- AllllSevens

- Posts

- Tesla, Inc. & Intel Corporation

Tesla, Inc. & Intel Corporation

A long-term & short-term perspective headed into important earnings reports.

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold ME, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

Make sure to follow my new twitter!!!

https://twitter.com/SevenParr

Preface:

Tesla, Inc. reports earnings this Wednesday after the bell.

First, I will analyze this stock from a LONG-TERM perspective.

A 10+ year perspective.

Then, I will break down the current situation, and what is needed for the ongoing downtrend to be broke, and what needs to happen for me to try taking calls into earnings.

Let’s keep in mind, an earnings report is always a big coin toss and whether I am right or wrong about this short-term move, I ask you not to expect the same results in the future. It’s a huge gamble. Let’s have fun with it.

After analyzing Tesla, I dive deep on another one of my favorite stocks:

INTC

TSLA

Long-term Outlook:

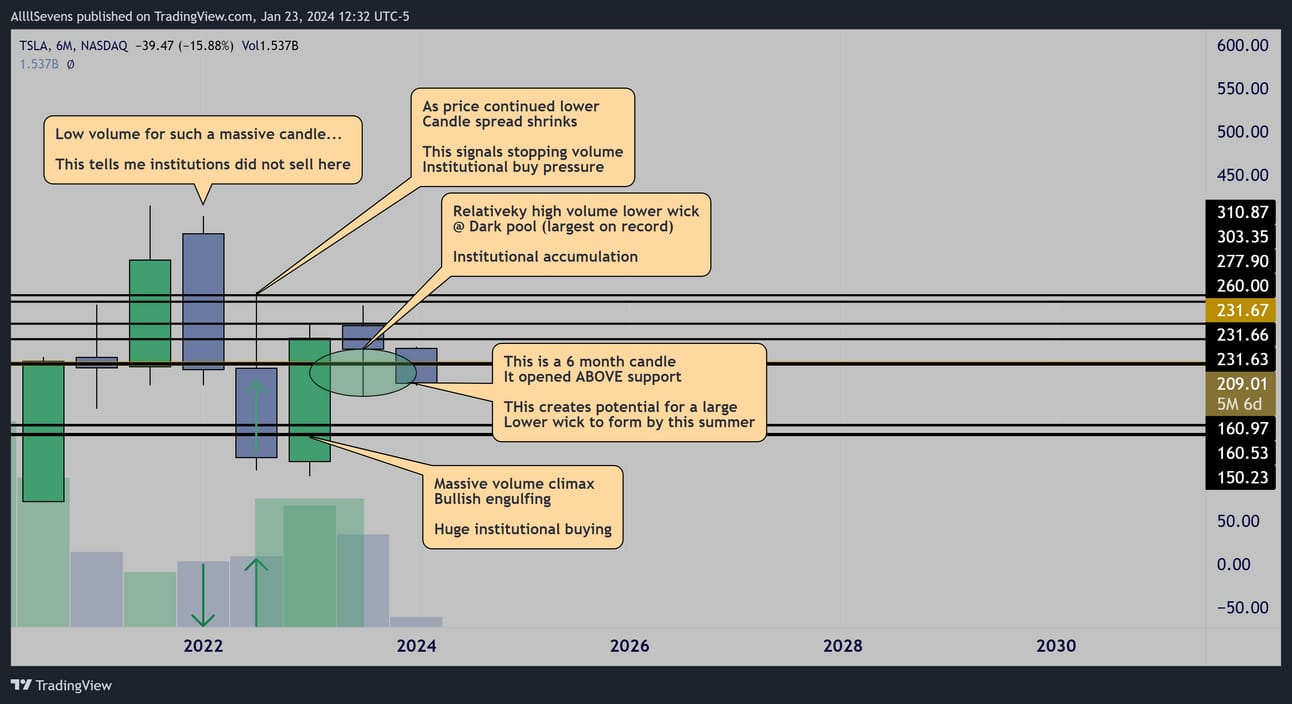

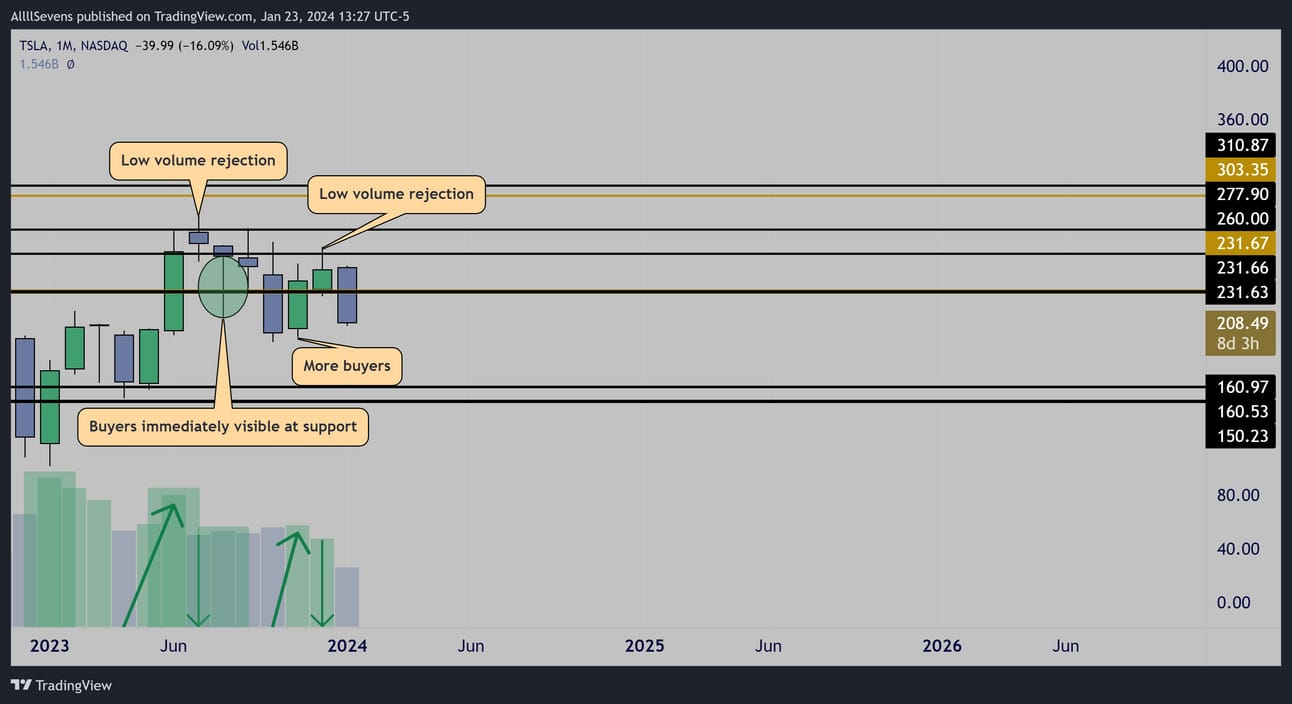

6 Month

The 2022 top is clearly not backed by any institutional money.

In fact, as price pulled back, we see a classic volume climax signaling institutional buy pressure:

Decreasing candle spreads & increasing volume.

The next candle is consolidation / accumulation over the largest dark pool on record. $231.67, which I’d also like to point out, is THE largest dark pool transaction on any indivudal stock in the entire stock market since December of 2020 totaling $42B

TSLA has the highest level of institutional interest out of any stock.

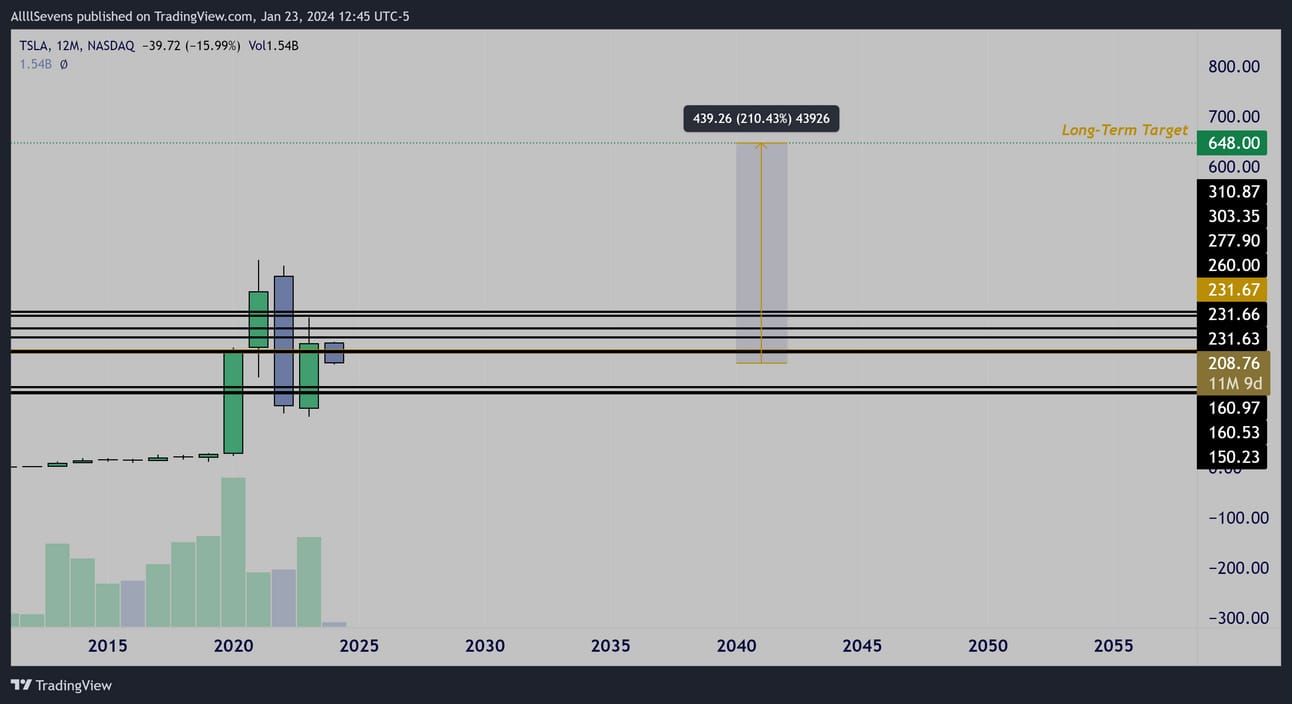

Yearly

I predict over the long-run TSLA will reach $648 per share.

This could take decades, it could take a few years, I have no idea.

This makes the risk of owning TSLA long-term, asymmetrical.

The stock either more than triples in value, or it goes to 0.

With proper position sizing and allocation, that’s a great investment to me. And when it’s clear institutional money is putting a large portion of their money here, it makes me pretty confident in this thesis.

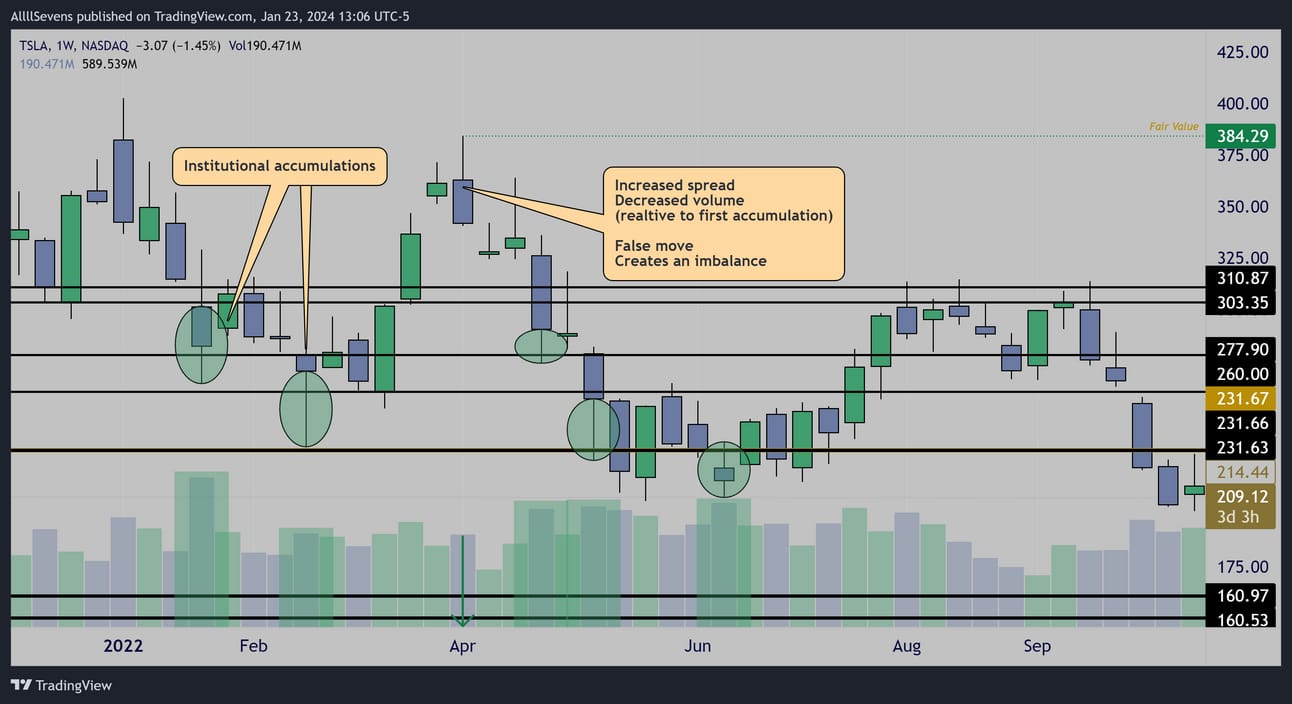

Weekly

Looking back at 2022 weekly price action,

I determine the “fair value” of TSLA stock as $384.29 per share

Any price below, I consider a discount.

This means there’s truly no reason to go ALL in now.

Sometimes the best thing to do is add into strength.

Let’s talk more short-term, and about this upcoming catalyst.

Short-Term Outlook:

The 6 month candle is currently pivoted UP over the $231.67 support. This gives short-term bulls a window of opportunity into summer.

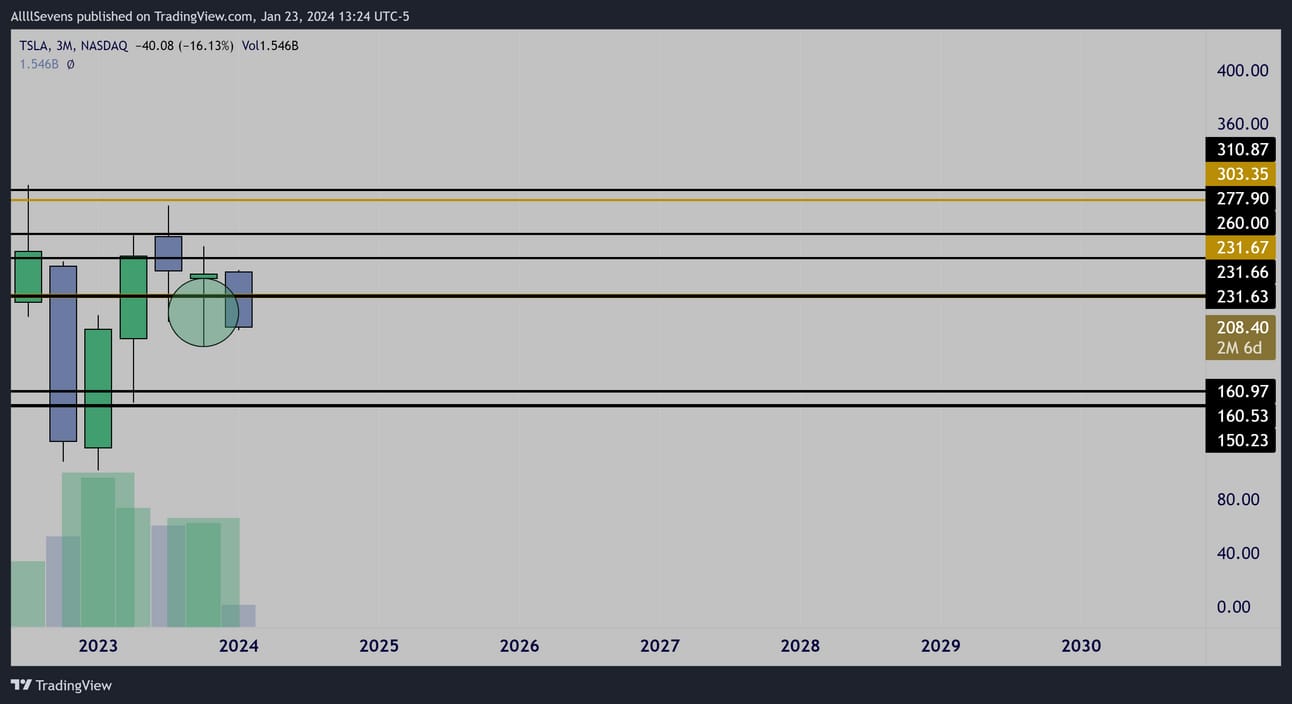

Quarterly

I’d go as far as saying, if we want to see EXPLOSIVE short-term upside, $231.67 needs reclaimed by the end of this quarter. If that fails to happen, price is likely to chop and potentially fade lower into the $150’s

Monthly

When I look at the monthly chart, it’s as clear as ever that institutional money is buying this stock.

WHY is it struggling so bad to trend up?? Why is this low volume rejection every single high?

Well, there’s a lot of uncertainty around TSLA stock at the moment.

Controversy even. This isn’t what short-term focused retail investors want to see. The long-term institutional investors don’t care.

They know the uncertainty and controversy will clear up in a decade.

This is why I believe the upcoming earnings report could be very critical to whether or not this 6 month candle can rally into the summer.

Short-term sentiment needs to be shifted!!!

Uncertainty needs to be unveiled.

So, how likely is it that this earnings report is extremely positive and shifts the current downtrend into an uptrend?

Well it’s inherently unlikely because this is a pretty much random news event, but I have been collecting lots of data on this stocks price action and options flow and I have to lean to the long side…

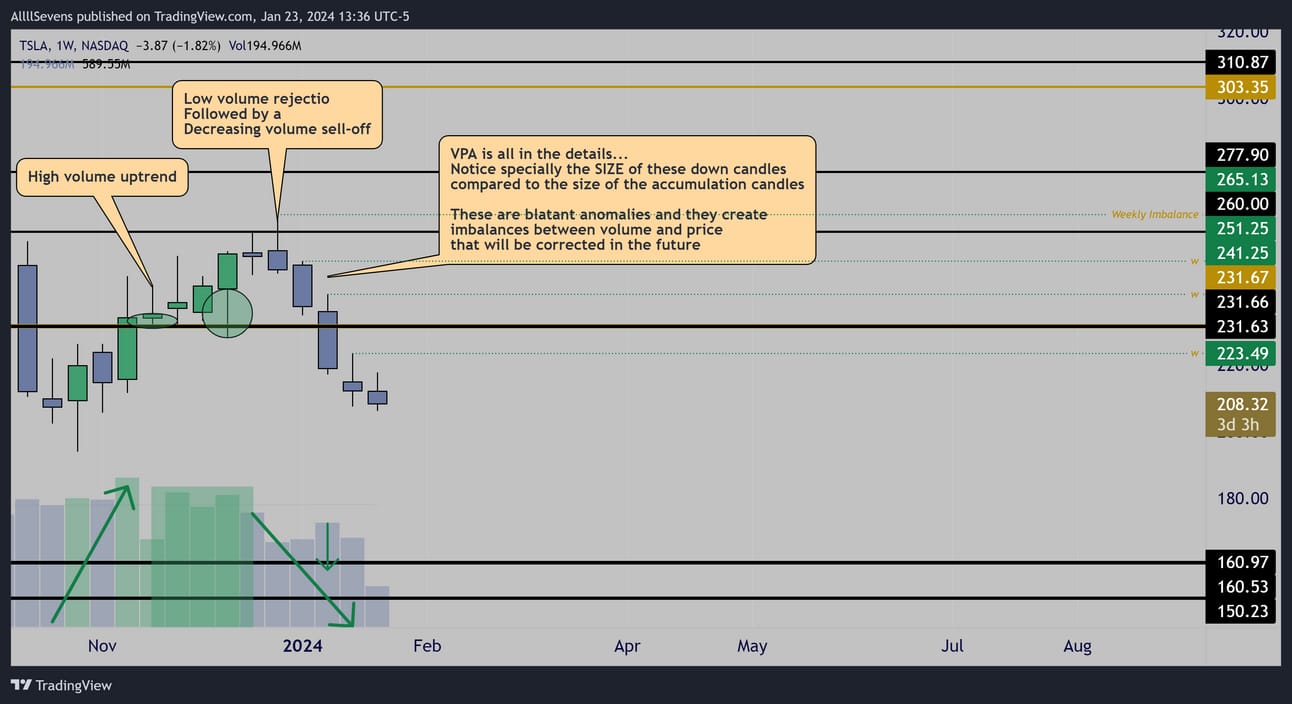

Weekly

The weekly chart perfectly displays what the monthly chart above shows:

High volume buying followed by low volume selling.

The recent sell-off is a major anomaly.

These candle spreads down are all larger than the accumulation candles we just saw off $231.67 creating a disagreement between price and volume. “Imbalances”

The highs of these candles will be rebalanced.

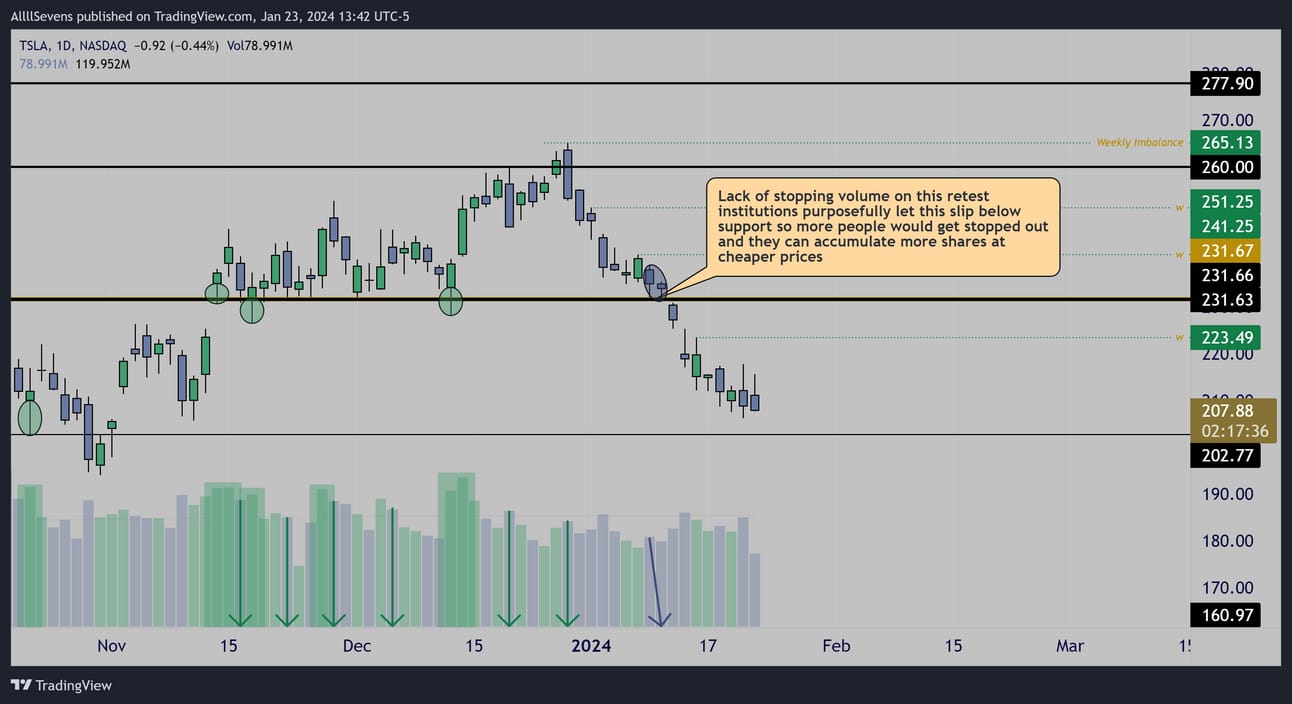

Daily

The daily chart shows the same thing,

but that’s not what’s important here.

Notice how institutions slowed down their accumulation when $231.67 was retested after FAILING to break over $260

Why would they not support $230 again?

Because the failure to break $260 told them that retail participants are absolutely not ready to buy. They need to absorb more shares.

They already absorbed the hell out of $230 so now they know that if they want $260 broke, they’re going to need to absorb lower.

Have they been absorbing more?

Yes. Subtly. Every day they are accumulating small amounts, but there has yet to be a strong daily or weekly candle on very high volume…

Our earnings report this week could bring exactly that.

Now, this almost makes me think-

Wouldn’t it be logical then for another sizable drop between now and tomorrow to allow for massive accumulation?

The final support I will be watching until range opens up to $150-$160 is the $202.77 level.

Before I wrap all of this up and give my plan, let’s check out the options flow for TSLA recently, because it has been RELENTLESS!

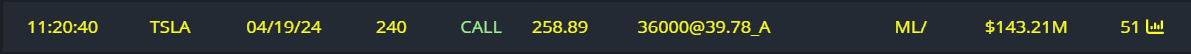

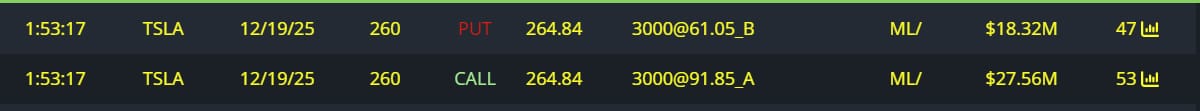

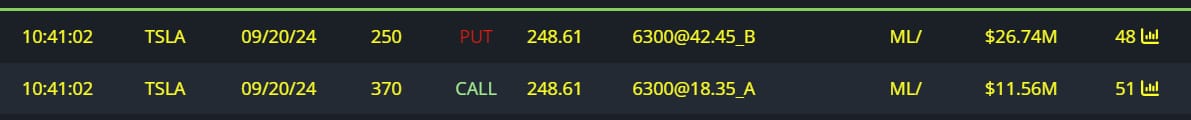

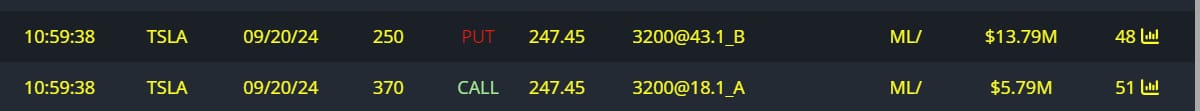

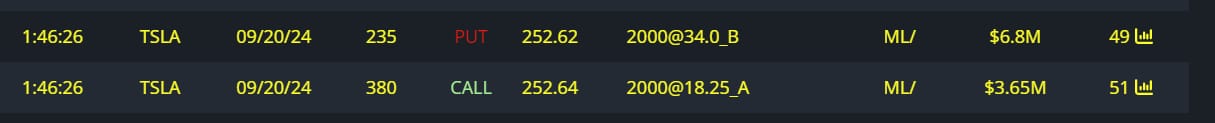

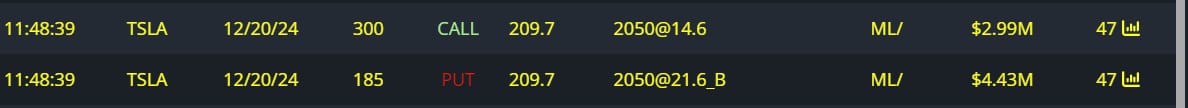

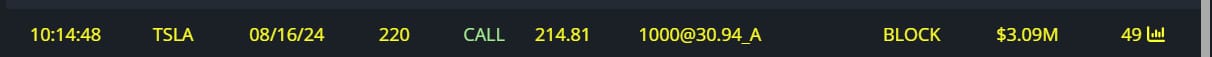

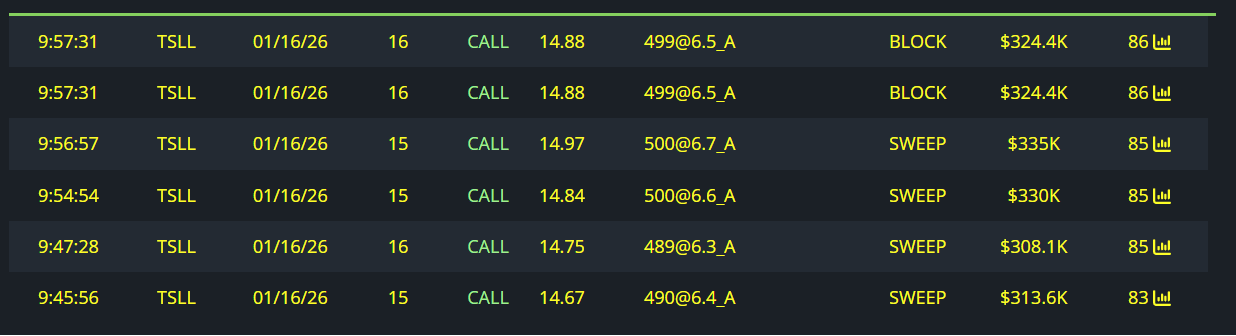

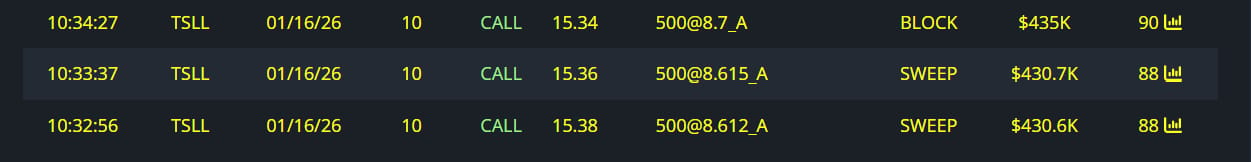

Unusual Options Flow

$143M Calls Bought

(12-28-23)

$45M Full Risk Bullish Order

(Months ago around the $231 level)

$38M Full Risk Bullish Order

(Months ago around the $230 level)

$19M Full Risk Bullish Order

(Months ago around the $230 level)

$10M Full Risk Bullish Order

(Months ago around the $230 level)

$7M Full Risk Bullish Order

(Today)

$5M Calls Bought

1-23-24

$3M Calls Bought

1-18

$2M Calls Bought

(Months ago around the $231 level)

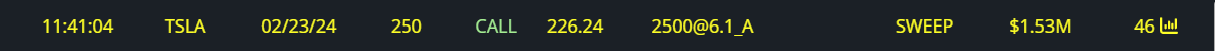

$1.5M Calls Bought

1-11-24

$1M Calls Bought

(Months ago around the $230 level)

A majority of this flow is heavily underwater, but they have LOTS OF TIME

They are betting on the 6 month and quarterly candles to hold $230

No doubt.

Conclusion

I love TSLA long-term. Being bearish TSLA long-term, you are betting against massive institutional money that quite literally controls the market given enough time passes by.

I predict a rise to $648 over the next few decades.

Any price below $384.29 is on a discount to me.

Therefore, I feel no urgency to “go all in” at these cheap prices.

I’d rather buy in every week or month at whatever price the stuck is as long as it’s below $384.29.

In the short-term…

I know the current downtrend will not last. But I don’t know when it will break. I do know, it will likely occur alongside a news catalysts such as a extremely positive earnings report…

So, I am willing to go long TSLA into this report, but under one condition.

Like I mentioned on the Daily chart-

Institutions clearly want to absorb at lower prices, shown by their lack of aggression on the $231.67 retest…

This tells me that I don’t want to take short-term longs until I see confirmation of major buyers appearing on the daily chart.

Tomorrow, I’ll be watching for a large volume bullish candle.

If I get that, I’m going long.

If I don’t get that, I have a feeling the earnings event itself will be the capitulation and we could see the buyers step in big time on a gap down following earnings. Then, I would go long.

If tomorrow show’s no urgency from buyers heading into the report,

Then unfortunately even though I might miss a $30 gap up, I will simply wait it out. The chances of a gap down before the move up are too heightened I do not see strong buyers on tomorrow’s candle headed into the event.

Reply