- AllllSevens

- Posts

- STNE - StoneCo Ltd

STNE - StoneCo Ltd

Emerging Markets, Brazilian Fintech, Call Options, and Stock

Disclaimer

This is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor. This newsletter represents my personal opinions and commentary for informational purposes only.

Please do your own research.

Read to the end of this newsletter to uncover my fully transparent position.

The theme:

This is a small-cap stock, trading around $4B right now.

It’s actually held within $IWM, which I am VERY bullish on.

Read my most recent update on here.

This stock also falls into the theme of “emerging markets” as it is not based in the United States, but rather, Brazil.

The idea here is basically that countries who’s economics are just past the low-income/less-industrialized phase now have very high growth potential as they can accelerate at a more rapid pace to reach maturity.

They’re high risk.

$EEM is the primary ETF I watch to track this theme.

It’s currently pushing out of a multi-decade base, trading at all-time highs, and EVERYONE is talking about it…

But hardly anyone is talking about how to actually capitalize on this.

See, I bought $EEM back in April of 2025. See here.

Where the risk to reward was amazing.

Here at ATH’s breaking from a 17 year base I’m obviously still holding, but I don’t see the setup to add more risk. I’m finding that elsewhere…

Like Brazil!

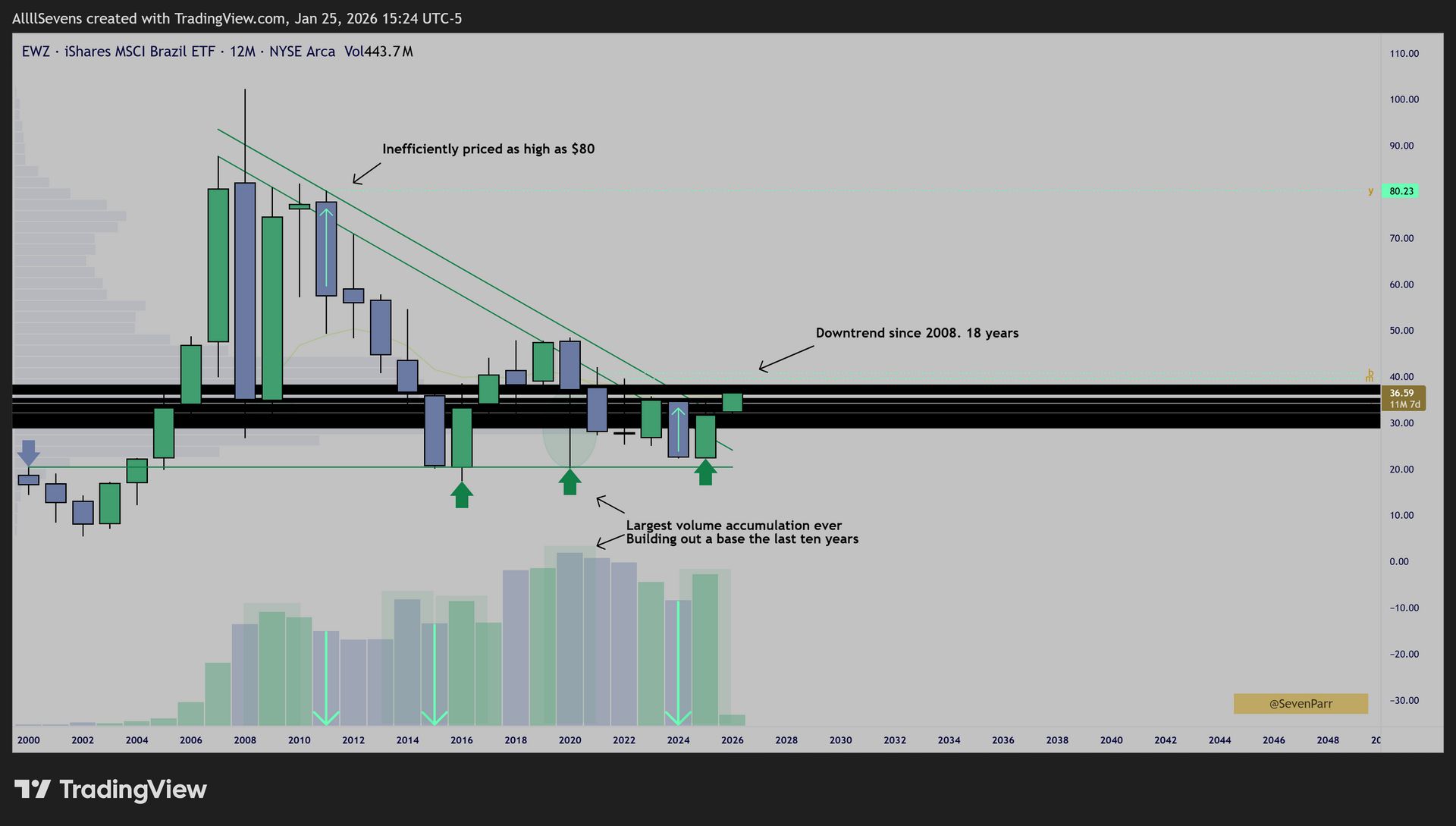

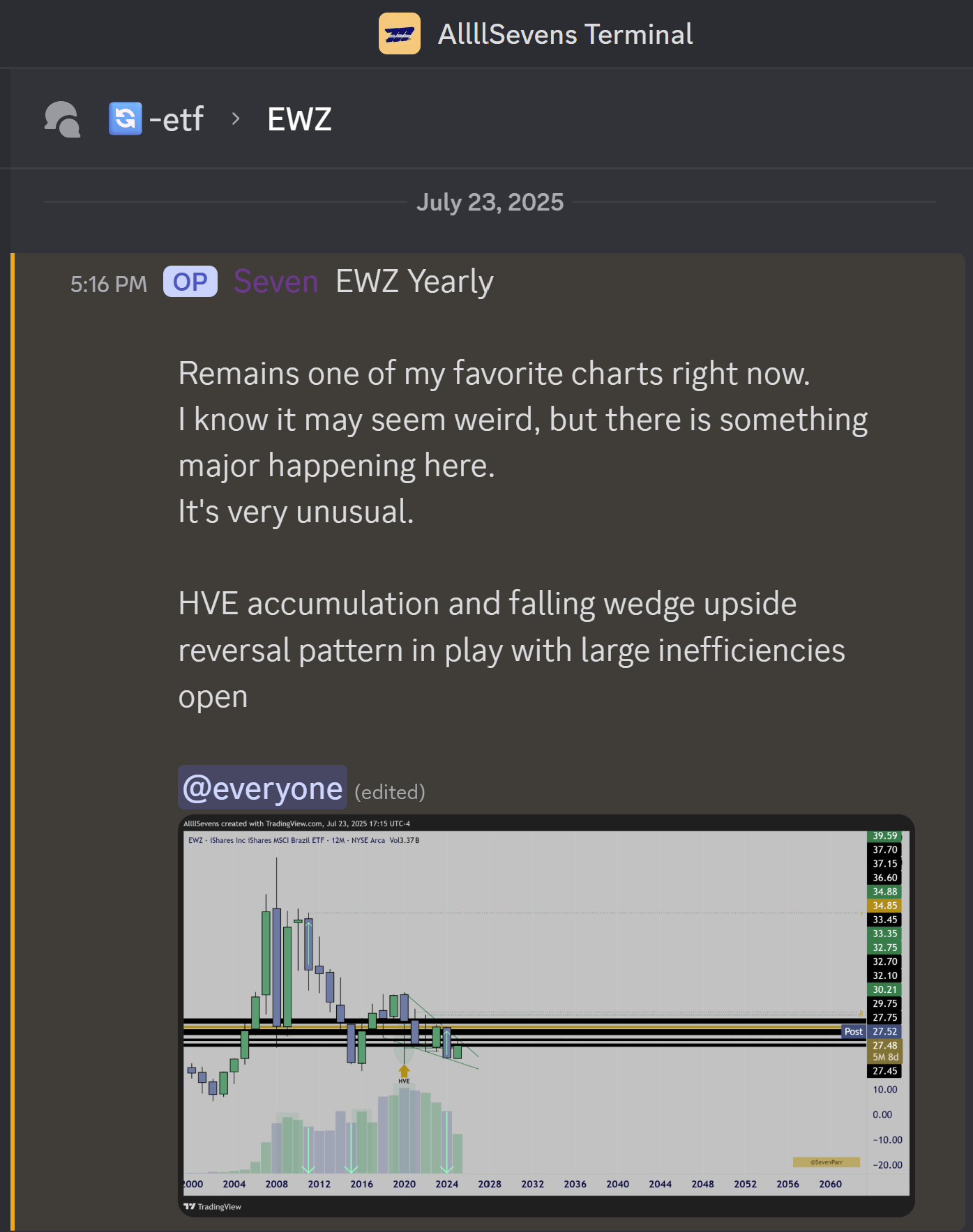

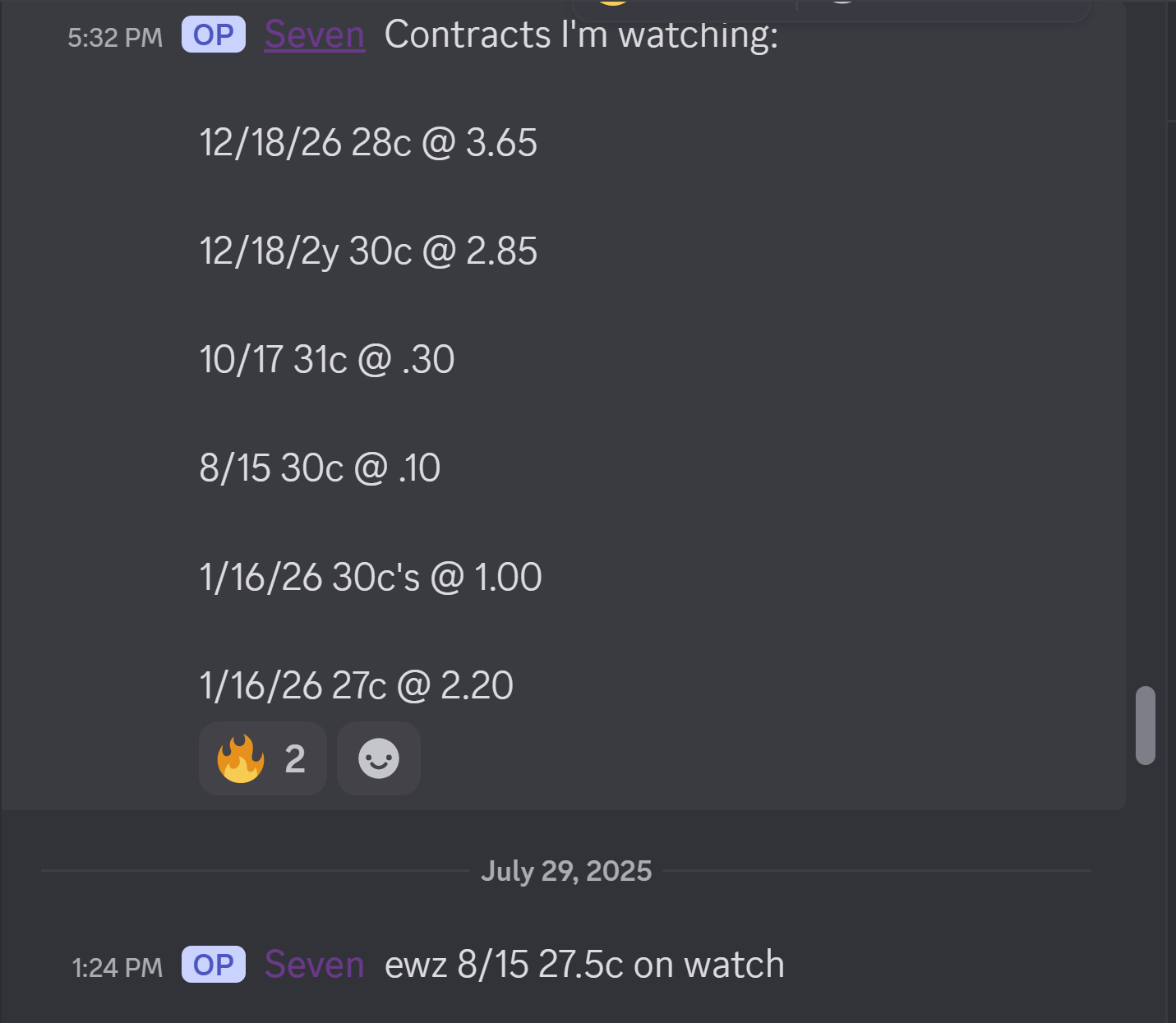

$EWZ

Like I said, these “emerging markets” are high risk.

That means their potential upside is huge! This thing is inefficiently priced as high as $80 and trending down ever since 2008, it has finally began to build out a sideways base ever since 2016…

Closing on strong volume last year, it could be on the verge of an upside break.

But this is still just like $EEM in a way.

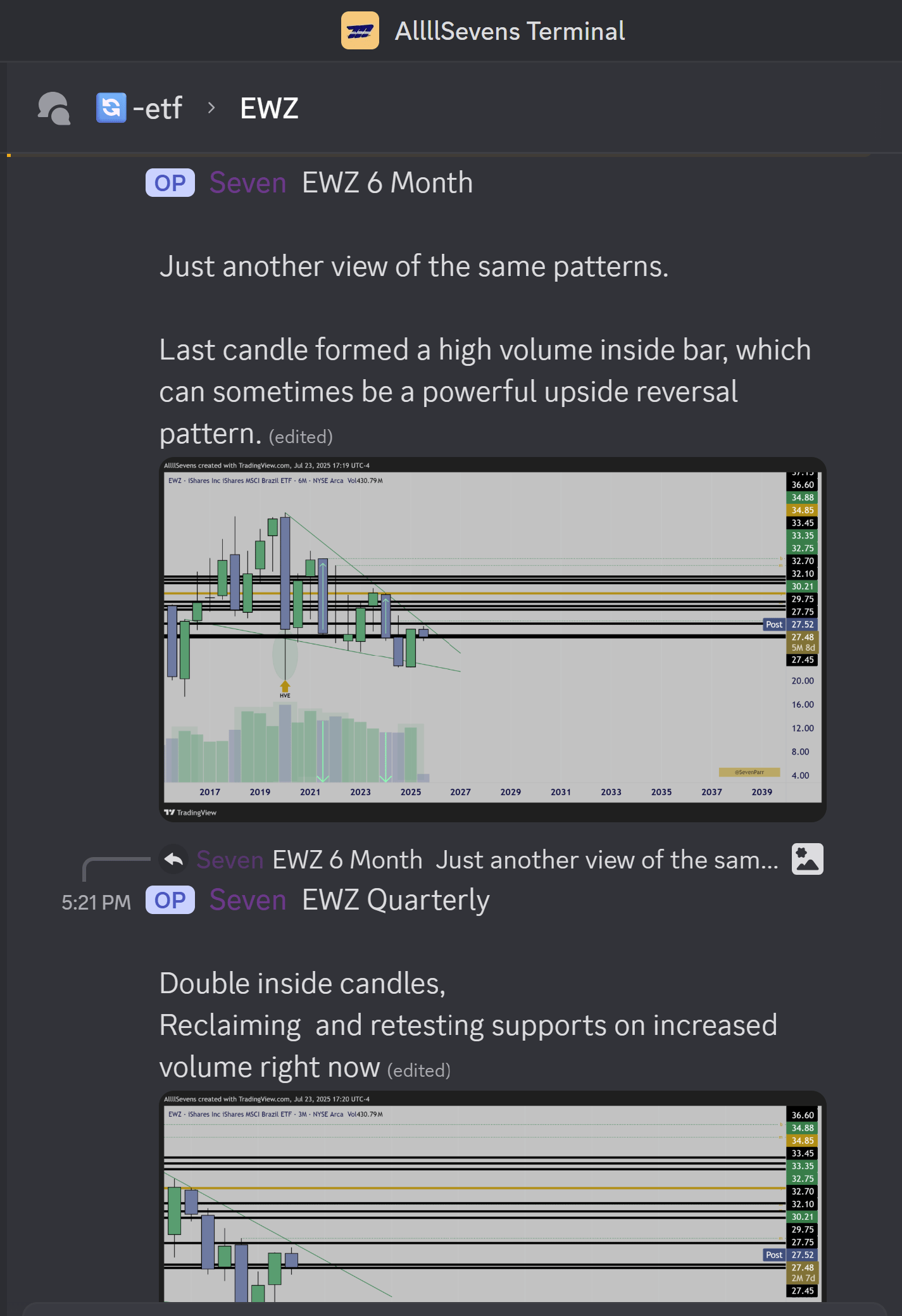

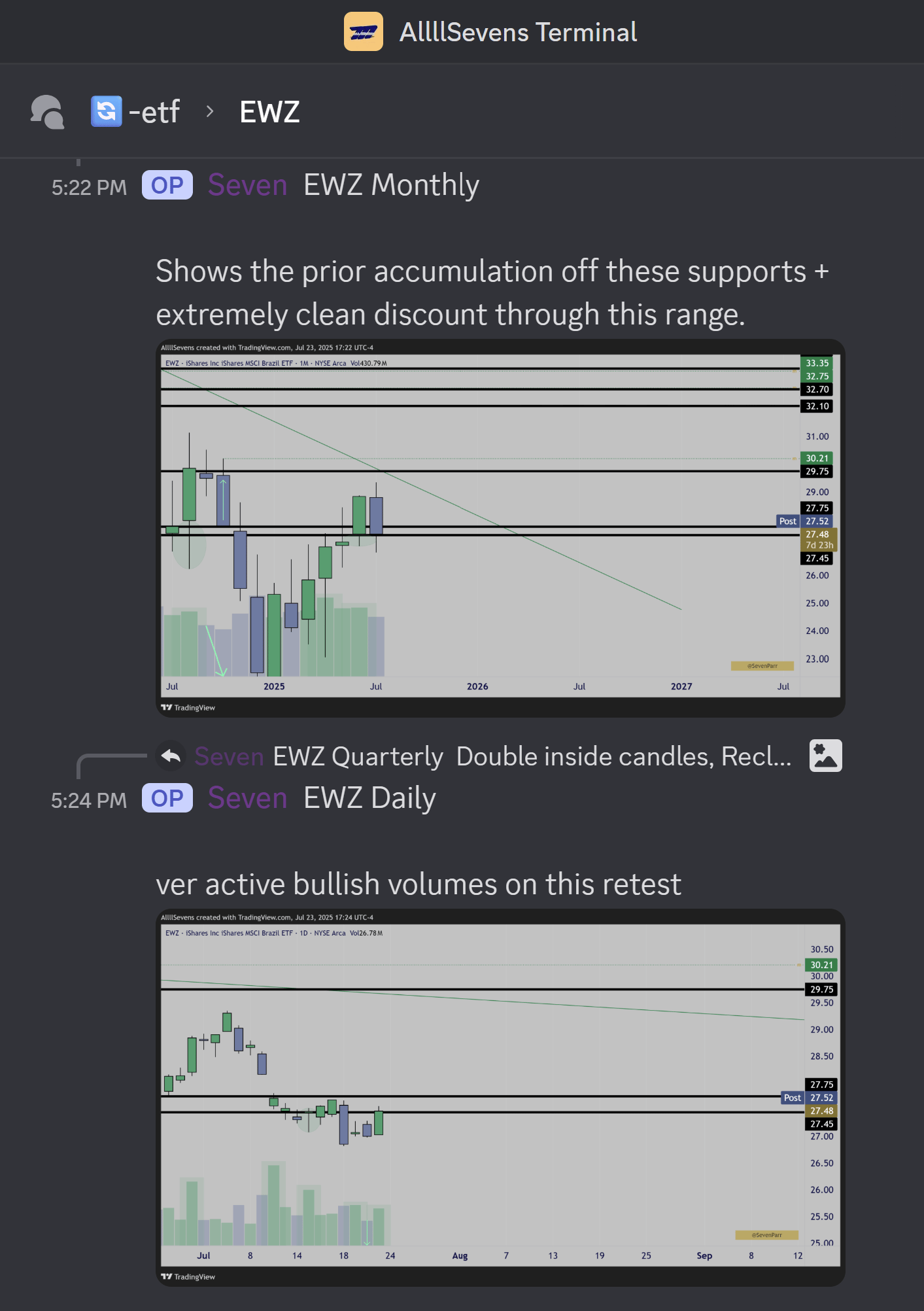

It looks incredibly bullish, but the most convicting time frame at the moment is the yearly chart…

You zoom into the weekly or monthly and at least for me, it becomes more difficult to identify a pattern with defined risk to buy into.

Also just like $EEM, I was buying this last year when exactly what I just explained above was not the case. Every time frame as low as the daily was priming.

I’m going to use this exact methodology to explain why I am buying $STNE here.

Look:

If you want to join my Research Terminal for $7.77, click here.

Moving on-

$STNE also falls into the Fintech category.

A group of stocks which actually isn’t particularly hot at the moment, but will surely come into rotation… potentially soon, with this being a leader.

But to avoid this newsletter getting too long, I am not goin to dive into this today, I’d rather just begin looking at the STNE chart.

If you want a jumpstart on the broader Fintech theme that could emerge, I am analyzing ETF’s like IPAY, ARKK, FMQQ, and individuals such as MELI, CPNG, GPN, TOST, etc all in Discord. Much more than just that, but I just named a few off the top of my head. This is 100% an underappreciated sector at the moment with institutional volumes preceding a future rotation.

Kinda just like EEM & EWZ did last year…

I want to be ready BEFORE the heard.

Anyways, let’s dive in to $STNE

$STNE- StoneCo Ltd

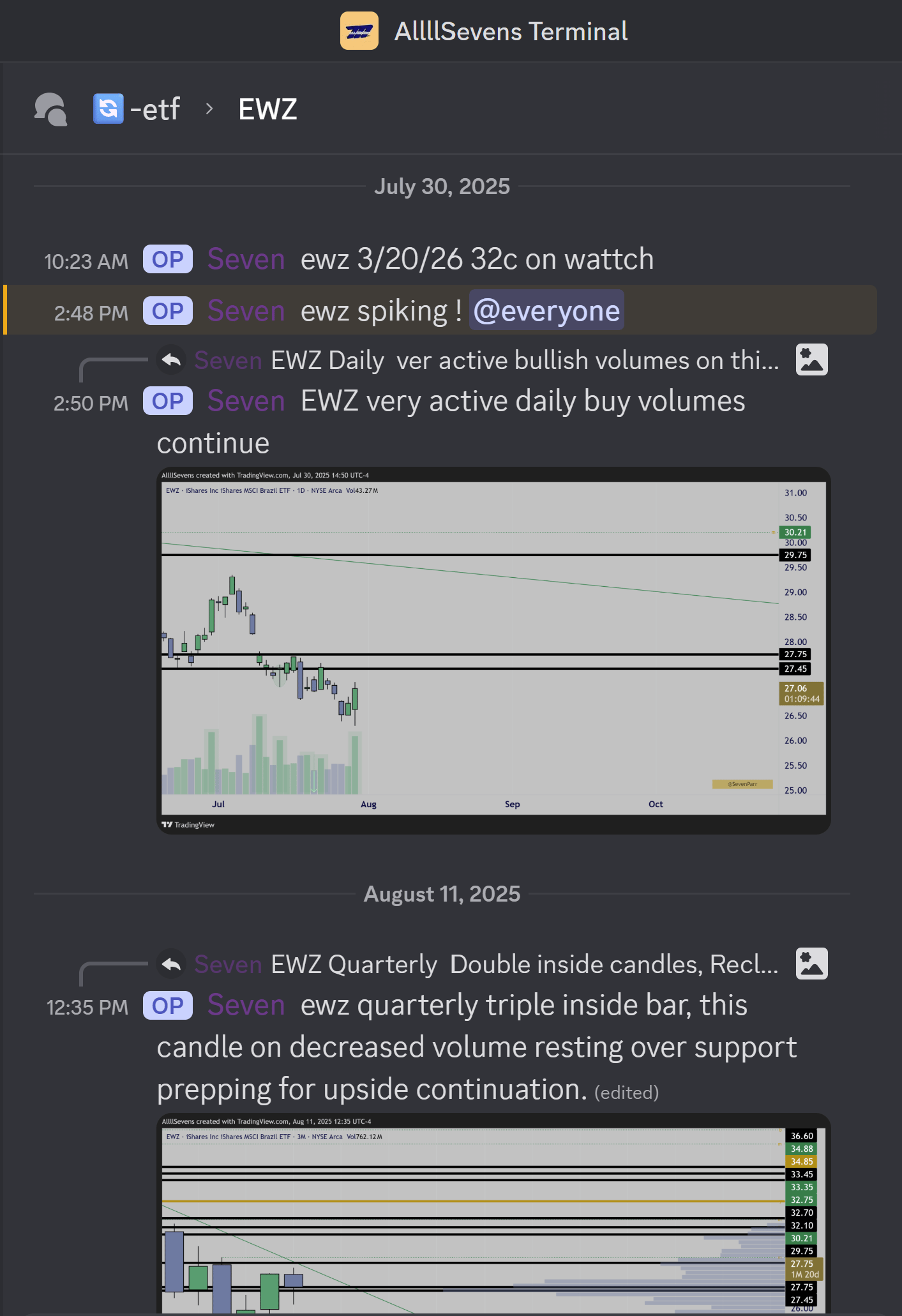

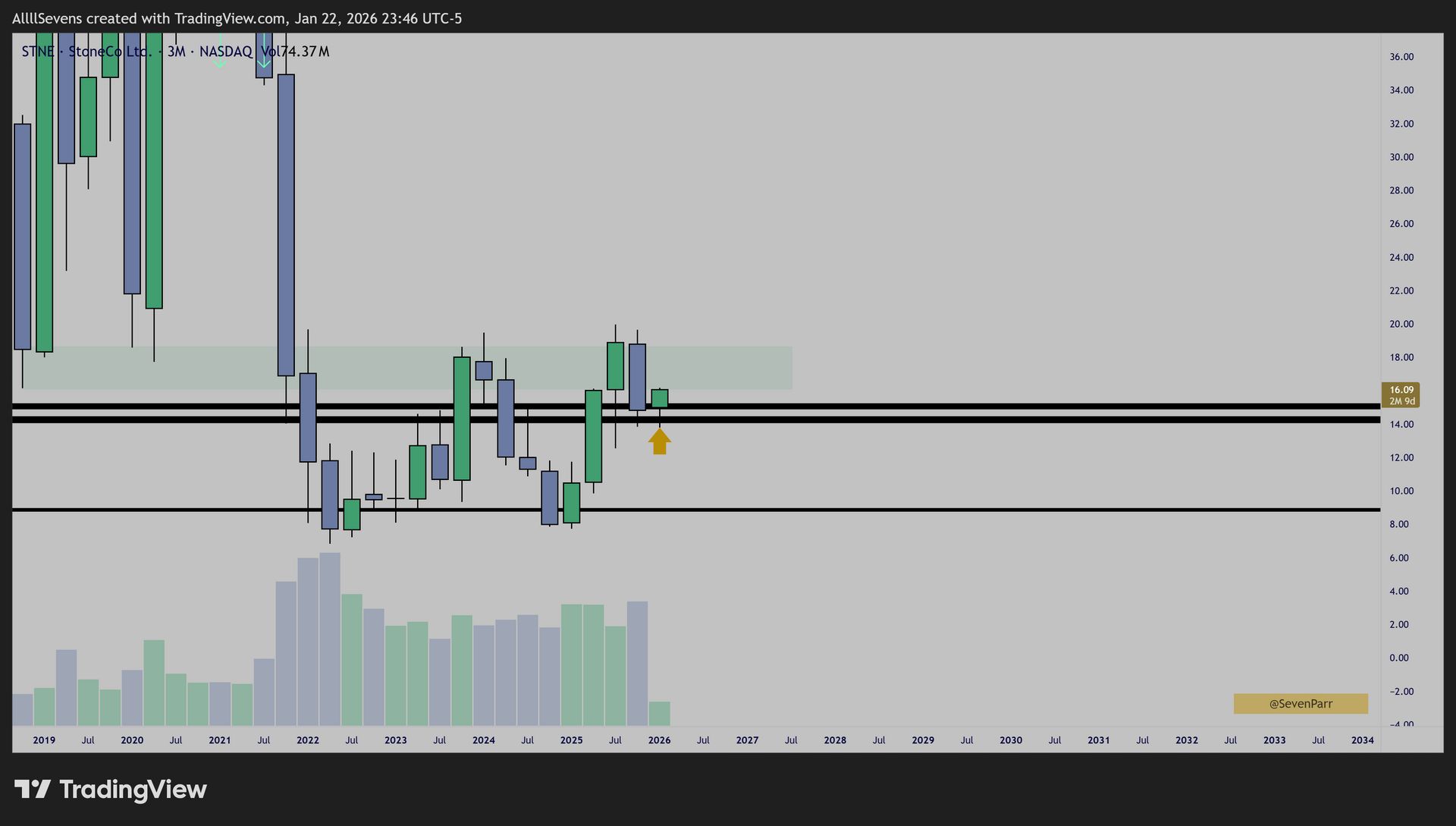

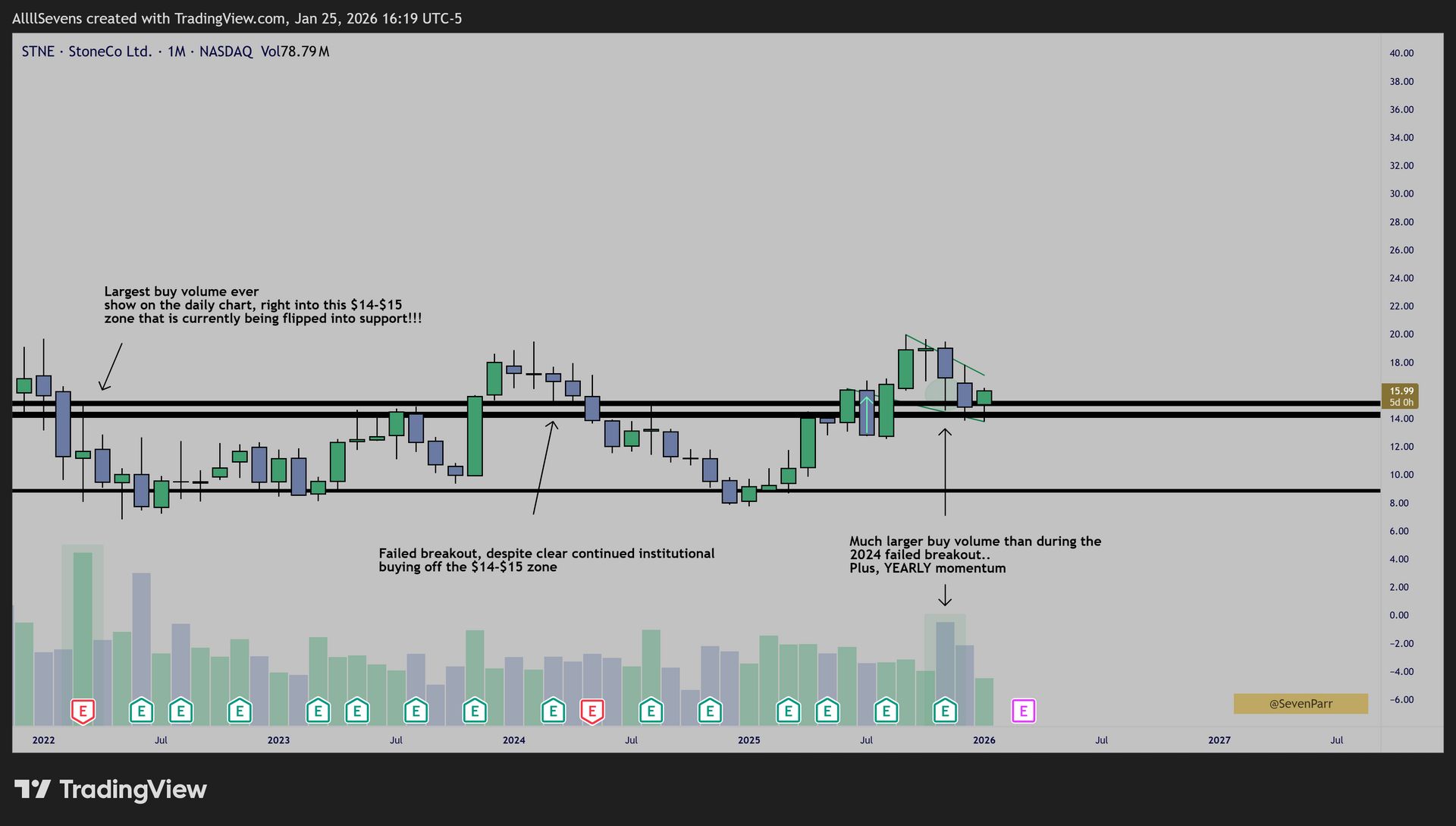

Yearly

In 2021 this sock crashed down from ATH’s, breaking it’s IPO lows before large institutional participants attempted to put in a floor during 2022, trading the stocks highest volume ever.

Three years of basing ever since, with last year’s candle peaking above 2022 highs before pulling back but still closing strong to end the year…

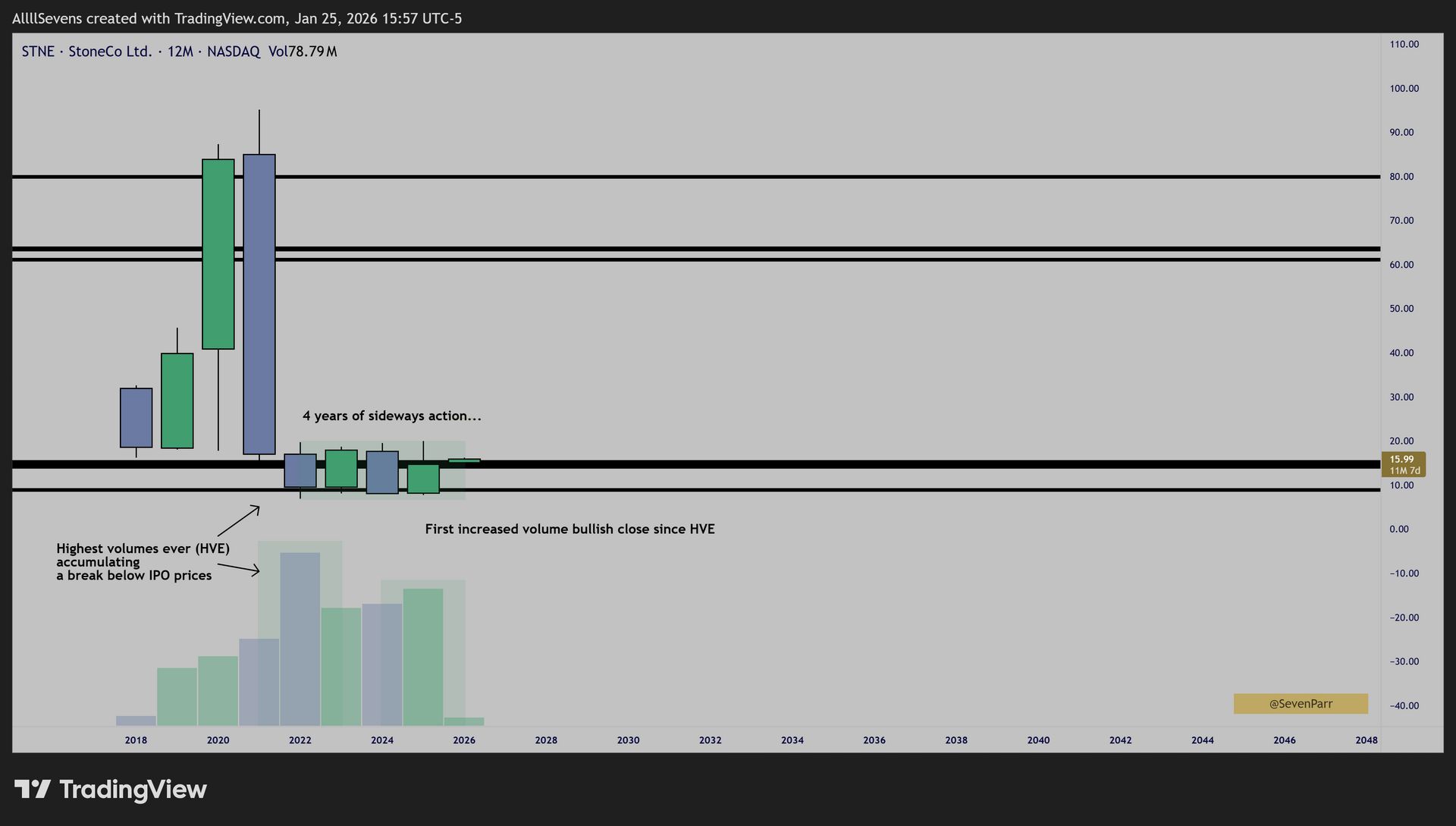

Quarterly

Here’s what that looks like.

The upper boundary of this three year compression has been the IPO range lows around $18-19, which rejected once in 2023-2024 and again just last year…

BUT, price has quickly found support off ths $14-$15 zone which it dd NOT in 2023 & 2024…

Lower time frames will reveal exactly why this is so profound in a moment.

In short, I based on the volumes I am about to show you I believe this $14-$15 area is the true institutional support, while the $18-19 area is a smaller psychological barrier due to it being IPO lows.

This is precisely why I am going long NOW, off the $14-$15 demand, because when price does finally crack $18-$19, it is going to be a retail driven frenzy. That’s where I will cash out on my call options and et m shares ride practically risk free.

More on my exact position and risk later.

Daily (2022)

At the time, this was the stocks largest daily buy volume EVER

Helping create the 2022 yearly candle!

This buy volume was right into the $14-$15 zone…

Daily (2024

Again, this zone was clearly accumulated by high volume institutional participants in 2024 after retail rejected the $18-19 zone.

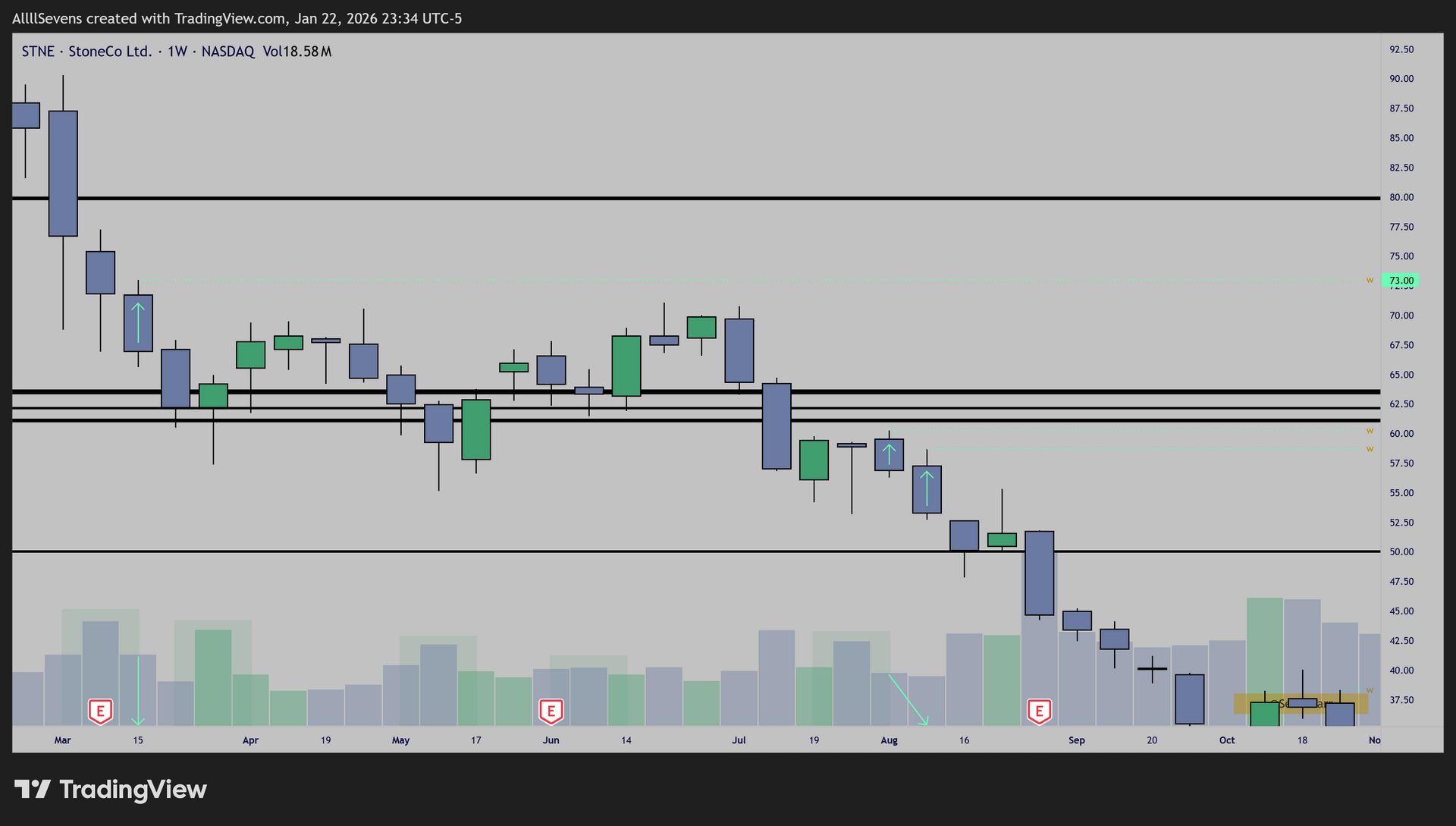

Weekly

Recent volume patterns show those same high volume participants defending the $14-$15 zone once again!!!

But unlike 2024, this time with potential momentum on the yearly chart and the support of an overall emerging markets / Brazilian theme.

I also want to point out how clearly exhausted sellers are.

Huge sell candle after the recent buy spike, but on decreased volume!

This supports my thesis that only RETAIL participants are willing sellers here.

Price has since managed to start curling higher with last week’s bullish engulfing candle. I think last week’s candle is a statement and that’s why I’m now long.

Monthly

My risk for this trade is this months low.

Like I said, I think last week’s bullish engulfing candle is a statement.

If this month’s low / this quarter’s current low breaks, that means the $14-$15 support failed, and I will be forced to manage risk on my position and re-consider my entry as my whole short-term thesis may be in jeopardy.

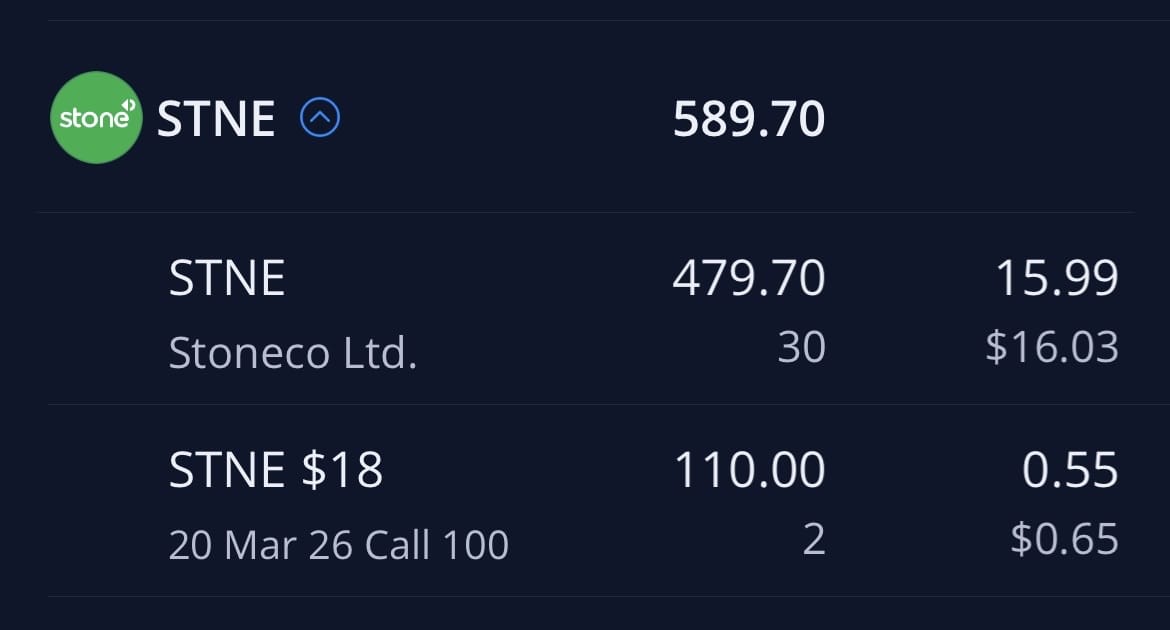

My position:

I currently hold 30 shares from $16.03

And two March 18c’s at .65 per contract

A roughly $600 position

If my stop-loss is is hit ($13.75) I lose about 14% or $70 on the shares.

My call options would get hurt pretty bad, but no more than max $130

This makes my risk defined at $200. Very tolerable.

If my thesis is correct, I this is an extremely asymmetrical bet as it will provide much more than $200 in potential gains.

Daily (2020)

When this stock first gained momentum in 2020 defending the $18-$19 area, this is what happened. I’m looking for those same buyers to get active again.

But, like I said, I will be selling my call options into a move like this.

Shares though,

Weekly (2021)

I’m lookin for all-time highs.

$55-$70 has been previously accumulated and inefficiently sold.

If my initial move is correct and I get to cash out these call options for a good gain, this covers my share position and will let me hold for as long as possible.

Got to keep in mind, this is a three year base on largest volumes ever…

I would expect the move lasts mote than just the March expiration.

However, price will see its ups and downs, this may not remain HOT, and so the initial spike on call options will make a majority of my gains and let me not worry about the opportunity cost of holding stock here for much longer and through potential drawdowns. Always keeping the same stop.

Thanks for reading.

I’ll be sure to share any updates on X!

Follow me: https://x.com/SevenParr

Join my Discord p for $7.77 where I share analysis like this on countless other stocks on a near daily basis. There is truly so much alpha in here. Join Here

Reply