- AllllSevens

- Posts

- Weekly Newsletter 2/20/24

Weekly Newsletter 2/20/24

SPY & QQQ Reversal or Continuation?

Disclaimer

I am not a legal professional.

The content shared in this newsletter is for information purposes only.

You should not interpret any of this as investment or financial advice.

The statements I make are not solicitations, recommendations, or endorsements to buy or sell a security or financial instrument.

I am not a fiduciary on account of your viewing of this information.

You are solely responsible for the risks involved with the use of any information shared in this newsletter.

By using this site and reading this newsletter, you agree to not hold me, my affiliates, or any third party liable for decisions you might make based of information shared in this newsletter.

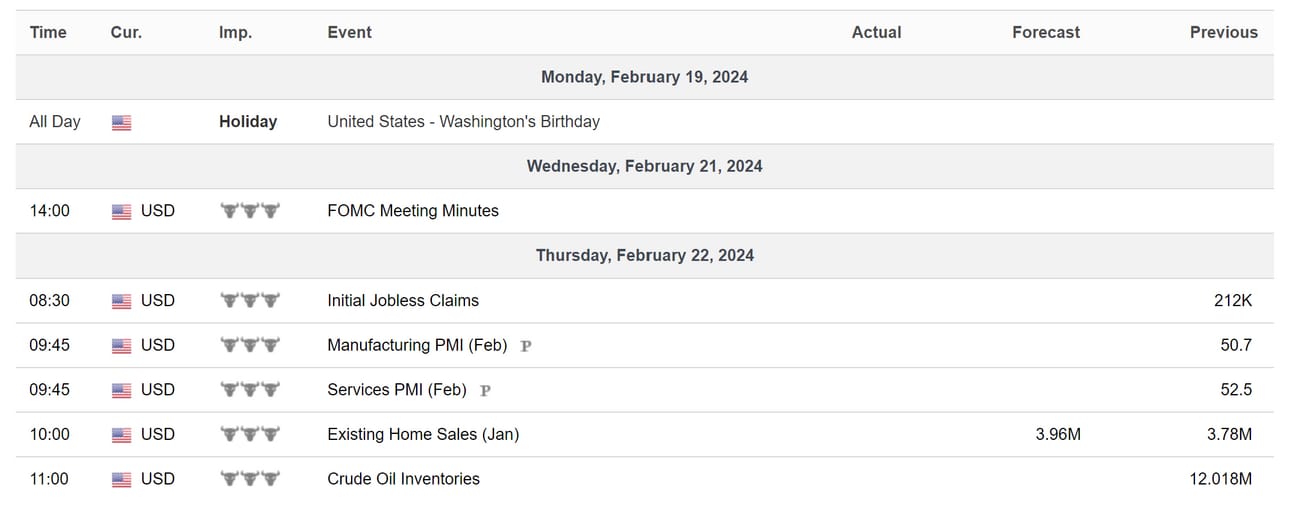

Calendar

SPY

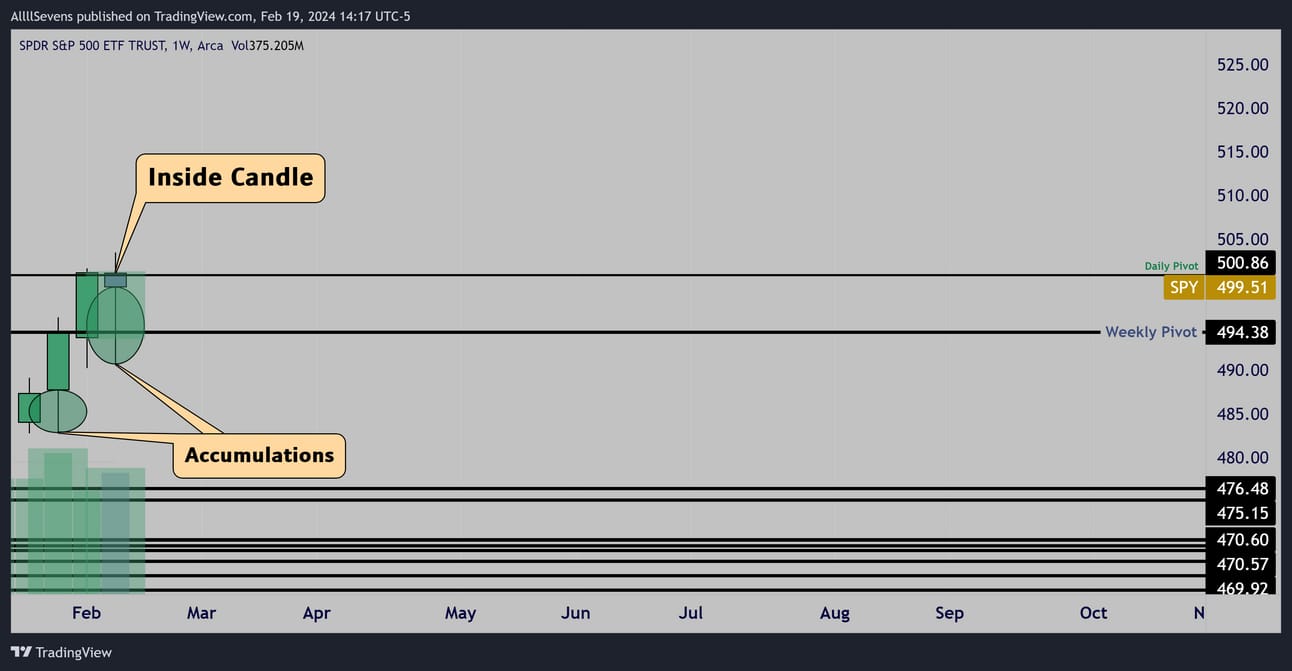

Weekly

My all-time favorite upside continuation pattern is a decreased volume inside candle resting over support following an increased volume impulse over that level.

9 times out of 10 this results in further upside.

This is NOT the pattern shown headed into this week…

We are working with a decreased volume impulse over support followed by an increased volume inside candle now resting over the resistance turned support. While buyers are clearly in control of the tape (accumulations), the current pattern actually favors a potential downside reversal and is enticing price to reverse rather than continue trend.

Conclusion

From an investor’s perspective:

Institutions are clearly buying here.

Short-term reversal or not, there’s absolutely no reason to question the long-term stability of the S&P500 at this time.

From a trader’s perspective:

The issue with trying to call a top here is that while there’s a potential reversal pattern taking shape… It’s not even close to A+. Why?

-Price isn’t at a major resistance

In in fact, it’s OVER a major support @ ($494.38)

-Volume screams more upside

I can’t imagine shorting this chart.

This leads me to be inherently bullish this week.

With a candle open over $494.38, if a downside reversal does begin, there is simply a higher probability of dips being bought than there is of an actual breakdown since the candle will technically be retesting a previously accumulated support ($494.38) and likely to hold.

However, I don’t plan to buy a dip this week.

I want to humor bears-

If they want to reverse price this week, I have a feeling it could cascade into a monthly reversal pattern. If price fails to hold $494.38 and opens below it next week, I’ll be talking about the potential downside trade setting up in next week’s newsletter.

I’m only interested in getting long this week over the $500.86 level, when the noise has cleared and this inside candle is ready to break and expand to the upside.

Anywhere below this level and I’m going to let impatient traders fight the battle for me. The easiest trade (and profitable) will be over $500.86

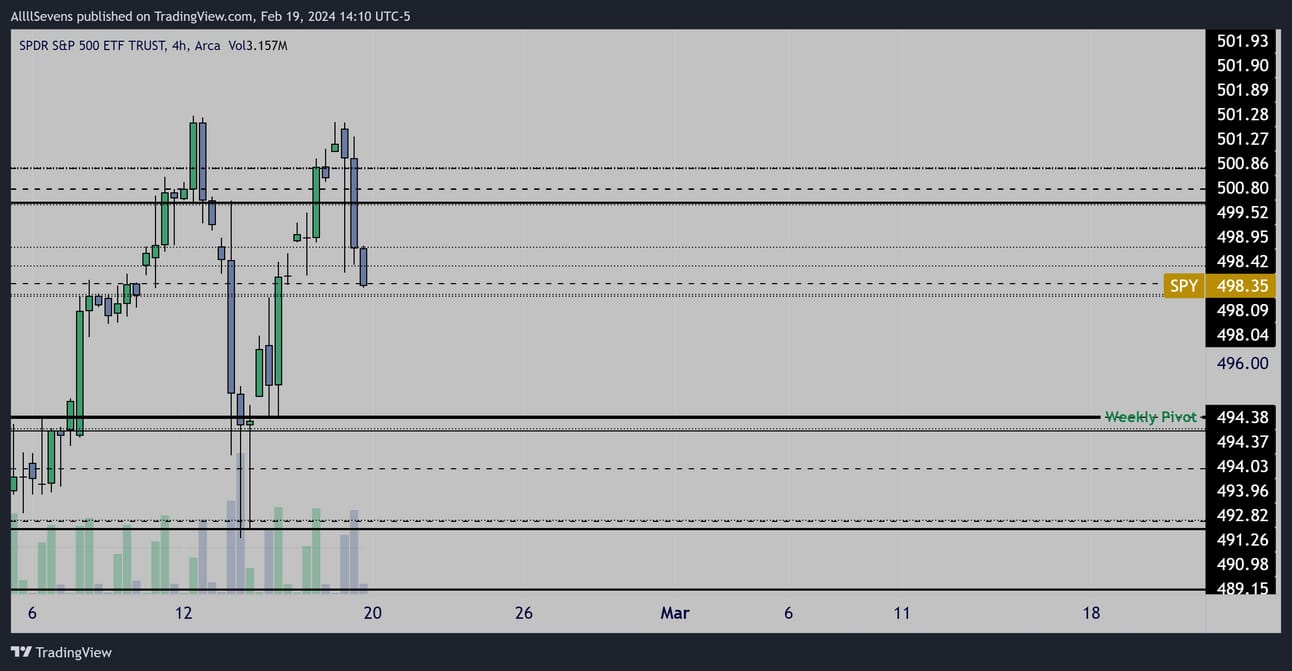

15m

I choose this level specifically because it’s the second largest Dark Pool other than $494.38 in the past three weeks, plus it has been accumulated a few times since it came in.

One last recap of my thoughts plan for this week:

I will not take a single trade unless I get an entry over $500.86.

While I do expect the week to remain generally bullish and dips to be bought, I also do see a very real possibility that a dip does not get bought, and this reversal begins to cascade below $494.38…

Part of the reason I am humoring this so much is the second half of February is seasonally bearish. It’s very possible!

And if this happens, next week’s newsletter could be a high conviction bearish setup… I’m actually hoping this happens it would be very fun and it would set the market up for a very healthy pullback before the next mega rally!

Here are ALL my intraday scalp levels I’ll be watching this week:

(All Dark Pools)

Keep in mind guys, this is just MY plan-

Really, I hope you can use my thought process and the data I shared to develop your own plan. I just hope you find this data I share useful in any way. Use it however you please!

4HR

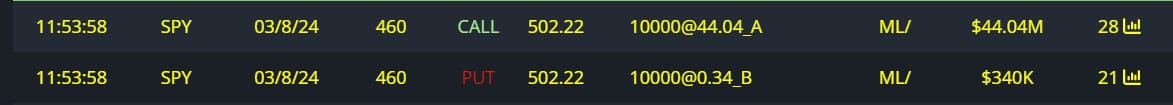

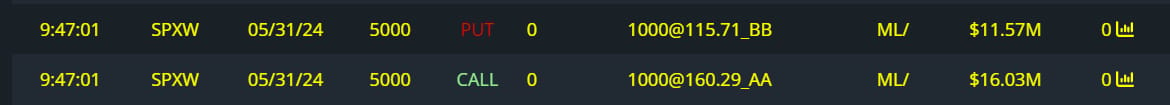

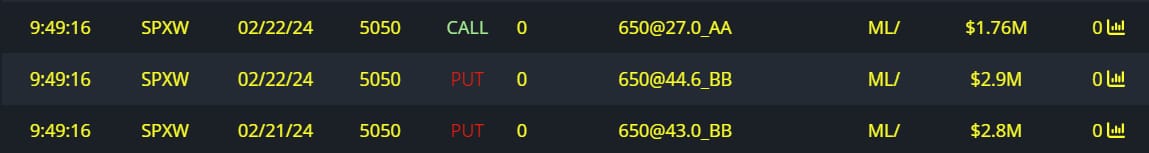

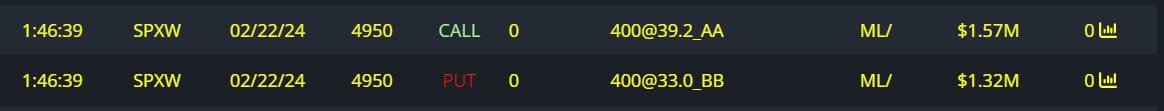

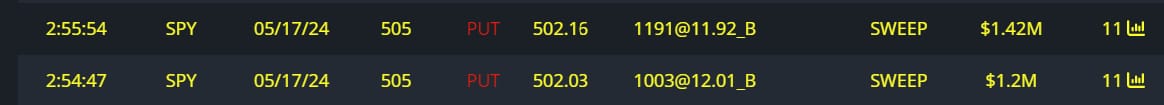

Unusual Options Flow

$44M Call Buyer

$27M Full Risk Bull

$12M Full Risk Bull

$10M Full Risk Bull

$7M Full Risk Bull

$2M Full Risk Bull

$2M Put Writing

$1M Call buyer

$800K Full Risk Bull

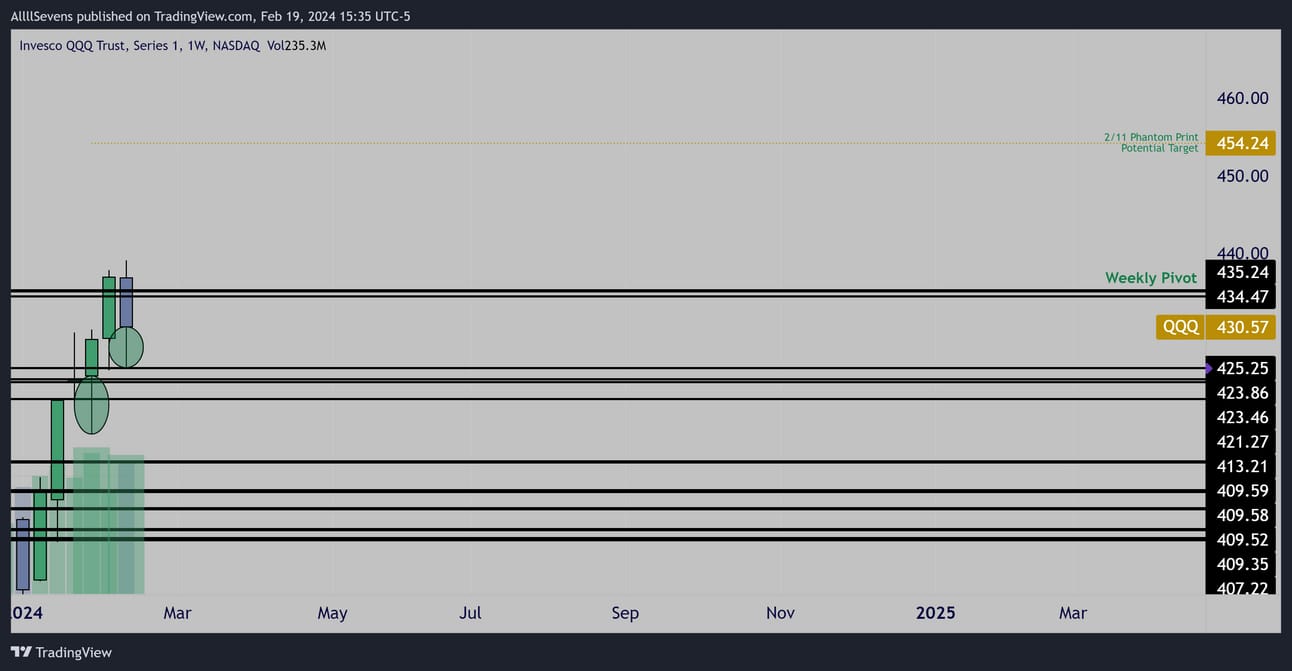

QQQ

Weekly

Practically the same formation as the SPY. Same ideas here.

I’m actually going to be looking at QQQ for relative strength this week.

Just like SPY though, I’m totally hands off until the levels above get broke.

I don’t want to be hunting a for a bottom this week during an IB.

If we can break and base over $434.47-$435.24 I’m in!

2/12

This $435.24 level has seen accumulation already.

2/16

Very strong accumulation on Friday for QQQ, not at a Dark Pool so not actionable, just adds to the conviction that while the weekly chart IS showing a potential downside reversal setup, all the volume here is bullish and I’ll be looking for the upside break and won’t trust downside.

Conclusion

From an investor’s perspective:

Institutions are clearly buying here.

Short-term reversal or not, there’s absolutely no reason to question the long-term stability of the QQQ

From a trader’s perspective:

There IS a threat for a short-term reversal in trend, but it’s not very strong yet, it’s not confirmed, and all volumes continue to point up.

Therefore, I continue to focus on the long trade here.

But, I will humor bears by not going long until I get confirmation that their reversal attempt is failing, which will be if $432.81-$435.24 can get reclaimed.

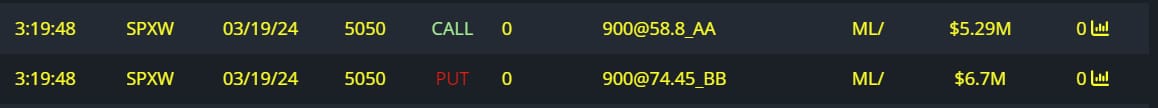

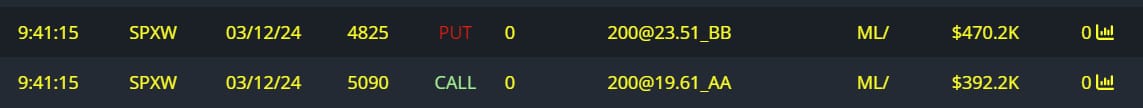

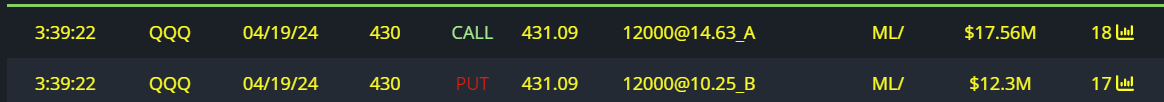

There’s some very notable flow on QQQ this week-

The SPY and SPX flow is never ending, and so it almost becomes numbing see the large orders come in…

When a QQQ order comes in it is especially notable because it’s much more rare.

A massive bullish order!!

$29M Full Risk Bull

AllllSevens+

I write a premium newsletter where I discuss individual stocks and more exclusively cover the Russell 2000 (IWM) which I believe is putting in strong swing low and starting a multi-year rally…

These newsletters are written simply whenever something screams at me to write about it. Usually once a week, but not always.

There’s also typically bonus content under the weekly newsletters.

(not this week)

Upon signing up for the premium newsletter you also get access to my Discord where I organize and consistently update my analysis on EVERYTHING everyday, every week with any volume anomalies or unusual options flow as they happen / come in.

It’s only $7.77 per month.

https://allllsevensnewsletter.beehiiv.com/upgrade

We-Bull Referral

https://a.webull.com/Tfjp9cTCDSzfJtjPDr

BlackBoxStocks

The Ultimate Tool For Traders

Dark Pool

Options Platform

Stocks Platform

Proprietary Indicators

Live Community & Members Chat

Education Program Courses

Mobile App

News

I collect all my Unusual Options Flow and Dark Pools through BBS

BlackBoxStocks offers a 20% discount to first time members!

Use my referral link >http://staygreen.blackboxstocks.com/aff_c?offer_id=5&aff_id=2544

BBS also offers a military discount!

See in detail what all BBS has to offer by reading this guide linked just below!

https://docs.blackboxstocks.com

Reply