- AllllSevens

- Posts

- Weekly Newsletter

Weekly Newsletter

Capitulation or more downside ahead?

Disclaimer

This newsletter presents my technical analysis and insights for informational purposes only. It is not financial, investment, or trading advice, nor is it a recommendation to buy, sell, or hold any asset. I am not a licensed financial advisor.

All content reflects my own personal opinions based on publicly available data as of April 06, 2025. I am not liable for any losses incurred by others.

Preface:

Last week, while highlighting a major long-term accumulation, I stressed that unless support was reclaimed, I was saving cash and prepared for more downside similar to 2022 price action. That’s what we’ve got.

What now?

Last week’s newsletter for context: CLICK HERE

The S&P500

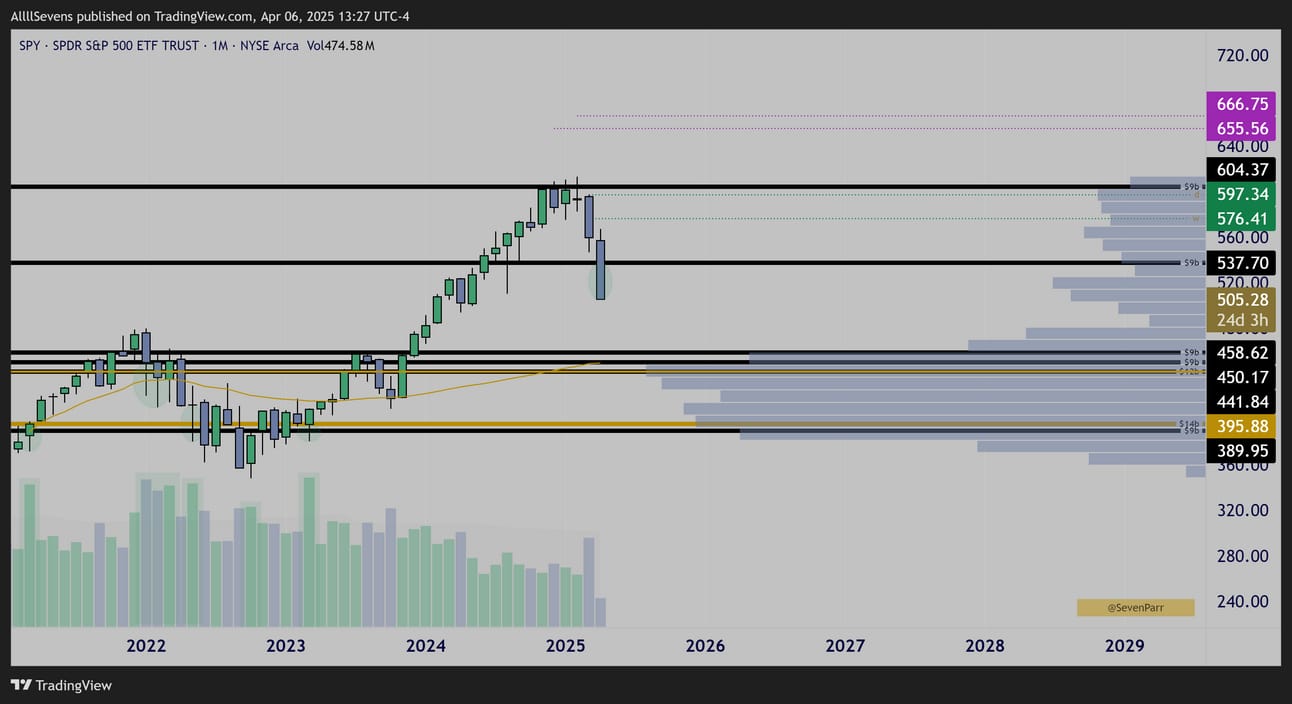

$8.75B Dark Pool @ $537.70

SPY Monthly Interval

We know that discounts have been left above and this is a large transfer of wealth from short-term speculative money to long-term institutional investors.

So, when are they going to initiate their second round of dark pool accumulation after the first range broke down over the last few weeks?

A very significant dark pool came in last week and it’s possible that price reverts back to that level creating a lower wick and showing accumulation on this months candle. If that’s the case, here’s what needs to happen:

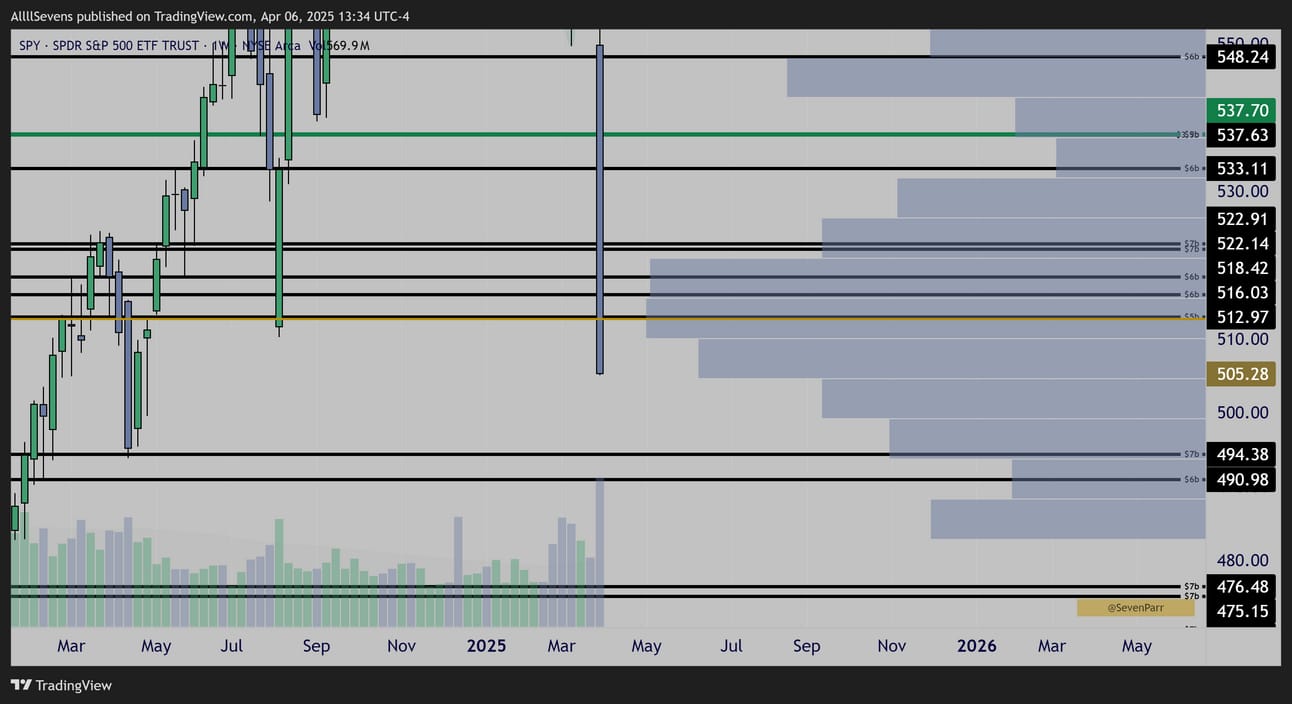

SPY Weekly Interval

Slicing through all support levels on high volume and closing at lows is not a great look. For bulls form this monthly wick, price needs to quickly reclaim this $512.97-$522.91 dark pool cluster and not use it as resistance.

Until / unless this happens I have pretty much the same outlook that I have had the last 3 weeks now. Major supports keep getting lost and until a statement is made by bulls, where these supports don’t immediately act as resistance after lost, I don’t see why I should initiate my second round of accumulation yet.

For now, I am still just holding, and saving cash.

While things remain broken short-term until proven otherwise, we have confirmation of an absolutely massive long-term wealth transfer undereway.

I could go ahead and start buying again, but like I said in last weeks newsletter, this correction has potential to be similar if not even more intense than 2022’s considering the dark pools are 3x larger, so I am being pretty laid back, knowing there’s a chance it takes quite some time for the dust to settle.

With that said, there is tons of data I am collecting and analyzing in anticipation of a risk-on signal at any moment. My goal is to know exactly which assets are experiencing the largest institutional investment during this downturn so I can outperform significantly when the secular bull market continues.

I will continue to update my thoughts each and every week.

For $7.77 / month you can get access to my DISCORD where I am sharing this extensive research before I talk about it here.

Sign up here, log in, and join with the link below 👇

Reply