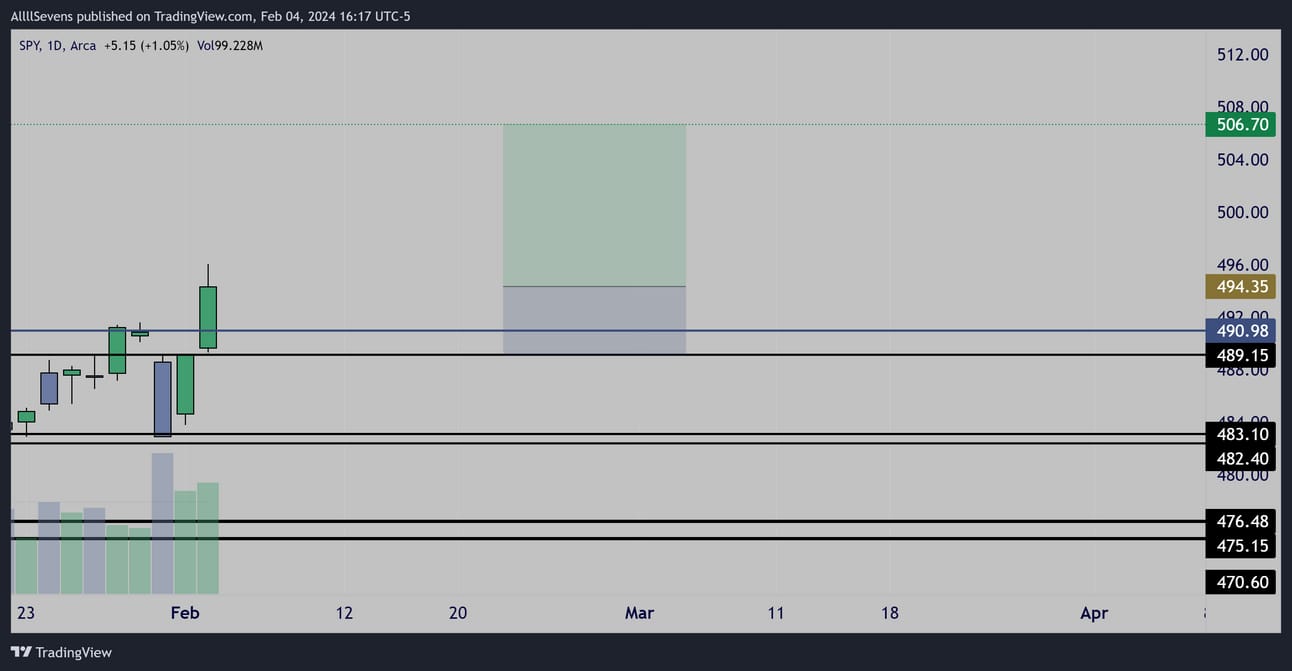

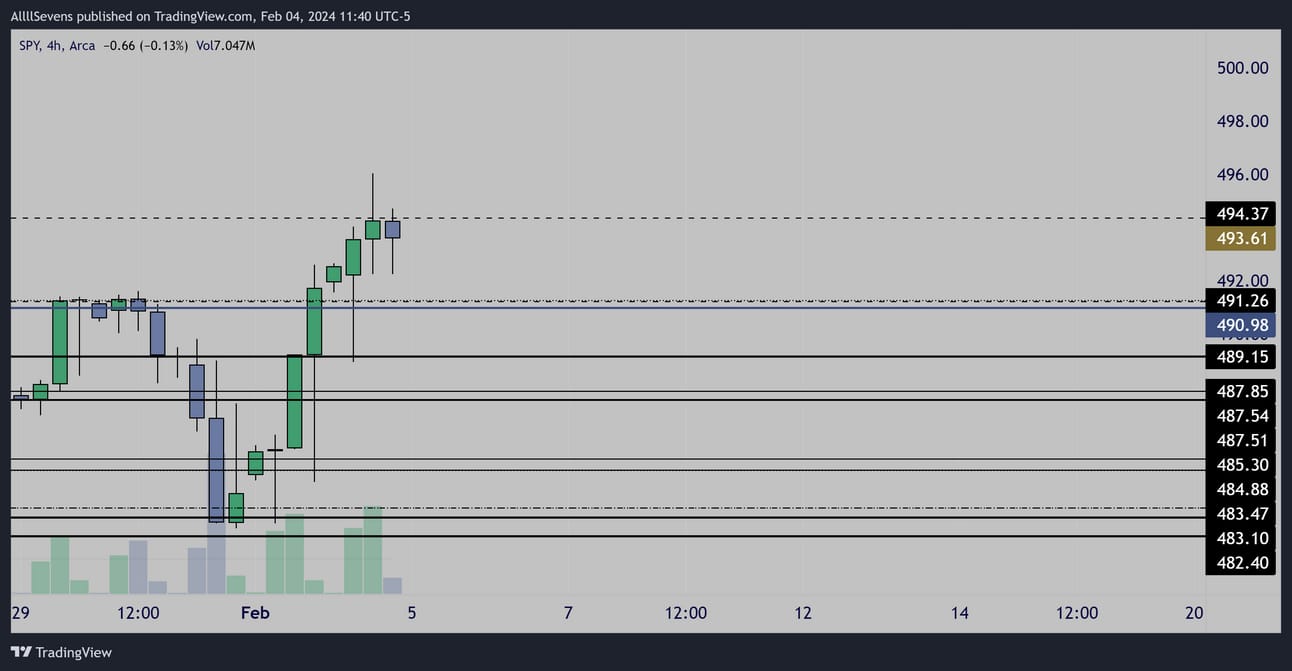

It’s all about the $490.98 pivot.

If price remains above this level, I assume retail participants are going to be forced to participate.

While I potentially missed the best R/R opportunity to re-load longs below $490.98, I can now use it as a general level to manage risk, targeting further expansion to the $506.70 area with hard stops below $489.15

That’s great risk-to-reward.

Daily

I’ll be focused on executing day trades on the SPY headed towards that upper target, updating my scalp levels daily on 𝕏

For swings, I likely will not be opening one on the SPY here, because I absolutely despise executing extended from my levels.

So, I’ll be focused on individual names and sectors inside the SPY that aren’t breakout trades for my swings.

These are much more my style and just as lucrative.

More on this later.

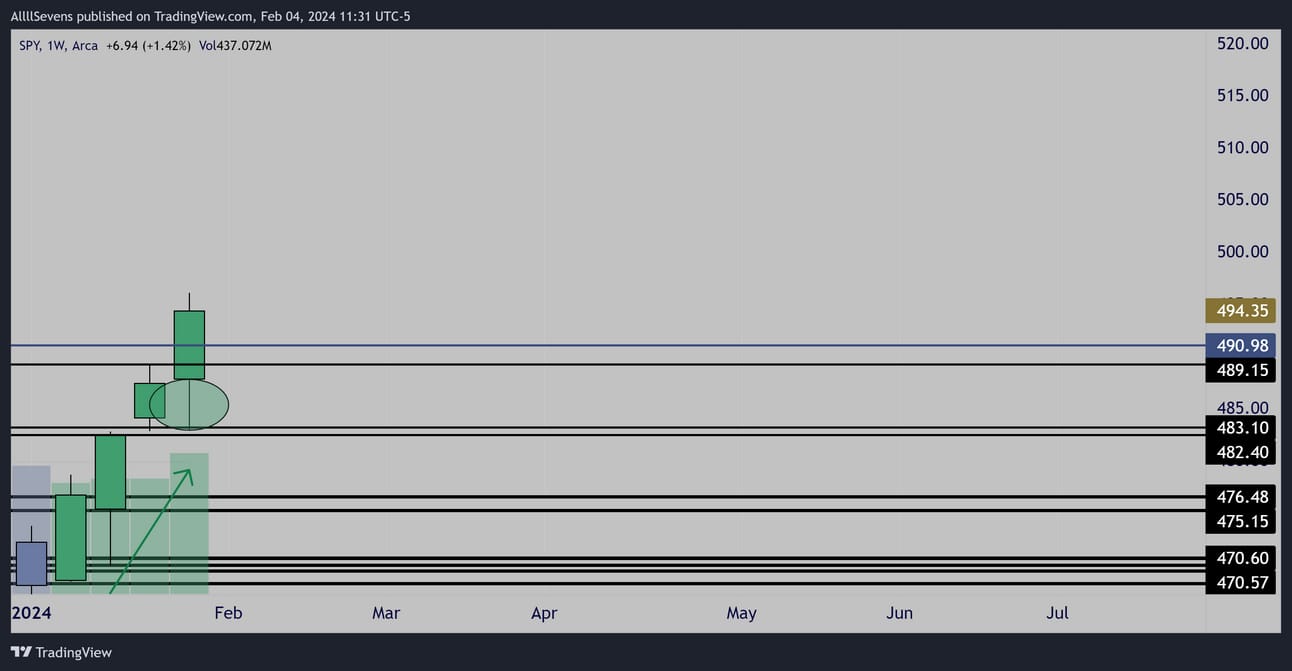

One last SPY image to share-

Weekly

I don’t see how anyone could be shorting this!

There are a LOT of bears around social media right now…

But I truly believe the best trade headed into this week is to look long until proven otherwise.

I’d much rather be hopeful and wrong than pessimistic and wrong…

The risk-to-reward heavily favors bulls, it’s that simple.

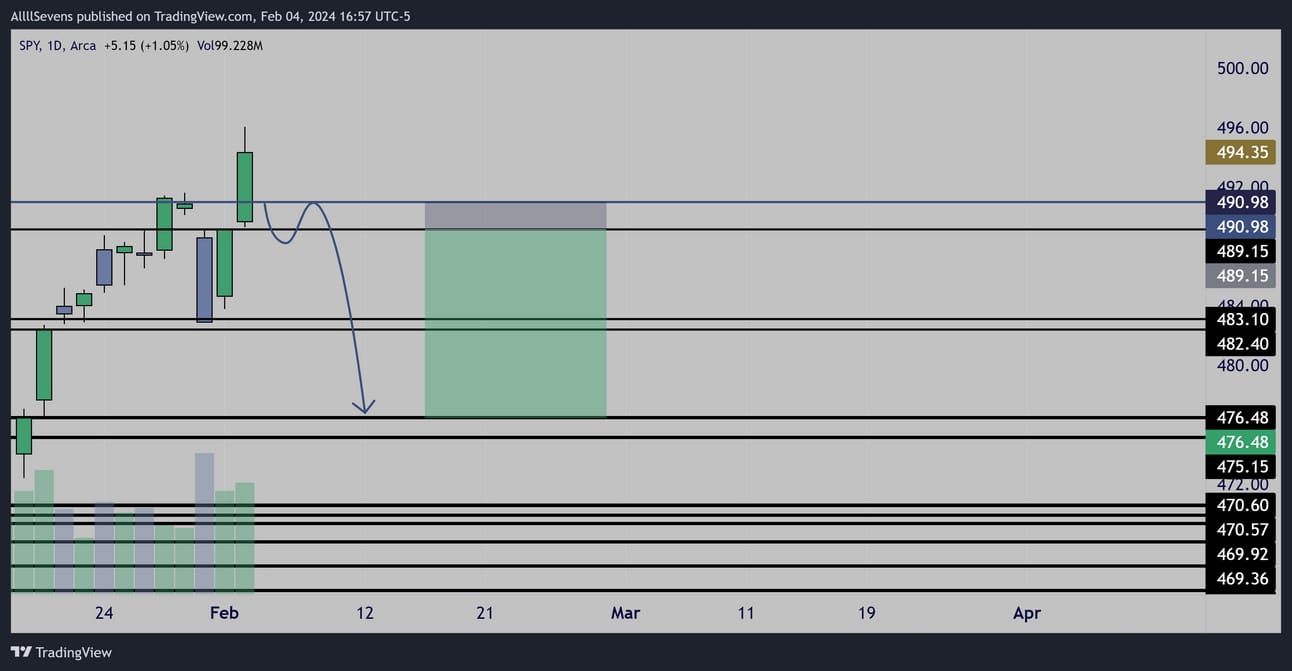

Daily

In the case that $490.98 gets lost, I expect a substantial pullback all the way to the $476.48 support.

Conclusion

As an investor-

I believe it’s always a great time to be averaging into S&P500

This chart has incredible 10yr+ potential regardless of any short-term fluctuations.

As a trader-

Let’s think about risk-to-reward here.

Over $490.98 the upside potential is massive…

This means being short above this level is extremely dangerous due to risk being relatively undefined.

Being long here definitely has it’s risks, but it’s defined.

So, over this level I naturally must be long targeting $506.70

If this level can’t be held, I’ll look to go short targeting $476.48

I want to point out how big it would be for this bearish pivot to take action this month…

If this monthly candle reverses, we’d be looking at a tweezer top bearish reversal pattern coming right off new ATH’s…

A “blow-off top” pattern. This would spark extreme panic.

Until that happens- I’m purely focused on the long side.

Bulls have the upper hand here there’s not questioning this.

In fact, because so many people WANT this bearish scenario to play out considering we know retail participants are STILL actively selling-

It adds fuel to the fire if this month’s pivot is held and price remains strong… It would force all these retail sellers to FOMO in.

Extremely lucrative and powerful moves occur in that type of environment.

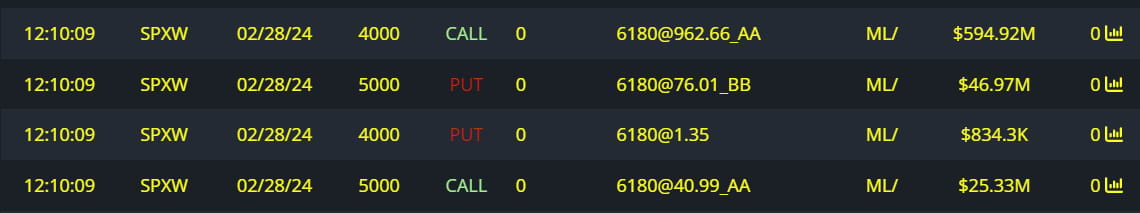

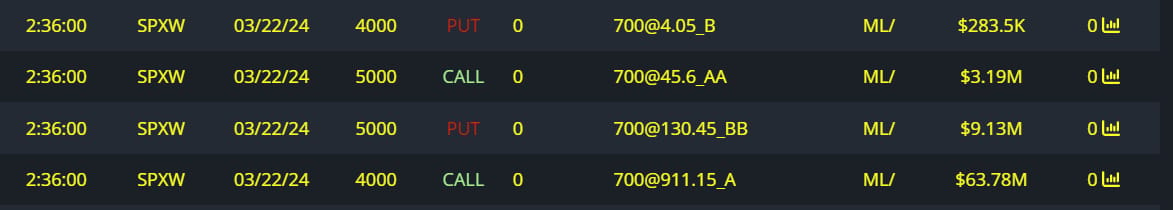

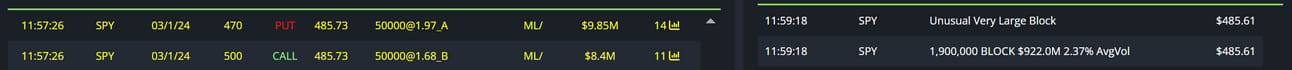

Unusual Options Flow

$600M+ Full Risk Bullish Order

$70M+ Full Risk Bullish Order

$18M Full Risk Bearish Order

The flow is clearly leaning bullish, with an unreal bullish positioning into the end of this month…

At the same time, a notable order on the 470p’s as well in the case of a reversal occurring…

I’d say the flow perfectly agrees with me here.

Bulls are in complete control until proven otherwise.

Here are the lower time frame Dark Pool levels so far headed into this week. I’ll update daily on 𝕏

4HR

In the premium portion of this week’s newsletter I will provide notable Dark Pools for the QQQ and IWM

+

The main focus of this evening’s content will be the Real-Estate sector.

I think something BIG is brewing here…

AllllSevens+

Access to premium weekly newsletter content below

Exclusive premium newsletters whenever something extremely notable appears on my screener

Discord Access

Community

Organized threads on EACH stock I’ve ever analyzed with very consistent chart updates (requests always welcomed as well)

Investment Idea (DCA) notifications

Trade Idea notifications

Unusual Options Flow

I believe $7.77 / month is MORE than fair for the amount of alpha I am sharing on a daily basis.

Try it out and feel free to cancel at any time!

Upgrade here 👇

https://allllsevensnewsletter.beehiiv.com/upgrade

Reply