- AllllSevens

- Posts

- SPY XLF XLY Weekly Outlook 2/12/24

SPY XLF XLY Weekly Outlook 2/12/24

Breadth is about to come into play...

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

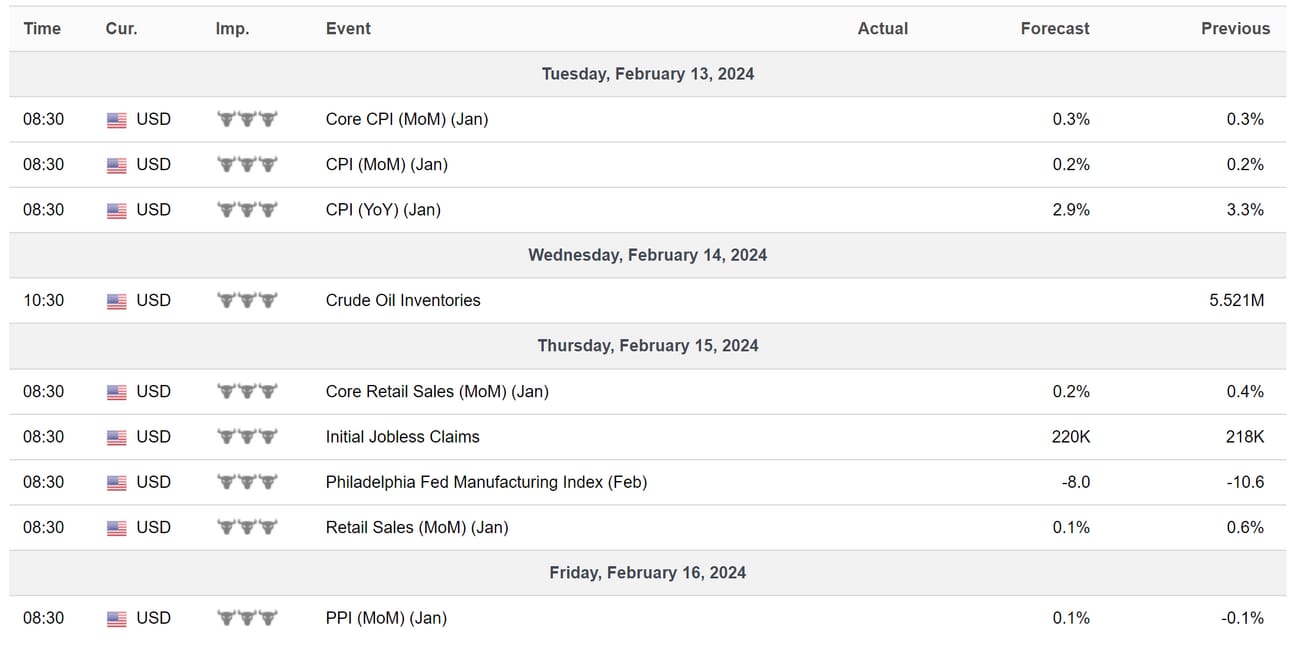

High Impact Economic Data (Bloomberg)

SPY

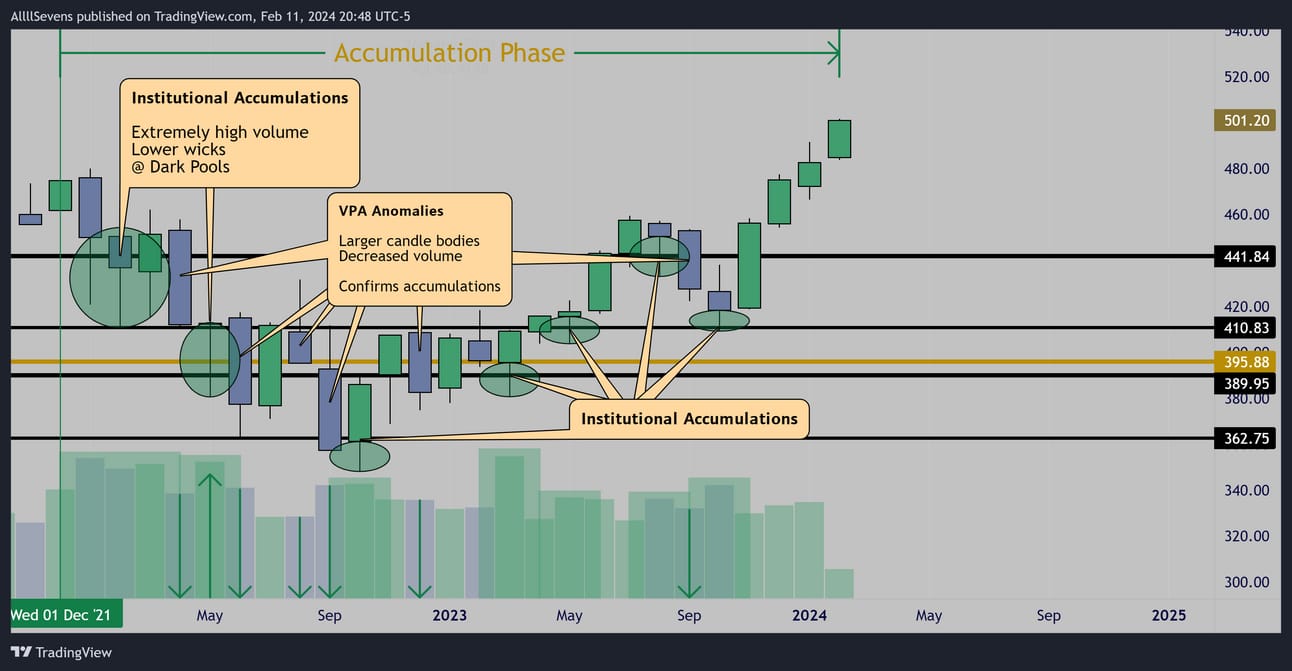

Monthly Accumulation Phase

The uncertain sentiment that has surrounded the market over the last two years creates the perfect environment for a massive transfer of shares from fearful, impatient participants, to patient and optimistic long-term focused participants.

We can see this blatantly through Institutional Accumulation patterns.

Extremely high volume lower wicks directly at Dark Pool levels.

The large candle spreads down, all backed by much lower volume confirming that only retail participants drove prices lower while institutional players held and then bought more.

A key take-away from the chart above is that Retail Participants are who create trend and move price in the short-term.

Institutional Participants position themselves before moves happen.

They do not chase trends. They anticipate long-term moves.

You’ll want to keep this in mind when in the future, price rallies higher and higher on decreased volume. Many people will claim this is bearish, when in fact it’s perfectly natural and has been a long time coming.

Eventually, all of the retail participants who have been selling out for the last two years straight will be overwhelmed by FOMO and begin re-purchasing their positions… Aggressively. That creates trend.

This is how price exits an Accumulation Stage and enters a Public Participation rally phase. That’s when the fun will truly begin.

The opportunity in front of us is surreal.

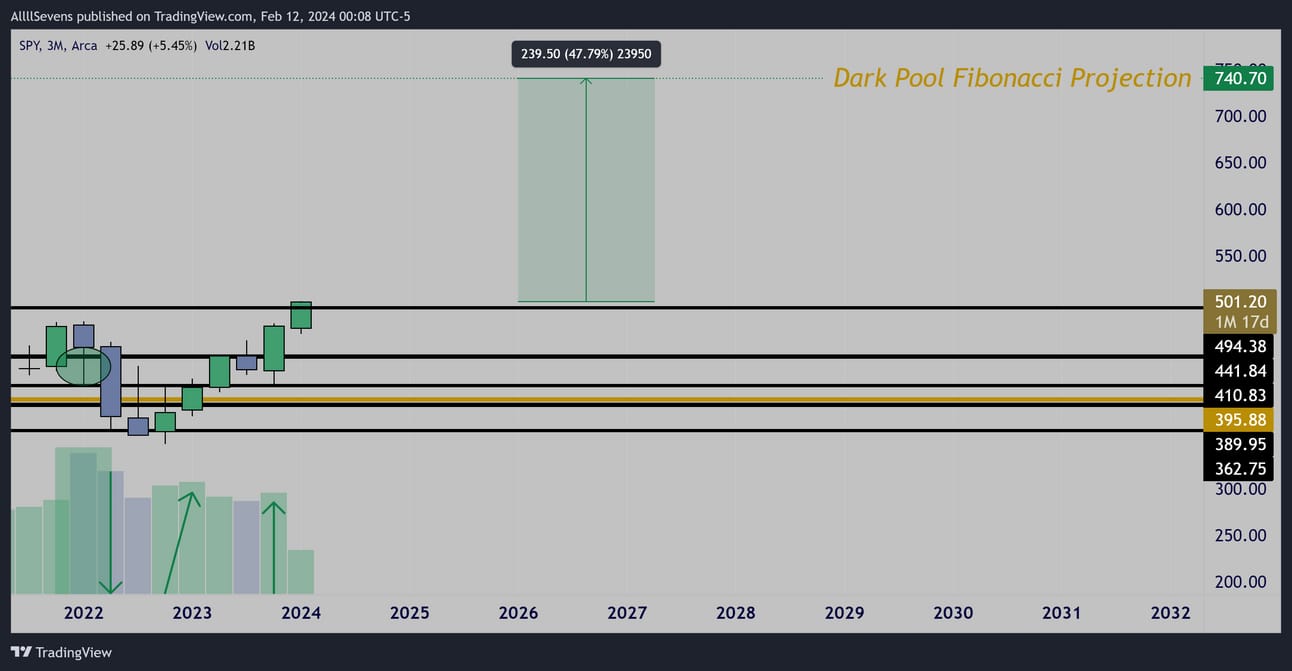

Quarterly (3 Month)

I project that once SPY fully enters the Public Participation Phase, price will reach $740+, and that is an extremely conservative projection.

Believe it or not. I anticipate much higher prices that that in all reality.

The question is…

Are we in the Public Participation stage?

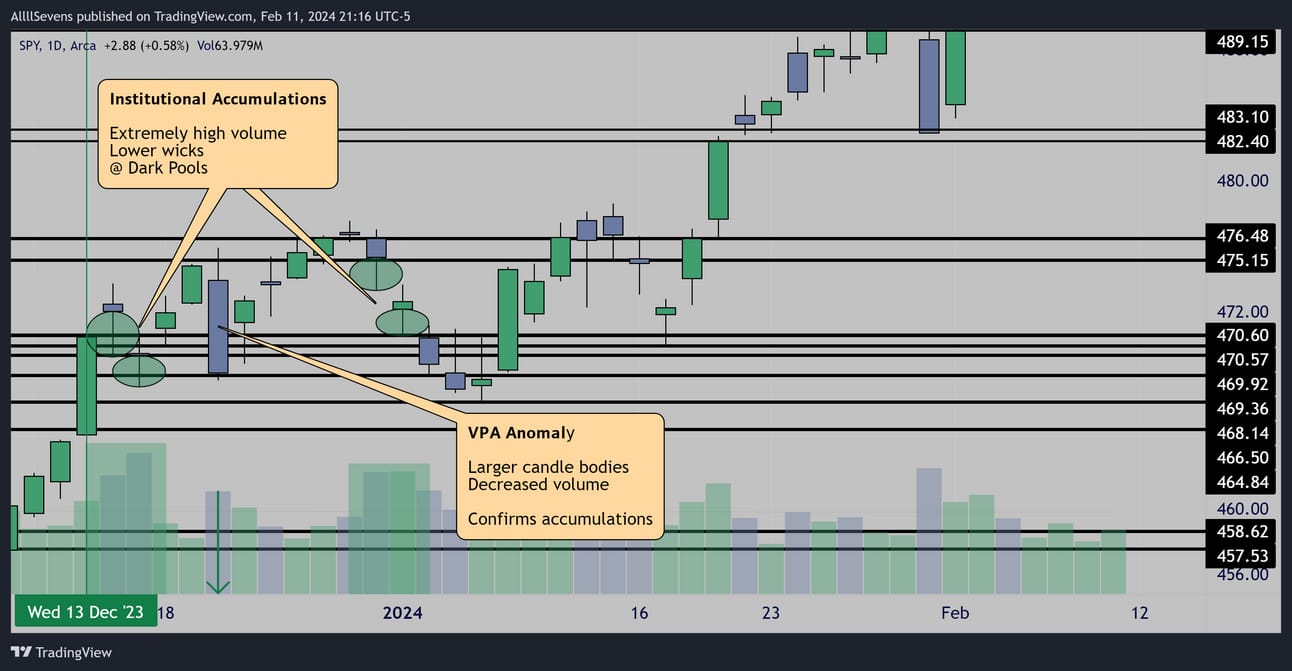

December→January Daily Accumulation

Last month, two years since the start of this Accumulation Phase with price nearing ATHs, market sentiment was STILL so uncertain that institutions were able to accumulate even more.

Retail participants are still not fully participating in the current rally…

Something needs to happen to FORCE retail participation.

Overall market breadth needs to improve.

Two of the largest sectors in the SPY are lagging- and very close to potential breakouts…

Financials (XLF) and Consumer Discretionary (XLY)

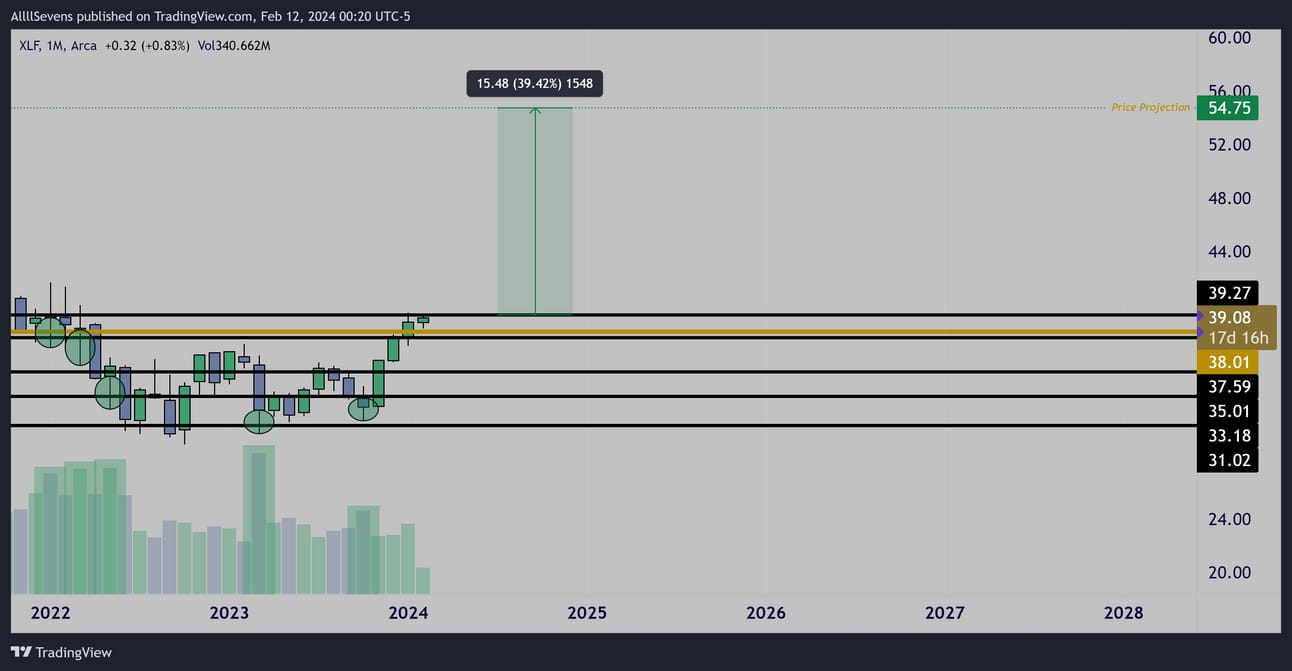

Monthly

The XLF shows the same accumulation patterns as the SPY-

But, has yet to break into ATH’s and is sitting just over its largest Dark Pool on record with one final resistance in the way before clear skies…

The XLY also shows the same accumulation patterns as SPY, and just like the XLF, it is sitting directly at a previous area of major accumulation…

Just waiting for a decision to be made.

A confirmed breakout in Financial and Consumer Discretionary stocks is what bulls NEED to see in the coming weeks.

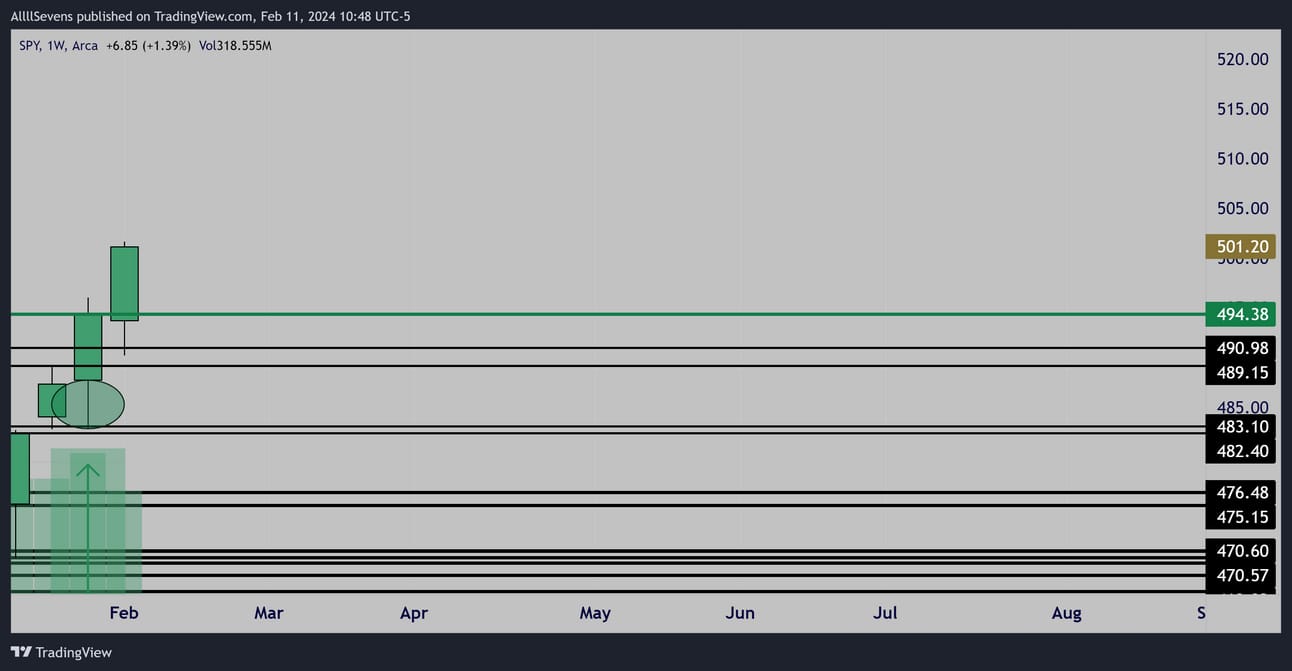

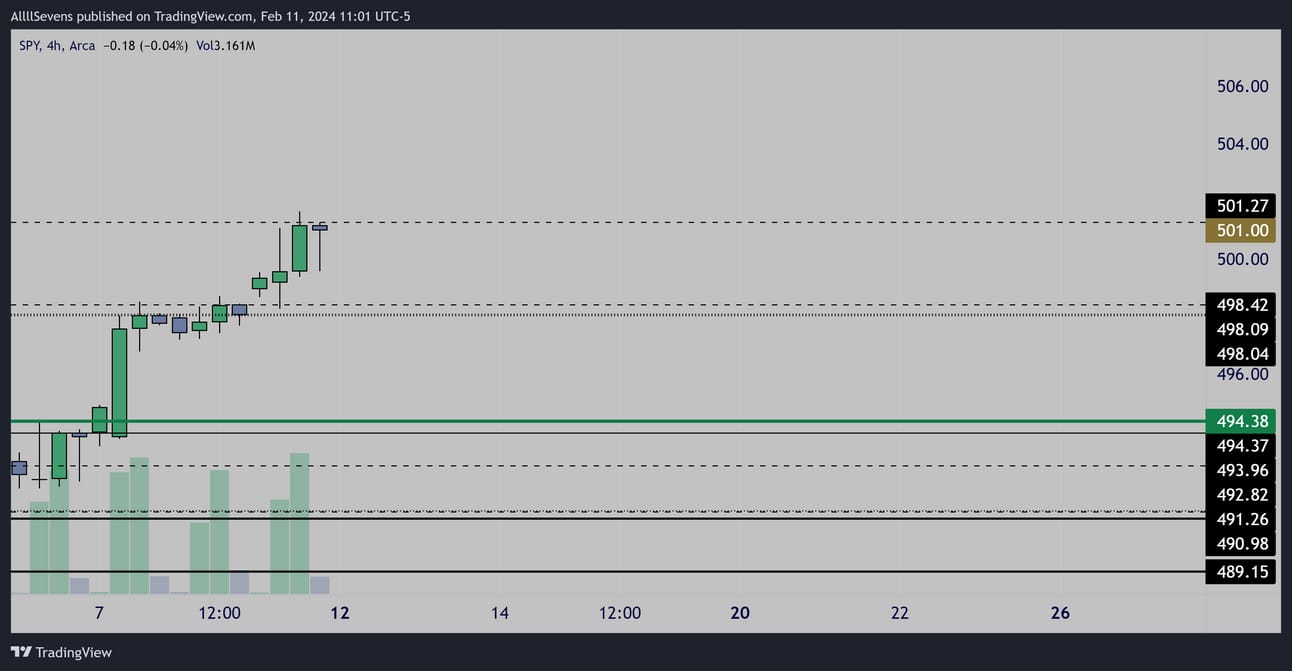

Weekly Momentum & Pivot

As long as price respects $494.38 (A recent large Dark Pool) in the coming weeks, the probability of a breakout in the XLF an XLY is high.

Over this level, I’m bullish.

Now, I do think it’s appropriate to discuss the very real window of opportunity bears have…

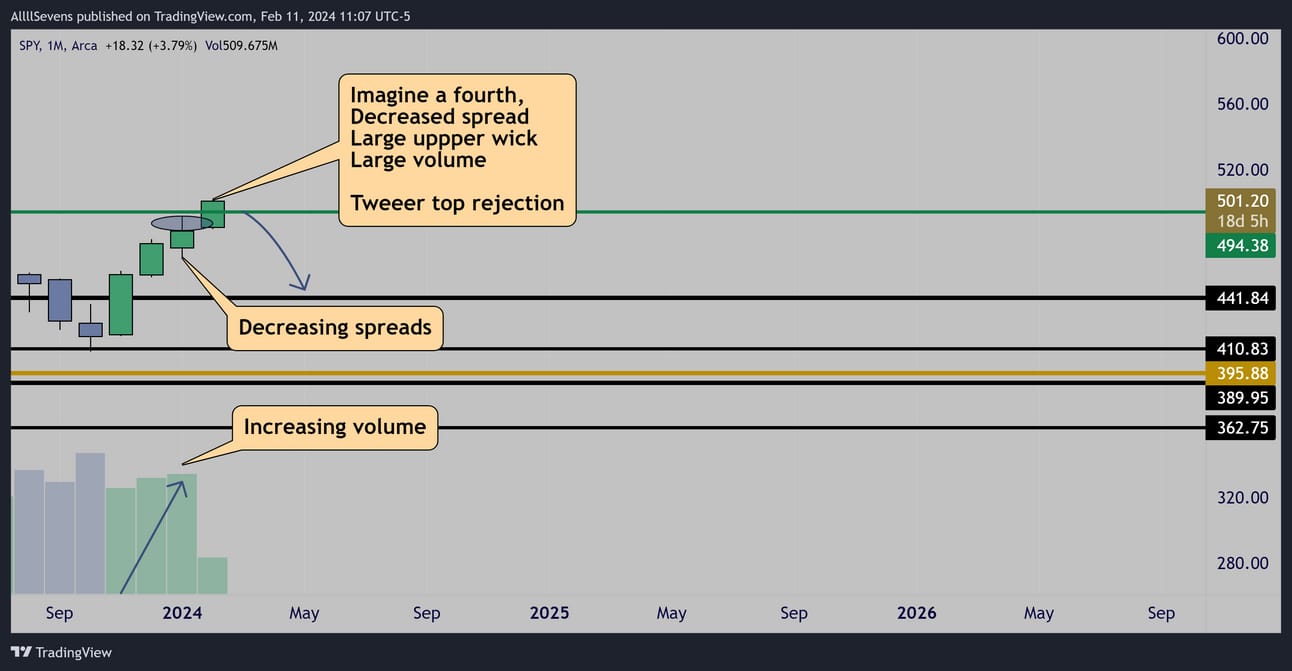

Monthly Topping Volume & Tweezer Top Potential

While December-January volumes were very bullish on the Daily chart I shared, the monthly candles themselves created potential warning signals- showing that retail participants are eager to sell up here…

If the XLF and XLY fail to breakout and the SPY loses $494.38, there’s potential for an extremely bearish candle to form here.

A tweezer top candle pattern on increasing volume right off the $500 psychological level would spark a few months of downside.

Like I said though, bulls have the upper hand at the moment.

A breakout seems much more likely and I don’t want to anticipate this bearish scenario unless it begins to confirm.

Otherwise, I could get stuck trying to short the start of a historic bull run.

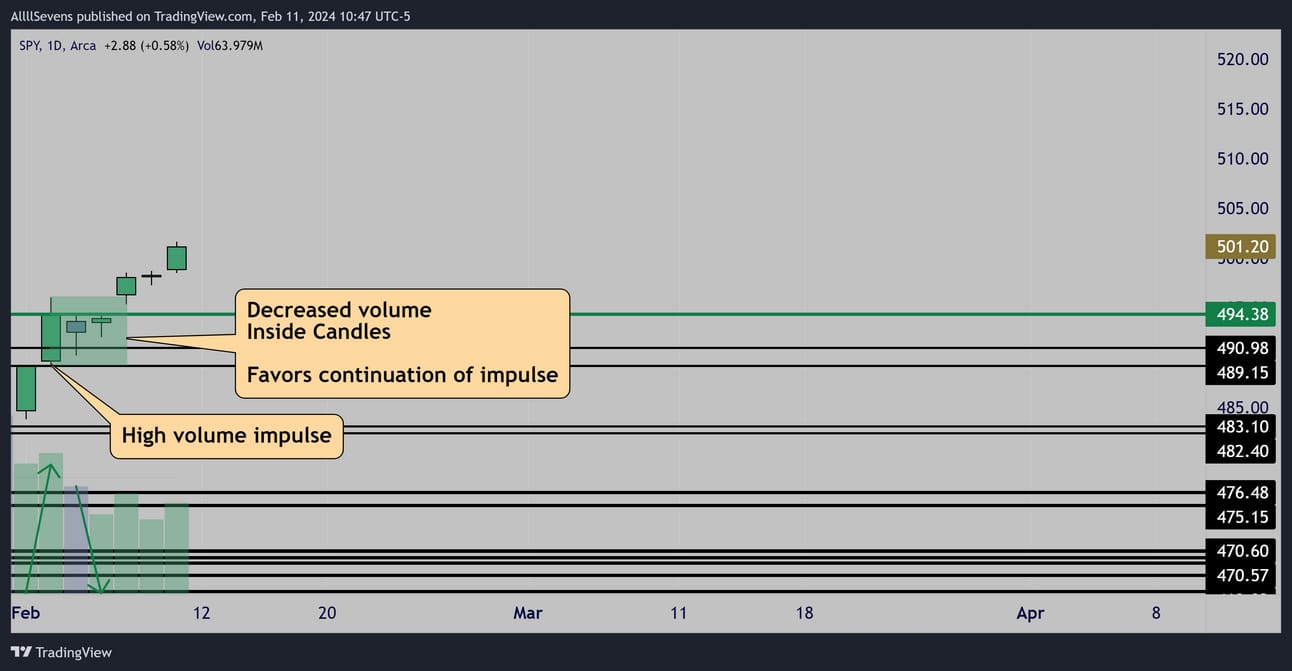

Daily

I want to point out the perfection behind last week’s Daily PA

A decreased volume consolidation (Inside candles) following an increased volume impulse favors continuation of the impulse.

This pattern presents itself on all time frames and is very consistent.

Overall,

The weekly and daily charts here do not give an A+ entry pattern.

Holding longs from weeks prior is the best position to be in right now.

To add new longs, I’ll be watching the levels below for any entry patterns.

4HR

Stay tuned for more newsletters this week…

I have some important data I need to share with you.

As I said,

The opportunity in front of us is surreal.

Reply