- AllllSevens

- Posts

- Stock Market Melt-Up

Stock Market Melt-Up

Higher time frame lock-out trend analysis.

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions and commentary based on publicly available data as of July 28th, 2025. I am not liable for any losses incurred by others.

Past performance is not guarantee of future results.

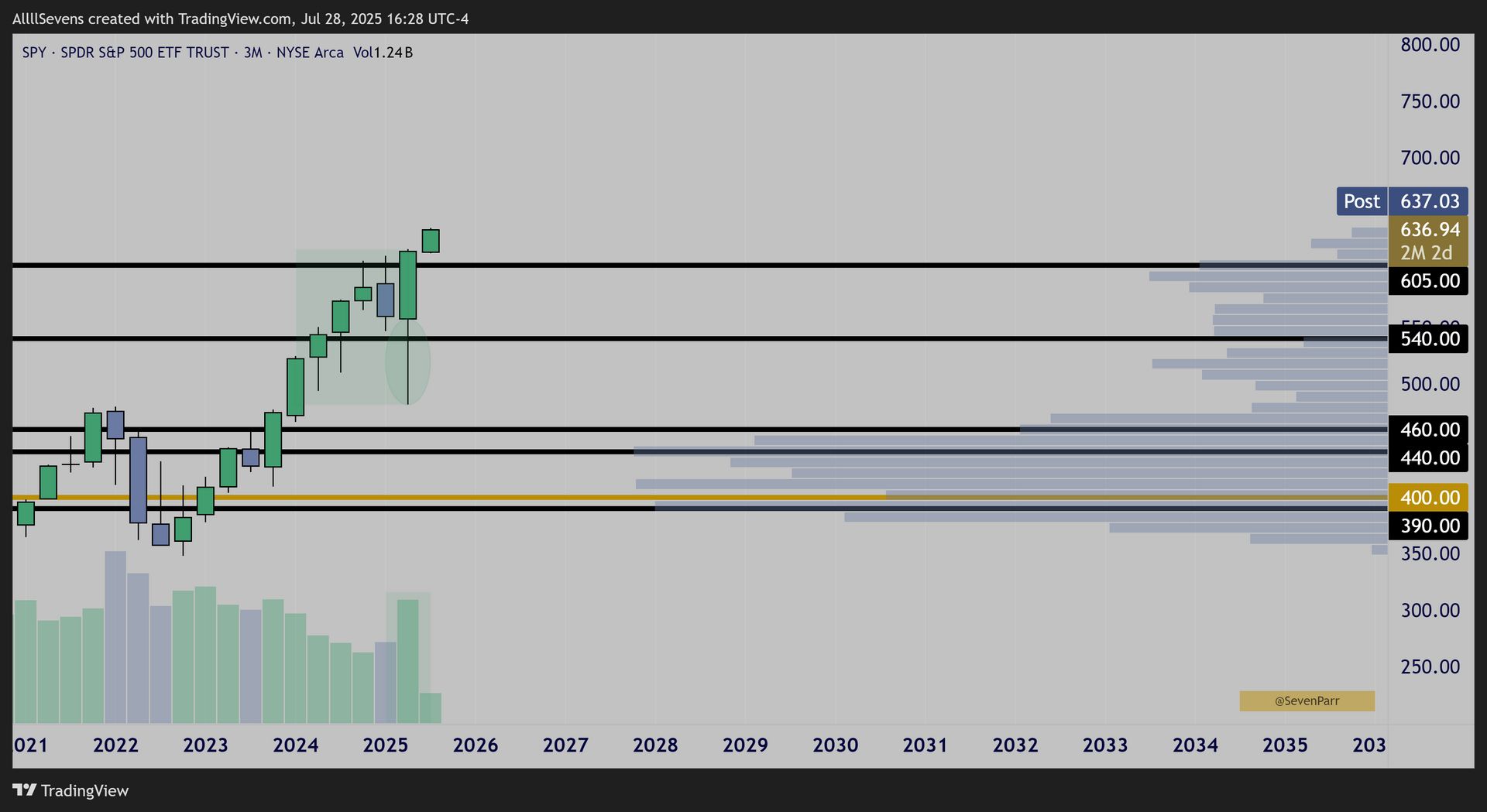

$SPY - SPDR S&P500 ETF TRUST

Quarterly Candles

Over the last two quarters, the market experienced a 20% correction and then bullish engulfed an entire year’s worth of price action on increased volume…

Certain parts of the market experienced HISTORICAL institutional investments during this period. Specifically VOO, IVV, as highlighted in prior newsletters:

Click here.

My point being, the current strength of the market is 100% backed by smart-money. The market is stable. The bearish and cautious narratives suggesting that institutions are sidelined is wrong. They are fully risk on.

In today’s newsletter I will be focusing primarily on why I believe semi-conductor stocks are absolutely unstoppable and only just beginning a massive melt-up.

I cover $SOXL, $NVDA ( $NVDL ) , $ORCL, & $TSM

Plus, $CVNA, $COIN, and $LQD

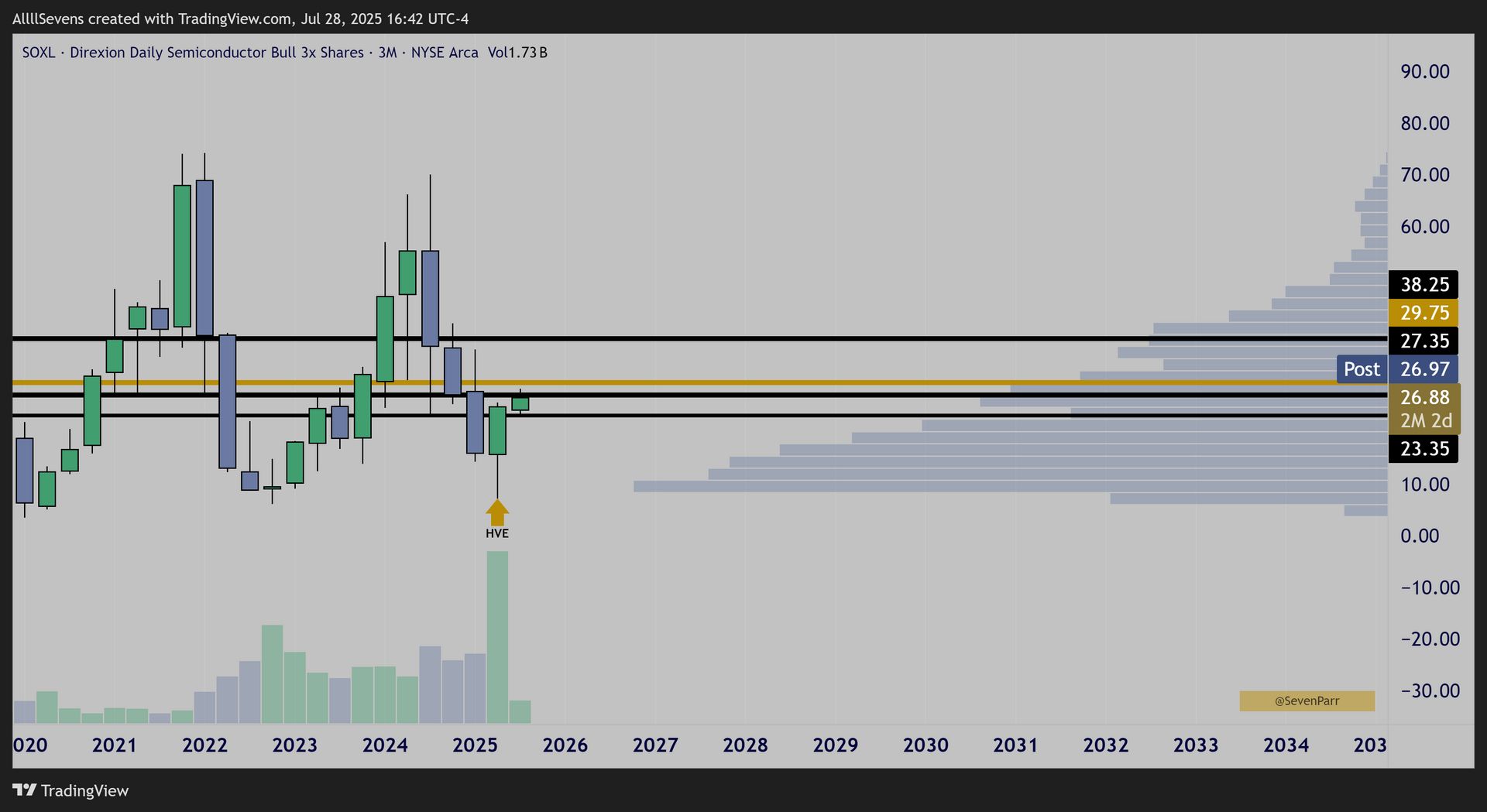

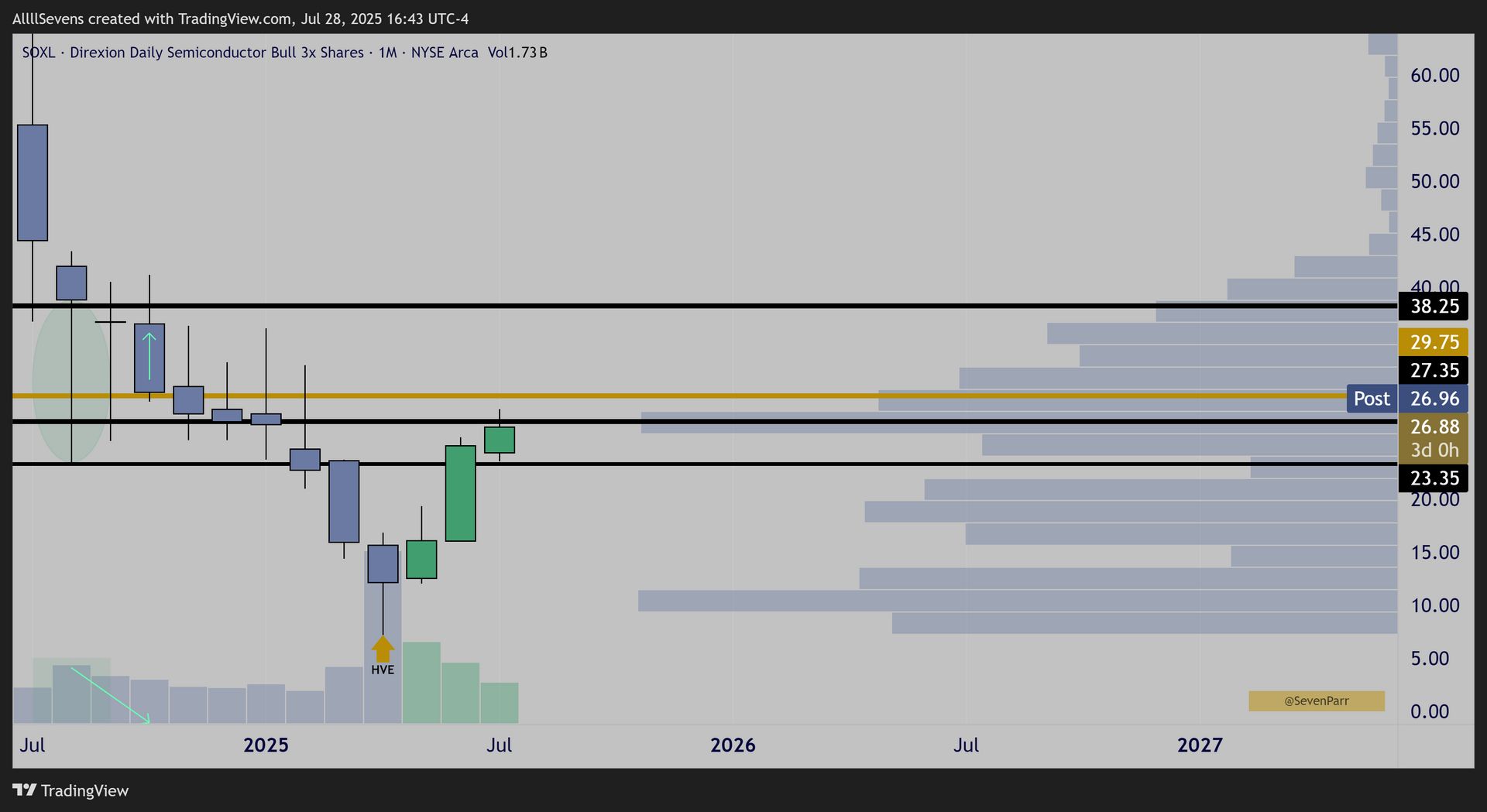

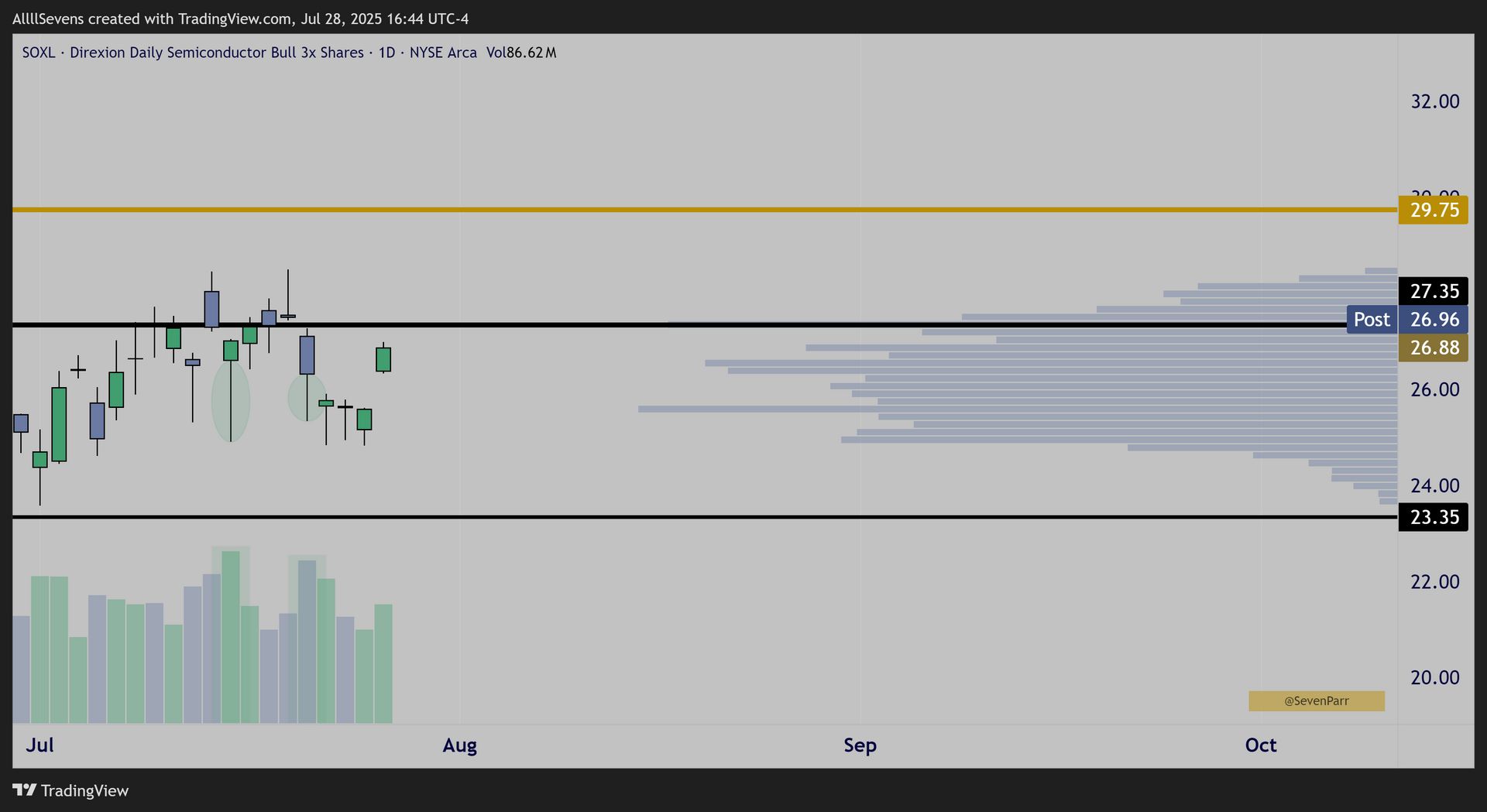

$SOXL - Direxion Daily Semiconductor Bull 3x Shares

Quarterly Candles

Monthly Candles

SOXL was just accumulated on its highest volume EVER last quarter.

With a clear discount open from the high $30’s…

Daily Candles

As price attempts to reclaim some major levels, buyers remain dominant on the volume. Let’s check out some individual leaders and see how they stack up…

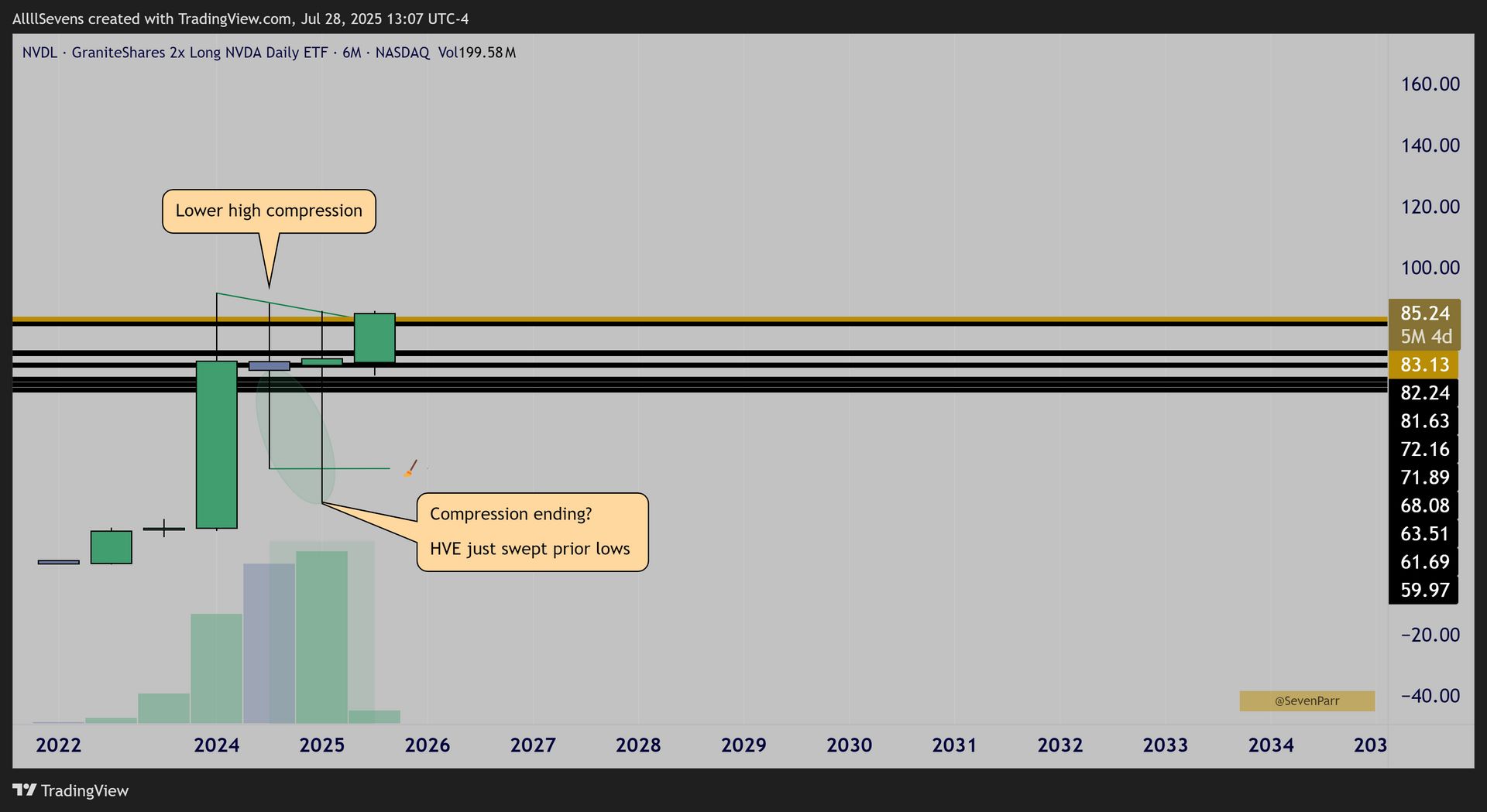

$NVDL - GraniteShares 2x Long NVDA Daily ETF

6 Month Candle Volume & Price Analysis

Ever since topping out in early 2024, NVDL’s price action has been locked in a choppy, sideways range. But in the first half of this year, institutions piled in with record volume—soaking up shares as range lows were “swept.”

This means a huge number of participants got stopped out while smart money used that opportunity to accumulate more aggressively than ever.

This setup creates peak FOMO and the ideal environment for an explosive upside move. While most are waiting for a dip—or too afraid to buy near all-time highs—this shows institutions are positioning for a massive melt-up.

The “top” isn’t in yet. Everyone who got stopped out earlier this year is about to chase back in—and that’s when the real breakout and euphoric move occurs.

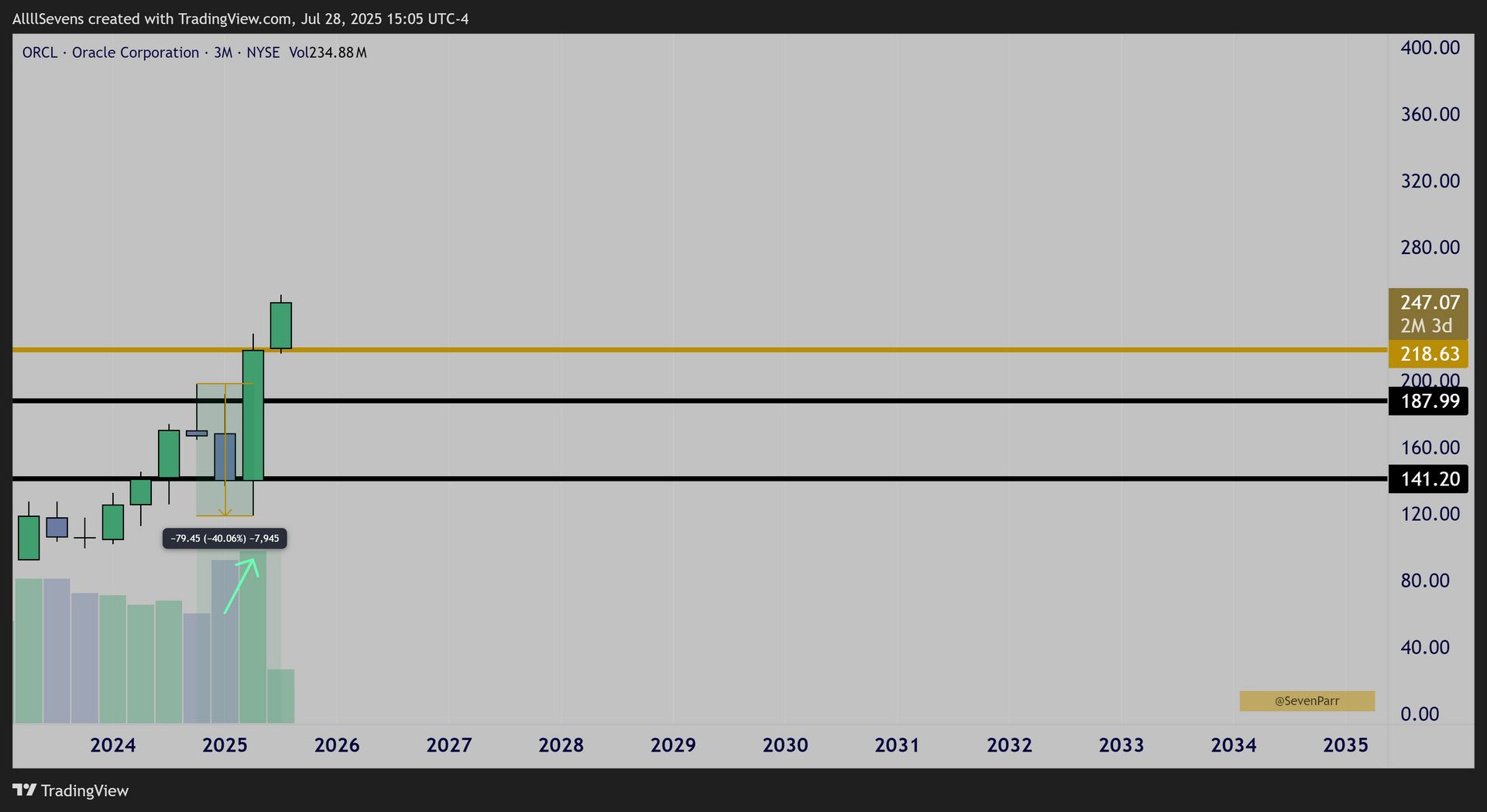

$ORCL - Oracle Corporation

Quarterly (3 Month) Candles

After this stock nearly got split in half (a 40% correction), last quarters candle bullish engulfed the prior three candles on a massive increase in volume…

Understand how insane that is. This creates a massive lock-out rally dynamic.

This stock should maintain a strong bullish trend over the coming months.

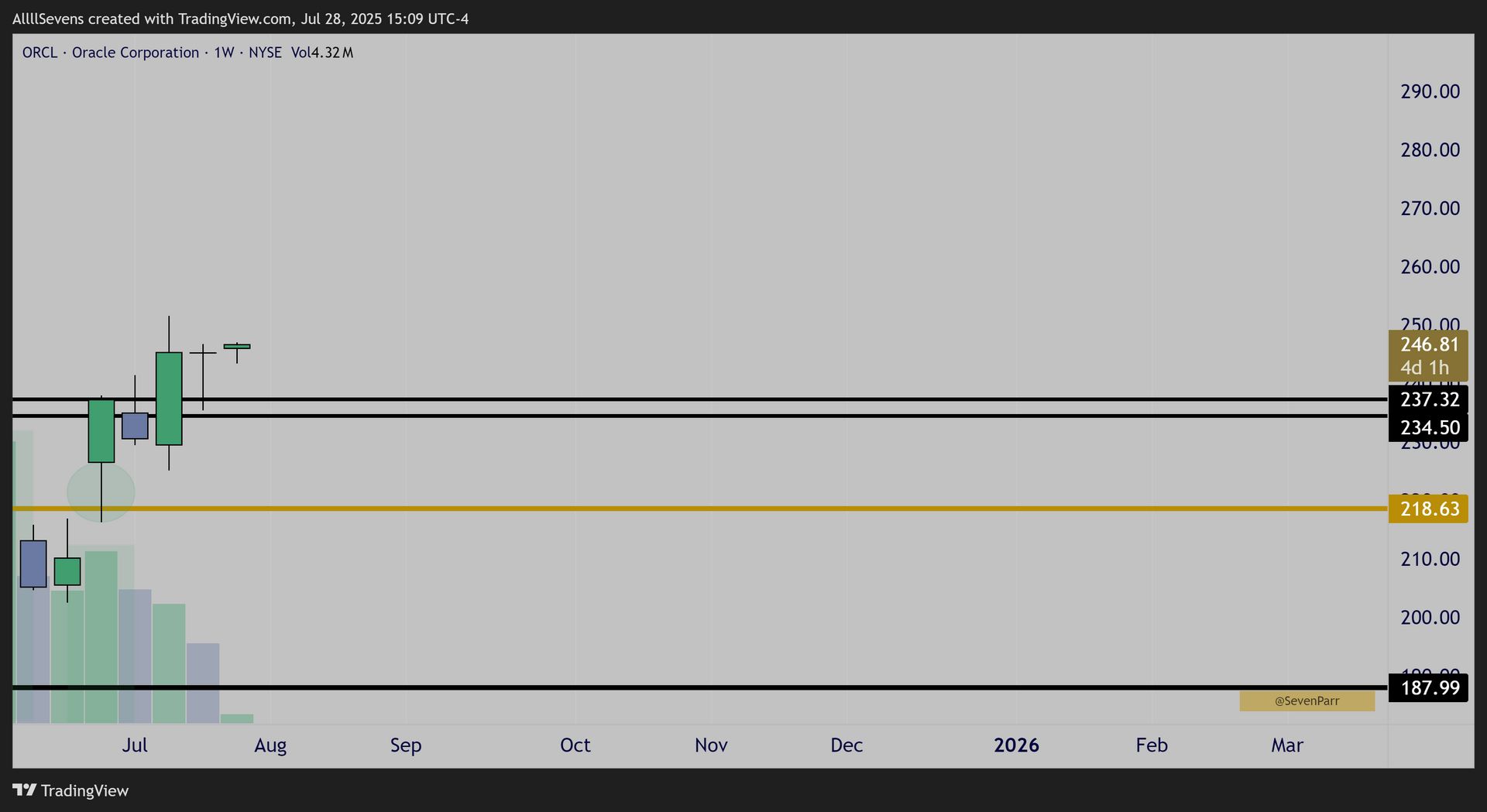

Weekly Candles

Here are a few more level to watch.

Last week an inside candle formed, holding support, favoring upside continuation. We’ll see. Any dips on this stock I will be looking to buy.

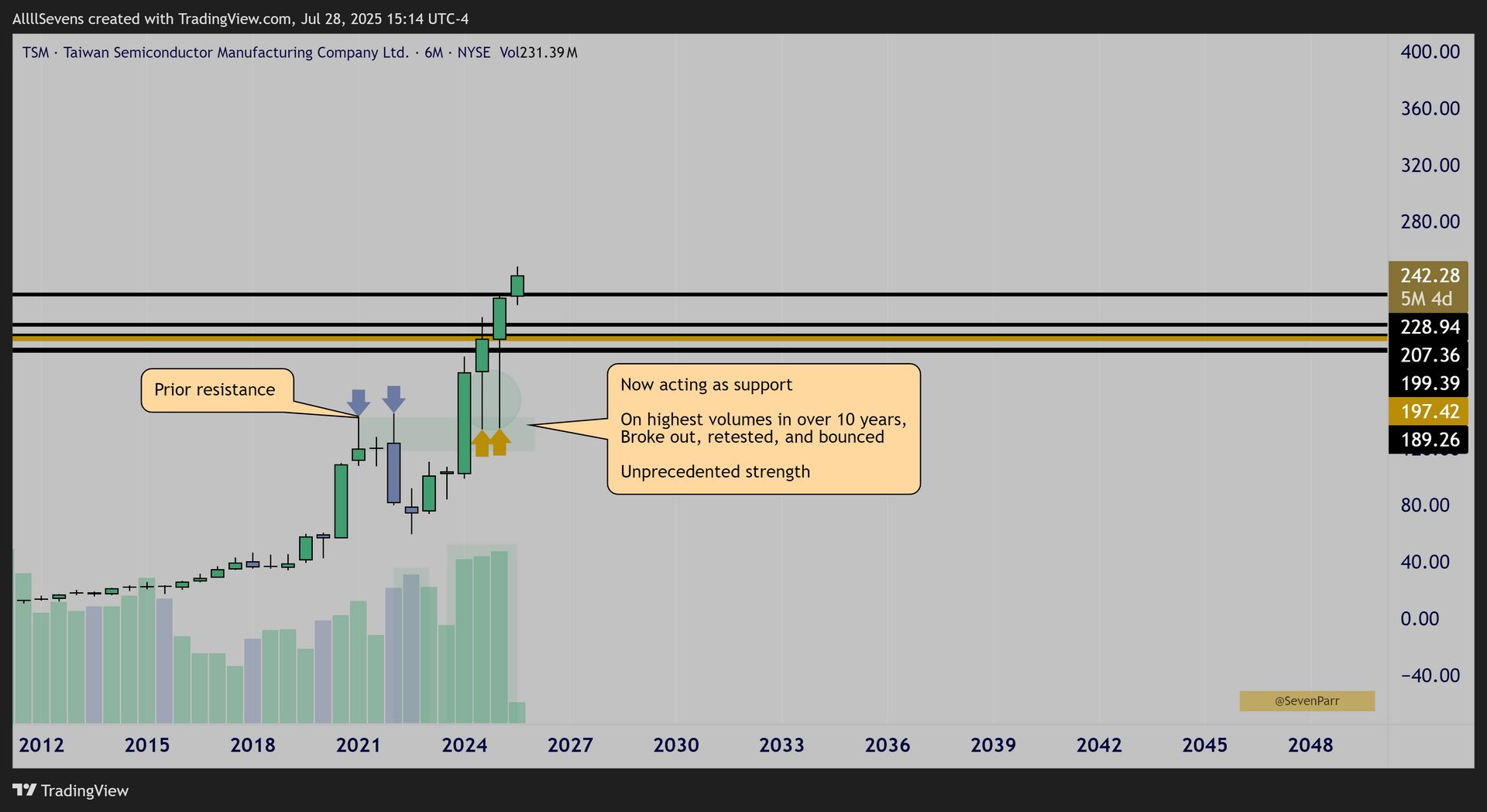

$TSM - Taiwan Semiconductor Manufacturing Company Ltd.

6 Month Candles

For three consecutive candles, this stock has traded its highest volume in over a DECADE, turning a major prior resistance into support…

I cannot begin to express how huge this is.

This is ant another “lock-out” scenario creating an amazing environment for a freakishly strong higher time frame bull trend.

Same idea as $ORCL - I’d argue even stronger.

$AVGO - Click Here

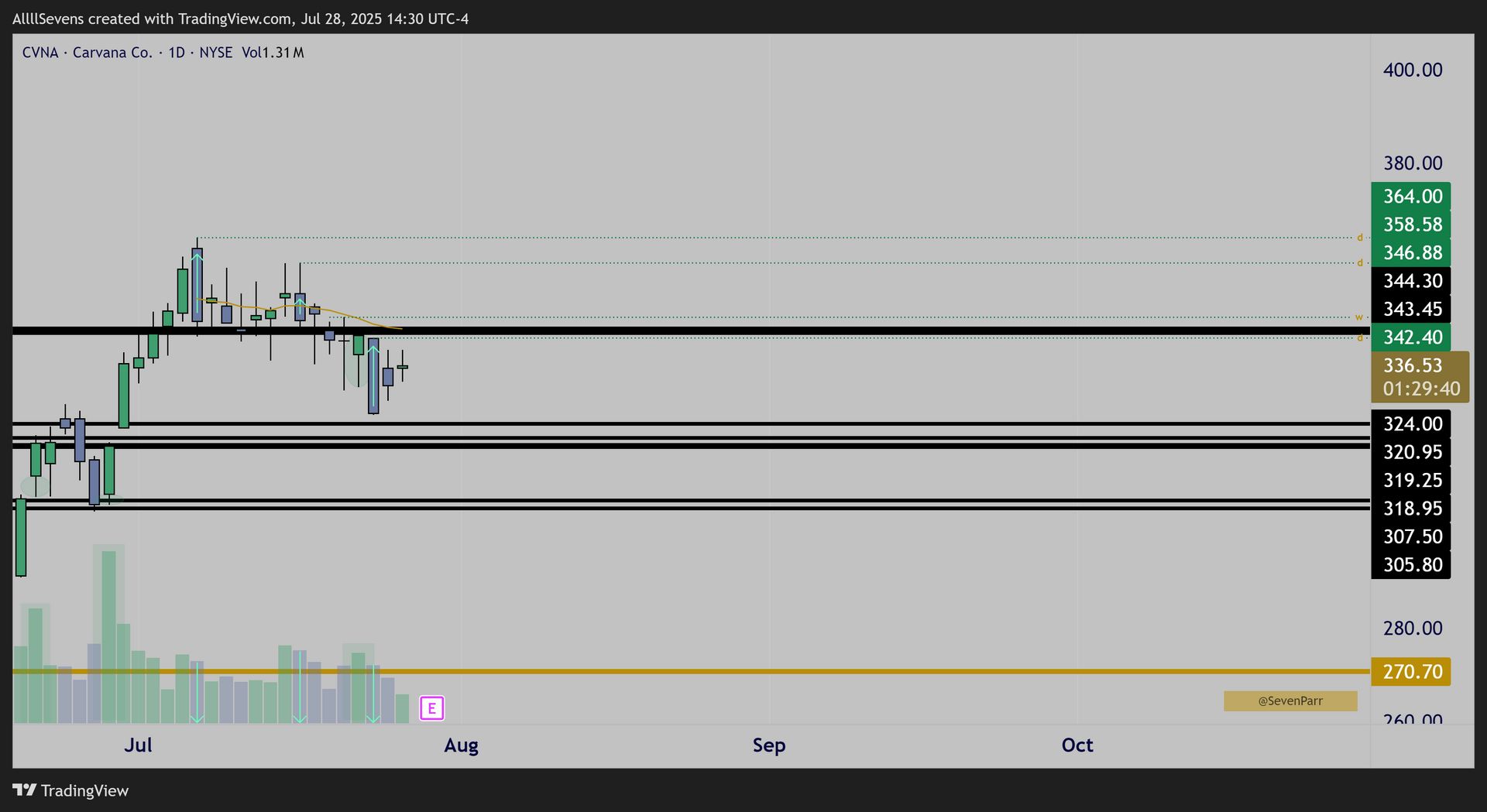

$CVNA - Carvana Co.

Daily Price & Volume Analysis

There is an extremely unusual, crystal clear institutional accumulation campaign occurring here. Textbook discounts open as high as $364.00

Earnings are very soon. Be aware. Something is brewing here. Whether or not there will be a dip to buy or a simple rocket ship, I do not know - but I do know the patterns I see here show crystal clear institutional investment.

I have a good feeling this will see new ATH’s by March at the latest.

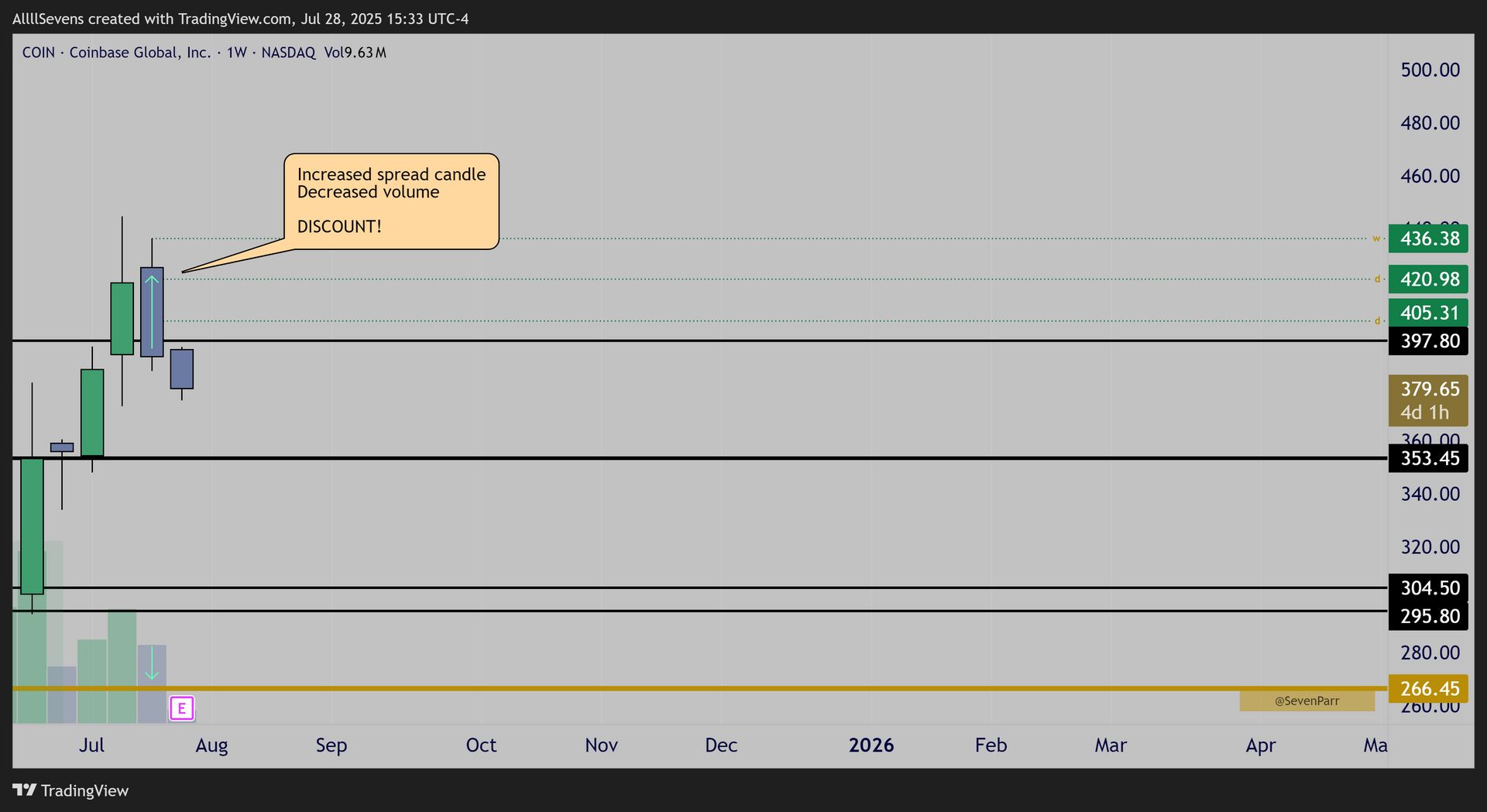

$COIN - Coinbase Global, Inc. $76M

Weekly Candles

Headed into earnings after S&P500 inclusion, short-term participants are taking profits whole long-term institutional investors clearly show zero participation.

In fact, they recently added long exposure from $353.45

Daily Candles

Clear institutional investment off the $353.45 level

Crystal clear discount selling off the recent high

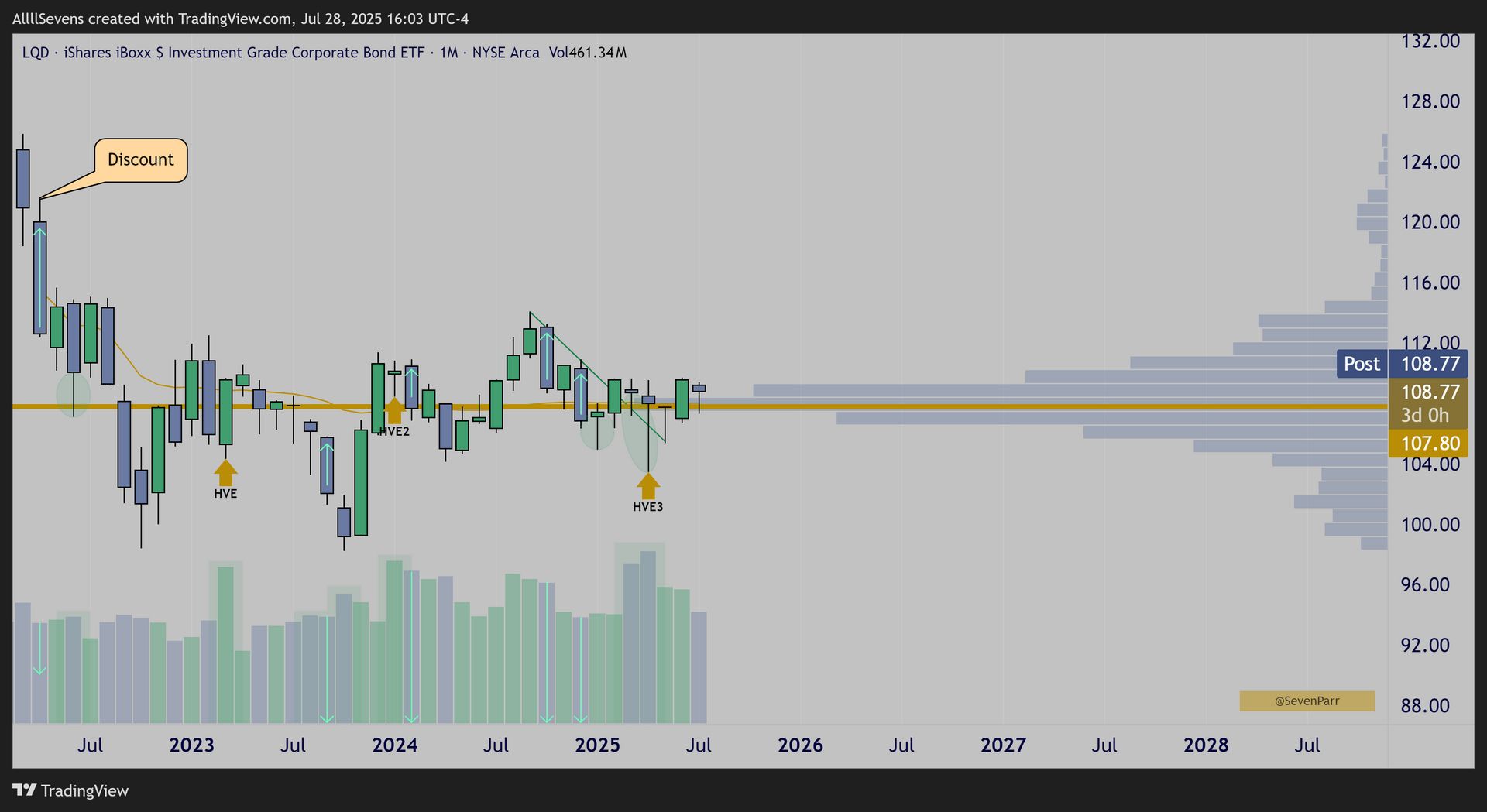

$LQD - iShares Iboxx $ Investment Grade Corporate Bond ETF $38M

Monthly Volume & Price Analysis

This is showing quite the aggressive accumulation base built off three highest volume candles ever over the last two years. I think not only is this setting up for a long-term recovery, but if $107.80 holds in the short-term, I really like 12/19 110c’s trading at about 1.15 right now.

This is set up for quite the explosive launch.

Sign up for more!

Get on my email list for FREE at the top right or bottom right of this page.

If you are finding value in my content, you’ll also love the occasional premium newsletter content I publish PLUS access to my discord where I am constantly scanning the market and preparing for the next move.

There are a handful of setups have covered exclusively in my discord that I simply don’t have time to write about in newsletters. See for yourself.

It costs just $7.77

Upgrade Here

Check out a free sample of a previous premium newsletter - Click Here

One of the next few free newsletters like this one is going to include paid content, so be prepared!

Reply