- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

SPY indisputable bullish candle?

Disclaimer

I am not a legal professional.

The content shared in this newsletter is purely my personal opinion and for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

SPY

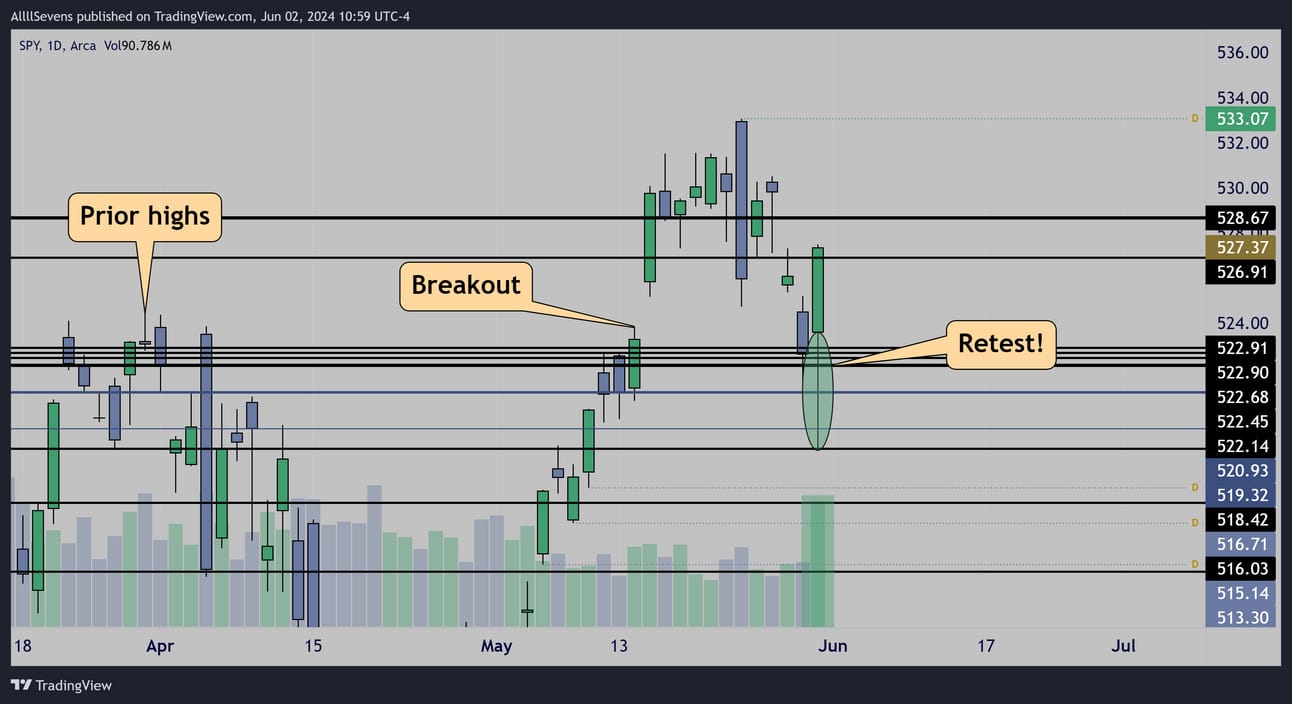

Friday’s candle ‘looks’ indisputably bullish;

A breakout and retest of prior highs resulting in an increased volume bullish engulfing candle with a prominent lower wick

Daily Interval

With that said, I’m here to dispute it

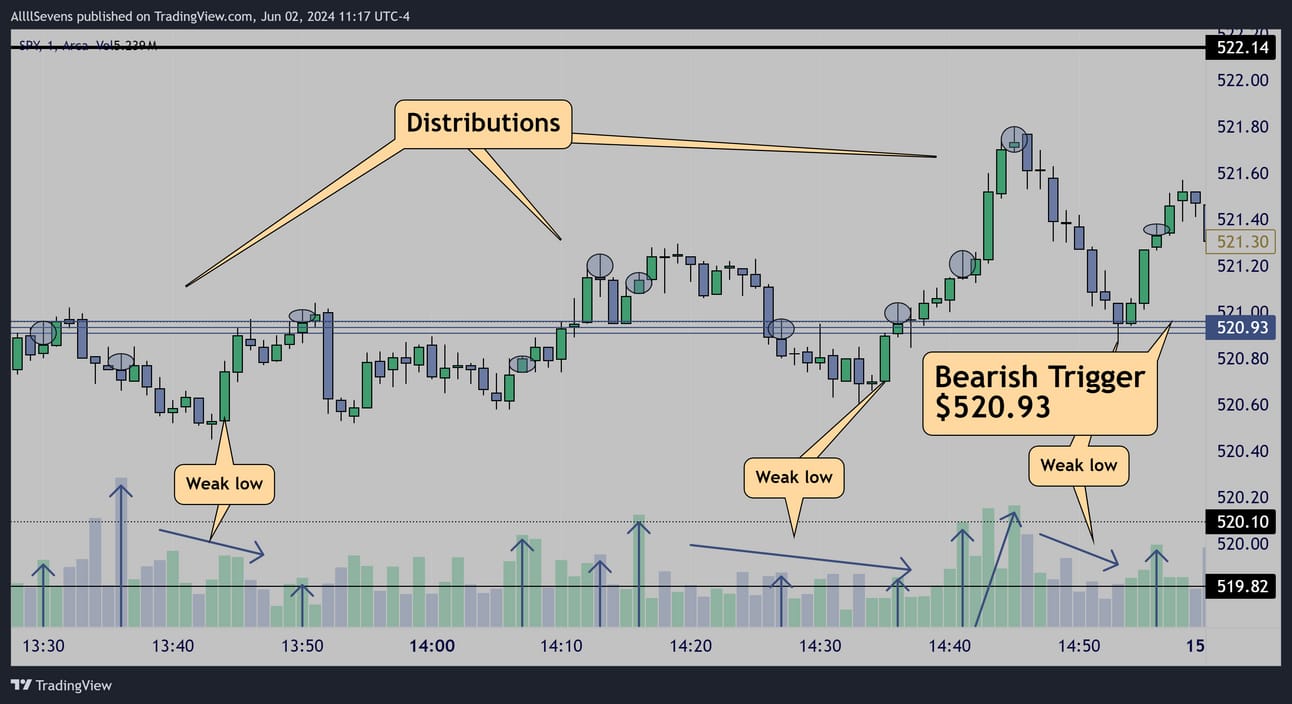

The internal tape of this candle shows major red flags. 👇

1m Interval

1m Interval

Institutions did not buy on Friday. They sold

Specifically off their dark pool levels, $519.32 & $520.93

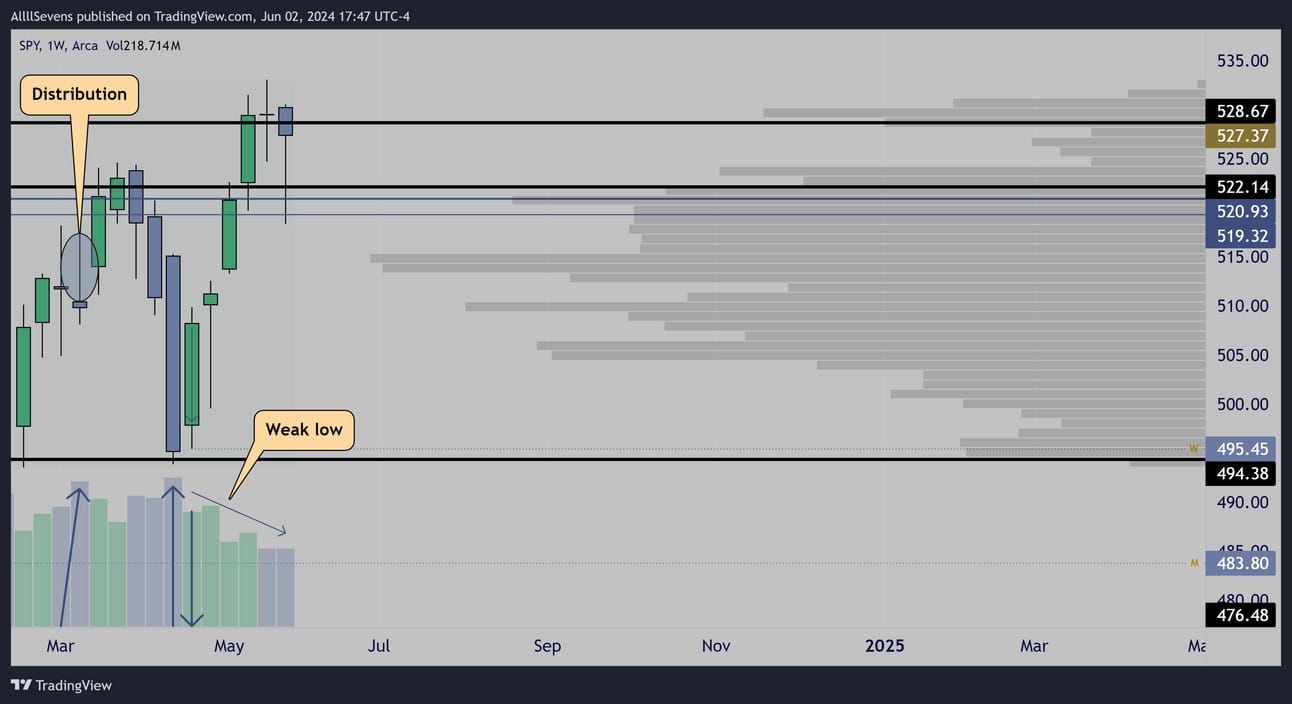

Weekly Interval

Zooming out, we see the reason institutions aren’t buying this retest…

Distribution began back in March and an unstable low was made in April

Daily Interval

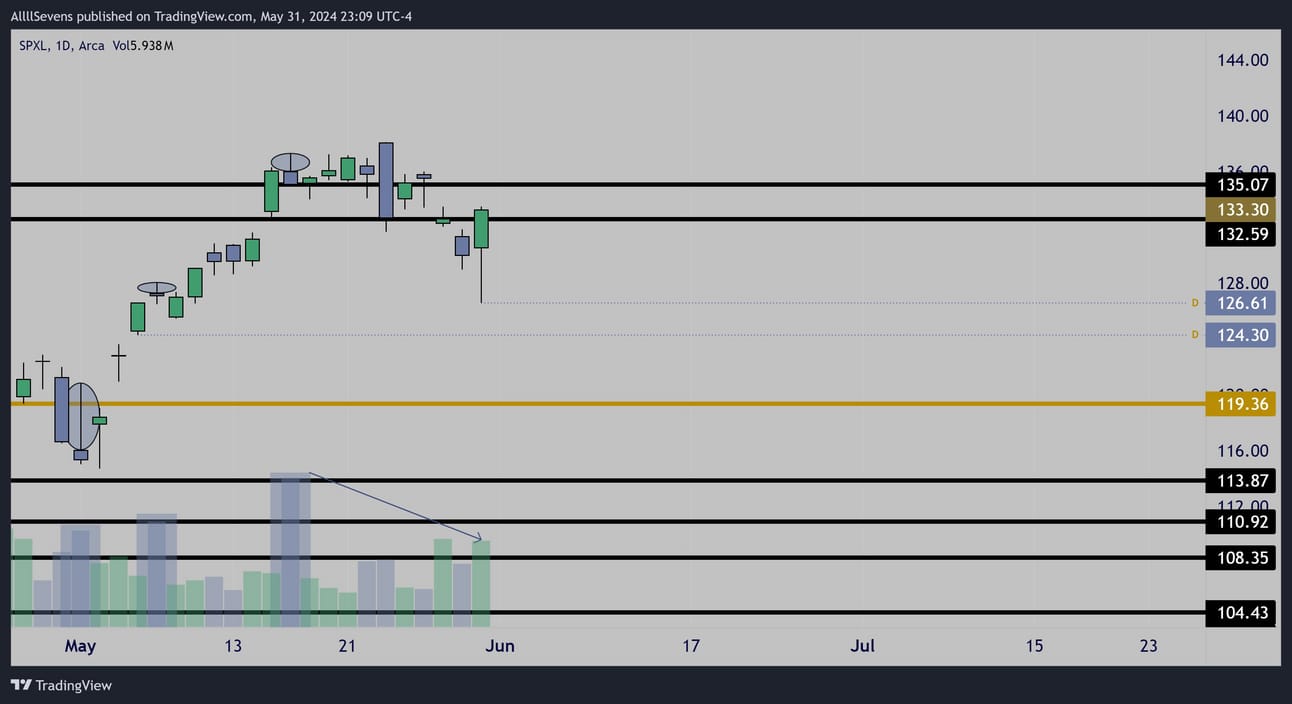

This is the 3x leveraged SPY, the SPXL

It shows strong distribution patterns

Another notable chart…

Weekly Interval

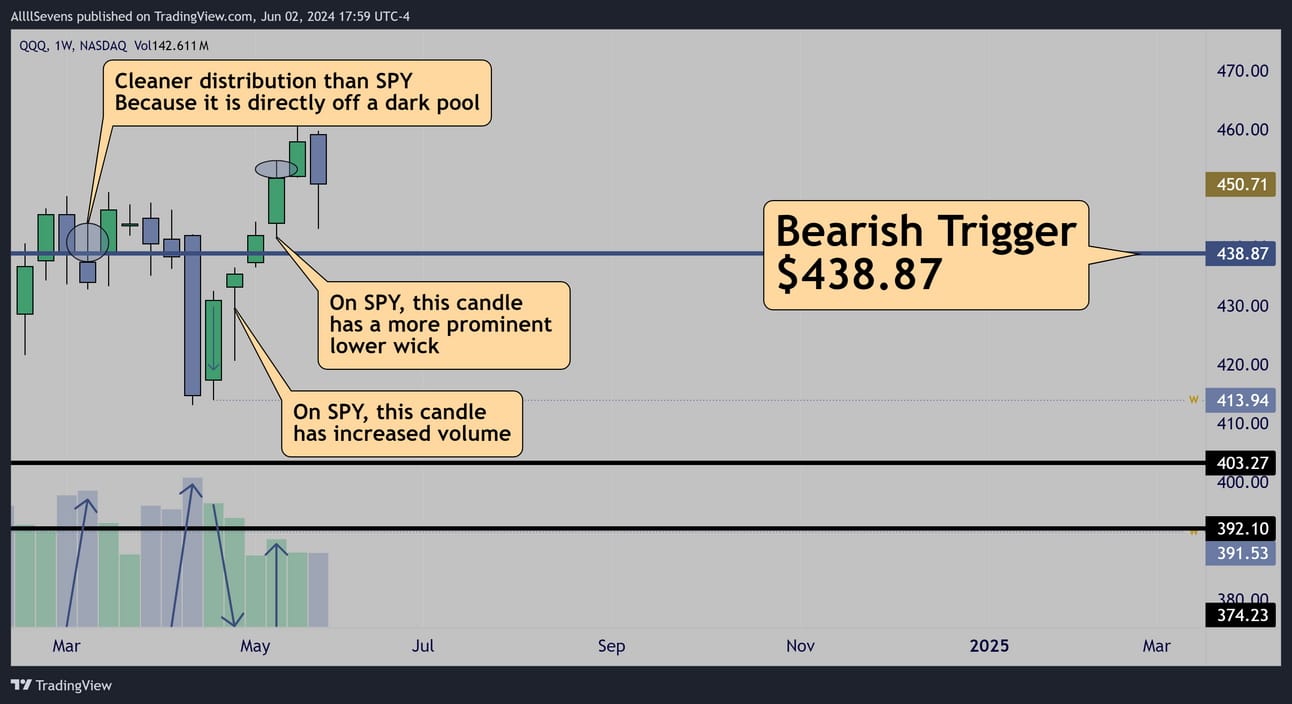

The QQQ is notably different than the SPY in all the right places…

Conclusion

As the market makes a seemingly perfect bullish setup into the new month, institutions are actually going risk-off.

I think it’s extremely notable they’re doing this more so on the higher risk / higher volatility instruments like the QQQ and SPXL

A short-term failure & pullback potentially below April lows is coming.

But, when??

I don’t have a crystal ball & I have absolutely zero interest in nailing THE TOP. That’s a losers game. This newsletter is NOT me calling top…

The market could ROCKET here for all I know.

I just know it won’t last.

This is why I’m going to play a winner’s game:

Wait for my bearish triggers to get broke.

SPY bearish triggers: $520.93 & $519.32

QQQ bearish trigger: $438.87

Until these get triggered, I have no trade.

If the market goes higher, I wait & I stack cash while everyone else gets sucked into a sucker’s rally.

Reply